ChinaNet Online Holdings, Inc. (Nasdaq:CNET) ("ChinaNet" or the

"Company"), an integrated online advertising, precision marketing

and data-analysis and management services platform, announced today

financial results for the second quarter of 2017.

Summary Financials

|

Second Quarter 2017 Financial Results (USD)

(Unaudited) |

| |

2017 |

2016 |

CHANGE |

| Sales |

$10.5 million |

|

$8.4million |

|

+24.5 |

% |

| Gross Profit |

$1.7 million |

|

$2.5 million |

|

-31.9 |

% |

| Gross Margin |

16.2% |

|

29.6% |

|

-45.3 |

% |

| Net Loss Attributable

to ChinaNet |

($0.8) million |

|

($1.3) million |

|

38.4 |

% |

| EPS from continuing

operations* (Basic & Diluted) |

($0.07) |

|

($0.11) |

|

36.4 |

% |

*Per share amount for the three months ended June, 2016 has been

retroactively restated to reflect the Company’s 1 for 2.5 reverse

stock split, which was effective on August 19, 2016.

For the three months ended June 30, 2017, total revenues

increased to $10.5 million from $8.4 million in the prior year,

primarily due to the increase from search engine marketing and data

service revenue during the quarter.

During the quarter, revenues from internet advertising and data

services was $2.5 million, which decreased 56.7% from $5.7 million

in the second quarter of 2016. ChinaNet continues to focus on

integrating and upgrading its internet advertising and data service

to SME clients and investing in developing new service modules for

clients, and believes that the launch of new services in future

will help to increase market penetration and recurring revenues.

The decline was offset by an increase in search engine marketing

and data service revenue of 188.9% from $2.8 million in the second

quarter of 2016 to $8.0 million in the second quarter of 2017. This

increase was supported by the CloudX system, which drove more

precision marketing and ROI for clients.

Gross profit for the quarter ended June 30, 2017 was $1.7

million, compared to $2.5 million in the second quarter of 2016, a

decrease of 31.9%. Gross margin was 16.2%, down from 29.6% in 2016,

primarily due to the increase in relative lower margin revenues

from search engine marketing and data service during the quarter.

Internet advertising and data service gross margin remained 43% in

the second quarter of 2017 as in 2016.

Operating expenses decreased by 39.1% to $2.1 million for the

three months ended June 30, 2017. Sales and marketing expenses

decreased by 22.4% to $0.8 million. General and administrative

expenses decreased by 45.9% to $1.0 million. Loss from operations

was $0.4 million in the second quarter of 2017, an improvement of

57.3% compared to a loss of $1.0 million in the second quarter of

2016.

Net loss attributable to ChinaNet for the three months ended

June 30, 2017 was $0.8 million and loss per share from continuing

operations was $0.07, compared to a net loss of $1.3 million and

loss per share from continuing operations of $0.11 in the second

quarter of 2016. The weighted average diluted shares outstanding

for the three months ended June 30, 2017 was 12.0 million shares

versus 11.4 million for the three months ended June 30, 2016.

|

First Half 2017 Financial Results (USD)

(Unaudited) |

| |

2017 |

2016 |

CHANGE |

| Sales |

$17.8 million |

|

$13.5 million |

|

+31.6 |

% |

| Gross Profit |

$3.0 million |

|

$4.1 million |

|

-27.5 |

% |

| Gross Margin |

16.7% |

|

30.4% |

|

-44.9 |

% |

| Net Loss Attributable

to ChinaNet |

($1.9) million |

|

($2.7) million |

|

30.3 |

% |

| EPS from continuing

operations* (Basic & Diluted) |

($0.16) |

|

($0.23) |

|

30.4 |

% |

*Per share amount for the six months ended June, 2016 has been

retroactively restated to reflect the Company’s 1 for 2.5 reverse

stock split, which was effective on August 19, 2016.

Revenues for the six months ended June 30, 2017 were $17.8

million, an increase of 31.6% from $13.5 million for the same

period a year ago, which was primarily an increase in search engine

marketing and data service revenue.

Gross profit was $3.0 million, a decrease of 27.5% for the first

six months of 2017, and gross profit margin of 16.7%, compared to

30.4% in 2016. Operating expenses decreased by 31.6% to $4.4

million compared to $6.5 million for the first six months of 2016.

The Company reported an operating loss of $1.5 million in the first

half of 2017 compared to an operating loss of $2.4 million in the

first half of 2016.

Net loss attributable to ChinaNet common shareholders and net

loss per share was $1.9 million and $0.16 for the six months ended

June 30, 2017.

Balance Sheet and Cash Flow

The Company had $1.8 million in cash and cash equivalents as of

June 30, 2017, compared to $3.0 million as of December 31, 2016,

working capital of $6.3 million compared to $6.9 million as of

December 31, 2016, and a current ratio of 1.7 to 1, compared 1.9 to

1 as of December 31, 2016. Total shareholders' equity of ChinaNet

was $21.2 million at June 30, 2017 compared to $22.2 million at

December 31, 2016.

The Company generated approximately $1.3 million of cash

outflows from operations for the six months ended June 30, 2017

compared to a $0.3 million of cash inflows for the six months ended

June 30, 2016.

Business Updates

In January 2017, ChinaNet announced the launch of its updated

comprehensive website www.chinanet-online.com, reflecting

ongoing efforts to provide up-to-date information for customers,

investors and shareholders. The new ChinaNet website has been

redesigned to be more dynamic, user-friendly and content rich. The

website allows visitors to efficiently access information needed

regarding ChinaNet's profile and history, products and services,

and investor relations content including press releases and SEC

reporting. The website now also includes enhanced video, including

a compressive overview of the Company's business which can be

viewed directly

at: http://www.chinanet-online.com/english_index.html

Conference Call DetailsDate: Wednesday,

August 16, 2017 Time: 8:30 a.m. EDT Toll-free dial-in number:

1-800-263-8506 International dial-in number: 1-719-457-2642

Conference ID: 3341576Webcast:

http://public.viavid.com/index.php?id=125967

A replay of the conference call will be available

after 11:30 a.m. Eastern time through September 16,

2017.

Toll-free replay number: 1-844-512-2921 International replay

number: 1-412-317-6671 Replay ID: 3341576

About ChinaNet Online Holdings, Inc.

ChinaNet Online Holdings, a parent company of ChinaNet Online

Media Group Ltd., incorporated in the BVI (ChinaNet), is an

integrated online advertising, precision marketing and

data-analysis and management services platform. ChinaNet provides

prescriptive analysis for its clients to improve business outcomes

and to create more efficient enterprises. The Company leverages an

optimization framework, provided by its comprehensive data-analysis

infrastructure, to blend data, mathematical, and computational

sciences into an outcome management platform for which it monetizes

on a per client basis. ChinaNet uniquely optimizes and prescribes

its clients decision making processes based on its proprietary

ecosystem. For more information,

visit www.chinanet-online.com.

Safe Harbor

This release contains certain "forward-looking statements"

relating to the business of ChinaNet Online Holdings, Inc., which

can be identified by the use of forward-looking terminology such as

"believes," "expects," "anticipates," "estimates" or similar

expressions. Such forward-looking statements involve known and

unknown risks and uncertainties, including business uncertainties

relating to government regulation of our industry, market demand,

reliance on key personnel, future capital requirements, competition

in general and other factors that may cause actual results to be

materially different from those described herein as anticipated,

believed, estimated or expected. Certain of these risks and

uncertainties are or will be described in greater detail in our

filings with the Securities and Exchange Commission. These

forward-looking statements are based on ChinaNet's current

expectations and beliefs concerning future developments and their

potential effects on the Company. There can be no assurance that

future developments affecting ChinaNet will be those anticipated by

ChinaNet. These forward-looking statements involve a number of

risks, uncertainties (some of which are beyond the control of the

Company) or other assumptions that may cause actual results or

performance to be materially different from those expressed or

implied by such forward-looking statements. ChinaNet undertakes no

obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, except as may be required under applicable securities

laws.

| CHINANET ONLINE HOLDINGS, INC. |

| CONSOLIDATED BALANCE SHEETS |

| (In thousands, except for number of shares and

per share data) |

| |

|

|

|

|

| |

|

June 30, |

|

December 31, |

| |

|

2017 |

|

2016 |

| |

|

(US $) |

|

(US $) |

| |

|

(Unaudited) |

|

|

|

Assets |

|

|

|

|

| Current

assets: |

|

|

|

|

| Cash and

cash equivalents |

|

$ |

1,816 |

|

|

$ |

3,035 |

|

| Term

deposit |

|

|

3,129 |

|

|

|

3,056 |

|

| Accounts

receivable, net |

|

|

5,091 |

|

|

|

3,322 |

|

|

Prepayment and deposit to suppliers |

|

|

4,693 |

|

|

|

4,754 |

|

| Due from

related parties, net |

|

|

229 |

|

|

|

213 |

|

| Other

current assets |

|

|

183 |

|

|

|

95 |

|

| Total current

assets |

|

|

15,141 |

|

|

|

14,475 |

|

| |

|

|

|

|

| Long-term

investments |

|

|

1,373 |

|

|

|

1,340 |

|

| Property and equipment,

net |

|

|

382 |

|

|

|

471 |

|

| Intangible assets,

net |

|

|

6,823 |

|

|

|

7,264 |

|

| Goodwill |

|

|

5,090 |

|

|

|

4,970 |

|

| Deferred tax

assets |

|

|

1,444 |

|

|

|

1,522 |

|

| Total

Assets |

|

$ |

30,253 |

|

|

$ |

30,042 |

|

| |

|

|

|

|

| Liabilities and

Equity |

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

Short-term bank loan |

|

$ |

738 |

|

|

$ |

721 |

|

| Accounts

payable |

|

|

130 |

|

|

|

102 |

|

| Advances

from customers |

|

|

2,519 |

|

|

|

1,420 |

|

| Accrued

payroll and other accruals |

|

|

467 |

|

|

|

685 |

|

| Due to

new investors related to terminated security purchase

agreements |

|

|

905 |

|

|

|

884 |

|

| Payable

for purchasing of software technology |

|

|

421 |

|

|

|

411 |

|

| Taxes

payable |

|

|

3,019 |

|

|

|

2,910 |

|

| Other

payables |

|

|

675 |

|

|

|

487 |

|

| Total current

liabilities |

|

|

8,874 |

|

|

|

7,620 |

|

| |

|

|

|

|

| Long-term

liabilities: |

|

|

|

|

| Long-term

borrowing from a director |

|

|

129 |

|

|

|

126 |

|

| Total

Liabilities |

|

|

9,003 |

|

|

|

7,746 |

|

| |

|

|

|

|

|

Equity: |

|

|

|

|

| ChinaNet

Online Holdings, Inc.’s stockholders’ equity |

|

|

|

|

| Common

stock (US$0.001 par value; authorized 50,000,000 shares; issued and

outstanding 12,265,542 shares and 12,158,542 shares at June 30,

2017 and December 31, 2016, respectively) |

|

|

12 |

|

|

|

12 |

|

|

Additional paid-in capital |

|

|

29,633 |

|

|

|

29,285 |

|

| Statutory

reserves |

|

|

2,607 |

|

|

|

2,607 |

|

|

Accumulated deficit |

|

|

(12,238 |

) |

|

|

(10,362 |

) |

|

Accumulated other comprehensive income |

|

|

1,167 |

|

|

|

700 |

|

| Total

ChinaNet Online Holdings, Inc.’s stockholders’ equity |

|

|

21,181 |

|

|

|

22,242 |

|

|

|

|

|

|

|

|

Noncontrolling interests |

|

|

69 |

|

|

|

54 |

|

| Total

equity |

|

|

21,250 |

|

|

|

22,296 |

|

| |

|

|

|

|

| Total

Liabilities and Equity |

|

$ |

30,253 |

|

|

$ |

30,042 |

|

| |

| CHINANET ONLINE HOLDINGS, INC. |

|

|

| CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE LOSS |

|

|

| (In thousands, except for number of shares and

per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Six Months Ended June 30, |

|

Three Months Ended June 30, |

|

|

| |

|

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2016 |

|

|

|

| |

|

(US $) |

|

(US $) |

|

(US $) |

|

(US $) |

|

|

| |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

|

|

Revenues |

|

|

|

|

|

|

|

|

|

|

| From

unrelated parties |

|

$ |

17,662 |

|

|

$ |

13,276 |

|

|

$ |

10,417 |

|

|

$ |

8,264 |

|

|

|

| From

related parties |

|

|

102 |

|

|

|

220 |

|

|

|

83 |

|

|

|

172 |

|

|

|

| Total revenues |

|

|

17,764 |

|

|

|

13,496 |

|

|

|

10,500 |

|

|

|

8,436 |

|

|

|

| Cost of

revenues |

|

|

14,792 |

|

|

|

9,395 |

|

|

|

8,800 |

|

|

|

5,939 |

|

|

|

| Gross

profit |

|

|

2,972 |

|

|

|

4,101 |

|

|

|

1,700 |

|

|

|

2,497 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Operating

expenses |

|

|

|

|

|

|

|

|

|

|

| Sales and

marketing expenses |

|

|

1,659 |

|

|

|

1,943 |

|

|

|

825 |

|

|

|

1,063 |

|

|

|

| General

and administrative expenses |

|

|

2,084 |

|

|

|

3,538 |

|

|

|

992 |

|

|

|

1,832 |

|

|

|

| Research

and development expenses |

|

|

700 |

|

|

|

1,016 |

|

|

|

305 |

|

|

|

590 |

|

|

|

| Total operating

expenses |

|

|

4,443 |

|

|

|

6,497 |

|

|

|

2,122 |

|

|

|

3,485 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Loss from

operations |

|

|

(1,471 |

) |

|

|

(2,396 |

) |

|

|

(422 |

) |

|

|

(988 |

) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Other income

(expenses) |

|

|

|

|

|

|

|

|

|

|

| Interest

income |

|

|

37 |

|

|

|

53 |

|

|

|

18 |

|

|

|

26 |

|

|

|

| Interest

expense |

|

|

(73 |

) |

|

|

- |

|

|

|

(37 |

) |

|

|

- |

|

|

|

| Other

expenses |

|

|

(206 |

) |

|

|

(13 |

) |

|

|

(203 |

) |

|

|

(1 |

) |

|

|

| Total other

(expenses)/income |

|

|

(242 |

) |

|

|

40 |

|

|

|

(222 |

) |

|

|

25 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Loss before

income tax expense, noncontrolling interests and discontinued

operation |

|

|

(1,713 |

) |

|

|

(2,356 |

) |

|

|

(644 |

) |

|

|

(963 |

) |

|

|

| Income

tax expense |

|

|

(113 |

) |

|

|

(152 |

) |

|

|

(113 |

) |

|

|

(180 |

) |

|

|

| Loss from

continuing operations |

|

|

(1,826 |

) |

|

|

(2,508 |

) |

|

|

(757 |

) |

|

|

(1,143 |

) |

|

|

| Loss from and

on disposal of discontinued operation, net of income

tax |

|

|

- |

|

|

|

(60 |

) |

|

|

- |

|

|

|

(14 |

) |

|

|

| Net

loss |

|

|

(1,826 |

) |

|

|

(2,568 |

) |

|

|

(757 |

) |

|

|

(1,157 |

) |

|

|

| Net

income attributable to noncontrolling interests from continuing

operations |

|

|

(50 |

) |

|

|

(123 |

) |

|

|

(32 |

) |

|

|

(123 |

) |

|

|

| Net loss

attributable to ChinaNet Online Holdings, Inc. |

|

$ |

(1,876 |

) |

|

$ |

(2,691 |

) |

|

$ |

(789 |

) |

|

$ |

(1,280 |

) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(1,826 |

) |

|

$ |

(2,568 |

) |

|

$ |

(757 |

) |

|

$ |

(1,157 |

) |

|

|

| Foreign currency

translation gain/(loss) |

|

|

432 |

|

|

|

(478 |

) |

|

|

326 |

|

|

|

(590 |

) |

|

|

| Comprehensive

loss |

|

$ |

(1,394 |

) |

|

$ |

(3,046 |

) |

|

$ |

(431 |

) |

|

$ |

(1,747 |

) |

|

|

| Comprehensive income

attributable to noncontrolling interests |

|

|

(15 |

) |

|

|

(94 |

) |

|

|

(34 |

) |

|

|

(111 |

) |

|

|

| Comprehensive

loss attributable to ChinaNet Online Holdings, Inc. |

|

$ |

(1,409 |

) |

|

$ |

(3,140 |

) |

|

$ |

(465 |

) |

|

$ |

(1,858 |

) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Loss per

share |

|

|

|

|

|

|

|

|

|

|

| Loss from continuing

operations per common share |

|

|

|

|

|

|

|

|

|

|

| Basic and

diluted |

|

$ |

(0.16 |

) |

|

$ |

(0.23 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.11 |

) |

|

|

| Loss from discontinued

operations per common share |

|

|

|

|

|

|

|

|

|

|

| Basic and

diluted |

|

$ |

- |

|

|

$ |

(0.01 |

) |

|

$ |

- |

|

|

$ |

- |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Weighted

average number of common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

| Basic and

diluted |

|

|

11,990,950 |

|

|

|

11,350,971 |

|

|

|

11,999,304 |

|

|

|

11,358,971 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| **

Weighted average number of shares outstanding and per share amounts

for the six and three months ended June 30, 2016 have been

retroactively restated to reflect the Company’s 1 for 2.5 reverse

stock split, which was effective on August 19, 2016. |

| CHINANET ONLINE HOLDINGS,

INC. |

| CONSOLIDATED STATEMENTS OF CASH

FLOWS |

| (In thousands) |

| |

|

|

|

|

| |

|

Six Months Ended June 30, |

| |

|

|

2017 |

|

|

|

2016 |

|

| |

|

(US $) |

|

(US $) |

| |

|

(Unaudited) |

|

(Unaudited) |

| Cash flows from

operating activities |

|

|

|

|

| Net

loss |

|

$ |

(1,826 |

) |

|

$ |

(2,568 |

) |

| Adjustments to

reconcile net loss to net cash (used in)/provided by operating

activities |

|

|

|

|

|

Depreciation and amortization |

|

|

707 |

|

|

|

760 |

|

|

Share-based compensation expenses |

|

|

348 |

|

|

|

1,135 |

|

| Loss on

disposal of fixed assets |

|

|

- |

|

|

|

21 |

|

| Reverse

of allowances for doubtful accounts |

|

|

(29 |

) |

|

|

- |

|

| Loss on

deconsolidation of VIEs |

|

|

- |

|

|

|

9 |

|

| Deferred

taxes |

|

|

113 |

|

|

|

152 |

|

| Changes in

operating assets and liabilities |

|

|

|

|

| Accounts

receivable |

|

|

(1,666 |

) |

|

|

(771 |

) |

| Other

receivables |

|

|

(19 |

) |

|

|

1,325 |

|

|

Prepayment and deposit to suppliers |

|

|

173 |

|

|

|

612 |

|

| Due from

related parties |

|

|

(10 |

) |

|

|

(25 |

) |

| Other

current assets |

|

|

(37 |

) |

|

|

1 |

|

| Accounts

payable |

|

|

24 |

|

|

|

(154 |

) |

| Advances

from customers |

|

|

1,050 |

|

|

|

(388 |

) |

| Accrued

payroll and other accruals |

|

|

(225 |

) |

|

|

(89 |

) |

| Other

payables |

|

|

86 |

|

|

|

296 |

|

| Taxes

payable |

|

|

38 |

|

|

|

86 |

|

|

Commitment and contingencies |

|

|

- |

|

|

|

(129 |

) |

| Net cash (used

in)/provided by operating activities |

|

|

(1,273 |

) |

|

|

273 |

|

| |

|

|

|

|

| Cash flows from

investing activities |

|

|

|

|

| Payment

for office equipment and leasehold improvement |

|

|

(2 |

) |

|

|

(148 |

) |

| Long-term

investment in and advance to cost/equity method investees |

|

|

- |

|

|

|

(754 |

) |

| Payment

for purchasing of software technology |

|

|

- |

|

|

|

(1,991 |

) |

| Proceeds

from disposal of VIEs |

|

|

- |

|

|

|

28 |

|

| Cash

effect on deconsolidation of VIEs |

|

|

- |

|

|

|

(18 |

) |

| Net cash used

in investing activities |

|

|

(2 |

) |

|

|

(2,883 |

) |

| |

|

|

|

|

| Cash flows from

financing activities |

|

|

|

|

| |

|

|

|

|

| Net cash

provided by/(used in) financing activities |

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

| Changes in cash and

cash equivalents included in assets classified as held for

sale |

|

|

- |

|

|

|

55 |

|

| |

|

|

|

|

| Effect of exchange rate

fluctuation on cash and cash equivalents |

|

|

56 |

|

|

|

(72 |

) |

| |

|

|

|

|

| Net decrease in

cash and cash equivalents |

|

|

(1,219 |

) |

|

|

(2,627 |

) |

| |

|

|

|

|

| Cash and cash

equivalents at beginning of the period |

|

|

3,035 |

|

|

|

5,503 |

|

| Cash and cash

equivalents at end of the period |

|

$ |

1,816 |

|

|

$ |

2,876 |

|

| |

|

|

|

|

Contact:

MZ North America

Ted Haberfield, President

Direct: +1-760-755-2716

Email: thaberfield@mzgroup.us

Web: www.mzgroup.us

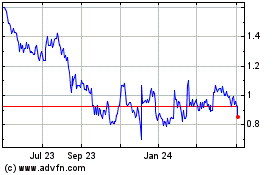

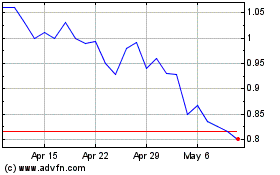

ZW Data Action Technolog... (NASDAQ:CNET)

Historical Stock Chart

From Mar 2024 to Apr 2024

ZW Data Action Technolog... (NASDAQ:CNET)

Historical Stock Chart

From Apr 2023 to Apr 2024