GSE Systems, Inc. (GSE or the Company) (NYSE MKT: GVP),

the world leader in real-time high-fidelity simulation systems and

training/consulting solutions to the power and process industries,

today announced financial results for the second quarter (Q2) ended

June 30, 2017.

Q2 2017 OVERVIEW

- Revenue increased 37.9% to $17.1

million, from $12.4 million in Q2 2016.

- Gross profit rose 40.9% to $5.0 million

from $3.6 million in Q2 2016.

- Net income grew to $0.8 million, or

$0.04 per diluted share, from $0.1 million, or $0.01 per diluted

share, in Q2 2016.

- Adjusted net income1 increased 92.5% to

$1.6 million, or $0.08 per diluted share, from $0.9 million, or

$0.05 per diluted share, in Q2 2016.

- Adjusted EBITDA increased 71.8% to $2.1

million from $1.2 million in Q2 2016.

- New orders totaled $8.1 million in Q2

2017.

- Cash flow provided by (used in)

operations was $1.8 million compared to $(0.6) million in Q2

2016.

1 Refer to the non-GAAP reconciliation tables at the end of this

press release for a definition of “adjusted EBITDA” and “adjusted

net income”.

At June 30, 2017

- Cash and equivalents of $24.5 million,

including $1.0 million of restricted cash, compared to $22.9

million, including $1.1 million of restricted cash, at December 31,

2016.

- Working capital of $15.4 million and

current ratio of 1.6x.

- No outstanding long-term debt.

- Backlog totaled $68.6 million, compared

to $73.2 million at December 31, 2016.

Kyle J. Loudermilk, GSE’s President and Chief Executive Officer,

said, “In Q2 2017, GSE achieved strong revenue and net income

growth, driven by robust demand for our Nuclear Industry Training

and Consulting staffing services and the advancement of three major

nuclear simulation projects in our Performance Improvement

Solutions division. Our backlog remains strong, reflecting our

focus on organic business initiatives and operational execution. We

ended the quarter with almost $25 million of cash and no debt. I am

delighted with our progress in the first half of 2017, and we are

well positioned to create additional shareholder value through

organic and inorganic growth initiatives."

Q2 2017 RESULTS

Q2 2017 revenue increased 37.9% to $17.1 million, from $12.4

million in Q2 2016, driven by a 32.9% rise in Nuclear Industry

Training and Consulting revenue, primarily due to higher staffing

demand from a major customer, combined with a 40.4% increase in

Performance Improvement Solutions revenue, mainly due to three

projects from a major customer.

(in thousands)

Three months ended

Six months ended

June 30, June 30,

Revenue 2017 2016 2017

2016 (unaudited) (unaudited) (unaudited) (unaudited)

Performance Improvement Solutions $11,686 $8,323 $21,356 $17,166

Nuclear Industry Training and Consulting $5,439 $4,092 $12,111

$8,225 Total Revenue $17,125 $12,415 $33,467 $25,391

Performance Improvement Solutions new orders totaled $4.2

million in Q2 2017 compared to $5.8 million in Q2 2016. Nuclear

Industry Training and Consulting new orders totaled $3.9 million in

Q2 2017 compared to $3.4 million in Q2 2016.

Q2 2017 gross profit increased to $5.0 million, or 29.3% of

revenue, from $3.6 million, or 28.7 % of revenue, in Q2 2016.

(in thousands)

Three months ended

Six months ended June 30, June 30,

Gross Profit: 2017 %

2016 % 2017 %

2016 % (unaudited) (unaudited)

(unaudited) (unaudited) Performance Improvement Solutions

$4,389 37.6% $2,911 35.0% $7,433 34.8% $6,056

35.3% Nuclear Industry Training and Consulting 628 11.5% 649

15.9% 1,706 14.1% 1,128 13.7% Total Gross Profit $5,017 29.3%

$3,560 28.7% $9,139 27.3% $7,184 28.3%

Performance Improvement Solutions gross profit for Q2 2017 was

$4.4 million, or 37.6% gross margin, compared to $2.9 million, or

35.0% gross margin, in Q2 2016. The year-over-year increase in

Performance Improvement Solutions gross margin percent in Q2 2017

primarily reflects the change in mix of projects with higher

margins.

Nuclear Industry Training and Consulting gross profit for Q2

2017 was $0.6 million, or 11.5% gross margin, compared to

approximately $0.6 million, or 15.9% gross margin, in Q2 2016. The

year-over-year decrease in Nuclear Industry Training and Consulting

gross margin percentage in Q2 2017 primarily is due to a lower

margin project from a major customer.

Selling, general and administrative expenses in Q2 2017 totaled

$3.8 million, or 22.0% of revenue, compared to $2.6 million, or

20.6% of revenue, in Q2 2016. The increase in selling, general, and

administrative expenses resulted from a $1.2 million year-over-year

rise in corporate charges primarily due to a higher non-cash stock

compensation expense and higher professional fees.

Research and development costs, net of capitalized software,

totaled approximately $0.3 million for Q2 2017 and Q2 2016,

respectively.

Operating income was approximately $0.8 million in Q2 2017,

compared to operating income of approximately $0.2 million in Q2

2016.

Net income for Q2 2017 totaled approximately $0.8 million, or

$0.04 per basic and diluted share, compared to net income of

approximately $0.1 million, or $0.01 per basic and diluted share,

in Q2 2016.

Adjusted net income, excluding the impact of gain/loss from the

change in fair value of contingent consideration, restructuring

charges, stock-based compensation expense, consulting support for

finance restructuring, and Westinghouse bankruptcy related charges

increased to approximately $1.6 million, or $0.08 per diluted

share, compared to approximately $0.9 million, or $0.05 per diluted

share, in Q2 2016.

Earnings before interest, taxes, depreciation and amortization

(EBITDA) for Q2 2017 was $1.3 million compared to $0.5 million in

Q2 2016.

Adjusted EBITDA, which excludes the impact of gain/loss from the

change in fair value of contingent consideration, restructuring

charges, stock-based compensation expense, consulting support for

finance restructuring, and Westinghouse bankruptcy related charges,

totaled approximately $2.1 million in Q2 2017, compared to

approximately $1.2 million in Q2 2016.

BACKLOG AND CASH

POSITION

Backlog at June 30, 2017, totaled $68.6 million compared to

$73.2 million at December 31, 2016. Backlog at June 30, 2017,

included $57.4 million of Performance Improvement Solutions backlog

and $11.2 million of Nuclear Industry Training and Consulting

backlog.

GSE’s cash position at June 30, 2017, was $24.5 million,

including $1.0 million of restricted cash, compared to $22.9

million, including $1.1 million of restricted cash, at December 31,

2016.

CONFERENCE CALL

Management will host a conference call today at 4:30 pm Eastern

Time to discuss Q2 results and other matters.

Interested parties may participate in the call by dialing:

- (877) 407-9753 (Domestic)

- (201) 493-6739 (International)

The conference call will also be accessible via the following

link:http://www.investorcalendar.com/IC/CEPage.asp?ID=17941

For those who cannot listen to the live broadcast, an online

webcast replay will be available at www.gses.com or through

November 14, 2017 at the following

link:http://www.investorcalendar.com/IC/CEPage.asp?ID=17941

ABOUT GSE SYSTEMS,

INC.

GSE Systems, Inc. is a world leader in real-time high-fidelity

simulation, providing a wide range of simulation, training,

consulting, and engineering solutions to the power and process

industries. Its comprehensive and modular solutions help customers

achieve performance excellence in design, training and operations.

GSE’s products and services are tailored to meet specific client

requirements such as scope, budget and timeline. The Company has

over four decades of experience, more than 1,100 installations, and

hundreds of customers in over 50 countries spanning the globe. GSE

Systems is headquartered in Sykesville (Baltimore), Maryland, with

offices in Huntsville, Alabama; Chennai, India; Nyk�ping, Sweden;

Stockton-on-Tees, UK; and Beijing, China. Information about GSE

Systems is available at www.gses.com.

FORWARD LOOKING

STATEMENTS

We make statements in this press release that are considered

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934. These statements reflect our

current expectations concerning future events and results. We use

words such as “expect,” “intend,” “believe,” “may,” “will,”

“should,” “could,” “anticipates,” and similar expressions to

identify forward-looking statements, but their absence does not

mean a statement is not forward-looking. These statements are not

guarantees of our future performance and are subject to risks,

uncertainties, and other important factors that could cause our

actual performance or achievements to be materially different from

those we project. For a full discussion of these risks,

uncertainties, and factors, we encourage you to read our documents

on file with the Securities and Exchange Commission, including

those set forth in our periodic reports under the forward-looking

statements and risk factors sections. We do not intend to update or

revise any forward-looking statements, whether as a result of new

information, future events, or otherwise.

GSE SYSTEMS, INC. AND

SUBSIDIARIES

Condensed Consolidated Statements of

Operations

(in thousands, except share and per share

data)

Three Months ended Six

Months ended June 30, June 30, 2017

2016 2017 2016 (unaudited) (unaudited)

(unaudited) (unaudited) Revenue

$17,125

$12,415 $33,467 $25,391 Cost of revenue 12,108 8,855 24,328 18,207

Gross profit 5,017 3,560 9,139 7,184 Selling, general and

administrative 3,774 2,563 7,366 5,319 Research and development 348

318 750 673 Restructuring charges - 277 45 402 Depreciation 99 102

175 202 Amortization of definite-lived intangible assets 34 73 98

146 Operating expenses 4,255 3,333 8,434 6,742

Operating income 762 227 705 442 Interest income, net

18 13 45 40 Gain (loss) on derivative instruments, net 315 (17) 155

(135) Other income (expense), net (34) (4) (37) 98 Income

before income taxes 1,061 219 868 445 Provision for income

taxes 234 108 307 196 Net income $827

$111 $561 $249 Basic earnings per common share $0.04 $0.01

$0.03 $0.01 Diluted earnings per common share $0.04 $0.01 $0.03

$0.01 Weighted average shares outstanding - Basic 19,196,133

18,010,949 19,154,297 17,956,622 Weighted average shares

outstanding - Diluted 19,561,245 18,262,413 19,471,794 18,194,039

GSE SYSTEMS, INC AND

SUBSIDIARIES

Selected Balance Sheet Data (in

thousands)

(unaudited)

(audited)

June 30, 2017

December 31, 2016 Cash and cash equivalents $23,528 $21,747

Restricted cash – current 959 1,140 Current assets 41,738 43,802

Total assets 49,875 53,656 Current liabilities $26,295

$31,386 Long-term liabilities 1,325 1,149 Stockholders' equity

22,255 21,121

EBITDA and Adjusted EBITDA

Reconciliation (in thousands)

EBITDA and Adjusted EBITDA are not measures of financial

performance under generally accepted accounting principles

(“GAAP”). Management believes EBITDA and Adjusted EBITDA, in

addition to operating profit, net income and other GAAP measures,

are useful to investors to evaluate the Company’s results because

it excludes certain items that are not directly related to the

Company’s core operating performance that may, or could, have a

disproportionate positive or negative impact on our results for any

particular period. Investors should recognize that EBITDA and

Adjusted EBITDA might not be comparable to similarly-titled

measures of other companies. This measure should be considered in

addition to, and not as a substitute for or superior to, any

measure of performance prepared in accordance with GAAP. A

reconciliation of non-GAAP EBITDA and Adjusted EBITDA to the most

directly comparable GAAP measure in accordance with SEC Regulation

G follows:

Three Months ended

Six Months ended

June 30,

June 30, 2017 2016 2017

2016 (unaudited) (unaudited) (unaudited) (unaudited) Net

income $827 $111 $561 $249 Interest income, net (18) (13) (45) (40)

Provision for income taxes 234 108 307 196 Depreciation and

amortization 250 279 507 533 EBITDA 1,293 485 1,330 938 Gain/loss

from the change in fair value of contingent consideration 43 224

297 155 Restructuring charges - 277 45 402 Stock-based compensation

expense 650 241 1,246 488 Consulting support for finance

restructuring - - - 78 Westinghouse bankruptcy related expense 122

- 122 - Adjusted EBITDA $2,108 $1,227 $3,040 $2,061

Adjusted Net Income and Adjusted EPS

Reconciliation (in thousands, except per share amounts)

Adjusted Net Income and adjusted earnings (loss) per share

(“adjusted EPS”) are not measures of financial performance under

generally accepted accounting principles (“GAAP”). Management

believes adjusted net income and adjusted EPS, in addition to other

GAAP measures, are useful to investors to evaluate the Company’s

results because they exclude certain items that are not directly

related to the Company’s core operating performance that may, or

could, have a disproportionate positive or negative impact on our

results for any particular period. These measures should be

considered in addition to, and not as a substitute for or superior

to, any measure of performance prepared in accordance with GAAP. A

reconciliation of non-GAAP adjusted net income and adjusted EPS to

GAAP net income, the most directly comparable GAAP financial

measure, is as follows:

Three Months ended

Six Months ended

June 30,

June 30, 2017 2016 2017

2016 (unaudited) (unaudited) (unaudited) (unaudited)

Net

income $827 $111 $561 $249

Gain/loss from the change in fair value of contingent consideration

43 224 297 155 Restructuring charges - 277 45 402 Stock-based

compensation expense 650 241 1,246 488 Consulting support for

finance restructuring - - - 78 Westinghouse bankruptcy related

expense 122 - 122 - Adjusted net income $1,642 $853 $2,271 $1,372

Earnings per share - diluted $0.04 $0.01 $0.03 $0.01

Adjusted earnings per share - diluted $0.08 $0.05 $0.12 $0.08

Weighted average shares outstanding - Diluted 19,561,245

18,262,413 19,471,794 18,194,039

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170814005869/en/

CompanyGSE Systems, Inc.Chris Sorrells, 410-970-7802Chief

Operating OfficerorThe Equity Group Inc.Devin Sullivan,

212-836-9608Senior Vice

Presidentdsullivan@equityny.comorKalle

Ahl, CFA, 212-836-9614Senior

Associatekahl@equityny.com

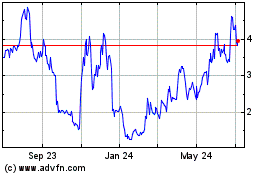

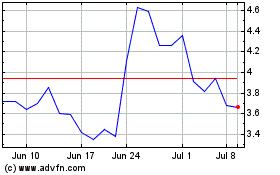

GSE Systems (NASDAQ:GVP)

Historical Stock Chart

From Mar 2024 to Apr 2024

GSE Systems (NASDAQ:GVP)

Historical Stock Chart

From Apr 2023 to Apr 2024