Essent Group Ltd. Prices Public Offering of Common Stock

August 08 2017 - 8:00AM

Business Wire

Essent Group Ltd. (the “Company”) (NYSE:ESNT) announced today

that it has priced a public offering of 5,000,000 common shares

(the “Offering”). The Company expects to receive gross proceeds

from the Offering of approximately $199.5 million before deducting

underwriting discounts and commissions and estimated offering

expenses payable by the Company. The Offering is expected to close

on August 11, 2017, subject to customary closing conditions.

Barclays is acting as sole underwriter for the Offering. In

connection with the Offering, Barclays has a thirty-day option to

purchase from the Company up to an additional 750,000 common

shares.

The Company intends to use the net proceeds from the Offering

for general corporate purposes, which may include (i) capital

contributions to support the growth of the Company’s insurance

subsidiaries, and (ii) reducing borrowings owed by the Company

under that certain amended and restated credit facility entered

into by the Company and certain of its affiliates.

The common shares are being offered pursuant to an effective

shelf registration statement (including a base prospectus) under

the Securities Act of 1933, as amended, that has been filed with

the U.S. Securities and Exchange Commission (the “SEC”). Any offer,

or solicitation to buy, if at all, will be made solely by means of

a preliminary prospectus supplement and the accompanying base

prospectus. Copies of the preliminary prospectus supplement and the

accompanying prospectus may be obtained, when available, from the

SEC’s website at www.sec.gov. Alternatively, when available, copies

may be obtained from the prospectus departments of: Barclays

Capital Inc., c/o Broadridge Financial Solutions, 1155 Long Island

Avenue, Edgewood, NY 11717, telephone: 888-603-5847, or email:

Barclaysprospectus@broadridge.com.

This press release is for informational purposes only and does

not constitute an offer to sell or the solicitation of an offer to

buy any security of the Company, nor will there be any sale of any

such security in any state or jurisdiction in which such offer,

sale or solicitation would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

Forward-Looking Statements

This press release may include “forward-looking statements”

which are subject to known and unknown risks and uncertainties,

many of which may be beyond our control. Forward-looking statements

generally can be identified by the use of forward-looking

terminology such as "may," "plan," "seek," "comfortable with,"

"will," "expect," "intend," "estimate," "anticipate," "believe" or

"continue" or the negative thereof or variations thereon or similar

terminology. Actual events, results and outcomes may differ

materially from our expectations due to a variety of known and

unknown risks, uncertainties and other factors. Although it is not

possible to identify all of these risks and factors, they include,

among others, the following: changes in or to Fannie Mae and

Freddie Mac (the “GSEs”), whether through Federal legislation,

restructurings or a shift in business practices; failure to

continue to meet the mortgage insurer eligibility requirements of

the GSEs; competition for customers or the loss of a significant

customer; lenders or investors seeking alternatives to private

mortgage insurance; an increase in the number of loans insured

through Federal government mortgage insurance programs, including

those offered by the Federal Housing Administration; decline in the

volume of low down payment mortgage originations; uncertainty of

loss reserve estimates; decrease in the length of time our

insurance policies are in force; deteriorating economic conditions;

the definition of "Qualified Mortgage" reducing the size of the

mortgage origination market or creating incentives to use

government mortgage insurance programs; the definition of

"Qualified Residential Mortgage" reducing the number of low down

payment loans or lenders and investors seeking alternatives to

private mortgage insurance; the implementation of the Basel III

Capital Accord discouraging the use of private mortgage insurance;

non-U.S. operations becoming subject to U.S. Federal income

taxation; becoming considered a passive foreign investment company

for U.S. Federal income tax purposes; and other risks and factors

described in Part I, Item 1A “Risk Factors” of our Annual Report on

Form 10-K for the year ended December 31, 2016 filed with the

Securities and Exchange Commission on February 16, 2017. Any

forward-looking information presented herein is made only as of the

date of this press release, and we do not undertake any obligation

to update or revise any forward-looking information to reflect

changes in assumptions, the occurrence of unanticipated events, or

otherwise.

About the Company

Essent Group Ltd. (NYSE: ESNT) is a Bermuda-based holding

company (collectively with its subsidiaries, “Essent”) which,

through its wholly-owned subsidiary Essent Guaranty, Inc., offers

private mortgage insurance for single-family mortgage loans in the

United States. Essent provides private capital to mitigate mortgage

credit risk, allowing lenders to make additional mortgage financing

available to prospective homeowners. Headquartered in Radnor,

Pennsylvania, Essent Guaranty, Inc. is licensed to write mortgage

insurance in all 50 states and the District of Columbia, and is

approved by Fannie Mae and Freddie Mac. Essent also offers

mortgage-related insurance, reinsurance and advisory services

through its Bermuda-based subsidiary, Essent Reinsurance Ltd.

Additional information regarding Essent may be found at

www.essentgroup.com and www.essent.us.

Source: Essent Group Ltd.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170808005519/en/

Essent Group

Ltd.Media:610-230-0556media@essentgroup.comorInvestor

Relations:Christopher G. Curran,

855-809-ESNTir@essentgroup.com

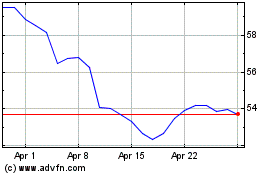

Essent (NYSE:ESNT)

Historical Stock Chart

From Mar 2024 to Apr 2024

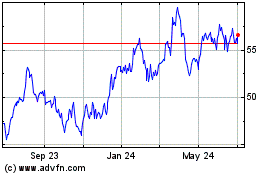

Essent (NYSE:ESNT)

Historical Stock Chart

From Apr 2023 to Apr 2024