Current Report Filing (8-k)

August 04 2017 - 4:13PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 3, 2017

Commission File Number 001-31921

Compass Minerals International, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

Delaware

(State or other jurisdiction of incorporation)

|

36-3972986

(I.R.S. Employer

Identification No.)

|

9900 West 109

th

Street

Suite 100

Overland Park, KS 66210

(913) 344-9200

(Address of principal executive offices, zip code and telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On August 3, 2017, Compass Minerals International, Inc. (the “Company”) entered into an Amended and Restated Employment Agreement with Francis J. Malecha to serve as the Company’s President and Chief Executive Officer (the “Employment Agreement”). Mr. Malecha has been serving as the Company’s President and Chief Executive Officer since January 17, 2013, and the initial term of his prior employment agreement with the Company would have terminated on January 17, 2018.

The Employment Agreement is effective as of August 3, 2017, and terminates after three years on August 3, 2020, but automatically extends for successive one-year periods unless the Company provides 60-day advance written notice of non-renewal, or unless earlier terminated as provided therein. Under the terms of the Employment Agreement, Mr. Malecha will be entitled to an annual base salary, target annual cash bonus and equity-based compensation as described in the Company’s 2017 Proxy Statement filed with the Securities and Exchange Commission on March 21, 2017, subject to adjustment in certain circumstances.

If Mr. Malecha’s employment terminates as a result of his disability, he will be entitled to receive the compensation due under the Employment Agreement, 60% of his then-current base salary for 12 months after the termination date and continued participation in the Company’s then applicable health plan at the then regular employee contribution rate. If the Company terminates Mr. Malecha’s employment without Cause or if Mr. Malecha terminates his employment for Good Reason (each as defined in the Employment Agreement), he will be entitled to the compensation due under the Employment Agreement through his termination, a pro-rated annual performance based incentive compensation bonus through the date of termination at the target level for such year and an amount equal to continuation of his base salary for 18 months from the date of termination, payable in a single lump sum. In addition, he will receive reimbursement up to a maximum of 18 months for premium payments for COBRA coverage, immediate vesting of all stock options and/or restricted stock units granted through the date of termination, and continued earning/vesting of any performance based units granted through the date of termination as if his employment continued through the date of earning or vesting for any such unit.

Mr. Malecha and the Company have also entered into a Restrictive Covenant Agreement, pursuant to which for a period of two years post-termination for any reason Mr. Malecha is subject to a non-solicit covenant for employees and customers and a non-compete covenant. To be eligible for the severance payments described above, the Employment Agreement requires that Mr. Malecha execute a release and be in compliance with his Restrictive Covenant Agreement and his Confidentiality Agreement.

The description of the Employment Agreement and Restrictive Covenant Agreement contained in this Form 8-K is not intended to be complete, and is qualified in its entirety by reference to the complete text of the Employment Agreement and Restrictive Covenant Agreement, copies of which are attached as Exhibit 10.1 and Exhibit 10.2, respectively, and incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

|

|

Exhibit No.

|

|

Exhibit Description

|

|

10.1

|

|

Amended and Restated Employment Agreement, effective August 3, 2017, between Compass Minerals International, Inc. and Francis J. Malecha.

|

|

10.2

|

|

Restrictive Covenant Agreement, effective August 3, 2017, between Compass Minerals International, Inc. and Francis J. Malecha.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

COMPASS MINERALS INTERNATIONAL, INC.

|

|

|

|

|

|

Date: August 4, 2017

|

By:

|

/s/ Diana C. Toman

|

|

|

|

Name: Diana C. Toman

|

|

|

|

Title: Senior Vice President, General Counsel and Corporate Secretary

|

|

|

|

|

EXHIBIT INDEX

|

|

|

|

|

|

|

Exhibit No.

|

|

Exhibit Description

|

|

10.1

|

|

Amended and Restated Employment Agreement, effective August 3, 2017, between Compass Minerals International, Inc. and Francis J. Malecha.

|

|

10.2

|

|

Restrictive Covenant Agreement, effective August 3, 2017, between Compass Minerals International, Inc. and Francis J. Malecha.

|

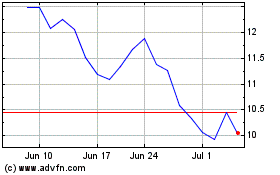

Compass Minerals (NYSE:CMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

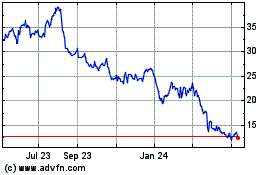

Compass Minerals (NYSE:CMP)

Historical Stock Chart

From Apr 2023 to Apr 2024