FBR Capital Markets & Co. Acts as Lead-Left Placement Agent to Eco-Stim Energy Solutions in its $28 Million Private Placement...

August 09 2017 - 9:00AM

FBR Capital Markets & Co. (“FBR”), a leading full service

investment bank and wholly owned subsidiary of B. Riley Financial,

Inc. (NASDAQ:RILY), acted as the lead-left placement agent to

Eco-Stim Energy Solutions (NASDAQ:ESES) in ESES’s private placement

of its common stock.

ESES issued 19,580,420 shares of its common stock for $1.43 per

share, which was the closing market price on August 1, 2017,

resulting in gross proceeds of $28 million. The transaction closed

on August 8, 2017.

About Eco-Stim Energy Solutions, Inc. Eco-Stim

is an environmentally focused oilfield service and technology

company providing well stimulation and completion services and

field management technologies to oil and gas producers. EcoStim's

methodology and technology offers the potential in high cost

regions to decrease the number of stages stimulated in shale plays

through a process that predicts high probability production zones

while confirming those production zones using the latest generation

down-hole diagnostic tools. In addition, EcoStim offers its clients

completion techniques that can dramatically reduce horsepower

requirements, emissions and surface footprint. EcoStim seeks to

deliver well completion services with better technology, better

ecology and significantly improved economics for unconventional oil

and gas producers worldwide.

About FBR Capital Markets & Co.FBR

Capital Markets & Co., LLC provides investment banking,

M&A advisory, institutional brokerage and research services

with focused capital and financial expertise in consumer, energy

and natural resources, financial institutions, healthcare,

insurance, industrials, real estate, technology, media and telecom

industries.

B. Riley Financial, Inc. is a publicly traded, diversified

financial services company which takes a collaborative approach to

the capital raising and financial advisory needs of public and

private companies and high net worth individuals. The Company

operates through several wholly-owned subsidiaries,

including B. Riley & Co., LLC, FBR Capital

Markets & Co., Wunderlich Securities, Inc., Great

American Group, LLC, B. Riley Capital Management,

LLC (which includes B. Riley Asset Management, B.

Riley Wealth Management, and Great American Capital Partners,

LLC) and B. Riley Principal Investments, a group that makes

proprietary investments in other businesses, such as the

acquisition of United Online, Inc.

Media Contact

press@brileyfin.com

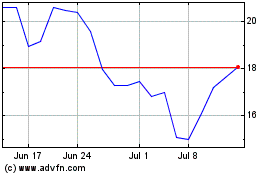

B Riley Financial (NASDAQ:RILY)

Historical Stock Chart

From Mar 2024 to Apr 2024

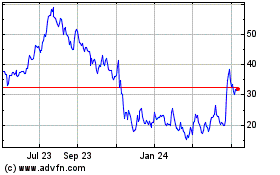

B Riley Financial (NASDAQ:RILY)

Historical Stock Chart

From Apr 2023 to Apr 2024