The LGL Group, Inc. (NYSE American: LGL) (the “Company” or

“LGL”), announced results for the three and six months ended June

30, 2017.

Summary of Q2 2017 Financial Results:

- Revenues of $5.9 million, up 12.0%

compared to Q2 2016

- Net income of $0.01 per share,

consistent with Q2 2016

- Order backlog improved 12.3% to $10.9

million, compared to $9.7 million at June 30, 2016

- Adjusted EBITDA(1) was $0.09 per share,

compared to $0.08 for Q2 2016

Commenting on the Company’s Q2 2017 results, Chairman and CEO,

Michael J. Ferrantino, Sr. said, “I would like to share with you a

little more detail around the financial results for this quarter.

First, we are always pleased to have a positive book to bill ratio

which certainly is an indicator of how the future of the business

is trending. What is most significant about this last quarter is

the increase in revenue was primarily generated by engineering

prototypes; investments that we are confident will produce future

revenue streams once qualified by our customers.”

Our Strategy

Mr. Ferrantino had these comments regarding the Company’s

strategy, “Our organic strategy continues to be providing complex,

less competitive integrated assemblies. This will, however, create

some unevenness to quarter over quarter revenue growth since the

dollar value of some of these projects can be substantial. As a

result, we expect the third quarter revenues to be down from the

second quarter, and back up again for the fourth quarter.”

Mr. Ferrantino continued, “As for our external strategy, we have

increased our acquisition bandwidth to include companies that are

inside and outside of our current space. At LGL, we will look

outside of our industry for undervalued companies much like ours

where our management expertise can rapidly drive top and bottom

line growth. Our motivation continues to be increasing shareholder

value as quickly as we can.”

About The LGL Group, Inc.

The LGL Group, Inc., through its two principal subsidiaries

MtronPTI and PTF, designs, manufactures and markets

highly-engineered electronic components used to control the

frequency or timing of signals in electronic circuits, and designs

high performance Frequency and Time reference standards that form

the basis for timing and synchronization in various

applications.

Headquartered in Orlando, Florida, the Company has additional

design and manufacturing facilities in Yankton, South Dakota,

Wakefield, Massachusetts and Noida, India, with local sales offices

in Hong Kong, Sacramento, California and Austin, Texas.

For more information on the Company and its products and

services, contact Patti Smith at The LGL Group, Inc., 2525 Shader

Rd., Orlando, Florida 32804, (407) 298-2000, or visit

www.lglgroup.com and www.mtronpti.com.

Caution Concerning Forward Looking Statements

This press release may contain forward-looking statements made

in reliance upon the safe harbor provisions of Section 27A of the

Securities Act of 1933, as amended, and Section 21 E of the

Securities Exchange Act of 1934, as amended. Forward-looking

statements include all statements that do not relate solely to

historical or current facts, and can be identified by the use of

words such as “may,” “will,” “expect,” “project,” “estimate,”

“anticipate,” “plan,” “believe,” “potential,” “should,” “continue”

or the negative versions of those words or other comparable words.

These forward-looking statements are not guarantees of future

actions or performance. These forward-looking statements are based

on information currently available to us and our current plans or

expectations, and are subject to a number of uncertainties and

risks that could significantly affect current plans, anticipated

actions and our future financial condition and results. Certain of

these risks and uncertainties are described in greater detail in

our filings with the Securities and Exchange Commission. We are

under no obligation to (and expressly disclaim any such obligation

to) update or alter our forward-looking statements, whether as a

result of new information, future events or otherwise.

(1) See reconciliation of GAAP to Non-GAAP measures.

THE LGL GROUP, INC.

Condensed Consolidated Statements of

Operations - UNAUDITED

(Dollars in Thousands, Except Shares and Per Share Amounts)

For the three months ended June

30,

2017 2016

REVENUES $ 5,859 $ 5,231 Costs and expenses: Manufacturing

cost of sales 3,992 3,459 Engineering, selling and administrative

1,823 1,746

OPERATING INCOME 44

26 Total other income (expense) 1 (11 )

INCOME BEFORE INCOME TAXES 45 15 Income tax (provision)

benefit (25 ) 1

NET INCOME

$ 20 $ 16 Weighted average number of shares

used in basic EPS calculation 2,675,465

2,665,434 Weighted average number of shares used in diluted

EPS calculation 2,687,774 2,665,434

BASIC AND DILUTED NET INCOME PER COMMON

SHARE

$ 0.01 $ 0.01

For the six months ended June

30,

2017 2016 REVENUES

$ 11,483 $ 9,987 Costs and expenses: Manufacturing cost of sales

7,550 6,716 Engineering, selling and administrative 3,781

3,407

OPERATING INCOME (LOSS) 152 (136

) Total other income 7 25

INCOME

(LOSS) BEFORE INCOME TAXES 159 (111 ) Income tax (provision)

benefit (28 ) 1

NET INCOME

(LOSS) $ 131 $ (110 ) Weighted average number of

shares used in basic EPS calculation 2,675,465

2,665,434 Weighted average number of shares used in diluted

EPS calculation 2,688,127 2,665,434

BASIC AND DILUTED NET INCOME (LOSS) PER COMMON SHARE $ 0.05

$ (0.04 )

THE LGL GROUP, INC.

Condensed Consolidated Balance

Sheets

(Dollars in Thousands)

June 30,

2017

December 31,

2016

(Unaudited)

ASSETS

Cash and cash equivalents $ 2,158 $ 2,778 Marketable securities

3,813 2,770 Accounts receivable, net of allowances of $32 and $31,

respectively 3,065 3,504 Inventories, net 4,082 3,638 Prepaid

expenses and other current assets 207 200 Total

Current Assets 13,325 12,890 Property, plant and equipment, net

2,415 2,711 Intangible assets, net 590 628 Deferred income taxes,

net 196 214 Other assets, net 219 203 Total Assets $

16,745 $ 16,646

LIABILITIES AND STOCKHOLDERS’

EQUITY

Total Liabilities 2,666 2,755 Stockholders’ Equity 14,079

13,891 Total Liabilities and Stockholders’ Equity $ 16,745 $

16,646

Reconciliations of GAAP to Non-GAAP Measures

To supplement our consolidated condensed financial statements

presented on a GAAP (generally accepted accounting principles)

basis, the Company uses certain Non-GAAP measures, including

Adjusted EBITDA, which we define as net income (loss) adjusted to

exclude depreciation and amortization expense, interest income

(expense), provision (benefit) for income taxes, stock-based

compensation expense and other items we believe are discrete events

which have a significant impact on comparable GAAP measures and

could distort an evaluation of our normal operating performance.

These adjustments to our GAAP results are made with the intent of

providing both management and investors a more complete

understanding of the underlying operational results and trends and

our marketplace performance. The presentation of this additional

information is not meant to be considered in isolation or as a

substitute for net earnings or diluted earnings per share prepared

in accordance with generally accepted accounting principles in the

United States.

Reconciliation of GAAP Income (Loss)

Before Income Taxes to Non-GAAP Adjusted EBITDA:

For the period ended June 30, 2017 (000’s, except

shares and per share amounts) Three months Six

months Net income before income taxes $ 45 $ 159

Interest expense 5 11 Depreciation and amortization 176 363

Non-cash stock compensation 8 15 Adjusted EBITDA $

234 $ 548

Basic per share information:

Weighted average shares outstanding. 2,675,465

2,675,465 Adjusted EBITDA. $ 0.09 $ 0.20

Diluted per share information:

Weighted average shares outstanding. 2,687,774

2,688,127 Adjusted EBITDA. $ 0.09 $ 0.20

For the period ended June 30, 2016 (000’s, except shares and

per share amounts)

Three months Six months Net income (loss)

before income taxes $ 15 $ (111 ) Interest expense 7 13

Depreciation and amortization 197 401 Non-cash stock compensation 3

(13 ) Gain on disposal of assets — (36 ) Adjusted

EBITDA $ 222 $ 254 Weighted average number of shares

used in basic and diluted EPS calculation 2,665,434

2,665,434 Adjusted EBITDA per share $ 0.08 $ 0.10

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170810006100/en/

The LGL Group, Inc.Patti Smith,

407-298-2000pasmith@lglgroup.com

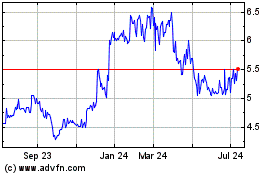

LGL (AMEX:LGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

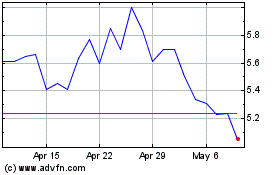

LGL (AMEX:LGL)

Historical Stock Chart

From Apr 2023 to Apr 2024