USD Partners LP (NYSE: USDP) (the “Partnership”) announced today

its operating and financial results for the three and six months

ended June 30, 2017. Highlights with respect to the second quarter

of 2017 include the following:

- Established rail-to-pipeline solution

from Western Canada with the Stroud terminal acquisition, which

~$25 million in total acquisition and other costs represents

approximately 2.5x the estimated 2018 Adjusted EBITDA expected to

be generated by the three-year, take-or-pay contract signed

concurrently with the transaction

- Extended contracted term for 25% of

Hardisty terminal’s available capacity through mid-2020

- Generated Net cash provided by

operating activities of $9.3 million, Adjusted EBITDA of $15.1

million and Distributable cash flow of $11.7 million

- Reported Net income of $8.4

million

- Raised $33.7 million from public equity

offering of 3,000,000 units

- Increased quarterly cash distribution

for ninth consecutive quarter to $0.34 per unit ($1.36 per unit

annualized)

- Ended quarter with $201.2 million of

available liquidity

“Our Stroud terminal acquisition − supported by a new customer

and multi-year take-or-pay cash flows − demonstrates the ongoing

value of rail takeaway solutions for Western Canada’s vast crude

oil resource,” said Dan Borgen, the Partnership’s Chief Executive

Officer. “We believe our origin-to-destination capabilities and

rail-to-pipeline solutions will drive additional commercial

opportunities at the Partnership, particularly as current

production normalizes and grows, new projects are brought online

and available takeaway capacity becomes constrained.”

Recent Transactions

On June 2, 2017, the Partnership acquired a 76-acre crude oil

terminal in Stroud, Oklahoma (the “Stroud terminal”) to facilitate

rail-to-pipeline shipments of crude oil from its Hardisty terminal

to Cushing, Oklahoma. The Stroud terminal includes unit

train-capable unloading capacity of approximately 50,000 barrels

per day, or Bpd, expandable to approximately 70,000 Bpd, as well as

onsite tanks with 140,000 barrels of total capacity and a truck

bay. Additionally, the terminal includes a 12-inch diameter,

17-mile pipeline with a direct connection to the crude oil storage

hub located in Cushing, Oklahoma. The Partnership also obtained a

lease for 300,000 barrels of crude oil tank storage at the Cushing

hub to receive outbound shipments of crude oil from the Stroud

terminal. Inbound product is delivered by the Stillwater Central

Rail, which handles deliveries from both the BNSF and the Union

Pacific railways.

Concurrent with the Stroud acquisition, the Partnership entered

into a new multi-year, take-or-pay terminalling services agreement

with an investment grade rated multi-national energy company (the

“Stroud customer”) for use of approximately 50% of the available

capacity at the Stroud terminal from October 2017 through June

2020. Additionally, to facilitate the origination of barrels from

the Partnership’s Hardisty terminal to be shipped to the Stroud

terminal, the Partnership extended the contracted term for

approximately 25% of the Hardisty terminal’s capacity to June

2020.

The Partnership believes the Stroud terminal represents one of

the most advantaged rail destinations for Western Canadian crude

oil given established connectivity from Cushing to multiple

refining centers across the U.S., including underutilized pipelines

to major refining centers along the Gulf Coast.

The Partnership expects to incur approximately $1.2 million of

growth capital expenditures to retrofit the Stroud terminal to

handle heavy grades of Canadian crude oil, of which approximately

$245 thousand was spent in the second quarter.

Second Quarter 2017 Operational and Financial Results

Substantially all of the Partnership’s cash flows are generated

from multi-year, take-or-pay terminal service agreements, which

include minimum monthly commitment fees. The Partnership’s

customers include major integrated oil companies, refiners and

marketers, the majority of which are investment grade rated.

For the second quarter of 2017 relative to the second quarter of

2016, Net cash provided by operating activities decreased by 31%,

while Adjusted EBITDA and Distributable cash flow both decreased by

7%. These decreases are primarily the result of discontinuing

operations at the San Antonio terminal during the second quarter of

2017 following the termination of the related customer contract and

were partially offset by lower operating costs. Additionally, the

Partnership received a smaller benefit from the settlement of its

derivatives contracts during the second quarter of 2017 relative to

2016 as the Partnership’s 2017 foreign exchange hedges have lower

exercise prices than its 2016 foreign exchange hedges, as it

relates to the relative strength of the Canadian dollar to the U.S.

dollar. Net cash provided by operating activities was also impacted

by net changes in working capital associated with the timing of

payments and collection of receipts.

During the second quarter of 2017, the Partnership revised its

estimated Canadian income tax expenses for the 2016 and 2017 tax

years based on actual taxable income calculated for 2016 and, as

such, recorded a $2.4 million Benefit from income taxes. As a

result, Net income for the second quarter of 2017 increased by 60%

relative to the prior year. Additionally, Distributable cash flow

for the second quarter of 2017 benefited from an approximate $0.7

million decrease in Cash paid for income taxes relative to the

second quarter of 2016, which was partially offset by higher Cash

paid for interest. The Partnership expects to receive a refund of

approximately C$3.4 million in the second half of 2017.

On July 27, 2017, the Partnership declared a quarterly cash

distribution of $0.34 per unit ($1.36 per unit on an annualized

basis), which represents growth of 1.5% relative to the prior

quarter and 7.9% relative to the second quarter of 2016. The

distribution is payable on August 11, 2017, to unitholders of

record as of the close of business on August 7, 2017.

As of June 30, 2017, the Partnership had total available

liquidity of $201.2 million, including $7.2 million of unrestricted

cash and cash equivalents and undrawn borrowing capacity of $194.0

million on its $400.0 million senior secured credit facility,

subject to continued compliance with financial covenants. The

Partnership is in compliance with its financial covenants and has

no maturities under its senior secured credit facility until

October 2019.

Second Quarter 2017 Conference Call Information

The Partnership will host a conference call and webcast

regarding second quarter 2017 results at 11:00 a.m. Eastern Time

(10:00 a.m. Central Time) on Tuesday, August 8, 2017.

To listen live over the Internet, participants are advised to

log on to the Partnership’s website at www.usdpartners.com and

select the “Events & Presentations” sub-tab under the

“Investors” tab. To join via telephone, participants may dial (877)

266-7551 domestically or +1 (339) 368-5209 internationally,

conference ID 61530722. Participants are advised to dial in at

least five minutes prior to the call.

An audio replay of the conference call will be available for 30

days by dialing (800) 585-8367 domestically or +1 (404) 537-3406

internationally, conference ID 61530722. In addition, a replay of

the audio webcast will be available by accessing the Partnership's

website after the call is concluded.

About USD Partners LP

USD Partners LP is a fee-based, growth-oriented master limited

partnership formed in 2014 by US Development Group, LLC (“USDG”) to

acquire, develop and operate midstream infrastructure and

complementary logistics solutions for crude oil, biofuels and other

energy-related products. The Partnership generates substantially

all of its operating cash flows from multi-year, take-or-pay

contracts with primarily investment grade customers, including

major integrated oil companies and refiners. The Partnership’s

principal assets include a network of crude terminals that

facilitate the transportation of heavy crude oil from Western

Canada to key demand centers across North America. The

Partnership’s operations include railcar loading and unloading,

storage and blending in on-site tanks, inbound and outbound

pipeline connectivity, truck transloading, as well as other related

logistics services. In addition, the Partnership provides customers

with leased railcars and fleet services to facilitate the

transportation of liquid hydrocarbons and biofuels by rail.

USDG, which owns the general partner of USD Partners LP, is

engaged in designing, developing, owning, and managing large-scale

multi-modal logistics centers and energy-related infrastructure

across North America. USDG solutions create flexible market access

for customers in significant growth areas and key demand centers,

including Western Canada, the Permian Basin and the U.S. Gulf

Coast. Among other projects, USDG is currently pursuing the

development of a premier energy logistics terminal on the Houston

Ship Channel with substantial tank storage capacity, multiple docks

(including barge and deepwater), inbound and outbound pipeline

connectivity, as well as a rail terminal with unit train

capabilities.

Non-GAAP Financial Measures

The Partnership defines Adjusted EBITDA as Net cash provided by

operating activities adjusted for changes in working capital items,

changes in restricted cash, interest, income taxes, foreign

currency transaction gains and losses, adjustments related to

deferred revenue associated with minimum monthly commitment fees

and other items which do not affect the underlying cash flows

produced by the Partnership’s businesses. Adjusted EBITDA is a

non-GAAP, supplemental financial measure used by management and

external users of the Partnership’s financial statements, such as

investors and commercial banks, to assess:

- the Partnership’s liquidity and the

ability of the Partnership’s businesses to produce sufficient cash

flows to make distributions to the Partnership’s unitholders;

and

- the Partnership’s ability to incur and

service debt and fund capital expenditures.

The Partnership defines Distributable cash flow, or DCF, as

Adjusted EBITDA less net cash paid for interest, income taxes and

maintenance capital expenditures. DCF does not reflect changes in

working capital balances. DCF is a non-GAAP, supplemental financial

measure used by management and by external users of the

Partnership’s financial statements, such as investors and

commercial banks, to assess:

- the amount of cash available for making

distributions to the Partnership’s unitholders;

- the excess cash being retained for use

in enhancing the Partnership’s existing businesses; and

- the sustainability of the Partnership’s

current distribution rate per unit.

The Partnership believes that the presentation of Adjusted

EBITDA and DCF in this press release provides information that

enhances an investor's understanding of the Partnership’s ability

to generate cash for payment of distributions and other purposes.

The GAAP measure most directly comparable to Adjusted EBITDA and

DCF is Net cash provided by operating activities. Adjusted EBITDA

and DCF should not be considered alternatives to Net cash provided

by operating activities or any other measure of liquidity or

performance presented in accordance with GAAP. Adjusted EBITDA and

DCF exclude some, but not all, items that affect cash from

operations and these measures may vary among other companies. As a

result, Adjusted EBITDA and DCF may not be comparable to similarly

titled measures of other companies.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of U.S. federal securities laws, including statements

with respect to the Partnership’s liquidity, the ability of the

Partnership to grow and opportunities to grow, the expected

Adjusted EBITDA contribution of the Stroud terminal, the expected

commencement date of operations of the Stroud terminal, and the

amount and timing of future distribution payments. Words and

phrases such as “is expected,” “is planned,” “believes,”

“projects,” and similar expressions are used to identify such

forward-looking statements. However, the absence of these words

does not mean that a statement is not forward-looking.

Forward-looking statements relating to the Partnership are based on

management’s expectations, estimates and projections about the

Partnership, its interests and the energy industry in general on

the date this press release was issued. These statements are not

guarantees of future performance and involve certain risks,

uncertainties and assumptions that are difficult to predict.

Therefore, actual outcomes and results may differ materially from

what is expressed or forecast in such forward-looking statements.

Factors that could cause actual results or events to differ

materially from those described in the forward-looking statements

include those as set forth under the heading “Risk Factors” in the

Partnership’s most recent Annual Report on Form 10-K and in our

subsequent filings with the Securities and Exchange Commission. The

Partnership is under no obligation (and expressly disclaims any

such obligation) to update or alter its forward-looking statements,

whether as a result of new information, future events or

otherwise.

USD

Partners LPConsolidated Statements of IncomeFor the

Three and Six Months Ended June 30, 2017 and

2016(unaudited) For the Three Months Ended

For the Six Months Ended June 30, June 30,

2017 2016 2017 2016 (in thousands)

Revenues Terminalling services $ 21,977 $ 23,459 $ 45,536 $

45,482 Terminalling services — related party 2,518 1,756 4,258

3,406 Railroad incentives 6 22 21 37 Fleet leases 643 647 1,286

1,290 Fleet leases — related party 891 891 1,781 1,781 Fleet

services 467 69 935 138 Fleet services — related party 279 684 558

1,368 Freight and other reimbursables 208 350 365 733 Freight and

other reimbursables — related party

—

— 1 —

Total

revenues 26,989 27,878

54,741 54,235

Operating costs Subcontracted rail services 1,795 2,026

3,808 4,069 Pipeline fees 5,369 5,338 10,786 10,052 Fleet leases

1,534 1,538 3,067 3,071 Freight and other reimbursables 208 350 366

733 Operating and maintenance 594 783 1,301 1,653 Selling, general

and administrative 2,362 2,073 4,677 4,967 Selling, general and

administrative — related party 1,396 1,439 2,828 2,931 Depreciation

and amortization 4,969 4,914

9,910 9,819

Total operating costs

18,227 18,461

36,743 37,295 Operating

income 8,762 9,417 17,998 16,940

Interest expense 2,513 2,533 5,120 4,716 Loss (gain) associated

with derivative instruments 401 (253 ) 612 1,270 Foreign currency

transaction gain (100 ) (15 ) (70 ) (145 ) Other expense, net

3 — 8 —

Income before provision for income taxes 5,945

7,152 12,328 11,099 Provision for (benefit

from) income taxes (2,434 ) 1,917

(1,249 ) 3,714

Net income $

8,379 $ 5,235 $

13,577 $ 7,385 USD

Partners LPConsolidated Statements of Cash FlowsFor

the Three and Six Months Ended June 30, 2017 and

2016(unaudited)

For the Three Months Ended For the

Six Months Ended June 30, June 30, 2017

2016 2017 2016 Cash flows from operating

activities: (in thousands) Net income $ 8,379 $ 5,235 $ 13,577

$ 7,385 Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization 4,969 4,914

9,910 9,819 Loss (gain) associated with derivative instruments 401

(253 ) 612 1,270 Settlement of derivative contracts 91 546 390

1,036 Unit based compensation expense 1,218 969 2,016 1,697 Other

473 165 755 334 Changes in operating assets and liabilities:

Accounts receivable (459 ) 269 (424 ) 207 Accounts receivable –

related party (34 ) 54 179 1,760 Prepaid expenses and other current

assets (2,687 ) (790 ) (1,108 ) (460 ) Accounts payable and accrued

expenses (1,409 ) (1,224 ) (1,316 ) (1,961 ) Accounts payable and

accrued expenses – related party (77 ) 119 230 24 Deferred revenue

and other liabilities (2,425 ) 1,857 (3,545 ) 2,729 Deferred

revenue – related party 1,025 (300 ) 1,025 (629 ) Change in

restricted cash (209 ) 1,793 (230 )

(633 ) Net cash provided by operating activities

9,256 13,354

22,071 22,578 Cash flows from

investing activities: Additions of property and equipment

(25,647 ) 27 (25,773 ) (246 )

Net cash provided by (used in) investing activities

(25,647 ) 27

(25,773 ) (246 ) Cash flows

from financing activities: Distributions (8,239 ) (7,366 )

(16,142 ) (14,396 ) Vested phantom units used for payment of

participant taxes (2 ) — (1,072 ) (77 ) Net proceeds from issuance

of common units 33,700 — 33,700 — Proceeds from long-term debt

35,000 5,000 40,000 10,000 Repayments of long-term debt

(41,000 ) (9,825 ) (57,342 ) (18,902 ) Net

cash provided by (used in) financing activities

19,459 (12,191 )

(856 ) (23,375 ) Effect of

exchange rates on cash (56 ) 114 49

439 Net change in cash and cash equivalents

3,012 1,304 (4,509 ) (604 ) Cash and cash equivalents – beginning

of period 4,184 8,592 11,705

10,500 Cash and cash equivalents – end of

period

$ 7,196 $ 9,896

$ 7,196 $ 9,896

USD Partners LPConsolidated Balance

Sheets(unaudited) June 30, December

31, 2017 2016 ASSETS (in thousands)

Current assets Cash and cash equivalents $ 7,196 $ 11,705

Restricted cash 5,861 5,433 Accounts receivable, net 4,800 4,321

Accounts receivable — related party — 219 Prepaid expenses 9,372

10,325 Other current assets 5,361 2,562

Total current assets 32,590 34,565 Property and equipment, net

148,626 125,702 Intangible assets, net 105,615 111,919 Goodwill

33,589 33,589 Other non-current assets 182 192

Total assets $ 320,602 $

305,967 LIABILITIES AND PARTNERS’

CAPITAL Current liabilities Accounts payable and accrued

expenses $ 976 $ 2,221 Accounts payable and accrued expenses —

related party 419 214 Deferred revenue, current portion 25,167

26,928 Deferred revenue, current portion — related party 5,481

4,292 Other current liabilities 2,904 3,513

Total current liabilities 34,947 37,168 Long-term debt, net

204,196 220,894 Deferred revenue, net of current portion — 264

Deferred income tax liability, net 1,153 823

Total liabilities 240,296

259,149 Commitments and contingencies Partners’

capital Common units 136,838 122,802 Class A units 1,416 1,811

Subordinated units (58,378 ) (76,749 ) General partner units 88 111

Accumulated other comprehensive income (loss) 342

(1,157 )

Total partners’ capital 80,306

46,818 Total liabilities and

partners’ capital $ 320,602 $

305,967

USD Partners LPGAAP to Non-GAAP

ReconciliationsFor the Three and Six Months Ended June 30,

2017 and 2016(unaudited) For the Three Months

Ended For the Six Months Ended June 30, June

30, 2017 2016 2017 2016 (in

thousands)

Net cash provided by operating activities

$ 9,256 $ 13,354 $ 22,071

$ 22,578 Add (deduct): Amortization of deferred

financing costs (215 ) (215 ) (430 ) (430 ) Deferred income taxes

(249 ) 50 (307 ) 96 Changes in accounts receivable and other assets

3,180 467 1,353 (1,507 ) Changes in accounts payable and accrued

expenses 1,486 1,105 1,086 1,937 Changes in deferred revenue and

other liabilities 1,400 (1,557 ) 2,520 (2,100 ) Change in

restricted cash 209 (1,793 ) 230 633 Interest expense, net 2,513

2,533 5,116 4,716 Provision for (benefit from) income taxes (2,434

) 1,917 (1,249 ) 3,714 Foreign currency transaction gain (1) (100 )

(15 ) (70 ) (145 ) Deferred revenue associated with minimum monthly

commitment fees (2) 62 424 142

1,187

Adjusted EBITDA 15,108

16,270 30,462 30,679 Add (deduct): Cash paid

for income taxes (3) (798 ) (1,486 ) (1,414 ) (3,196 ) Cash paid

for interest (2,575 ) (2,180 ) (4,937 ) (3,987 ) Maintenance

capital expenditures (72 ) (18 ) (198 )

(18 )

Distributable cash flow $ 11,663

$ 12,586 $ 23,913

$ 23,478 (1) Represents foreign

exchange transaction gains and losses associated with activities

between the Partnership’s U.S. and Canadian subsidiaries.

(2) Represents deferred revenue associated with minimum monthly

commitment fees in excess of throughput utilized, which fees are

not refundable to the Partnership's customers. Amounts presented

are net of: (a) the corresponding prepaid Gibson pipeline fee that

will be recognized as expense concurrently with the recognition of

revenue; (b) revenue recognized in the current period that was

previously deferred; and (c) expense recognized for previously

prepaid Gibson pipeline fees, which correspond with the revenue

recognized that was previously deferred. (3) Includes

amounts we received as a partial refund of approximately $0.7

million (representing C$0.9 million) for our 2015 foreign income

taxes.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170807005993/en/

USD Partners LPAdam Altsuler, (281) 291-3995Vice President,

Chief Financial Officeraaltsuler@usdg.comorAshley Means Zavala,

(281) 291-3965Director, Finance & Investor

Relationsameans@usdg.com

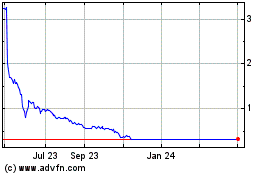

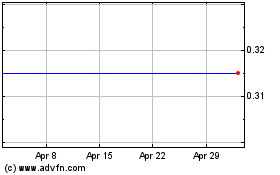

USD Partners (NYSE:USDP)

Historical Stock Chart

From Mar 2024 to Apr 2024

USD Partners (NYSE:USDP)

Historical Stock Chart

From Apr 2023 to Apr 2024