Second Quarter Net Sales of $597 Million

and GAAP Diluted EPS (Loss) of $(7.11);

Fossil Group, Inc. (NASDAQ:FOSL) (the “Company”) today reported its

financial results for the fiscal quarter ended July 1,

2017. In the second quarter of fiscal 2017, the stronger U.S.

dollar negatively impacted net sales by $8.3 million. Second

quarter fiscal 2017 net sales decreased 13% (12% on a constant

currency basis) as compared to the second quarter of fiscal 2016.

Second Quarter Fiscal

Year 2017 Revenue

SummaryIn the second quarter of fiscal 2017, reported

worldwide net sales decreased 13% or $88.6 million as growth in

connected watches was more than offset by declines in traditional

watches. Declines in leathers and jewelry and changes in

foreign currency also negatively impacted net sales. The following

table provides a summary of net sales performance for the second

quarter of fiscal 2017 compared to the second quarter of fiscal

year 2016.

| |

Second Quarter 2017 |

| |

Reported Results (1) |

|

Constant Currency (2) |

| |

|

|

|

| Total

Company |

(13 |

)% |

|

(12 |

)% |

| Americas |

(16 |

)% |

|

(16 |

)% |

| Europe |

(10 |

)% |

|

(7 |

)% |

| Asia |

(9 |

)% |

|

(8 |

)% |

| |

|

|

|

| Watches |

(9 |

)% |

|

(8 |

)% |

| Leathers |

(25 |

)% |

|

(24 |

)% |

| Jewelry |

(22 |

)% |

|

(20 |

)% |

|

|

|

|

|

(1) Includes impacts from currency.(2) Eliminates the effect of

the stronger U.S. dollar in fiscal 2017 to give investors a better

understanding of the underlying trends within the business.

See constant currency financial information at the end of this

release for more information.

The Company reported net income (loss) for the

second quarter of fiscal 2017 of $(344.7) million compared to $6.0

million for the second quarter of fiscal 2016. Diluted

earnings (loss) per share were $(7.11) compared to $0.12 for the

second quarter of fiscal 2016. Diluted earnings (loss) per

share for the second quarter of fiscal 2017 included non-cash

intangible asset impairment charges of $6.50, a restructuring

charge of $0.13 per diluted share and a negative impact from

changes in foreign currency of $0.08 per diluted share. The

non-cash intangible asset impairment charge was triggered by the

sustained compression of the Company’s market capitalization that

occurred throughout most of the latter part of the second quarter

of fiscal 2017.

Kosta Kartsotis, Chief Executive Officer,

commented. "With the first half of 2017 now behind us, we

believe that our traction in wearables, our significant progress in

our supply chain evolution and our reduction in infrastructure

costs, show that we are pursuing strategies that can improve our

profitability and return the company to solid growth over

time. Even as we operate in a market and retail environment

experiencing unprecedented disruption, we believe we are focusing

on actions that can deliver solid results and returns for our

shareholders over time."

Kosta Kartsotis continued, "In the second

quarter, the strength of our wearables product, particularly in key

brands, once again demonstrated that wearables have the ability to

help mitigate the ongoing softness in the traditional watch

category and ultimately, we believe, turn current headwinds into

tailwinds. We remain confident that technology in wrist wear

is increasingly important for many consumers and the catalyst for

stabilizing and growing our watch business overtime. We have

a significant number of exciting new products hitting the market

over the next few months that are much improved over our current

models. This next generation of wearables has increased

functionality, slimmer cases, brighter screens, more brands and

more robust software. We continue to believe we are in the

best position to take advantage of the convergence of fashion and

technology given our capabilities and portfolio of brands."

Mr. Kartsotis concluded, "Our focus remains

on executing our New World Fossil restructuring efforts, advancing

our wearables initiative, and stabilizing and growing our core

watch business to drive long term profitable growth. Given

our conviction in the positive impact these initiatives can have on

our financial performance, we are also working to ensure that we

have the proper capital structure needed to support our long-term

financial objectives. We are taking the necessary steps to

strengthen our financial position to further enable us to execute

our strategies well into the future and position our business model

for continued strong cash flow generation."

Operating ResultsCompared to

the second quarter of fiscal 2016, the impact of a stronger U.S.

dollar decreased the Company’s fiscal 2017 reported net sales by

$8.3 million and operating income by $4.5 million. The following

discussion of the Company’s net sales is presented on a GAAP basis

and in constant dollars and reflects regional performance based on

sales in all channels within the geographic location.

Second quarter fiscal 2017 worldwide net sales

decreased $88.6 million or 13% and $80.3 million in constant

currency (a 12% decline) compared to the second quarter of fiscal

2016. Across product categories, watches declined with growth

in connected watches more than offset by a decline in traditional

watches. Leathers and jewelry also declined compared to last

fiscal year.

Net sales in the Americas decreased $56.4

million or 16% and $55.0 million in constant currency (also a 16%

decline) compared to the second quarter of fiscal 2016.

Across product categories, watches declined with growth in

connected watches more than offset by a decline in traditional

watches. Leathers and jewelry also declined compared to last

fiscal year. A sales decline in the U.S. drove the decrease

in the region.

Net sales in Europe decreased $21.2 million or

10% and $14.8 million in constant currency (a 7% decline) compared

to the second quarter of fiscal 2016. Across product

categories, watches declined with growth in connected watches more

than offset by a decline in traditional watches. Jewelry and

leathers also declined compared to last fiscal year. Within

the region, modest growth in Spain was more than offset by declines

in the Middle East, France and the U.K.

Net sales in Asia decreased $11.0 million or 9%

and $10.5 million in constant currency (an 8% decline) compared to

the second quarter of fiscal 2016. Across product categories,

watches declined with growth in connected watches more than offset

by a decline in traditional watches. Leathers and jewelry

also declined compared to last fiscal year. Within the

region, an increase in India and China was more than offset by a

decline in nearly all other countries.

Global retail comps, including e-commerce sales,

for the second quarter of fiscal 2017 decreased 11% compared to the

second quarter of fiscal 2016 with declines in all product

categories and all regions.

During the second quarter of fiscal 2017, gross

margin decreased 140 basis points to 50.5%. The decrease in

gross margin was primarily driven by lower retail margins due to

increased promotional activity in outlets and the e-commerce

channel, as well as an increased mix toward lower margin connected

product. A higher level of off-price sales and the negative

impact of changes in foreign currencies also contributed to the

decline. Those headwinds were partially offset by margin

improvement initiatives and a higher mix of international

sales.

The Company’s operating expenses were $731.1

million, including $407.1 million in non-cash intangible asset

impairment charges and $9.8 million of restructuring costs

associated with realigning and optimizing the organizational

structure as well as costs associated with store closures.

Excluding those items, expenses were lower compared to the second

quarter of fiscal 2016 driven by lower infrastructure costs and a

reduction in store expenses.

Operating income (loss) for the second quarter

of fiscal 2017 decreased to $(429.8) million, driven by non-cash

intangible asset impairment charges and lower sales and gross

margin.

During the fiscal 2017 second quarter, interest

expense increased $5.2 million to $11.6 million and other income

decreased $0.5 million to $2.0 million compared to the prior fiscal

year.

The Company’s effective income tax rate in the

second quarter of fiscal 2017 was 21.9% compared to 30.2% for the

second quarter of fiscal 2016 due to the effect of the non-cash

intangible asset impairment charges and changes in jurisdictional

earnings.

Sales and Earnings Guidance

The Company is providing guidance on a GAAP

basis. For comparison purposes, the Company has also provided

a table at the end of this release which quantifies the estimated

impact on its operating income margin and its diluted earnings per

share related to unusual items impacting the operational results

for fiscal 2017 as compared to fiscal 2016.

GAAP GuidanceFor fiscal 2017, the

Company now expects the following:

- Net sales to decline in the range of a 8.5% to 4.5%

- Operating margin in a range of (14.7)% to (12.5)%

- Diluted earnings (loss) per share in a range of ($7.42) to

($6.62), including $6.50 of non-cash intangible asset impairment

charges and $0.60 of restructuring charges

For the third quarter of fiscal 2017, the Company

expects the following:

- Net sales to decline in the range of 14.0% to 8.0%

- Operating margin in a range of (2.7)% to 0.5%

- Diluted earnings (loss) per share in a range of ($0.44) to

($0.11), including $0.06 of restructuring charges

Safe HarborCertain statements

contained herein that are not historical facts, including

multi-year profit improvement estimates, the success of our

connected accessories, future financial guidance as well as

estimated impacts from foreign currency translation, amortization

expense, foreign tax credits, non-cash impairments and

restructuring charges, constitute “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995 and involve a number of risks and uncertainties. The

actual results of the future events described in such

forward-looking statements could differ materially from those

stated in such forward-looking statements. Among the factors

that could cause actual results to differ materially are: changes

in economic trends and financial performance, changes in consumer

demands, tastes and fashion trends, lower levels of consumer

spending resulting from a general economic downturn, shifts in

market demand resulting in inventory risks, changes in foreign

currency exchange rates, risks related to the success of the

multi-year profit improvement initiative, risks related to the

success of our connected accessories and the outcome of current and

possible future litigation, as well as the risks and uncertainties

set forth in the Company’s Annual Report on Form 10-K for the

fiscal year ended December 31, 2016 filed with the Securities and

Exchange Commission (the “SEC”). These forward-looking

statements are based on our current expectations and beliefs

concerning future developments and their potential effect on us.

While management believes that these forward-looking statements are

reasonable as and when made, there can be no assurance that future

developments affecting us will be those that we anticipate.

Readers of this release should consider these factors in

evaluating, and are cautioned not to place undue reliance on, the

forward-looking statements contained herein. The Company

assumes no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events, or otherwise, except as required by law.

About Fossil Group, Inc.Fossil

Group, Inc. is a global design, marketing, distribution and

innovation company specializing in lifestyle accessories.

Under a diverse portfolio of owned and licensed brands, our

offerings include fashion watches, jewelry, handbags, small leather

goods and wearables. With our newest owned brand, Misfit,

we’re bringing style and technology to the high-growth connected

space. We’re committed to delivering the best in design and

innovation across our owned brands, Fossil, Michele, Misfit, Relic,

Skagen and Zodiac, and licensed brands, Armani Exchange, Burberry,

Chaps, Diesel, DKNY, Emporio Armani, Karl Lagerfeld, kate spade new

york, Marc Jacobs, Michael Kors and Tory Burch. We bring each

brand story to life through an extensive wholesale distribution

network across approximately 150 countries and over 550 retail

locations. Certain press release and SEC filing information

concerning the Company is also available at

www.fossilgroup.com.

| Consolidated

Income Statement Data |

|

For the 13Weeks EndedJuly 1,

2017 |

|

For the 13Weeks EndedJuly 2,

2016 |

|

For the 26Weeks EndedJuly 1,

2017 |

|

For the 26Weeks EndedJuly 2,

2016 |

| ($ in millions,

except per share data): |

|

|

| Net sales |

|

$ |

596.8 |

|

|

$ |

685.4 |

|

|

$ |

1,178.6 |

|

|

$ |

1,345.2 |

|

| Cost of sales |

|

295.5 |

|

|

329.6 |

|

|

587.8 |

|

|

641.1 |

|

| Gross

profit |

|

301.3 |

|

|

355.8 |

|

|

590.9 |

|

|

704.1 |

|

| Gross margin |

|

50.5 |

% |

|

51.9 |

% |

|

50.1 |

% |

|

52.3 |

% |

| Operating

expenses: |

|

|

|

|

|

|

|

|

| Selling,

general and administrative expenses |

|

314.2 |

|

|

340.3 |

|

|

622.7 |

|

|

674.2 |

|

| Goodwill

and trade name impairment |

|

407.1 |

|

|

— |

|

|

407.1 |

|

|

— |

|

|

Restructuring charges |

|

9.8 |

|

|

— |

|

|

36.0 |

|

|

— |

|

| Total operating

expenses |

|

731.1 |

|

|

340.3 |

|

|

1,065.9 |

|

|

674.2 |

|

| Total operating

expenses (% of net sales) |

|

122.5 |

% |

|

49.6 |

% |

|

90.4 |

% |

|

50.1 |

% |

| Operating income

(loss) |

|

(429.8 |

) |

|

15.5 |

|

|

(475.0 |

) |

|

29.9 |

|

| Operating

margin |

|

(72.0 |

)% |

|

2.3 |

% |

|

(40.3 |

)% |

|

2.2 |

% |

| Interest expense |

|

11.6 |

|

|

6.4 |

|

|

20.0 |

|

|

12.4 |

|

| Other income (expense)

- net |

|

2.0 |

|

|

2.5 |

|

|

7.6 |

|

|

4.8 |

|

| Income (loss) before

income taxes |

|

(439.4 |

) |

|

11.6 |

|

|

(487.4 |

) |

|

22.3 |

|

| Provision for income

taxes |

|

(96.3 |

) |

|

3.5 |

|

|

(97.5 |

) |

|

6.8 |

|

| Less: Net

income attributable to noncontrolling interest |

|

1.6 |

|

|

2.1 |

|

|

3.0 |

|

|

3.7 |

|

| Net income (loss)

attributable to Fossil Group, Inc. |

|

$ |

(344.7 |

) |

|

$ |

6.0 |

|

|

$ |

(392.9 |

) |

|

$ |

11.8 |

|

| Earnings (loss) per

share: |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(7.11 |

) |

|

$ |

0.13 |

|

|

$ |

(8.12 |

) |

|

$ |

0.25 |

|

|

Diluted |

|

$ |

(7.11 |

) |

|

$ |

0.12 |

|

|

$ |

(8.12 |

) |

|

$ |

0.24 |

|

| Weighted average common

shares outstanding: |

|

|

|

|

|

|

|

|

|

Basic |

|

48.5 |

|

|

48.1 |

|

|

48.4 |

|

|

48.1 |

|

|

Diluted |

|

48.5 |

|

|

48.2 |

|

|

48.4 |

|

|

48.2 |

|

|

Consolidated Balance Sheet Data ($ in

millions): |

|

July 1, 2017 |

|

July 2, 2016 |

|

Assets: |

|

|

|

|

| Cash

and cash equivalents |

|

$ |

319.8 |

|

|

$ |

231.8 |

|

|

Accounts receivable - net |

|

240.4 |

|

|

257.1 |

|

|

Inventories |

|

618.1 |

|

|

661.7 |

|

| Other

current assets |

|

126.5 |

|

|

161.7 |

|

|

Total current assets |

|

1,304.8 |

|

|

1,312.3 |

|

|

Property, plant and equipment - net |

|

255.8 |

|

|

328.0 |

|

|

Goodwill |

|

0.0 |

|

|

364.2 |

|

|

Intangible and other assets - net |

|

215.4 |

|

|

222.0 |

|

|

Total long-term assets |

|

471.2 |

|

|

914.2 |

|

| Total

assets |

|

$ |

1,776.0 |

|

|

$ |

2,226.5 |

|

| |

|

|

|

|

|

Liabilities and stockholders’ equity: |

|

|

|

|

|

Accounts payable, accrued expenses and other current

liabilities |

|

$ |

381.4 |

|

|

$ |

385.4 |

|

|

Short-term debt |

|

32.7 |

|

|

26.3 |

|

|

Total current liabilities |

|

414.1 |

|

|

411.7 |

|

|

Long-term debt |

|

613.6 |

|

|

708.7 |

|

| Other

long-term liabilities |

|

93.5 |

|

|

150.6 |

|

|

Total long-term liabilities |

|

707.1 |

|

|

859.3 |

|

|

Stockholders’ equity |

|

654.8 |

|

|

955.5 |

|

| Total

liabilities and stockholders’ equity |

|

$ |

1,776.0 |

|

|

$ |

2,226.5 |

|

Net Sales by Segment and Product Category

Information

| |

|

For the 13

Weeks Ended |

|

|

For the 26

Weeks Ended |

| ($ in

millions): |

|

July 1, 2017 |

|

|

July 2, 2016 |

|

|

July 1, 2017 |

|

|

July 2, 2016 |

|

Segment: |

|

|

|

|

|

|

|

|

|

|

|

|

Americas |

|

$ |

288.8 |

|

|

|

$ |

345.2 |

|

|

|

$ |

566.3 |

|

|

|

$ |

681.0 |

|

|

Europe |

|

194.7 |

|

|

|

215.9 |

|

|

|

390.4 |

|

|

|

425.9 |

|

|

Asia |

|

113.3 |

|

|

|

124.3 |

|

|

|

221.9 |

|

|

|

238.3 |

|

| Total

net sales |

|

$ |

596.8 |

|

|

|

$ |

685.4 |

|

|

|

$ |

1,178.6 |

|

|

|

$ |

1,345.2 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Product

Categories: |

|

|

|

|

|

|

|

|

|

|

|

|

Watches |

|

$ |

469.4 |

|

|

|

$ |

517.6 |

|

|

|

$ |

919.2 |

|

|

|

$ |

1,014.1 |

|

|

Leathers |

|

69.6 |

|

|

|

93.2 |

|

|

|

142.3 |

|

|

|

185.6 |

|

|

Jewelry |

|

44.3 |

|

|

|

56.8 |

|

|

|

92.2 |

|

|

|

111.5 |

|

|

Other |

|

13.5 |

|

|

|

17.8 |

|

|

|

24.9 |

|

|

|

34.0 |

|

| Total net

sales |

|

$ |

596.8 |

|

|

|

$ |

685.4 |

|

|

|

$ |

1,178.6 |

|

|

|

$ |

1,345.2 |

|

Store Count Information

| |

|

July 1, 2017 |

|

July 2, 2016 |

| |

|

Americas |

|

Europe |

|

Asia |

|

Total |

|

Americas |

|

Europe |

|

Asia |

|

Total |

| Full price

accessory |

|

114 |

|

|

112 |

|

|

61 |

|

|

287 |

|

|

126 |

|

|

124 |

|

|

69 |

|

|

319 |

|

| Outlets |

|

137 |

|

|

74 |

|

|

48 |

|

|

259 |

|

|

155 |

|

|

73 |

|

|

45 |

|

|

273 |

|

| Full priced

multi-brand |

|

— |

|

|

8 |

|

|

10 |

|

|

18 |

|

|

— |

|

|

7 |

|

|

16 |

|

|

23 |

|

| Total stores |

|

251 |

|

|

194 |

|

|

119 |

|

|

564 |

|

|

281 |

|

|

204 |

|

|

130 |

|

|

615 |

|

Constant Currency Financial Information

The following table presents the Company’s

business segment and product net sales on a constant currency

basis. To calculate net sales on a constant currency basis,

net sales for the current fiscal year period for entities reporting

in currencies other than the U.S. dollar are translated into U.S.

dollars at the average rates during the comparable period of the

prior fiscal year. The Company presents constant currency

information to provide investors with a basis to evaluate how its

underlying business performed excluding the effects of foreign

currency exchange rate fluctuations. The constant currency

financial information presented herein should not be considered a

substitute for, or superior to, the measures of financial

performance prepared in accordance with GAAP.

| |

|

Net Sales |

Net Sales |

|

|

For the 13 Weeks Ended |

For the 26 Weeks Ended |

|

|

July 1, 2017 |

July 1, 2017 |

| ($ in

millions) |

|

AsReported |

|

Impact

ofForeignCurrencyExchangeRates |

|

ConstantCurrency |

AsReported |

|

Impact

ofForeignCurrencyExchangeRates |

|

ConstantCurrency |

| Segment: |

|

|

|

|

|

|

|

|

|

|

|

|

Americas |

|

$ |

288.8 |

|

|

$ |

(1.4 |

) |

|

$ |

290.2 |

|

$ |

566.3 |

|

|

$ |

(2.3 |

) |

|

$ |

568.6 |

|

|

Europe |

|

194.7 |

|

|

(6.4 |

) |

|

201.1 |

|

390.4 |

|

|

(14.7 |

) |

|

405.1 |

|

|

Asia |

|

113.3 |

|

|

(0.5 |

) |

|

113.8 |

|

221.9 |

|

|

0.2 |

|

|

221.7 |

|

| Total net

sales |

|

$ |

596.8 |

|

|

$ |

(8.3 |

) |

|

$ |

605.1 |

|

$ |

1,178.6 |

|

|

$ |

(16.8 |

) |

|

$ |

1,195.4 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Product

Categories: |

|

|

|

|

|

|

|

|

|

|

|

|

Watches |

|

$ |

469.4 |

|

|

$ |

(6.1 |

) |

|

$ |

475.5 |

|

$ |

919.2 |

|

|

$ |

(12.4 |

) |

|

$ |

931.6 |

|

|

Leathers |

|

69.6 |

|

|

(0.9 |

) |

|

70.5 |

|

142.3 |

|

|

(1.6 |

) |

|

143.9 |

|

|

Jewelry |

|

$ |

44.3 |

|

|

$ |

(1.1 |

) |

|

$ |

45.4 |

|

$ |

92.2 |

|

|

$ |

(2.4 |

) |

|

$ |

94.6 |

|

|

Other |

|

13.5 |

|

|

(0.2 |

) |

|

13.7 |

|

24.9 |

|

|

(0.4 |

) |

|

25.3 |

|

| Total net

sales |

|

$ |

596.8 |

|

|

$ |

(8.3 |

) |

|

$ |

605.1 |

|

$ |

1,178.6 |

|

|

$ |

(16.8 |

) |

|

$ |

1,195.4 |

|

Items Impacting Comparison of Fiscal 2017 Operations to

Fiscal 2016 Operations

The following table quantifies the estimated

impact on the Company's operating margin and its diluted earnings

(loss) per share related to non-operating currency gains and

losses, operating currency changes and restructuring and non-cash

intangible asset impairment charges for fiscal 2017 as compared to

fiscal 2016. The table also includes the impact of higher

interest expense in 2017 and reflects an adjusted tax rate to

normalize for quarter to quarter fluctuations due to mix in

jurisdictional earnings and / or losses and discrete items

generated from changes in accounting rules. Numbers may not

add due to rounding.

The Company believes that the fiscal 2016 and

2017 operating margin and diluted EPS measures are useful to

investors in comparing the Company's projected financial

performance year-over-year without the impact of non-operating

currency gains and losses in both fiscal 2016 and 2017, operating

currency headwinds between fiscal 2016 and 2017, restructuring

charges in both fiscal 2016 and 2017, intangible asset impairment

charges in 2017 and higher anticipated 2017 interest expenses as

well as the fiscal 2016 real estate gain. The Company uses

the fiscal 2016 and 2017 non-GAAP operating margin and diluted EPS

measures to evaluate its operating performance

year-over-year. The non-GAAP financial measures presented

herein should not be considered a substitute for, or superior to,

guidance or financial measures prepared in accordance with

GAAP.

| Fiscal

Year |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2017 |

|

|

2016 |

| |

|

High |

|

Low |

|

| |

|

OpMargin |

|

DilutedEPS |

|

OpMargin |

|

DilutedEPS |

|

OpMargin |

|

DilutedEPS |

| GAAP |

|

(12.5 |

)% |

|

$ |

(6.62 |

) |

|

(14.7 |

)% |

|

$ |

(7.42 |

) |

|

4.2 |

% |

|

$ |

1.63 |

|

| Restructuring

Charges |

|

1.6 |

|

|

|

0.60 |

|

|

1.6 |

|

|

|

0.60 |

|

|

0.9 |

|

|

|

0.37 |

|

| Fiscal 2016 Real Estate

Gain |

|

— |

|

|

|

— |

|

|

— |

|

|

|

— |

|

|

(0.2 |

) |

|

|

(0.09 |

) |

| Currency

Impact |

|

0.4 |

|

|

|

0.05 |

|

|

0.4 |

|

|

|

0.05 |

|

|

— |

|

|

|

(0.11 |

) |

| Incremental Interest

Expense |

|

— |

|

|

|

0.25 |

|

|

— |

|

|

|

0.25 |

|

|

— |

|

|

|

— |

|

| Non-cash Intangible

Asset Impairment Charge |

|

14.0 |

|

|

|

6.50 |

|

|

14.7 |

|

|

|

6.50 |

|

|

— |

|

|

|

— |

|

| Tax - Normalized

Rate |

|

— |

|

|

|

0.37 |

|

|

— |

|

|

|

0.37 |

|

|

— |

|

|

|

— |

|

|

Non-GAAP |

|

3.5 |

% |

|

$ |

1.15 |

|

|

2.0 |

% |

|

$ |

0.35 |

|

|

4.9 |

% |

|

$ |

1.80 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Third Fiscal Quarter |

|

|

|

|

|

|

|

|

|

|

| |

|

2017 |

|

|

2016 |

| |

|

High |

|

Low |

|

| |

|

OpMargin |

|

DilutedEPS |

|

OpMargin |

|

DilutedEPS |

|

OpMargin |

|

DilutedEPS |

| GAAP |

|

0.5 |

% |

|

$ |

(0.11 |

) |

|

(2.7 |

)% |

|

$ |

(0.44 |

) |

|

4.2 |

% |

|

$ |

0.36 |

|

| Restructuring

Charges |

|

0.7 |

|

|

|

0.06 |

|

|

0.7 |

|

|

|

0.06 |

|

|

0.6 |

|

|

|

0.22 |

|

| Fiscal 2016 Real Estate

Gain |

|

— |

|

|

|

— |

|

|

— |

|

|

|

— |

|

|

(0.2 |

) |

|

|

(0.09 |

) |

| Currency

Impact |

|

0.8 |

|

|

|

0.05 |

|

|

0.8 |

|

|

|

0.05 |

|

|

— |

|

|

|

(0.01 |

) |

| Incremental Interest

Expense |

|

— |

|

|

|

0.07 |

|

|

— |

|

|

|

0.07 |

|

|

— |

|

|

|

— |

|

|

Non-GAAP |

|

2.0 |

% |

|

$ |

0.07 |

|

|

(1.2 |

)% |

|

$ |

(0.26 |

) |

|

4.6 |

% |

|

$ |

0.48 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Second Fiscal Quarter |

|

|

|

|

|

|

|

|

|

|

| |

|

Q2 2017 Actual |

|

Q2 2016 Actual |

|

|

| |

|

OpMargin |

|

DilutedEPS |

|

OpMargin |

|

DilutedEPS |

|

|

|

|

| GAAP |

|

(72.0 |

)% |

|

$ |

(7.11 |

) |

|

2.3 |

% |

|

$ |

0.12 |

|

|

|

|

|

| Non-Cash Intangible

Asset Impairment Charge |

|

68.2 |

|

|

|

6.50 |

|

|

|

|

|

|

|

|

|

| Restructuring

Charges |

|

1.6 |

|

|

|

0.13 |

|

|

— |

|

|

|

— |

|

|

|

|

|

| Currency

Impact |

|

0.8 |

|

|

|

0.05 |

|

|

— |

|

|

|

(0.03 |

) |

|

|

|

|

| Incremental Interest

Expense |

|

— |

|

|

|

0.08 |

|

|

— |

|

|

|

— |

|

|

|

|

|

| Tax - Normalized

Rate |

|

— |

|

|

|

0.12 |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

Non-GAAP |

|

(1.4 |

%) |

|

$ |

(0.23 |

) |

|

2.3 |

% |

|

$ |

0.09 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Investor Relations:

Eric M. Cerny

FOSSIL GROUP, Inc.

(855) 336-7745

Allison Malkin

ICR, Inc.

(203) 682-8225

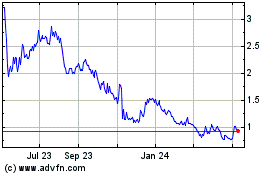

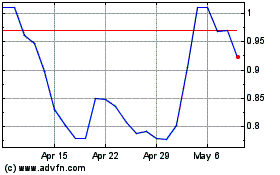

Fossil (NASDAQ:FOSL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Fossil (NASDAQ:FOSL)

Historical Stock Chart

From Apr 2023 to Apr 2024