The "Principal Amount Outstanding" in the financial table

of release should read: $445,465,000 (instead of

$445,000,000).

The corrected release reads:

AES ANNOUNCES TENDER OFFER FOR UP TO $217 MILLION OF ITS

8.00% SENIOR NOTES DUE 2020

The AES Corporation (NYSE: AES) announced today the commencement

of a tender offer to purchase (the “Tender Offer”) for cash,

subject to certain terms and conditions, up to $217 million

aggregate principal amount of its outstanding 8.00% senior notes

due 2020 (the “Securities”).

The Tender Offer is scheduled to expire at 11:59 p.m., Eastern

time, on September 11, 2017 (the “Expiration Date”), unless

extended or earlier terminated by AES. The Tender Offer is being

made pursuant to an Offer to Purchase dated August 14, 2017 and a

related Letter of Transmittal dated August 14, 2017 (together, the

“Tender Offer Materials”), which set forth a more detailed

description of the Tender Offer. Holders of the Securities are

urged to carefully read the Tender Offer Materials before making

any decision with respect to the Tender Offer.

The principal amount of the Securities to be purchased pursuant

to the Tender Offer is up to $217,000,000 (the “Tender Cap

Amount”). As discussed in more detail in the Tender Offer

Materials, AES reserves the right, but is under no obligation, to

increase or decrease the Tender Cap Amount, at any time, subject to

compliance with applicable law.

The following table sets forth certain terms of the Tender

Offer:

Dollars per $1,000

PrincipalAmount of Securities

Title of Security CUSIP Number

Principal

AmountOutstanding

Tender

OfferConsideration(1)

Early TenderPremium

TotalConsideration(1)(2)

8.00% Senior Notes due 2020 00130HBN4

$445,465,000

$1,132.60

$30.00

$1,162.60

(1)

Excludes accrued and unpaid interest up

to, but not including, the applicable Settlement Date, which will

be paid in addition to the Tender Offer Consideration or Total

Consideration, as applicable.

(2)

Includes the Early Tender Premium.

The total consideration (the “Total Consideration”) payable for

each $1,000 principal amount of Securities validly tendered at or

prior to 5:00 p.m., Eastern time, on August 25, 2017 (such date and

time, as it may be extended, the “Early Tender Date”) and accepted

for purchase pursuant to the Tender Offer will be the total

consideration set forth in the table above. The Total Consideration

includes the early tender premium set forth in the table above (the

“Early Tender Premium”). Holders must validly tender and not

subsequently validly withdraw their Securities at or prior to the

Early Tender Date in order to be eligible to receive the Total

Consideration for such Securities purchased in the Tender

Offer.

Subject to the terms and conditions of the Tender Offer, each

Holder who validly tenders and does not subsequently validly

withdraw their Securities at or prior to the Early Tender Date will

be entitled to receive the Total Consideration, plus accrued and

unpaid interest up to, but not including, the applicable Settlement

Date (as defined below) if and when such Securities are accepted

for payment. Holders who validly tender their Securities after the

Early Tender Date but at or prior to the Expiration Date will be

entitled to receive only the tender offer consideration equal to

the Total Consideration less the Early Tender Premium (the “Tender

Offer Consideration”), plus accrued and unpaid interest up to, but

not including, the applicable Settlement Date, if and when such

Securities are accepted for payment.

AES reserves the right but is under no obligation, at any point

following the Early Tender Date and before the Expiration Date, to

accept for purchase any Securities validly tendered at or prior to

the Early Tender Date (the date of such purchase, the “Early

Settlement Date”). The Early Settlement Date will be determined at

AES’ option and is currently expected to occur on the first

business day following the Early Tender Date, subject to all

conditions to the Tender Offer having been satisfied or waived. The

expected Early Settlement Date is August 28, 2017, unless extended

by AES, assuming all conditions to the Tender Offer have been

satisfied or waived. Irrespective of whether AES chooses to

exercise its option to have an Early Settlement Date, AES will

purchase any remaining Securities that have been validly tendered

by the Expiration Date and that it chooses to accept for purchase,

subject to the Tender Cap Amount and all conditions to the Tender

Offer having been satisfied or waived by AES, on a date immediately

following the Expiration Date (the “Final Settlement Date” and each

of the Early Settlement Date and Final Settlement Date, a

“Settlement Date”). The Final Settlement Date is expected to occur

on the first business day following the Expiration Date, subject to

all conditions to the Tender Offer having been satisfied or waived

by AES. The expected Final Settlement Date is September 12, 2017,

unless extended by AES, assuming all conditions to the Tender Offer

have been satisfied or waived.

To receive either the Total Consideration or the Tender Offer

Consideration, holders of the Securities must validly tender and

not validly withdraw their Securities prior to the Early Tender

Date or the Expiration Date, respectively. Securities tendered may

be withdrawn from the Tender Offer at or prior to, but not after,

5:00 p.m., Eastern time, on August 25, 2017, unless extended, by

following the procedures described in the Tender Offer

Materials.

Subject to the Tender Cap Amount and the other terms and

conditions described in the Tender Offer Materials, including the

Financing Condition (as defined below) and AES’ right to increase

or decrease the Tender Cap Amount, AES intends to accept for

payment all Securities validly tendered at or prior to the

Expiration Date, and will only prorate the Securities if the

aggregate amount of Securities validly tendered and not validly

withdrawn at or prior to the Early Tender Date or the Expiration

Date, as applicable, exceeds the Tender Cap Amount. If the

aggregate principal amount of Securities validly tendered and not

validly withdrawn exceeds the Tender Cap Amount, AES will accept

such Securities on a pro rata basis.

If the Tender Offer is not fully subscribed as of the Early

Tender Date and we elect to have an Early Settlement Date, Holders

who validly tender Securities after the Early Tender Date may be

subject to proration, whereas Holders who validly tender Securities

at or prior to the Early Tender Date will not be subject to

proration. In addition, if the aggregate amount of Securities

validly tendered at or prior to the Early Tender Date exceeds the

Tender Cap Amount and we elect to have an Early Settlement Date,

Holders who validly tender Securities after the Early Tender Date

will not have any of their Securities accepted for payment.

However, in the event we do not elect to have an Early Settlement

Date and the aggregate amount of Securities validly tendered at or

prior to the Final Settlement Date exceeds the Tender Cap Amount,

all Holders who validly tendered Securities will be subject to

proration. Securities which were not accepted for purchase due to

the Tender Cap Amount may be accepted if we increase the Tender Cap

Amount, which we are entitled to do at our sole discretion, and

such increase is not fully met or exceeded by Securities validly

tendered at or prior to the Early Tender Date (in the event we

elect to have an Early Settlement Date). There can be no assurance

that we will increase the Tender Cap Amount.

The obligation of AES to accept for purchase and to pay either

the Total Consideration or Tender Offer Consideration and the

accrued and unpaid interest on the Securities pursuant to the

Tender Offer is not subject to any minimum tender condition, but is

subject to the Tender Cap Amount and the satisfaction or waiver of

the Financing Condition and certain other conditions described in

the Tender Offer Materials.

AES’ obligation to accept for purchase, and to pay for,

Securities validly tendered pursuant to the Tender Offer is subject

to, and conditioned upon, having obtained debt financing (the “New

Debt Financing”) in a minimum aggregate principal amount that will

generate sufficient proceeds to purchase the tendered Securities,

including payment of the Tender Offer Consideration or Total

Consideration, as applicable, and any fees payable in connection

with the Tender Offer, subsequent to the date hereof and on or

prior to the Final Settlement Date, on terms and conditions

reasonably satisfactory to AES (the “Financing Condition”). AES’

current intention is to satisfy the Financing Condition by issuing

long-term senior debt securities but, subject to market conditions

and at AES’ sole discretion, AES may elect to enter into

alternative debt financing. There can be no assurance any such New

Debt Financing will be available, and thus no assurance that the

Financing Condition will be satisfied.

AES has retained J.P. Morgan Securities LLC to serve as Dealer

Manager for the Tender Offer. Global Bondholder Services

Corporation has been retained to serve as the Information and

Depositary Agent for the Tender Offer. Questions regarding the

Tender Offer may be directed to J.P. Morgan Securities LLC at 383

Madison Avenue, 3rd Floor, New York, New York 10179, Attn:

Liability Management Group, (866) 834-4666 (toll-free), (212)

834-3260 (collect). Requests for the Tender Offer Materials may be

directed to Global Bondholder Services Corporation at 65 Broadway –

Suite 404, New York, New York 10006, Attn: Corporate Actions, (212)

430-3774 (for banks and brokers) or (866) 470-4200 (for all

others).

AES is making the Tender Offer only by, and pursuant to, the

terms of the Tender Offer Materials. None of AES, the Dealer

Manager, the Information and Depositary Agent make any

recommendation as to whether Holders should tender or refrain from

tendering their Securities. Holders must make their own decision as

to whether to tender Securities and, if so, the principal amount of

the Securities to tender. The Tender Offer is not being made to

holders of Securities in any jurisdiction in which the making or

acceptance thereof would not be in compliance with the securities,

blue sky or other laws of such jurisdiction. In any jurisdiction in

which the securities laws or blue sky laws require the Tender Offer

to be made by a licensed broker or dealer, the Tender Offer will be

deemed to be made on behalf of AES by the Dealer Manager, or one or

more registered brokers or dealers that are licensed under the laws

of such jurisdiction.

This press release does not constitute an offer to purchase

securities or a solicitation of an offer to sell any securities or

an offer to sell or the solicitation of an offer to purchase any

new securities, including in connection with the New Debt

Financing, nor does it constitute an offer or solicitation in any

jurisdiction in which such offer or solicitation is unlawful.

Capitalized terms used in this press release but not otherwise

defined herein have the meanings assigned to them in the Tender

Offer Materials.

About AES

The AES Corporation (NYSE: AES) is a Fortune 200 global power

company. We provide affordable, sustainable energy to 17 countries

through our diverse portfolio of distribution businesses as well as

thermal and renewable generation facilities. Our workforce of

19,000 people is committed to operational excellence and meeting

the world’s changing power needs. Our 2016 revenues were $14

billion and we own and manage $36 billion in total assets. To

learn more, please visit www.aes.com. Follow AES on Twitter

@TheAESCorp.

Safe Harbor Disclosure

This news release contains forward-looking statements within the

meaning of the Securities Act of 1933 and of the Securities

Exchange Act of 1934. Forward-looking statements are not intended

to be a guarantee of future results, but instead constitute AES’

current expectations based on reasonable assumptions. Actual

results could differ materially from those projected in AES’

forward-looking statements due to risks, uncertainties and other

factors. Important factors that could affect actual results are

discussed in the Tender Offer Materials related to the Tender Offer

and AES’ filings with the SEC, including, but not limited to, the

risks discussed under Item 1A “Risk Factors” and Item 7

“Management’s Discussion & Analysis of Financial Condition and

Results of Operations” in AES’ 2016 Annual Report on Form 10-K and

in subsequent reports filed with the SEC. Readers are encouraged to

read AES’ filings to learn more about the risk factors associated

with AES’ business. AES undertakes no obligation to update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise.

Any Stockholder who desires a copy of AES’ 2016 Annual Report on

Form 10-K filed on or about February 27, 2017 with the SEC may

obtain a copy (excluding Exhibits) without charge by addressing a

request to the Office of the Corporate Secretary, The AES

Corporation, 4300 Wilson Boulevard, Arlington, Virginia 22203.

Exhibits also may be requested, but a charge equal to the

reproduction cost thereof will be made. A copy of the Form 10-K may

be obtained by visiting AES’ website at www.aes.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170814005549/en/

The AES CorporationInvestor Contact:Ahmed Pasha,

703-682-6451orMedia Contact:Amy Ackerman, 703-682-6399

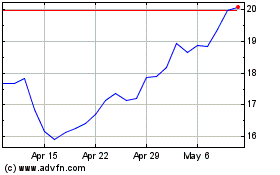

AES (NYSE:AES)

Historical Stock Chart

From Mar 2024 to Apr 2024

AES (NYSE:AES)

Historical Stock Chart

From Apr 2023 to Apr 2024