AECOM (NYSE:ACM), a premier, fully integrated global

infrastructure firm, today reported third quarter revenue of $4.6

billion. Net income1 and diluted earnings per share1 were $101

million and $0.64 in the third quarter, respectively. On an

adjusted basis, diluted earnings per share2 was $0.78.

- Third consecutive quarter of positive

organic3 revenue growth.

- Record $9.0 billion of wins and $46.4

billion backlog, led by a $3.6 billion Management Services win for

the U.S. Air Force and contributions across the business.

- Generated all-time high free cash flow4

of $394 million, enabling continued debt reduction.

- Addition of Shimmick Construction

greatly expands the Company’s integrated civil infrastructure

capabilities in strong Western U.S. markets.

($ in millions, except EPS)

As Reported

Adjusted (Non-GAAP) As Reported YoY

% Change Adjusted YoY % Change

Highlights Revenue $4,561

- 3% - Growth led by

Building Construction, Power and Management Services Operating

Income $208 $2395 88%

9% Reflects benefits of diverse business model Net

Income $1011 $1232 50%

(2%) EPS (Fully Diluted) $0.641

$0.782 49% (4%) Operating Cash

Flow $414 - 59%

- Consistent with expectations for strong second half cash

performance Free Cash Flow - $3944

- 106% Year-to-date free cash flow up

10% over year-ago period Backlog $46,401

- 13%6 - Mix shifting to

higher-margin work in Management Services and Power

Note: All comparisons are year over year unless otherwise

noted.

“Our third quarter results demonstrate the benefits of our fully

integrated business model, which produced positive organic growth

for the third consecutive quarter, record wins and backlog, and

strong execution on our key priorities,” said Michael S. Burke,

AECOM’s chairman and chief executive officer. “We continue to make

deliberate investments to strengthen our foundation for future

growth, such as the recent addition of Shimmick Construction’s

leading heavy civil infrastructure construction capabilities. As a

result, we are better positioned than ever to capitalize on the

growth opportunities across our markets and to best serve our

clients’ growing preference for alternative delivery

solutions.”

“We are pleased to have delivered another strong quarter of cash

flow and debt reduction, reflecting the benefits of our diverse

business and commitment to achieving our cash flow targets,” said

W. Troy Rudd, AECOM’s chief financial officer. “We remain confident

in our cash flow outlook and are focused on delivering stockholder

value through balanced capital allocation and continued emphasis on

deleveraging.”

Wins and Backlog

Wins were $9.0 billion, an increase of 164% from last quarter,

and resulted in a book-to-burn ratio7 of 1.8. Wins were highlighted

by a $3.6 billion win in the Management Services segment, and

strong performance across the company. Total backlog increased 13%6

over the prior-year period to $46.4 billion.

Business Segments

In addition to providing consolidated financial results, AECOM

reports separate financial information for its four segments:

Design & Consulting Services, Construction Services, Management

Services, and AECOM Capital.

Design & Consulting Services

(DCS)

The DCS segment delivers planning, consulting, architectural and

engineering design services to commercial and government clients

worldwide in markets such as transportation, facilities,

environmental, energy, water and government.

Revenue in the third quarter was $1.9 billion. Constant-currency

organic3 revenue decreased by 1%. Performance in the Asia-Pacific

region remains strong, however, low oil prices continue to

negatively impact the Company’s markets. The pace of activity in

the Americas is slower than previously contemplated earlier in the

year, but substantial funding initiatives and continued investments

in business development have resulted in a new high for backlog and

positions the Company to deliver future growth.

Operating income was $94 million compared to $124 million in the

year-ago period. On an adjusted basis, operating income8 was $104

million compared to $150 million in the year-ago period. Third

quarter adjusted operating income reflects solid underlying

execution offset by the impact of lower revenue in the EMEA region

and increased investment in business development to capitalize on

growth opportunities.

Construction Services (CS)

The CS segment provides construction services for energy,

sports, commercial, industrial, and public and private

infrastructure clients.

Revenue in the third quarter was $1.8 billion. Constant-currency

organic3 revenue increased by 8%, highlighted by double-digit

growth in the Building Construction and Power businesses.

Operating income was $33 million compared to $11 million in the

year-ago period. On an adjusted basis, operating income9 was $42

million compared to $22 million in the year-ago period, and was

driven by strong performance in the Building Construction and Power

businesses.

Management Services (MS)

The MS segment provides program and facilities management and

maintenance, training, logistics, consulting, technical assistance

and systems-integration services and information technology

services, primarily for agencies of the U.S. government, national

governments around the world and commercial customers.

Revenue in the third quarter was $856 million. Organic3 revenue

increased by 2%, reflecting strong business momentum and the

successful conversion of the Company’s pipeline to wins.

Operating income was $66 million compared to $55 million in the

year-ago period. On an adjusted basis, operating income9 was $79

million compared to $76 million in the year-ago period, reflecting

strong execution across the Company’s vast and diverse portfolio of

projects.

AECOM Capital (ACAP)

The ACAP segment invests in private-sector real estate,

public-private partnerships (P3), and infrastructure. Operating

income in the third quarter was $46 million and included the

Company’s first investment monetization, which closed during the

quarter for an approximately 30% IRR, and also resulted in fees

earned by the CS segment. ACAP continues to manage a diverse

portfolio that includes numerous active investments and $220

million of committed capital.

Tax Rate

The effective tax rate in the third quarter was 8.2%. On an

adjusted basis, the effective tax rate was 15.5%. Both rates

reflect the benefit from the Company’s decision in the third

quarter to indefinitely reinvest a portion of its non-U.S.

undistributed earnings for which U.S. tax had previously been

provided. The net impact to full-year earnings per share resulting

from tax variances incorporated in the Company’s updated tax

guidance is a $0.07 benefit. The adjusted tax rate was derived by

re-computing the expected annual effective tax rate on earnings

from adjusted net income.10 The adjusted tax expense differs from

the GAAP tax expense based on the taxability or deductibility and

tax rate applied to each of the adjustments.

Cash Flow

Operating cash flow for the third quarter was $414 million and

free cash flow4 was $394 million, both of which set new quarterly

highs. The Company remains on track with its annual free cash flow

guidance of $600 million to $800 million for fiscal 2017.

Balance Sheet

As of June 30, 2017, AECOM had $812 million of total cash and

cash equivalents, $3.2 billion of net debt and $992 million in

unused capacity under its $1.05 billion revolving credit facility.

Total debt has declined by $1.4 billion since closing the URS

acquisition in October 2014.

Financial Outlook

AECOM is reiterating fiscal year 2017 adjusted EPS2 guidance of

$2.80 to $3.20, which includes approximately $0.20 of anticipated

gains related to AECOM Capital realizations at the mid-point of the

range.

The Company expects fiscal 2017 full-year interest expense,

excluding amortization of deferred financing fees, of approximately

$215 million as compared to $210 million previously, which now

reflects the Shimmick transaction. The Company expects an effective

tax rate10 for adjusted earnings of approximately 16% compared to

18% previously, reflecting a lower than anticipated fiscal third

quarter effective tax rate and a higher than previously anticipated

fiscal fourth quarter effective tax rate.

The Company continues to expect a full-year share count of 159

million, and also expects $36 million of acquisition and

integration expenses during the fiscal year. Fiscal year 2017

capital expenditures11 are expected to be approximately $115

million. The Company expects depreciation expense of approximately

$165 million and the amortization of intangible assets12 to be

approximately $100 million compared to $95 million previously.

Conference Call

AECOM is hosting a conference call today at 12 p.m. EDT, during

which management will make a brief presentation focusing on the

Company's results, strategies and operating trends. Interested

parties can listen to the conference call and view accompanying

slides via webcast at http://investors.aecom.com. The webcast will

be available for replay following the call.

1 Defined as attributable to AECOM.

2 Defined as attributable to AECOM, excluding acquisition and

integration related expenses, financing charges in interest

expense, the amortization of intangible assets, and financial

impacts associated with expected and actual dispositions of

non-core businesses and assets.

3 Organic growth is at constant currency and excludes revenue

associated with actual and planned non-core asset and business

dispositions. Results expressed in constant currency are presented

excluding the impact from changes in currency exchange rates.

4 Free cash flow is defined as cash flow from operations less

capital expenditures net of proceeds from disposals.

5 Excluding acquisition and integration related expenses,

financing charges in interest expense, the amortization of

intangible assets, and financial impacts associated with expected

and actual dispositions of non-core businesses and assets.

6 On a constant-currency basis.

7 Book-to-burn ratio is defined as the amount of wins divided by

revenue recognized during the period, including revenue related to

work performed in unconsolidated joint ventures.

8 Excluding intangible amortization and financial impacts

associated with expected and actual dispositions of non-core

businesses and assets.

9 Excluding intangible amortization.

10 Inclusive of non-controlling interest deduction and adjusted

for acquisition and integration expenses, financing charges in

interest expense, the amortization of intangible assets and

financial impacts associated with actual and planned dispositions

of non-core businesses and assets.

11 Capital expenditures, net of proceeds from disposals.

12 Amortization of intangible assets expense includes the impact

of amortization included in equity in earnings of joint ventures

and non-controlling interests.

About AECOM

AECOM (NYSE:ACM) is built to deliver a better world. We design,

build, finance and operate infrastructure assets for governments,

businesses and organizations in more than 150 countries. As a fully

integrated firm, we connect knowledge and experience across our

global network of experts to help clients solve their most complex

challenges. From high-performance buildings and infrastructure, to

resilient communities and environments, to stable and secure

nations, our work is transformative, differentiated and vital.

A Fortune 500 firm, AECOM had revenue of approximately

$17.4 billion during fiscal year 2016. See how we deliver what

others can only imagine at aecom.com and @AECOM.

All statements in this press release other than statements of

historical fact are “forward-looking statements” for purposes of

federal and state securities laws, including any projections of

earnings, revenue, cash flows, tax rate, share count, interest

expense, amortization of intangible assets and financial fees,

AECOM Capital realizations, acquisition and integration expense, or

other financial items; any statements of the plans, strategies and

objectives for future operations; and any statements regarding

future economic conditions or performance. Although we believe that

the expectations reflected in our forward-looking statements are

reasonable, actual results could differ materially from those

projected or assumed in any of our forward-looking statements.

Important factors that could cause our actual results,

performance and achievements, or industry results to differ

materially from estimates or projections contained in our

forward-looking statements include, but are not limited to, the

following: our business is cyclical and vulnerable to economic

downturns and client spending reductions; we are dependent on

long-term government contracts and subject to uncertainties related

to government contract appropriations; governmental agencies may

modify, curtail or terminate our contracts; government contracts

are subject to audits and adjustments of contractual terms; we may

experience losses under fixed-price contracts; we have limited

control over operations run through our joint venture entities; we

may be liable for misconduct by our employees or consultants or our

failure to comply with laws or regulations applicable to our

business; we may not maintain adequate surety and financial

capacity; we are highly leveraged and may not be able to service

our debt and guarantees; we have exposure to political and economic

risks in different countries where we operate as well as currency

exchange rate fluctuations; we may not be able to retain and

recruit key technical and management personnel; we may be subject

to legal and claims and inadequate insurance coverage; we are

subject to environmental law compliance and may not have adequate

nuclear indemnification; there may be unexpected adjustments and

cancellations related to our backlog; we are dependent on partners

and third parties who may fail to satisfy their obligations; we may

not be able to manage pension costs; we may face cybersecurity

issues and data loss; as well as other additional risks and factors

that could cause actual results to differ materially from our

forward-looking statements set forth in our reports filed with the

Securities and Exchange Commission. We do not intend, and undertake

no obligation, to update any forward-looking statement.

This press release contains financial information calculated

other than in accordance with U.S. generally accepted accounting

principles (“GAAP”). In particular, the Company believes that

non-GAAP financial measures such as adjusted EPS, adjusted

operating income, adjusted tax rate, adjusted interest expense,

organic revenue, and free cash flow also provide a meaningful

perspective on its business results as the Company utilizes this

information to evaluate and manage the business. We use adjusted

net and operating income to exclude the impact of prior

acquisitions and dispositions. We use free cash flow to represent

the cash generated after capital expenditures to maintain our

business. Our non-GAAP disclosure has limitations as an analytical

tool, should not be viewed as a substitute for financial

information determined in accordance with GAAP, and should not be

considered in isolation or as a substitute for analysis of our

results as reported under GAAP, nor is it necessarily comparable to

non-GAAP performance measures that may be presented by other

companies. A reconciliation of these non-GAAP measures is found in

the Regulation G tables at the back of this release.

AECOM

Consolidated Statements of

Income

(unaudited - in thousands, except per

share data)

Three Months Ended Nine Months Ended

June 30,2016 June 30,2017

%Change June 30,2016 June

30,2017 %Change Revenue $ 4,408,782

$ 4,561,467 3.5 % $ 13,087,729 $ 13,347,014 2.0 % Cost of revenue

4,237,439 4,386,291 3.5 % 12,592,084 12,833,421 1.9 % Gross profit

171,343 175,176 2.2 % 495,645 513,593 3.6 % Equity in

earnings of joint ventures 18,513 66,458 259.0 % 82,792 109,667

32.5 % General and administrative expenses (28,863 ) (33,944 ) 17.6

% (86,957 ) (96,427 ) 10.9 % Acquisition and integration expenses

(50,678 ) — (100.0 )% (142,427 ) (35,409 ) (75.1 )% (Loss) gain on

disposal — — 0.0 % (42,589 ) 572 (101.3 )% Income from operations

110,315 207,690 88.3 % 306,464 491,996 60.5 % Other income

1,498 2,136 42.6 % 5,286 4,237 (19.8 )% Interest expense (62,516 )

(61,547 ) (1.6 )% (184,757 ) (176,985 ) (4.2 )% Income before

income tax expense 49,297 148,279 200.8 % 126,993 319,248 151.4 %

Income tax (benefit) expense (35,097 ) 12,205 (134.8 )%

(23,592 ) 1,556 (106.6 )% Net income 84,394 136,074 61.2 %

150,585 317,692 111.0 % Noncontrolling interests in income

of consolidated subsidiaries, net of tax (16,950 ) (34,747 ) 105.0

% (61,680 ) (66,790 ) 8.3 % Net income attributable to AECOM

$ 67,444 $ 101,327 50.2 % $ 88,905 $ 250,902 182.2 % Net

income attributable to AECOM per share: Basic $ 0.44 $ 0.65 47.7 %

$ 0.58 $ 1.62 179.3 % Diluted $ 0.43 $ 0.64 48.8 % $ 0.57 $ 1.58

177.2 % Weighted average shares outstanding: Basic 154,852

155,763 0.6 % 154,256 155,128 0.6 % Diluted 156,175 158,820 1.7 %

155,479 158,488 1.9 %

Balance Sheet and Cash Flow

Information

(unaudited - in thousands)

September 30,2016 June 30,2017

Balance Sheet Information: Total cash and cash equivalents $

692,145 $ 812,459 Accounts receivable – net 4,531,460 4,759,306

Working capital 696,015 1,143,689 Total debt, excluding unamortized

debt issuance costs 4,125,290 3,966,343 Total assets 13,669,936

13,836,242 Total AECOM stockholders’ equity 3,366,921 3,708,618

AECOMReportable

Segments(unaudited - in thousands)

Design &ConsultingServices

ConstructionServices ManagementServices

ACAP Corporate Total Three Months Ended

June 30, 2017 Revenue $ 1,863,475 $ 1,841,620 $ 856,372 $ - $ -

$ 4,561,467 Cost of revenue 1,772,240

1,815,467 798,584 - -

4,386,291 Gross profit 91,235 26,153 57,788 -

- 175,176 Equity in earnings of joint ventures 2,371 7,022 8,638

48,427 - 66,458 General and administrative expenses -

- - (2,147 ) (31,797 )

(33,944 ) Income (loss) from operations $ 93,606 $

33,175 $ 66,426 $ 46,280 $ (31,797 ) $ 207,690

Gross profit as a % of revenue 4.9 % 1.4 % 6.7 % - -

3.8 %

Three Months Ended June 30, 2016*

Revenue $ 1,920,576 $ 1,650,766 $ 837,440 $ - $ - $ 4,408,782 Cost

of revenue 1,797,577 1,643,104

796,758 - - 4,237,439

Gross profit 122,999 7,662 40,682 - - 171,343 Equity in

earnings of joint ventures 1,041 3,518 13,954 - - 18,513 General

and administrative expenses - - - (1,613 ) (27,250 ) (28,863 )

Acquisition and integration expenses - -

- - (50,678 )

(50,678 ) Income (loss) from operations $ 124,040 $ 11,180

$ 54,636 $ (1,613 ) $ (77,928 ) $ 110,315

Gross profit as a % of revenue 6.4 % 0.5 % 4.9 % - - 3.9 %

AECOMReportable

Segments(unaudited - in thousands)

Design &ConsultingServices

ConstructionServices ManagementServices

ACAP Corporate Total Nine Months Ended June

30, 2017 Revenue $ 5,571,823 $ 5,324,561 $ 2,450,630 $ - $ - $

13,347,014 Cost of revenue 5,279,322 5,264,199

2,289,900 - -

12,833,421 Gross profit 292,501 60,362 160,730 - -

513,593 Equity in earnings of joint ventures 12,578 16,596 32,066

48,427 - 109,667 General and administrative expenses - - - (6,594 )

(89,833 ) (96,427 ) Acquisition and integration expenses - - - -

(35,409 ) (35,409 ) Gain on disposal 572 -

- - - 572

Income (loss) from operations $ 305,651 $ 76,958

$ 192,796 $ 41,833 $ (125,242 ) $ 491,996

Gross profit as a % of revenue 5.2 % 1.1 % 6.6 % - -

3.8 % Contracted backlog $ 8,523,849 $ 11,650,567 $

3,376,912 $ - $ - $ 23,551,328 Awarded backlog 6,738,345 4,696,196

8,395,977 - - 19,830,518 Unconsolidated JV backlog -

2,023,084 995,820 -

- 3,018,904 Total backlog $ 15,262,194

$ 18,369,847 $ 12,768,709 $ - $ -

$ 46,400,750

Nine Months Ended June

30, 2016* Revenue $ 5,748,825 $ 4,842,461 $ 2,496,443 $ - $ - $

13,087,729 Cost of revenue 5,449,328 4,819,486

2,323,270 - -

12,592,084 Gross profit 299,497 22,975 173,173 - -

495,645 Equity in earnings of joint ventures 6,202 8,906 67,684 - -

82,792 General and administrative expenses - - - (4,558 ) (82,399 )

(86,957 ) Acquisition and integration expenses - - - - (142,427 )

(142,427 ) Loss on disposal - (42,589 )

- - - (42,589 ) Income

(loss) from operations $ 305,699 $ (10,708 ) $ 240,857

$ (4,558 ) $ (224,826 ) $ 306,464 Gross profit

as a % of revenue 5.2 % 0.5 % 6.9 % - - 3.8 % Contracted

backlog $ 8,053,550 $ 12,001,079 $ 3,787,741 - $ - $ 23,842,370

Awarded backlog 5,737,196 4,572,028 4,259,460 - - 14,568,684

Unconsolidated JV backlog - 1,525,363

1,054,849 - -

2,580,212 Total backlog $ 13,790,746 $ 18,098,470

$ 9,102,050 $ - $ - $ 40,991,266

* During the first quarter of fiscal year 2017, a maintenance

related operation previously reported within our CS segment was

realigned within our MS segment to reflect present management

oversight. Accordingly, to conform to the current period

presentation, approximately $33 million of revenue and

$32 million of cost of revenue was reclassified for the

quarter ended June 30, 2016. For the nine months ended June 30,

2016, $99 million of revenue and $95 million of cost of

revenue was reclassified.

AECOMRegulation G

Information($ in millions)

Reconciliation of

Amounts Provided by Acquired Companies

Three Months EndedJune 30, 2017 Nine Months

EndedJune 30, 2017 Total Provided by

Acquired Companies Excluding Effect of Acquired

Companies Total Provided by Acquired

Companies Excluding Effect of Acquired Companies

Revenue AECOM Consolidated $ 4,561.5 $ 64.0 $ 4,497.5 $

13,347.0 $ 159.8 $ 13,187.2 Design & Consulting Services

1,863.5 - 1,863.5 5,571.8 - 5,571.8 Construction Services 1,841.7

64.0 1,777.7 5,324.6 159.8 5,164.8 Management Services 856.3 -

856.3 2,450.6 - 2,450.6

Reconciliation of

Net Income Attributable to AECOM to EBITDA

Three Months Ended

Nine Months Ended Jun 30, 2016 Mar 31,

2017

Jun 30,

2017

Jun 30,

2016

Jun 30,

2017

Net income attributable to AECOM $ 67.4 $ 102.4 $ 101.3 $

88.9 $ 250.9 Income tax (benefit) expense (35.1 )

(35.4 ) 12.1 (23.6 ) 1.5 Income

attributable to AECOM before income taxes 32.3 67.0 113.4 65.3

252.4 Depreciation and amortization1 98.3 72.1 67.4 322.4 206.0

Interest income2 (1.2 ) (1.3 ) (1.7 ) (3.0 ) (3.7 ) Interest

expense3 57.1 52.7 58.5

170.4 161.6 EBITDA $ 186.5 $

190.5 $ 237.6 $ 555.1 $ 616.3

1 Includes the amount for noncontrolling

interests in consolidated subsidiaries

2 Included in other

income

3 Excludes related amortization

Reconciliation of

Total Debt to Net Debt

Balances at: Jun 30, 2016 Mar 31,

2017 Jun 30, 2017 Short-term debt $ 20.8 $ 21.4 $

1.7 Current portion of long-term debt 333.3 331.2 155.4 Long-term

debt, gross 3,941.1 3,908.9 3,809.2 Total

debt, excluding unamortized debt issuance costs 4,295.2 4,261.5

3,966.3 Less: Total cash and cash equivalents 628.0

725.9 812.5 Net debt $ 3,667.2 $ 3,535.6 $ 3,153.8

Reconciliation of

Net Cash Provided by Operating Activities to Free Cash

Flow

Three Months Ended Dec 31, 2015 Mar

31, 2016 Jun 30, 2016 Sep 30, 2016

Dec 31, 2016

Mar 31, 2017 Jun 30, 2017 Net cash

provided by (used in) operating activities $ 78.0 $ 113.2 $ 260.1 $

362.9 $ 77.5 $ (46.1 ) $ 413.9 Capital expenditures, net

(0.8 ) (30.3 ) (68.8 ) (36.9 ) (21.0 )

(17.7 ) (19.8 ) Free cash flow $ 77.2 $ 82.9

$ 191.3 $ 326.0 $ 56.5 $ (63.8 ) $

394.1

AECOMRegulation G

Information(in millions, except per share data)

Reconciliation of Reported Amounts to

Adjusted Amounts Excluding Acquisition and Integration

Related Expenses, Financing Charges in

Interest Expense, the Amortization of Intangible Assets

and the Financial Impacts Associated with

Dispositions of Non-core Businesses and Assets

Three Months Ended Nine Months Ended Jun

30,2016 Mar 31,2017 Jun

30,2017 Jun 30,2016 Jun

30,2017 Income from operations $ 110.4 $ 140.9 $ 207.7 $

306.5 $ 492.0 Non-core operating losses 14.4 0.5 3.2 27.0 5.7

Acquisition and integration expenses 50.6 20.0 – 142.4 35.4 (Loss)

gain on disposal activity – (0.6 ) – 42.6 (0.6 ) Amortization of

intangible assets 43.8 27.7 28.4 188.8

83.5 Adjusted income from operations $ 219.2 $ 188.5 $ 239.3

$ 707.3 $ 616.0 Income before income tax expense $ 49.3 $

80.4 $ 148.2 $ 127.0 $ 319.2 Non-core operating losses 14.4 0.5 3.2

27.0 5.7 Acquisition and integration expenses 50.7 20.0 – 142.4

35.4 (Loss) gain on disposal activity – (0.6 ) – 42.6 (0.6 )

Amortization of intangible assets 43.8 27.7 28.4 188.8 83.5

Financing charges in interest expense 5.1 8.7

2.9 13.3 14.4 Adjusted income before income tax

expense $ 163.3 $ 136.7 $ 182.7 $ 541.1 $ 457.6 Income tax

(benefit) expense $ (35.1 ) $ (35.4 ) $ 12.1 $ (23.6 ) $ 1.5

Tax effect of the above adjustments*

53.1 15.5 10.5 124.1 34.8

Adjusted income tax expense (benefit) $ 18.0 $ (19.9 ) $ 22.6 $

100.5 $ 36.3

*Adjusts the income tax expense (benefit)

during the period to exclude the impact on our effective tax rate

of the pre-tax adjustments shown above

Noncontrolling interests in income of consolidated

subsidiaries, net of tax $ (17.0 ) $ (13.4 ) $ (34.8 ) $ (61.7 ) $

(66.8 ) Amortization of intangible assets included in NCI, net of

tax (2.2 ) (2.4 ) (2.1 ) (12.7 )

(6.9 ) Adjusted noncontrolling interests in income of consolidated

subsidiaries, net of tax $ (19.2 ) $ (15.8 ) $ (36.9 ) $ (74.4 ) $

(73.7 ) Net income attributable to AECOM $ 67.4 $ 102.4 $

101.3 $ 88.9 $ 250.9 Non-core operating losses 14.4 0.5 3.2 27.0

5.7 Acquisition and integration expenses 50.7 20.0 – 142.4 35.4

Amortization of intangible assets 43.8 27.7 28.4 188.8 83.5 (Loss)

gain on disposal activity – (0.6 ) – 42.6 (0.6 ) Financing charges

in interest expense 5.1 8.7 2.9 13.3 14.4 Tax effect of the above

adjustments (53.1 ) (15.6 ) (10.4 ) (124.1 ) (34.8 ) Amortization

of intangible assets included in NCI, net of tax (2.2 )

(2.4 ) (2.1 ) (12.7 ) (6.9 ) Adjusted

net income attributable to AECOM $ 126.1 $ 140.7 $ 123.3 $ 366.2 $

347.6 Net income attributable to AECOM – per diluted share $

0.43 $ 0.65 $ 0.64 $ 0.57 $ 1.58 Per diluted share adjustments:

Non-core operating losses 0.09 0.01 0.02 0.18 0.04 Acquisition and

integration expenses 0.32 0.12 – 0.91 0.22 Amortization of

intangible assets 0.28 0.18 0.18 1.21 0.53 Loss on disposal

activity – – – 0.27 – Financing charges in interest expense 0.03

0.05 0.02 0.09 0.09 Tax effect of the above adjustments (0.33 )

(0.11 ) (0.07 ) (0.79 ) (0.23 ) Amortization of intangible assets

included in NCI, net of tax (0.01 ) (0.01 )

(0.01 ) (0.08 ) (0.04 ) Adjusted net income

attributable to AECOM – per diluted share $ 0.81 $ 0.89 $ 0.78 $

2.36 $ 2.19 Weighted average shares outstanding - diluted 156.2

158.7 158.8 155.5 158.5

AECOMRegulation G

Information($ in millions)

Reconciliation of Reported Amounts to

Adjusted Amounts Excluding Acquisition and Integration

Related Expenses, Financing Charges in

Interest Expense, the Amortization of Intangible Assets

and the Financial Impacts Associated with

Dispositions of Non-core Businesses and Assets

Three Months Ended Nine Months

Ended Jun 30,2016 Mar 31,2017

Jun 30,2017 Jun 30,2016 Jun

30,2017 EBITDA(1) $ 186.5 $ 190.5 $ 237.6 $ 555.1

$ 616.3 Non-core operating losses 14.4 0.5 3.2 27.0 5.7 Acquisition

and integration expenses 50.7 20.0 – 142.4 35.4 (Gain) loss on

disposal activity – (0.6 ) – 42.6 (0.6 ) Depreciation expense

included in acquisition and integration expense line above

(7.7 ) (0.5 ) – (19.8 ) (0.8 ) Adjusted

EBITDA $ 243.9 $ 209.9 $ 240.8 $ 747.3 $ 656.0 Other expense

(income) (1.5 ) (1.3 ) (2.1 ) (5.3 ) (4.2 ) Interest income(2) 1.2

1.3 1.7 3.0 3.7 Depreciation(3) (43.6 ) (37.2 ) (38.0 ) (112.2 )

(113.2 ) Noncontrolling interests in income of consolidated

subsidiaries, net of tax 16.9 13.4 34.8 61.7 66.8 Amortization of

intangible assets included in NCI, net of tax 2.3 2.4

2.1 12.8 6.9 Adjusted income from operations $

219.2 $ 188.5 $ 239.3 $ 707.3 $ 616.0

(1) See Reconciliation of Net Income

Attributable to AECOM to EBITDA

(2) Included in other income

(3) Excluding acquisition and integration related expenses

Segment Income from Operations‡ Design &

Consulting Services Segment: Income from operations $ 124.0 $ 112.7

$ 93.7 $ 305.7 $ 305.7 Non-core operating losses 14.4 0.5 3.1 21.8

5.6 Gain on disposal activity – (0.6 ) – – (0.6 ) Amortization of

intangible assets 11.5 6.9 6.8 84.0

20.7 Adjusted income from operations $ 149.9 $ 119.5 $ 103.6

$ 411.5 $ 331.4 Construction Services Segment: Income (loss)

from operations $ 11.2 $ 25.7 $ 33.2 $ (10.7 ) $ 77.0 Non-core

operating losses – – – 5.2 – Loss on disposal activity – – – 42.6 –

Amortization of intangible assets 10.6 7.8 8.7

32.1 23.8 Adjusted income from operations $ 21.8 $

33.5 $ 41.9 $ 69.2 $ 100.8 Management Services Segment:

Income from operations $ 54.6 $ 52.4 $ 66.4 $ 240.8 $ 192.8

Amortization of intangible assets 21.7 13.0

12.9 72.7 39.0 Adjusted income from operations $ 76.3

$ 65.4 $ 79.3 $ 313.5 $ 231.8

‡ During the first quarter of fiscal year 2017, a maintenance

related operation previously reported within our CS segment was

realigned within our MS segment to reflect present management

oversight. Accordingly, to conform to the current period

presentation, approximately $33 million of revenue and

$32 million of cost of revenue was reclassified for the

quarter ended June 30, 2016. For the nine months ended,

$99 million of revenue and $95 million of cost of revenue

was reclassified.

FY17 GAAP EPS

Guidance based on Adjusted EPS Guidance

Fiscal Year End

2017

GAAP EPS Guidance $2.09 to $2.49 Adjusted EPS Excludes:

Amortization of intangible assets $0.63 Acquisition and

integration-related expenses $0.23 Financing charges in interest

expense $0.11 Year-to-date non-core operating losses $0.03 Tax

effect of the above items* ($0.29) Adjusted EPS Guidance (Non-GAAP)

$2.80 to $3.20

*The adjusted tax expense differs from the GAAP tax expense

based on the deductibility and tax rate applied to each of the

adjustments.

FY17 GAAP Tax

Rate Guidance based on Adjusted Tax Rate Guidance

Fiscal Year End

2017

GAAP Tax Rate Guidance 9% Tax rate impact from

adjustments to GAAP earnings 5% Tax rate impact from inclusion of

NCI deduction 2% Effective Tax Rate for Adjusted Earnings Guidance

16%

FY17 GAAP

Interest Expense Guidance based on Adjusted Interest Expense

Guidance

Fiscal Year End

2017

(in millions) GAAP Interest Expense Guidance $232 Financing charge

in interest expense $17 Adjusted Interest Expense Guidance $215

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170808005463/en/

AECOMInvestors:Will Gabrielski, 213-593-8208Vice

President, Investor

RelationsWilliam.Gabrielski@aecom.comorMedia:Brendan

Ranson-Walsh, 212-739-7212Vice President, Global External

CommunicationsBrendan.Ranson-Walsh@aecom.com

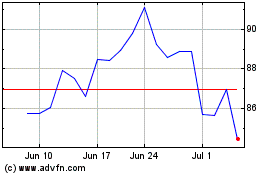

AECOM (NYSE:ACM)

Historical Stock Chart

From Mar 2024 to Apr 2024

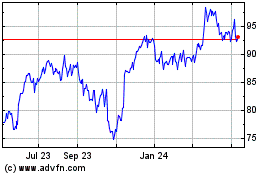

AECOM (NYSE:ACM)

Historical Stock Chart

From Apr 2023 to Apr 2024