Smith Micro Software, Inc. (NASDAQ: SMSI) today reported

financial results for its second quarter ended June 30, 2017.

“During the first half of fiscal 2017, Smith Micro completed a

significant restructure of our business, aligned our cost

structure, and created a strong foundation for growth in the second

half and 2018,” said William W. Smith, Jr., President and CEO of

Smith Micro Software.

“The success of our SafePath™ Family platform has provided us

with a strong lead product. New business wins with SafePath will

provide the company with significant new recurring revenue in the

back half of this year and accelerating into 2018. As we continue

to build our customer base, we are extremely focused and optimistic

about our future and our return to strong growth and

profitability.”

Fiscal Second Quarter 2017 Financial Results:

Smith Micro Software reported revenues of $5.9 million for the

second quarter ended June 30, 2017, compared to $7.5 million

reported in the second quarter ended June 30, 2016.

Second quarter 2017 gross profit was $4.6 million, compared to

$5.5 million reported in the second quarter of 2016.

GAAP gross profit as a percentage of revenue was 78 percent for

the second quarter of 2017, compared to 74 percent for the second

quarter of 2016.

GAAP net loss for the second quarter of 2017 was $2.6 million,

or $0.20 loss per share, compared to a GAAP net loss of $3.3

million, or $0.28 loss per share, for the second quarter of

2016.

Non-GAAP net loss (which excludes stock-based compensation,

amortization of intangibles, fair value adjustments, non-cash debt

issuance and discount costs, and normalized tax expense) for the

second quarter of 2017 was $0.8 million, or $0.06 loss per share,

compared to a non-GAAP net loss of $1.8 million, or $0.15 loss per

share, for the second quarter of 2016.

Fiscal June Year-To-Date 2017 Financial Results:

For the six months ended June 30, 2017, the Company reported

revenues of $11.4 million, compared to $14.7 million for the six

months ended June 30, 2016.

GAAP gross profit was $8.9 million for the six months ended June

30, 2017, compared to $10.6 million for the six months ended June

30, 2016.

GAAP gross profit as a percentage of revenues was 78 percent for

the six months ended June 30, 2017, compared to 73 percent for the

same period last year.

GAAP net loss for the six months ended June 30, 2017 was $4.8

million, or $0.38 loss per share, compared to a GAAP net loss for

the six months ended June 30, 2016 of $7.0 million, or $0.60 loss

per share.

Non-GAAP net loss (which excludes stock-based compensation,

amortization of intangibles, fair value adjustments, non-cash debt

issuance and discount costs, and normalized tax expense) for the

six months ended June 30, 2017 was $2.2 million, or $0.18 loss per

share, compared to a non-GAAP net loss of $3.8 million, or $0.33

loss per share, for the six months ended June 30, 2016.

Total cash and cash equivalents at June 30, 2017 were $2.4

million.

The Company uses a non-GAAP reconciliation of gross profit,

income (loss) before taxes, net income (loss), and earnings (loss)

per share in the presentation of financial results in this press

release. Management believes that this presentation may be more

meaningful in analyzing our income generation since stock-based

compensation, amortization of intangible assets, fair value

adjustments, and non-cash debt issuance and discount costs are

excluded from the non-GAAP earnings calculation and adjustments are

made for Proforma taxes. Since we are in a cumulative loss

position, the non-GAAP income tax expense (benefit) for the fiscal

year 2017 was computed by using a tax rate of 38 percent using the

Company’s normalized combined U.S. federal, state and foreign

statutory tax rates less various tax adjustments. This presentation

may be considered more indicative of our ongoing operational

performance. The tables below present the differences between

non-GAAP earnings and net loss on an absolute and per-share basis.

Non-GAAP financial measures should not be considered in isolation

from, or as a substitute for, financial information presented in

compliance with GAAP, and the non-financial measures as reported by

Smith Micro Software may not be comparable to similarly titled

amounts reported by other companies.

Investor Conference Call:

Smith Micro Software will hold an investor conference call today

to discuss the Company’s second quarter 2017 results at 4:30 p.m.

ET, August 8, 2017. To access the call, dial 1-877-270-2148;

international participants can call 1-412-902-6510. A passcode is

not required to join the call; ask the operator to be placed into

the Smith Micro conference. Participants are asked to call the

assigned number approximately 10 minutes before the conference call

begins. In addition, the conference call will be available on the

Smith Micro website in the Investor Relations section.

About Smith Micro Software, Inc.:

Smith Micro develops software to simplify and enhance the mobile

experience, providing solutions to some of the leading wireless

service providers, device manufacturers, and enterprise businesses

around the world. From optimizing wireless networks to uncovering

customer experience insights, and from streamlining Wi-Fi access to

ensuring family safety, our solutions enrich today’s connected

lifestyles while creating new opportunities to engage consumers via

smartphones. Our portfolio also includes a wide range of products

for creating, sharing and monetizing rich content, such as visual

messaging, video streaming, and 2D/3D graphics applications. For

more information, visit smithmicro.com.

Safe Harbor Statement:

This release contains forward-looking statements that involve

risks and uncertainties, including without limitation,

forward-looking statements relating to the company’s financial

prospects and other projections of its performance, the existence

of new sales opportunities and interest in the company’s products

and solutions, the company's ability to increase its revenue by

capitalizing on new opportunities, and customer concentration given

that the majority of our sales depend on a few large client

relationships, including Sprint. Among the important factors that

could cause actual results to differ materially from those

expressed or implied in the forward-looking statements are the

company’s ability to continue as a going concern, our ability to

raise more funds to meet our capital needs, changes in demand for

the company’s products from its customers and their end-users, new

and changing technologies, customer acceptance and timing of

deployment of those technologies, and the company's ability to

compete effectively with other software and technology companies.

These and other factors discussed in the company's filings with the

Securities and Exchange Commission, including our filings on Forms

10-K and 10-Q, could cause actual results to differ materially from

those expressed or implied in any forward-looking statements. The

forward-looking statements contained in this release are made on

the basis of the views and assumptions of management regarding

future events and business performance as of the date of this

release, and the company does not undertake any obligation to

update these statements to reflect events or circumstances

occurring after the date of this release.

Smith Micro and the Smith Micro logo are registered trademarks

or trademarks of Smith Micro Software, Inc. All other trademarks

and product names are the property of their respective

companies.

Note: Financial Schedules Attached

Smith Micro Software, Inc.

Reconciliation of GAAP to Non-GAAP

Results (in thousands, except per share amounts) - unaudited

Note Stock Intangibles Change in Issue/ Non-

GAAP

Compensation Amortization Fair

Value Discount Taxes

GAAP

Three Months Ended

6/30/17:

Gross profit $ 4,577 $- $- $- $- $- $4,577 Loss before provision

for income taxes ($2,569 ) $388 $65 $561 $192 $- ($1,363 ) Net loss

($2,574 ) $388 $65 $561 $192 $524 ($844 ) Loss per share: basic and

diluted ($0.20 ) $0.03 $0.00 $0.05 $0.01 $0.05 ($0.06 )

Three Months Ended

6/30/16:

Gross profit $ 5,546 $0 $- $- $- $- $5,546 Loss before provision

for income taxes ($3,269 ) $406 $27 $- $- $- ($2,836 ) Net loss

($3,280 ) $406 $27 $- $- $1,089 ($1,758 ) Loss per share: basic and

diluted ($0.28 ) $0.03 $0.00 $0.00 $0.00 $0.10 ($0.15 )

Six Months Ended

6/30/17:

Gross profit $ 8,870 $- $- $- $- $- $8,870 Loss before provision

for income taxes ($4,793 ) $834 $130 ($147 ) $382 $- ($3,594 ) Net

loss ($4,806 ) $834 $130 ($147 ) $382 $1,380 ($2,227 ) Loss per

share: basic and diluted ($0.38 ) $0.06 $0.01 ($0.01 ) $0.03 $0.11

($0.18 )

Six Months Ended

6/30/16:

Gross profit $ 10,647 $2 $- $- $- $- $10,649 Loss before provision

for income taxes ($6,949 ) $767 $27 $- $- $- ($6,155 ) Net loss

($6,986 ) $767 $27 $- $- $2,376 ($3,816 ) Loss per share: basic and

diluted ($0.60 ) $0.07 $0.00 $0.00 $0.00 $0.20 ($0.33 )

Note: Loss per share: basic and diluted - impacted by rounding to

allow rows to calculate.

Smith Micro Software, Inc.

Statements of Operations and Comprehensive Loss for the Three

and Six Months Ended June 30, 2017 and 2016 (in thousands,

except per share amounts) - unaudited For the

Three Months For the Six Months Ended June 30, Ended June 30,

2017

2016

2017

2016

Revenues $ 5,862 $ 7,459 $ 11,438 $ 14,673 Cost of revenues

1,285 1,913 2,568 4,026

Gross profit 4,577 5,546 8,870 10,647 Operating

expenses: Selling and marketing 1,461 2,478 3,254 4,848 Research

and development 2,174 4,107 4,671 8,030 General and administrative

2,239 2,870 4,428 5,356 Restructuring expense 322

- 714 - Total operating

expenses 6,196 9,455 13,067

18,234 Operating loss (1,619 ) (3,909 ) (4,197

) (7,587 ) Non-operating income: Change in carrying value of

contingent liability - 657 - 657 Change in fair value of warrant

liability (561 ) - 147 - Interest income (expense), net (390 ) (2 )

(734 ) - Other income (expense), net 1 (15 )

(9 ) (19 ) Loss before provision for income taxes

(2,569 ) (3,269 ) (4,793 ) (6,949 )

Provision for income tax expense 5 11

13 37 Net loss $ (2,574 ) $ (3,280 ) $

(4,806 ) $ (6,986 ) Other comprehensive income, before tax:

Unrealized holding gains on available-for-sale securities -

- - 2 Other

comprehensive income, net of tax - -

- 2 Comprehensive loss $ (2,574 ) $

(3,280 ) $ (4,806 ) $ (6,984 ) Loss per share: Basic and

diluted $ (0.20 ) $ (0.28 ) $ (0.38 ) $ (0.60 ) Weighted

average shares outstanding: Basic and diluted 13,179 11,741 12,674

11,632

Smith Micro Software, Inc.

Consolidated Balance Sheets (in thousands) June 30, December

31,

2017

2016

(unaudited) (audited) ASSETS Current Assets: Cash & cash

equivalents $ 2,377 $ 2,229 Accounts receivable, net 4,711 4,962

Income tax receivable 1 1 Inventory, net 13 12 Prepaid and other

assets 751 713 Total current assets

7,853 7,917 Equipment & improvements, net 1,542 1,811 Other

assets 146 149 Intangible assets, net 616 745 Goodwill 3,685

3,686 TOTAL ASSETS $ 13,842 $ 14,308

LIABILITIES & STOCKHOLDERS' EQUITY Current

Liabilities: Accounts payable $ 1,296 $ 1,907 Accrued liabilities

3,212 3,503 Related-party notes payable 2,000 - Deferred revenue

568 98 Total current liabilities 7,076

5,508 Related-party notes payable, net 1,158 967 Notes

payable, net 1,158 967 Warrant liability 1,063 1,210 Other

long-term liabilities 2,738 2,971 Deferred tax liability 181

181 Total non-current liabilities 6,298 6,296

Stockholders' Equity: Common stock 14 12 Additional paid in

capital 230,657 227,889 Accumulated comprehensive deficit

(230,203 ) (225,397 ) Total stockholders' equity 468

2,504 TOTAL LIABILITIES & STOCKHOLDERS'

EQUITY $ 13,842 $ 14,308

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170808006303/en/

IR INQUIRIES:Smith Micro Software, Inc.Charles

MessmanInvestor Relations949-362-5800IR@smithmicro.com

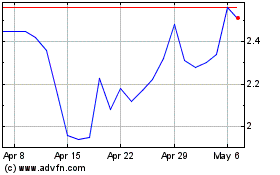

Smith Micro Software (NASDAQ:SMSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Smith Micro Software (NASDAQ:SMSI)

Historical Stock Chart

From Apr 2023 to Apr 2024