Current Report Filing (8-k)

August 04 2017 - 5:10PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported):

August 1, 2017

ADVANCED

MEDICAL ISOTOPE CORPORATION

(Exact

name of Registrant as specified in its Charter)

|

Delaware

|

|

00-53497

|

|

80-0138937

|

|

(State

or other jurisdiction

of

incorporation)

|

|

(Commission

File No.)

|

|

(IRS

Employer

Identification

No.)

|

1021

N. Kellogg Street, Kennewick, WA 99336

(Address

of principal executive offices)

(509)

736-4000

(Registrant’s

Telephone Number)

Not

Applicable

(Former

name or address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company

[ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

[ ]

|

Item

5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory

Arrangements of Certain Officers.

|

At

the 2017 Annual Meeting of Stockholders of

Advanced Medical Isotope Corporation (the “

Company

”),

held on August 1, 2017 (the “Annual Meeting”), stockholders approved the appointment of Drs. Michael K. Korenko

and Robert G. Wolfangel to the Board of Directors, to serve until the next annual meeting of stockholders or until his successor

is elected and qualified.

Dr.

Michael K. Korenko has served as President and Chief Executive Officer of the Company since December 2016. Dr. Korenko joined

the Company as an Advisor to the Board of the Company during 2009 and previously served as member of the Board from May 2009 to

March 2010. Dr. Korenko has also served on the Hanford Advisory Board since 2009. Dr. Korenko served as Business Development Manager

for Curtiss-Wright from 2006 to 2009, as Chief Operating Officer for Curtiss-Wright from 2000 to 2005 and was Executive Vice President

of Closure for Safe Sites of Colorado at Rocky Flats from 1994 to 2000. Dr. Korenko served as Vice President of Westinghouse from

1987 to 1994 and was responsible for the 300 and 400 areas, including the Fast Flux Testing Facility (“FFTF”) and

all engineering, safety analysis, and projects for the Hanford site. Dr. Korenko is the author of 28 patents and has received

many awards, including the National Energy Resources Organization Research and Development Award, the U.S. Steelworkers Award

for Excellence in Promoting Safety, and the Westinghouse Total Quality Award for Performance Manager of the Year. Dr. Korenko

has a Doctor of Science from MIT, was a NATO Postdoctoral Fellow at Oxford University, and was selected as a White House Fellow

for the Department of Defense, reporting to Secretary Cap Weinberger. Dr. Korenko brings to the Board over seven years’

experience working with and advising various small businesses, including companies involved in turnarounds. Dr. Korenko has also

been involved as an advisor to the Company since 2009 in the development of medical isotopes.

Dr.

Robert G. Wolfangel, has served as Vice President, Scientific Affairs of Certus International Inc. Board since 2001. His responsibilities

include providing strategic scientific and regulatory guidance to start-up and major pharmaceutical firms engaged in the research

and development of new diagnostic and therapeutic drugs. This includes development of clinical protocols, audit of manufacturing

and quality processes, stability protocol design, process validation and preparation of regulatory submissions for diagnostic

imaging drugs, including radiopharmaceutical, ultrasound contrast agents and diagnostic devices. Dr. Wolfangel has Ph.D. in Bionucleonics

from Purdue University, an MS in Industrial Pharmacy and a BS in Pharmacy (with honors) from St. Louis College of Pharmacy. Dr.

Wolfangel brings to the Board over sixteen years’ experience in providing strategic and regulatory guidance to start-up

pharmaceutical firms

There

are no relationships or related party transactions between the Company or any of its executive officers or directors and Drs.

Korenko or Wolfangel that would require disclosure under Item 401(d) or 404(a) of Regulation S-K, or arrangements or understandings

in connection with Dr. Korenko’s or Dr. Wolfangel’s appointment.

Item

5.07 Submission of Matters to a Vote of Security Holders.

The

matters voted upon at the Annual Meeting and the results of the voting are set forth below.

Proposal

No. 1- Election of Directors

|

|

|

For

|

|

|

Abstain

|

|

|

|

|

Votes

|

|

|

% Voted

|

|

|

Votes

|

|

|

% Voted

|

|

|

Carlton M. Cadwell

|

|

|

131,209,138

|

|

|

|

88

|

%

|

|

|

104,253

|

|

|

|

<1

|

%

|

|

Michael K. Korenko

|

|

|

131,217,112

|

|

|

|

88

|

%

|

|

|

96,279

|

|

|

|

<1

|

%

|

|

Robert G. Wolfangel

|

|

|

131,221,629

|

|

|

|

88

|

%

|

|

|

91,792

|

|

|

|

<1

|

%

|

The

election of directors required the affirmative vote of a plurality of the voting shares present or represented by proxy and entitled

to vote at the Annual Meeting. Accordingly, each of the nominees named above were elected to serve on the Board of Directors until

the 2018 Annual Meeting of Stockholders, or until their successors are elected and qualified.

Proposal

No. 2- Amendment to the Company’s Certificate of Incorporation to Implement a Reverse Stock Split (“Reverse Stock

Split Proposal”)

|

|

|

For

|

|

|

Against

|

|

|

Abstain

|

|

|

Votes

|

|

|

137,935,446

|

|

|

|

11,195,735

|

|

|

|

361,030

|

|

|

% Entitled to Vote

|

|

|

64.26

|

%

|

|

|

5.2

|

%

|

|

|

<1

|

%

|

The

Reverse Stock Split proposal required the affirmative vote of the holders of a majority of the outstanding shares entitled to

vote at the Annual Meeting. Accordingly, the Company’s stockholders voted in favor of the proposal to provide the Board

the authority, but not the obligation, in its sole and absolute discretion, and without further action on the part of the stockholders,

to select one of the Approved Split Ratios and effect the Reverse Split by filing the Amendment with the Delaware Division of

Corporations. If such Amendment is not filed with the Delaware Division of Corporations within one year from the date of the Annual

Meeting, the Board will abandon the Reverse Split. The text of the proposed Amendment to affect the Reverse Split was included

as Appendix A to the Company’s definitive proxy statement, filed with the Securities and Exchange Commission on July 10,

2017.

Proposal

No. 3- Advisory Vote to Approve Executive Compensation (“Say-On-Pay Proposal”)

|

|

|

For

|

|

|

Against

|

|

|

Abstain

|

|

|

Votes

|

|

|

130,643,820

|

|

|

|

644,753

|

|

|

|

24,818

|

|

|

% Voted

|

|

|

87

|

%

|

|

|

<1

|

%

|

|

|

<1

|

%

|

The

Say-On-Pay Proposal required the affirmative vote of a majority of the votes present at the Annual Meeting, either in person or

by proxy, to be approved. Accordingly, the Company’s stockholders voted, on an advisory basis, in favor of the compensation

paid to the Company’s named executive officers, as disclosed in the Company’s definitive proxy statement, filed with

the Securities and Exchange Commission on July 10, 2017.

Proposal

No. 4- Advisory Vote on the Frequency of Future Executive Compensation Votes

|

|

|

Three Years

|

|

|

Two Years

|

|

|

One Year

|

|

|

Votes

|

|

|

110,751,929

|

|

|

|

909,393

|

|

|

|

19,547,056

|

|

|

% Voted

|

|

|

74

|

%

|

|

|

<1

|

%

|

|

|

13

|

%

|

On

this non-binding matter, stockholders were able to vote to set the frequency of the Say-on-Pay Vote to occur every year, every

two years, or every three years, or the stockholder may vote to abstain. The choice among those three choices that received

the highest number of votes was deemed the choice of the stockholders. The Company’s stockholders voted for the advisory

vote on the frequency of the advisory vote on executive compensation to occur every three years, by the votes set forth

above.

Proposal

No. 5- Ratification of Appointment of Auditors

|

|

|

For

|

|

|

Against

|

|

|

Abstain

|

|

|

Votes

|

|

|

148,426,294

|

|

|

|

521,710

|

|

|

|

544,206

|

|

|

% Voted

|

|

|

99

|

%

|

|

|

<1

|

%

|

|

|

<1

|

%

|

The

vote required to approve this proposal was the affirmative vote of a majority of the votes cast on the proposal. Accordingly,

stockholders ratified the appointment of Fruci & Associates as the Company’s independent auditors for the fiscal year

ending December 31, 2017.

For

more information about the foregoing proposals, please review the Company’s definitive proxy statement, filed with the

Securities and Exchange Commission on

July 10

, 2017.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

ADVANCED

MEDICAL ISOTOPE CORP.

|

|

|

|

|

|

Date:

August 4, 2017

|

By:

|

/s/

L. Bruce Jolliff

|

|

|

|

L.

Bruce Jolliff

|

|

|

|

Chief

Financial Officer

|

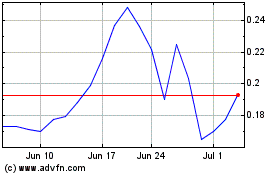

Vivos (QB) (USOTC:RDGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

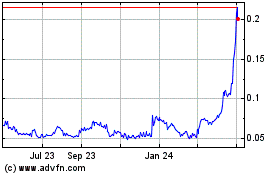

Vivos (QB) (USOTC:RDGL)

Historical Stock Chart

From Apr 2023 to Apr 2024