Hudson Technologies, Inc. (NASDAQ: HDSN) announced results for

the second quarter and six months ended June 30, 2017.

The Company reported record revenues of $52.2 million for the

second quarter ended June 30, 2017, an increase of 51% compared to

$34.6 million in the comparable 2016 period. The revenue increase

in the quarter is primarily related to both price and volume

increases of certain refrigerants sold. Gross margin in the second

quarter of 2017 was 33% compared to 30% in the prior year period.

Net income for the quarter, including the recognition of $0.8

million of non-recurring SG&A expense related to corporate

development initiatives, was $8.5 million, or $0.21 per basic and

$0.20 per diluted share, compared to net income of $4.8 million, or

$0.15 per basic and $0.14 diluted share, in the second quarter of

2016.

For the six months ended June 30, 2017, Hudson reported revenues

of $91.1 million, a 45% increase compared to $62.8 million in the

comparable 2016 period. The increase is primarily related to a

higher selling price of certain refrigerants and higher volumes of

certain refrigerants sold. Gross margin increased to 33% for the

first half of 2017 compared to 29% for the first half of 2016. Net

income for the first six months of 2017 was $14.3 million, or $0.34

per basic and $0.33 per diluted share, compared to $7.8 million or

$0.24 per basic and $0.23 per diluted share in 2016.

Kevin J. Zugibe, Chairman and Chief Executive Officer of Hudson

Technologies commented, “We’re very pleased to have built upon our

strong first quarter performance to deliver record revenues,

enhanced margins and significantly improved profitability in the

second quarter of 2017. During the second quarter, which is the

midpoint of our nine-month refrigerant sales season, our results

were particularly strong as we saw increased sales volume for

refrigerants and benefitted from incremental increases in the

average selling price for R-22 refrigerant as well as a temporary

increase in pricing for HFC refrigerants.”

Mr. Zugibe continued, “In addition to the evident gains we are

realizing through our sales of virgin refrigerants, we also see a

tremendous opportunity associated with our ability to reclaim

refrigerants as we enter the final years of the R-22 production

phase out, which will be completed by the end of 2019, and look

toward the anticipated phase-down of HFC refrigerants. As the

industry transitions to new technology and next generation

refrigerants, Hudson, as a leading reclaimer, is well positioned to

apply our reclamation capabilities to help fill demand for

refrigerants as virgin production is phased down and eliminated. We

remain focused on leveraging our expansive distribution network,

decades of experience and long-standing customer relationships to

capitalize on opportunities that arise from the evolving industry

landscape.”

CONFERENCE CALL INFORMATION

The Company will host a conference call to discuss the second

quarter results today, August 9, 2017 at 5:00 P.M. Eastern

Time.

To access the live webcast, please use the following link:

https://www.hudsontech.com/investor-relations/events-presentations/

To participate in the call by phone, dial (877) 407-9205

approximately five minutes prior to the scheduled start time.

International callers please dial (201) 689-8054.

A replay of the teleconference will be available until September

9, 2017 and may be accessed by dialing (877) 481-4010.

International callers may dial (919) 882-2331. Callers should use

conference ID: 19253.

About Hudson Technologies

Hudson Technologies, Inc. is a leading provider of innovative

and sustainable solutions for optimizing performance and enhancing

reliability of commercial and industrial chiller plants and

refrigeration systems. Hudson's proprietary RefrigerantSide®

Services increase operating efficiency, provide energy and cost

savings, reduce greenhouse gas emissions and the plant’s carbon

footprint while enhancing system life and reliability of operations

at the same time. RefrigerantSide® Services can be performed at a

customer's site as an integral part of an effective scheduled

maintenance program or in response to emergencies. Hudson also

offers SMARTenergy OPS®, which is a cloud-based Managed Software as

a Service for continuous monitoring, Fault Detection and

Diagnostics and real-time optimization of chilled water plants. In

addition, the Company sells refrigerants and provides traditional

reclamation services for commercial and industrial air conditioning

and refrigeration uses. For further information on Hudson, please

visit the Company's web site at www.hudsontech.com.

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995

Statements contained herein which are not historical facts

constitute forward-looking statements. Such forward-looking

statements involve a number of known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of the Company to be materially

different from any future results, performance or achievements

expressed or implied by such forward-looking statements. Such

factors include, but are not limited to, changes in the laws and

regulations affecting the industry, changes in the demand and price

for refrigerants (including unfavorable market conditions adversely

affecting the demand for, and the price of, refrigerants), the

Company's ability to source refrigerants, regulatory and economic

factors, seasonality, competition, litigation, the nature of

supplier or customer arrangements that become available to the

Company in the future, adverse weather conditions, possible

technological obsolescence of existing products and services,

possible reduction in the carrying value of long-lived assets,

estimates of the useful life of its assets, potential environmental

liability, customer concentration, the ability to obtain financing,

any delays or interruptions in bringing products and services to

market, the timely availability of any requisite permits and

authorizations from governmental entities and third parties as well

as factors relating to doing business outside the United States,

including changes in the laws, regulations, policies, and

political, financial and economic conditions, including inflation,

interest and currency exchange rates, of countries in which the

Company may seek to conduct business, the Company’s ability to

successfully integrate any assets it acquires from third parties

into its operations, and other risks detailed in the Company's 10-K

for the year ended December 31, 2016 and other subsequent filings

with the Securities and Exchange Commission. The words "believe",

"expect", "anticipate", "may", "plan", "should" and similar

expressions identify forward-looking statements. Readers are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date the statement was

made.

Hudson Technologies, Inc. and

Subsidiaries

Consolidated Income Statements

(unaudited)

(Amounts in thousands, except for share

and per share amounts)

Three month period Six month

period ended June 30, ended June 30, 2017

2016 2017 2016

Revenues $ 52,231 $ 34,605 $ 91,061 $ 62,772

Cost

of sales 34,811 24,114

61,174 44,759 Gross profit

17,420 10,491 29,887

18,013 Operating expenses: Selling and

marketing 1,110 1,019 2,149 2,136 General and administrative

2,410 1,328 4,445

2,714 Total operating expenses

3,520 2,347 6,594

4,850 Operating income 13,900 8,144

23,293 13,163

Interest expense, net 61

352 146 623 Income

before income taxes 13,839 7,792 23,147 12,540

Income

tax expense 5,314 2,962

8,888 4,766 Net income $

8,525 $

4,830 $

14,259 $

7,774 Net income per common share – Basic $

0.21 $

0.15 $

0.34 $

0.24 Net income per common share – Diluted $

0.20 $

0.14 $

0.33 $

0.23 Weighted average number of shares outstanding –

Basic

41,567,848 33,128,518

41,537,894 33,008,588 Weighted average

number of shares outstanding – Diluted

43,550,226

34,270,337 43,490,914

34,045,125

Hudson Technologies, Inc. and

Subsidiaries

Consolidated Balance Sheets

(Amounts in thousands, except for share

and par value amounts)

June 30, December 31,

2017 2016 (unaudited)

Assets

Current assets: Cash and cash equivalents $ 33,673 $ 33,931

Trade accounts receivable – net 24,522 4,797 Inventories 64,612

68,601 Prepaid expenses and other current assets

6,331

847 Total current assets 129,138 108,176

Property, plant and equipment, less accumulated depreciation 7,203

7,532 Deferred tax asset 2,036 2,532 Intangible assets, less

accumulated amortization 3,056 3,299 Goodwill 856 856 Other assets

88 75 Total Assets $

142,377 $

122,470

Liabilities and

Stockholders' Equity

Current liabilities: Trade accounts payable $ 9,746 $ 5,110

Accrued expenses and other current liabilities 2,681 2,888 Accrued

payroll 968 1,782 Income taxes payable 2,155 322 Short-term debt

and current maturities of long-term debt

90

199 Total current liabilities 15,640 10,301

Long-term debt, less current maturities

107

152 Total Liabilities 15,747

10,453 Commitments and contingencies

Stockholders' equity: Preferred stock, shares

authorized 5,000,000: Series A Convertible preferred stock, $0.01

par value ($100 liquidation preference value); shares authorized

150,000; none issued or outstanding - - Common stock, $0.01 par

value; shares authorized 100,000,000; issued and outstanding

41,625,181 and 41,465,820 416 415 Additional paid-in capital

114,385 114,032 Retained earnings (Accumulated deficit)

11,829 (2,430) )

Total Stockholders'

Equity 126,630 112,017

Total Liabilities and Stockholders' Equity $

142,377 $

122,470

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170809005970/en/

Investor Relations:Institutional Marketing Services

(IMS)John Nesbett/Jennifer Belodeau(203)

972-9200jnesbett@institutionalms.comorCompany:Hudson

Technologies, Inc.Brian F. Coleman, President & COO(845)

735-6000bcoleman@hudsontech.com

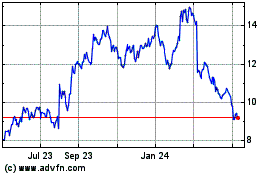

Hudson Technologies (NASDAQ:HDSN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hudson Technologies (NASDAQ:HDSN)

Historical Stock Chart

From Apr 2023 to Apr 2024