Partners Announces $7.8 Million and $5.6 Million Mortgages at Ontario Properties

August 14 2017 - 1:58PM

Partners Real Estate Investment Trust ("Partners" or the "REIT")

(TSX:PAR.UN) is pleased to announce that it has finalized a $7.8

million mortgage at the REIT's St. Clair Beach Town Centre property

(“St. Clair”) in Tecumseh, Ontario and a $5.6 million mortgage at

the REIT’s Grand Bend Town Centre property (“Grand Bend”) in Grand

Bend, Ontario. These new mortgages are both with CMLS.

The St. Clair mortgage closed today and is for

$7.8 million, has a ten-year term, a 25 year amortization period

and an interest rate of 3.867%. Partners will devote $5.1 million

of the mortgage towards repayment of the property's existing

mortgage, which carried an interest rate of 4.60%.

The Grand Bend mortgage closed on the 10th of

August and is for $5.6 million, has a ten-year term, a 25 year

amortization period and an interest rate of 3.898%. Partners will

devote $3.3 million of the mortgage towards repayment of the

property's existing mortgage, which carried an interest rate of

5.12%.

The combined net proceeds of $5.0 million prior

to financing costs, will be utilized for general corporate

purposes.

In association with these new mortgages,

Partners will pay a total broker fee of $46,900 to First National

Financial (TSX:FN) (TSX:FN.PR.A). Moray Tawse, a significant

unitholder of the REIT, has an interest in First National

Financial.

About Partners REIT

Partners REIT is a growth-oriented real estate

investment trust focused on the expansion and management of a

portfolio of 34 retail and mixed-use community and neighbourhood

shopping centres. These properties are located in both primary and

secondary markets across British Columbia, Alberta, Manitoba,

Ontario, and Quebec, and comprise a total of approximately 2.3

million square feet of leasable space.

Disclaimer

Certain statements included in this press

release constitute forward-looking statements, including, but not

limited to, those identified by the expressions "expect," "will"

and similar expressions to the extent they relate to Partners REIT.

The forward- looking statements are not historical facts but

reflect Partners REIT's current expectations regarding future

results or events. These forward looking statements are subject to

a number of risks and uncertainties that could cause actual results

or events to differ materially from current expectations, including

access to capital, regulatory approvals, intended acquisitions and

general economic and industry conditions. Although Partners REIT

believes that the assumptions inherent in the forward-looking

statements are reasonable, forward-looking statements are not

guarantees of future performance and, accordingly, readers are

cautioned not to place undue reliance on such statements due to the

inherent uncertainty therein.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Partners REIT Investor Relations

1 (844) 474-9620 ext. 401

investor.relations@partnersreit.com

Partners REIT

Jane Domenico Chief Executive Officer

(416) 855-3313 ext. 501

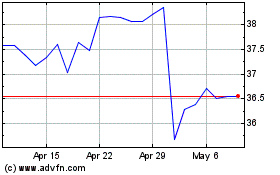

First National Financial (TSX:FN)

Historical Stock Chart

From Mar 2024 to Apr 2024

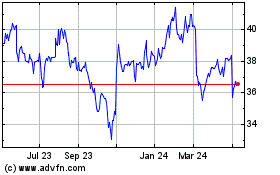

First National Financial (TSX:FN)

Historical Stock Chart

From Apr 2023 to Apr 2024