Amphastar Pharmaceuticals, Inc. (NASDAQ:AMPH) (“Amphastar” or the

“Company”) today reported results for the three months ended June

30, 2017.

Second Quarter Highlights

- Net revenues of $65.2 million for the second quarter

- GAAP net income of $2.0 million, or $0.04 per diluted share,

for the second quarter

- Adjusted non-GAAP net income of $5.4 million, or $0.11 per

diluted share, for the second quarter

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Six Months Ended |

|

| |

|

June 30, |

|

June 30, |

|

| |

|

2017 |

|

2016 |

|

2017 |

|

2016 |

|

| |

|

(in thousands, except per share data) |

|

| Net revenues |

|

$ |

65,187 |

|

$ |

68,033 |

|

$ |

121,857 |

|

$ |

127,399 |

|

| GAAP net income |

|

$ |

1,972 |

|

$ |

6,895 |

|

$ |

2,865 |

|

$ |

9,384 |

|

| Adjusted non-GAAP net

income* |

|

$ |

5,430 |

|

$ |

10,347 |

|

$ |

9,905 |

|

$ |

15,906 |

|

| GAAP diluted EPS |

|

$ |

0.04 |

|

$ |

0.15 |

|

$ |

0.06 |

|

$ |

0.21 |

|

| Adjusted non-GAAP

diluted EPS* |

|

$ |

0.11 |

|

$ |

0.23 |

|

$ |

0.21 |

|

$ |

0.35 |

|

|

|

| * Adjusted

non-GAAP net income and Adjusted non-GAAP diluted EPS are non-GAAP

financial measures. Please see the discussion in the section

entitled “Non-GAAP Financial Measures” and the reconciliation of

GAAP to non-GAAP financial measures in Table II of this press

release. |

Second Quarter Results

For the three months ended June 30, 2017, the

Company reported net revenues of $65.2 million, a decrease of 4%

compared to $68.0 million for the three months ended June 30,

2016.

For the three months ended June 30, 2017, net

revenues of enoxaparin were $8.3 million, representing a decrease

of 52% compared to $17.3 million for the three months ended June

30, 2016. Of the decrease, $7.1 million was due to lower unit

volumes, while the remainder was due to lower pricing.

Other finished pharmaceutical product revenues were

$55.5 million for the three months ended June 30, 2017,

representing an increase of 19% compared to $46.4 million for the

three months ended June 30, 2016. This was primarily due to an

increase in sales of epinephrine to $10.6 million from $5.2 million

resulting from increases in both average selling price and unit

volumes. The FDA requested that the Company discontinue the

manufacturing and distribution of its epinephrine injection, USP

vial product, which had been marketed under the “grandfather”

exception to the FDA’s “Prescription Drug Wrap-Up” program. The

Company discontinued selling this product in the second quarter of

2017. Net revenues from this product were $9.9 million for

the three months ended June 30, 2017.

For the three months ended June 30, 2017, sales of

lidocaine increased to $9.3 million from $8.2 million for the three

months ended June 30, 2016, and sales of phytonadione increased to

$10.0 million from $8.8 million for the three months ended June 30,

2016, both of which were primarily due to an increase in unit

volumes. These increases were partially offset by a decrease in

sales of naloxone to $10.3 million for the three months ended June

30, 2017 from $15.6 million for the three months ended June 30,

2016, primarily as a result of a decrease in unit volumes as well

as a lower average selling price.

Sales of the Company’s insulin active

pharmaceutical ingredient, or API, products were $1.4 million for

the three months ended June 30, 2017, compared to $4.3 million for

the three months ended June 30, 2016, as the Company did not ship

any API to MannKind in the second quarter of 2017.

Cost of revenues were $38.4 million, or 59% of

revenues, and $36.3 million, or 53% of revenues, for the three

months ended June 30, 2017 and 2016, respectively, representing an

increase of $2.1 million. Cost of revenues in the second

quarter of 2017 included a charge of $4.7 million to adjust certain

inventory items to their net realizable value, including $2.9

million for enoxaparin inventory.

Selling, distribution, and marketing expenses were

$1.6 million and $1.3 million for the three months ended June 30,

2017 and 2016, respectively. For the three months ended June 30,

2017, general and administrative expenses increased to $12.2

million from $9.5 million for the three months ended June 30, 2016,

primarily due to an increase in legal fees, in preparation for the

Company’s patent trial in July 2017.

For the three months ended June 30, 2017, research

and development expenses increased by 1% to $10.7 million from

$10.5 million for the three months ended June 30, 2016.

Expenditures on clinical trials and materials related to our

pipeline products increased, which were partially offset by a

decrease in FDA fees pertaining to the NDA filing of our intranasal

naloxone product candidate that was submitted in the second quarter

of 2016.

The Company recorded an income tax expense of $1.2

million for the three months ended June 30, 2017, compared to an

income tax expense of $2.9 million for the three months ended June

30, 2016.

The Company recognized net income of $2.0 million,

or $0.04 per fully diluted share, for the three months ended June

30, 2017, compared to a net income of $6.9 million, or $0.15 per

fully diluted share, for the three months ended June 30, 2016. The

Company’s adjusted non-GAAP quarterly net income was $5.4 million,

or $0.11 per fully diluted share, for the three months ended June

30, 2017, compared to an adjusted non-GAAP net income of $10.3

million, or $0.23 per fully diluted share, for the three months

ended June 30, 2016. Please see the discussion in the section

entitled “Non-GAAP Financial Measures” and the reconciliation of

GAAP to non-GAAP measures in Table II of this press release.

The Company’s cash and cash equivalents, short-term

investments, and unrestricted short-term investments were $87.4

million as of June 30, 2017. Cash flow provided by operating

activities for the six months ended June 30, 2017, was $27.0

million.

Share buyback program

On August 7, 2017, the Company’s Board of Directors

authorized an increase of $20.0 million to the Company’s share

buyback program, which is expected to continue for an indefinite

period of time. The primary goal of the program is to offset

dilution created by the Company’s equity compensation programs.

Purchases may be made through the open market and

private block transactions pursuant to Rule 10b5-1 plans, privately

negotiated transactions, or other means, as determined by the

Company’s management and in accordance with the requirements of

the Securities and Exchange Commission.

The timing and actual number of shares repurchased

will depend on a variety of factors including price, corporate and

regulatory requirements, and other conditions.

Pipeline Information

The Company currently has six abbreviated new drug

applications, or ANDAs, filed with the FDA targeting products with

a market size of over $1.1 billion, three biosimilar products in

development targeting products with a market size of $15.0 billion,

and 11 generic products in development targeting products with a

market size of over $12.0 billion. This market information is based

on IMS Health data for the 12 months ended June 30, 2017. The

Company’s proprietary pipeline includes NDAs for Primatene® Mist

and intranasal naloxone. The Company is currently developing four

other proprietary products, which include injectable, inhalation

and intranasal dosage forms.

Company Information

Amphastar is a specialty pharmaceutical company

that focuses primarily on developing, manufacturing, marketing, and

selling technically-challenging generic and proprietary injectable,

inhalation, and intranasal products. Additionally, the Company

sells insulin API products. Most of the Company’s

finished products are used in hospital or urgent care clinical

settings and are primarily contracted and distributed through group

purchasing organizations and drug wholesalers. More

information is available at the Company’s website at

www.amphastar.com.

Amphastar’s logo and other trademarks or service

marks of Amphastar Pharmaceuticals, Inc., including, but not

limited to Primatene®, Amphadase® and Cortrosyn®, are the property

of Amphastar Pharmaceuticals, Inc.

Non-GAAP Financial Measures

To supplement its consolidated financial

statements, which are prepared and presented in accordance with

U.S. generally accepted accounting principles, or GAAP, the Company

is disclosing non-GAAP financial measures when providing financial

results. The Company believes that an evaluation of its ongoing

operations (and comparisons of its current operations with

historical and future operations) would be difficult if the

disclosure of its financial results were limited to financial

measures prepared only in accordance with GAAP. As a result, the

Company is disclosing certain non-GAAP results, including (i)

Adjusted non-GAAP net income (loss) and (ii) Adjusted non-GAAP

diluted EPS, that exclude amortization expense, share-based

compensation, and impairment charges in order to supplement

investors’ and other readers’ understanding and assessment of the

Company’s financial performance, because the Company’s management

uses these measures internally for forecasting, budgeting, and

measuring its operating performance. Whenever the Company uses such

non-GAAP measures, it will provide a reconciliation of non-GAAP

financial measures to their most directly comparable GAAP financial

measures. Investors and other readers are encouraged to review the

related GAAP financial measures and the reconciliation of non-GAAP

measures to their most directly comparable GAAP measures set forth

below and should consider non-GAAP measures only as a supplement

to, not as a substitute for or as a superior measure to, measures

of financial performance prepared in accordance with GAAP.

Conference Call Information

The Company will hold a conference call to discuss

its financial results today, August 9, 2017, at 2:00 p.m. Pacific

Time.

To access the conference call, dial toll-free (877)

881-2595 or (315) 625-3083 for international callers, five minutes

before the conference. The passcode for the conference call is

62348267.

The call can also be accessed on the Investors page

on the Company’s website at www.amphastar.com.

Forward Looking Statements

All statements in this press release and in the

conference call referenced above that are not historical are

forward-looking statements, including, among other things,

statements relating to the Company’s expectations regarding future

financial performance, backlog, sales and marketing of its

products, market size and growth, the timing of FDA filings or

approvals, acquisitions and other matters related to its pipeline

of product candidates, the timing for completion of construction at

the Company’s IMS facility, its share buyback program and other

future events. These statements are not historical facts but rather

are based on Amphastar’s historical performance and its current

expectations, estimates, and projections regarding Amphastar’s

business, operations and other similar or related factors. Words

such as “may,” “might,” “will,” “could,” “would,” “should,”

“anticipate,” “predict,” “potential,” “continue,” “expect,”

“intend,” “plan,” “project,” “believe,” “estimate,” and other

similar or related expressions are used to identify these

forward-looking statements, although not all forward-looking

statements contain these words. You should not place undue reliance

on forward-looking statements because they involve known and

unknown risks, uncertainties, and assumptions that are difficult or

impossible to predict and, in some cases, beyond Amphastar’s

control. Actual results may differ materially from those in

the forward-looking statements as a result of a number of factors,

including those described in Amphastar’s filings with the

Securities and Exchange Commission. You can locate these reports

through the Company’s website at http://ir.amphastar.com and on the

SEC’s website at www.sec.gov. Amphastar undertakes no

obligation to revise or update information in this press release or

the conference call referenced above to reflect events or

circumstances in the future, even if new information becomes

available or if subsequent events cause Amphastar’s expectations to

change.

| Table I |

| Amphastar Pharmaceuticals, Inc. |

| Condensed Consolidated Statement of

Operations |

| (Unaudited; in thousands, except per share

data) |

| |

| |

|

Three Months Ended |

|

Six Months Ended |

|

| |

|

June 30, |

|

June 30, |

|

| |

|

2017 |

|

2016 |

|

|

2017 |

|

|

2016 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net revenues |

|

$ |

65,187 |

|

$ |

68,033 |

|

|

$ |

121,857 |

|

|

$ |

127,399 |

|

|

| Cost of revenues |

|

|

38,440 |

|

|

36,319 |

|

|

|

72,282 |

|

|

|

70,783 |

|

|

| Gross profit |

|

|

26,747 |

|

|

31,714 |

|

|

|

49,575 |

|

|

|

56,616 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating (income)

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selling,

distribution, and marketing |

|

|

1,596 |

|

|

1,332 |

|

|

|

3,075 |

|

|

|

2,684 |

|

|

| General

and administrative |

|

|

12,234 |

|

|

9,458 |

|

|

|

23,572 |

|

|

|

20,328 |

|

|

| Research

and development |

|

|

10,732 |

|

|

10,594 |

|

|

|

21,982 |

|

|

|

19,199 |

|

|

| Gain on

sale of intangible assets |

|

|

— |

|

|

— |

|

|

|

(2,643 |

) |

|

|

— |

|

|

| Total operating

expenses |

|

|

24,562 |

|

|

21,384 |

|

|

|

45,986 |

|

|

|

42,211 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from

operations |

|

|

2,185 |

|

|

10,330 |

|

|

|

3,589 |

|

|

|

14,405 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-operating income

(expense), net |

|

|

988 |

|

|

(578 |

) |

|

|

1,088 |

|

|

|

(837 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income

taxes |

|

|

3,173 |

|

|

9,752 |

|

|

|

4,677 |

|

|

|

13,568 |

|

|

| Income tax expense |

|

|

1,201 |

|

|

2,857 |

|

|

|

1,812 |

|

|

|

4,184 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

1,972 |

|

$ |

6,895 |

|

|

$ |

2,865 |

|

|

$ |

9,384 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income per

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.04 |

|

$ |

0.15 |

|

|

$ |

0.06 |

|

|

$ |

0.21 |

|

|

|

Diluted |

|

$ |

0.04 |

|

$ |

0.15 |

|

|

$ |

0.06 |

|

|

$ |

0.21 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average shares used to compute net income per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

46,025 |

|

|

44,957 |

|

|

|

46,047 |

|

|

|

44,999 |

|

|

|

Diluted |

|

|

47,866 |

|

|

45,968 |

|

|

|

47,962 |

|

|

|

45,712 |

|

|

| Table II |

| Amphastar Pharmaceuticals, Inc. |

| Reconciliation of Non-GAAP

Measures |

| (Unaudited; in thousands, except per share

data) |

| |

| |

|

Three Months Ended |

|

Six Months Ended |

| |

|

June 30, |

|

June 30, |

| |

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP net income |

|

$ |

1,972 |

|

|

$ |

6,895 |

|

|

$ |

2,865 |

|

|

$ |

9,384 |

|

| Adjusted for: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Intangible amortization |

|

|

705 |

|

|

|

570 |

|

|

|

1,426 |

|

|

|

1,050 |

|

|

Share-based compensation |

|

|

4,298 |

|

|

|

4,198 |

|

|

|

8,749 |

|

|

|

8,049 |

|

|

Impairment of long-lived assets |

|

|

— |

|

|

|

114 |

|

|

|

— |

|

|

|

331 |

|

| Income

tax expense on pre-tax adjustments |

|

|

(1,545 |

) |

|

|

(1,430 |

) |

|

|

(3,135 |

) |

|

|

(2,908 |

) |

| Non-GAAP net

income |

|

$ |

5,430 |

|

|

$ |

10,347 |

|

|

$ |

9,905 |

|

|

$ |

15,906 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP net income per

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.12 |

|

|

$ |

0.23 |

|

|

$ |

0.22 |

|

|

$ |

0.35 |

|

|

Diluted |

|

$ |

0.11 |

|

|

$ |

0.23 |

|

|

$ |

0.21 |

|

|

$ |

0.35 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average shares used to compute non-GAAP net income per

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

46,025 |

|

|

|

44,957 |

|

|

|

46,047 |

|

|

|

44,999 |

|

|

Diluted |

|

|

47,866 |

|

|

|

45,968 |

|

|

|

47,962 |

|

|

|

45,712 |

|

| |

|

Three Months Ended

June 30, 2017 |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Selling, |

|

General |

|

Research |

|

Income |

| |

|

Cost of |

|

distribution |

|

and |

|

and |

|

tax expense |

| |

|

revenue |

|

and marketing |

|

administrative |

|

development |

|

(benefit) |

| GAAP |

|

$ |

38,440 |

|

|

$ |

1,596 |

|

|

$ |

12,234 |

|

|

$ |

10,732 |

|

|

$ |

1,201 |

| Intangible

amortization |

|

|

(669 |

) |

|

|

— |

|

|

|

(36 |

) |

|

|

— |

|

|

|

— |

| Share-based

compensation |

|

|

(897 |

) |

|

|

(65 |

) |

|

|

(2,985 |

) |

|

|

(351 |

) |

|

|

— |

| Income tax expense on

pre-tax adjustments |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,545 |

| Non-GAAP |

|

$ |

36,874 |

|

|

$ |

1,531 |

|

|

$ |

9,213 |

|

|

$ |

10,381 |

|

|

$ |

2,746 |

| |

|

Three Months Ended

June 30, 2016 |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Selling, |

|

General |

|

Research |

|

Income |

| |

|

Cost of |

|

distribution |

|

and |

|

and |

|

tax expense |

| |

|

revenue |

|

and marketing |

|

administrative |

|

development |

|

(benefit) |

| GAAP |

|

$ |

36,319 |

|

|

$ |

1,332 |

|

|

$ |

9,458 |

|

|

$ |

10,594 |

|

|

$ |

2,857 |

| Intangible

amortization |

|

|

(535 |

) |

|

|

— |

|

|

|

(35 |

) |

|

|

— |

|

|

|

— |

| Share-based

compensation |

|

|

(771 |

) |

|

|

(65 |

) |

|

|

(3,100 |

) |

|

|

(262 |

) |

|

|

— |

| Impairment of

long-lived assets |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(114 |

) |

|

|

— |

| Income tax expense on

pre-tax adjustments |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,430 |

| Non-GAAP |

|

$ |

35,013 |

|

|

$ |

1,267 |

|

|

$ |

6,323 |

|

|

$ |

10,218 |

|

|

$ |

4,287 |

|

Reconciliation of Non-GAAP Measures

(continued) |

|

|

| |

|

Six Months Ended

June 30, 2017 |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Selling, |

|

General |

|

Research |

|

Income |

| |

|

Cost of |

|

distribution |

|

and |

|

and |

|

tax expense |

| |

|

revenue |

|

and marketing |

|

administrative |

|

development |

|

(benefit) |

| GAAP |

|

$ |

72,282 |

|

|

$ |

3,075 |

|

|

$ |

23,572 |

|

|

$ |

21,982 |

|

|

$ |

1,812 |

| Intangible

amortization |

|

|

(1,354 |

) |

|

|

— |

|

|

|

(72 |

) |

|

|

— |

|

|

|

— |

| Share-based

compensation |

|

|

(2,028 |

) |

|

|

(149 |

) |

|

|

(5,768 |

) |

|

|

(804 |

) |

|

|

— |

| Income tax expense on

pre-tax adjustments |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,135 |

| Non-GAAP |

|

$ |

68,900 |

|

|

$ |

2,926 |

|

|

$ |

17,732 |

|

|

$ |

21,178 |

|

|

$ |

4,947 |

| |

|

Six Months Ended

June 30, 2016 |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Selling, |

|

General |

|

Research |

|

Income |

| |

|

Cost of |

|

distribution |

|

and |

|

and |

|

tax expense |

| |

|

revenue |

|

and marketing |

|

administrative |

|

development |

|

(benefit) |

| GAAP |

|

$ |

70,783 |

|

|

$ |

2,684 |

|

|

$ |

20,328 |

|

|

$ |

19,199 |

|

|

$ |

4,184 |

| Intangible

amortization |

|

|

(981 |

) |

|

|

— |

|

|

|

(69 |

) |

|

|

— |

|

|

|

— |

| Share-based

compensation |

|

|

(1,570 |

) |

|

|

(131 |

) |

|

|

(5,746 |

) |

|

|

(602 |

) |

|

|

— |

| Impairment of

long-lived assets |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(331 |

) |

|

|

— |

| Income tax expense on

pre-tax adjustments |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,908 |

| Non-GAAP |

|

$ |

68,232 |

|

|

$ |

2,553 |

|

|

$ |

14,513 |

|

|

$ |

18,266 |

|

|

$ |

7,092 |

Contact Information:

Amphastar Pharmaceuticals, Inc.

Bill Peters

Chief Financial Officer

(909) 980-9484

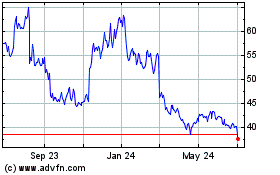

Amphastar Pharmaceuticals (NASDAQ:AMPH)

Historical Stock Chart

From Mar 2024 to Apr 2024

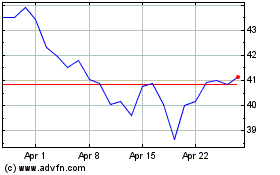

Amphastar Pharmaceuticals (NASDAQ:AMPH)

Historical Stock Chart

From Apr 2023 to Apr 2024