Forecasts Improving

Operating Performance for Second Half of 2017

Fuel Tech, Inc. (NASDAQ:FTEK), a world leader in advanced

engineering solutions for the optimization of combustion systems

and emissions control in utility and industrial applications, today

reported financial results for the second quarter (“Q2 2017”) and

six months ended June 30, 2017.

Corporate Initiatives, Progress to

Date

As announced on July 5, 2017, working with a third-party

consultant Fuel Tech has undertaken a strategic review of its

operating model and organizational design which, in combination

with ongoing and completed corporate initiatives, is expected to

produce improved financial performance for the second half of 2017

(“2H 2017”) compared to the first six months of the year (“1H

2017”) while positioning the Company for growth and profitability

in 2018. Included among these actions was the suspension of all

operations associated with the pre-revenue development stage Fuel

Conversion business segment, effective June 28, 2017. Accordingly,

the financial results of Fuel Conversion have been presented as

discontinued operations for all periods presented.

Results from continuing operations for Q2 2017 included total

charges of $4.5 million ($4.0 million of which were non-cash),

reflecting activities associated with the strategic operations

review.

“The actions we have taken to date, while difficult, are

allowing us to stabilize the business and create a foundation for

improving operating results,” said Vincent J. Arnone, President and

CEO of Fuel Tech. Mr. Arnone noted the following:

- Fuel Tech has announced $22 million of

new orders thus far in 2017, making it one of the most successful

booking periods in the Company’s recent history;

- capital projects backlog rose to $21.4

million at June 30, 2017, a $13.4 million increase from December

31, 2016; with our recent contract award announcements in July, our

effective backlog today is in excess of $25 million;

- Q2 2017 revenues rose by 15%

sequentially from Q1 2017, reflecting the initial conversion of new

Air Pollution Control (“APC”) orders announced thus far in

2017;

- backlog-to-revenue conversion is

expected to accelerate beginning in Q3 2017;

- Q2 2017 Selling, General &

Administrative (“S,G&A”) expenses, excluding $0.8 million in

charges, declined to $5.1 million from $6.8 million in Q2 2016;

and

- approximately $19 million of costs

(excluding charges) are expected to be removed over the three-year

period ending December 31, 2017.

Outlook for 2H 2017

“Although challenges remain, both operationally and within our

existing end markets, we are confident that our results in 2H 2017

will benefit from higher revenue, a continuing decline in corporate

costs, and the elimination of losses associated with Fuel

Conversion,” said Mr. Arnone.

Although there can be no assurances, based on the Company’s

current operations and expectations, Fuel Tech management forecasts

the following financial trends for 2H 2017:

- an approximate 50% increase in revenues

from the $18.2 million reported in 1H 2017

- SG&A of between $10 and $11

million, as compared to $11.1 million in 1H 2017

- a significantly narrowed operating loss

when compared to an operating loss of $7.4 million in 1H 2017

- target slightly positive Adjusted

EBITDA, as compared to an Adjusted EBITDA loss of $4.1 million in

1H 2017

- cash balances will remain stable to

slightly higher from June 30, 2017

“We will also continue to invest in new technologies and pursue

outside opportunities that we believe will help broaden our

industry presence and address new markets that leverage our

experience as a global provider of environmental solutions,” Mr.

Arnone concluded.

Q2 2017 Results Overview

Consolidated revenues declined to $9.7 million from $15.2

million in Q2 2016, reflecting slower business activity within our

APC and FUEL CHEM® business segments.

SG&A expenses declined 12.4% to $5.9 million from $6.8

million in Q2 2016, reflecting the impact of ongoing cost

containment initiatives. Excluding $0.8 million of non-cash charges

recorded in Q2 2017, SG&A was $5.1 million representing a 24.2%

decline from Q2 2016.

Operating loss for Q2 2017 rose to $5.6 million from an

operating loss of $1.5 million in Q2 2016. Operating loss in Q2

2017 included $4.5 million in charges (collectively, “the charges”)

consisting of the following: $3.0 million non-cash building

impairment charge; $0.8 million non-cash accelerated stock vesting

charge; $0.4 million in accruals associated with foreign

operations; $0.2 million of incremental inventory reserves; and

$0.1 million in severance. Exclusive of the charges, operating loss

for Q2 2017 was $1.1 million.

Net loss from continuing operations for Q2 2017 was $5.6

million, or $0.24 per share, compared to a net loss from continuing

operations of $1.8 million, $0.08 per share, in Q2 2016; excluding

the charges, net loss from continuing operations for Q2 2017 was

$1.1 million, or $0.05 per share.

APC segment revenues in Q2 2017 declined by 45% to $5.5 million

from $10.0 million in Q2 2016. Although the challenging operating

environment for coal-fired utility and industrial plants remains,

the pace of U.S. bookings increased considerably during the first

six months of 2017 as compared to historical levels. APC gross

margin was $1.4 million, or 26%, as compared to $2.9 million, or

28.7%, in Q2 2016.

FUEL CHEM segment revenues declined to $4.2 million during Q2

2017 from $5.1 million during Q2 2016, with gross margin of 52% as

compared to 53% for the same period last year. This segment will

likely continue to be affected by a reduction in electricity demand

from coal-fired combustion units and low natural gas prices, which

leads to fuel switching, unscheduled outages, and combustion units

operating at less than capacity.

Research and development (“R&D”) expenses for Q2 2017 were

$0.3 million, comparable with Q2 2016. R&D for the first half

of 2017 was $0.6 million, down from $0.8 million in the comparable

prior year period.

Adjusted EBITDA loss for Q2 2017 was $2.2 million as compared to

an Adjusted EBITDA loss of $1.1 million for Q2 2016. Excluding the

charges, Adjusted EBITDA loss for Q2 2017 was $1.2 million.

At June 30, 2017, cash and cash equivalents were $12.6 million,

which included restricted cash of $6.0 million. The decline in cash

from March 31, 2017 was due primarily to cash used in operations

due to historically low backlog at December 31, 2016. Shareholders’

equity was $35.4 million, or $1.49 per share, and the Company had

zero long-term debt.

Year-to-Date Results

Overview

Consolidated revenues for the first six months of 2017 were

$18.2 million as compared to $33.0 million in 2016, due primarily

to the reasons cited above.

SG&A expenses for the six months ended June 30, 2017

and 2016 were $11.1 million and $13.9 million, respectively. On a

total dollar basis, SG&A for the year-to-date period decreased

by $2.8 million, or 20.1%, for the same reasons as Q2 2017.

Excluding the charges, SG&A for the first half of 2017 was

$10.3 million, or 56.4% of total revenues.

Operating loss was $7.4 million as compared to an operating loss

of $3.4 million in 2016, and included the above-referenced charges.

Absent the charges, operating loss for Q2 2017 was $2.9

million.

Net loss from continuing operations was $7.4 million, or $0.31

per share, compared to a net loss from continuing operations of

$3.8 million, $0.16 per share, in the same period last year.

Excluding the charges, net loss from continuing operations for the

first half of 2017 was $2.9 million, or $0.12 per share.

Conference Call

Management will host a conference call on Tuesday, August 15,

2017 at 9:00 am ET to discuss the results and business activities.

Interested parties may participate in the call by dialing:

- (877) 423-9820 (Domestic) or

- (201) 493-6749 (International)

The conference call will also be accessible via the Upcoming

Events section of the Company’s web site at www.ftek.com. Following management’s opening

remarks, there will be a question and answer session. Questions may

be asked during the live call, or alternatively, you may e-mail

questions in advance to dsullivan@equityny.com. For those who cannot

listen to the live broadcast, an online replay will be available at

www.ftek.com.

About Fuel Tech

Fuel Tech is a leading technology company engaged in the

worldwide development, commercialization and application of

state-of-the-art proprietary technologies for air pollution

control, process optimization, and advanced engineering services.

These technologies enable customers to produce both energy and

processed materials in a cost-effective and environmentally

sustainable manner.

The Company’s nitrogen oxide (NOx) reduction technologies

include advanced combustion modification techniques and

post-combustion NOx control approaches, including NOxOUT®, HERT™,

and Advanced SNCR systems, ASCR™ Advanced Selective Catalytic

Reduction systems, and I-NOx® Integrated NOx Reduction Systems,

which utilize various combinations of these systems, along with the

ULTRA® process for safe ammonia generation. These technologies have

established Fuel Tech as a leader in NOx reduction, with

installations on over 900 units worldwide.

Fuel Tech’s technologies for particulate control include

Electrostatic Precipitator (ESP) products and services including

complete turnkey capability for ESP retrofits, with experience on

units up to 700 MW. Flue gas conditioning (FGC) systems include

treatment using sulfur trioxide (SO3) and ammonia (NH3) based

conditioning to improve the performance of ESPs by modifying the

properties of fly ash particles. Fuel Tech’s particulate control

technologies have been installed on more than 125 units

worldwide.

The Company’s FUEL CHEM® technology revolves around the unique

application of chemicals to improve the efficiency, reliability,

fuel flexibility, boiler heat rate, and environmental status of

combustion units by controlling slagging, fouling, corrosion,

opacity and improving boiler operations. The Company has experience

with this technology, in the form of a customizable FUEL CHEM

program, on over 110 units.

Fuel Tech also provides a range of services, including boiler

tuning and selective catalytic reduction (SCR) optimization

services. In addition, flow corrective devices and physical and

computational modeling services are available to optimize flue gas

distribution and mixing in both power plant and industrial

applications.

Many of Fuel Tech’s products and services rely heavily on the

Company’s exceptional Computational Fluid Dynamics modeling

capabilities, which are enhanced by internally developed, high-end

visualization software. These capabilities, coupled with the

Company’s innovative technologies and multi-disciplined team

approach, enable Fuel Tech to provide practical solutions to some

of our customers’ most challenging problems. For more information,

visit Fuel Tech’s web site at www.ftek.com.

NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This press release contains “forward-looking statements” as

defined in Section 21E of the Securities Exchange Act of 1934, as

amended, which are made pursuant to the safe harbor provisions of

the Private Securities Litigation Reform Act of 1995 and reflect

Fuel Tech’s current expectations regarding future growth, results

of operations, cash flows, performance and business prospects, and

opportunities, as well as assumptions made by, and information

currently available to, our management. Fuel Tech has tried to

identify forward-looking statements by using words such as

“anticipate,” “believe,” “plan,” “expect,” “estimate,” “intend,”

“will,” and similar expressions, but these words are not the

exclusive means of identifying forward-looking statements. These

statements are based on information currently available to Fuel

Tech and are subject to various risks, uncertainties, and other

factors, including, but not limited to, those discussed in Fuel

Tech’s Annual Report on Form 10-K in Item 1A under the caption

“Risk Factors,” and subsequent filings under the Securities

Exchange Act of 1934, as amended, which could cause Fuel Tech’s

actual growth, results of operations, financial condition, cash

flows, performance and business prospects and opportunities to

differ materially from those expressed in, or implied by, these

statements. Fuel Tech undertakes no obligation to update such

factors or to publicly announce the results of any of the

forward-looking statements contained herein to reflect future

events, developments, or changed circumstances or for any other

reason. Investors are cautioned that all forward-looking statements

involve risks and uncertainties, including those detailed in Fuel

Tech’s filings with the Securities and Exchange Commission.

FUEL TECH, INC.

CONSOLIDATED BALANCE SHEETS

(Unaudited)

(in thousands, except share and per share

data)

June 30,2017 December 31,2016

ASSETS Current

assets: Cash and cash equivalents $ 6,576 $ 11,826 Restricted cash

1,020 6,020 Marketable securities 11 9 Accounts receivable, net

18,969 18,790 Inventories, net 1,560 1,012 Prepaid expenses and

other current assets 2,984 2,891 Income taxes receivable 65

87 Total current assets 31,185 40,635 Property and

equipment, net 6,601 10,517 Goodwill 2,116 2,116 Other intangible

assets, net 1,722 1,796 Restricted cash 5,000 — Assets held for

sale 1,839 2,058 Other assets 595 666 Total assets $

49,058 $ 57,788

LIABILITIES AND SHAREHOLDERS'

EQUITY Current liabilities: Accounts payable 4,737 6,303

Accrued liabilities: Employee compensation 1,189 1,390 Other

accrued liabilities 7,192 6,357 Total current

liabilities 13,118 14,050 Other liabilities 512 346

Total liabilities 13,630 14,396 COMMITMENTS AND

CONTINGENCIES (Note 10) Shareholders’ equity:

Common stock, $.01 par value, 40,000,000

shares authorized, 24,777,001 and 23,800,924shares issued, and

24,132,910, and 23,446,035 shares outstanding, respectively

248 238 Additional paid-in capital 138,527 137,380 Accumulated

deficit (100,880 ) (91,520 ) Accumulated other comprehensive loss

(1,071 ) (1,568 ) Nil coupon perpetual loan notes 76 76 Treasury

stock, 644,091 and 354,889 shares in 2017 and 2016, respectively,

at cost (1,472 ) (1,214 ) Total shareholders’ equity 35,428

43,392 Total liabilities and shareholders’ equity $ 49,058

$ 57,788

FUEL

TECH, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(in thousands, except share and per-share

data)

Three Months Ended June 30, Six Months

Ended June 30, 2017 2016

2017 2016 Revenues $ 9,741 $ 15,175 $

18,232 $ 32,997

Costs and expenses: Cost of sales 6,116

9,595 10,885 21,369 Selling, general and administrative 5,923 6,760

11,077 13,922 Restructuring charge 58 — 119 317 Research and

development 280 295 564 766 Building impairment 2,965 —

2,965 — 15,342 16,650 25,610

36,374

Operating loss (5,601 ) (1,475 ) (7,378

) (3,377 ) Interest income 3 6 6 16 Other expense (2 ) (221 ) (4 )

(484 )

Loss from continuing operations before income taxes

(5,600 ) (1,690 ) (7,376 ) (3,845 ) Income tax benefit (expense) 15

(111 ) 15 94

Net loss from continuing

operations (5,585 ) (1,801 ) (7,361 ) (3,751 ) Loss from

discontinued operations (net of income tax benefit of $0 in 2017

and 2016) (1,269 ) (827 ) (1,999 ) (1,514 )

Net loss $

(6,854 ) $ (2,628 ) $ (9,360 ) $ (5,265 )

Net loss per common

share: Basic Continuing operations $ (0.24 ) $ (0.08 ) $

(0.31 ) $ (0.16 ) Discontinued operations $ (0.05 ) $ (0.04 ) $

(0.08 ) $ (0.07 )

Basic net loss per common share $ (0.29 )

$ (0.12 ) $ (0.39 ) $ (0.23 )

Diluted Continuing operations

$ (0.24 ) $ (0.08 ) $ (0.31 ) $ (0.16 ) Discontinued operations $

(0.05 ) $ (0.04 ) $ (0.08 ) $ (0.07 )

Diluted net loss per

common share $ (0.29 ) $ (0.12 ) $ (0.39 ) $ (0.23 )

Weighted-average number of common shares outstanding: Basic

23,738,000 23,381,000 23,606,000 23,283,000

Diluted 23,738,000 23,381,000 23,606,000

23,283,000

FUEL

TECH, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE

LOSS

(Unaudited)

(in thousands)

Three Months Ended June 30, Six Months

Ended June 30, 2017 2016

2017 2016 Net loss $ (6,854 ) $ (2,628 ) $

(9,360 ) $ (5,265 ) Other comprehensive income (loss): Foreign

currency translation adjustments 380 (111 ) 496 318 Unrealized

gains (losses) from marketable securities, net of tax — (5 )

1 (8 ) Total other comprehensive income (loss) 380

(116 ) 497 310 Comprehensive loss $ (6,474 ) $ (2,744

) $ (8,863 ) $ (4,955 )

FUEL TECH,

INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(in thousands)

Six Months EndedJune 30, 2017 2016

Operating

Activities Net loss $ (9,360 ) $ (5,265 ) Loss from

discontinued operations 1,999 1,514 Net loss from

continuing operations (7,361 ) (3,751 ) Adjustments to reconcile

net loss to net cash used in operating activities: Depreciation 755

926 Amortization 109 560 Loss on disposal of equipment 114 26

Provision for doubtful accounts, net of recoveries 30 151 Excess

and obsolete inventory reserve 228 — Deferred income taxes — (10 )

Building impairment 2,965 — Stock-based compensation, net of

forfeitures 1,156 1,041 Changes in operating assets and

liabilities: Accounts receivable (110 ) 173 Inventories (570 ) 149

Prepaid expenses, other current assets and other non-current assets

16 2,861 Accounts payable (1,591 ) (1,630 ) Accrued liabilities and

other non-current liabilities 323 (1,482 ) Net cash used in

operating activities - continuing operations (3,936 ) (986 ) Net

cash used in operating activities - discontinued operations (1,316

) (1,213 ) Net cash used in operating activities (5,252 ) (2,199 )

Investing Activities Purchases of equipment and patents (233

) (302 ) Proceeds from the sale of equipment 1 1 Net

cash used in investing activities (232 ) (301 )

Financing

Activities Change in restricted cash — (7,020 ) Taxes paid on

behalf of equity award participants (258 ) (172 ) Net cash used in

financing activities (258 ) (7,192 ) Effect of exchange rate

fluctuations on cash 492 434

Net decrease in cash

and cash equivalents (5,250 ) (9,258 ) Cash and cash

equivalents at beginning of period 11,826 21,684

Cash and cash equivalents at end of period $ 6,576 $

12,426

FUEL TECH, INC.

BUSINESS SEGMENT FINANCIAL DATA

(Unaudited)

(in thousands)

Three months ended June 30, 2017

Air PollutionControl Segment

FUEL CHEMSegment Other Total Revenues from external customers $

5,545 $ 4,196 $ — $ 9,741 Cost of sales (4,103 ) (2,013 ) —

(6,116 ) Gross margin 1,442 2,183 — 3,625 Selling, general and

administrative — — (5,923 ) (5,923 ) Restructuring charge (58 ) — —

(58 ) Research and development — — (280 ) (280 ) Building

Impairment — — (2,965 ) (2,965 ) Operating income

(loss) $ 1,384 $ 2,183 $ (9,168 ) $ (5,601 )

Three months ended June 30, 2016 Air PollutionControl Segment FUEL

CHEMSegment Other Total Revenues from external customers $ 10,031 $

5,144 $ — $ 15,175 Cost of sales (7,152 ) (2,443 ) — (9,595

) Gross margin 2,879 2,701 — 5,580 Selling, general and

administrative — — (6,760 ) (6,760 ) Restructuring charge — — — —

Research and development — — (295 ) (295 ) Operating

income (loss) $ 2,879 $ 2,701 $ (7,055 ) $ (1,475 )

Six months ended June 30, 2017 Air PollutionControl Segment

FUEL CHEMSegment Other Total Net Sales from external customers $

9,547 $ 8,685 $ — $ 18,232 Cost of sales (6,603 ) (4,282 ) —

(10,885 ) Gross margin 2,944 4,403 — 7,347 Selling, general and

administrative — — (11,077 ) (11,077 ) Restructuring charge (58 )

(61 ) — (119 ) Research and development — — (564 ) (564 ) Building

Impairment — — (2,965 ) (2,965 ) Operating income

(loss) $ 2,886 $ 4,342 $ (14,606 ) $ (7,378 )

Six months ended June 30, 2016 Air PollutionControl Segment FUEL

CHEMSegment Other Total Net Sales from external customers $ 23,021

$ 9,976 $ — $ 32,997 Cost of sales (16,471 ) (4,898 ) —

(21,369 ) Gross margin 6,550 5,078 — 11,628 Selling, general and

administrative — — (13,922 ) (13,922 ) Restructuring charge (164 )

(153 ) — (317 ) Research and development — — (766 )

(766 ) Operating income (loss) $ 6,386 $ 4,925 $

(14,688 ) $ (3,377 )

Note: Fuel Tech is an integrated company that segregates its

financial results into three reportable segments. The Air Pollution

Control technology segment includes technologies to reduce NOx

emissions in flue gas from boilers, incinerators, furnaces and

other stationary combustion sources. The FUEL CHEM® technology

segment, which uses chemical processes in combination with advanced

CFD and CKM boiler modeling, for the control of slagging, fouling,

corrosion, opacity and other sulfur trioxide-related issues in

furnaces and boilers through the addition of chemicals into the

furnace using TIFI® Targeted In-Furnace Injection™ technology. The

Fuel Conversion segment represents CARBONITE® fuel conversion

process and technology, which can convert coals of various grades

into value-added products that are high in energy content,

carbon-rich and less pollutive. The “Other” classification includes

those profit and loss items not allocated by Fuel Tech to each

reportable segment.

FUEL TECH, INC. GEOGRAPHIC

INFORMATION(Unaudited)(in thousands)

Information concerning Fuel Tech’s operations by geographic area

is provided below. Revenues are attributed to countries based on

the location of the customer. Assets are those directly associated

with operations of the geographic area.

Three Months EndedJune 30, Six

Months EndedJune 30, 2017 2016 2017 2016

Revenues: United States $ 5,915 $ 12,255 $ 12,649 $

26,685 Foreign 3,826 2,920 5,583 6,312 $ 9,741

$ 15,175 $ 18,232 $ 32,997

June 30,2017 December 31,2016 Assets: United

States $ 29,619 $ 37,684 Foreign 19,439 20,104 $ 49,058

$ 57,788

FUEL TECH,

INC.

RECONCILIATION OF GAAP NET LOSS TO EBITDA

AND ADJUSTED EBITDA

(Unaudited)

(in thousands)

Three Months EndedJune 30,

Six Months EndedJune 30, 2017 2016 2017 2016 Net loss

$ (6,854 ) $ (2,628 ) $ (9,360 ) $ (5,265 ) Interest income 3 — — —

Income tax benefit (15 ) 111 (15 ) (94 ) Depreciation expense 350

440 755 926 Amortization expense 205 427 410

861 EBITDA (6,311 ) (1,650 ) (8,210 ) (3,572 ) Stock

compensation expense 1,166 580 1,156 1,041 Building impairment

2,965 — 2,965 — ADJUSTED EBITDA (2,180

) (1,070 ) (4,089 ) (2,531 )

Adjusted EBITDA

To supplement the Company's consolidated financial statements

presented in accordance with generally accepted accounting

principles in the United States (GAAP), the Company has provided an

Adjusted EBITDA disclosure as a measure of financial performance.

Adjusted EBITDA is defined as net income (loss) before interest

expense, income tax expense (benefit), depreciation expense,

amortization expense and stock compensation expense. The Company's

reference to these non-GAAP measures should be considered in

addition to results prepared in accordance with GAAP standards, but

are not a substitute for, or superior to, GAAP results.

Adjusted EBITDA is provided to enhance investors' overall

understanding of the Company's current financial performance and

ability to generate cash flow, which we believe is a meaningful

measure for our investor and analyst communities. In many cases

non-GAAP financial measures are utilized by these individuals to

evaluate Company performance and ultimately determine a reasonable

valuation for our common stock. A reconciliation of Adjusted EBITDA

to the nearest GAAP measure of net income (loss) has been included

in the above financial table.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170814005916/en/

Fuel Tech, Inc.David S. Collins, (630) 845-4500Chief Financial

OfficerorThe Equity Group Inc.Devin Sullivan, (212) 836-9608Senior

Vice President

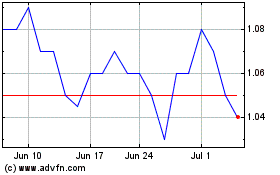

Fuel Tech (NASDAQ:FTEK)

Historical Stock Chart

From Mar 2024 to Apr 2024

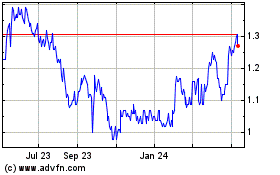

Fuel Tech (NASDAQ:FTEK)

Historical Stock Chart

From Apr 2023 to Apr 2024