Atrion Reports Second Quarter Results

August 08 2017 - 4:30PM

Atrion Corporation (NASDAQ:ATRI) today announced that for the

second quarter ended June 30, 2017 revenues totaled $36.2 million

compared with $36.1 million in the same period in 2016. On a

diluted per share basis, earnings for the period increased to $5.40

as compared to $4.02 in the same period of last year. Net income

for the second quarter totaled $10.0 million in 2017 as compared to

$7.5 million in the same period in 2016.

Commenting on the Company’s results for the

second quarter of 2017 compared to the same period last year, David

A. Battat, President & CEO, said, “Overall sales were

essentially flat, impacted by a $700,000 interruption in orders

from a customer that was rebalancing its inventory levels. This

interruption masked solid performance in Fluid Delivery and our

Other product areas." Mr. Battat added, "Operating income was up

1.0% while net income and diluted earnings per share increased by

35% and 34%, respectively, due to significant tax benefits from

employee stock-based compensation that were recognized in the just

ended quarter."

Mr. Battat added, “As of June 30, we continued

to be debt-free, while holding cash, cash equivalents, and short

and long term investments of $57.3 million.” Mr. Battat concluded,

“During the quarter, we purchased a large tract of land adjacent to

our manufacturing facility in Alabama that we plan to expand to

meet anticipated sales growth. Construction is likely to begin in

2018. For the remainder of the year we expect our operating results

to reflect uneven quarters, while our tax rates revert to the

levels we have typically experienced.”

Atrion Corporation develops and manufactures

products primarily for medical applications. The Company’s

website is www.atrioncorp.com.

Statements in this press release that are

forward looking are based upon current expectations and actual

results or future events may differ materially. Such

statements include, but are not limited to, Atrion’s expectations

regarding the expansion of one of the Company’s manufacturing

facilities, operating results for the remainder of 2017 and future

tax rates. Words such as “expects,” “believes,”

“anticipates,” “intends,” "should", "plans," "will" and variations

of such words and similar expressions are intended to identify such

forward-looking statements. Forward-looking statements

involve risks and uncertainties. The following are some of

the factors that could cause actual results or future events to

differ materially from those expressed in or underlying our

forward-looking statements: changing economic, market and business

conditions; acts of war or terrorism; the effects of governmental

regulation; competition and new technologies;

slower-than-anticipated introduction of new products or

implementation of marketing strategies; the Company’s ability to

protect its intellectual property; changes in the prices of raw

materials; changes in product mix; and intellectual property and

product liability claims and product recalls. The foregoing

list of factors is not exclusive, and other factors are set forth

in the Company’s filings with the Securities and Exchange

Commission.

| |

| ATRION CORPORATION |

| UNAUDITED CONSOLIDATED STATEMENTS OF

INCOME |

| (In thousands, except per share

data) |

|

|

|

|

Three Months EndedJune

30, |

|

Six Months EndedJune

30, |

|

|

2017 |

|

2016 |

|

2017 |

|

2016 |

|

Revenues |

$ |

36,164 |

|

|

$ |

36,143 |

|

|

$ |

74,669 |

|

|

$ |

72,358 |

|

| Cost of goods

sold |

|

18,470 |

|

|

|

18,928 |

|

|

|

38,344 |

|

|

|

37,578 |

|

| Gross

profit |

|

17,694 |

|

|

|

17,215 |

|

|

|

36,325 |

|

|

|

34,780 |

|

| Operating

expenses |

|

7,519 |

|

|

|

7,141 |

|

|

|

14,823 |

|

|

|

14,241 |

|

|

Operating income |

|

10,175 |

|

|

|

10,074 |

|

|

|

21,502 |

|

|

|

20,539 |

|

|

|

|

|

|

|

|

|

|

| Interest

income |

|

370 |

|

|

|

85 |

|

|

|

519 |

|

|

|

208 |

|

| Other income

(expense), net |

|

-- |

|

|

|

36 |

|

|

|

1 |

|

|

|

(309 |

) |

| Income before

income taxes |

|

10,545 |

|

|

|

10,195 |

|

|

|

22,022 |

|

|

|

20,438 |

|

| Income tax

provision |

|

(519 |

) |

|

|

(2,745 |

) |

|

|

(2,046 |

) |

|

|

(6,042 |

) |

| Net

income |

$ |

10,026 |

|

|

$ |

7,450 |

|

|

$ |

19,976 |

|

|

$ |

14,396 |

|

|

|

|

|

|

|

|

|

|

| Income per

basic share |

$ |

5.44 |

|

|

$ |

4.09 |

|

|

$ |

10.86 |

|

|

$ |

7.90 |

|

|

|

|

|

|

|

|

|

|

| Weighted

average basic shares outstanding |

|

1,844 |

|

|

|

1,822 |

|

|

|

1,839 |

|

|

|

1,823 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income per

diluted share |

$ |

5.40 |

|

|

$ |

4.02 |

|

|

$ |

10.76 |

|

|

$ |

7.76 |

|

|

|

|

|

|

|

|

|

|

| Weighted

average diluted shares outstanding |

|

1,858 |

|

|

|

1,853 |

|

|

|

1,856 |

|

|

|

1,855 |

|

| ATRION CORPORATION |

| CONSOLIDATED BALANCE SHEETS |

| (In thousands) |

| |

|

|

|

| |

June 30, |

|

Dec. 31, |

|

ASSETS |

2016 |

|

2016 |

|

|

(Unaudited) |

|

|

| Current

assets: |

|

|

|

|

Cash and cash equivalents |

$ |

20,223 |

|

$ |

20,022 |

|

Short-term investments |

|

27,073 |

|

|

24,080 |

|

Total cash and short-term investments |

|

47,296 |

|

|

44,102 |

|

Accounts receivable |

|

19,690 |

|

|

17,166 |

|

Inventories |

|

29,965 |

|

|

29,015 |

|

Prepaid expenses and other |

|

6,022 |

|

|

3,181 |

|

Total current assets |

|

102,973 |

|

|

93,464 |

| |

|

|

|

|

|

| Long-term

investments |

|

10,046 |

|

|

9,945 |

| |

|

|

|

|

|

| Property, plant

and equipment, net |

|

66,556 |

|

|

65,265 |

| Other

assets |

|

13,096 |

|

|

13,268 |

|

|

|

|

|

|

|

$ |

192,671 |

|

$ |

181,942 |

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Current

liabilities |

|

9,383 |

|

|

9,073 |

| Line of

credit |

|

-- |

|

|

-- |

| Other

non-current liabilities |

|

10,965 |

|

|

9,881 |

| Stockholders’

equity |

|

172,323 |

|

|

162,988 |

|

|

|

|

|

|

|

$ |

192,671 |

|

$ |

181,942 |

Contact:

Jeffery Strickland

Vice President and Chief Financial Officer

(972) 390-9800

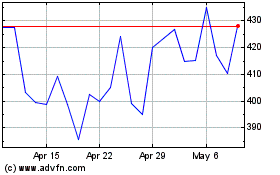

ATRION (NASDAQ:ATRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

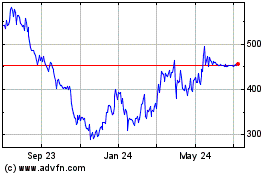

ATRION (NASDAQ:ATRI)

Historical Stock Chart

From Apr 2023 to Apr 2024