Eldorado Resorts, Inc. (NASDAQ: ERI) (“Eldorado,” “ERI,” or “the

Company”) today reported operating results for the second quarter

ended June 30, 2017.

Total Net Revenue

($ in thousands, except per share data)

Three Months Ended

June 30, 2017

2017 Pre-Acquisition(1)

2017 Total(2) 2016

2016 Pre-Acquisition(3)

2016 Total(2)

Change West $ 98,360 $ 11,001 $ 109,361 $

84,161 $ 31,730 $ 115,891 (5.6)% Midwest 67,503

36,279 103,782 - 102,247 102,247 1.5% South 69,617 21,259 90,876

32,088 63,232 95,320 (4.7)% East 119,564 2,990 122,554 115,066

9,375 124,441 (1.5)% Corporate and Other 136

45 181 - 20 20

805.0%

Total Net Revenue $ 355,180

$ 71,574 $ 426,754

$ 231,315 $ 206,604 $

437,919 (2.5)% Operating

(Loss) Income ($ in thousands, except per share data)

Three

Months Ended June 30, 2017

2017 Pre-Acquisition(1)

2017 Total(2) 2016

2016 Pre-Acquisition(3)

2016 Total(2)

Change West $ 16,468 $ 2,709 $ 19,177

$ 13,655 $ 6,163 $ 19,818 (3.2)%

Midwest 15,408 10,637 26,045 - 20,387 20,387 27.8% South 11,069

3,943 15,012 5,541 10,131 15,672 (4.2)% East 18,153 (197) 17,956

14,934 (1,215) 13,719 30.9% Corporate and Other (93,214)

(2,550) (95,764) (4,475)

(8,464) (12,939) (640.1)%

Total Operating

(Loss) Income $ (32,116) $

14,542 $ (17,574) $

29,655 $ 27,002 $ 56,657

(131.0)% Adjusted EBITDA ($ in

thousands, except per share data)

Three Months Ended June

30, 2017

2017 Pre-Acquisition(1)

2017 Total(2) 2016

2016 Pre-Acquisition(3)

2016 Total(2)

Change West $ 23,105 $ 3,640 $ 26,745

$ 18,915 $ 8,297 $ 27,212 (1.7)%

Midwest 20,468 12,686 33,154 - 30,224 30,224 9.7% South 15,774

5,425 21,199 7,456 14,343 21,799 (2.8)% East 26,541 42 26,583

24,039 (124) 23,915 11.2% Corporate and Other (3) (5,917)

(1,729) (7,646) (3,758)

(6,623) (10,381) 26.3%

Total

Adjusted EBITDA (4) $ 79,971 $

20,064 $ 100,035 $

46,652 $ 46,117 $

92,769 7.8% Net (Loss) Income

$ (46,328)

$ 10,791 Basic EPS $

(0.69) $ 0.23 Diluted EPS

$

(0.69)

$ 0.23

Total Net Revenue ($ in thousands, except per share data)

Six Months Ended June 30, 2017

2017 Pre-Acquisition(1)

2017 Total (2) 2016

2016 Pre-Acquisition(3)

2016 Total (2)

Change West $ 161,061 $ 43,414 $ 204,475 $

156,932 $ 63,759 $ 220,691 (7.3)% Midwest 67,503 142,237

209,740 - 207,149 207,149 1.3% South 101,528 92,002 193,530 66,530

137,631 204,161 (5.2)% East 225,877 11,717 237,594 221,419 17,724

239,143 (0.6)% Corporate and Other 136 226

362 - 30 30

1,106.7%

Total Net Revenue $ 556,105

$ 289,596 $ 845,701

$ 444,881 $ 426,293

$ 871,174 (2.9)%

Operating (Loss) Income ($ in thousands, except per share

data)

Six Months Ended June 30, 2017

2017 Pre-Acquisition(1)

2017 Total (2) 2016

2016 Pre-Acquisition(3)

2016 Total (2)

Change West $ 17,994 $ 9,525 $ 27,519

$ 19,219 $ 13,109 $ 32,328 (14.9)%

Midwest 15,408 34,819 50,227 - 42,867 42,867 17.2% South 16,987

19,165 36,152 12,043 26,179 38,222 (5.4)% East 33,195 (1,072)

32,123 28,665 (2,543) 26,122 23.0% Corporate and Other

(101,551) (8,811) (110,362)

(12,010) (15,520) (27,530)

300.9%

Total Operating (Loss) Income $

(17,967) $ 53,626 $

35,659 $ 47,917 $

64,092 $ 112,009 (68.2)%

Adjusted EBITDA ($ in thousands, except per

share data)

Six Months Ended June 30, 2017

2017 Pre-Acquisition(1)

2017 Total(2) 2016

2016 Pre-Acquisition(3)

2016 Total (2)

Change West $ 29,434 $ 13,231 $ 42,665

$ 29,908 $ 17,427 $ 47,335 (9.9)%

Midwest 20,468 46,856 67,324 - 62,636 62,636 7.5% South 23,624

24,918 48,542 15,903 34,483 50,386 (3.7)% East 50,619 (120) 50,499

46,944 (376) 46,568 8.4% Corporate and Other (4) (10,769)

(5,996) (16,765) (7,766)

(11,996) (19,762) (15.2)%

Total Adjusted EBITDA (5) $ 113,376

$ 78,889 $ 192,265

$ 84,989 $ 102,174

$ 187,163 2.7% Net (Loss)

Income

$ (45,307)

$ 14,160 Basic EPS $

(0.79) $ 0.30 Diluted EPS

$

(0.79)

$ 0.30 (1) Figures are for Isle of

Capri Casinos, Inc. (“Isle”) for the one and four months ended

April 30, 2017, the day before ERI acquired Isle on May 1, 2017.

ERI reports its financial results on a calendar fiscal year. Prior

to the Company’s acquisition of Isle, Isle's fiscal year typically

ended on the last Sunday in April. Isle's fiscal 2017 and 2016 were

52-week years, which commenced on April 25, 2016 and April 27,

2015, respectively. Such figures were prepared by the Company to

reflect Isle’s unaudited consolidated historical net revenues and

Adjusted EBITDA for periods corresponding to ERI's fiscal quarterly

calendar. Such figures are based on the unaudited internal

financial statements and have not been reviewed by the Company's

auditors and do not conform to GAAP. (2) Total figures for 2016 and

2017 include combined results of operations for Isle and ERI for

periods preceding the date that ERI acquired Isle. Such

presentation does not conform with GAAP or the Securities and

Exchange Commission rules for pro forma presentation; however, we

believe that the additional financial information will be helpful

to investors in comparing current results with results of prior

periods. This is non-GAAP data and should not be considered a

substitute for data prepared in accordance with GAAP, but should be

viewed in addition to the results of operations reported by the

Company. (3) Figures are for Isle the three and six months ended

June 30, 2016. Such figures were prepared by the Company to reflect

Isles' unaudited consolidated historical net revenues, operating

income and Adjusted EBITDA for periods corresponding to ERI's

fiscal quarterly calendar. Such figures are based on the unaudited

internal financial statements and have not been reviewed by the

Company's auditors and do not conform to GAAP. (4) Corporate for

six months ended June 30, 2016 excludes severance expense of $1.5

million. (5) Adjusted EBITDA is not a GAAP measurement and is

presented solely as a supplemental disclosure because the Company

believes it is a widely used measure of operating performance in

the gaming industry. See "Reconciliation of GAAP Measures to

Non-GAAP Measures" below for a definition of Adjusted EBITDA and a

quantitative reconciliation of Adjusted EBITDA to operating income

(loss), which the Company believes is the most comparable financial

measure calculated in accordance with GAAP.

“Eldorado’s operating momentum and financial growth continued in

the second quarter as, on a combined basis after giving effect to

the acquisition of Isle of Capri, Adjusted EBITDA rose 7.8% year

over year,” said Gary Carano, Chairman and Chief Executive Officer

of Eldorado. “Our second quarter growth was broad-based as Adjusted

EBITDA improved at 13 of our 19 properties and we delivered year

over year property margin increases at our West, Midwest and East

regions and flat margin results for our South region. As a result,

Eldorado’s combined consolidated Adjusted EBITDA margin improved

230 basis points in the quarter to 23.4%.

“Our expanded scale following the May 1 completion of the Isle

of Capri transaction significantly diversified our Adjusted EBITDA

composition, as no single market accounted for more than

approximately 15% of total property Adjusted EBITDA in the second

quarter. Overall, our second quarter results continue to highlight

the efficacy of our strategy to build shareholder value by

leveraging our proven operating model into a more diversified

regional gaming entity.

“Our integration of the Isle of Capri properties is off to a

very strong start. We have already achieved nearly $30 million of

the anticipated $35 million in annual synergies and with the

implementation of a four region reporting structure we are bringing

best-practice operating strategies from across the organization

down to the property-level quickly and efficiently. We have started

to implement such best practices from our legacy and newly acquired

operations as we target further margin enhancement and elevated

guest service and satisfaction across the entire property

portfolio. Looking ahead, we believe that there are significant

opportunities for continued margin enhancement as we extract a

range of efficiencies from our marketing, advertising, player

promotion, and food and beverage operations.

“We are also evaluating opportunities across our portfolio for

return-focused investments that are intended to unlock underlying

value in properties and drive future profitable growth. Eldorado

has a solid record of success in undertaking property-specific

enhancements that elevate the guest experience and its market

competitiveness while also generating a return on our investment.

Thus far in 2017, we have completed the renovation of 153 rooms and

the Showroom at Eldorado Reno, the new Canter’s Delicatessen and

poker room opening at Silver Legacy, and upgrades at Circus Circus

which include the renovation of 648 rooms, a redesigned 6,700

square foot video arcade, and new food and beverage operations

including Madame Butterworks Curious Café, Kanpai Sushi, El Jefe’s

Cantina and the new food court featuring three distinct culinary

options, with Habit Burger, Piezzetta Pizza Kitchen and Panda

Express. This comprehensive facility enhancement program is helping

Eldorado deliver a more integrated experience across the Reno

Tri-Properties’ operations for our guests while also providing a

variety of amenities that makes each property feel distinctive and

unique.

“We are very optimistic as we look forward to the second half of

the year, and believe our successful integration of the Isle of

Capri properties to date, the benefit of our expanded scale, and

the ongoing implementation of operating strategies have positioned

the Company to deliver additional value for our shareholders.”

Balance Sheet and Liquidity

At June 30, 2017, Eldorado had $103.6 million in cash and cash

equivalents and $22.6 million in restricted cash. Outstanding

indebtedness at June 30, 2017 totaled $2.3 billion, including $90

million outstanding on the Company’s revolving credit facility. Our

purchase price accounting is preliminary as of June 30, 2017.

Capital expenditures in the second quarter and first six months of

2017 totaled $23.6 million and $29.8 million, respectively. The

Company expects 2017 full-year capital expenditures of $80.0

million, with approximately $26.8 million allocated to project

cap-ex and the remaining $53.2 million for maintenance cap-ex.

“Our expanded scale is delivering the expected benefit in free

cash flow as we paid down $39.5 million of debt in the second

quarter,” said Tom Reeg, President and Chief Financial Officer.

“Our priority continues to be to deploy free cash flow to reduce

leverage which should position us to pursue future growth

opportunities.”

Eldorado expects the $134.5 million sale of Isle of Capri Hotel

Lake Charles to close later in 2017, subject to regulatory

approval, and the Company intends to allocate all of the net

proceeds from the sale to debt reduction. The operations of Lake

Charles has been classified as discontinued operations and as

assets held for sale for all periods presented.

Summary of 2017 Second Quarter Region Results

Reflecting the completion on May 1 of the Company’s acquisition

of Isle of Capri, Eldorado has changed its quarterly property

results reporting to report results in four regions. The new

reporting format is also consistent with changes the Company has

made in its management reporting structure.

West Region (Reno Tri-Properties, Isle Casino Hotel Black

Hawk and Lady Luck Casino Black Hawk)

Net revenue for the West Region properties for the quarter ended

June 30, 2017 declined approximately 5.6% to $109.4 million

compared to $115.9 million in the prior-year period, with operating

income of $19.2 million compared to $19.8 million in the year-ago

quarter. Adjusted EBITDA was $26.7 million reflecting an Adjusted

EBITDA margin of 24.5% compared to Adjusted EBITDA of $27.2 million

on an Adjusted EBITDA margin of 23.5% in the prior-year period. Net

revenue, operating income and Adjusted EBITDA for the West region

in the second quarter of 2017 were impacted by a challenging

comparison to the prior year period which included the benefit to

the Reno Tri-Properties’ operations from the men’s bowling

tournament.

Midwest Region (Isle Casino Waterloo, Isle Casino

Bettendorf, Isle of Capri Casino Boonville, Isle Casino Cape

Girardeau, Lady Luck Casino Caruthersville and Isle of Capri Casino

Kansas City)

Net revenue for the Midwest Region properties for the quarter

ended June 30, 2017 increased approximately 1.5% to $103.8 million

compared to $102.2 million in the prior-year period, with operating

income of $26.0 million compared to $20.4 million in the year-ago

quarter. Adjusted EBITDA rose approximately 9.7% to $33.2 million

as the Adjusted EBITDA margin for the segment rose 230 basis points

to 31.9%. Adjusted EBITDA increased year over year at five of the

six Midwest Region properties. Adjusted EBITDA for the Midwest

Region in the prior-year period was $30.2 million reflecting an

Adjusted EBITDA margin of 29.6%.

South Region (Isle Casino Racing Pompano Park, Eldorado

Shreveport, Isle of Capri Casino Lula and Lady Luck Casino

Vicksburg)

Net revenue for the South Region properties for the quarter

ended June 30, 2017 declined approximately 4.7% to $90.9 million

compared to $95.3 million in the prior-year period, with operating

income of $15.0 million compared to $15.7 million in the year-ago

quarter. Adjusted EBITDA was $21.2 million compared to Adjusted

EBITDA of $21.8 million in the prior-year period with Adjusted

EBITDA margin for the region increasing 40 basis points to 23.3%.

The South Region results were impacted by severe flooding in 2017

over the course of approximately seven days at Lady Luck Casino in

Vicksburg, MS, which remained opened but experienced a significant

decline in visitation throughout the seven-day period.

East Region (Presque Isle Downs and Casino, Lady Luck

Casino Nemacolin, Eldorado Scioto Downs Racino and Mountaineer

Casino, Racetrack and Resort)

Net revenue for the East Region properties for the quarter ended

June 30, 2017 declined approximately 1.5% to $122.6 million

compared to $124.4 million in the prior-year period, with operating

income of $18.0 million compared to $13.7 million in the year-ago

quarter. Despite the modest revenue decline, Adjusted EBITDA for

the East Region rose 11.2% to $26.6 million compared to Adjusted

EBITDA of $23.9 million in the prior-year period as the East

region’s Adjusted EBITDA margin improved 240 basis points to 21.7%.

The East region’s three largest properties delivered year-over-year

Adjusted EBITDA growth, including the tenth consecutive quarter of

Adjusted EBITDA growth for Eldorado Scioto Downs and the second

consecutive quarter of double digit growth at Mountaineer Casino,

Racetrack & Resort which continues to benefit from the

Company’s initiatives to improve amenities and right-size operating

expenses to match current visitation and revenue volumes.

Reconciliation of GAAP Measures to Non-GAAP Measures

Adjusted EBITDA (defined below), a non GAAP financial measure,

has been presented as a supplemental disclosure because it is a

widely used measure of performance and basis for valuation of

companies in our industry and we believe that this non GAAP

supplemental information will be helpful in understanding the

Company’s ongoing operating results. Adjusted EBITDA represents

operating income (loss) before depreciation and amortization, stock

based compensation, transaction expenses, S-1 expenses, severance

expenses and other, which includes equity in income (loss) of

unconsolidated affiliates, (gain) loss on the sale or disposal of

property, and other regulatory gaming assessments, including the

impact of the change in regulatory reporting requirements, to the

extent that such items existed in the periods presented. Adjusted

EBITDA is not a measure of performance or liquidity calculated in

accordance with U.S. GAAP, is unaudited and should not be

considered an alternative to, or more meaningful than, net income

(loss) as an indicator of our operating performance. Uses of cash

flows that are not reflected in Adjusted EBITDA include capital

expenditures, interest payments, income taxes, debt principal

repayments and certain regulatory gaming assessments, which can be

significant. As a result, Adjusted EBITDA should not be considered

as a measure of our liquidity. Other companies that provide EBITDA

information may calculate EBITDA differently than we do. The

definition of Adjusted EBITDA may not be the same as the

definitions used in any of our debt agreements.

Second Quarter Conference Call

Eldorado will host a conference call at 4:30 p.m. ET today.

Senior management will discuss the financial results and host a

question and answer session. The dial in number for the audio

conference call is 719/457-2701, conference ID 9062486 (domestic

and international callers). Participants can also access a live

webcast of the call through the “Events & Presentations”

section of Eldorado’s website at http://www.eldoradoresorts.com/

and a replay of the webcast will be archived on the site for 90

days following the live event.

About Eldorado Resorts, Inc.

Eldorado Resorts is a leading casino entertainment company that

owns and operates nineteen properties in ten states, including

Colorado, Florida, Iowa, Louisiana, Mississippi, Missouri, Nevada,

Ohio, Pennsylvania and West Virginia. In aggregate, Eldorado’s

properties feature approximately 20,000 slot machines and VLTs,

more than 550 table games and over 6,500 hotel rooms. For more

information, please visit www.eldoradoresorts.com.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. Forward-looking statements include

statements regarding our strategies, objectives and plans for

future development or acquisitions of properties or operations, as

well as expectations, future operating results and other

information that is not historical information. When used in this

press release, the terms or phrases such as “anticipates,”

“believes,” “projects,” “plans,” “intends,” “expects,” “might,”

“may,” “estimates,” “could,” “should,” “would,” “will likely

continue,” and variations of such words or similar expressions are

intended to identify forward-looking statements. Although our

expectations, beliefs and projections are expressed in good faith

and with what we believe is a reasonable basis, there can be no

assurance that these expectations, beliefs and projections will be

realized. There are a number of risks and uncertainties that could

cause our actual results to differ materially from those expressed

in the forward-looking statements which are included elsewhere in

this press release. Such risks, uncertainties and other important

factors include, but are not limited to: Eldorado’s ability to

promptly and effectively integrate the business of Eldorado and

Isle and realize synergies resulting from the combined operations;

our substantial indebtedness and the impact of such obligations on

our operations and liquidity; competition; sensitivity of our

operations to reductions in discretionary consumer spending and

changes in general economic and market conditions; governmental

regulations and increases in gaming taxes and fees in jurisdictions

in which we operate; and other risks and uncertainties described in

our reports on Form 10-K, Form 10-Q and Form 8-K.

In light of these and other risks, uncertainties and

assumptions, the forward-looking events discussed in this press

release might not occur. These forward-looking statements speak

only as of the date of this press release, even if subsequently

made available on our website or otherwise, and we do not intend to

update publicly any forward-looking statement to reflect events or

circumstances that occur after the date on which the statement is

made, except as may be required by law.

ELDORADO RESORTS, INC. CONSOLIDATED

STATEMENTS OF OPERATIONS ($ in thousands, except per share

data) Three Months Ended Six Months Ended

June 30, June 30, 2017 2016

2017 2016 REVENUES:

Casino $ 298,182 $ 178,459 $ 460,966 $ 347,537 Pari-mutuel

commissions 4,143 2,893 4,784 3,577 Food and beverage 46,438 36,967

75,951 70,706 Hotel 28,924 25,677 46,937 45,842 Other

11,550 11,014 20,145

21,899 389,237 255,010 608,783 489,561 Less-promotional allowances

(34,057 ) (23,695 )

(52,678 ) (44,680 ) Net operating revenues

355,180 231,315 556,105

444,881 EXPENSES: Casino 152,417 100,374 242,870 196,636

Pari-mutuel commissions 4,874 2,931 6,081 4,255 Food and beverage

22,834 20,783 40,255 40,511 Hotel 8,026 7,979 14,629 15,108 Other

5,644 6,618 10,923 12,692 Marketing and promotions 20,158 9,766

30,214 19,341 General and administrative 55,379 32,380 87,154

64,035 Corporate 7,442 4,354 14,016 11,258 Depreciation and

amortization 24,909 15,583

40,513 31,787 Total operating expenses 301,683

200,768 486,655 395,623 LOSS ON SALE OF ASSET OR DISPOSAL OF

PROPERTY (89 ) (836 ) (57 ) (765 ) ACQUISITION CHARGES (85,464 )

(56 ) (87,078 ) (576 ) EQUITY IN LOSS OF UNCONSOLIDATED AFFILIATE

(60 ) — (282 )

— OPERATING (LOSS) INCOME (32,116 )

29,655 (17,967 ) 47,917 OTHER

EXPENSE: Interest expense, net (27,527 ) (12,795 ) (40,197 )

(25,786 ) Loss on early retirement of debt, net

(27,317 ) (89 ) (27,317 )

(155 ) Total other expense (54,844 )

(12,884 ) (67,514 ) (25,941 ) NET

(LOSS) INCOME FROM CONTINUING OPERATIONS BEFORE INCOME TAXES

(86,960 ) 16,771 (85,481 ) 21,976 BENEFIT (PROVISION) FOR INCOME

TAXES 39,677 (5,980 )

39,219 (7,816 ) NET (LOSS) INCOME FROM CONTINUING

OPERATIONS (47,283 ) 10,791 (46,262 ) 14,160 INCOME FROM

DISCONTINUED OPERATIONS, NET OF TAXES 955

— 955 — NET (LOSS) INCOME $

(46,328 ) $ 10,791 $ (45,307 ) $ 14,160

(Loss) income per common share attributable to common

stockholders - basic: Net (loss) income from continuing operations

$ (0.70 ) $ 0.23 $ (0.81 ) $ 0.30 Income from discontinued

operations net of income taxes 0.01 —

0.02 — Net (loss) income attributable

to common stockholders $ (0.69 ) $ 0.23 $

(0.79 ) $ 0.30 (Loss) income per common share

attributable to common stockholders - diluted: Net (loss) income

from continuing operations $

(0.70

) $ 0.23 $

(0.81

) $ 0.30 Income from discontinued operations, net of income taxes

0.01 —

0.02

— Net (loss) income attributable to common

stockholders $

(0.69

) $ 0.23 $

(0.79

) $ 0.30 Weighted Average Basic Shares Outstanding

67,453,095 47,071,608

57,405,834 46,966,391 Weighted Average Diluted Shares

Outstanding 68,469,191 47,721,075

58,339,438 47,591,958

The accompanying condensed notes are an

integral part of these consolidated financial statements.

ELDORADO RESORTS, INC. SUMMARY INFORMATION AND

RECONCILIATION OF OPERATING INCOME (LOSS) TO ADJUSTED

EBITDA ($ in thousands) Three Months Ended

June 30, 2017 Operating

Income

(Loss)

Depreciation

and

Amortization

Stock-Based

Compensation

Transaction

Expenses

Severance

Expense

Other (6) Adjusted

EBITDA

Excluding Pre-Acquisition:

West $ 16,468 $ 6,576 $ 52 $ — $ 36 $ (27 ) $

23,105 Midwest 15,408 4,966 86 — 1 7 20,468 South 11,069 4,662 40 —

3 — 15,774 East 18,153 8,273 4 — 22 89 26,541 Corporate

(93,214 ) 432 1,123

85,464 300 (22 )

(5,917 )

Total Excluding Pre-Acquisition $

(32,116 ) $ 24,909 $

1,305 $ 85,464 $

362 $ 47 $ 79,971

Pre-Acquisition (1): West $ 2,709 $ 925 $ 2 $ — $ — $

4 $ 3,640 Midwest 10,637 2,001 14 — 5 29 12,686 South 3,943 1,442 7

— — 33 5,425 East (197 ) 239 — — — — 42 Corporate

(2,550 ) 96 461 286

— (22 ) (1,729 )

Total

Pre-Acquisition $ 14,542 $

4,703 $ 484 $ 286

$ 5 $ 44 $

20,064 Including Pre-Acquisition: West $

19,177 $ 7,501 $ 54 $ — $ 36 $ (23 ) $ 26,745 Midwest 26,045 6,967

100 — 6 36 33,154 South 15,012 6,104 47 — 3 33 21,199 East 17,956

8,512 4 — 22 89 26,583 Corporate (95,764 )

528 1,584 85,750

300 (44 ) (7,646 )

Total Including

Pre-Acquisition (2) $ (17,574 )

$ 29,612 $ 1,789 $

85,750 $ 367 $

91 $ 100,035 Three

Months Ended June 30, 2016 Operating

Income

(Loss)

Depreciation

and

Amortization

Stock-Based

Compensation

Transaction

Expenses

Severance

Expense

Other (6) Adjusted

EBITDA

Excluding Pre-Acquisition:

West $ 13,655 $ 5,046 $ — $ — $ — $ 214 $

18,915 Midwest — — — — — — — South 5,541 1,964 — — — (49 ) 7,456

East 14,934 8,459 — — — 646 24,039 Corporate (4,475 )

114 579 56

17 (49 ) (3,758 )

Total Excluding

Pre-Acquisition $ 29,655 $

15,583 $ 579 $ 56

$ 17 $ 762 $

46,652 Pre-Acquisition (3): West $

6,163 $ 2,122 $ 12 $ — $ — $ — $ 8,297 Midwest 20,387 9,236 45 — —

556 30,224 South 10,131 4,188 24 — — — 14,343 East (1,215 ) 1,091 —

— — — (124 ) Corporate (8,464 ) 344

1,307 — —

190 (6,623 )

Total Pre-Acquisition $

27,002 $ 16,981 $

1,388 $ — $ —

$ 746 $ 46,117

Including Pre-Acquisition: West $ 19,818 $ 7,168 $ 12 $ — $

— $ 214 $ 27,212 Midwest 20,387 9,236 45 — — 556 30,224 South

15,672 6,152 24 — — (49 ) 21,799 East 13,719 9,550 — — — 646 23,915

Corporate (12,939 ) 458

1,886 56 17 141

(10,381 )

Total Including Pre-Acquisition (2)

$ 56,657 $ 32,564

$ 1,967 $ 56 $

17 $ 1,508 $

92,769 Six Months Ended June 30, 2017

Operating

Income

(Loss)

Depreciation

and

Amortization

Stock-Based

Compensation

Transaction

Expenses

Severance

Expense

Other (6) Adjusted

EBITDA

Excluding Pre-Acquisition:

West $ 17,994 $ 11,219 $ 52 $ — $ 196 $ (27 )

$ 29,434 Midwest 15,408 4,966 86 — 1 7 20,468 South 16,987 6,594 40

— 3 — 23,624 East 33,195 17,153 4 — 22 245 50,619 Corporate

(101,551 ) 581 2,856

87,078 289 (22 )

(10,769 )

Total Excluding Pre-Acquisition $

(17,967 ) $ 40,513 $

3,038 $ 87,078 $

511 $ 203 $

113,376 Pre-Acquisition (3): West $ 9,525 $

3,694 $ 8 $ — $ — $ 4 $ 13,231 Midwest 34,819 11,952 51 — 5 29

46,856 South 19,165 5,694 26 — — 33 24,918 East (1,072 ) 952 — — —

— (120 ) Corporate (8,811 ) 371

1,631 286 549 (22

) (5,996 )

Total Pre-Acquisition $

53,626 $ 22,663 $

1,716 $ 286 $ 554

$ 44 $ 78,889

Including Pre-Acquisition: West $ 27,519 $ 14,913 $ 60 $ — $

196 $ (23 ) $ 42,665 Midwest 50,227 16,918 137 — 6 36 67,324 South

36,152 12,288 66 — 3 33 48,542 East 32,123 18,105 4 — 22 245 50,499

Corporate (110,362 ) 952

4,487 87,364 838 (44 )

(16,765 )

Total Including Pre-Acquisition (2)

$ 35,659 $ 63,176

$ 4,754 $ 87,364 $

1,065 $ 247 $

192,265 Six Months Ended June 30, 2016

Operating

Income

(Loss)

Depreciation

and

Amortization

Stock-Based

Compensation

Transaction

Expenses (5)

Severance

Expense

Other (4)(6) Adjusted

EBITDA

Excluding Pre-Acquisition:

West $ 19,219 $ 10,509 $ — $ — $ — $ 180 $

29,908 Midwest — — — — — — — South 12,043 3,910 — — — (50 ) 15,903

East (3) 28,665 17,143 — — — 1,136 46,944 Corporate

(12,010 ) 225 2,033 574

1,461 (49 ) (7,766 )

Total Excluding Pre-Acquisition $

47,917 $ 31,787 $

2,033 $ 574 $

1,461 $ 1,217 $

84,989 Pre-Acquisition (3): West $ 13,109 $

4,292 $ 26 $ — $ — $ — $ 17,427 Midwest 42,867 18,976 88 — — 705

62,636 South 26,179 8,256 48 — — — 34,483 East (2,543 ) 2,167 — — —

— (376 ) Corporate (15,520 ) 796

1,858 — — 870

(11,996 )

Total Pre-Acquisition $

64,092 $ 34,487 $

2,020 $ — $ —

$ 1,575 $ 102,174

Including Pre-Acquisition: West $ 32,328 $ 14,801 $ 26 $ — $

— $ 180 $ 47,335 Midwest 42,867 18,976 88 — — 705 62,636 South

38,222 12,166 48 — — (50 ) 50,386 East (3) 26,122 19,310 — — —

1,136 46,568 Corporate (27,530 ) 1,021

3,891 574 1,461

821 (19,762 )

Total Including

Pre-Acquisition (2) $ 112,009 $

66,274 $ 4,053 $

574 $ 1,461 $

2,792 $ 187,163 (1)

Figures are for Isle the one and four months ended April 30, 2017,

the day before the Company acquired Isle on May 1, 2017. The

Company reports its financial results on a calendar fiscal year.

Prior to the Company’s acquisition of Isle, Isle’s fiscal year

typically ended on the last Sunday in April. Isle’s fiscal 2017 and

2016 were 52-week years, which commenced on April 25, 2016 and

April 27, 2015, respectively. Such figures were prepared by the

Company to reflect Isles’ unaudited consolidated historical net

revenues and Adjusted EBITDA for periods corresponding to the

Company’s fiscal quarterly calendar. Such figures are based on the

unaudited internal financial statements and have not been reviewed

by the Company’s auditors and do not conform to GAAP. (2) Total

figures for 2016 and 2017 include combined results of operations

for Isle and the Company for periods preceding the date that the

Company acquired Isle. Such presentation does not conform with GAAP

or the Securities and Exchange Commission rules for proforma

presentation; however, we believe that the additional financial

information will be helpful to investors in comparing current

results with results of prior periods. This is non-GAAP data and

should not be considered a substitute for data prepared in

accordance with GAAP, but should be viewed in addition to the

results of operations reported by the Company. (3) Figures are for

Isle for the three and six months ended June 30, 2016. Such figures

were prepared by the Company to reflect Isle’s unaudited

consolidated historical net revenues, operating income and Adjusted

EBITDA for periods corresponding to the Company’s fiscal quarterly

calendar. Such figures are based on the unaudited internal

financial statements and have not been reviewed by the Company’s

auditors and do not conform to GAAP. (4) Effective January 1, 2016,

the Ohio Lottery Commission enacted a regulatory change which

resulted in the establishment of a $1.0 million progressive slot

liability and a corresponding decrease in net slot win during the

first quarter of 2016. The changes are non-cash and related

primarily to prior years. The net non-cash impact to Adjusted

EBITDA was $0.6 million for the six months ended June 30, 2016. (5)

Transaction expenses for the three and six months ended June 30,

2017 represent acquisition costs related to the Isle Acquisition.

Transaction expenses for the three and six months ended June 30,

2016 represent acquisition costs related to the Reno Acquisition

and includes a credit of $2.0 thousand related to S-1 offering

costs. (6) Other is comprised of (gain) loss on the sale or

disposal of property, equity in loss of unconsolidated affiliate

and other regulatory gaming assessments, including the item listed

in footnote (4) above.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170808006431/en/

Eldorado Resorts, Inc.Thomas Reeg, 775-328-0112President and

Chief Financial

Officerinvestorrelations@eldoradoresorts.comorJCIRJoseph N.

Jaffoni, Richard Land, 212-835-8500eri@jcir.com

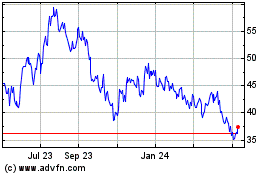

Caesars Entertainment (NASDAQ:CZR)

Historical Stock Chart

From Mar 2024 to Apr 2024

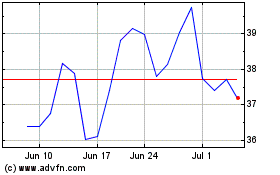

Caesars Entertainment (NASDAQ:CZR)

Historical Stock Chart

From Apr 2023 to Apr 2024