CAM to deploy 20th B767 freighter for Amazon;

Northern Aviation Services commits to three B767 leases

Air Transport Services Group, Inc. (Nasdaq: ATSG), the leading

provider of medium wide-body aircraft leasing, air cargo

transportation and related services, today reported consolidated

financial results for the quarter ended June 30, 2017.

Compared with amounts for the second quarter of 2016 (except as

noted):

- Revenues increased $77 million,

or 43 percent, to $253.2 million. Excluding revenues from

reimbursable airline expenses, revenues increased $60 million, or

37 percent. ATSG's airline services operations, and maintenance and

logistics businesses, recorded double-digit revenue increases.

- GAAP Earnings from Continuing

Operations were a loss of $53.9 million or $0.91 per share

diluted and included charges totaling $67.8 million for the

warrants granted last year in connection with operating and lease

agreements with Amazon Fulfillment Services, Inc. The value of the

warrants increased sharply during the quarter in conjunction with a

36 percent increase in the traded price of ATSG stock since March

31, 2017, resulting in a significant mark-to-market loss for the

quarter. Earnings from Continuing Operations were a positive $11.5

million, or $0.12 per share diluted a year earlier.

- Adjusted Earnings from Continuing

Operations, which exclude non-cash warrant-related items, were

$13.9 million, up 64 percent. Adjusted Earnings Per Share from

Continuing Operations were $0.21, up eight cents per share. These

Adjusted Earnings and other adjusted amounts referenced below are

non-GAAP financial measures, and are reconciled to comparable GAAP

results in tables in this release. Adjustments include both

dollar-amount and share count items.

- GAAP Pre-tax Earnings from

Continuing Operations were a negative $48.4 million, versus a

positive $18.8 million a year ago. Adjusted Pre-tax Earnings, which

exclude warrant effects along with additional non-cash items,

increased 39 percent to $22.7 million.

- Adjusted EBITDA (Earnings Before

Interest, Taxes, Depreciation and Amortization, as defined and

adjusted in a table later in this release) increased 23 percent to

$64.2 million.

- Capital expenditures in the

first half of 2017 were $144.3 million, versus $125.1 million in

the first half of 2016.

- Share repurchases were $11.2

million for the first half. This includes 380,637 shares ATSG

repurchased in June as part of an underwritten secondary offering

by an affiliate of Red Mountain Capital Partners.

Joe Hete, President and Chief Executive Officer of ATSG, said,

“In addition to the outstanding financial results we are reporting

today, I’m pleased to say that we are scheduled to deliver the

twentieth leased Boeing 767 freighter to Amazon later this week, 17

months after we formalized our relationship in March 2016. Our

total leased-aircraft portfolio has grown by eight 767s as of June

30, compared to the same date a year ago. Excluding the two

767-300s required to complete Amazon's twenty-aircraft order,

our current purchase and conversion commitments

will yield twelve additional 767-300s extending through

the first half of next year. We currently have signed leases

or are finalizing others for nine of the twelve

aircraft. The remaining three aircraft are under

discussion with multiple parties."

ATSG's results for the first half of 2017 included a revenue

increase of 39 percent to $491.1 million, and GAAP Earnings from

Continuing Operations of negative $44.1 million, or a $0.75 loss

per share. First-half Adjusted Earnings From Continuing Operations

were $25.1 million, up 48 percent from a year ago. On a per-share

adjusted basis, ATSG earned $0.38 per share, up from $0.26 in the

first half of 2016.

Segment Results

Cargo Aircraft Management (CAM)

CAM Second Quarter Six Months ($

in thousands)

2017 2016 2017

2016 Aircraft leasing and related revenues $ 52,813 $ 48,373

$ 103,382 $ 100,099 Lease incentive amortization (3,283 ) (934 )

(5,874 ) (934 ) Total CAM revenues $ 49,530 $ 47,439

$ 97,508 $ 99,165 Pre-Tax Earnings $ 12,795

$ 16,229 $ 26,125 $

35,739

Significant Developments:

- CAM's revenues increased $2.1 million

to $49.5 million from the second quarter last year, and included

$3.3 million of non-cash amortization associated with the

warrant-related Amazon lease incentive. Excluding this lease

incentive, CAM’s revenues increased nine percent. CAM was leasing

forty-five 767s to external customers as of June 30, 2017, ten more

than a year earlier.

- Pre-tax earnings were $12.8 million for

the quarter, down $3.4 million. Principal effects were the

warrant-related lease incentive, increased depreciation, and higher

pre-deployment expenses.

- At June 30, 2017, CAM owned 64 Boeing

cargo aircraft, all of which were in service, including fifty-six

767s. Eight other aircraft were awaiting or undergoing modification

from passenger to freighter configuration at the end of the

quarter, including six 767s and two 737s. In addition to the six

767s in mod, CAM expects to close on purchases of seven additional

767s in the last half of 2017. CAM currently has no 767 purchase

commitments in 2018.

- In July, CAM announced long-term dry

lease commitments for three 767-300 freighters with Northern

Aviation Services, for deployments beginning with the first in

October and two during the first quarter of 2018. Some may

replace 767 freighters that ATSG's airlines operate for Northern on

an ACMI basis.

- Production delays at CAM's freighter

modification contractor this year will defer two 767s expected to

be deployed in the second half of 2017 into 2018.

ACMI Services

ACMI Services Second Quarter Six

Months ($ in thousands)

2017 2016

2017 2016 Revenues Airline services $ 111,851

$ 98,187 $ 219,917 $ 199,840 Reimbursables 32,648 15,958

69,531 29,261 Total ACMI Services Revenues

144,499 114,145 289,448 229,101 Pre-Tax Earnings (Loss)

87 (7,130 ) (3,618 ) (17,486 )

Significant Developments:

- Airline services revenues increased 14

percent to $111.9 million and the segment recorded a pre-tax profit

of $0.1 million in the second quarter. The improvement reflects

continued growth of CMI operations for Amazon, and reduced pension

expense compared with the second quarter last year.

- Costs for pilot training and premium

pay for pilots who accept additional flying assignments declined

from the first quarter, and heavy maintenance expense was lower

than projected for the second quarter.

- Second-quarter block hours increased 29

percent from the year-earlier period. ACMI Services revenues are

dependent in part on hours flown as determined by customer network

designs, which can change as additional aircraft come on line and

networks evolve. Average per-aircraft utilization rates began to

decline in late May this year as CMI customers reconfigured their

air networks.

Other Activities

Other Activities Second Quarter Six

Months ($ in thousands)

2017 2016

2017 2016 Revenues $ 116,508 $ 57,253 $

205,714 $ 112,264 Pre-Tax Earnings 6,539 4,130

11,322 7,998

Significant Developments:

- Total revenues from all other

activities in the second quarter more than doubled from a year ago

to $116.5 million. External customer revenues increased $43.3

million, to $76.3 million. External maintenance revenues and those

from parcel handling and logistical support services increased

substantially during the quarter. PEMCO, acquired in December 2016,

accounted for $21.1 million of external revenues during

quarter.

- Second-quarter pre-tax earnings of $6.5

million increased 58 percent, reflecting improved results from

heavy maintenance and logistics services.

- As announced this morning, ATSG

completed a joint-venture agreement with Precision Aircraft

Solutions, LLC, to develop a passenger-to-freighter conversion

program for Airbus A321-200 aircraft. The venture anticipates

approval of a supplemental type certificate in 2019.

Outlook

ATSG expects that its Adjusted EBITDA from Continuing Operations

for 2017 will be approximately $260 million, including a projected

28 percent increase in the second half compared with the prior-year

period.

Principal factors affecting our 2017 second-half guidance

include:

- Seven additional freighters will be dry

leased in the second half, including five 767s and two 737s.

Production delays to complete aircraft cargo modifications have

deferred delivery of two 767s from the second half to 2018,

reducing Adjusted EBITDA from continuing operations by $2.0 to $2.5

million in the second half.

- A new contract for engine overhauls on

General Electric-powered 767-300 aircraft with Delta TechOps will

result in $3.0 to $4.0 million in additional maintenance expense

for the second half of 2017, with a corresponding decrease in

Adjusted EBITDA. The payments to Delta are now recorded as

maintenance expense as engine cycles occur, and will yield cash

flow savings compared with the prior arrangement. Previously,

overhaul events for these engines were capitalized and

depreciated.

- Recent changes by CMI customers to

their air networks, which have reduced average utilization and

associated variable revenue compared with previous run-rates.

ATSG projects 2017 capital expenditures of approximately $335

million, mostly for purchase and freighter modification of

passenger aircraft. The reduction in guidance for capex of $20

million compared to the $355 million projection provided in May is

due to production delays in the passenger-to-freighter conversion

lines for Boeing 767 aircraft, and lower maintenance capex

associated with the new Delta engine contract.

"Following a great first half, our outlook for the last six

months of 2017 remains positive as we complete the Amazon

deployments and lease more freighters to other customers," Hete

said. "Our operational flexibility and broad service offerings keep

us well positioned to support customers' long-term and peak

shipping season requirements."

Conference Call

ATSG will host a conference call on August 8, 2017, at 10 a.m.

Eastern time to review its financial results for the second quarter

of 2017. Participants should dial (888) 771-4371 and international

participants should dial (847) 585-4405 ten minutes before the

scheduled start of the call and ask for conference pass code

45367629. The call will also be webcast live (listen-only

mode) via www.atsginc.com.

A replay of the conference call will be available by phone on

August 8, 2017, beginning at 2 p.m. and continuing through August

15, 2017, at (888) 843-7419 (international callers (630) 652-3042);

use pass code 45367629#. The webcast replay will remain

available via www.atsginc.com for 30 days.

About ATSG

ATSG is a leading provider of aircraft leasing and air cargo

transportation and related services to domestic and foreign air

carriers and other companies that outsource their air cargo lift

requirements. ATSG, through its leasing and airline subsidiaries,

is the world's largest owner and operator of converted Boeing 767

freighter aircraft. Through its principal subsidiaries, including

two airlines with separate and distinct U.S. FAA Part 121 Air

Carrier certificates, ATSG provides aircraft leasing, air cargo

lift, aircraft maintenance services and airport ground services.

ATSG's subsidiaries include ABX Air, Inc.; Airborne Global

Solutions, Inc.; Air Transport International, Inc.; Cargo Aircraft

Management, Inc.; and Airborne Maintenance and Engineering

Services, Inc. including its division, PEMCO World Air Services,

Inc. For more information, please see www.atsginc.com.

Except for historical information contained herein, the matters

discussed in this release contain forward-looking statements that

involve risks and uncertainties. There are a number of important

factors that could cause Air Transport Services Group's (ATSG's)

actual results to differ materially from those indicated by such

forward-looking statements. These factors include, but are not

limited to, changes in market demand for our assets and services;

our operating airlines' ability to maintain on-time service and

control costs; the cost and timing with respect to which we are

able to purchase and modify aircraft to a cargo configuration; the

number, timing and scheduled routes of our aircraft deployments to

customers; and other factors that are contained from time to time

in ATSG's filings with the U.S. Securities and Exchange Commission,

including its Annual Report on Form 10-K and Quarterly Reports on

Form 10-Q. Readers should carefully review this release and should

not place undue reliance on ATSG's forward-looking statements.

These forward-looking statements were based on information, plans

and estimates as of the date of this release. ATSG undertakes no

obligation to update any forward-looking statements to reflect

changes in underlying assumptions or factors, new information,

future events or other changes.

AIR TRANSPORT SERVICES GROUP, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF EARNINGS(In

thousands, except per share data)

Three Months Ended Six Months Ended

June 30, June 30, 2017 2016

2017 2016 REVENUES $ 253,211 $ 176,549 $

491,128 $ 353,934 OPERATING EXPENSES Salaries, wages and

benefits 66,010 53,647 138,673 106,066 Depreciation and

amortization 37,781 33,132 74,223 65,666 Maintenance, materials and

repairs 37,588 30,345 67,870 60,772 Fuel 32,258 17,168 67,099

33,799 Contracted ground and aviation services 32,151 8,931 52,838

19,799 Travel 6,820 4,678 14,186 9,486 Landing and ramp 4,357 2,652

9,656 6,303 Rent 3,753 2,579 7,039 5,206 Insurance 955 1,087 2,217

2,236 Other operating expenses 8,590 6,529 16,626

13,449 230,263 160,748 450,427 322,782

OPERATING INCOME 22,948 15,801 40,701 31,152 OTHER

INCOME (EXPENSE) Interest income 16 37 48 61 Interest expense

(3,759 ) (2,633 ) (7,307 ) (5,332 ) Net gain (loss) on financial

instruments (67,649 ) 5,558 (65,780 ) 5,030 (71,392 )

2,962 (73,039 ) (241 ) EARNINGS (LOSS)

FROM CONTINUING OPERATIONS BEFORE INCOME TAXES (48,444 ) 18,763

(32,338 ) 30,911 INCOME TAX EXPENSE (5,474 ) (7,235 ) (11,784 )

(11,212 ) EARNINGS (LOSS) FROM

CONTINUING OPERATIONS (53,918 ) 11,528 (44,122 ) 19,699

EARNINGS FROM DISCONTINUED OPERATIONS, NET OF TAX 192 47

384 94 NET EARNINGS (LOSS) $ (53,726 ) $

11,575 $ (43,738 ) $ 19,793 EARNINGS (LOSS)

PER SHARE - CONTINUING OPERATIONS Basic $ (0.91 ) $ 0.18 $ (0.75 )

$ 0.31 Diluted* $ (0.91 ) $ 0.12 $ (0.75 ) $ 0.25 WEIGHTED

AVERAGE SHARES - CONTINUING OPERATIONS Basic 59,035 63,267

59,084 63,452 Diluted 59,035 66,763

59,084 65,910

Revenues and operating expenses include the activities of PEMCO

World Air Services, Inc., a wholly owned subsidiary, for periods

since its acquisition by ATSG on December 30, 2016. Certain

historical expenses have been reclassified to conform to the

presentation above.

* For additional information about the calculation of diluted

earnings per share, see accompanying schedule.

AIR TRANSPORT SERVICES GROUP, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE SHEETS(In thousands,

except share data)

June 30, December 31, 2017

2016 ASSETS CURRENT ASSETS: Cash and cash equivalents

$ 63,020 $ 16,358 Accounts receivable, net of allowance of $1,380

in 2017 and $1,264 in 2016 75,303 77,247 Inventory 16,412 19,925

Prepaid supplies and other 23,918 19,123 TOTAL

CURRENT ASSETS 178,653 132,653 Property and equipment, net

1,074,239 1,000,992 Other assets 86,526 80,099 Goodwill and

acquired intangibles 45,455 45,586

TOTAL

ASSETS $ 1,384,873 $

1,259,330 LIABILITIES AND STOCKHOLDERS’

EQUITY CURRENT LIABILITIES: Accounts payable $ 77,945 $ 60,704

Accrued salaries, wages and benefits 30,963 37,044 Accrued expenses

9,902 10,324 Current portion of debt obligations 20,133 29,306

Unearned revenue 22,480 18,407 TOTAL CURRENT

LIABILITIES 161,423 155,785 Long term debt 508,152 429,415

Post-retirement obligations 71,866 77,713 Other liabilities 50,143

52,542 Stock warrants 177,850 89,441 Deferred income taxes 135,506

122,532 STOCKHOLDERS’ EQUITY: Preferred stock, 20,000,000

shares authorized, including 75,000 Series A Junior Participating

Preferred Stock — — Common stock, par value $0.01 per share;

85,000,000 shares authorized; 59,123,112 and 59,461,291 shares

issued and outstanding in 2017 and 2016, respectively 591 595

Additional paid-in capital 432,510 443,416 Accumulated deficit

(75,981 ) (32,243 ) Accumulated other comprehensive loss (77,187 )

(79,866 ) TOTAL STOCKHOLDERS’ EQUITY 279,933 331,902

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY $

1,384,873 $ 1,259,330

AIR TRANSPORT SERVICES GROUP, INC. AND

SUBSIDIARIESPRE-TAX EARNINGS AND ADJUSTED PRE-TAX EARNINGS

SUMMARYFROM CONTINUING OPERATIONSNON-GAAP RECONCILIATION(In

thousands)

Three Months Ended Six Months Ended

June 30, June 30, 2017 2016

2017 2016 Revenues CAM Aircraft

leasing and related revenues $ 52,813 $ 48,373 $ 103,382 $ 100,099

Lease incentive amortization (3,283 ) (934 ) (5,874 ) (934 )

Total CAM 49,530 47,439 97,508 99,165

ACMI Services

Airline services 111,851 98,187 219,917 199,840 Reimbursables

32,648 15,958 69,531 29,261

Total

ACMI Services 144,499 114,145 289,448 229,101

Other

Activities 116,508 57,253 205,714 112,264

Total Revenues 310,537 218,837 592,670 440,530

Eliminate internal revenues (57,326 ) (42,288 ) (101,542 ) (86,596

)

Customer Revenues $ 253,211 $

176,549 $ 491,128 $

353,934 Pre-tax Earnings (Loss) from

Continuing Operations CAM, inclusive of interest expense

12,795 16,229 26,125 35,739

ACMI Services 87 (7,130 ) (3,618

) (17,486 )

Other Activities 6,539 4,130 11,322 7,998

Net, unallocated interest expense (216 ) (24 ) (387 ) (370 )

Net gain (loss) on financial instruments (67,649 ) 5,558

(65,780 ) 5,030

Total Earnings (Loss) from

Continuing Operations before Income Taxes $

(48,444 ) $ 18,763 $

(32,338 ) $ 30,911

Adjustments to Pre-tax Earnings Add non-service components

of retiree benefit costs, net 177 2,203 354 4,406 Add debt issuance

charge from non-consolidating affiliate — — — 1,229 Add lease

incentive amortization 3,283 934 5,874 934 Add (subtract) net loss

(gain) on financial instruments 67,649 (5,558 ) 65,780

(5,030 )

Adjusted Pre-tax Earnings $

22,665 $ 16,342 $

39,670 $ 32,450

Non-GAAP financial measures: This report contains

non-GAAP financial measures that management uses to evaluate the

Company’s historical results. Management believes that these

non-GAAP measures assist in highlighting operational trends,

facilitate period-over-period comparisons and provide additional

clarity about events and trends impacting core operating

performance. Disclosing these non-GAAP measures provides insight to

investors about additional metrics that the Company’s management

uses to evaluate past performance and prospects for future

performance

Adjusted Pre-tax Earnings excludes certain items included in

GAAP based pre-tax earnings (loss) from continuing operations

because they are distinctly different in their predictability among

periods or not closely related to our operations. Presenting this

measure provides investors with a comparative metric of fundamental

operations while highlighting changes to certain items among

periods. Adjusted Pre-tax Earnings is defined as Earnings (Loss)

from Continuing Operations Before Income Taxes less financial

instrument gains or losses, non-service components of retiree

benefit costs, lease incentive amortization and the write-off of

debt issuance costs from a non-consolidating affiliate.

Adjusted Pre-tax Earnings is a non-GAAP financial measure and

should not be considered an alternative to Earnings from Continuing

Operations Before Income Taxes or any other performance measure

derived in accordance with GAAP.

AIR TRANSPORT SERVICES GROUP, INC. AND

SUBSIDIARIESADJUSTED EARNINGS FROM CONTINUING OPERATIONSBEFORE

INTEREST, TAXES, DEPRECIATION AND AMORTIZATIONNON-GAAP

RECONCILIATION(In thousands)

Three Months Ended Six Months Ended

June 30, June 30, 2017

2016 2017 2016 Earnings

(Loss) from Continuing Operations Before Income Taxes $ (48,444

) $ 18,763 $ (32,338 ) $ 30,911 Interest Income (16 ) (37 ) (48 )

(61 ) Interest Expense 3,759 2,633 7,307 5,332 Depreciation and

Amortization 37,781 33,132 74,223 65,666

EBITDA from Continuing Operations $ (6,920 ) $ 54,491

$ 49,144 $ 101,848 Add non-service components of retiree benefit

costs, net 177 2,203 354 4,406 Add debt issuance charge from

non-consolidating affiliate — — — 1,229 Add lease incentive

amortization 3,283 934 5,874 934 Add (subtract) net loss (gain) on

financial instruments 67,649 (5,558 ) 65,780 (5,030 )

Adjusted EBITDA $ 64,189 $ 52,070

$ 121,152 $ 103,387

Management uses Adjusted EBITDA to assess the performance of its

operating results among periods. It is a metric that facilitates

the comparison of financial results of underlying operations.

Additionally, these non-GAAP adjustments are similar to the

adjustments used by lenders in the Company’s Senior Credit

Agreement to assess financial performance and determine cost of

borrowed funds. The adjustments also exclude the non-service cost

components of retiree benefit plans because they are not closely

related to on-going operating activities. Management presents

EBITDA from Continuing Operations, a commonly referenced metric, as

a subtotal toward computing Adjusted EBITDA.

EBITDA from Continuing Operations is defined as Earnings (Loss)

from Continuing Operations Before Income Taxes plus net interest

expense, depreciation, and amortization expense. Adjusted EBITDA is

defined as EBITDA from Continuing Operations less financial

instrument gains or losses, non-service components of retiree

benefit costs, amortization of lease incentive costs recorded in

revenue and the write-off of debt issuance costs from a

non-consolidating affiliate.

Adjusted EBITDA and EBITDA from Continuing Operations are

non-GAAP financial measures and should not be considered as

alternatives to Earnings from Continuing Operations Before Income

Taxes or any other performance measure derived in accordance with

GAAP. Adjusted EBITDA and EBITDA from Continuing Operations should

not be considered in isolation or as a substitute for analysis of

the Company's results as reported under GAAP, or as an alternative

measure of liquidity.

AIR TRANSPORT SERVICES GROUP, INC. AND

SUBSIDIARIESADJUSTED EARNINGS PER SHARE FROM CONTINUING

OPERATIONSNON-GAAP RECONCILIATION(In thousands)

The Company's financial results as reported under GAAP, include

the effects of stock warrants granted to a customer as a lease

incentive. The value of the stock warrants is recorded as a

customer lease incentive asset and is amortized against revenue

over the term of the related aircraft leases. The stock warrant

obligation is reflected as a liability and revalued to fair value

at the end of each reporting period. The stock warrant liability

was revalued as of June 30, 2017, with the change in fair value

recorded to earnings. Adjusted Earnings from Continuing Operations

and Adjusted Earnings per Share from Continuing Operations,

non-GAAP measures presented below, reflect the Company's results

after removing the lease incentive amortization and the warrant

revaluation effects during the periods presented.

Three Months Ended Six Months Ended

June 30, June 30, 2017 2016

2017 2016 Earnings (loss) from

Continuing Operations - basic (GAAP) $ (53,918 ) $ 11,528 $

(44,122 ) $ 19,699 Gain from warrant revaluation, net of tax —

(3,664 ) — (3,405 )

Earnings (loss) from

Continuing Operations - diluted (GAAP) (53,918 ) 7,864 (44,122

) 16,294 Loss from warrant revaluation, net of tax 63,396 — 61,857

— Lease incentive amortization, net of tax 4,378 595

7,340 595

Adjusted Earnings from Continuing

Operations (non-GAAP) $ 13,856 $ 8,459 $ 25,075

$ 16,889

Weighted Average Shares - diluted

(GAAP) 59,035 66,763 59,084 65,910 Additional weighted average

shares 8,474 — 7,152 —

Adjusted

Shares (non-GAAP) 67,509 66,763 66,236 65,910

Earnings (loss) per Share from Continuing Operations - diluted

(GAAP) $ (0.91 ) $ 0.12 $ (0.75 ) $ 0.25 Effect of warrant

revaluation, net of tax 1.05 — 1.01 — Effect of lease incentive

amortization, net of tax 0.07 0.01 0.12 0.01

Adjusted Earnings per Share from Continuing Operations

(non-GAAP) $ 0.21 $ 0.13 $ 0.38 $ 0.26

Management presents Adjusted Earnings per Share from Continuing

Operations to remove the effects in the income statement of a large

grant of stock warrants, including their related adjustment to fair

value which is recorded at the end of each quarter. Under U.S.

GAAP, these warrants are reflected as a liability and unrealized

warrant gains are typically removed from diluted earnings per share

(“EPS”) calculations while unrealized warrant losses are not

removed because they are dilutive to EPS. As a result, the

Company’s EPS, as calculated under U.S. GAAP, can vary

significantly among periods due to unrealized mark-to-market losses

which are not directly related to the Company's operating

performance. Accordingly, the non-GAAP calculation of EPS provides

additional information to investors regarding the earnings per

share without the volatility otherwise caused by the stock

warrants.

Adjusted Earnings per Share from Continuing Operations equals

Adjusted Earnings from Continuing Operations divided by Adjusted

Shares. Adjusted Shares include warrants which correspond to the

revaluation adjustment that were not already included in weighted

average shares used for GAAP. Adjusted Earnings from Continuing

Operations is defined as Earnings from Continuing Operations

excluding the amortization of the lease incentive asset, net of

taxes, and excluding the warrant revaluation loss or gain, net of

taxes. Management uses Adjusted Earnings from Continuing Operations

and Adjusted Earnings per Share from Continuing Operations to

compare the performance of its operating results among periods.

Adjusted Earnings from Continuing Operations, Adjusted Shares

and Adjusted Earnings per Share from Continuing Operations are

non-GAAP financial measures and should not be considered as

alternatives to Earnings from Continuing Operations, Weighted

Average Shares - diluted or Earnings per Share from Continuing

Operations or any other performance measure derived in accordance

with GAAP. Adjusted Earnings and Adjusted Earnings per Share from

Continuing Operations should not be considered in isolation or as a

substitute for analysis of the company's results as reported under

GAAP.

AIR TRANSPORT SERVICES GROUP, INC. AND

SUBSIDIARIESCARGO AIRCRAFT FLEET

Aircraft Types December 31,

June 30, December 31, 2016 2017

2017 Projected Operating

Operating Operating Total Owned Lease Total Owned

Lease Total Owned Lease B767-200 36 36 — 36 36 — 36 36 — B767-300

16 16 — 20 20 — 25 25 — B757-200 4 4 — 4 4 — 4 4 — B757 Combi 4 4 —

4 4 — 4 4 — B737-400 — — — — — — 2 2 —

Total Aircraft

60 60 — 64 64 — 71

71 — Owned Aircraft In Serviceable

Condition December 31, June 30, December

31, 2016 2017 2017 Projected Dry

leased without CMI 13 15 20 Dry leased with CMI 28 30 32

ACMI/Charter 18 19 19 Staging/Unassigned 1 — —

60 64

71 Owned Aircraft In or Awaiting Cargo

Conversion December 31, June 30, December

31, 2016 2017 2017 Projected B767-300 7 6

8 B737-400 — 2 —

Total Aircraft 7 8 8

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170807005989/en/

ATSG Inc.Quint O. Turner, 937-382-5591Chief Financial

Officer

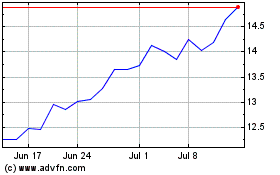

Air Transport Services (NASDAQ:ATSG)

Historical Stock Chart

From Mar 2024 to Apr 2024

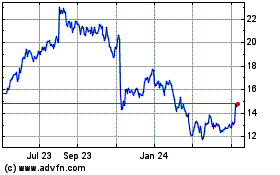

Air Transport Services (NASDAQ:ATSG)

Historical Stock Chart

From Apr 2023 to Apr 2024