Today's Top Supply Chain and Logistics News From WSJ

August 04 2017 - 7:06AM

Dow Jones News

By Paul Page

Sign up: With one click, get this newsletter delivered to your

inbox.

Pricing competition is already breaking out in the parcel world

well before this year's holiday shipping season. FedEx Corp. came

out with its new surcharges for the peak delivery period, and the

carrier is taking a sharply different path than rival United Parcel

Service Inc. FedEx is raising charges, but the WSJ's Paul Ziobro

reports the operator is focusing its increases on the weight and

size of shipments, adding hefty penalties for oversize boxes and

odd-shaped goods that fall outside the company's handling

guidelines. UPS, by contrast, is basing new surcharges on the

timing of shipments, making it more expensive to deliver to homes

around the peak periods. Both companies are trying to manage the

surge of e-commerce shipments that strains operations and profit

margins, and UPS with its surcharge strategy aims to convince

retailers to spread out shipments. FedEx is gambling it can cover

the extra costs of a demand spike while ensuring that bigger

shipments pay a hefty price for slowing down operations.

A new generation of robots is heading into warehouses with a new

message for workers: we want to collaborate, not compete. Several

automation companies are designing robots meant to work alongside

people rather than to completely replace manpower, WSJ Logistics

Report's Jennifer Smith writes, a sign that strategies for using

robotics in warehouse operations are evolving as the technology

develops and companies get more experience in using it on a daily

basis. The new robots being deployed by companies including

Deutsche Post AG's DHL, Quiet Logistics Inc. and RK Logistics Group

are small and relatively cheap mobile machines that move alongside

humans and help them work more efficiently. Robotics firms pitch

them as a way to boost productivity during busy times, such as the

holidays, when extra labor is harder to find. That's not as

ambitious as automating an entire warehouse, of course, but

developers say the lower cost makes them easier to insert into

existing operations -- and find the common ground between robots

and humans.

Alibaba Group Holding Ltd.'s new pact with luxury conglomerate

Kering Co. comes laden with significance beyond any goods it may

bring to online marketplaces. Kering, whose brands include Gucci

and Saint Laurent, is dropping its lawsuit against Alibaba over the

sale of counterfeit goods on Alibaba's websites, the WSJ's Matthew

Dalton and Liza Lin report, adding to an ongoing rapprochement

between the luxury industry and China's e-commerce companies. Key

high-end retailers are cautiously agreeing to sell through China's

online platforms, pushing aside concerns about China's unruly

counterfeiting industry using these websites to peddle fakes. Just

this week, Saint Laurent said it would sell over the internet in

China for the first time through a partnership involving JD.com,

China's second-largest online retailer. Under its deal with

Alibaba, Kering will take part in a "joint task force" aimed at

pursuing counterfeiters, at step toward what Kering's brands hope

will be the pursuit of more sales in China.

SUPPLY CHAIN STRATEGIES

Retailer Uniqlo is trying to put its clothing in front of

customers in the real world without investing in more

brick-and-mortar stores. The apparel seller owned by Fast Retailing

Co. is rolling out vending machines at several airports and

shopping malls that will dispense Uniqlo's apparel to people who

may need a quick addition to their outfits, the WSJ's Khadeeja

Safdar reports. It's part of a retooled expansion after the company

stumbled in its early efforts to move into the U.S., and the latest

sign of imaginative strategies retailers are undertaking to find

consumers without investing in big storefronts. Many retailers are

looking for a middle-ground between physical stores and moving

entirely online, and some like Best Buy Co. have already turned to

vending for some staples. Clothing marks a new frontier, and Uniqlo

will cope with added complications in its distribution channels,

including delivering goods to the sites, tracking the inventory and

dealing with those returns.

QUOTABLE

IN OTHER NEWS

Toyota Motor Corp and rival Mazda Motor Corp. plan to build a

$1.6 billion factory in the U.S. by 2021 that would create 4,000

jobs.(WSJ)

Orders for heavy-duty trucks in the U.S. rose 5% from June to

July. (WSJ)

Inflation in the Group of 20 largest economies fell in June to

its lowest level in almost eight years. (WSJ)

China is urging the Trump administration to back off plans for

tough trade actions, warning that conflict would hurt both sides.

(WSJ)

Drug giant Teva Pharmaceuticals Industries Ltd. slashed its

outlook amid growing competition, leadership woes and difficulties

in a sprawling supply chain built through acquisitions. (WSJ)

Tesla Inc. may issue new debt this year as efforts to ramp up

production of its Model 3 sedan drain cash reserves. (WSJ)

Amazon.com Inc. says its new 260,000-square-foot distribution

center outside Melbourne is "just the start" of its expansion in

Australia. (The Australian)

An Australian court fined Nippon Yusen Kabushiki Kaisha, or NYK

Line, nearly $20 million for colluding with other carriers to fix

prices for shipping cars. (Sydney Morning Herald)

Mercedes-Benz Trucks will start using 3D printing to produce

spare and replacement truck parts. (Fleet Owner)

Uber Technologies Inc. expanded the geographic reach of its Uber

Freight truck load-matching app. (Heavy Duty Trucking)

DHL Supply Chain is expanding its use of "smart glasses" for

warehouse workers in its world-wide operations after completing a

test of the devices. (Supply Chain Digital)

Teekay Tankers Ltd. swung to a $7.1 million net loss on a steep

decline in revenue in what it called an oversupplied global tanker

market. (Lloyd's List)

U.S. ethanol inventories are near an all-time high. (Omaha

World-Herald)

Australia's IFM Investors bought a 40% stake in Turkey's Mersin

International Port from Akfen Holding. (Daily Sabah)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the entire WSJ Logistics Report team:

@brianjbaskin , @jensmithWSJ and @EEPhillips_WSJ. Follow the WSJ

Logistics Report on Twitter at @WSJLogistics.

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

August 04, 2017 06:51 ET (10:51 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

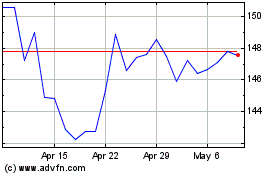

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

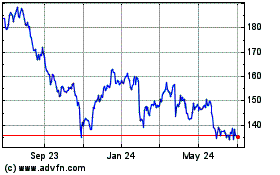

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Apr 2023 to Apr 2024