Report of Foreign Issuer (6-k)

August 14 2017 - 6:15AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

6-K

Report of

Foreign Private Issuer

Pursuant to Rule

13a-16

or

15d-16

under

the Securities Exchange Act of 1934

For the month of August 2017

Commission File

No. 000-54189

MITSUBISHI UFJ FINANCIAL GROUP, INC.

(Translation of registrant’s name into English)

7-1,

Marunouchi

2-chome,

Chiyoda-ku

Tokyo

100-8330,

Japan

(Address of principal executive office)

Indicate by

check mark whether the registrant files or

will file annual reports under cover of Form

20-F

or Form

40-F.

Form

20-F

X

Form

40-F

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(7):

THIS REPORT ON FORM

6-K

SHALL BE DEEMED TO BE INCORPORATED BY REFERENCE

IN THE REGISTRATION STATEMENT ON FORM

F-3

(NO.

333-209455)

OF MITSUBISHI UFJ FINANCIAL GROUP, INC. AND TO BE A PART THEREOF FROM THE DATE ON WHICH THIS REPORT IS

FURNISHED TO THE U.S. SECURITIES AND EXCHANGE COMMISSION TO THE EXTENT NOT SUPERSEDED BY DOCUMENTS OR REPORTS SUBSEQUENTLY FILED WITH OR FURNISHED TO THE U.S. SECURITIES AND EXCHANGE COMMISSION.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

Date: August 14, 2017

|

|

|

|

|

Mitsubishi UFJ Financial Group, Inc.

|

|

|

|

|

By:

|

|

/s/ Zenta Morokawa

|

|

Name:

|

|

Zenta Morokawa

|

|

Title:

|

|

Chief Manager

Documentation & Corporate Secretary Department

|

|

|

|

Corporate Administration Division

|

English Translation of Excerpts from Quarterly Securities Report Filed in Japan

This document is an English translation of selected information included in the Quarterly Securities Report for the quarter ended June 30,

2017 filed by Mitsubishi UFJ Financial Group, Inc. (“MUFG” or “we”) with the Kanto Local Financial Bureau, the Ministry of Finance of Japan, on August 14, 2017 (the “Quarterly Securities Report”). An English

translation of certain information included in the Quarterly Securities Report was previously submitted in a report on Form 6-K dated August 1, 2017. Accordingly, this document should be read together with the previously submitted report.

The Quarterly Securities Report has been prepared and filed in Japan in accordance with applicable Japanese disclosure requirements as well as

generally accepted accounting principles in Japan (“J-GAAP”). There are significant differences between

J-GAAP

and generally accepted accounting principles in the United States. In

addition, the Quarterly Securities Report is intended to update prior disclosures filed by MUFG in Japan and discusses selected recent developments in the context of those prior disclosures. Accordingly, the Quarterly Securities Report may not

contain all of the information that is important to you. For a more complete discussion of the background to information provided in the Quarterly Securities Report disclosure, please see our annual report on Form 20-F for the fiscal year ended

March 31, 2017 and the other reports filed with or submitted to the U.S. Securities and Exchange Commission by MUFG.

1

Additional Japanese GAAP Financial Information for the three months ended June 30, 2017

|

1.

|

Changes in the Scope of Consolidation or Application of the Equity Method

|

|

|

I.

|

Significant changes in the scope of consolidation

|

None.

II. Significant changes in the scope of application of the equity method

None.

2

|

2.

|

Consolidated Balance Sheets

|

|

|

I.

|

Risk-monitored loans included in “Loans and bills discounted”

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions of yen)

|

|

|

|

|

March 31, 2017

|

|

|

June 30, 2017

|

|

|

Loans to bankrupt borrowers

|

|

¥

|

46,498

|

|

|

¥

|

47,060

|

|

|

Non-accrual delinquent loans

|

|

|

738,103

|

|

|

|

716,718

|

|

|

Accruing loans contractually past due 3 months or more

|

|

|

46,301

|

|

|

|

46,825

|

|

|

Restructured loans

|

|

|

708,354

|

|

|

|

637,795

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

¥

|

1,539,258

|

|

|

¥

|

1,448,399

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The amounts above represent gross amounts before the deduction of allowance for credit losses.

|

|

|

II.

|

The principal amount of money trusts entrusted to domestic trust banking subsidiaries, for which repayment of the principal to the customers was guaranteed

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions of yen)

|

|

|

|

|

March 31, 2017

|

|

|

June 30, 2017

|

|

|

Principal-guaranteed money trusts

|

|

¥

|

6,678,398

|

|

|

¥

|

6,188,356

|

|

|

|

III.

|

Guarantee obligations for private placement bonds (provided in accordance with the Article 2-3 of the Financial Instruments and Exchange Law) among the bonds and other securities included in “Securities”

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions of yen)

|

|

|

|

|

March 31, 2017

|

|

|

June 30, 2017

|

|

|

Guarantee obligations for private placement bonds

|

|

¥

|

563,884

|

|

|

¥

|

547,929

|

|

|

|

IV.

|

Contingent liabilities

|

|

|

|

In the ordinary course of business, MUFG is subject to various litigation and regulatory matters. In accordance with applicable accounting guidance, MUFG establishes a Reserve for Contingent Losses arising

from litigation and regulatory matters when they are determined to be probable in their occurrences and the probable loss amount can be reasonably estimated. Based upon current knowledge and consultation with counsel, management believes the

eventual outcome of such litigation and regulatory matters, where losses are probable and the probable loss amounts can be reasonably estimated, would not have a material adverse effect on the MUFG’s financial position, results of operations or

cash flows.

|

|

|

|

Management also believes the amount of loss that is reasonably possible, but not probable, from various litigation and regulatory matters is not material to MUFG’s financial position, results of

operations or cash flows.

|

3

|

3.

|

Consolidated Statements of Income

|

|

|

“Other ordinary income” for the periods indicated included the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions of yen)

|

|

|

|

|

For the three months ended June 30,

|

|

|

|

|

2016

|

|

|

2017

|

|

|

Equity in gains of the equity method investees

|

|

¥

|

61,116

|

|

|

¥

|

68,021

|

|

|

Gains on sales of equity securities

|

|

|

25,478

|

|

|

|

31,120

|

|

|

|

“Other ordinary expenses” for the periods indicated included the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions of yen)

|

|

|

|

|

For the three months ended June 30,

|

|

|

|

|

2016

|

|

|

2017

|

|

|

Write-offs of loans

|

|

¥

|

27,636

|

|

|

¥

|

33,597

|

|

|

Provision for reserve for contingent losses

|

|

|

5,680

|

|

|

|

28,131

|

|

|

Provision for allowance for credit losses

|

|

|

40,334

|

|

|

|

—

|

|

|

4.

|

Consolidated Statements of Cash Flows

|

|

|

No consolidated statements of cash flows have been prepared for the three months periods ended June 30, 2016 and 2017.

|

|

|

Depreciation (including amortization of intangible assets other than goodwill) and amortization of goodwill for the periods indicated were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions of yen)

|

|

|

|

|

For the three months ended June 30,

|

|

|

|

|

2016

|

|

|

2017

|

|

|

Depreciation

|

|

¥

|

75,716

|

|

|

¥

|

78,784

|

|

|

Amortization of goodwill

|

|

|

4,037

|

|

|

|

4,244

|

|

4

|

|

For the three months ended June 30, 2016

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of approval

|

|

Type of stock

|

|

|

Total

Dividends

(in millions

of yen)

|

|

|

Dividend

per share

(yen)

|

|

|

Dividend

record date

|

|

|

Effective

date

|

|

|

Source of

dividends

|

|

|

Annual General Meeting of Shareholders on June 29, 2016

|

|

|

Common stock

|

|

|

|

124,116

|

|

|

|

9

|

|

|

|

March 31, 2016

|

|

|

|

June 29, 2016

|

|

|

|

Retained earnings

|

|

|

|

II.

|

Dividends the record date for which fell within the three months periods and the effective date of which was after the end of the three months periods

|

|

|

For the three months ended June 30, 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of approval

|

|

Type of stock

|

|

|

Total

Dividends

(in millions

of yen)

|

|

|

Dividend

per share

(yen)

|

|

|

Dividend

record date

|

|

|

Effective

date

|

|

|

Source of

dividends

|

|

|

Annual General Meeting of Shareholders on June 29, 2017

|

|

|

Common stock

|

|

|

|

121,160

|

|

|

|

9

|

|

|

|

March 31, 2017

|

|

|

|

June 30, 2017

|

|

|

|

Retained earnings

|

|

|

|

II.

|

Dividends the record date for which fell within the three months periods and the effective date of which was after the end of the three months periods

|

5

6. Segment Information

I. Business segment information

(1) Information on net revenue and operating profit (loss) for each reporting segment

For the three months ended June 30, 2016

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions of yen)

|

|

|

|

|

For the three months ended June 30, 2016

|

|

|

|

|

Retail

Banking

Business

Group

|

|

|

Corporate

Banking

Business

Group

|

|

|

Global

Business

Group

|

|

|

Trust

Assets

Business

Group

|

|

|

Total of

Customer

Business

|

|

|

Global

Markets

Business

Group

|

|

|

Other

|

|

|

Total

|

|

|

Net revenue

|

|

¥

|

284,760

|

|

|

¥

|

228,889

|

|

|

¥

|

305,447

|

|

|

¥

|

41,903

|

|

|

¥

|

820,856

|

|

|

¥

|

207,730

|

|

|

¥

|

(14,582

|

)

|

|

¥

|

1,014,004

|

|

|

Operating expenses

|

|

|

237,523

|

|

|

|

142,167

|

|

|

|

198,608

|

|

|

|

26,402

|

|

|

|

568,285

|

|

|

|

51,672

|

|

|

|

44,394

|

|

|

|

664,351

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating profit (loss)

|

|

¥

|

47,237

|

|

|

¥

|

86,721

|

|

|

¥

|

106,838

|

|

|

¥

|

15,500

|

|

|

¥

|

252,570

|

|

|

¥

|

156,058

|

|

|

¥

|

(58,976

|

)

|

|

¥

|

349,652

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Notes)

|

|

1.

|

“Net revenue” in the above table is used in lieu of net sales generally used by Japanese non-financial companies.

|

|

|

2.

|

“Net revenue” includes net interest income, trust fees, net fees and commissions, net trading profit, and net other operating profit.

|

|

|

3.

|

“Operating expenses” includes personnel expenses and premise expenses.

|

|

|

4.

|

“Net revenue” and “Operating expenses” for each of the Corporate Banking Business Group and the Global Business Group include net revenue and operating expenses relating to overseas Japanese

corporate transactions.

|

|

|

|

The amounts relating to such transactions included in each of these reporting segments are as follows: ¥ 40,145 million of net revenue, ¥36,417 million of operating expenses and ¥

3,727 million of operating profit. Adjustments have been made by deducting these amounts from the Total of Customer Business.

|

For the three months ended June 30, 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions of yen)

|

|

|

|

|

For the three months ended June 30, 2017

|

|

|

|

|

Retail

Banking

Business

Group

|

|

|

Corporate

Banking

Business

Group

|

|

|

Global

Business

Group

|

|

|

Trust

Assets

Business

Group

|

|

|

Total of

Customer

Business

|

|

|

Global

Markets

Business

Group

|

|

|

Other

|

|

|

Total

|

|

|

Net revenue

|

|

¥

|

293,447

|

|

|

¥

|

216,258

|

|

|

¥

|

309,722

|

|

|

¥

|

44,053

|

|

|

¥

|

819,184

|

|

|

¥

|

202,127

|

|

|

¥

|

7,730

|

|

|

¥

|

1,029,042

|

|

|

Operating expenses

|

|

|

235,409

|

|

|

|

144,224

|

|

|

|

212,936

|

|

|

|

28,062

|

|

|

|

582,402

|

|

|

|

55,292

|

|

|

|

46,245

|

|

|

|

683,940

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating profit (loss)

|

|

¥

|

58,038

|

|

|

¥

|

72,033

|

|

|

¥

|

96,785

|

|

|

¥

|

15,991

|

|

|

¥

|

236,781

|

|

|

¥

|

146,834

|

|

|

¥

|

(38,514

|

)

|

|

¥

|

345,101

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Notes)

|

|

1.

|

“Net revenue” in the above table is used in lieu of net sales generally used by Japanese non-financial companies.

|

|

|

2.

|

“Net revenue” includes net interest income, trust fees, net fees and commissions, net trading profit, and net other operating profit.

|

|

|

3.

|

“Operating expenses” includes personnel expenses and premise expenses.

|

|

|

4.

|

“Net revenue” and “Operating expenses” for each of the Corporate Banking Business Group and the Global Business Group include net revenue and operating expenses relating to overseas Japanese

corporate transactions.

|

|

|

|

The amounts relating to such transactions included in each of these reporting segments are as follows: ¥ 44,297 million of net revenue, ¥38,230 million of operating expenses and ¥

6,066 million of operating profit. Adjustments have been made by deducting these amounts from the Total of Customer Business.

|

6

|

(2)

|

Reconciliation of the total operating profit in each of the above tables to the ordinary profit in the consolidated statements of income for the corresponding three months periods

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions of yen)

|

|

|

|

|

For the three months ended June 30,

|

|

|

|

|

2016

|

|

|

2017

|

|

|

Total operating profit of reporting segments

|

|

¥

|

349,652

|

|

|

¥

|

345,101

|

|

|

Operating profit of consolidated subsidiaries excluded from reporting segments

|

|

|

13,711

|

|

|

|

5,868

|

|

|

Provision for general allowance for credit losses

|

|

|

(11,452

|

)

|

|

|

—

|

|

|

Credit related expenses

|

|

|

(56,938

|

)

|

|

|

(59,378

|

)

|

|

Reversal of allowance for credit losses

|

|

|

—

|

|

|

|

18,792

|

|

|

Gains on collection of bad debts

|

|

|

12,865

|

|

|

|

20,500

|

|

|

Net gains on equity securities and other securities

|

|

|

1,710

|

|

|

|

24,266

|

|

|

Equity in gains of the equity method investees

|

|

|

61,116

|

|

|

|

68,021

|

|

|

Others

|

|

|

(29,851

|

)

|

|

|

(25,695

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary profit in the consolidated statements of income

|

|

¥

|

340,812

|

|

|

¥

|

397,476

|

|

|

|

|

|

|

|

|

|

|

|

|

(3)

|

Changes in reporting segments

|

|

|

From the three months ended June 30, 2017, MUFG has reflected changes in the allocation of net revenue and operating expenses among reporting segments.

|

|

|

Accordingly, the business segment information for the three months ended June 30, 2016 has been restated based on the new allocation.

|

7

|

|

There are no material changes to be disclosed as of June 30, 2017 compared to March 31, 2017.

|

|

|

There are no material changes to be disclosed as of June 30, 2017 compared to March 31, 2017.

|

|

|

There are no material changes to be disclosed as of June 30, 2017 compared to March 31, 2017.

|

8

|

|

The following shows those derivatives as of June 30, 2017 which were deemed material in the management of our group company businesses and showed material changes as compared to those as of March 31, 2017.

|

|

|

I.

|

Currency-related derivatives

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions of yen)

|

|

|

|

|

|

|

March 31, 2017

|

|

|

Classification

|

|

Type of transaction

|

|

Contract amount

|

|

|

Fair value

|

|

|

Valuation

gains (losses)

|

|

|

Transactions listed on exchanges

|

|

Currency futures

|

|

¥

|

552,865

|

|

|

¥

|

(3,750

|

)

|

|

¥

|

(3,750

|

)

|

|

Over-the-counter (“OTC”) transactions

|

|

Currency swaps

|

|

|

57,568,038

|

|

|

|

(65,667

|

)

|

|

|

(65,667

|

)

|

|

|

|

Forward contracts on foreign exchange

|

|

|

120,447,312

|

|

|

|

72,713

|

|

|

|

72,713

|

|

|

|

|

Currency options

|

|

|

15,290,877

|

|

|

|

14,445

|

|

|

|

59,351

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

—

|

|

|

¥

|

17,740

|

|

|

¥

|

62,646

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes:

|

|

1.

|

The transactions above are stated at fair value and the related valuation gains (losses) are reported in the consolidated statements of income.

|

|

|

2.

|

Those derivatives transactions to which the hedge accounting is applied as described in JICPA Industry Audit Committee Report No. 25 “Treatment of Accounting and Auditing concerning Accounting for Foreign

Currency Transactions in the Banking Industry” (July 29, 2002) (“JICPA Industry Audit Committee Report No. 25”) and other relevant standards are excluded from the above table.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions of yen)

|

|

|

|

|

|

|

June 30, 2017

|

|

|

Classification

|

|

Type of transaction

|

|

Contract amount

|

|

|

Fair value

|

|

|

Valuation

gains (losses)

|

|

|

Transactions listed on exchanges

|

|

Currency futures

|

|

¥

|

627,613

|

|

|

¥

|

(1,323

|

)

|

|

¥

|

(1,323

|

)

|

|

OTC transactions

|

|

Currency swaps

|

|

|

59,772,364

|

|

|

|

104,303

|

|

|

|

104,303

|

|

|

|

|

Forward contracts on foreign exchange

|

|

|

116,110,131

|

|

|

|

43,835

|

|

|

|

43,835

|

|

|

|

|

Currency options

|

|

|

13,865,060

|

|

|

|

4,407

|

|

|

|

44,286

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

—

|

|

|

¥

|

151,221

|

|

|

¥

|

191,100

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes:

|

|

1.

|

The transactions above are stated at fair value and the related valuation gains (losses) are reported in the consolidated statements of income.

|

|

|

2.

|

Those derivatives transactions to which the hedge accounting is applied as described in JICPA Industry Audit Committee Report No. 25 and other relevant standards are excluded from the above table.

|

9

|

|

II.

|

Equity-related derivatives

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions of yen)

|

|

|

|

|

|

|

March 31, 2017

|

|

|

Classification

|

|

Type of transaction

|

|

Contract amount

|

|

|

Fair value

|

|

|

Valuation

gains (losses)

|

|

|

Transactions listed on exchanges

|

|

Stock index futures

|

|

¥

|

927,570

|

|

|

¥

|

16,462

|

|

|

¥

|

16,462

|

|

|

|

|

Stock index options

|

|

|

1,526,029

|

|

|

|

(29,893

|

)

|

|

|

7,146

|

|

|

OTC transactions

|

|

OTC securities option transactions

|

|

|

1,229,248

|

|

|

|

14,380

|

|

|

|

24,022

|

|

|

|

|

OTC securities index swap transactions

|

|

|

596,888

|

|

|

|

20,484

|

|

|

|

20,484

|

|

|

|

|

Forward transactions in OTC securities indexes

|

|

|

69,583

|

|

|

|

(1,075

|

)

|

|

|

(1,075

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

—

|

|

|

¥

|

20,358

|

|

|

¥

|

67,039

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes:

|

|

1.

|

The transactions above are stated at fair value and the related valuation gains (losses) are reported in the consolidated statements of income.

|

|

|

2.

|

Those derivatives transactions to which the hedge accounting is applied are excluded from the above table.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions of yen)

|

|

|

|

|

|

|

June 30, 2017

|

|

|

Classification

|

|

Type of transaction

|

|

Contract amount

|

|

|

Fair value

|

|

|

Valuation

gains (losses)

|

|

|

Transactions listed on exchanges

|

|

Stock index futures

|

|

¥

|

851,661

|

|

|

¥

|

8,128

|

|

|

¥

|

8,128

|

|

|

|

|

Stock index options

|

|

|

1,934,399

|

|

|

|

(26,736

|

)

|

|

|

11,898

|

|

|

OTC transactions

|

|

OTC securities option transactions

|

|

|

1,348,151

|

|

|

|

12,047

|

|

|

|

23,325

|

|

|

|

|

OTC securities index swap transactions

|

|

|

744,067

|

|

|

|

13,886

|

|

|

|

13,886

|

|

|

|

|

Forward transactions in OTC securities indexes

|

|

|

28,694

|

|

|

|

905

|

|

|

|

905

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

—

|

|

|

¥

|

8,231

|

|

|

¥

|

58,145

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes:

|

|

1.

|

The transactions above are stated at fair value and the related valuation gains (losses) are reported in the consolidated statements of income.

|

|

|

2.

|

Those derivatives transactions to which the hedge accounting is applied are excluded from the above table.

|

10

|

|

III.

|

Bond-related derivatives

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions of yen)

|

|

|

|

|

|

|

March 31, 2017

|

|

|

Classification

|

|

Type of transaction

|

|

Contract amount

|

|

|

Fair value

|

|

|

Valuation

gains (losses)

|

|

|

Transactions listed on exchanges

|

|

Bond futures

|

|

¥

|

1,113,861

|

|

|

¥

|

3,583

|

|

|

¥

|

3,583

|

|

|

|

|

Bond futures options

|

|

|

1,053,852

|

|

|

|

(721

|

)

|

|

|

(121

|

)

|

|

OTC transactions

|

|

Bond OTC options

|

|

|

531,044

|

|

|

|

(149

|

)

|

|

|

(152

|

)

|

|

|

|

Bond forward contracts

|

|

|

1,755,354

|

|

|

|

777

|

|

|

|

777

|

|

|

|

|

Bond OTC swaps

|

|

|

275,314

|

|

|

|

(2,626

|

)

|

|

|

(2,626

|

)

|

|

|

|

Total return swaps

|

|

|

237,243

|

|

|

|

10,223

|

|

|

|

10,223

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

—

|

|

|

¥

|

11,086

|

|

|

¥

|

11,683

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes:

|

|

1.

|

The transactions above are stated at fair value and the related valuation gains (losses) are reported in the consolidated statements of income.

|

|

|

2.

|

Those derivatives transactions to which the hedge accounting is applied are excluded from the above table.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions of yen)

|

|

|

|

|

|

|

June 30, 2017

|

|

|

Classification

|

|

Type of transaction

|

|

Contract amount

|

|

|

Fair value

|

|

|

Valuation

gains (losses)

|

|

|

Transactions listed on exchanges

|

|

Bond futures

|

|

¥

|

1,612,797

|

|

|

¥

|

6,159

|

|

|

¥

|

6,159

|

|

|

|

|

Bond futures options

|

|

|

4,161,602

|

|

|

|

2,262

|

|

|

|

3,155

|

|

|

OTC transactions

|

|

Bond OTC options

|

|

|

320,046

|

|

|

|

(59

|

)

|

|

|

(200

|

)

|

|

|

|

Bond forward contracts

|

|

|

2,031,543

|

|

|

|

(1,897

|

)

|

|

|

(1,897

|

)

|

|

|

|

Bond OTC swaps

|

|

|

165,864

|

|

|

|

(3,019

|

)

|

|

|

(3,019

|

)

|

|

|

|

Total return swaps

|

|

|

228,918

|

|

|

|

1,034

|

|

|

|

1,034

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

—

|

|

|

¥

|

4,479

|

|

|

¥

|

5,231

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes:

|

|

1.

|

The transactions above are stated at fair value and the related valuation gains (losses) are reported in the consolidated statements of income.

|

|

|

2.

|

Those derivatives transactions to which the hedge accounting is applied are excluded from the above table.

|

11

IV. Credit-related derivatives

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions of yen)

|

|

|

|

|

|

|

March 31, 2017

|

|

|

Classification

|

|

Type of transaction

|

|

Contract amount

|

|

|

Fair value

|

|

|

Valuation

gains (losses)

|

|

|

OTC transactions

|

|

Credit default options

|

|

¥

|

5,914,221

|

|

|

¥

|

(2,181

|

)

|

|

¥

|

(2,181

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

—

|

|

|

¥

|

(2,181

|

)

|

|

¥

|

(2,181

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note:

|

The transactions above are stated at fair value and the related valuation gains (losses) are reported in the consolidated statements of income.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions of yen)

|

|

|

|

|

|

|

June 30, 2017

|

|

|

Classification

|

|

Type of transaction

|

|

Contract amount

|

|

|

Fair value

|

|

|

Valuation

gains (losses)

|

|

|

OTC transactions

|

|

Credit default options

|

|

¥

|

5,890,010

|

|

|

¥

|

(1,239

|

)

|

|

¥

|

(1,239

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

—

|

|

|

¥

|

(1,239

|

)

|

|

¥

|

(1,239

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note:

|

The transactions above are stated at fair value and the related valuation gains (losses) are reported in the consolidated statements of income.

|

12

11. Per Share Information

The bases for the calculation of basic earnings per common share and diluted earnings per common share for the periods indicated were as

follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

(in yen)

|

|

|

|

|

For the three months ended June 30,

|

|

|

|

|

2016

|

|

|

2017

|

|

|

Basic earnings per common share

|

|

¥

|

13.76

|

|

|

¥

|

21.58

|

|

|

Diluted earnings per common share

|

|

|

13.71

|

|

|

|

21.50

|

|

|

|

|

|

|

|

(in millions of yen)

|

|

|

|

|

For the three months ended June 30,

|

|

|

|

|

2016

|

|

|

2017

|

|

|

Profits attributable to owners of the parent

|

|

¥

|

188,924

|

|

|

¥

|

289,025

|

|

|

Profits not attributable to common shareholders

|

|

|

—

|

|

|

|

—

|

|

|

Profits attributable to owners of the parent related common shares

|

|

|

188,924

|

|

|

|

289,025

|

|

|

|

|

|

|

|

(in thousands)

|

|

|

|

|

For the three months ended June 30,

|

|

|

|

|

2016

|

|

|

2017

|

|

|

Average number of common shares during the periods

|

|

|

13,721,696

|

|

|

|

13,389,288

|

|

|

|

|

|

|

|

(in millions of yen)

|

|

|

|

|

For the three months ended June 30,

|

|

|

|

|

2016

|

|

|

2017

|

|

|

Diluted earnings per share

|

|

|

|

|

|

|

|

|

|

Adjustment to profits attributable to owners of the parent

|

|

¥

|

(486

|

)

|

|

¥

|

(1,098

|

)

|

|

Adjustment related to dilutive shares of consolidated subsidiaries and others

|

|

|

(486

|

)

|

|

|

(1,098

|

)

|

|

|

|

|

|

|

(in thousands)

|

|

|

|

|

For the three months ended June 30,

|

|

|

|

|

2016

|

|

|

2017

|

|

|

Increase in common share

|

|

|

16,765

|

|

|

|

711

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended June 30,

|

|

|

|

2016

|

|

|

2017

|

|

Description of antidilutive securities which were not included in the calculation of diluted

earnings per share but which materially changed after the end of the previous fiscal year

|

|

|

—

|

|

|

Share subscription rights issued by equity method affiliates:

Morgan Stanley

Stock options

—

0 million units

as of March, 2017

|

13

12. Subsequent Events

I. Cancellation of Own Shares

MUFG resolved, at a meeting of the Board of Directors held on May 15, 2017, to cancel shares of its common stock in accordance with the

provisions of Article 178 of the Company Act. The cancellation was carried out on July 20, 2017.

|

|

(1)

|

Reason for the cancellation: To enhance shareholder returns, improve capital efficiency and conduct capital management flexibly

|

|

|

(2)

|

Type of shares canceled: Common shares of MUFG

|

|

|

(3)

|

Number of shares canceled: 141,158,900 shares (equivalent to 1.00% of the total number of shares issued before the cancellation)

|

|

|

(4)

|

Cancellation date: July 20, 2017

|

14

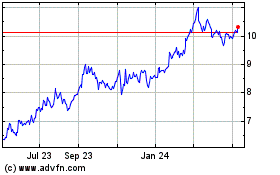

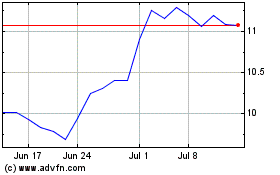

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Apr 2023 to Apr 2024