Current Report Filing (8-k)

August 07 2017 - 4:52PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

August 2, 2017

PAYMENT DATA SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

Nevada

|

|

000-30152

|

|

98-0190072

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(IRS Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

|

|

|

|

|

|

|

12500 San Pedro, Suite 120, San Antonio, TX

|

|

78216

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(210) 249-4100

(Registrant's telephone number, including area code)

Not applicable.

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

|

|

|

|

|

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

On August 2, 2017, we and Singular Payments, LLC, a Florida limited liability company, mutually agreed to increase the secured line of credit promissory note by $100,000 to a total of $600,000 and extend the interest start date from August 1, 2017 to the earlier of August 30, 2017, the date of closing and funding our proposed acquisition of Singular Payments or the termination of a non-binding letter of intent regarding the proposed acquisition, or until such mutually agreed upon extended date. Thereafter, interest will accrue at a rate of ten percent per annum. Upon an event of default, interest will accrue at the maximum lawful rate or 15% per annum. The line of credit matures on November 1, 2019.

The foregoing description of the secured line of credit promissory note does not purport to be complete and is qualified in its entirety by reference to the agreement, a copy of which is attached hereto as Exhibit 10.1 and incorporated herein by reference.

This report contains forward-looking statements. Forward-looking statements include, but are not limited to, statements that express the Company’s intentions, beliefs, expectations, strategies, predictions or any other statements related to its future activities or future events or conditions. The words “continue,” “will,” “bring,” “believe,” “estimate,” “expect,” “intend,” “plan,” “expand,” “should,” “likely,” and similar expressions as they relate to us or our management are intended to identify these forward-looking statements. These statements are based on current expectations, estimates and projections about the Company’s business based, in part, on assumptions made by management. These statements are not guarantees of future performances and involve risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in the forward-looking statements due to numerous factors, including risks related to risks related to the to the closing of the proposed Singular acquisition, the realization of the anticipated opportunities from the proposed Singular acquisition, management of the Company’s growth, the loss of key resellers, the relationships with the Automated Clearinghouse network, bank sponsors, third-party card processing providers and merchants, the loss of key personnel, growing competition in the electronic commerce market, the security of the Company’s software, hardware and information, and compliance with complex federal, state and local laws and regulations, and other risks detailed from time to time in its filings with the SEC, including those risks discussed in the Company’s Annual Report on Form 10-K and in other documents that it files from time to time with the SEC. Any forward-looking statement speaks only as of the date as of which such statement is made, and, except as required by law, the Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances, including unanticipated events, after the date as of which such statement was made.

|

|

|

|

|

|

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

|

|

|

|

|

|

10.1

|

First Amended and Restated Line of Credit Promissory Note, dated August 2, 2017, by and between Singular Payments, LLC, as Borrower and Payment Data Systems, Inc., as Lender.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

PAYMENT DATA SYSTEMS, INC.

|

|

|

|

|

|

Date: August 7, 2017

|

|

By:

|

/s/ Louis A. Hoch

|

|

|

|

Name:

|

Louis A. Hoch

|

|

|

|

Title:

|

Chief Executive Officer and President

|

|

|

|

|

|

|

|

|

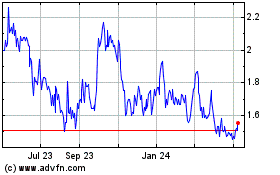

Usio (NASDAQ:USIO)

Historical Stock Chart

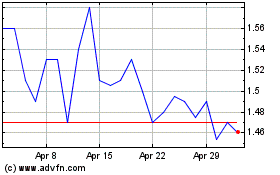

From Mar 2024 to Apr 2024

Usio (NASDAQ:USIO)

Historical Stock Chart

From Apr 2023 to Apr 2024