Collegium Pharmaceutical, Inc. (Nasdaq:COLL) today reported its

financial results for the second quarter of 2017 and provided a

corporate update.

“In the second quarter, we accelerated the growth of Xtampza ER

with consistent prescription growth, especially in the second half

of the quarter,” said Michael Heffernan, CEO of Collegium. “We are

also pleased to welcome two experienced pharmaceutical executives

to Collegium. Joseph Ciaffoni has joined as our Chief Operating

Officer, a newly created role within the Collegium organization,

and Gwen Melincoff has joined our Board of Directors. With these

additions, we have strengthened our team with significant

operational, commercial and business development expertise.”

Recent Milestones

Corporate

- In May 2017, Collegium appointed Joe Ciaffoni as Executive Vice

President and Chief Operating Officer.

- Effective today, Collegium appointed Gwen Melincoff to the

Company’s Board of Directors. Ms. Melincoff has over 25 years

of experience in the pharmaceutical industry, including senior

leadership positions at BTG International, Shire Pharmaceuticals

and Adolor Corporation. Her experience includes business

development, licensing, financing, marketing and product

management.

Commercial

- Prescriptions for Xtampza ER grew to 18,632 for the quarter, a

34% increase over the first quarter of 2017.

- During the second quarter of 2017, over 1,100 prescribers wrote

a prescription for Xtampza ER for the first time and over 4,000

prescribers have written since launch.

- Continued improvement in managed care:• Effective April

1, 2017, Xtampza ER is a preferred brand and the exclusive branded

oxycodone extended-release product on Aetna Medicare Part D.•

Effective June 1, 2017, Xtampza ER is a preferred brand and

the exclusive oxycodone extended-release product on Humana Medicare

Part D. • Effective July 1, 2017, Xtampza ER is covered

by Blue Cross Blue Shield of Florida.

Intellectual Property

- In June 2017, a new patent covering Xtampza ER granted by the

United States Patent and Trademark Office was added to the FDA

Orange Book and provides additional patent protection for Xtampza

ER until December 2030.

- Recently, a Notice of Allowance for a new patent covering

Xtampza ER was granted by the United States Patent and Trademark

Office. Once issued, the new patent will be added to the FDA

Orange Book and provides additional patent protection for Xtampza

ER until December 2036.

Clinical

- Continued success in demonstrating the clinical differentiation

between Xtampza ER and alternative extended-release opioids with

four new manuscripts published or accepted for publication:•

“Relative abuse of crush resistant prescription opioid

tablets via alternative oral modes of administration” (Pain

Medicine, July 2017)• “Tolerability, safety and effectiveness

of oxycodone DETERx in elderly patients >65 years of age with

chronic low back pain; a randomized controlled trial” (Drugs and

Aging, June 2017)• “The comparative pharmacokinetics of

physical manipulation by crushing of Xtampza ER compared with

Oxycontin” (Pain Management, Accepted for publication)• “In

Vitro Drug Release After Crushing: Evaluation of Xtampza ER and

Other ER Opioid Formulations” (Clinical Drug Investigations,

Accepted for publication)

Second Quarter 2017 Financial

Results

Collegium had cash and cash equivalents of $111.2 million as of

June 30, 2017 compared to $129.6 million as of March 31, 2017 and

$153.2 million as of December 31, 2016. During the quarter

ended June 30, 2017 cash used by operating activities was $17.5

million compared to $23.7 million for the quarter ended March 31,

2017.

Net loss for the quarter ended June 30, 2017 (the “2017

Quarter”) was $21.1 million, or $0.72 per share (basic and

diluted), as compared to net loss of $24.5 million, or $1.05 per

share (basic and diluted), for the quarter ended June 30, 2016 (the

“2016 Quarter”). Net loss includes stock-based compensation

expense of $1.9 million and $1.4 million for the 2017 Quarter and

2016 Quarter, respectively.

Net product revenues for Xtampza ER were $3.6 million for the

2017 Quarter compared to none for the 2016 Quarter. Net

product revenues increased by 64% for the 2017 Quarter compared to

the quarter ended March 31, 2017.

Research and development expenses were $2.2 million for the 2017

Quarter compared to $4.3 million for the 2016 Quarter. The

$2.1 million decrease was primarily related to a decrease in

clinical trial costs of $1.8 million due to the completion of

clinical trials in 2016 and a decrease in manufacturing costs of

$579,000 for Xtampza ER prior to FDA approval, partially offset by

an increase in manufacturing costs of $209,000 for clinical trials

associated with our hydrocodone product candidate.

Selling, general and administrative expenses were $22.1 million

for the 2017 Quarter compared to $20.2 million for the 2016

Quarter. The $1.9 million increase was primarily related to

an increase in personnel related costs of $4.0 million, an increase

in legal fees of $583,000 and an increase in sales and marketing

costs of $482,000. These increases were partially offset by a

decrease in consulting costs of $3.0 million following the launch

of Xtampza in June 2016.

As of June 30, 2017, there were 29,565,411 common shares

outstanding.

Financial Outlook

Based on our current operating plans, we believe that our

existing cash resources, together with expected cash inflows from

the commercialization of Xtampza ER will fund our operating

expenses, debt service and capital expenditure requirements into

2019.

Conference Call Information

Collegium will host a conference call and live audio webcast on

Wednesday, August 9, 2017 at 4:30 p.m. Eastern Time. To

access the conference call, please dial (888)698-6931 (U.S.) or

(805)905-2993 (International) and refer to Conference ID:

5785-1943. An audio webcast will be accessible from the

Investor Relations section of the Company’s website:

http://www.collegiumpharma.com/. An archived

webcast will be available on the Company’s website approximately

two hours after the event.

About Collegium Pharmaceutical,

Inc.

Collegium is a specialty pharmaceutical company focused on

developing a portfolio of products that incorporate its proprietary

DETERx® technology platform for the treatment of chronic pain and

other diseases. The DETERx technology platform is designed to

provide extended-release delivery, unique abuse-deterrent

properties, and flexible dose administration options.

About Xtampza ER

Xtampza® ER is Collegium’s first product utilizing the DETERx

technology platform. Xtampza ER is an abuse-deterrent,

extended-release, oral formulation of oxycodone approved by the FDA

for the management of pain severe enough to require daily,

around-the-clock, long-term opioid treatment and for which

alternative treatment options are inadequate.

LIMITATIONS OF USE

Because of the risks of addiction, abuse, and misuse with

opioids, even at recommended doses, and because of the greater

risks of overdose and death with extended-release opioid

formulations, reserve Xtampza ER for use in patients for whom

alternative treatment options (e.g., non-opioid analgesics or

immediate-release opioids) are ineffective, not tolerated, or would

be otherwise inadequate to provide sufficient management of

pain.

Xtampza ER is not indicated as an as-needed (prn) analgesic.

The Full Prescribing Information for Xtampza ER contains the

following Boxed Warning:

WARNING: ADDICTION, ABUSE, AND MISUSE;

LIFE-THREATENING RESPIRATORY DEPRESSION; ACCIDENTAL INGESTION;

NEONATAL OPIOID WITHDRAWAL SYNDROME; and CYTOCHROME P450 3A4

INTERACTION

Addiction, Abuse, and Misuse Xtampza ER exposes

patients and other users to the risks of opioid addiction, abuse,

and misuse, which can lead to overdose and death. Assess each

patient’s risk prior to prescribing Xtampza ER and monitor all

patients regularly for the development of these behaviors or

conditions.

Life-Threatening Respiratory Depression

Serious, life-threatening, or fatal respiratory depression may

occur with use of Xtampza ER. Monitor for respiratory

depression, especially during initiation of Xtampza ER or following

a dose increase.

Accidental Ingestion Accidental ingestion of

even one dose of Xtampza ER, especially by children, can result in

a fatal overdose of oxycodone.

Neonatal Opioid Withdrawal Syndrome Prolonged

use of Xtampza ER during pregnancy can result in neonatal opioid

withdrawal syndrome, which may be life threatening if not

recognized and treated, and requires management according to

protocols developed by neonatology experts. If opioid use is

required for a prolonged period in a pregnant woman, advise the

patient of the risk of neonatal opioid withdrawal syndrome and

ensure that appropriate treatment will be available.

Cytochrome P450 3A4 Interaction The concomitant

use of Xtampza ER with all cytochrome P450 3A4 inhibitors may

result in an increase in oxycodone plasma concentrations, which

could increase or prolong adverse drug effects and may cause

potentially fatal respiratory depression. In addition,

discontinuation of a concomitantly used cytochrome P450 3A4 inducer

may result in an increase in oxycodone plasma concentration.

Monitor patients receiving Xtampza ER and any CYP3A4 inhibitor or

inducer.

IMPORTANT SAFETY INFORMATION

Xtampza ER is contraindicated in patients with: significant

respiratory depression; acute or severe bronchial asthma in an

unmonitored setting or in the absence of resuscitative equipment;

known or suspected gastrointestinal obstruction, including

paralytic ileus; and hypersensitivity (e.g., anaphylaxis) to

oxycodone.

Xtampza ER contains oxycodone, a Schedule II controlled

substance. As an opioid, Xtampza ER exposes users to the risks of

addiction, abuse, and misuse. As extended-release products, such as

Xtampza ER, deliver the opioid over an extended period of time,

there is a greater risk for overdose and death due to the larger

amount of oxycodone present.

Potential serious adverse events caused by opioids include

addiction, abuse, and misuse, life-threatening respiratory

depression, neonatal opioid withdrawal syndrome, risks of

concomitant use or discontinuation of cytochrome P450 3A4

inhibitors and inducers, risks due to interactions with central

nervous system depressants, risk of life-threatening respiratory

depression in patients with chronic pulmonary disease or in

elderly, cachectic, or debilitated patients, adrenal insufficiency,

severe hypotension, risks of use in patients with increased

intracranial pressure, brain tumors, head injury, or impaired

consciousness, risks of use in patients with gastrointestinal

conditions, risk of use in patients with seizure disorders,

withdrawal, risks of driving and operating machinery, and

laboratory monitoring.

The most common AEs (>5%) reported by patients in the Phase 3

clinical trial during the titration phase were: nausea

(16.6%), headache (13.9%), constipation (13.0%), somnolence (8.8%),

pruritus (7.4%), vomiting (6.4%), and dizziness (5.7%).

For Important Safety Information including full prescribing

information visit: http://www.xtampzaer.com/

Forward-Looking StatementsThis press release

contains forward-looking statements within the meaning of The

Private Securities Litigation Reform Act of 1995. We may, in some

cases, use terms such as "predicts," "believes," "potential,"

"proposed," "continue," "estimates," "anticipates," "expects,"

"plans," "intends," "may," "could," "might," "should" or other

words that convey uncertainty of future events or outcomes to

identify these forward-looking statements. Such statements are

subject to numerous important factors, risks and uncertainties that

may cause actual events or results to differ materially from the

company's current expectations. Management's expectations and,

therefore, any forward-looking statements in this press release

could also be affected by risks and uncertainties relating to a

number of other factors, including the following: our ability to

obtain and maintain regulatory approval of our products and product

candidates, and any related restrictions, limitations, and/or

warnings in the label of an approved product; our plans to

commercialize our product candidates and grow sales of our

products; the size and growth potential of the markets for our

products and product candidates, and our ability to service those

markets; the success of competing products that are or become

available; our ability to obtain reimbursement and third-party

payor contracts for our products; the costs of commercialization

activities, including marketing, sales and distribution; our

ability to develop sales and marketing capabilities, whether alone

or with potential future collaborators; the rate and degree of

market acceptance of our products and product candidates; changing

market conditions for our products and product candidates; the

outcome of any patent infringement or other litigation that may be

brought against us, including litigation with Purdue Pharma, L.P.;

our ability to attract collaborators with development, regulatory

and commercialization expertise; the success, cost and timing of

our product development activities, studies and clinical trials;

our ability to obtain funding for our operations; regulatory

developments in the United States and foreign countries; our

expectations regarding our ability to obtain and adequately

maintain sufficient intellectual property protection for our

products and product candidates; our ability to operate our

business without infringing the intellectual property rights of

others; the performance of our third-party suppliers and

manufacturers; our ability to comply with stringent U.S. and

foreign government regulation in the manufacture of pharmaceutical

products, including U.S. Drug Enforcement Agency compliance; the

loss of key scientific or management personnel; our expectations

regarding the period during which we qualify as an emerging growth

company under the JOBS Act; and the accuracy of our estimates

regarding expenses, revenue, capital requirements and need for

additional financing. These and other risks are described

under the heading "Risk Factors" in our Annual Report on Form 10-K

for the year ended December 31, 2016, and those risks described

from time to time in other reports which we file with the SEC. Any

forward-looking statements that we make in this press release speak

only as of the date of this press release. We assume no obligation

to update our forward-looking statements whether as a result of new

information, future events or otherwise, after the date of this

press release.

| |

|

|

|

|

|

|

| Collegium Pharmaceutical,

Inc.Unaudited Selected Consolidated Balance Sheet

Information(in thousands) |

| |

|

|

|

|

|

|

| |

|

|

|

June

30, |

|

|

|

December 31, |

| |

|

|

|

2017 |

|

|

|

2016 |

| Cash and cash

equivalents |

|

|

$ |

111,209 |

|

|

$ |

153,225 |

| Accounts

receivable |

|

|

|

4,877 |

|

|

|

2,129 |

| Inventory |

|

|

|

1,520 |

|

|

|

1,316 |

| Prepaid expenses and

other current assets |

|

|

|

3,009 |

|

|

|

1,905 |

| Property and equipment,

net |

|

|

|

1,583 |

|

|

|

1,038 |

| Intangible assets,

net |

|

|

|

1,925 |

|

|

|

2,103 |

| Restricted cash |

|

|

|

97 |

|

|

|

97 |

| Other long-term

assets |

|

|

|

295 |

|

|

|

204 |

| Total

assets |

|

|

$ |

124,515 |

|

|

$ |

162,017 |

| |

|

|

|

|

|

|

| Accounts payable and

accrued expenses |

|

|

$ |

15,811 |

|

|

$ |

17,985 |

| Deferred revenue |

|

|

|

10,361 |

|

|

|

4,944 |

| Other liabilities |

|

|

|

2,830 |

|

|

|

4,180 |

| Stockholders’

equity |

|

|

|

95,513 |

|

|

|

134,908 |

| Total

liabilities and stockholders’ equity |

|

|

$ |

124,515 |

|

|

$ |

162,017 |

| |

|

|

|

|

|

|

| Collegium Pharmaceutical,

Inc.Unaudited Condensed Statements of

Operations(in thousands, except share and per share

amounts) |

| |

|

|

|

|

|

|

| |

|

|

Three months ended June 30, |

|

|

Six months ended June 30, |

| |

|

|

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2016 |

| Product revenues,

net |

|

|

$ 3,560 |

|

|

|

$ — |

|

|

$ 5,732 |

|

|

|

$ — |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Costs and

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of

product revenues |

|

|

|

577 |

|

|

|

— |

|

|

|

948 |

|

|

|

— |

| Research

and development |

|

|

|

2,179 |

|

|

|

4,301 |

|

|

|

4,309 |

|

|

|

8,363 |

| Selling,

general and administrative |

|

|

|

22,062 |

|

|

|

20,173 |

|

|

|

44,909 |

|

|

|

31,698 |

| Total costs and

expenses |

|

|

|

24,818 |

|

|

|

24,474 |

|

|

|

50,166 |

|

|

|

40,061 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from

operations |

|

|

|

(21,258) |

|

|

|

(24,474) |

|

|

|

(44,434) |

|

|

|

(40,061) |

| Interest income

(expense), net |

|

|

|

137 |

|

|

|

(46) |

|

|

|

235 |

|

|

|

(111) |

| Net

loss |

|

|

($21,121) |

|

|

($24,520) |

|

|

($44,199) |

|

|

($40,172) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Loss per share–basic

and diluted |

|

|

($0.72) |

|

|

($1.05) |

|

|

($1.50) |

|

|

($1.73) |

| Weighted-average shares

-basic and diluted |

|

|

|

29,441,514 |

|

|

|

23,417,378 |

|

|

|

29,396,143 |

|

|

|

23,273,765 |

Contact:

Alex Dasalla

adasalla@collegiumpharma.com

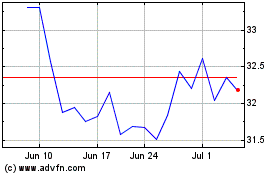

Collegium Pharmaceutical (NASDAQ:COLL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Collegium Pharmaceutical (NASDAQ:COLL)

Historical Stock Chart

From Apr 2023 to Apr 2024