The Charles Schwab Corporation released its Monthly Activity

Report today. Company highlights for the month of July 2017

include:

This Smart News Release features multimedia.

View the full release here:

http://www.businesswire.com/news/home/20170814005193/en/

- Net new assets brought to the company

by new and existing clients in July 2017 totaled

$15.8 billion.

- Total client assets were a record $3.10

trillion as of month-end July, up 15% from July 2016 and up 2%

compared to June 2017.

- New brokerage accounts totaled 107,000

in July, up 27% from July 2016, representing a record-tying eighth

consecutive month of new accounts in excess of 100,000.

About Charles Schwab

The Charles Schwab Corporation (NYSE:SCHW) is a leading provider

of financial services, with more than 340 offices and 10.5

million active brokerage accounts, 1.5 million corporate retirement

plan participants, 1.2 million banking accounts, and

$3.10 trillion in client assets as of July 31, 2017. Through its

operating subsidiaries, the company provides a full range of wealth

management, securities brokerage, banking, money management,

custody, and financial advisory services to individual investors

and independent investment advisors. Its broker-dealer subsidiary,

Charles Schwab & Co., Inc. (member SIPC, http://www.sipc.org),

and affiliates offer a complete range of investment services and

products including an extensive selection of mutual funds;

financial planning and investment advice; retirement plan and

equity compensation plan services; referrals to independent

fee-based investment advisors; and custodial, operational and

trading support for independent, fee-based investment advisors

through Schwab Advisor Services. Its banking subsidiary, Charles

Schwab Bank (member FDIC and an Equal Housing Lender), provides

banking and lending services and products. More information is

available at www.schwab.com and www.aboutschwab.com.

The Charles Schwab Corporation Monthly Activity Report

For July 2017 2016

2017

Change

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

Apr

May

Jun

Jul

Mo.

Yr.

Market Indices (at month end) Dow Jones Industrial Average

18,432 18,401 18,308 18,142 19,124 19,763 19,864 20,812 20,663

20,941 21,009 21,350 21,891 3 % 19 % Nasdaq Composite 5,162 5,213

5,312 5,189 5,324 5,383 5,615 5,825 5,912 6,048 6,199 6,140 6,348 3

% 23 % Standard & Poor’s 500 2,174 2,171 2,168 2,126 2,199

2,239 2,279 2,364 2,363 2,384 2,412 2,423 2,470 2 % 14 %

Client

Assets (in billions of dollars) Beginning Client Assets 2,622.0

2,698.2 2,710.4 2,725.3 2,686.7 2,734.6 2,779.5 2,831.3 2,895.2

2,922.5 2,948.8 2,995.8 3,040.6 Net New Assets (1) 9.0 10.4 10.6

6.1 11.9 18.9 11.1 6.6 21.2 2.8 24.0 37.7 15.8 (58 %) 76 % Net

Market Gains (Losses) 67.2 1.8 4.3

(44.7 ) 36.0 26.0

40.7 57.3 6.1 23.5

23.0 7.1 43.5 Total

Client Assets (at month end) 2,698.2 2,710.4

2,725.3 2,686.7 2,734.6

2,779.5 2,831.3 2,895.2

2,922.5 2,948.8 2,995.8

3,040.6 3,099.9 2 % 15 % Receiving

Ongoing Advisory Services (at month end) Investor Services 210.2

211.7 213.4 211.3 213.2 217.1 220.8 227.9 230.9 234.4 239.1 242.2

247.2 2 % 18 % Advisor Services (2) 1,142.3 1,149.4 1,155.4 1,140.5

1,161.8 1,184.3 1,208.4 1,239.0 1,250.9 1,262.7 1,283.4 1,297.6

1,323.8 2 % 16 %

Client Accounts (at month end, in

thousands) Active Brokerage Accounts (3) 9,989 10,021 10,046 10,068

10,102 10,155 10,198 10,254 10,320 10,386 10,439 10,487 10,477 - 5

% Banking Accounts 1,074 1,083 1,088 1,092 1,099 1,106 1,109 1,117

1,120 1,128 1,138 1,143 1,154 1 % 7 % Corporate Retirement Plan

Participants 1,559 1,565 1,561 1,547 1,550 1,543 1,543 1,534 1,545

1,543 1,541 1,540 1,540 - (1 %)

Client Activity New

Brokerage Accounts (in thousands) 84 96 84 84 93 116 111 113 138

125 115 117 107 (9 %) 27 % Inbound Calls (in thousands) 1,605 1,755

1,633 1,565 1,642 1,931 1,817 1,787 2,111 1,788 1,727 1,736 1,683

(3 %) 5 % Web Logins (in thousands) 46,217 42,627 38,237 35,429

37,687 40,720 40,047 40,717 45,441 39,750 44,024 43,790 42,236 (4

%) (9 %) Client Cash as a Percentage of Client Assets (4) 12.5 %

12.5 % 12.5 % 12.8 % 12.8 % 13.0 % 12.7 % 12.4 % 12.4 % 12.1 % 11.8

% 11.5 % 11.3 % (20) bp (120) bp

Mutual Fund and Exchange-Traded

Fund Net Buys (Sells) (5, 6) (in millions of dollars)

Large Capitalization Stock (1,173 ) (755 ) (1,209 ) (652 ) 200 565

265 580 (125 ) 346 134 (63 ) (95 ) Small / Mid Capitalization Stock

(320 ) (214 ) 460 (190 ) 877 1,103 1,364 673 (409 ) (797 ) (285 )

(322 ) (139 ) International (347 ) 386 (26 ) (1 ) 348 (683 ) 1,296

1,633 1,703 2,410 3,610 3,631 2,675 Specialized 357 189 (274 ) (159

) (1,019 ) 20 411 1,007 273 570 529 647 236 Hybrid (463 ) (219 ) 58

(432 ) (687 ) (456 ) (53 ) 258 563 92 65 (340 ) 142 Taxable Bond

1,420 1,888 1,585 1,475 (1,110 ) 1,045 3,144 3,535 3,876 2,060

3,618 3,499 3,064 Tax-Free Bond 766 920 539 20 (1,090 ) (1,692 )

864 472 300 155 290 507 453

Net Buy (Sell) Activity (in

millions of dollars) Mutual Funds (5) (1,683 ) (297 ) (656 ) (1,979

) (5,864 ) (5,825 ) 2,522 4,005 2,368 1,116 3,837 2,980 3,201

Exchange-Traded Funds (6) 1,923 2,492 1,789 2,040 3,383 5,727 4,769

4,153 3,813 3,720 4,124 4,579 3,135 Money Market Funds 701 (768 )

(658 ) 211 1,851 1,141 (1,761 ) (181 ) 1,218 (4,434 ) (1,167 )

(1,260 ) 1,022

Average Interest-Earning Assets (7) (in

millions of dollars) 191,850 194,268 199,107 201,894 206,970

212,052 216,001 216,112 218,554 217,407 215,252 214,709 212,108

(1 %) 11 % (1) June 2017 includes an inflow of

$15.6 billion from a mutual fund clearing services client. February

2017 includes an outflow of $9.0 billion from a mutual fund

clearing services client. (2) Excludes Retirement Business

Services. (3) Periodically, the Company reviews its active account

base. In July 2017, active brokerage accounts were reduced by

approximately 48,000 as a result of low-balance closures. (4)

Schwab One®, certain cash equivalents, bank deposits and money

market fund balances as a percentage of total client assets. (5)

Represents the principal value of client mutual fund transactions

handled by Schwab, including transactions in proprietary funds.

Includes institutional funds available only to Investment Managers.

Excludes money market fund transactions. (6) Represents the

principal value of client ETF transactions handled by Schwab,

including transactions in proprietary ETFs. (7) Represents average

total interest-earning assets on the Company's balance sheet.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170814005193/en/

MEDIA:Charles SchwabAlison Wertheim,

415-667-0475orINVESTORS/ANALYSTS:Charles SchwabJennifer

Como, 415-667-0026

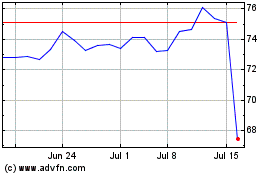

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Mar 2024 to Apr 2024

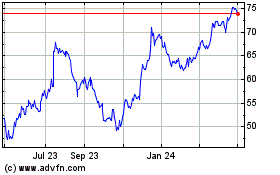

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Apr 2023 to Apr 2024