Company to host conference call on August 9,

2017, at 10:00 a.m. EDT

Real Industry, Inc. (NASDAQ:RELY) (“Real Industry” or the

“Company”) today reported financial results for its fiscal

second quarter ended June 30, 2017.

Second Quarter 2017 Highlights

- Revenues increased to $350.2 million,

compared to $320.9 million in the prior-year period and $337.1

million sequentially from the fiscal 2017 first quarter

- Net loss was $6.2 million, compared to

a loss of $1.2 million in the prior-year period and a loss of $11.3

million sequentially from the fiscal 2017 first quarter

- Segment Adjusted EBITDA was $17.2

million, down from $20.9 million in the prior-year period but up

40% from $12.3 million sequentially from the fiscal 2017 first

quarter

- Consolidated liquidity remains solid at

$71.3 million of which $66.9 million relates to Real Alloy

Third Quarter 2017 Outlook

- Scrap spread environment for Real Alloy

North America (“RANA”) expected to remain similar to second

quarter, while Real Alloy Europe (“RAEU”) market is expected to

tighten compared to the strong spreads RAEU experienced

year-to-date

- Automotive industry in both segments

expected to have more typical seasonal summer shutdowns compared to

prior-year

Management Commentary

Mr. Kyle Ross, President and Chief Executive Officer of Real

Industry, stated, “During the fiscal 2017 second quarter, our

corporate team remained focused on assessing opportunities for

successful execution of our long-term M&A strategy. At Real

Alloy, as expected, a more favorable secondary aluminum pricing and

scrap spread environment, along with the team’s focus on

operational excellence drove improved performance in the second

quarter of 2017. Segment Adjusted EBITDA improved by approximately

40% compared to the first quarter, and RAEU delivered its highest

Segment Adjusted EBITDA performance since 2011. We anticipate the

current scrap market environment in North America will continue to

have a positive impact on our results in the second half of the

year, even though secondary alloy prices remain well below recent

historical averages. We also expect our automotive customers to

take normal seasonal summer and holiday shutdowns this year, which

was not the case the past two years.”

Second Quarter 2017 Consolidated Financial Results

Real Industry reported revenues of $350.2 million in the second

quarter of 2017, driven by Real Alloy’s aggregate 289,900 metric

tonnes invoiced. This compares to $320.9 million in revenues on an

aggregate 294,000 metric tonnes invoiced in the second quarter of

2016. The year-over-year increase in revenue was primarily due to

the increased proportion of buy/sell volume, which contributes

substantially more revenue per tonne than tolling arrangements

because the metal value is included in sales, as well as a higher

metal price environment. Real Industry reported a net loss of $6.2

million and a net loss available to common stockholders of $7.3

million in the quarter ended June 30, 2017, or a loss of $0.25 per

basic and diluted share.

During the period, RANA reported $234.4 million in revenues on

194,800 tonnes invoiced. The mix between buy/sell and tolling

transactions for RANA was 56% and 44%, respectively, compared to

51% and 49% in the second quarter of 2016. Compared to the

prior-year period, total volume decreased slightly, but revenues

were higher by 10% driven primarily by a 5% shift from tolling to

buy/sell volume which includes the incremental contribution of the

Beck Alloys acquisition’s 8,100 metric tonnes. Compared to the

prior sequential quarter, second quarter revenues were 4% higher,

similarly driven by increased buy/sell volumes due to commercial

sales efforts.

RAEU reported revenues of $115.8 million on 95,100 tonnes

invoiced in the second quarter. The mix between buy/sell and

tolling arrangements was unchanged when compared to that of the

prior-year period at 44% and 56%, respectively. Total volume was

relatively flat when compared to the prior-year period, but

revenues increased by 7% due to increased selling prices

year-over-year. Compared to the prior sequential quarter, second

quarter revenues were higher by 4% driven by higher selling prices

offsetting a 3% shift from buy/sell to tolling volume.

In the aggregate, Real Alloy generated Segment Adjusted EBITDA

of $17.2 million in the second quarter of 2017, compared to $20.9

million in the prior-year period, and $12.3 million sequentially

from the first quarter of 2017. While Segment Adjusted EBITDA

improved by approximately 40% from the sequential quarter, the

business continued to experience quite different operating

conditions in each segment.

RANA’s Segment Adjusted EBITDA of $8.7 million in the second

quarter compared to $14.3 million in the prior-year period and $6.3

million in the first quarter of 2017. Segment Adjusted EBITDA per

tonne increased to $45 sequentially from $32, but remained below

the prior-year second quarter’s $72. RAEU’s Segment Adjusted EBITDA

increased year-over-year and sequentially to $8.5 million in the

second quarter, from $6.6 million in the prior-year period and $6.0

million in the first quarter. RAEU’s Segment Adjusted EBITDA per

tonne increased to $89 sequentially from $63 and over the

prior-year second quarter’s $70. RANA’s results improved

sequentially due to higher scrap spreads and reduced costs, but

they were negatively impacted by lower volume, changes in business

mix between tolling and buy/sell, and lower scrap spreads compared

to the prior-year period. With stable volume and product mix, RAEU

benefited from lower costs in the second quarter and more favorable

scrap spreads and margins year-over-year.

Real Alloy reduced its SG&A expenses by $1.1 million in the

second quarter compared to the prior-year period. Capital

expenditures for the second quarter decreased to $4.9 million from

$5.8 million in the prior-year period.

Outside of the Company’s segments, corporate operating costs,

which primarily represent SG&A expenses, were $2.5 million in

the second quarter of 2017, which is a reduction of $1.1 million

from the prior-year period. Of these expenses, $0.7 million was

noncash shared-based compensation expense, compared to $0.5 million

in the prior-year period.

Balance Sheet and Liquidity

As of June 30, 2017, Real Industry’s cash and cash equivalents

were $18.4 million, total debt was $379.5 million, and

stockholders’ equity was $21.6 million. The Company’s total

liquidity was $71.3 million as of June 30, 2017, of which $66.9

million relates to Real Alloy.

Conference Call and Webcast Information

The Company will host a conference call at 10:00 a.m. EDT on

Wednesday, August 9, 2017, during which management will discuss the

results of operations for the second quarter ended June 30,

2017.

The dial-in numbers are:(877) 407-9163 (Toll-free U.S. &

Canada)(412) 902-0043 (International)

Participants may also access the live call via webcast at

http://realindustryinc.equisolvewebcast.com/q2-2017. The webcast

will be archived and accessible for approximately 30 days.

A replay will be available shortly after the call in the

investor relations section of the Company’s website,

www.realindustryinc.com, and will remain available for 90 days.

About Real Industry, Inc.

Real Industry is a holding company that seeks to create a

sustainably profitable enterprise by allocating capital to improve

the value of its existing businesses and to execute accretive

acquisitions with a disciplined approach to value and structure.

Our business strategy also seeks to take advantage of Real

Industry’s U.S. federal net operating loss tax carryforwards of

$916 million. For more information about Real Industry, visit its

corporate website at www.realindustryinc.com.

Cautionary Statement Regarding Forward-Looking

Statements

This release contains forward-looking statements, which are

based on our current expectations, estimates, and projections about

the Company’s and its subsidiaries’ businesses and prospects, as

well as management’s beliefs, and certain assumptions made by

management. Words such as “anticipates,” “expects,” “intends,”

“plans,” “believes,” “seeks,” “estimates,” “may,” “should,” “will”

and variations of these words are intended to identify

forward-looking statements. Such statements speak only as of the

date hereof and are subject to change. The Company undertakes no

obligation to revise or update publicly any forward-looking

statements for any reason. These statements include, but are not

limited to, statements about: our financial results, including for

the fiscal second quarter of 2017, as well as our expectations for

future financial trends and performance of our business and our

strategy in future periods including during fiscal 2017; our

ability to take advantage of opportunities to acquire assets with

upside potential; the expected benefits to the Company of the

integration of Beck Aluminum Alloys into Real Alloy; future

opportunistic investments; our evaluation of other potential

M&A opportunities; our long-term outlook; our preparation for

future market conditions; and any statements or assumptions

underlying any of the foregoing. Such statements are not guarantees

of future performance and are subject to certain risks,

uncertainties, and assumptions that are difficult to predict.

Accordingly, actual results could differ materially and adversely

from those expressed in any forward-looking statements as a result

of various factors. Important factors that may cause such

differences include, but are not limited to, changes in domestic

and international demand for recycled aluminum; the cyclical nature

and general health of the aluminum industry and related industries;

commodity and scrap price fluctuations and our ability to enter

into effective commodity derivatives or arrangements to effectively

manage our exposure to such commodity price fluctuations; inventory

risks, commodity price risks, and energy risks associated with Real

Alloy’s buy/sell business model; the impact of tariffs and trade

regulations on our operations; the impact of any changes in U.S. or

non-U.S. tax laws on our operations or the value of our NOLs; our

ability to service, and the high leverage associated with, Real

Alloy’s indebtedness, and compliance with the terms of the

indebtedness, including the restrictive covenants that constrain

the operation of its business and the businesses of our

subsidiaries; our ability to successfully identify, acquire and

integrate additional companies and businesses that perform and meet

expectations after completion of such acquisitions; our ability to

achieve future profitability; our ability to control operating

costs and other expenses; that general economic conditions may be

worse than expected; that competition may increase significantly;

changes in laws or government regulations or policies affecting our

current business operations and/or our legacy businesses, as well

as those risks and uncertainties disclosed under the sections

entitled “Risk Factors” and “Management’s Discussion and Analysis

of Financial Condition and Results of Operations” in Real Industry,

Inc.’s Forms 10-Q filed with the Securities and Exchange Commission

(“SEC”) on May 10, 2017 and August 8, 2017 and Form 10-K filed with

the SEC on March 13, 2017, and similar disclosures in subsequent

reports filed with the SEC, which are available on our website at

www.realindustryinc.com and on the SEC website at

https://www.sec.gov.

Real Industry, Inc. Unaudited Condensed Consolidated

Balance Sheets

June 30,

December 31, (In millions, except share and per share

amounts) 2017 2016

ASSETS

Current assets: Cash and cash equivalents $ 18.4 $ 27.2 Trade

accounts receivable, net 112.9 88.4 Financing receivable 32.5 28.4

Inventories 120.1 118.2 Prepaid expenses, supplies and other

current assets 29.0 24.6 Total current

assets 312.9 286.8 Property, plant and equipment, net 289.8 289.2

Equity method investment 5.6 5.0 Identifiable intangible assets,

net 11.3 12.5 Goodwill 42.9 42.2 Other noncurrent assets 8.5

9.8 TOTAL ASSETS $ 671.0 $ 645.5

LIABILITIES,

REDEEMABLE PREFERRED STOCK AND STOCKHOLDERS' EQUITY

Current liabilities: Trade payables $ 124.3 $ 115.8 Accrued

liabilities 51.4 46.4 Long-term debt due within one year 3.1

2.3 Total current liabilities 178.8 164.5

Accrued pension benefits 45.9 42.0 Environmental liabilities 11.6

11.6 Long-term debt, net 376.4 354.2 Common stock warrant liability

2.1 4.4 Deferred income taxes, net 2.5 2.5 Other noncurrent

liabilities 6.7 6.9 TOTAL LIABILITIES

624.0 586.1 Redeemable Preferred Stock

25.4 24.9 Stockholders' equity:

Preferred stock — — Additional paid-in capital 545.9 546.7

Accumulated deficit (524.0 ) (506.2 ) Treasury stock — —

Accumulated other comprehensive loss (1.4 ) (7.1 )

Total stockholders' equity—Real Industry, Inc. 20.5 33.4

Noncontrolling interest 1.1 1.1 TOTAL

STOCKHOLDERS' EQUITY 21.6 34.5

TOTAL LIABILITIES, REDEEMABLE PREFERRED

STOCK AND STOCKHOLDERS' EQUITY

$ 671.0 $ 645.5

Real Industry, Inc.Unaudited

Condensed Consolidated Statements of Operations

Three Months Ended June 30,

Six Months Ended June 30, (In millions, except per share

amounts) 2017 2016 2017

2016 Revenues $ 350.2 $ 320.9 $ 687.3 $ 630.3 Cost of sales

332.1 298.6 655.8

591.4 Gross profit 18.1 22.3 31.5 38.9

Selling, general and administrative

expenses

12.4 14.6 26.8 30.0

Losses (gains) on derivative financial

instruments, net

0.6 (1.5 ) 1.7 (0.3 )

Amortization of identifiable intangible

assets

0.6 0.6 1.2 1.2 Other operating expense, net 0.7

0.5 1.6 2.0 Operating

profit 3.8 8.1 0.2

6.0 Nonoperating expense (income): Interest expense, net 9.6

9.1 20.6 18.3

Change in fair value of common stock

warrant liability

0.2 (1.3 ) (2.3 ) (0.7 )

Loss (income) from equity method

investment

0.5 — (0.6 ) —

Foreign exchange losses (gains) on

intercompany loans

(1.4 ) 1.6 (2.2 ) (1.0 ) Other, net — (0.2 )

0.3 (0.2 ) Total nonoperating expense, net

8.9 9.2 15.8 16.4

Loss from continuing operations before

income taxes

(5.1 ) (1.1 ) (15.6 ) (10.4 ) Income tax expense 1.1

0.2 1.9 0.9 Loss from

continuing operations (6.2 ) (1.3 ) (17.5 ) (11.3 )

Earnings from discontinued operations, net

of income taxes

— 0.1 — 0.1

Net loss (6.2 ) (1.2 ) (17.5 ) (11.2 )

Earnings from continuing operations

attributable to noncontrolling interest

0.3 0.3 0.4 0.4

Net loss attributable to Real Industry, Inc. $ (6.5 ) $ (1.5

) $ (17.9 ) $ (11.6 ) LOSS PER SHARE Net loss attributable to Real

Industry, Inc. $ (6.5 ) $ (1.5 ) $ (17.9 ) $ (11.6 ) Dividends on

Redeemable Preferred Stock, in-kind — (0.5 ) — (0.9 )

Dividends on Redeemable Preferred Stock,

in cash or accrued

(0.5 ) — (1.1 ) —

Accretion of fair value adjustment to

Redeemable Preferred Stock

(0.3 ) (0.2 ) (0.5 ) (0.5 )

Net loss available to common

stockholders

$ (7.3 ) $ (2.2 ) $ (19.5 ) $ (13.0 ) Basic and diluted loss per

share: Continuing operations $ (0.25 ) $ (0.08 ) $ (0.67 ) $ (0.43

) Discontinued operations — 0.01

— — Basic and diluted loss per share $ (0.25 )

$ (0.07 ) $ (0.67 ) $ (0.43 )

Real Industry, Inc.Unaudited

Segment Information

Three Months Ended June 30, 2017

(Dollars in millions, except per

tonneinformation, tonnes in thousands)

RANA RAEU

Corporate andOther

Total Metric tonnes invoiced: Tolling

arrangements 86.1 53.6 139.7 Buy/sell arrangements 108.7

41.5 150.2 Total metric tonnes invoiced 194.8

95.1 289.9 Revenues $ 234.4 $ 115.8 $ — $ 350.2 Cost

of sales 225.8 106.3 — 332.1 Gross

profit $ 8.6 $ 9.5 $ — $ 18.1 Selling, general and

administrative expenses $ 5.9 $ 4.0 $ 2.5 $ 12.4 Depreciation and

amortization $ 6.7 $ 3.4 $ — $ 10.1 Capital expenditures $ 2.9 $

2.0 $ — $ 4.9 Segment Adjusted EBITDA $ 8.7 $ 8.5 $ 17.2

Segment Adjusted EBITDA per metric tonne

invoiced

$ 45 $ 89 $ 59

Three Months Ended June 30,

2016

(Dollars in millions, except per

tonneinformation, tonnes in thousands)

RANA RAEU

Corporate andOther

Total Metric tonnes invoiced: Tolling arrangements 98.3 52.7

151.0 Buy/sell arrangements 101.1 41.9 143.0

Total metric tonnes invoiced 199.4 94.6 294.0

Revenues $ 212.4 $ 108.4 $ 0.1 $ 320.9 Cost of sales 197.3

101.3 — 298.6 Gross profit $ 15.1 $ 7.1 $ 0.1

$ 22.3 Selling, general and administrative expenses $ 7.2 $

3.8 $ 3.6 $ 14.6 Depreciation and amortization $ 7.7 $ 2.9 $ — $

10.6 Capital expenditures $ 3.5 $ 2.3 $ — $ 5.8 Segment Adjusted

EBITDA $ 14.3 $ 6.6 $ 20.9

Segment Adjusted EBITDA per metric tonne

invoiced

$ 72 $ 70 $ 71

Six Months Ended June 30, 2017

(Dollars in millions, except per

tonneinformation, tonnes in thousands)

RANA RAEU

Corporate andOther

Total Metric tonnes invoiced: Tolling arrangements 172.9

104.2 277.1 Buy/sell arrangements 218.5 86.1

304.6 Total metric tonnes invoiced 391.4 190.3

581.7 Revenues $ 460.0 $ 227.3 $ — $ 687.3 Cost of sales

445.5 210.3 — 655.8 Gross profit $ 14.5 $ 17.0

$ — $ 31.5 Selling, general and administrative expenses $

12.9 $ 8.2 $ 5.7 $ 26.8 Depreciation and amortization $ 15.0 $ 6.6

$ — $ 21.6 Capital expenditures $ 5.3 $ 5.2 $ — $ 10.5

Segment Adjusted EBITDA

$ 15.0 $ 14.5 $ 29.5

Segment Adjusted EBITDA per metric tonne

invoiced

$

38

$

76

$

51

Six Months Ended June 30, 2016

(Dollars in millions, except per

tonneinformation, tonnes in thousands)

RANA RAEU

Corporate andOther

Total Metric tonnes invoiced: Tolling arrangements 199.8

104.7 304.5 Buy/sell arrangements 195.9 85.8

281.7 Total metric tonnes invoiced 395.7 190.5

586.2 Revenues $ 413.2 $ 217.0 $ 0.1 $ 630.3 Cost of sales

383.3 208.1 — 591.4 Gross profit $ 29.9 $ 8.9

$ 0.1 $ 38.9

Selling, general and administrative

expenses

$ 15.0 $ 8.1 $ 6.9 $ 30.0 Depreciation and amortization $ 15.5 $

9.8 $ — $ 25.3 Capital expenditures $ 7.5 $ 3.6 $ — $ 11.1 Segment

Adjusted EBITDA $ 27.5 $ 11.7 $ 39.2

Segment Adjusted EBITDA per metric tonne

invoiced

$ 69 $ 61 $ 67

NON-GAAP FINANCIAL MEASURES

A non-GAAP financial measure is a numerical measure of

historical or future financial performance, financial position or

cash flows that excludes amounts, or is subject to adjustments that

have the effect of excluding amounts, that are included in the most

directly comparable measure calculated and presented in accordance

with GAAP in the condensed consolidated balance sheets, statements

of operations, or statements of cash flows; or includes amounts, or

is subject to adjustments that have the effect of including

amounts, that are excluded from the most directly comparable

measures so calculated and presented. We report our financial

results in accordance with GAAP; however, our chief operating

decision-maker (“CODM”) and management use Segment Adjusted EBITDA

as the primary performance metric for the Company’s segments and

believe this measure provides additional information commonly used

by holders of our common stock, as well as the holders of the

Senior Secured Notes and parties to the revolving credit facilities

with respect to the ongoing performance of our underlying business

activities. In addition, Segment Adjusted EBITDA is a component of

certain covenants under the Indenture governing the Senior Secured

Notes.

Our Segment Adjusted EBITDA calculation represents segment net

earnings (loss) before interest, taxes, depreciation and

amortization, and certain other items including, unrealized gains

and losses on derivative financial instruments, charges and

expenses related to acquisitions, and certain other gains and

losses.

Segment Adjusted EBITDA as we use it may not be comparable to

similarly titled measures used by other companies. We calculate

Segment Adjusted EBITDA by eliminating the impact of a number of

items we do not consider indicative of our ongoing operating

performance and certain other items. You are encouraged to evaluate

each adjustment and the reasons we consider it appropriate for

supplemental analysis. While we disclose Segment Adjusted EBITDA as

the primary performance metric of our segments in accordance with

GAAP, it is not a financial measurement calculated in accordance

with GAAP, and when analyzing our operating performance, investors

should use Segment Adjusted EBITDA in addition to, and not as an

alternative for, net earnings (loss), operating profit (loss) or

any other performance measure derived in accordance with GAAP.

Segment Adjusted EBITDA has limitations as an analytical tool, and

it should not be considered in isolation, or as a substitute for,

or superior to, our measures of financial performance prepared in

accordance with GAAP.

These limitations include, but are not limited to the

following:

- Segment Adjusted EBITDA does not

reflect our cash expenditures or future requirements for capital

expenditures, asset replacements or contractual commitments;

- Segment Adjusted EBITDA does not

reflect changes in, or cash requirements for, working capital

needs;

- Segment Adjusted EBITDA does not

reflect interest expense or cash requirements necessary to service

interest and/or principal payments under our long-term debt;

- Segment Adjusted EBITDA does not

reflect certain tax payments that may represent a reduction in cash

available to us; and

- Segment Adjusted EBITDA does not

reflect the operating results of Corporate and Other.

Other companies, including companies in our industry, may

calculate these measures differently and the degree of their

usefulness as a comparative measure correspondingly decreases as

the number of differences in computations increases.

In addition, in evaluating Segment Adjusted EBITDA it should be

noted that in the future we may incur expenses similar to the

adjustments in the reconciliation provided below. Our presentation

of Segment Adjusted EBITDA should not be construed as an inference

that our future results will be unaffected by unusual or

nonrecurring items.

The following table presents a reconciliation of Segment

Adjusted EBITDA to consolidated net loss for the three and six

months ended June 30, 2017 and 2016:

Real Industry, Inc. Unaudited Reconciliation of

Segment Adjusted EBITDA to Net Loss

Three Months Ended June 30, Six Months

Ended June 30, (In millions) 2017

2016 2017 2016 Segment Adjusted

EBITDA $ 17.2 $20.9 $ 29.5 $ 39.2

Unrealized gains (losses) on derivative

financial instruments

(0.1 ) 1.9 (0.4 ) 1.5 Segment depreciation and amortization (10.1 )

(10.6 ) (21.6 ) (25.3 )

Amortization of inventories and supplies

purchase accounting adjustments

— (0.3 ) — (0.9 )

Corporate and Other selling, general and

administrative expenses

(2.5 ) (3.6 ) (5.7 ) (6.9 ) Other, net (0.7 ) (0.2 ) (1.6 )

(1.6 ) Operating profit 3.8 8.1 0.2 6.0 Interest expense,

net (9.6 ) (9.1 ) (20.6 ) (18.3 )

Change in fair value of common stock

warrant liability

(0.2 ) 1.3 2.3 0.7

Foreign exchange gains (losses) on

intercompany loans

1.4 (1.6 ) 2.2 1.0 Income (loss) from equity method investment (0.5

) — 0.6 — Other nonoperating income (expense), net — 0.2 (0.3 ) 0.2

Income tax expense (1.1 ) (0.2 ) (1.9 ) (0.9 )

Earnings from discontinued operations, net

of income taxes

— 0.1 — 0.1 Net loss $

(6.2 ) $(1.2 ) $ (17.5 ) $ (11.2 )

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170808006432/en/

Real Industry, Inc.Jeehae Shin,

212-201-4126investor.relations@realindustryinc.comorThe Equity

Group, Inc.Adam Prior, 212-836-9606aprior@equityny.comorCarolyne Y.

Sohn, 415-568-2255csohn@equityny.com

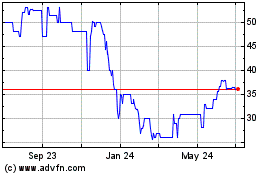

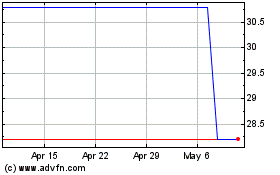

Elah (PK) (USOTC:ELLH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Elah (PK) (USOTC:ELLH)

Historical Stock Chart

From Apr 2023 to Apr 2024