Recent Developments

- Implementing Strategic Priorities to

Further Position for Growth

- Reducing Operational and Structural

Costs

- Expanding the Customer Experience

through the Introduction of New Products and Technologies

Second Quarter Financial Highlights

- Q2 Total Revenues $2.7 million, a 9.2%

Increase from Q2 2016

- Q2 Total Expenses $2.3 million, a

decrease of 27.1% from Q2 2016

- Q2 Net Income $365,000, as compared to

a net loss of $728,000 for Q2 2016

First Half Financial Highlights

- Total Revenues for the six months ended

June 30, 2017 were $5.1 million, an increase of 2.2% from the same

period in 2016

- Total expenses for the six months ended

June 30, 2017 were $4.6 million, a decrease of 24.9% from the same

period in 2016

- Net income of $424,000 for the six

months ended June 30, 2017 as compared to a net loss of $1,229,000

from the same period in 2016

- Stockholder’s Equity $3.8 million at

June 30, 2017

- Total Retail Customer Net Worth $7.3

billion at June 30, 2017, an increase of 6.2% as compared to the

same period in 2016

Siebert Financial Corp. (NASDAQ:SIEB) today reported financial

results for the three and six months ended June 30, 2017.

Gloria E. Gebbia, majority shareholder and board member of

Siebert Financial said, “I am very pleased with our financial

results for the first half of 2017. We have made significant

progress with our core strategy of driving long term shareholder

value by improving our technology infrastructure, streamlining

operations and introducing new products and services to enhance the

customer experience.”

Following the change of ownership in December 2016, Siebert

Financial Corp. has continued to serve clients throughout the

United States and globally. The firm is dedicated to the core value

of integrity and the safety of investments as first established in

1967 by founder Muriel Siebert.

“Our management team including Andrew Reich has worked to

realize certain economies of scale and collective benefit with the

purpose of increasing revenue and being profitable, and as a

result, we have been able to reduce relative costs. We are strongly

committed to building a world-class firm dedicated to serving

client financial needs, and I am delighted with the activities

underway which will position us strongly for the future,” she

added.

For additional information, please refer to our Quarterly Report

on Form 10-Q for the period ended June 30, 2017 filed with the SEC

on August 14, 2017. You may also access the Form 10-Q through our

website.

About Siebert Financial Corp.

Siebert Financial is a holding company that conducts its retail

discount brokerage business through its wholly-owned subsidiary,

Muriel Siebert & Co., Inc. The firm became a member of the NYSE

in 1967, when Ms. Siebert became the first woman to own a seat on

the Exchange. In addition, in 2014 the Company began business as a

registered investment advisor through a wholly-owned subsidiary,

Siebert Investment Advisors, Inc. Siebert Financial is based in New

York City with additional retail branches in Boca Raton, FL and

Jersey City, NJ. www.siebertnet.com

Cautionary note regarding forward-looking statements

Statements in this press release that are not statements of

historical or current fact constitute “forward looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. Such forward looking statements involve risks and

uncertainties and known and unknown factors that could cause the

actual results of the Siebert Financial Corp. (the “Company”) to be

materially different from historical results or from any future

results expressed or implied by such forward looking statements,

including without limitation: changes in general economic and

market conditions; changes and prospects for changes in interest

rates; fluctuations in volume and prices of securities; changes in

demand for brokerage services; competition within and without the

brokerage business, including the offer of broader services;

competition from electronic discount brokerage firms offering

greater discounts on commissions than the Company; the prevalence

of a flat fee environment; limited trading opportunities; the

method of placing trades by the Company’s customers; computer and

telephone system failures; the level of spending by the Company on

advertising and promotion; trading errors and the possibility of

losses from customer non-payment of amounts due; other increases in

expenses and changes in net capital or other regulatory

requirements. As a result of these and other factors, the Company

may experience material fluctuations in its operating results on a

quarterly or annual basis, which could materially and adversely

affect its business, financial condition, operating results, and

stock price, as well as other risks detailed in the Company’s

filings with the Securities and Exchange Commission (“SEC”).

Accordingly, investors are cautioned not to place undue reliance on

any such “forward-looking statements. The Company undertakes no

obligation to update the information contained herein or to

publicly announce the result of any revisions to such

“forward-looking statements” to reflect future events or

developments. An investment in the Company involves various risks,

including those mentioned above and those, which are detailed from

time to time in the Company’s SEC filings, copies of which may be

obtained from the Company or through the SEC’s website.

Notice to Investors

This communication is provided for informational purposes only

and is neither an offer to sell nor a solicitation of an offer to

buy any securities in the United States or elsewhere.

Part I - FINANCIAL INFORMATION Item 1.

Financial Statements. Siebert Financial Corp. &

Subsidiaries Condensed Consolidated Statements of Financial

Condition

June

30,2017(unaudited)

December 31,2016

ASSETS Cash and cash equivalents $ 2,264,000 $ 2,730,000

Receivable from brokers 896,000 606,000 Securities owned, at fair

value — 92,000 Furniture, equipment and leasehold improvements, net

243,000 46,000 Prepaid expenses 281,000 342,000 Other assets

125,000 — $ 3,809,000 $ 3,816,000

LIABILITIES AND STOCKHOLDERS’ EQUITY Liabilities:

Accounts payable and accrued liabilities $ 329,000 $ 738,000

Accrued settlement liability — 825,000

329,000 1,563,000 Commitments and

Contingencies Stockholders’ equity: Common stock, $.01 par

value; 49,000,000 shares authorized, 22,085,126 shares issued

and outstanding as of June 30, 2017 and

22,085,126 shares issued and outstanding

as of December 31, 2016

221,000 221,000 Additional paid-in capital 7,692,000 6,889,000

(Accumulated deficit) (4,433,000 ) (4,857,000 )

3,480,000 2,253,000 $ 3,809,000 $ 3,816,000

See notes to condensed consolidated

financial statements.

Siebert Financial Corp. & Subsidiaries

Condensed Consolidated Statements of Operations

(unaudited)

Three Months EndedJune

30,

Six Months EndedJune 30,

2017 2016

2017 2016

Revenues: Commissions and fees $ 1,037,000 $ 1,231,000 $ 2,219,000

$ 2,441,000 Margin interest, marketing and distribution fees

1,545,000 957,000 2,626,000 1,825,000 Investment banking 6,000

11,000 12,000 23,000 Trading profits 98,000 125,000 206,000 390,000

Interest and dividends 3,000 138,000

5,000 281,000

2,689,000 2,462,000

5,068,000 4,960,000

Expenses: Employee compensation and benefits

1,000,000 1,200,000 2,038,000 2,487,000 Clearing fees, including

floor brokerage 304,000 236,000 568,000 474,000 Professional fees

468,000 915,000 893,000 1,585,000 Advertising and promotion 25,000

67,000 45,000 133,000 Communications 55,000 132,000 135,000 262,000

Occupancy 79,000 197,000 221,000 379,000 Other general and

administrative 393,000 443,000

744,000 869,000

2,324,000 3,190,000 4,644,000 6,189,000

Net income (loss) $

365,000 $ (728,000 ) $ 424,000

$ (1,229,000 ) Net income (loss) per share of common

stock – Continuing operations $ .02 $ (.03 ) $ .02 $ (.06 )

Basic and diluted $ .02 $ (.03 ) $ .02

$ (.06 ) Weighted average shares outstanding -

Basic 22,085,126 22,085,126 22,085,126 22,085,126 Diluted

22,085,126 22,085,126 22,085,126 22,085,126 See notes to

condensed consolidated financial statements.

Siebert Financial Corp. & Subsidiaries Condensed

Consolidated Statements of Cash Flows (unaudited)

Six Months EndedJune 30,

2017 2016 Cash Flows From Operating

Activities: Net income (loss) $ 424,000 $

(1,229,000 ) Adjustments to reconcile net income (loss) to net cash

used in operating activities: Depreciation and amortization 71,000

136,000 Interest accrued on note receivable from business

sold to former affiliate — (274,000 ) Changes in: Securities Sold

92,000 — Securities Purchased — (67,000 ) Advance to former

affiliate — (10,000 ) Receivable from brokers (290,000 ) 82,000

Prepaid expenses and other assets 61,000 114,000 Other

assets (125,000 ) — Accounts payable and

accrued liabilities (431,000 ) (784,000 ) Net

cash used in operating activities (198,000 )

(2,032,000 ) Purchase of furniture, equipment and leasehold

improvements (268,000 ) (30,000 ) Collection of

receivable from former affiliate — 493,000

Net cash (used in) provided by investing activities (268,000

) 463,000 Net decrease in cash and cash equivalents

(466,000 ) (1,569,000 ) Cash and cash equivalents -

beginning of period 2,730,000 9,420,000

Cash and cash equivalents - end of period $ 2,264,000 $

7,851,000 Supplemental Schedule Of Non-Cash Financing

Activities: Payment by parent of expenses $ 803,000

— See notes to condensed consolidated

financial statements.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170814005683/en/

Investors:Siebert Financial Corp.Yesenia Berdugo,

212-644-2435Office of the AdministratororMedia:LHK Communications

LLCLaura Hynes-Keller,

212-758-8602laurahk@lhkcommunications.com

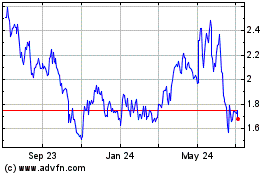

Siebert Financial (NASDAQ:SIEB)

Historical Stock Chart

From Mar 2024 to Apr 2024

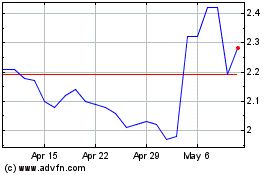

Siebert Financial (NASDAQ:SIEB)

Historical Stock Chart

From Apr 2023 to Apr 2024