Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

August 09 2017 - 5:10PM

Edgar (US Regulatory)

Pricing Term Sheet

Dated August 7, 2017

Filed

pursuant to Rule 433

Registration Statement

No. 333-212974

Supplementing the Preliminary

Prospectus dated August 7, 2017

(the “Preliminary Prospectus Supplement”)

BioMarin Pharmaceutical Inc.

Offering of

$450,000,000

principal amount of

0.599% Senior Subordinated Convertible Notes due 2024

The information in this pricing term sheet should be read together with the Preliminary Prospectus Supplement, including the documents incorporated by

reference therein, and the related base prospectus (the “Prospectus”) dated August 8, 2016, filed pursuant to Rule 424(b) under the Securities Act of 1933, as amended. This pricing term sheet supplements and, to the extent of a

conflict, supersedes the information in the Preliminary Prospectus Supplement, the Prospectus and the documents incorporated by reference therein. As used in this pricing term sheet, “we,” “our” and “us” refer to

BioMarin Pharmaceutical Inc. and not to its subsidiaries.

|

Issuer:

|

BioMarin Pharmaceutical Inc., a Delaware corporation.

|

|

Notes:

|

0.599% Senior Subordinated Convertible Notes due 2024.

|

|

Principal Amount:

|

$450,000,000 (or, if the underwriters fully exercise their option to purchase additional Notes, $495,000,000) aggregate principal amount of Notes.

|

|

Ticker / Exchange for Common Stock:

|

BMRN / NASDAQ Global Select Market (“NASDAQ”).

|

|

Last Reported Sale Price of Common Stock on NASDAQ on August 7, 2017:

|

$89.05 per share of our common stock (the “Common Stock”).

|

|

Maturity Date:

|

August 1, 2024, unless earlier repurchased or converted.

|

|

Interest:

|

0.599% per year. Interest will accrue from, and including, the Settlement Date, or from the most recent date to which interest has been paid or duly provided for, and will be payable semi-annually in arrears on February 1 and August 1

of each year, commencing February 1, 2018, to holders of record at the close of business on the preceding January 15 and July 15, respectively.

|

|

Conversion Premium:

|

Approximately 40.0% above the Last Reported Sale Price of Common Stock on NASDAQ on August 7, 2017.

|

-1-

|

Initial Conversion Price:

|

Approximately $124.67 per share of Common Stock, subject to adjustment.

|

|

Initial Conversion Rate:

|

8.0212 shares of Common Stock per $1,000 principal amount of Notes, subject to adjustment.

|

|

ISIN Number:

|

US09061GAH48

|

|

Pricing Date:

|

August 7, 2017.

|

|

Trade Date:

|

August 8, 2017.

|

|

Settlement Date:

|

August 11, 2017.

|

|

Denomination:

|

$1,000 and integral multiples thereof

|

|

Price at Issuance:

|

98.0%, plus accrued interest, if any, from the Settlement Date

|

|

Price to Underwriters:

|

97.5%

|

|

Use of Proceeds:

|

We estimate that our net proceeds from the sale of the Notes will be approximately $437.9 million (or, if the underwriters fully exercise their option to purchase additional notes, $481.8 million), after deducting the underwriting discounts

and commissions and estimated offering expenses that are payable to us.

|

|

|

We intend to use a majority of the net proceeds from this offering to repay, repurchase or settle in cash some or all of our 0.75% senior subordinated convertible notes due in 2018, although we do not intend to effect

any such repayment or repurchase concurrently with this offering. We intend to use the remaining net proceeds from this offering for general corporate purposes, including clinical trials of our product candidates and the expansion of our

manufacturing capacity, particularly with respect to our manufacturing capability for our gene therapy program. See “Use of proceeds” in the Preliminary Prospectus Supplement.

|

|

Underwriting Discount:

|

2.50%

|

|

Book-Running Managers:

|

Merrill Lynch, Pierce, Fenner & Smith

Incorporated

|

Goldman Sachs & Co. LLC

J.P. Morgan Securities LLC

|

Make-Whole Premium Upon a Make-Whole Fundamental Change:

|

If a make-whole fundamental change (as described in the Preliminary Prospectus Supplement) occurs, then, subject to the provisions described in the Preliminary

|

-2-

|

|

Prospectus Supplement under the caption “Description of the notes—Make-whole premium upon a make-whole fundamental change,” we will pay a make-whole premium on Notes converted in

connection with that make-whole fundamental change by increasing the conversion rate of such Notes. The make-whole premium will be in addition to, and not in substitution for, any cash, securities or other assets otherwise due to holders of Notes

upon conversion.

|

|

|

The following table shows what the make-whole premium would be for each stock price and effective date set forth below, expressed as additional shares of common stock per $1,000 principal amount of Notes.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock Price

|

|

|

Effective Date

|

|

$89.05

|

|

|

$100.00

|

|

|

$110.00

|

|

|

$124.67

|

|

|

$140.00

|

|

|

$160.00

|

|

|

$200.00

|

|

|

$250.00

|

|

|

$300.00

|

|

|

$350.00

|

|

|

$400.00

|

|

|

$500.00

|

|

|

August 11, 2017

|

|

|

3.2084

|

|

|

|

2.5922

|

|

|

|

2.1244

|

|

|

|

1.6392

|

|

|

|

1.2761

|

|

|

|

0.9428

|

|

|

|

0.5470

|

|

|

|

0.2994

|

|

|

|

0.1720

|

|

|

|

0.1009

|

|

|

|

0.0589

|

|

|

|

0.0169

|

|

|

August 1, 2018

|

|

|

3.2084

|

|

|

|

2.5877

|

|

|

|

2.1242

|

|

|

|

1.6201

|

|

|

|

1.2457

|

|

|

|

0.9055

|

|

|

|

0.5095

|

|

|

|

0.2683

|

|

|

|

0.1483

|

|

|

|

0.0834

|

|

|

|

0.0459

|

|

|

|

0.0111

|

|

|

August 1, 2019

|

|

|

3.2084

|

|

|

|

2.5688

|

|

|

|

2.1064

|

|

|

|

1.5825

|

|

|

|

1.1972

|

|

|

|

0.8523

|

|

|

|

0.4600

|

|

|

|

0.2302

|

|

|

|

0.1207

|

|

|

|

0.0638

|

|

|

|

0.0323

|

|

|

|

0.0061

|

|

|

August 1, 2020

|

|

|

3.2084

|

|

|

|

2.5681

|

|

|

|

2.0591

|

|

|

|

1.5150

|

|

|

|

1.1206

|

|

|

|

0.7745

|

|

|

|

0.3938

|

|

|

|

0.1829

|

|

|

|

0.0887

|

|

|

|

0.0424

|

|

|

|

0.0185

|

|

|

|

0.0020

|

|

|

August 1, 2021

|

|

|

3.2084

|

|

|

|

2.5094

|

|

|

|

1.9722

|

|

|

|

1.4071

|

|

|

|

1.0062

|

|

|

|

0.6643

|

|

|

|

0.3077

|

|

|

|

0.1269

|

|

|

|

0.0535

|

|

|

|

0.0213

|

|

|

|

0.0077

|

|

|

|

—

|

|

|

August 1, 2022

|

|

|

3.2084

|

|

|

|

2.3964

|

|

|

|

1.8245

|

|

|

|

1.2360

|

|

|

|

0.8335

|

|

|

|

0.5074

|

|

|

|

0.1984

|

|

|

|

0.0653

|

|

|

|

0.0209

|

|

|

|

0.0061

|

|

|

|

0.0007

|

|

|

|

—

|

|

|

August 1, 2023

|

|

|

3.2084

|

|

|

|

2.1807

|

|

|

|

1.5541

|

|

|

|

0.9378

|

|

|

|

0.5497

|

|

|

|

0.2731

|

|

|

|

0.0689

|

|

|

|

0.0131

|

|

|

|

0.0022

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

August 1, 2024

|

|

|

3.2084

|

|

|

|

1.9788

|

|

|

|

1.0697

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

The actual stock price and effective date may not be set forth on the table, in which case:

|

|

•

|

|

if the actual stock price on the effective date is between two stock prices on the table or the actual effective date is between two effective dates on the table, the make-whole premium will be determined by a

straight-line interpolation between the make-whole premiums set forth for the two stock prices and the two effective dates on the table based on a

365-

or

366-day

year,

as applicable;

|

|

|

•

|

|

if the stock price exceeds $500.00 per share, subject to adjustment as described in the Preliminary Prospectus Supplement under the caption “Description of the notes—Make-whole premium upon a make-whole

fundamental change,” no make-whole premium will be paid; and

|

|

|

•

|

|

if the stock price is less than $89.05 per share, subject to adjustment as described in the Preliminary Prospectus Supplement under the caption “Description of the notes—Make-whole premium upon a make-whole

fundamental change,” no make-whole premium will be paid.

|

Notwithstanding the foregoing, in no event will the conversion rate exceed

11.2296 shares per $1,000 principal amount of notes, subject to adjustments in the same manner as the conversion rate with respect to the events described in clauses (1) through (5), inclusive, under the caption “Description of the

notes—Conversion rights—Adjustment of conversion rate” in the Preliminary Prospectus Supplement.

* * *

We have filed a registration statement, including the Prospectus, and the Preliminary Prospectus Supplement with the Securities and Exchange Commission, or

SEC, for the offering to which this communication relates. Before you invest, you should read the Preliminary Prospectus Supplement, the Prospectus and the other documents we have filed with the SEC for more complete information

-3-

about us and the offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, copies may be obtained from BioMarin Pharmaceutical Inc., 770

Lindaro Street, San Rafael, California 94901, Attention: Investor Relations, Telephone Number: (415)

506-6700;

or from BofA Merrill Lynch, Telephone Number: (800)

294-1322,

Email: dg.prospectus_requests@baml.com; or from Goldman Sachs & Co. LLC, 200 West Street, New York, New York 10282, Attention: Prospectus Department, Telephone Number (866)

471-2526

or (212)

902-1171,

Facsimile: (212)

902-9316,

Email:

prospectus-ny@ny.email.gs.com;

or

from J.P. Morgan, c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, New York 11717, Telephone Number: (866)

803-9204.

ANY DISCLAIMERS OR OTHER NOTICES THAT MAY APPEAR BELOW ARE NOT APPLICABLE TO THIS COMMUNICATION AND SHOULD BE DISREGARDED. SUCH DISCLAIMERS OR OTHER NOTICES

WERE AUTOMATICALLY GENERATED AS A RESULT OF THIS COMMUNICATION BEING SENT VIA BLOOMBERG OR ANOTHER EMAIL SYSTEM.

-4-

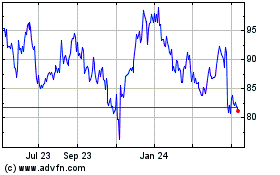

BioMarin Pharmaceutical (NASDAQ:BMRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

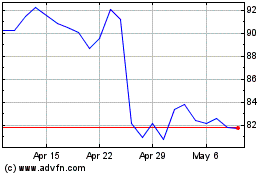

BioMarin Pharmaceutical (NASDAQ:BMRN)

Historical Stock Chart

From Apr 2023 to Apr 2024