Item 1.01 Entry into a Material Definitive Agreement.

Transaction Agreement

On August 13, 2017, Transocean Ltd., a Swiss corporation (“Transocean”), Transocean Inc., a Cayman Islands exempted company and wholly owned subsidiary of Transocean, and Songa Offshore SE, a European public company limited by shares (or societas Europaea) existing under the laws of Cyprus (“Songa”), entered into a transaction agreement (the “Transaction Agreement”), pursuant to which Transocean will, subject to certain conditions, offer to acquire all of the outstanding shares of Songa (the “Transaction”).

Pursuant to the Transaction Agreement, Transocean and Transocean Inc. or another wholly owned subsidiary of Transocean Ltd. (collectively referred to as the “Offeror”) will make a public voluntary exchange offer (the “Offer”) to exchange each share of Songa (the “Songa Shares”) for

consideration consisting of a combination of (i) newly issued shares of Transocean, par value CHF 0.10 per share (the “Consideration Shares”), and (ii) senior unsecured exchangeable bonds convertible into new shares of Transocean (the “Exchangeable Bonds”). As part of the Offer, each Songa shareholder may also elect to receive an amount in cash of up to NOK 125,000 (the “Cash Election”) in lieu of some or all of the Exchangeable Bonds and Consideration Shares such shareholder would otherwise be entitled to receive in the Offer (the value of such cash and the value of the aggregate number of Consideration Shares and Exchangeable Bonds to be delivered per Songa Share, the “Offer Price”). The Offer Price shall be equal to NOK 47.50 per Songa Share. The value of each Consideration Share delivered in the Offer is NOK 66.4815, which is based on the USD 8.39 per share closing price of the registered shares of Transocean on the New York Stock Exchange (the “NYSE”) and the NOK/USD closing price of 7.9239 as determined by Norges Bank, each on August 14, 2017 (being the trading day immediately prior to the announcement of the Offer). The value of each Exchangeable Bond delivered in the Offer will be the nominal amount of such Exchangeable Bond. The number of Consideration Shares and Exchangeable Bonds issued to (a) each Songa shareholder who accepts the Offer and (b) any Songa shareholder in connection with any mandatory offer in accordance with the rules of chapter 6 of the Norwegian Securities Trading Act 2007 or compulsory acquisition following the completion of the Offer, in each case, will be rounded down to the nearest whole number of Consideration Shares or Exchangeable Bonds, as applicable. The aggregate Offer Price paid to each Songa shareholder participating in the Offer will be comprised, as near as possible, of 50% Consideration Shares and 50% Exchangeable Bonds, with any exercise by such shareholder of the Cash Election being deducted first from the aggregate number of Exchangeable Bonds issued to such shareholder and second from the aggregate number of Consideration Shares issued to such shareholder.

Pursuant to the Transaction Agreement and subject to making the Offer, the Offeror will also make an offer (the “Bond Offer”) to the holders (the “Bondholders”) of Songa bonds of the series SONG04 (ISIN NO 001 062875.3) (“SONG04 Bonds”) and SONG05 (ISIN NO 001 064940.3) (“SONG05 Bonds”, and together with SONG04 Bonds the “Bonds”) to exchange (i) each SONG04 Bond for Exchangeable Bonds, cash or a combination thereof in a total amount equal to 103.5% of the principal amount of such bonds and (ii) each SONG05 Bond for Exchangeable Bonds, cash or a combination thereof in a total amount equal to 101% of the principal amount of such bonds (the value of the Exchangeable Bonds and/or cash to be delivered per Bond, the “Bond Offer Price”), in each case plus accrued interest up to completion. Subject to making the Offer, the Offeror will also issue to Perestroika AS (“Perestroika AS”) Exchangeable Bonds in exchange for its USD 50 million loan to Songa (the “Loan”) in a total amount equal to 100% of the principal amount of the Loan, plus accrued interest until the time of the completion of such exchange.

The Transaction Agreement also provides that Perestroika AS shall have the right, conditional upon completion of the Offer, to designate one individual for election to the Board of Directors of Transocean (the “Perestroika Designee”), which designee shall be Mr. Frederik Mohn, Chairman of Songa and an affiliate of Perestroika AS. The Perestroika Designee shall be submitted as a director nominee for election by Transocean’s shareholders at an extraordinary general meeting of Transocean’s shareholders.

The Transaction Agreement was approved by the Board of Directors of each of Transocean, Transocean Inc. and Songa. The consummation of the Offer is subject to the satisfaction of customary closing conditions, including, among others (i) acceptance by shareholders representing more than 90% of the total share capital of Songa on a fully diluted basis and representing more than 90% of the votes which can be exercised in the general meeting of Songa, (ii) receipt of all governmental and regulatory approvals, (iii) the absence of any court, governmental or regulatory action restraining or prohibiting the completion of the Offer or imposing conditions upon the Offer that the Offeror, in its sole discretion,

determines to be unduly burdensome, (iv) the absence of certain changes or decisions to make changes to the share capital of Songa, (v) prior to the completion of the Offer, there shall have been no material adverse change (as defined in the Transaction Agreement), (vi) (a) approval by Transocean’s shareholders of the issuance of the Consideration Shares and the creation of certain additional authorized share capital and (b) registration of the Consideration Shares with the Swiss commercial register, (vii) listing on the NYSE of the Consideration Shares and the Transocean shares issuable upon conversion of the Exchangeable Bonds, (viii) the declaration of effectiveness of one or more registration statements on Form S-4 with respect to the Offer (or a Form CB having been filed by Transocean with respect to the Offer), (ix) the information about Songa provided to the Offeror remaining accurate in all material respects, (x) compliance by Songa with its obligations under the Transaction Agreement in all material respects, and (xi) the election of the Perestroika Designee to the Transocean board of directors at the Transocean extraordinary general meeting and (xii) to the extent the Offer is commenced prior to September 17, 2017, the Offeror concluding its confirmatory due diligence on or prior to September 17, 2017, without any findings that are material to the business or value of Songa.

Each of Songa and Transocean has agreed to various customary covenants and agreements, including covenants to conduct its respective business in the ordinary course and in accordance with past practice and applicable laws prior to the completion of the Offer. Songa has also agreed not to (i) solicit proposals relating to certain alternative transactions or (ii) enter into discussions or negotiations or provide non-public information in connection with any proposal for an alternative transaction from a third party, subject to certain exceptions to permit Songa’s board of directors to comply with its fiduciary duties. Notwithstanding these restrictions, under specified circumstances Songa’s board of directors may change its recommendation and may also terminate the Transaction Agreement to accept a superior proposal.

The Transaction Agreement may be terminated under certain circumstances, including (in each case subject to certain exceptions) (i) if the Offer has not been completed by the long stop date under the Transaction Agreement of January 31, 2018 (as the long stop date may be extended, the “long stop date”), (ii) a change in recommendation regarding the Offer by the Songa Board, (iii) a material breach of the Transaction Agreement by either party or by shareholders who have executed Pre-acceptances (as defined below) representing a specified percentage of the total share capital of Songa, (iv) the occurrence of a material adverse change relating to Songa, (v) failure to receive the Pre-acceptances from shareholders representing a specified percentage of the total share capital of Songa, (vi) Pre-acceptances representing a specified percentage of the total share capital of Songa ceasing to remain in full force and effect, (vii) the Offeror making findings in its confirmatory due diligence that are material to the business or value of Songa, (viii) following the occurrence of any event that makes any of the conditions to the Offer described above incapable of satisfaction prior to the long stop date or (ix) by mutual consent of the parties.

The foregoing description of the Transaction Agreement does not purport to be complete and is qualified in its entirety by reference to the Transaction Agreement, a copy of which is filed herewith as Exhibit 2.1 and is incorporated herein by reference.

Pre-acceptances

Simultaneously with the execution of the Transaction Agreement, Perestroika AS executed an irrevocable pre-acceptance agreement (the “Perestroika AS Pre-acceptance”), pursuant to which Perestroika AS irrevocably and unconditionally agreed to exchange all of its Songa Shares (including any shares acquired after the date of the Perestroika AS Pre-acceptance and any shares acquired upon exercise, exchange or conversion of any other securities to acquire Songa Shares) in the Offer. As part of the Perestroika AS Pre-acceptance, Perestroika also agreed to (1) sell and exchange with the Offeror all Bonds owned by Perestroika AS for the applicable Bond Offer Price and (2) sell and exchange all Perestroika AS’s holdings in the USD 50 million loan to Songa for Exchangeable Bonds in a total amount equal to 100% of the principal amount of the Loan, plus accrued interest until the time of the completion of such exchange.

The Offeror has also entered into similar irrevocable pre-acceptances of the Offer with certain funds affiliated with Asia Research & Capital Management Ltd., York Capital Management and Songa’s directors (collectively, the “Post-Execution Pre-acceptances” and together with the Perestroika AS Pre-acceptance, the “Pre-acceptances”). Collectively, the Pre-acceptances represent approximately 76.6% of all Songa Shares on a fully diluted basis.

The Pre-acceptances (as applicable) terminate, among other events, in the event that the Offer has lapsed as a result of the conditions to completion of the Offer not having been fulfilled or waived by the Offeror, subject to certain exceptions, as of January 31, 2018. The Perestroika AS Pre-acceptance also terminates if (1) a material adverse change

(as defined in the Perestroika AS Pre-acceptance) with respect to Transocean and its subsidiaries has occurred or (2) Transocean’s shareholders fail to approve the election of the Perestroika Designee.

The foregoing description of the Pre-acceptances does not purport to be complete and is qualified in its entirety by reference to the forms of Pre-acceptance, copies of which are filed herewith as Exhibits 10.1, 10.2 and 10.3 and are incorporated herein by reference.

The Transaction Agreement and Pre-acceptances have been included to provide investors with information regarding their terms. They are not intended to provide any other factual information about Transocean or Songa or their respective subsidiaries or affiliates or to modify or supplement any factual disclosures about Transocean in its public reports filed with the Securities and Exchange Commission (the “SEC”) or in Songa’s reports made publicly available. The representations, warranties and covenants contained in the Transaction Agreement and the Pre-acceptances were made only for purposes of such agreements and as of specific dates, were solely for the benefit of the respective parties to such agreements, may be subject to limitations agreed upon by the contracting parties, including being qualified by confidential disclosures made for the purposes of allocating contractual risk between the respective parties to such agreements instead of establishing these matters as facts, and may be subject to standards of materiality that differ from those applicable to investors. Investors should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or condition of the parties thereto or of any of their respective subsidiaries or affiliates. Moreover, information concerning the subject matter of representations and warranties may change after the date of the Transaction Agreement and the Pre-acceptances, which subsequent information may or may not be fully reflected in Transocean’s or Songa’s respective public disclosures.

Item 7.01 Regulation FD Disclosure.

On August 15, 2017, Transocean issued a press release and released an investor presentation announcing the transaction, copies of which are being furnished as Exhibits 99.1 and 99.2, respectively, and are incorporated herein by reference.

Transocean is furnishing the information in this Item 7.01, including the information contained in Exhibits 99.1 and 99.2, to comply with Regulation FD. The information contained in this Item 7.01, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for any purpose, including for the purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that Section, nor shall such information be deemed incorporated by reference into any filing under the Securities Act of 1933, regardless of any general incorporation language in such filings.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

|

|

|

|

|

Exhibit No

.

|

|

Description

|

|

|

|

|

|

2.1*

|

|

Transaction Agreement, dated August 13, 2017, among Transocean Ltd., Transocean Inc. and Songa Offshore SE.

|

|

|

|

|

|

10.1

|

|

Pre-acceptance, dated August 13, 2017, between Transocean Ltd. and Perestroika AS.

|

|

|

|

|

|

10.2

|

|

Pre-acceptance, dated August 15, 2017, between Transocean Ltd. and certain funds affiliated with Asia Research & Capital Management Ltd.

|

|

|

|

|

|

10.3

|

|

Form of Pre-acceptance among Transocean Ltd. and certain shareholders of Songa Offshore SE.

|

|

|

|

|

|

99.1

|

|

Press release issued by Transocean Ltd., dated August 15, 2017.

|

|

|

|

|

|

99.2

|

|

Investor presentation, dated August 15, 2017.

|

* Certain of the appendices to this exhibit have been omitted pursuant to Item 601(b)(2) of Regulation S-K. The Registrant agrees to furnish a copy of any schedule omitted from this exhibit to the SEC upon request.

Additional Information and Where to Find It

In connection with the Transaction, Transocean will file with the SEC a proxy statement of Transocean Ltd. (the “Proxy Statement”) and the Offeror will file a Registration Statement on Form S-4 (the “Registration Statement”) containing a prospectus with respect to the Consideration Shares and Exchangeable Bonds to be issued in the Transaction (the “Prospectus”). When available, Transocean will mail the Proxy Statement to its shareholders in connection with the vote to approve certain matters in connection with the Transaction and the Offeror will distribute the Prospectus to certain securityholders of Songa in the United States in connection with the transaction and related Offer contemplated by the Transaction Agreement. Transocean Ltd. and Transocean Inc. are also expected to file an offer document with the Financial Supervisory Authority of Norway (the “Norwegian FSA”).

INVESTORS AND SECURITYHOLDERS ARE URGED TO READ CAREFULLY THE DEFINITIVE PROXY STATEMENT AND/OR PROSPECTUS REGARDING THE TRANSACTION IN ITS/THEIR ENTIRETY WHEN THEY BECOME AVAILABLE (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) OR ANY DOCUMENTS WHICH ARE INCORPORATED BY REFERENCE IN THE DEFINITIVE PROXY STATEMENT OR PROSPECTUS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION

. You may obtain, free of charge, copies of the definitive Proxy Statement, Prospectus and Registration Statement, when available, and other relevant documents filed by Transocean with the SEC, at the SEC’s website at: www.sec.gov. In addition, shareholders may obtain free copies of the Proxy Statement and Prospectus and other relevant documents filed by Transocean and Transocean Inc. with the SEC from Transocean’s website at: www.deepwater.com.

This communication does not constitute an offer to buy or exchange, or the solicitation of an offer to sell or exchange, any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. This communication is not a substitute for any prospectus, proxy statement or any other document that Transocean and Transocean Inc. may file with the SEC in connection with the proposed transaction. The final terms and further provisions regarding the Offer will be disclosed in the offer document after the publication has been approved by the Norwegian FSA and in documents that will be filed by Transocean and Transocean Inc. with the SEC. No money, securities or other consideration is being solicited, and, if sent in response to the information contained herein, will not be accepted.

No offering of securities shall be made except by means of a prospectus meeting the requirements of the U.S. Securities Act of 1933, as amended, and any applicable European and Norwegian regulations. The transaction and distribution of this document may be restricted by law in certain jurisdictions and persons into whose possession any document or other information referred to herein should inform themselves about and observe any such restrictions. Any failure to comply with these restrictions may constitute a violation of the securities laws of any such jurisdiction. No offering of securities will be made directly or indirectly, in or into any jurisdiction where to do so would be inconsistent with the laws of such jurisdiction.

Participants in the Solicitation

Each of Transocean, Transocean Inc., and their respective directors and executive officers and other members of management and employees, may be deemed to be participants in the solicitation of proxies from Transocean’ shareholders with respect to the approvals required to complete the Transaction and the solicitation of acceptances for the exchange offer. More detailed information regarding the identity of these potential participants, and any direct or indirect interests they may have in the proposed transaction, by security holdings or otherwise, will be set forth in the Proxy Statement and Prospectus when they are filed with the SEC. Information regarding Transocean’s directors and executive officers is set forth in the definitive proxy statement on Schedule 14A filed by Transocean with the SEC on March 16, 2017, and in the Annual Report on Form 10-K filed by Transocean with the SEC on March 7, 2017. Additional information regarding the interests of participants in the solicitation of proxies in respect of the extraordinary general meeting and the exchange offer will be included in the proxy statement to be filed with the SEC. These documents are available to shareholders free of charge from the SEC’s website at: www.sec.gov and from the investor relations section of Transocean’s website at: www.deepwater.com.

Cautionary Statement About Forward Looking Statements

The statements described in this Form 8-K

and referenced press release that are not historical facts are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements contain words such as “possible,” “intend,” “will,” “if,” “expect” or other similar expressions. These forward-looking statements include, but are not limited to, statements regarding benefits of the Transaction, integration plans and expected synergies, and anticipated future growth, financial and operating performance and results. Forward-looking statements are based on management’s current expectations and assumptions, and are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. As a result, actual results could differ materially from those indicated in these forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to: estimated duration of customer contracts; contract dayrate amounts; future contract commencement dates and locations; planned shipyard projects; timing of Transocean’s newbuild deliveries; operating hazards and delays; risks associated with international operations; actions by customers and other third parties; the future prices of oil and gas; the intention to scrap certain drilling rigs; the expected timing and likelihood of the completion of the contemplated transaction, including the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the contemplated transaction that could reduce anticipated benefits or cause the parties to abandon the transaction; the occurrence of any event, change or other circumstances that could give rise to the termination of the Transaction Agreement; the ability to successfully complete the Transaction, including the related exchange offers; regulatory or other limitations imposed as a result of the Transaction; the success of the business following completion of the Transaction; the ability to successfully integrate the Transocean and Songa businesses; the possibility that Transocean’s shareholders may not approve certain matters that are conditions to the Transaction or that the requisite number of Songa shares may not be exchanged in the public offer; the risk that the parties may not be able to satisfy the conditions to closing of the Transaction in a timely manner or at all; risks related to disruption of management time from ongoing business operations due to the proposed business combination; the risk that the announcement or completion of the Transaction could have adverse effects on the market price of Transocean’s or Songa’s shares or the ability of Transocean or Songa to retain customers, retain or hire key personnel, maintain relationships with their respective suppliers and customers, and on their operating results and businesses generally; the risk that Transocean may be unable to achieve expected synergies or that it may take longer or be more costly than expected to achieve those synergies; and other factors, including those and other risks discussed in Transocean’s most recent Annual Report on Form 10-K for the year ended December 31, 2016, and in Transocean’s other filings with the SEC, which are available free of charge on the SEC's website at:

www.sec.gov

, and in Songa’s annual and quarterly financial reports made publicly available. Should one or more of these risks or uncertainties materialize (or the other consequences of such a development worsen), or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or expressed or implied by such forward-looking statements. All subsequent written and oral forward-looking statements attributable to Transocean or to persons acting on Transocean’s behalf are expressly qualified in their entirety by reference to these risks and uncertainties. You should not place undue reliance on forward-looking statements. Each forward-looking statement speaks only as of the date of the particular statement, and each of Transocean and Songa undertake no obligation to publicly update or revise any forward-looking statements to reflect events or circumstances that occur, or which either Transocean or Songa become aware of, after the date hereof, except as otherwise may be required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

TRANSOCEAN LTD.

|

|

|

|

|

|

|

|

Date: August 15, 2017

|

By:

|

/s/ Daniel Ro-Trock

|

|

|

|

Name: Daniel Ro-Trock

|

|

|

|

Title: Authorized Person

|

Index to Exhibits

|

|

|

|

|

Exhibit No

.

|

|

Description

|

|

|

|

|

|

2.1*

|

|

Transaction Agreement, dated August 13, 2017, among Transocean Ltd., Transocean Inc. and Songa Offshore SE.

|

|

|

|

|

|

10.1

|

|

Pre-acceptance, dated August 13, 2017, between Transocean Ltd. and Perestroika AS.

|

|

|

|

|

|

10.2

|

|

Pre-acceptance, dated August 15, 2017, between Transocean Ltd. and certain funds affiliated with Asia Research & Capital Management Ltd.

|

|

|

|

|

|

10.3

|

|

Form of Pre-acceptance among Transocean Ltd. and certain shareholders of Songa Offshore SE.

|

|

|

|

|

|

99.1

|

|

Press release issued by Transocean Ltd., dated August 15, 2017.

|

|

|

|

|

|

99.2

|

|

Investor presentation, dated August 15, 2017.

|

* Certain of the appendices to this exhibit have been omitted pursuant to Item 601(b)(2) of Regulation S-K. The Registrant agrees to furnish a copy of any schedule omitted from this exhibit to the SEC upon request.

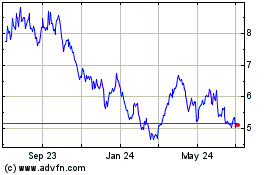

Transocean (NYSE:RIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

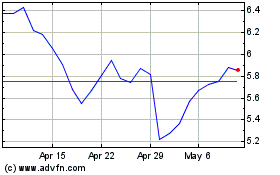

Transocean (NYSE:RIG)

Historical Stock Chart

From Apr 2023 to Apr 2024