The selling stockholders

identified in this prospectus supplement are selling an aggregate of 3,000,000 shares of our common stock. We will not receive any proceeds from the sale of shares of our common stock in this offering.

Our common stock is listed on the NASDAQ Global Select Market under the symbol “FANG.” The last reported sales price of our common stock on

the NASDAQ Global Select Market on August 9, 2017 was $94.58 per share.

The selling stockholders have granted the underwriter the option to

purchase up to an aggregate of 450,000 additional shares of our common stock at the public offering price less underwriting discounts and commission. See “Selling Stockholders” beginning on

page

S-12.

The underwriter has agreed to purchase the shares of common stock from the selling stockholders at a

price of $91.98 per share, which will result in approximately $275.9 million of net proceeds to the selling stockholders.

The underwriter proposes

to offer the shares of common stock from time to time for sale in one or more transactions on the NASDAQ Global Select Market, in the

over-the-counter

market, through

negotiated transactions or otherwise at market prices prevailing at the time of sale, at prices related to prevailing market prices or at negotiated prices. See “Underwriting.”

Delivery of the shares of common stock will be made on or about August 15, 2017 through the book-entry facilities of the Depository Trust Company.

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering. The second

part, the accompanying prospectus, gives more general information, some of which may not apply to this offering. You should read the entire prospectus supplement, as well as the accompanying prospectus and the documents incorporated by reference

that are described under “

Where You

Can Find More Information

” in the accompanying prospectus and “

Information Incorporated by Reference

” in this prospectus supplement. In the event that the description of

this offering varies between this prospectus supplement and the accompanying prospectus, you should rely on the information contained in this prospectus supplement.

You should rely only on the information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus

or to which we have referred you. We have not, and the selling stockholders and the underwriter have not, authorized any other person to provide you with information different from that contained in this prospectus supplement and the accompanying

prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. You should read this entire prospectus supplement and the accompanying prospectus, as well as the documents incorporated by reference herein

and therein that are described under “

Where You Can Find More Information

” in the accompanying prospectus and “

Information Incorporated by Reference

” in the accompanying prospectus and in this prospectus supplement.

The selling stockholders and the underwriter are only offering to sell, and only seeking offers to buy, shares of our common stock in jurisdictions where offers and sales are permitted.

The information contained in this prospectus supplement and the accompanying prospectus or in any document incorporated herein or therein is

accurate and complete only as of the date hereof or thereof, respectively, regardless of the time of delivery of this prospectus supplement and the accompanying prospectus or of any sale of our common stock by the selling stockholders or the

underwriter. Our business, financial condition, results of operations and prospects may have changed since those dates.

Industry and

Market Data

This prospectus supplement includes industry and market data and forecasts that we obtained from internal company

surveys, publicly available information and industry publications and surveys. Our internal research and forecasts are based on management’s understanding of industry conditions, and such information has not been verified by independent

sources. Industry publications and surveys generally state that the information contained therein has been obtained from sources believed to be reliable.

Unless the context otherwise requires, the information in this prospectus supplement assumes that the underwriter will not exercise its option

to purchase additional shares.

ii

PROSPECTUS SUPPLEMENT SUMMARY

In this prospectus supplement, we refer to Diamondback Energy, Inc., together with its consolidated subsidiaries, as “we,”

“us,” “our” or “the Company.”

Diamondback Energy, Inc.

Overview

We are an independent oil and

natural gas company focused on the acquisition, development, exploration and exploitation of unconventional, onshore oil and natural gas reserves in the Permian Basin in West Texas. This basin, which is one of the major producing basins in the

United States, is characterized by an extensive production history, a favorable operating environment, mature infrastructure, long reserve life, multiple producing horizons, enhanced recovery potential and a large number of operators.

Our activities are primarily directed at the horizontal development of the Wolfcamp and Spraberry formations in the Midland Basin and the

Wolfcamp and Bone Spring formations in the Delaware Basin. We intend to continue to develop our reserves and increase production through development drilling and exploitation and exploration activities on our multi-year inventory of identified

potential drilling locations and through acquisitions that meet our strategic and financial objectives, targeting

oil-weighted

reserves. Substantially all of our revenues are generated through the sale of oil,

natural gas liquids and natural gas production.

Risk Factors

Investing in our common stock involves risks that include the speculative nature of oil and natural gas exploration, competition, volatile oil

and natural gas prices and other material factors. You should read carefully the section entitled “

Risk Factors

” in this prospectus supplement and the accompanying prospectus, as well as other risk factors incorporated by reference

into this prospectus supplement and the accompanying prospectus from the filings we make with the Securities and Exchange Commission, or the SEC, for an explanation of these risks before investing in our common stock. In particular, the following

considerations may offset our competitive strengths or have a negative effect on our strategy or operating activities, which could cause a decrease in the price of our common stock and a loss of all or part of your investment:

|

|

•

|

|

Our failure to successfully identify, complete and integrate acquisitions of properties or businesses could reduce our earnings and slow our growth.

|

|

|

•

|

|

The volatility of oil and natural gas prices due to factors beyond our control greatly affects our profitability and the present value of our estimated reserves.

|

|

|

•

|

|

Difficulties managing the growth of our business may adversely affect our financial condition and results of operations.

|

|

|

•

|

|

Our failure to develop our undeveloped acreage could adversely affect our future cash flow and income.

|

|

|

•

|

|

Our exploration and development operations require substantial capital that we may be unable to obtain, which could lead to a loss of properties and a decline in our reserves.

|

|

|

•

|

|

Our future success depends on our ability to find, develop or acquire additional oil and natural gas reserves.

|

|

|

•

|

|

Our estimated reserves are based on many assumptions that may turn out to be inaccurate. Any material inaccuracies in these reserve estimates or underlying assumptions will materially affect the quantities and present

values of our estimated reserves.

|

S-1

|

|

•

|

|

Our producing properties are located in the Permian Basin of West Texas, making us vulnerable to risks associated with a concentration of operations in a single geographic area. In addition, we have a large amount of

proved reserves attributable to a small number of producing horizons within this area.

|

|

|

•

|

|

We depend upon several significant purchasers for the sale of most of our oil and natural gas production. The loss of one or more of these purchasers could limit our access to suitable markets for the oil and natural

gas we produce.

|

|

|

•

|

|

Our operations are subject to various governmental regulations which require compliance that can be burdensome and expensive.

|

|

|

•

|

|

Any failure by us to comply with applicable environmental laws and regulations, including those relating to hydraulic fracturing, could result in governmental authorities taking actions that adversely affect our

operations and financial condition.

|

|

|

•

|

|

Our operations are subject to operational hazards for which we may not be adequately insured.

|

For a discussion of other considerations that could negatively affect us, see “

Risk Factors

” beginning on page

S-4

and those incorporated by reference into this prospectus supplement and the accompanying prospectus from the filings we make with the SEC, as well as “

Cautionary Note Regarding Forward-Looking

Statements

”.

Our Offices

Our principal executive offices are located at 500 West Texas, Suite 1200, Midland, Texas, and our telephone number at that address is (432)

221-7400.

We also lease additional office space in Midland and in Oklahoma City, Oklahoma. Our website address is

www.diamondbackenergy.com

. Information contained on our website does not constitute part of

this prospectus supplement.

S-2

THE OFFERING

|

Common stock offered by the selling stockholders

|

3,000,000 shares (3,450,000 shares if the underwriter’s option to purchase additional shares is exercised in full).

|

|

Option to purchase additional shares

|

The selling stockholders have granted the underwriter a

30-day

option to purchase up to an aggregate of 450,000 additional shares of our common stock.

|

|

Common stock to be outstanding immediately after completion of this offering

|

98,132,793 shares.

|

|

Use of proceeds

|

We will not receive any proceeds from the sale of shares of common stock by the selling stockholders in this offering. See “

Use of Proceeds

”.

|

|

Dividend policy

|

We currently anticipate that we will retain all future earnings, if any, to finance the growth and development of our business. In addition, the terms of our revolving credit facility and the indentures governing our existing senior notes

restrict our ability to pay dividends. We do not intend to pay cash dividends in the foreseeable future.

|

|

NASDAQ Global Select Market symbol

|

“FANG”

|

|

Risk Factors

|

You should carefully read and consider the information set forth under the heading “

Risk Factors

” and other risk factors incorporated by reference into this prospectus supplement and the accompanying prospectus from the filings

we make with the SEC, as well as all other information included or incorporated by reference in this prospectus supplement and the accompanying prospectus, before deciding to invest in our common stock.

|

Except as otherwise indicated, all share information contained in this prospectus supplement assumes the underwriter does not exercise its

option to purchase additional shares of our common stock.

S-3

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the following risks, as well as the risks

described in our most recent Annual Report on Form

10-K

and subsequent Quarterly Reports on Form

10-Q

and other filings we make with the SEC incorporated by reference

into this prospectus supplement and the accompanying prospectus, and all of the other information contained in or incorporated by reference into this prospectus supplement and the accompanying prospectus, before deciding to invest in our common

stock. Our business, financial condition and results of operations could be materially and adversely affected by any of these risks. The risks described below and those incorporated by reference into this prospectus supplement and the accompanying

prospectus are not the only ones facing us. Additional risks not presently known to us or which we currently consider immaterial also may adversely affect us.

Risks Related to this Offering and Our Common Stock

If the price of our common stock fluctuates significantly, your investment could lose value.

Although our common stock is listed on the NASDAQ Global Select Market, we cannot assure you that an active public market will continue for our

common stock. If an active public market for our common stock does not continue, the trading price and liquidity of our common stock will be materially and adversely affected. If there is a thin trading market or “float” for our stock, the

market price for our common stock may fluctuate significantly more than the stock market as a whole. Without a large float, our common stock would be less liquid than the stock of companies with broader public ownership and, as a result, the trading

prices of our common stock may be more volatile. In addition, in the absence of an active public trading market, investors may be unable to liquidate their investment in us. Furthermore, the stock market is subject to significant price and volume

fluctuations, and the price of our common stock could fluctuate widely in response to several factors, including:

|

|

•

|

|

the volatility of oil and natural gas prices;

|

|

|

•

|

|

our quarterly or annual operating results;

|

|

|

•

|

|

changes in our earnings estimates;

|

|

|

•

|

|

investment recommendations by securities analysts following our business or our industry;

|

|

|

•

|

|

additions or departures of key personnel;

|

|

|

•

|

|

changes in the business, earnings estimates or market perceptions of our competitors;

|

|

|

•

|

|

our failure to achieve operating results consistent with securities analysts’ projections;

|

|

|

•

|

|

changes in industry, general market or economic conditions; and

|

|

|

•

|

|

announcements of legislative or regulatory changes.

|

The stock market has experienced extreme

price and volume fluctuations in recent years that have significantly affected the quoted prices of the securities of many companies, including companies in our industry. The changes often appear to occur without regard to specific operating

performance. The price of our common stock could fluctuate based upon factors that have little or nothing to do with our company and these fluctuations could materially reduce our stock price.

Market conditions for oil and natural gas, and particularly the recent decline in prices for oil and natural gas, could adversely affect our revenue, cash

flows, profitability, growth, production and the present value of our estimated reserves.

Our revenue, cash flows, profitability,

growth, production and present value of our estimated reserves depend substantially upon prevailing prices for oil and natural gas. During the past five years, the posted price for

S-4

West Texas intermediate light sweet crude oil, which we refer to as West Texas Intermediate or WTI, has ranged from a low of $26.19 per barrel, or Bbl, in February 2016 to a high of $110.62 per

Bbl in September 2013. The Henry Hub spot market price of natural gas has ranged from a low of $1.49 per MMBtu in March 2016 to a high of $8.15 per MMBtu in February 2014. During 2016, WTI prices ranged from $26.19 to $54.01 per Bbl and the Henry

Hub spot market price of natural gas ranged from $1.49 to $3.80 per MMBtu. During the first six months of 2017, oil traded between a low of $42.53 per barrel on June 21, 2017 and a high of $54.45 per barrel on February 23, 2017, and closed

at $46.04 per barrel on June 30, 2017. If the prices of oil and natural gas continue at current levels or decline further, our operations, financial condition and level of expenditures for the development of our oil and natural gas reserves may

be materially and adversely affected. In addition, lower oil and natural gas prices may reduce the amount of oil and natural gas that we can produce economically. This may result in our having to make substantial downward adjustments to our

estimated proved reserves. If this occurs or if our production estimates change or our exploration or development activities are curtailed, full cost accounting rules may require us to write down, as a

non-cash

charge to earnings, the carrying value of our oil and natural gas properties. Reductions in our reserves could also negatively impact the borrowing base under our revolving credit facility, which

could further limit our liquidity and ability to conduct additional exploration and development activities.

We have entered into fixed price swap

contracts, fixed price basis swap contracts and costless collars with corresponding put and call options and may in the future enter into forward sale contracts or additional fixed price swap, fixed price basis swap derivatives or costless collars

for a portion of our production. Although we have hedged a portion of our estimated 2017 and 2018 production, we may still be adversely affected by continuing and prolonged declines in the price of oil.

We use fixed price swap contracts, fixed price basis swap contracts and costless collars with corresponding put and call options to reduce

price volatility associated with certain of our oil and natural gas sales. Under these swap contracts, we receive a fixed price per barrel of oil and pay a floating market price per barrel of oil to the counterparty based on NYMEX WTI pricing. The

fixed-price payment and the floating-price payment are offset, resulting in a net amount due to or from the counterparty. Under the Company’s costless collar contracts, we are required to make a payment to the counterparty if the settlement

price for any settlement period is greater than the call option price. The counterparty is required to make a payment to us if the settlement price for any settlement period is less than the put option price. These contracts and any future economic

hedging arrangements may expose us to risk of financial loss in certain circumstances, including instances where production is less than expected or oil prices increase.

We have relied in the past, and we may rely from time to time in the future, on borrowings under our revolving credit facility to fund a portion of our

capital expenditures. Unless we are able to repay borrowings under our revolving credit facility with cash flow from operations and proceeds from equity offerings, implementing our capital programs may require an increase in our total leverage

through additional debt issuances. In addition, a reduction in availability under our revolving credit facility and the inability to otherwise obtain financing for our capital programs could require us to curtail our drilling activities.

Historically, we have relied on availability under our revolving credit facility to fund a portion of our capital expenditures as such

expenditures have generally exceeded our cash flow from operations. We expect that we will continue to fund a portion of our capital expenditures with borrowings under our revolving credit facility and from the proceeds of debt and equity offerings,

including equity offerings of our common units in Viper Energy Partners LP, or Viper. In the past, we have created availability under our revolving credit facility by repaying outstanding borrowings with the proceeds from equity offerings. We cannot

assure you that we will be able to access the equity capital markets to repay any such future borrowings. Instead, we may be required to finance our capital expenditures through additional debt issuances, which would increase our total amount of

debt outstanding. Further, if the availability under our revolving credit facility were reduced, and we were otherwise unable to secure other sources of financing, we may be required to curtail our drilling programs, which could

S-5

result in a loss of acreage through lease expirations. In addition, we may not be able to complete acquisitions that may be favorable to us or finance the capital expenditures necessary to

replace our reserves.

Future sales of our common stock, or the perception that such future sales may occur, may cause our stock price to decline.

Sales of substantial amounts of our common stock in the public market, or the perception that these sales may occur, could cause the

market price of our common stock to decline. In addition, the sale of such shares, or the perception that such sales may occur, could impair our ability to raise capital through the sale of additional common or preferred stock. Except for any shares

purchased by our affiliates, all of the shares of common stock sold in our initial public offering and our subsequent equity offerings are, and all of the shares of common stock sold in this offering will be, freely tradable. In connection with this

offering, we agreed that, subject to certain exceptions, we will not offer, sell, contract to sell, pledge or otherwise dispose of, directly or indirectly, or file with the SEC a registration statement under the Securities Act, relating to, any

shares of our common stock or securities convertible into or exchangeable or exercisable for any shares of our common stock, or publicly disclose the intention to make any offer, sale, pledge, disposition or filing, without the prior written consent

of Credit Suisse Securities (USA) LLC for a period of 45 days after the date of this prospectus supplement. Further, the selling stockholders identified in this prospectus supplement and our directors and executive officers are subject to agreements

that limit their ability to sell our common stock held by them. These holders cannot sell or otherwise dispose of any shares of our common stock for a period of 45 days after the date of this prospectus supplement without the prior written approval

of Credit Suisse Securities (USA) LLC. The

lock-up

agreements with the selling stockholders and our directors and executive officers are also subject to certain specific exceptions, including transfers of

common stock as a bona fide gift or by will or intestate succession and transfers to such person’s immediate family or to a trust or to an entity controlled by such holder, provided that the recipient of the shares agrees to be bound by the

same restrictions on sales and, with respect to our directors and executive officers, the right of such individuals to sell up to 300,000 shares in the aggregate. In the event that one or more of our stockholders sells a substantial amount of our

common stock in the public market, or the market perceives that such sales may occur, the price of our stock could decline.

If securities or industry

analysts do not publish research or reports about our business, if they adversely change their recommendations regarding our stock or if our operating results do not meet their expectations, our stock price could decline.

The trading market for our common stock will be influenced by the research and reports that industry or securities analysts publish about us or

our business. If one or more of these analysts cease coverage of our company or fail to publish reports on us regularly, we could lose visibility in the financial markets, which in turn could cause our stock price or trading volume to decline.

Moreover, if one or more of the analysts who cover our company downgrade our stock or if our operating results do not meet their expectations, our stock price could decline.

We may issue preferred stock whose terms could adversely affect the voting power or value of our common stock.

Our certificate of incorporation authorizes us to issue, without the approval of our stockholders, one or more classes or series of preferred

stock having such designations, preferences, limitations and relative rights, including preferences over our common stock respecting dividends and distributions, as our board of directors may determine. The terms of one or more classes or series of

preferred stock could adversely impact the voting power or value of our common stock. For example, we might grant holders of preferred stock the right to elect some number of our directors in all events or on the happening of specified events or the

right to veto specified transactions. Similarly, the repurchase or redemption rights or liquidation preferences we might assign to holders of preferred stock could affect the residual value of the common stock.

S-6

Provisions in our certificate of incorporation and bylaws and Delaware law make it more difficult to effect a

change in control of the Company, which could adversely affect the price of our common stock.

The existence of some provisions in our

certificate of incorporation and bylaws and Delaware corporate law could delay or prevent a change in control of our company, even if that change would be beneficial to our stockholders. Our certificate of incorporation and bylaws contain provisions

that may make acquiring control of our company difficult, including:

|

|

•

|

|

provisions regulating the ability of our stockholders to nominate directors for election or to bring matters for action at annual meetings of our stockholders;

|

|

|

•

|

|

limitations on the ability of our stockholders to call a special meeting and act by written consent;

|

|

|

•

|

|

the ability of our board of directors to adopt, amend or repeal our bylaws, and the requirement that the affirmative vote of holders representing at least 66 2/3% of the voting power of all outstanding shares of capital

stock be obtained for stockholders to amend our bylaws;

|

|

|

•

|

|

the requirement that the affirmative vote of holders representing at least 66 2/3% of the voting power of all outstanding shares of capital stock be obtained to remove directors;

|

|

|

•

|

|

the requirement that the affirmative vote of holders representing at least 66 2/3% of the voting power of all outstanding shares of capital stock be obtained to amend our certificate of incorporation; and

|

|

|

•

|

|

the authorization given to our board of directors to issue and set the terms of preferred stock without the approval of our stockholders.

|

These provisions also could discourage proxy contests and make it more difficult for you and other stockholders to elect directors and take

other corporate actions. As a result, these provisions could make it more difficult for a third party to acquire us, even if doing so would benefit our stockholders, which may limit the price that investors are willing to pay in the future for

shares of our common stock.

We do not intend to pay cash dividends on our common stock in the foreseeable future and, therefore, only appreciation of

the price of our common stock will provide a return to our stockholders.

We have not paid dividends since our inception and we

currently anticipate that we will retain all future earnings, if any, to finance the growth and development of our business. We do not intend to pay cash dividends in the foreseeable future. Any future determination as to the declaration and payment

of cash dividends will be at the discretion of our board of directors and will depend upon our financial condition, results of operations, contractual restrictions, capital requirements, business prospects and other factors deemed relevant by our

board of directors. In addition, the terms of our revolving credit facility and the indentures governing our existing senior notes restrict us from paying dividends and making other distributions. As a result, only appreciation of the price of our

common stock, which may not occur, will provide a return to our stockholders.

S-7

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement and the accompanying prospectus, including the documents incorporated by reference, contain forward-looking

statements. These forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond our control, which may include statements about our:

|

|

•

|

|

exploration and development drilling prospects, inventories, projects and programs;

|

|

|

•

|

|

ability to successfully identify, complete and integrate acquisitions of properties or businesses;

|

|

|

•

|

|

oil and natural gas reserves;

|

|

|

•

|

|

identified drilling locations;

|

|

|

•

|

|

ability to obtain permits and governmental approvals;

|

|

|

•

|

|

realized oil and natural gas prices;

|

|

|

•

|

|

lease operating expenses, general and administrative costs and finding and development costs;

|

|

|

•

|

|

future operating results; and

|

|

|

•

|

|

plans, objectives, expectations and intentions.

|

All of these types of statements, other than

statements of historical fact included or incorporated by reference in this prospectus supplement and the accompanying prospectus, are forward-looking statements. These forward-looking statements may be found in “

Prospectus Supplement

Summary

” and “

Risk Factors

” of this prospectus supplement, in “

Risk Factors

”, “

Business

” and “

Management’s Discussion and Analysis of Financial Condition and Results of

Operations

” included, as applicable, in our most recent Annual Report on Form

10-K

and subsequent Quarterly Reports on Form

10-Q

incorporated by reference

herein and elsewhere in this prospectus supplement and the accompanying prospectus and the documents incorporated by reference herein. In some cases, you can identify forward-looking statements by terminology such as “may,”

“could,” “should,” “expect,” “plan,” “project,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “pursue,”

“target,” “seek,” “objective” or “continue,” the negative of such terms or other comparable terminology.

The forward-looking statements contained or incorporated by reference in this prospectus supplement and the accompanying prospectus are

largely based on our expectations, which reflect estimates and assumptions made by our management. These estimates and assumptions reflect our best judgment based on currently known market conditions and other factors. Although we believe such

estimates and assumptions to be reasonable, they are inherently uncertain and involve a number of risks and uncertainties that are beyond our control. In addition, our management’s assumptions about future events may prove to be inaccurate. Our

management cautions all readers that the forward-looking statements contained or incorporated by reference in this prospectus supplement and the accompanying prospectus are not guarantees of future performance, and we cannot assure any reader that

such statements will be realized or the forward-looking events and circumstances will occur. Actual results may differ materially from those anticipated or implied in the forward-looking statements due to the many factors including those described

under “

Risk Factors

” in this prospectus supplement and the accompanying prospectus and in our most recent Annual Report on Form

10-K

and subsequent Quarterly Reports on Form

10-Q

and other filings we make with the SEC incorporated by reference herein and elsewhere in this prospectus supplement and the accompanying prospectus. All forward-looking statements contained in this prospectus

supplement and the accompanying prospectus or included in a document incorporated by reference herein speak only as of the date hereof or thereof, respectively. We do not intend to publicly update or revise any forward-looking statements as a result

of new information, future events or otherwise. These cautionary statements qualify all forward-looking statements attributable to us or persons acting on our behalf.

S-8

USE OF PROCEEDS

The selling stockholders identified in this prospectus supplement are selling all of the shares of common stock being sold in this offering,

including any shares that may be sold in connection with the underwriter’s option to purchase additional shares. Accordingly, we will not receive any proceeds from the sale of shares of our common stock in this offering. We will bear all costs,

fees and expenses in connection with this offering, except that the selling stockholders will pay all of their respective underwriting discounts and commissions. See

“Selling Stockholders”

and “

Underwriting.

”

DIVIDEND POLICY

We have never declared or paid any cash dividends on our capital stock. We currently intend to retain all available funds and any future

earnings for use in the operation and expansion of our business and do not anticipate declaring or paying any cash dividends in the foreseeable future. Any future determination as to the declaration and payment of dividends will be at the discretion

of our board of directors and will depend on

then-existing

conditions, including our financial condition, results of operations, contractual restrictions, capital requirements, business prospects and other

factors that our board of directors considers relevant. In addition, the terms of our revolving credit facility and the indentures governing our existing senior notes restrict the payment of dividends to the holders of our common stock and any other

equity holders.

S-9

CAPITALIZATION

The following table sets forth our unaudited cash and cash equivalents and capitalization as of June 30, 2017:

The following table should be read in conjunction with, and is qualified in its entirety by reference to, “

Management’s

Discussion and Analysis of Financial Condition and Results of Operations

” and our combined consolidated financial statements and related notes included in our most recent Annual Report on Form

10-K

and Quarterly Report on Form

10-Q

for the period ended June 30, 2017, which are incorporated by reference into this prospectus supplement and the accompanying prospectus.

|

|

|

|

|

|

|

|

|

As of June 30,

2017

|

|

|

|

|

(in thousands)

|

|

|

Cash and cash equivalents(1)

|

|

$

|

16,588

|

|

|

|

|

|

|

|

|

Long-term debt, including current maturities:

|

|

|

|

|

|

Revolving credit facility(2)

|

|

$

|

84,000

|

|

|

4.750% Senior Notes due 2024

|

|

|

500,000

|

|

|

5.375% Senior Notes due 2025

|

|

|

500,000

|

|

|

Unamortized debt issuance costs

|

|

|

(13,985

|

)

|

|

Partnership revolving credit facility

|

|

|

81,500

|

|

|

|

|

|

|

|

|

Total long-term debt

|

|

|

1,151,515

|

|

|

|

|

|

|

|

|

Stockholders’ equity:

|

|

|

|

|

|

Common stock, par value $0.01; 200,000,000 shares authorized and 98,128,877 shares issued and

outstanding

|

|

|

981

|

|

|

Additional

paid-in-capital

|

|

|

5,041,359

|

|

|

Accumulated deficit

|

|

|

(224,716

|

)

|

|

|

|

|

|

|

|

Total Diamondback Energy, Inc. stockholders’ equity

|

|

|

4,817,624

|

|

|

|

|

|

|

|

|

Noncontrolling interest

|

|

|

469,310

|

|

|

|

|

|

|

|

|

Total stockholders’ equity

|

|

|

5,286,934

|

|

|

|

|

|

|

|

|

Total capitalization

|

|

$

|

6,438,449

|

|

|

|

|

|

|

|

|

(1)

|

Includes $1.6 million of cash and cash equivalents attributable to our subsidiary Viper.

|

|

(2)

|

As of August 9, 2017, there was $137.5 million in borrowings outstanding under our revolving credit facility, and we had available borrowing capacity of $612.5 million. As of August 9, 2017, Viper had no outstanding

borrowings under the partnership revolving credit facility and available borrowing capacity of $315.0 million.

|

S-10

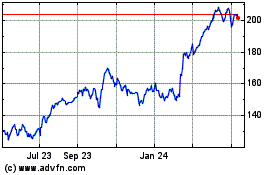

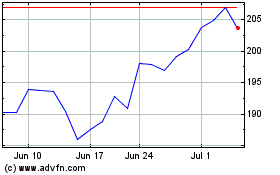

PRICE RANGE OF COMMON STOCK

Our common stock is listed and traded on the NASDAQ Global Select Market under the symbol “FANG.” The following table sets forth the

range of high and low sales prices of our common stock as reported on the NASDAQ Global Select Market for the periods presented:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year

|

|

Quarter

|

|

|

High

|

|

|

Low

|

|

|

2015

|

|

|

1

st

Quarter

|

|

|

$

|

78.75

|

|

|

$

|

55.53

|

|

|

2015

|

|

|

2

nd

Quarter

|

|

|

$

|

85.82

|

|

|

$

|

73.36

|

|

|

2015

|

|

|

3

rd

Quarter

|

|

|

$

|

77.36

|

|

|

$

|

60.28

|

|

|

2015

|

|

|

4

th

Quarter

|

|

|

$

|

82.19

|

|

|

$

|

61.51

|

|

|

2016

|

|

|

1

st

Quarter

|

|

|

$

|

79.87

|

|

|

$

|

55.48

|

|

|

2016

|

|

|

2

nd

Quarter

|

|

|

$

|

96.01

|

|

|

$

|

73.12

|

|

|

2016

|

|

|

3

rd

Quarter

|

|

|

$

|

99.69

|

|

|

$

|

83.90

|

|

|

2016

|

|

|

4

th

Quarter

|

|

|

$

|

113.23

|

|

|

$

|

88.74

|

|

|

2017

|

|

|

1

st

Quarter

|

|

|

$

|

114.00

|

|

|

$

|

96.05

|

|

|

2017

|

|

|

2

nd

Quarter

|

|

|

$

|

108.17

|

|

|

$

|

83.22

|

|

|

2017

|

|

|

3

rd

Quarter

|

(1)

|

|

$

|

97.99

|

|

|

$

|

82.77

|

|

|

(1)

|

Through August 9, 2017.

|

The closing price of our common stock on the NASDAQ Global

Select Market on August 9, 2017 was $94.58 per share. Immediately prior to this offering, we had 98,132,793 issued and outstanding shares of common stock, which were held by seven holders of record. This number does not include owners for whom

common stock may be held in “street” name or whose common stock is restricted.

S-11

SELLING STOCKHOLDERS

The following table presents information regarding the selling stockholders in this offering, the shares that the underwriter has agreed to

purchase from the selling stockholders and the shares subject to the underwriter’s option to purchase additional shares from the selling stockholders. In addition, the nature of any position, office or other material relationship which the

selling stockholders have had, within the past three years, with us or with any of our predecessors or affiliates, is indicated in a footnote to the table. We have paid all expenses relating to the registration of the shares by the selling

stockholders under the Securities Act and will pay other offering expenses, except that the selling stockholders will pay all underwriting discounts and commissions. We will not receive any proceeds from the sale of our common stock by the selling

stockholders.

We prepared the table based on information provided to us by the selling stockholders. We have not sought to verify such

information.

Except as otherwise indicated, we believe that the selling stockholders have sole voting and dispositive power with respect

to the shares indicated as beneficially owned.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares Beneficially

Owned Prior to

Offering(1)

|

|

|

Shares

Offered

|

|

|

Shares Beneficially

Owned After

Offering(1)

|

|

|

Additional

Shares

Offered if

Option to

Purchase

Additional

Shares is

Exercised

in Full

|

|

|

Shares Beneficially

Owned After Offering

if Option to Purchase

Additional Shares is

Exercised in Full

|

|

|

Name of Selling Stockholder

|

|

Number

|

|

|

Percentage

|

|

|

|

Number

|

|

|

Percentage

|

|

|

|

Number

|

|

|

Percentage

|

|

|

Brigham Resources, LLC(2)(3)

|

|

|

368,422

|

|

|

|

0.4

|

%

|

|

|

169,184

|

|

|

|

199,238

|

|

|

|

0.2%

|

|

|

|

25,378

|

|

|

|

173,860

|

|

|

|

0.2

|

%

|

|

Brigham Resources Upstream Holdings, LP(2)(3)

|

|

|

6,164,493

|

|

|

|

6.3

|

%

|

|

|

2,830,816

|

|

|

|

3,333,677

|

|

|

|

3.4%

|

|

|

|

424,622

|

|

|

|

2,909,055

|

|

|

|

3.0

|

%

|

|

(1)

|

Percentage of beneficial ownership is based upon 98,132,793 shares of common stock outstanding as of August 8, 2017. For purposes of this table, a person or group of persons is deemed to have “beneficial

ownership” of any shares which such person has the right to acquire within 60 days. For purposes of computing the percentage of outstanding shares held by each person or group of persons named above, any security which such person or group of

persons has the right to acquire within 60 days is deemed to be outstanding for the purpose of computing the percentage ownership for such person or persons, but is not deemed to be outstanding for the purpose of computing the percentage ownership

of any other person. As a result, the denominator used in calculating the beneficial ownership among our stockholders may differ.

|

|

(2)

|

Brigham Resources LLC, a selling stockholder in this offering (“Brigham”), and its affiliate, Brigham

Resources Operating, LLC (“Brigham Operating” and, together with Brigham, the “Initial Brigham Holders”), acquired shares of our common stock covered by this prospectus supplement and the accompanying prospectus pursuant to a

transaction with us and our wholly- owned subsidiary, Diamondback E&P LLC, in connection with an acquisition by us and Diamondback E&P LLC of certain of the assets of Brigham Operating and Brigham Resources Midstream, LLC (the

“Sellers”). Brigham subsequently transferred beneficial ownership of 6,164,493 shares of our common stock it acquired in this acquisition to its affiliate, Brigham Resources Upstream Holdings, LP, a selling stockholder in this offering

(“Brigham Upstream”). This common stock was restricted from immediate resale, subject to certain exceptions, pursuant to a

90-day

lock-up

contained in the

purchase and sale agreement between us, Diamondback E&P LLC and the Sellers entered into in connection with the acquisition. That

lock-up

expired on May 29, 2017. Other than this transaction, none of

the selling stockholders has had any material relationship with us or any of our predecessors or affiliates within the past three years. In connection with the consummation of this acquisition, we entered into a Registration Rights Agreement (the

“Registration Rights Agreement”) with the Initial Brigham Holders and Brigham Upstream, which granted them and their transferees certain demand and “piggyback” registration rights with respect to the shares of our common stock

issued to the Initial Brigham Holders. These registration rights are subject to customary conditions and

|

S-12

|

|

limitations, including the right of the underwriters of an offering to limit the number of shares. Pursuant to the terms of the Registration Rights Agreement, we agreed to indemnify the selling

stockholders against certain liabilities, including liabilities under the Securities Act of 1933 (the “Securities Act”), and the selling stockholders have agreed to indemnify us against certain liabilities, including liabilities under the

Securities Act, which may arise from any written information furnished to us by the selling stockholders specifically for use in this prospectus supplement and the accompanying prospectus. The shares of common stock offered by the selling

stockholders pursuant to this prospectus supplement and the accompanying prospectus have been included herein in connection with the exercise by the selling stockholders of their demand right under the Registration Rights Agreement. Under the terms

of the Registration Rights Agreement, the expenses of this offering, other than any underwriting discounts and commissions, will be paid by us.

|

|

(3)

|

The information in the footnote is based solely on Schedule 13G jointly filed with the SEC on March 13, 2017 jointly by Brigham Upstream, Brigham, Warburg Pincus & Company US, LLC (“Warburg

Pincus”), PBRA, LLC (“Pine Brook”), Yorktown IX Associates LLC (“Yorktown IX”), Yorktown X Associates LLC (“Yorktown X”), Yorktown XI Associates LLC (“Yorktown XI”), and YT Brigham Associates LLC

(together with Yorktown IX, Yorktown X and Yorktown XI, “Yorktown”). Brigham Upstream reported shared voting power and shared dispositive power over 6,164,493 shares of common stock. Brigham, Warburg Pincus, Pine Brook, Yorktown IX,

Yorktown X, Yorktown XI and YT Brigham Associates LLC reported shared voting power and shared dispositive power over 6,532,915 shares of common stock. Warburg Pincus is the ultimate controlling entity of certain Warburg Pincus affiliated entities

that are members of Brigham (the “WP Group”) and that, collectively, hold the right to appoint three of the nine representatives to the board of managers of Brigham. As a result, the WP Group (and Warburg Pincus, as the ultimate controller

of the WP Group) may be deemed to have the power to vote or direct the vote or to dispose or direct the disposition of the shares owned by Brigham and, because Brigham is the general partner of Brigham Upstream, may be deemed to have the power to

vote or direct the vote or to dispose or direct the disposition of the shares owned by Brigham Upstream. Pine Brook is the ultimate controlling entity of certain Pine Brook affiliated entities that are members of Brigham (the “Pine Brook

Group”) and that, collectively, hold the right to appoint two of the nine representatives to the board of managers of Brigham. As a result, the Pine Brook Group (and Pine Brook, as the ultimate controller of the Pine Brook Group) may be deemed

to have the power to vote or direct the vote or to dispose or direct the disposition of the shares owned by Brigham and, because Brigham is the general partner of Brigham Upstream, may be deemed to have the power to vote or direct the vote or to

dispose or direct the disposition of the shares owned by Brigham Upstream. Yorktown and certain of its affiliates (the “Yorktown Entities”), collectively, hold the right to appoint two of the nine representatives to the board of managers

of Brigham. As a result, the Yorktown Entities may be deemed to have the power to vote or direct the vote or to dispose or direct the disposition of the shares owned by Brigham and, because Brigham is the general partner of Brigham Upstream, may be

deemed to have the power to vote or direct the vote or to dispose or direct the disposition of the shares owned by Brigham Upstream.

|

S-13

MATERIAL U.S. FEDERAL INCOME AND ESTATE TAX

CONSIDERATIONS FOR

NON-U.S.

HOLDERS

The following is a general discussion of material U.S. federal income and estate tax consequences of the acquisition, ownership and

disposition of our common stock by a

non-U.S.

holder (as defined below). This discussion deals only with common stock purchased in this offering that is held as a “capital asset” within the meaning

of Section 1221 of the Internal Revenue Code of 1986, as amended, or the Code (generally, property held for investment), by a

non-U.S.

holder. Except as modified for estate tax purposes, the term

“non-U.S.

holder” means a beneficial owner of our common stock that is not a “U.S. person” or an entity treated as a partnership for U.S. federal income and estate tax purposes. A U.S. person is

any of the following:

|

|

•

|

|

an individual who is a citizen or resident of the United States;

|

|

|

•

|

|

a corporation (including any entity treated as a corporation for U.S. federal income tax purposes) created or organized in or under the laws of the United States, any state thereof or the District of Columbia;

|

|

|

•

|

|

an estate whose income is subject to U.S. federal income taxation regardless of its source; or

|

|

|

•

|

|

trust, if a court within the United States is able to exercise primary supervision over the administration of the trust and one or more U.S. persons have authority to control all substantial decisions of the trust, or

if it has a valid election in effect under applicable U.S. Treasury Regulations to be treated as a U.S. person.

|

An

individual may generally be treated as a resident of the United States in any calendar year for U.S. federal income tax purposes, by, among other ways, being present in the United States for at least 31 days in that calendar year and for an

aggregate of at least 183 days during a three-year period ending in the current calendar year. For purposes of the

183-day

calculation, all of the days present in the current year,

one-third

of the days present in the immediately preceding year and

one-sixth

of the days present in the second preceding year are counted. Residents are taxed for U.S.

federal income tax purposes as if they were U.S. citizens.

This discussion is based upon provisions of the Code, and Treasury

Regulations, administrative rulings and judicial decisions, all as of the date hereof. Those authorities may be changed, perhaps retroactively, so as to result in U.S. federal income and estate tax consequences different from those discussed below.

No ruling has been or will be sought from the Internal Revenue Service, or IRS, with respect to the matters discussed below, and there can be no assurance the IRS will not take a contrary position regarding the tax consequences of the acquisition,

ownership or disposition of our common stock, or that such contrary position would not be sustained by a court. This discussion does not address all aspects of U.S. federal income and estate taxation, including the impact of the unearned income

Medicare contribution tax and does not deal with other U.S. federal tax laws (such as gift tax laws) or foreign, state, local or other tax considerations that may be relevant to

non-U.S.

holders in light of

their personal circumstances. In addition, this discussion does not address tax considerations applicable to investors that may be subject to special treatment under the U.S. federal income tax laws, such as (without limitation):

|

|

•

|

|

certain former U.S. citizens or residents;

|

|

|

•

|

|

shareholders that hold our common stock as part of a straddle, constructive sale transaction, synthetic security, hedge, conversion transaction or other integrated investment or risk reduction transaction;

|

|

|

•

|

|

shareholders that acquired our common stock through the exercise of employee stock options or otherwise as compensation or through a

tax-qualified

retirement plan;

|

|

|

•

|

|

shareholders that are partnerships or entities treated as partnerships for U.S. federal income tax purposes or other pass- through entities or owners thereof;

|

|

|

•

|

|

shareholders that own, or are deemed to own, more than five percent (5%) of our outstanding common stock (except to the extent specifically set forth below);

|

S-14

|

|

•

|

|

shareholders subject to the alternative minimum tax;

|

|

|

•

|

|

financial institutions, banks and thrifts;

|

|

|

•

|

|

real estate investment trusts;

|

|

|

•

|

|

“controlled foreign corporations,” “passive foreign investment companies” or corporations that accumulate earnings to avoid U.S. federal income tax;

|

|

|

•

|

|

broker-dealers or dealers in securities or foreign currencies; and

|

|

|

•

|

|

traders in securities that use a

mark-to-market

method of accounting for U.S. federal income tax purposes.

|

If a partnership (including an entity treated as a partnership for U.S. federal income tax purposes) holds our common stock, the U.S. federal

income tax treatment of a partner generally will depend upon the status of the partner and the activities of the partnership. If you are a partner of a partnership (including an entity treated as a partnership for U.S. federal income tax purposes)

holding our common stock, you should consult your tax advisor.

THIS DISCUSSION IS FOR GENERAL INFORMATION ONLY AND SHOULD NOT BE VIEWED

AS TAX ADVICE. INVESTORS CONSIDERING THE PURCHASE OF OUR COMMON STOCK SHOULD CONSULT THEIR OWN TAX ADVISORS REGARDING THE APPLICATION OF THE U.S. FEDERAL INCOME AND ESTATE AND GIFT TAX LAWS TO THEIR PARTICULAR SITUATION AS WELL AS THE APPLICABILITY

AND EFFECT OF ANY STATE, LOCAL OR FOREIGN TAX LAWS OR TAX TREATIES AND ANY OTHER U.S. FEDERAL TAX LAWS.

Distributions on Common Stock

We do not expect to pay any cash distributions on our common stock in the foreseeable future. However, in the event we do make such

cash distributions, these distributions generally will constitute dividends for U.S. federal income tax purposes to the extent paid from our current or accumulated earnings and profits, as determined under U.S. federal income tax principles. If any

such distribution exceeds our current and accumulated earnings and profits, the excess will be treated as a

non-taxable

return of capital to the extent of the

non-U.S.

holder’s tax basis in our common stock and thereafter as capital gain from the sale or exchange of such common stock. See “—

Gain on Disposition of Common Stock

” below. Dividends paid to a

non-U.S.

holder of our common stock that are not effectively connected with the

non-U.S.

holder’s conduct of a trade or business within the United States will be

subject to U.S. withholding tax at a 30% rate, or if an income tax treaty applies, a lower rate specified by the treaty. In order to receive a reduced treaty rate, a

non-U.S.

holder must provide to us or our

withholding agent IRS Form

W-8BEN

or

W-8BEN-E

(or applicable substitute or successor form for either) properly certifying

eligibility for the reduced rate.

Non-U.S.

holders that do not timely provide us or our withholding agent with the required certification, but that qualify for a reduced treaty rate, may obtain a refund of any

excess amounts withheld by timely filing an appropriate claim for refund with the IRS.

Non-U.S.

holders should consult their tax advisors regarding their entitlement to benefits under an applicable income tax

treaty.

Dividends that are effectively connected with a

non-U.S.

holder’s conduct of a trade

or business in the United States and, if an income tax treaty so requires, are attributable to a permanent establishment maintained by the

non-U.S.

holder in the United States, are taxed on a net income basis

at the regular graduated rates and in the manner applicable to U.S. persons. In that case, we or our withholding agent will not have to withhold U.S. federal withholding tax if the

non-U.S.

holder complies

with applicable certification and disclosure requirements (which may generally be met by providing an IRS Form

W-8ECI).

In addition, a “branch profits tax” may be imposed at a 30% rate (or a lower

rate specified under an applicable income tax treaty) on a foreign corporation’s effectively connected earnings and profits for the taxable year, as adjusted for certain items.

Non-U.S.

holders should

consult any applicable income tax treaties that may provide for different rules.

S-15

Gain on Disposition of Common Stock

Subject to the discussion below regarding backup withholding, a

non-U.S.

holder generally will not be

subject to U.S. federal income tax on gain recognized on a disposition of our common stock unless:

|

|

•

|

|

the gain is effectively connected with the

non-U.S.

holder’s conduct of a trade or business in the United States and, if an income tax treaty applies, is attributable to a

permanent establishment maintained by the

non-U.S.

holder in the United States, in which case, the gain will be taxed on a net income basis at the U.S. federal income tax rates and in the manner applicable to

U.S. persons, and if the

non-U.S.

holder is a foreign corporation, the branch profits tax described above may also apply;

|

|

|

•

|

|

the

non-U.S.

holder is an individual who is present in the United States for 183 days or more in the taxable year of the disposition and meets other requirements, in which case,

the

non-U.S.

holder will be subject to a flat 30% tax on the gain derived from the disposition (or such lower rate specified by an applicable income tax treaty), which may be offset by U.S. source capital

losses, provided the

non-U.S.

holder has timely filed U.S. federal income tax returns with respect to such losses; or

|

|

|

•

|

|

we are or have been a “United States real property holding corporation,” or USRPHC, for U.S. federal income tax purposes at any time during the shorter of the five-year period ending on the date of disposition

or the period that the non-U.S. holder held our common stock.

|

Generally, a corporation is a USRPHC if the fair market value

of its United States real property interests equals or exceeds 50% of the sum of the fair market value of its worldwide real property interests and its other assets used or held for use in a trade or business. We believe we currently are a USRPHC.

If we are or become a USRPHC, a

non-U.S.

holder nonetheless will not be subject to U.S. federal income tax or withholding in respect of any gain realized on a sale or other disposition of our common stock so

long as (i) our common stock is “regularly traded on an established securities market” for U.S. federal income tax purposes and (ii) such non- U.S. holder does not actually or constructively own, at any time during the applicable

period described in the third bullet point, above, more than 5% of our outstanding common stock. We expect our common stock to be “regularly traded” on an established securities market, although we cannot guarantee it will be so traded.

Accordingly, a

non-U.S.

holder who actually or constructively owns more than 5% of our common stock would be subject to U.S. federal income tax and withholding in respect of any gain realized on any sale or

other disposition of common stock (taxed in the same manner as gain that is effectively connected income, except that the branch profits tax would not apply).

Non-U.S.

holders should consult their own advisor

about the consequences that could result if we are, or become, a USRPHC.

Information Reporting and Backup Withholding Tax

Dividends paid to you will generally be subject to information reporting and may be subject to U.S. backup withholding. You will be exempt

from backup withholding if you properly provide a Form

W-8BEN,

W-8BEN-E

or

W-8ECI

certifying under penalties of perjury that you are a

non-U.S.

holder or otherwise meet documentary evidence requirements for establishing that you are a

non-U.S.

holder,

or you otherwise establish an exemption. Copies of the information returns reporting such dividends and the tax withheld with respect to such dividends also may be made available to the tax authorities in the country in which you reside.

The gross proceeds from the disposition of our common stock may be subject to information reporting and backup withholding. If you receive

payments of the proceeds of a disposition of our common stock to or through a U.S. office of a broker, the payment will be subject to both U.S. backup withholding and information reporting unless you properly provide a Form

W-8BEN,

W-8BEN-E

or

W-8ECI

certifying under penalties of perjury that you are a

non-U.S.

person (and the payor does not have actual knowledge or reason to know that you are a U.S. person) or you otherwise establish an exemption. If you sell your common stock outside the United States through a

non-U.S.

office of a

non-U.S.

broker and the sales proceeds are paid to you outside the United States, then the U.S. backup withholding and information reporting requirements

generally will not apply to that

S-16

payment. However, U.S. information reporting, but not backup withholding, will generally apply to a payment of sales proceeds, even if that payment is made outside the United States, if you sell

your common stock through a

non-U.S.

office of a broker that has certain relationships with the United States unless the broker has documentary evidence in its files that you are a

non-U.S.

person and certain other conditions are met, or you otherwise establish an exemption.

Backup

withholding is not an additional tax. You may obtain a refund or credit of any amounts withheld under the backup withholding rules that exceed your U.S. federal income tax liability, if any, provided the required information is timely furnished to

the IRS.

Federal Estate Tax

Our common stock that is owned (or treated as owned) by an individual who is not a citizen or resident of the United States (as specially

defined for U.S. federal estate tax purposes) at the time of death will be included in such individual’s gross estate for U.S. federal estate tax purposes, unless an applicable estate tax treaty provides otherwise, and, therefore, may be

subject to U.S. federal estate tax.

Foreign Account Tax Compliance Act

Under the Foreign Account Tax Compliance Act, or FATCA, a 30% withholding tax will generally apply to dividends on, or gross proceeds from the

sale or other disposition of, common stock paid to a foreign financial institution unless the foreign financial institution (i) enters into an agreement with the U.S. Treasury to, among other things, undertake to identify accounts held by

certain U.S. persons or U.S.-owned foreign entities, annually report certain information about such accounts, and withhold 30% on payments to account holders whose actions prevent it from complying with these reporting and other requirements,

(ii) is resident in a country that has entered into an intergovernmental agreement with the United States in relation to such withholding and information reporting and the financial entity complies with related information reporting

requirements of such country, or (iii) qualifies for an exemption from these rules. A foreign financial institution generally is a foreign entity that (i) accepts deposits in the ordinary course of a banking or similar business,

(ii) as a substantial portion of its business, holds financial assets for the benefit of one or more other persons, or (iii) is an investment entity that, in general, primarily conducts as a business on behalf of customers trading in

certain financial instruments, individual or collective portfolio management or otherwise investing, administering, or managing funds, money or certain financial assets on behalf of other persons. In addition, FATCA generally imposes a 30%

withholding tax on the same types of payments to a

non-financial

foreign entity unless the entity certifies that it does not have any substantial U.S. owners, furnishes identifying information regarding each

substantial U.S. owner, or otherwise qualifies for an exemption from these rules. In either case, such payments would include U.S.-source dividends and the gross proceeds from the sale or other disposition of stock that can produce U.S.-source

dividends. FATCA’s withholding obligations generally will apply to payments of dividends on our common stock, and to payments of gross proceeds from the sale or other disposition of our common stock made on or after January 1, 2019.

The final Treasury regulations and subsequent guidance provide detailed guidance regarding the reporting, withholding and other obligations

under FATCA. Investors should consult their tax advisors regarding the possible impact of the FATCA rules on their investment in our common stock, including, without limitation, the process and deadlines for meeting the applicable requirements to

prevent the imposition of the 30% withholding tax under FATCA.

THE SUMMARY OF MATERIAL U.S. FEDERAL INCOME AND ESTATE TAX CONSIDERATIONS

ABOVE IS INCLUDED FOR GENERAL INFORMATION PURPOSES ONLY. POTENTIAL PURCHASERS OF OUR COMMON STOCK ARE URGED TO CONSULT THEIR OWN TAX ADVISORS TO DETERMINE THE U.S. FEDERAL, STATE, LOCAL AND

NON-U.S.

TAX

CONSIDERATIONS OF PURCHASING, OWNING AND DISPOSING OF OUR COMMON STOCK.

S-17

UNDERWRITING

Under the terms and subject to the conditions contained in an underwriting agreement dated August 9, 2017, the selling stockholders

identified in this prospectus supplement have agreed to sell to Credit Suisse Securities (USA) LLC, the underwriter in this offering, and the underwriter has agreed to purchase from the selling stockholders, an aggregate of 3,000,000 shares of

common stock:

The underwriting agreement provides that the

underwriter is obligated to purchase all the shares of common stock in the offering if any are purchased, other than those shares covered by the option described below.

The selling stockholders have granted the underwriter a 30-day option to purchase up to 450,000 additional shares at the public offering price

less the underwriting discounts and commissions. See “Selling Stockholders.”

The underwriter proposes to offer the shares of

common stock from time to time for sale in one or more transactions on the NASDAQ Global Select Market, in the over-the-counter market, through negotiated transactions or otherwise at market prices prevailing at the time of sale, at prices related

to prevailing market prices or at negotiated prices, subject to receipt and acceptance by it and subject to its right to reject any order in whole or in part. In connection with the sale of the shares of common stock offered hereby, the underwriter

may be deemed to have received compensation in the form of underwriting discounts. The underwriter may affect such transactions by selling shares of common stock to or through dealers and such dealers may receive compensation in the form of

discounts, concessions or commissions from the underwriter and/or purchasers of shares of common stock for whom it may act as agent or to whom it may sell as principal.

Pursuant to the registration rights agreement with the selling stockholders, we are obligated to pay the expenses incurred in relation to this

offering. We estimate that our

out-of-pocket

expenses for this offering will be approximately $170,000. All of the offering expenses will be paid by us. We have also

agreed to reimburse the underwriter for certain of their expenses in an amount up to $20,000 as set forth in the underwriting agreement.

The selling stockholders will receive all of the proceeds from this offering and we will not receive any proceeds from the sale of shares in

this offering.

Credit Suisse Securities (USA) LLC has informed us that it does not expect sales to accounts over which it has

discretionary authority to exceed 5% of the shares of common stock being offered.

In connection with this offering, we agreed that,

subject to certain exceptions, we will not offer, sell, contract to sell, pledge or otherwise dispose of, directly or indirectly, or file with the SEC a registration statement

S-18

under the Securities Act relating to, any shares of our common stock or securities convertible into or exchangeable or exercisable for any shares of our common stock, or publicly disclose the

intention to make any offer, sale, pledge, disposition or filing, without the prior written consent of Credit Suisse Securities (USA) LLC for a period of 45 days after the date of this prospectus supplement.

Each of the selling stockholders and our officers and directors have agreed in connection with this offering that they will not offer, sell,

contract to sell, pledge or otherwise dispose of, directly or indirectly, any shares of our common stock or securities convertible into or exchangeable or exercisable for any shares of our common stock, enter into a transaction that would have the

same effect, or enter into any swap, hedge or other arrangement that transfers, in whole or in part, any of the economic consequences of ownership of our common stock, whether any of these transactions are to be settled by delivery of our common

stock or other securities, in cash or otherwise, or publicly disclose the intention to make any offer, sale, pledge or disposition, or to enter into any transaction, swap, hedge or other arrangement, without, in each case, the prior written consent

of Credit Suisse Securities (USA) LLC for a period of 45 days after the date of this prospectus supplement.

These

lock-up

restrictions are subject to certain specific exceptions, including transfers of common stock as a bona fide gift or by will or intestate succession and transfers to such person’s immediate family or to

a trust or to an entity controlled by such holder, provided that the recipient of the shares agrees to be bound by the same restrictions on sales and, in the case of our executive officers and directors, the right of such individuals to sell up to

300,000 shares in the aggregate.

Credit Suisse Securities (USA) LLC, in its sole discretion, may release the common stock and other

securities subject to the

lock-up

agreements described above in whole or in part at any time. When determining whether or not to release the common stock and other securities from

lock-up

agreements, Credit Suisse Securities (USA) LLC will consider, among other factors, the holder’s reasons for requesting the release and the number of shares of common stock or other securities for which

the release is being requested.

We and the selling stockholders have agreed to indemnify the underwriter against liabilities under the

Securities Act, or contribute to payments that the underwriter may be required to make in that respect.

Our common stock is listed on the

NASDAQ Global Select Market under the symbol “FANG.” On August 9, 2017, the closing price of our common stock was $94.58.

The underwriter and its affiliates are full service financial institutions engaged in various activities, which may include securities

trading, commercial and investment banking, financial advisory, investment management, investment research, principal investment hedging, financing and brokerage activities. The underwriter and its affiliates have from time to time performed, and

may in the future perform, various financial advisory, commercial banking and investment banking services for us and for our affiliates in the ordinary course of business for which they have received and would receive customary compensation. In the

ordinary course of their various business activities, the underwriter and its affiliates may make or hold a broad array of investments and actively trade debt and equity securities (or related derivative securities) and financial instruments

(including bank loans) for their own account and for the accounts of their customers, and such investments and securities activities may involve securities and/or instruments of the issuer. The underwriter and its affiliates may also make investment

recommendations and/or publish or express independent research views in respect of such securities or instruments and may at any time hold, or recommend to clients that they acquire, long and/or short positions in such securities and instruments.