– Net Income of $3.2 Million; Best Second

Quarter Since 2008 –– Adjusted EBITDA of $12.8 Million; Best Second

Quarter Since 2008 – – Gross Margin of 12.8%, up 150 Basis Points

From Q2 2016 – – Debt Principal Reduction of

$76.4 Million From Q2 2016 –

BlueLinx Holdings Inc. (NYSE:BXC), a leading distributor of

building and industrial products in the United States, today

reported financial results for the fiscal second quarter ended July

1, 2017.

“We continue to make progress in our local

market and sales excellence emphasis, which coupled with our

ongoing deleveraging efforts, enabled us to improve our financial

performance while significantly reducing our debt from prior year

levels. As we remain focused on our customers and markets, our team

is energized and motivated to continue improving our operating

results and garnering market share,” said Mitch Lewis, President

and Chief Executive Officer.

Susan O’Farrell, Senior Vice President and Chief

Financial Officer added, “With the successful completion of our

operational efficiency initiatives, we have experienced excellent

performance this quarter, even with fewer facilities. Our

commitment to improving our business resulted in our best second

quarter net income, gross margin, and Adjusted EBITDA results since

2008.

“We have also significantly reduced our debt

principal by $76.4 million from this period a year ago. We

continue to focus on deleveraging our balance sheet while actively

marketing certain owned facilities for sale leaseback opportunities

and exploring financing alternatives. Furthermore, with the working

capital efficiencies we have achieved, we have reduced our

operating working capital by $21.6 million from second quarter

2016.”

Second Quarter Results Compared to Prior

Year PeriodBlueLinx generated net sales of $474.0 million

for the second quarter of fiscal 2017, compared to $509.0 million

from the prior fiscal second quarter. As previously disclosed, the

Company undertook several operational efficiency initiatives

beginning in the second quarter of fiscal 2016, pursuant to which

it closed and sold certain facilities and rationalized inventory by

discontinuing certain underperforming products. When excluding

the effects of these operational efficiency initiatives, adjusted

same-center net sales increased by $23.2 million or 5.1% from this

period a year ago. We believe that excluding the effects of the

Company’s operational efficiency initiatives from our financial

performance is helpful in presenting comparability across

periods.

Even with the pressure on commodity lumber

prices during the period, the Company recorded gross profit of

$60.5 million during the fiscal second quarter, up $3.2 million

from the prior fiscal second quarter, with a gross margin of 12.8%,

up 150 basis points from this period a year ago. When excluding the

effects of the Company’s operational efficiency initiatives,

adjusted same-center gross profit increased by $3.4 million from

fiscal second quarter 2016.

BlueLinx recorded net income of $3.2 million for

the fiscal second quarter, up $6.4 million from this period a year

ago. Adjusted EBITDA, which is a non-GAAP measure, was $12.8

million for the fiscal second quarter.

First Six Months of Fiscal 2017 Compared

to Prior Year PeriodFor the first six months of fiscal

2017, the Company generated $902.6 million in net sales compared to

$983.3 million from the prior year period. When excluding the

effects of our operational efficiency initiatives, adjusted

same-center net sales increased by $32.2 million or 3.7% from the

same period in 2016.

Gross profit for the first six months of fiscal

2017 was equal to the prior period at $115.0 million, with a gross

margin of 12.7%, an increase of 100 basis points from the prior

year period. When excluding the effects of the Company’s

operational efficiency initiatives, adjusted same-center gross

profit increased by $6.0 million or 5.5% from the first six months

ended July 2, 2016.

The Company recorded net income of $3.8 million

for the first six months of fiscal 2017, up $13.1 million from this

period a year ago. Adjusted EBITDA, which is a non-GAAP measure,

for the six month period was $20.1 million, an increase of $0.5

million or 2.3% from the first six months of fiscal 2016. Excluding

the effects of our operational efficiency initiatives, same-center

Adjusted EBITDA, a non-GAAP measure, was up $1.7 million or 8.9%

from the same period in 2016.

Working Capital and LiquidityAs

of July 1, 2017, the Company had $74.2 million of excess

availability under its asset-based revolving credit facility, based

on qualifying inventory and receivables, an increase of $8.9

million from the same period a year ago. As a result of our working

capital initiatives and mortgage reduction efforts, interest

expense decreased by $0.9 million or 14.1% from fiscal second

quarter 2016 and by $2.8 million or 21.2% from the first six months

of fiscal 2016.

Conference CallBlueLinx will

host a conference call today at 10:00 a.m. Eastern Time,

accompanied by a supporting slide presentation. Investors can

listen to the conference call and view the accompanying slide

presentation by going to the BlueLinx website, www.BlueLinxCo.com,

and selecting the conference link on the Investor Relations page.

Investors will be able to access an archived recording of the

conference call for one week following the live call by dialing

404-537-3406, Conference ID# 5957625. The recording will be

available two hours after the conference call has concluded.

Investors can also access a recording of this call on the BlueLinx

website.

Use of Non-GAAP Measures and

Supplementary InformationBlueLinx reports its financial

results in accordance with accounting principles generally accepted

in the United States (“GAAP”). The Company also believes that

presentation of certain non-GAAP measures may be useful to

investors. Any non-GAAP measures used herein are reconciled in the

financial tables accompanying this news release. The Company

cautions that non-GAAP measures should be considered in addition

to, but not as a substitute for, the Company’s reported GAAP

results.

We define Adjusted EBITDA as an amount equal to

net income (loss) plus interest expense and all interest expense

related items, income taxes, depreciation and amortization, and

further adjusted to exclude certain non-cash items and other

adjustments to Consolidated Net Income (Loss). Further, we also

exclude, as an additional measure, the effects of the operational

efficiency initiatives, to determine same-center Adjusted EBITDA,

which is useful for period over period comparability.

We present Adjusted EBITDA (and the exclusion of

the effects of the operational efficiency initiatives) because it

is a primary measure used by management to evaluate operating

performance and, we believe, helps to enhance investors’ overall

understanding of the financial performance and cash flows of our

business. However, Adjusted EBITDA is not a presentation made in

accordance with GAAP, and is not intended to present a superior

measure of the financial condition from those determined under

GAAP. Adjusted EBITDA, as used herein, is not necessarily

comparable to other similarly titled captions of other companies

due to differences in methods of calculation. We believe Adjusted

EBITDA is helpful in highlighting operating trends. We also

believe that Adjusted EBITDA is frequently used by securities

analysts, investors and other interested parties in their

evaluation of companies, many of which present an Adjusted EBITDA

measure when reporting their results. We compensate for the

limitations of using non-GAAP financial measures by using them to

supplement GAAP results to provide a more complete

understanding of the factors and trends affecting the business than

using GAAP results alone.

We define the non-GAAP metrics of adjusted

same-center net sales and adjusted same-center gross profit as net

sales and gross profit excluding the effects of both closed

facilities and the inventory rationalization initiative. These

measures are not in accordance with GAAP, and are not intended to

present a superior measure of the financial condition from those

determined under GAAP. Adjusted same-center net sales and adjusted

same-center gross profit, as used herein, are not necessarily

comparable to other similarly titled captions of other companies

due to differences in methods of calculation.

We believe adjusted same-center net sales and

adjusted same-center gross profit are helpful in presenting

comparability across periods without the effect of our operational

efficiency initiatives. We also believe that these non-GAAP

metrics are used by securities analysts, investors, and other

interested parties in their evaluation of our company, to

illustrate the effects of these initiatives. We compensate for the

limitations of using non-GAAP financial measures by using them to

supplement GAAP results to provide a more complete

understanding of the factors and trends affecting the business than

using GAAP results alone.

Additionally, we believe supplementary

GAAP-based information such as operating working capital and debt

principal are helpful to investors in explaining the impacts of our

operating efficiencies. Operating working capital is defined as

current assets less current liabilities plus the current portion of

long-term debt. Operating working capital is an important measure

we use to determine the efficiencies of our operations and our

ability to readily convert assets into cash. Debt principal is

defined as the principal amount of debt payable at the stated

period-end date and is used by management to monitor our progress

in meeting our goals to reduce the debt on our balance sheet.

About BlueLinx Holdings

Inc.BlueLinx Holdings Inc., operating through its wholly

owned subsidiary BlueLinx Corporation, is a leading distributor of

building and industrial products in the United States. The Company

is headquartered in Atlanta, Georgia and operates its distribution

business through its broad network of distribution centers.

BlueLinx is traded on the New York Stock Exchange under the symbol

BXC. Additional information about BlueLinx can be found on its

website at www.BlueLinxCo.com.

Forward-looking StatementsThis

press release includes “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995,

including statements relating to our ability to return to

profitability, and our guidance regarding anticipated financial

results. All of these forward-looking statements are based on

estimates and assumptions made by our management that, although

believed by BlueLinx to be reasonable, are inherently uncertain.

Forward-looking statements involve risks and uncertainties,

including, but not limited to, economic, competitive, governmental,

and technological factors outside of BlueLinx’s control that may

cause its business, strategy or actual results to differ materially

from the forward-looking statements. These risks and uncertainties

may include, among other things: changes in the prices, supply

and/or demand for products that it distributes, general economic

and business conditions in the United States; the activities of

competitors; changes in significant operating expenses; changes in

the availability of capital and interest rates; adverse weather

patterns or conditions; acts of cyber intrusion; variations in the

performance of the financial markets, including the credit markets;

and other factors described in the “Risk Factors” section in the

Company’s Annual Report on Form 10-K for the year ended December

31, 2016, its Quarterly Reports on Form 10-Q, and in its periodic

reports filed with the Securities and Exchange Commission from time

to time. Given these risks and uncertainties, you are cautioned not

to place undue reliance on forward-looking statements. BlueLinx

undertakes no obligation to publicly update or revise any

forward-looking statement as a result of new information, future

events, and changes in expectation or otherwise, except as required

by law.

| BLUELINX HOLDINGS INC.CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS(In thousands, except

per share data)(Unaudited) |

| |

| |

Three Months Ended |

|

Six Months Ended |

| |

July 1, 2017 |

|

July 2, 2016 |

|

July 1, 2017 |

|

July 2, 2016 |

| Net sales |

$ |

474,001 |

|

|

$ |

509,011 |

|

|

$ |

902,609 |

|

|

$ |

983,337 |

|

| Cost of sales |

413,455 |

|

|

451,624 |

|

|

787,629 |

|

|

868,354 |

|

| Gross profit |

60,546 |

|

|

57,387 |

|

|

114,980 |

|

|

114,983 |

|

| Operating expenses

(income): |

|

|

|

|

|

|

|

| Selling,

general, and administrative |

49,012 |

|

|

52,678 |

|

|

101,925 |

|

|

107,855 |

|

| Gains

from sales of property |

— |

|

|

(384 |

) |

|

(6,700 |

) |

|

(761 |

) |

|

Depreciation and amortization |

2,253 |

|

|

2,396 |

|

|

4,616 |

|

|

4,871 |

|

| Total

operating expenses |

51,265 |

|

|

54,690 |

|

|

99,841 |

|

|

111,965 |

|

| Operating income |

9,281 |

|

|

2,697 |

|

|

15,139 |

|

|

3,018 |

|

| Non-operating expenses

(income): |

|

|

|

|

|

|

|

| Interest

expense |

5,367 |

|

|

6,250 |

|

|

10,610 |

|

|

13,457 |

|

| Other

expense (income), net |

— |

|

|

135 |

|

|

(2 |

) |

|

(237 |

) |

| Income (loss) before

provision for (benefit from) income taxes |

3,914 |

|

|

(3,688 |

) |

|

4,531 |

|

|

(10,202 |

) |

| Provision for (benefit

from) income taxes |

676 |

|

|

(544 |

) |

|

709 |

|

|

(913 |

) |

| Net income (loss) |

$ |

3,238 |

|

|

$ |

(3,144 |

) |

|

$ |

3,822 |

|

|

$ |

(9,289 |

) |

| |

|

|

|

|

|

|

|

| Basic earnings (loss)

per share |

$ |

0.36 |

|

|

$ |

(0.35 |

) |

|

$ |

0.42 |

|

|

$ |

(1.05 |

) |

| Diluted earnings (loss)

per share |

$ |

0.35 |

|

|

$ |

(0.35 |

) |

|

$ |

0.42 |

|

|

$ |

(1.05 |

) |

| BLUELINX HOLDINGS INC.CONDENSED

CONSOLIDATED BALANCE SHEETS(In thousands, except share

data)(Unaudited) |

| |

| |

July 1, 2017 |

|

December 31, 2016 |

|

Assets: |

|

|

|

| Current assets: |

|

|

|

| Cash |

$ |

4,777 |

|

|

$ |

5,540 |

|

|

Receivables, less allowances of $2,701 and $2,733,

respectively |

167,570 |

|

|

125,857 |

|

|

Inventories, net |

220,677 |

|

|

191,287 |

|

| Other

current assets |

20,228 |

|

|

23,126 |

|

| Total current

assets |

413,252 |

|

|

345,810 |

|

| Property and

equipment: |

|

|

|

| Land and

land improvements |

30,703 |

|

|

34,609 |

|

|

Buildings |

84,772 |

|

|

80,131 |

|

| Machinery

and equipment |

75,036 |

|

|

72,122 |

|

|

Construction in progress |

358 |

|

|

3,104 |

|

| Property and equipment,

at cost |

190,869 |

|

|

189,966 |

|

|

Accumulated depreciation |

(103,926 |

) |

|

(101,644 |

) |

| Property and equipment,

net |

86,943 |

|

|

88,322 |

|

| Other non-current

assets |

12,089 |

|

|

10,005 |

|

| Total assets |

$ |

512,284 |

|

|

$ |

444,137 |

|

|

Liabilities: |

|

|

|

| Current

liabilities: |

|

|

|

| Accounts

payable |

$ |

96,363 |

|

|

$ |

82,735 |

|

| Bank

overdrafts |

22,296 |

|

|

21,696 |

|

| Accrued

compensation |

6,047 |

|

|

8,349 |

|

| Current

maturities of long-term debt, net of discount of $415 and $201,

respectively |

56,585 |

|

|

29,469 |

|

| Other

current liabilities |

13,892 |

|

|

12,092 |

|

| Total current

liabilities |

195,183 |

|

|

154,341 |

|

| Non-current

liabilities: |

|

|

|

| Long-term

debt, net of discount of $1,997 and $2,544, respectively |

270,185 |

|

|

270,792 |

|

| Pension

benefit obligation |

32,879 |

|

|

34,349 |

|

| Other

non-current liabilities |

39,432 |

|

|

14,496 |

|

| Total liabilities |

537,679 |

|

|

473,978 |

|

| Stockholders’

deficit: |

|

|

|

| Common

Stock, $0.01 par value, Authorized - 20,000,000 shares, Issued and

Outstanding - 9,098,221 and 9,031,263, respectively |

91 |

|

|

90 |

|

|

Additional paid-in capital |

258,548 |

|

|

257,972 |

|

|

Accumulated other comprehensive loss |

(36,693 |

) |

|

(36,651 |

) |

|

Accumulated stockholders’ deficit |

(247,341 |

) |

|

(251,252 |

) |

| Total stockholders’

deficit |

(25,395 |

) |

|

(29,841 |

) |

| Total liabilities and

stockholders’ deficit |

$ |

512,284 |

|

|

$ |

444,137 |

|

| BLUELINX HOLDINGS INC.CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS(In

thousands)(Unaudited) |

| |

| |

Six Months Ended |

| |

July 1, 2017 |

|

July 2, 2016 |

| Net cash used

in operating activities |

$ |

(54,491 |

) |

|

$ |

(25,943 |

) |

| |

|

|

|

| Cash flows from

investing activities: |

|

|

|

| Property and equipment

investments |

(189 |

) |

|

(344 |

) |

| Proceeds from sale of

assets |

27,598 |

|

|

2,197 |

|

| Net cash

provided by investing activities |

27,409 |

|

|

1,853 |

|

| |

|

|

|

| Cash flows from

financing activities: |

|

|

|

| Repayments on revolving

credit facilities |

(172,932 |

) |

|

(282,371 |

) |

| Borrowings from

revolving credit facilities |

227,654 |

|

|

308,673 |

|

| Principal payments on

mortgage |

(28,976 |

) |

|

(9,431 |

) |

| Increase in cash held

in escrow related to the mortgage |

1,490 |

|

|

9,118 |

|

| Other, net |

(917 |

) |

|

(1,467 |

) |

| Net cash

provided by financing activities |

26,319 |

|

|

24,522 |

|

| |

|

|

|

| (Decrease) increase in

cash |

(763 |

) |

|

432 |

|

| Cash, beginning of

period |

5,540 |

|

|

4,808 |

|

| Cash, end of

period |

$ |

4,777 |

|

|

$ |

5,240 |

|

| BLUELINX HOLDINGS INC.RECONCILIATION

OF NON-GAAP MEASUREMENTS(In

thousands)(Unaudited) |

|

|

| The

following schedule sets forth a reconciliation of net income (loss)

to Adjusted EBITDA, including same-center Adjusted EBITDA versus

comparable prior year periods: |

|

|

| |

Quarter Ended |

|

Six Months Ended |

| |

July 1, 2017 |

|

July 2, 2016 |

|

July 1, 2017 |

|

July 2, 2016 |

| Net income (loss) |

$ |

3,238 |

|

|

$ |

(3,144 |

) |

|

$ |

3,822 |

|

|

$ |

(9,289 |

) |

| Adjustments: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

2,253 |

|

|

2,396 |

|

|

4,616 |

|

|

4,871 |

|

| Interest

expense |

5,367 |

|

|

6,250 |

|

|

10,610 |

|

|

13,457 |

|

| Provision

for (benefit from) income taxes |

676 |

|

|

(544 |

) |

|

709 |

|

|

(913 |

) |

| Gain from

sales of property |

— |

|

|

(384 |

) |

|

(6,700 |

) |

|

(761 |

) |

|

Share-based compensation expense |

695 |

|

|

430 |

|

|

1,459 |

|

|

845 |

|

|

Multi-employer pension withdrawal |

1,000 |

|

|

— |

|

|

5,500 |

|

|

— |

|

|

Restructuring, severance, and legal, and other |

(427 |

) |

|

7,581 |

|

|

108 |

|

|

8,069 |

|

|

Refinancing-related expenses |

— |

|

|

69 |

|

|

— |

|

|

3,385 |

|

| Adjusted EBITDA |

$ |

12,802 |

|

|

$ |

12,654 |

|

|

$ |

20,124 |

|

|

$ |

19,664 |

|

| |

|

|

|

|

|

|

|

| Adjusted EBITDA |

$ |

12,802 |

|

|

$ |

12,654 |

|

|

$ |

20,124 |

|

|

$ |

19,664 |

|

| Less:

non-GAAP adjustments |

— |

|

|

106 |

|

|

— |

|

|

1,190 |

|

| Same-center Adjusted

EBITDA |

$ |

12,802 |

|

|

$ |

12,548 |

|

|

$ |

20,124 |

|

|

$ |

18,474 |

|

The following schedule sets forth a

reconciliation of net sales and gross profit to the non-GAAP

measures of adjusted same-center sales and adjusted same-center

gross profit versus comparable prior periods:

| |

Quarter Ended |

|

Six Months Ended |

| |

July 1, 2017 |

|

July 2, 2016 |

|

July 1, 2017 |

|

July 2, 2016 |

| Net sales |

$ |

474,001 |

|

|

$ |

509,011 |

|

|

$ |

902,609 |

|

|

$ |

983,337 |

|

| Less:

non-GAAP adjustments |

— |

|

|

58,222 |

|

|

— |

|

|

112,893 |

|

| Adjusted same-center

net sales |

$ |

474,001 |

|

|

$ |

450,789 |

|

|

$ |

902,609 |

|

|

$ |

870,444 |

|

| Adjusted year-over-year

percentage increase - sales |

5.1 |

% |

|

|

|

3.7 |

% |

|

|

| |

|

|

|

|

|

|

|

| Gross profit |

$ |

60,546 |

|

|

$ |

57,387 |

|

|

$ |

114,980 |

|

|

$ |

114,983 |

|

| Less:

non-GAAP adjustments |

— |

|

|

224 |

|

|

— |

|

|

5,959 |

|

| Adjusted same-center

gross profit |

$ |

60,546 |

|

|

$ |

57,163 |

|

|

$ |

114,980 |

|

|

$ |

109,024 |

|

| BLUELINX HOLDINGS INC.SUPPLEMENTARY

INFORMATION(In

thousands)(Unaudited) |

| Debt Principal |

| |

| The following schedule presents debt principal for the

second quarters of fiscal 2017 and fiscal 2016, respectively: |

| |

| |

July 1, 2017 |

|

July 2, 2016 |

|

YOY Change |

| Revolving credit

facilities - principal |

$ |

231,335 |

|

|

$ |

246,858 |

|

|

$ |

(15,523 |

) |

| Mortgage -

principal |

97,847 |

|

|

158,769 |

|

|

(60,922 |

) |

| Total |

$ |

329,182 |

|

|

$ |

405,627 |

|

|

$ |

(76,445 |

) |

|

Operating Working Capital |

|

|

| Operating

working capital is defined as current assets less current

liabilities plus the current portion of long-term debt. The

following schedule displays the selected balance sheet components

of our operating working capital calculation: |

|

|

| |

July 1, 2017 |

|

July 2, 2016 |

|

YOY Change |

| Current assets: |

|

|

|

|

|

| Cash |

$ |

4,777 |

|

|

$ |

5,240 |

|

|

$ |

(463 |

) |

|

Receivables, less allowance for doubtful accounts |

167,570 |

|

|

181,623 |

|

|

(14,053 |

) |

|

Inventories, net |

220,677 |

|

|

214,802 |

|

|

5,875 |

|

| Other

current assets |

20,228 |

|

|

28,562 |

|

|

(8,334 |

) |

| Total current

assets |

$ |

413,252 |

|

|

$ |

430,227 |

|

|

$ |

(16,975 |

) |

| |

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

| Accounts

payable |

$ |

96,363 |

|

|

$ |

96,830 |

|

|

$ |

(467 |

) |

| Bank

overdrafts |

22,296 |

|

|

17,330 |

|

|

4,966 |

|

| Accrued

compensation |

6,047 |

|

|

6,829 |

|

|

(782 |

) |

| Current

maturities of long-term debt, net of discount |

56,585 |

|

|

62,653 |

|

|

(6,068 |

) |

| Other

current liabilities |

13,892 |

|

|

12,942 |

|

|

950 |

|

| Total current

liabilities |

$ |

195,183 |

|

|

$ |

196,584 |

|

|

$ |

(1,401 |

) |

| |

|

|

|

|

|

| Operating working

capital |

$ |

274,654 |

|

|

$ |

296,296 |

|

|

$ |

(21,642 |

) |

BlueLinx Contact Information:

Susan O’Farrell, SVP, CFO & Treasurer

BlueLinx Holdings Inc.

(770) 953-7000

Natalie Poulos, Investor Relations

BlueLinx Holdings Inc.

(770) 953-7522

investor.relations@bluelinxco.com

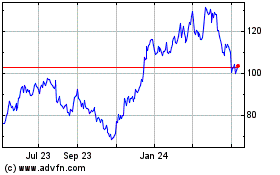

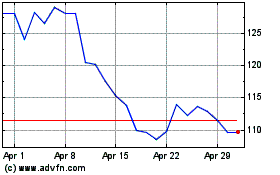

BlueLinx (NYSE:BXC)

Historical Stock Chart

From Mar 2024 to Apr 2024

BlueLinx (NYSE:BXC)

Historical Stock Chart

From Apr 2023 to Apr 2024