Civitas Solutions, Inc. (NYSE: CIVI) today reported financial

results for the fiscal third quarter ended June 30,

2017.

Third Quarter Fiscal 2017 Results At A Glance

- Third quarter net revenue increased

5.2% to $372.3 million

- Third quarter net income was $7.4

million, compared to net income of $4.8 million in the third

quarter of fiscal 2016

- Third quarter Adjusted EBITDA increased

by 4.0% to $42.3 million

- Completed seven acquisitions, including

one that closed on July 1st, with total annual revenues of $23.2

million

- Expanded platform of Adult Day Health

services to third state with acquisition of New Jersey

provider

“We are pleased that, as expected, our growth accelerated during

the third quarter, led by continued strong performance in our two

fastest growing businesses, SRS and ADH,” stated Bruce Nardella,

president and chief executive officer. “In addition, organic growth

has expanded in our largest service line, I/DD, and we are

realizing benefits from our cost efficiency program. We have also

quickened the pace of acquisitions. Even with the recent flurry of

deals, our acquisition pipeline remains robust. Taken together, we

believe all of this activity positions us well for fiscal

2018.”

Third Quarter Fiscal 2017 Financial Results

Net revenue for the third quarter was $372.3 million, an

increase of $18.4 million, or 5.2%, over net revenue for the same

period of the prior year. Net revenue increased $11.7 million from

organic growth and $6.7 million from acquisitions that closed

during and after the third quarter ended June 30, 2016.

Net revenue consisted of:

- Intellectual and Developmental

Disabilities ("I/DD") services net revenue of $243.5 million, an

increase of 4.1% compared to the third quarter of fiscal 2016.

- Post-Acute Specialty Rehabilitation

Services ("SRS") services net revenue of $77.8 million, an increase

of 5.8% compared to the third quarter of fiscal 2016.

- At-risk youth ("ARY") services net

revenue of $35.4 million, which is consistent with the third

quarter of fiscal 2016.

- Adult Day Health ("ADH") services net

revenue of $15.7 million, an increase of 39.7% compared to the

third quarter of fiscal 2016.

Income from operations for the third quarter was $20.3 million,

or 5.4% of net revenue, compared to $17.8 million, or 5.0% of net

revenue, for the third quarter of the prior year. The increase in

our operating margin when compared to three months ended

June 30, 2016 was primarily due to a decrease in general and

administrative expenses as a percentage of net revenue. This was

primarily due to a decrease in indirect labor expense as well as

reduced administrative costs resulting from our continued focus on

optimizing our cost structure. In addition, general and

administrative expenses during the third quarter of the prior year

were negatively impacted by a $2.6 million charge for acquisition

related contingent consideration liabilities. The increase in our

operating margin was partially offset by an increase in direct

labor costs due to higher overtime pay and an increase in health

insurance expense due to higher enrollment and utilization compared

to the three months ended June 30, 2016.

Net income for the third quarter was $7.4 million compared to

$4.8 million for the same period of the prior year.

Basic and diluted net income per common share was $0.20 for the

third quarter ended June 30, 2017, compared to basic and

diluted net income per common share of $0.13 for the same period of

the prior year.

Adjusted EBITDA for the third quarter was $42.3 million, or

11.4% of net revenue, compared to Adjusted EBITDA of $40.6 million,

or 11.5% of net revenue, for the third quarter of the prior year.

The slight decrease in Adjusted EBITDA margin was due to the

increase in direct labor costs described above. This was offset by

a decrease in general and administrative expense primarily due to a

decrease in indirect labor expense as well as reduced

administrative costs resulting from our continued focus on

optimizing our cost structure.

Year-to-Date Fiscal 2017 Financial Results

Net revenue for the nine months ended June 30, 2017 was $1,094.1

million, an increase of $48.7 million, or 4.7%, over net revenue

for the same period of the prior year. The growth in net revenue

was negatively impacted by the divestiture of our ARY operations in

six states during the first half of fiscal 2016, which resulted in

a decrease in net revenue of $6.9 million compared to the nine

months ended June 30, 2016. Excluding these operations, net revenue

increased by $55.6 million, or 5.4%, of which $28.2 million was

from organic growth and $27.4 million was from acquisitions that

closed during and after the nine months ended June 30, 2016. The

increase in net revenue during the nine months ended June 30, 2017

was also negatively impacted by an increase in sales adjustments of

$3.8 million compared to the nine months ended June 30, 2016.

Net revenue consisted of:

- I/DD services net revenue of $719.2

million, an increase of 3.6% compared to the nine months ended June

30, 2016.

- SRS services net revenue of $229.3

million, an increase of 7.4% compared to the nine months ended June

30, 2016.

- ARY service net revenue of $106.8

million, a decrease of 5.7% compared to the nine months ended June

30, 2016. Excluding the ARY divestitures, ARY service net revenue

would have increased 0.4% compared to the nine months ended June

30, 2016.

- ADH services net revenue of $38.8

million, an increase of 60.4% compared to the nine months ended

June 30, 2016.

Income from operations for the nine months ended June 30, 2017

was $52.0 million, or 4.8% of net revenue, compared to $46.4

million, or 4.4% of net revenue, for the same period of the prior

year. The increase in our operating margin when compared to the

nine months ended June 30, 2016 was primarily due to a decrease in

general and administrative expenses as a percentage of net revenue.

This decrease was primarily attributable to an $8.6 million

reduction in stock based compensation resulting from a $10.5

million stock based compensation charge recorded during the prior

year, and decreases in indirect labor expense as well as reduced

administrative costs resulting from our continued focus on

optimizing our cost structure. The increase in our operating margin

was partially offset by increases in direct labor costs and client

occupancy costs as a percentage of revenue. The increase in direct

labor costs was the result of higher overtime pay and an increase

in health insurance expense due to higher enrollment and

utilization compared to the nine months ended June 30, 2016. The

increase in occupancy costs was due to increases in rent,

utilities, and maintenance expenses compared to the same period of

the prior year.

Net income for the nine months ended June 30, 2017 was $17.0

million, compared to $6.5 million for the same period of the prior

year.

Basic net income per common share was $0.46 and diluted net

income per common share was $0.45 for the nine months ended June

30, 2017, compared to basic and diluted net income per common share

of $0.18 for the nine months ended June 30, 2016.

Adjusted EBITDA for the nine months ended June 30, 2017 was

$118.4 million, or 10.8% of net revenue, compared to Adjusted

EBITDA of $118.2 million, or 11.3% of net revenue, for the same

period of the prior year. The decrease in our Adjusted EBITDA

margin was primarily due to the increases in direct labor and

occupancy costs described above. In addition,

the year-over-year results in Adjusted EBITDA were negatively

impacted by a $2.9 million gain from favorable contract settlements

realized during the prior year that did not recur. The decrease was

partially offset by the decreases in indirect labor expense and

other administrative costs described above.

Fiscal 2017 Outlook and Guidance

The Company is updating its fiscal year 2017 net revenue and

Adjusted EBITDA guidance that it communicated on May 10, 2017

during the release of fiscal second quarter results.

For fiscal 2017, the Company is reducing the top-end of its net

revenue and Adjusted EBITDA guidance while maintaining the low-end

of both ranges. The Company now expects fiscal 2017 net revenue in

the range of $1.48 billion to $1.49 billion and fiscal 2017

Adjusted EBITDA in the range of $162 million to $165 million. This

compares to our previous ranges of $1.48 billion to $1.52 billion

and $162 million to $166 million, respectively.

A reconciliation of the low-end and high-end of the Adjusted

EBITDA guidance to net income is as follows:

Fiscal Year Ending September 30, 2017

(In millions)

Low-end High-end Net income $

24.8 $ 26.6 Provision for income taxes 16.6 17.8 Interest expense,

net 32.7 32.7 Depreciation and amortization 75.0 75.0 Stock-based

compensation 10.0 10.0 Contingent consideration adjustment 0.2 0.2

Expense reduction project costs 2.7 2.7 Adjusted EBITDA $

162.0 $ 165.0

Modeling guidelines for the current fiscal year assume the

following:

Average basic and diluted shares outstanding

for the year: 37.5 million

Capital expenditures: 3.3% of net revenue

Annual tax rate: 40%

Net income as presented in the reconciliation of Adjusted EBITDA

guidance to net income may be further impacted by potential future

non-operating charges that would impact net income without

affecting Adjusted EBITDA.

Conference Call

This afternoon, Wednesday, August 9, 2017, Civitas Solutions

management will host a conference call at 5:00 pm (Eastern Time) to

discuss the fiscal 2017 third quarter results.

Conference Call Dial-in #: Domestic

U.S. Toll Free: 877-255-4315 International: 412-317-5467

Replay Details (available 1 hour after conclusion of the

conference call through 8/16/2017):

Domestic U.S. Toll Free: 877-344-7529

International: 412-317-0088 Canada Toll Free: 855-669-9658

Replay Access Code: 10111038

A live webcast of the conference call will be available via the

investor relations section of the Company’s website: www.civitas-solutions.com. Following the call, an

archived replay of the webcast will be available on this website

through November 9, 2017.

Non-GAAP Financial Information

This earnings release includes a discussion of Adjusted EBITDA,

net revenue excluding ARY divested operations, and net debt, which

are non-GAAP financial measures. Adjusted EBITDA is presented

because it is an important measure used by management to assess

financial performance, and management believes it provides a more

transparent view of the Company’s underlying operating performance

and operating trends. In addition, the Company believes this

measurement is important because securities analysts, investors and

lenders use this measurement to compare the Company’s performance

to other companies in our industry. Net revenue excluding ARY

divested operations is presented to enhance investors’

understanding of the financial performance and operating trends of

the continuing operations. Net debt is presented because it is

useful for lenders, securities analysts, and investors in

determining the Company's net debt leverage ratio.

The non-GAAP financial measures are not determined in accordance

with GAAP and should not be considered in isolation or as

alternatives to net income, revenues or total debt or other

financial statement data presented as indicators of financial

performance or liquidity, each as presented in accordance with

GAAP. Adjusted EBITDA should not be considered as a measure of

discretionary cash available to us to invest in the growth of our

business. While we and other companies in our industry frequently

use Adjusted EBITDA as a measure of operating performance and the

ability to meet debt service requirements, it is not necessarily

comparable to other similarly titled captions of other companies

due to potential inconsistencies in the methods of calculation. All

non-GAAP financial measures should be reviewed in conjunction with

the Company’s financial statements filed with the SEC.

For a reconciliation of each non-GAAP financial measure to the

most directly comparable GAAP financial measure, please see

“Reconciliation of non-GAAP Financial Measures” on page 8 of this

press release.

Forward-Looking Statements

This press release contains statements about future events and

expectations that constitute forward-looking statements, including

our guidance, outlook and statements about our expectations for

future financial performance. Forward-looking statements are based

on our beliefs, assumptions and expectations of industry trends,

our future financial and operating performance and our growth,

taking into account the information currently available to us.

These statements are not statements of historical fact.

Forward-looking statements involve risks and uncertainties that may

cause our actual results to differ materially from the expectations

of future results we express or imply in any forward-looking

statements and you should not place undue reliance on such

statements. Factors that could contribute to these differences

include, but are not limited to: reductions or changes in Medicaid

or other funding; changes in budgetary priorities by federal, state

and local governments; substantial claims, litigation and

governmental proceedings; reductions in reimbursement rates or

changes in policies or payment practices by the Company’s payors;

increases in labor costs; matters involving employees that may

expose the Company to potential liability; the Company’s

substantial amount of debt; the Company’s ability to comply with

billing and collection rules and regulations; changes in economic

conditions; increases in insurance costs; increases in workers

compensation-related liability; the Company’s ability to maintain

relationships with government agencies and advocacy groups;

negative publicity; the Company’s ability to maintain existing

service contracts and licenses; the Company’s ability to implement

its growth strategies successfully; the Company’s financial

performance; and other factors described in “Risk Factors” in

Civitas’ Form 10-K. Words such as “anticipates”, “believes”,

“continues”, "positions", “estimates”, “expects”, “goal”,

"aspiration", “objectives”, “intends”, “may”, “hope”,

“opportunity”, “plans”, “potential”, “near-term”, “long-term”,

“projections”, “assumptions”, “projects”, “guidance”, “forecasts”,

“outlook”, “target”, “trends”, “should”, “could”, “would”, “will”

and similar expressions are intended to identify such

forward-looking statements. We qualify any forward-looking

statements entirely by these cautionary factors. We assume no

obligation to update or revise any forward-looking statements for

any reason, or to update the reasons actual results could differ

materially from those anticipated in these forward-looking

statements, even if new information becomes available in the

future. Comparisons of results for current and any prior periods

are not intended to express any future trends or indications of

future performance, unless expressed as such, and should only be

viewed as historical data.

Select Financial Highlights ($ in thousands,

except share and per share data) (unaudited)

Three Months EndedJune 30,

Nine Months EndedJune 30, 2017

2016 2017 2016 Gross revenue $ 377,768

$ 358,572 $ 1,109,964 $ 1,057,394 Sales adjustments (5,423 ) (4,609

) (15,826 ) (12,001 ) Net revenue 372,345 353,963 1,094,138

1,045,393 Cost of revenue 292,498 274,569 861,992 811,385 Operating

expenses: General and administrative 40,413 42,988 123,992 132,614

Depreciation and amortization 19,161 18,634 56,146

54,952 Total operating expenses 59,574 61,622

180,138 187,566 Income from operations 20,273

17,772 52,008 46,442 Other income (expense): Other income

(expense), net (149 ) (140 ) 762 (1,098 ) Interest expense (8,339 )

(8,493 ) (25,117 ) (25,530 ) Income from continuing operations

before income taxes 11,785 9,139 27,653 19,814 Provision for income

taxes 4,424 4,296 10,634 13,032 Income

from continuing operations 7,361 4,843 17,019 6,782 Loss from

discontinued operations, net of tax — (27 ) — (255 )

Net income $ 7,361 $ 4,816 $ 17,019 $ 6,527

Income per common share, basic Income from continuing

operations $ 0.20 $ 0.13 $ 0.46 $ 0.18 Loss from discontinued

operations, net of tax — — — — Net

income $ 0.20 $ 0.13 $ 0.46 $ 0.18

Income per common share, diluted Income from continuing operations

$ 0.20 $ 0.13 $ 0.45 $ 0.18 Loss from discontinued operations, net

of tax $ — $ — $ — $ — Net income $

0.20 $ 0.13 $ 0.45 $ 0.18 Weighted

average number of common shares outstanding, basic 37,323,458

37,108,486 37,278,760 37,101,968 Weighted average number of common

shares outstanding, diluted 37,495,488 37,252,344 37,413,264

37,247,784

Selected Balance Sheet and Cash Flow

Highlights ($ in thousands) (unaudited)

As of June 30, 2017 September 30,

2016 Cash and cash equivalents $ 26,103 $ 50,683 Working

capital (a) $ 74,119 $ 77,354 Total assets $ 1,081,105 $ 1,086,158

Total debt (b) $ 639,269 $ 644,591 Net debt (c) $ 563,166 $ 543,908

Stockholders' equity $ 171,844 $ 145,590

Nine Months

Ended June 30, 2017 2016 Cash flows provided by

(used in): Operating activities $ 70,020 $ 60,641 Investing

activities $ (82,211 ) $ (75,038 ) Financing activities $ (12,389 )

$ (8,047 ) Purchases of property and equipment $ (32,981 ) $

(31,655 ) Acquisition of businesses (d) $ (51,883 ) $ (44,481 )

(a) Calculated as current assets minus current liabilities.

(b) Total debt includes obligations under capital leases and

excludes deferred financing costs and original issue discount on

the term loan.

(c) Represents net debt as defined in our senior credit

agreement (total debt, net of cash and cash equivalents and

restricted cash). See Reconciliation of non-GAAP Financial Measures

for a reconciliation of total debt to net debt.

(d) For the nine months ended June 30, 2017, cash paid for

acquisitions includes a $9.5 million deposit made on an acquisition

within our SRS business that closed on July 1, 2017.

Reconciliation of Non-GAAP Financial Measures ($

in thousands) (unaudited)

Three Months

EndedJune 30, Nine Months EndedJune

30, Reconciliation from Net income to Adjusted EBITDA:

2017 2016 2017 2016 Net

income $ 7,361 $ 4,816 $ 17,019 $ 6,527 Loss from discontinued

operations, net of tax — 27 — 255 Provision for income taxes 4,424

4,296 10,634 13,032 Interest expense, net 8,339 8,490 25,112 25,300

Depreciation and amortization 19,161 18,634 56,146 54,952

Adjustments: Stock-based compensation (a) 2,223 1,766 6,596

15,200 Exit costs(b) — — — 2,005 Contingent consideration

adjustment (c) (181 ) 2,600 194 (345 ) Sale of business(d) — — —

1,250 Expense reduction project costs(e) 945 — 2,694

— Adjusted EBITDA $ 42,272 $ 40,629 $

118,395 $ 118,176

(a) Represents non-cash stock-based compensation expense. For

the nine months ended June 30, 2016, stock-based compensation

includes $10.5 million of expense related to certain awards under

our former equity compensation plan that vested in connection with

our secondary offering and the distribution of our shares held by

NMH Investment, LLC in October 2015. The vesting of these awards

impacted the allocation of the shares of Civitas that were

distributed from NMH Investment, LLC to our private equity sponsor

and management and not the number of shares outstanding.

(b) Represents severance and lease terminations costs associated

with our ARY divestitures.

(c) Represents the fair value adjustment associated with

acquisition related contingent consideration liabilities.

(d) Represents the loss recorded on the sale of our North

Carolina ARY business.

(e) Represents consulting, severance and other costs incurred in

connection with the Company's project to optimize business

operations and reduce company-wide expenses.

Reconciliation of Non-GAAP Financial

Measures (continued)($ in thousands)(unaudited)

Reconciliations of net revenue to net revenue excluding ARY

divested operations, for the nine months ended June 30, 2017

and 2016 are as follows:

Nine Months

EndedJune 30, 2017 2016 $

Change % Change Net revenue $ 1,094,138 $ 1,045,393 $

48,745 4.7 % Less net revenue from ARY divested operations 18

6,922 (6,904 ) ARY net revenue excluding ARY

divested operations $ 1,094,120 $ 1,038,471 $ 55,649 5.4 %

Nine Months EndedJune 30,

2017 2016 $ Change %

Change ARY net revenue $ 106,784 $ 113,279 $ (6,495 ) (5.7 )%

Less net revenue from ARY divested operations 18 6,922

(6,904 ) ARY net revenue excluding ARY divested

operations $ 106,766 $ 106,357 $ 409 0.4 %

A reconciliation of reported debt to net debt is as follows:

As of June 30, 2017

September 30, 2016 Reported Debt(1) $ 632,732 $

637,523 Original issue discount on term loan, net of accumulated

amortization 970 1,178 Deferred financing costs, net of accumulated

amortization 5,567 5,890 Total debt $ 639,269 $ 644,591 Cash

and cash equivalents 26,103 50,683 Restricted cash 50,000

50,000 Net debt $ 563,166 $ 543,908

(1) Reported debt includes obligations under capital leases.

About Civitas

Civitas Solutions, Inc. is the leading national provider of

home- and community-based health and human services to must-serve

individuals with intellectual, developmental, physical or

behavioral disabilities and other special needs. Since our founding

in 1980, we have evolved from a single residential program to a

diversified national network offering an array of quality services

in 36 states.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170809006070/en/

Civitas Solutions, Inc.Dwight Robson, 617-790-4800Chief Public

Strategy and Marketing

Officerdwight.robson@civitas-solutions.com

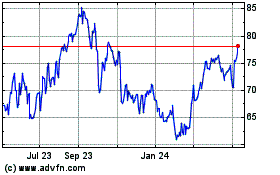

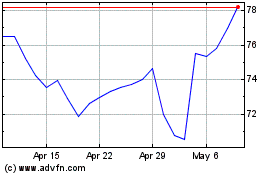

Civitas Resources (NYSE:CIVI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Civitas Resources (NYSE:CIVI)

Historical Stock Chart

From Apr 2023 to Apr 2024