Filed pursuant to Rule 424(b)(5)

Registration No. 333-219592

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of

Securities to be Registered

|

|

Amount to be

Registered

(1)

|

|

Proposed Maximum

Offering Price Per

Share

|

|

Proposed Maximum

Aggregate Offering

Price

|

|

Amount of

Registration Fee

(2)

|

|

Common Stock, $0.001 par value per share

|

|

11,500,000

|

|

$13.50

|

|

$155,250,000

|

|

$17,994

|

_____________

|

|

|

|

(1)

|

Includes shares of common stock that may be purchased by the underwriters pursuant to an option to purchase additional shares of common stock.

|

|

|

|

|

(2)

|

Calculated in accordance with Rule 457(r) under the Securities Act of 1933, as amended. Represents payment of registration fees previously deferred in connection with the Registration Statement on Form S-3 (Registration No. 333-219592).

|

PROSPECTUS

10,000,000 Shares

Chegg, Inc.

Common Stock

_____________

Chegg, Inc. is offering 10,000,000 shares of its common stock.

Our common stock is listed on the New York Stock Exchange under the symbol “CHGG.” On August 2, 2017, the reported closing sale price of our common stock on the New York Stock Exchange was $14.05 per share.

Investing in our common stock involves risks. See “

Risk Factors

” beginning on page 8, and under similar headings in other documents which are incorporated by reference herein.

_____________

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Price to

Public

|

|

Underwriting

Discounts

and

Commissions

(1)

|

|

Proceeds, Before Expenses, to

Chegg

|

|

Per share

|

$

|

13.50

|

|

|

$

|

0.6075

|

|

|

$

|

12.8925

|

|

|

Total

|

$

|

135,000,000

|

|

|

$

|

6,075,000

|

|

|

$

|

128,925,000

|

|

_____________

(1) See “Underwriters.”

We have granted the underwriters the option to purchase, for 30 days after the date of this prospectus, up to an additional 1,500,000 shares of common stock at the public offering price less the underwriting discounts and commissions.

The Securities and Exchange Commission and state regulators have not approved or disapproved of these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock to purchasers on August 8, 2017.

_____________

|

|

|

|

|

|

|

|

|

Morgan Stanley

|

|

BofA Merrill Lynch

|

|

Allen & Company LLC

|

|

Barrington Research

|

|

|

|

Northland Capital Markets

|

The date of this prospectus is August 2, 2017

TABLE OF CONTENTS

_____________

Neither we nor the underwriters have authorized anyone to provide you with any information other than the information contained or incorporated by reference in this prospectus or any free writing prospectus prepared by or on behalf of us to which we have referred you. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. Neither we nor the underwriters are making an offer to sell securities in any jurisdiction where the offer or sale is not permitted. The information contained or incorporated by reference in this prospectus or any free writing prospectus prepared by or on behalf of us to which we have referred you is accurate only as of the date thereof, regardless of the time of delivery of such document or of any sale of our shares of common stock. Our business, financial condition and results of operations may have changed since those dates. It is important for you to read and consider all the information contained in this prospectus, including the documents incorporated by reference herein or any free writing prospectus prepared by or on behalf of us to which we have referred you, in making your investment decision.

For investors outside the United States: Neither we nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of our common stock and the distribution of this prospectus outside of the United States.

PROSPECTUS SUMMARY

This summary highlights selected information about us, this offering and information appearing elsewhere in this prospectus and in the documents incorporated by reference herein and therein. This summary is not complete and does not contain all the information you should consider before investing in our common stock pursuant to this prospectus. Before making an investment decision, to fully understand this offering and its consequences to you, you should carefully read this entire prospectus and the information incorporated by reference, including "Risk Factors," the financial statements, and related notes, and the other information that we incorporate by reference herein and therein. Unless the context otherwise requires, we use the terms “Chegg,” “we,” “us,” the “Company” and “our” in this prospectus to refer to Chegg, Inc. and its subsidiaries.

Company Overview

Chegg is the leading student-first connected learning platform. Our goal is to help students transition from high school to a career. As such, we are committed to improving student outcomes throughout this decade long journey. We help students study more effectively for college admissions exams, find the right college to accomplish their goals, get better grades and test scores while in school, and find internships that allow them to gain valuable skills to help them enter the workforce after college. Our student platform offers products and services that help students transition from high school to college to career. We strive to improve the overall return on investment in education by helping students maximize their outcomes through more efficient and cost-effective solutions that bridge the gap between what formal institutions offer and students actually need. During 2016, nearly 6.5 million students turned to Chegg to help them save money and improve their outcomes.

In 2016, over 1.5 million students subscribed to our Chegg Services, an increase of 47% year over year from 1.0 million students in 2015. These subscribers represent approximately 4% of the 36 million students enrolled in high school through college education, according to the National Center for Education and Statistics and the U.S. Census Bureau. Students subscribe to our digital products and services, which we collectively refer to as Chegg Services. These include Chegg Study, Chegg Tutors, Writing Tools (acquired in May 2016), Enrollment Marketing, Brand Partnership, Internships, and Test Prep, which, according to comScore, collectively bring 40 million annual unique visitors to our platform. Chegg Study service provides 6 million step-by-step Textbook Solutions and over 10 million answers, powered by our expert network, helping students with their course work. When students need additional help on a subject, they can reach a live tutor online, anytime, anywhere through Chegg Tutors. According to comScore, our Writing Tools, including EasyBib, Citation Machine, BibMe, CiteThisForMe, and NormasAPA, provide 30 million unique annual visitors with online citation, bibliography, and anti-plagiarism services. In 2016, we matched approximately 5.3 million domestic and international students with colleges in the United States to help them find the best fit school for them. As of December 31, 2016, we provided access to approximately 340,000 internships to help students gain skills and experiences that are critical to securing their first job. We provide high school students with an online adaptive test preparation service currently covering the ACT and SAT exams. Through our strategic partnership with Ingram Content Group, or Ingram, we offer Required Materials, which includes an extensive print textbook and eTextbook library for rent and sale, helping students save money compared to the cost of buying new. In 2016, students rented or bought over 5.7 million textbooks and eTextbooks from Chegg.

To deliver services to students, we partner with a variety of third parties. We work with colleges to help shape their incoming classes. We source print textbooks, eTextbooks, and supplemental materials directly or indirectly from thousands of publishers in the United States, including Pearson, Cengage Learning, McGraw Hill, Wiley, and MacMillan. We have a large network of students and professionals who leverage our platform to tutor in their spare time and employers who leverage our platform to post their internships and jobs. In addition, because we have a large student user base, local and national brands partner with us to reach the college and high school demographics.

During the three and six months ended June 30, 2017, we generated net revenues of $56.3 million and $118.9 million, respectively, and in the same periods had net losses of $6.0 million and $12.4 million, respectively. During the three and six months ended June 30, 2016, we generated net revenues of $53.0 million and $119.7 million, respectively, and in the same periods had net losses of $9.0 million and $24.7 million, respectively. For the three months ended September 30, 2015 and September 30, 2016, our overall customer acquisition cost was $3.73 and $2.57 per customer respectively, which represents a decrease of 31% year over year. We calculate customer acquisition cost by dividing

(1) Required Materials, Chegg Study and Chegg Tutors marketing spend, which includes paid marketing spend and investments in Adobe Marketing Cloud for these services and excludes marketing spend for Writing Tools, which we acquired in May 2016, by (2) the combined number of new subscriptions for Chegg Study and Chegg Tutors started in the same quarter and new Required Materials orders made in the same quarter.

Our strategy for achieving and maintaining profitability is centered upon our ability to utilize Chegg Services to increase student engagement with our connected learning platform. We believe this expanded and deeper penetration of the student demographic will allow us to drive further growth in our existing Chegg Services. In addition, we believe that the investments we have made to achieve our current scale will allow us to drive increased operating margins over time that, together with increased contributions of Chegg Services products, will enable us to accomplish profitability and become cash-flow positive in the long-term. Our ability to achieve these long-term objectives is subject to numerous risks and uncertainties, including our ability to attract, retain, and increasingly engage the student population, intense competition in our markets, the ability to achieve sufficient contributions to revenue from Chegg Services and other factors described in greater detail in “Risk Factors.” We have presented revenues for our two product lines, Chegg Services and Required Materials, based on how students view us and the utilization of our products by them. More detail on our two product lines is discussed in the next two sections titled “Chegg Services” and “Required Materials.”

Chegg Services

Our Chegg Services for students primarily includes our Chegg Study service, our Chegg Tutors service, and our Writing Tools service. We also work with leading brands, such as Proctor & Gamble, Starbucks, The Truth, Microsoft, Best Buy, DirectTV, Bare Escentuals, and Shutterfly, to provide students with discounts, promotions, and other products that, based on student feedback, delight them. For example, for Proctor & Gamble, we inserted free laundry care samples and for Starbucks, we inserted free drinks in our textbook rental shipments to students. All of our brand advertising services and the discounts, promotions, and other products provided to students are paid for by the brands. We additionally provide Internship services and our Test Prep service currently covering the ACT and SAT exams.

Our total number of Chegg Services Subscribers has tripled over the past four years. In 2013, 2014, 2015 and 2016, we had 0.5 million, 0.7 million, 1.0 million and 1.5 million Chegg Services Subscribers, respectively. We have also reduced our overall customer acquisition cost over the same period.

Students typically pay to access Chegg Services such as Chegg Study on a monthly or annual basis, while colleges subscribe to our enrollment marketing services through the National Research Center for College and University Admissions and brands pay us depending on the nature of the campaign. In the aggregate, Chegg Services revenues were 79% and 72% of net revenues during the three and six months ended June 30, 2017, respectively, and 56% and 46% of net revenues during the three and six months ended June 30, 2016, respectively. Our Chegg Services Average Revenue Per User increased from $77.05 in 2012 to $85.00 in 2016, representing approximately a 10% increase over this period. We calculate Average Revenue Per User by dividing the total Chegg Services revenue during the period by the total number of Chegg Services net paying subscribers for the same period.

Required Materials

Our Required Materials product line includes commissions from partners, such as Ingram and textbook publishers, on the rental and sale of print textbooks, as well as revenues from eTextbooks. Our web-based, multiplatform eTextbook Reader, eTextbooks and supplemental course materials are available from approximately 120 publishers as of June 30, 2017. We offer our eTextbooks on a standalone basis or as a rental-equivalent solution and for free to students awaiting the arrival of their print textbook rental.

We also use our website to rent and sell, on behalf of Ingram and textbook publishers, as well as source for used print textbooks for our partner Ingram. We attract students to our website by offering more for their used print textbooks than they could generally get by selling them back to their campus bookstore.

In the aggregate, Required Materials revenues were 21% and 28% of net revenues during the three and six months ended June 30, 2017, respectively, and 44% and 54% of net revenues during the three and six months ended June 30, 2016, respectively.

Strategic Partnership with Ingram

Our strategic partnership with Ingram has helped to accelerate the growth of our Chegg Services products by allowing us to utilize capital otherwise spent on the purchase of print textbooks, and at the same time allowing us to maintain a leading position and high brand recognition through our iconic orange boxes. We entered into a definitive inventory purchase and consignment agreement with Ingram that allows us to focus on eTextbooks and Chegg Services. Under the agreement, since May 2015, Ingram has been responsible for all new investments in the print textbook library, fulfillment logistics, and has title and risk of loss related to print textbook rentals. As a result of our strategic partnership with Ingram, our revenues include a commission on the total revenues that we earn from Ingram upon their fulfillment of a rental transaction using print textbooks for which Ingram has title and risk of loss. This partnership allows us to reduce and eliminate the operating expenses we historically incurred to acquire and maintain a print textbook library. We will continue to buy books on Ingram’s behalf including books through our buyback program and invoice Ingram at cost.

Risks Associated with our Business and an Investment in our Common Stock

Our business, financial condition, results of operations and prospects are subject to numerous risks. These risks include, among others, that:

|

|

|

|

•

|

our limited operating history, recent business model transition and evolving digital offerings make it difficult to evaluate our current business and future prospects;

|

|

|

|

|

•

|

our operating results are expected to be difficult to predict based on a number of factors;

|

|

|

|

|

•

|

we have a history of losses and we may not achieve or sustain profitability in the future;

|

|

|

|

|

•

|

we operate in a rapidly changing market and we have recently transitioned our business model to a fully digital business, and if we do not successfully adapt to known or unforeseen market developments, our business may be harmed;

|

|

|

|

|

•

|

if our efforts to attract new students to use our products and services and increase student engagement with our connected learning platform are not successful, our business will be adversely affected;

|

|

|

|

|

•

|

if our efforts to build a strong brand are not successful, we may not be able to grow our student user base, which could adversely affect our operating results;

|

|

|

|

|

•

|

we intend to offer new products and services to students to grow our business, and if our efforts are not successful, our business and financing results would be adversely affected;

|

|

|

|

|

•

|

our future revenues depend on our ability to continue to attract new students from a high school and college student population that has an inherently high rate of turnover primarily due to graduation, requiring us to invest continuously in marketing to the student population to build brand awareness and loyalty, which we may not be able to accomplish on a cost-effective basis or at all;

|

|

|

|

|

•

|

if we are not able to manage the growth of our business both in terms of scale and complexity, our operating results and financial condition could be adversely affected; and

|

|

|

|

|

•

|

we may not realize the anticipated benefits of past and any future acquisitions, which could disrupt our business and harm our financial condition and results of operations.

|

If we are unable to adequately address these and other risks we face, our business, financial condition, results of operations and prospects may be materially and adversely affected. In addition, there are numerous risks related to an investment in our common stock.

You should carefully read the section entitled “Risk Factors” in this prospectus and contained in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2017 for an explanation of the foregoing risks, as well as other risks, before investing in our common stock.

Company Information

We were incorporated in Delaware in July 2005. We launched our online print textbook rental business in 2007. We hired our current Chief Executive Officer in 2010, who implemented our current business strategy to create the leading student-first connected learning platform for students to help them improve their outcomes. Beginning in 2010, we made a series of strategic acquisitions to expand our Chegg Services, including Cramster in 2010 to add our Chegg Study service, InstaEDU in 2014 to add our Tutoring service, internships.com in 2014 to add to our Internship service, and Imagine Easy Solutions in 2016 to add a portfolio of online writing tools. We completed our initial public offering in November 2013 and our common stock is listed on the New York Stock Exchange under the symbol “CHGG.” Our principal executive offices are located at 3990 Freedom Circle, Santa Clara, California 95054 and our telephone number is (408) 855-5700.

We use various trademarks and trade names in our business, including without limitation “Chegg,” “Chegg.com,” “Chegg Study,” “internships.com” and “EasyBib.” This prospectus also contains trademarks and trade names of other businesses that are the property of their respective holders. We have omitted the

®

and ™ designations, as applicable, for the trademarks we name in this prospectus.

THE OFFERING

|

|

|

|

|

|

|

Common stock offered by us

|

|

10,000,000 shares

|

|

|

|

|

Common stock to be outstanding after this offering

|

|

105,684,945 shares

|

|

|

|

|

Option to purchase additional shares of common stock from us

|

|

1,500,000 shares

|

|

|

|

|

Use of proceeds

|

|

We plan to use the net proceeds from this offering for working capital and other general corporate purposes, which may include acquisitions of businesses, technologies, or other assets. See “Use of Proceeds.”

|

|

|

|

|

Risk factors

|

|

See “Risk Factors” for a discussion of factors that you should consider carefully before deciding whether to purchase shares of our common stock.

|

|

|

|

|

New York Stock Exchange symbol

|

|

“CHGG”

|

The number of shares of common stock to be outstanding after this offering is based on

95,684,945

shares of our common stock outstanding as of June 30, 2017, and excludes:

• 9,819,342 shares of common stock issuable upon the exercise of outstanding stock options as of June 30, 2017, with a weighted-average exercise price of $8.65 per share;

• 15,059,800 shares subject to performance-based or other restricted stock units, or RSUs, outstanding as of June 30, 2017;

• 141,290 shares subject to RSUs granted after June 30, 2017;

• 200,000 shares of common stock issuable upon the exercise of warrants to purchase common stock outstanding as of June 30, 2017 with an exercise price of $12.00 per share;

• 11,017,995 shares of common stock reserved for future issuance under our 2013 Equity Incentive Plan as of June 30, 2017, plus annual increases thereunder; and

• 5,990,343 shares of common stock reserved for future issuance under our 2013 Employee Stock Purchase Plan as of June 30, 2017, plus annual increases thereunder.

Unless otherwise noted, all information in this prospectus assumes no exercise of the underwriters’ option to purchase additional shares of common stock from us and no exercise of outstanding stock options or warrants, and does not reflect the vesting of any RSUs outstanding as of June 30, 2017.

SUMMARY CONSOLIDATED FINANCIAL DATA

The following table summarizes our consolidated financial data. The summary consolidated statements of operations data for the years ended December 31, 2016, 2015 and 2014 and our summary consolidated balance sheet data as of December 31, 2016 and 2015 are derived from our audited consolidated financial statements incorporated by reference into this prospectus. The selected consolidated statements of operations data for the six months ended June 30, 2017 and 2016 and the selected consolidated balance sheet data as of June 30, 2017 are derived from our unaudited consolidated financial statements incorporated by reference into this prospectus. Our historical results presented below are not necessarily indicative of financial results to be achieved in future periods and our results for interim periods are not necessarily indicative of financial results to be achieved for the full year. You should read the following summary consolidated financial data in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our audited consolidated financial statements and related notes, each included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2016, which is incorporated herein by reference into this prospectus, as well as “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our unaudited consolidated financial statements and related notes, each included in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2017, which is incorporated herein by reference into this prospectus.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30,

|

|

Year Ended December 31,

|

|

|

2017

|

|

2016

|

|

2016

|

|

2015

|

|

2014

|

|

|

(unaudited)

|

|

|

|

|

|

|

|

|

(in thousands, except per share amounts)

|

|

Consolidated Statements of Operations Data:

|

|

|

|

|

|

|

|

|

|

|

Net revenues

|

$

|

118,919

|

|

|

$

|

119,690

|

|

|

$

|

254,090

|

|

|

$

|

301,373

|

|

|

$

|

304,834

|

|

|

Cost of revenues

(1)

:

|

38,438

|

|

|

60,330

|

|

|

119,601

|

|

|

189,849

|

|

|

210,985

|

|

|

Gross profit

|

80,481

|

|

|

59,360

|

|

|

134,489

|

|

|

111,524

|

|

|

93,849

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

Technology and development

(1)

|

39,201

|

|

|

32,991

|

|

|

66,331

|

|

|

59,391

|

|

|

49,386

|

|

|

Sales and marketing

(1)

|

26,062

|

|

|

26,193

|

|

|

53,949

|

|

|

64,082

|

|

|

72,315

|

|

|

General and administrative

(1)

|

29,843

|

|

|

27,235

|

|

|

55,372

|

|

|

45,209

|

|

|

41,837

|

|

|

Restructuring charges (credits)

|

959

|

|

|

(198

|

)

|

|

(423

|

)

|

|

4,868

|

|

|

—

|

|

|

Gain on liquidation of textbooks

|

(4,766

|

)

|

|

(3,196

|

)

|

|

(670

|

)

|

|

(4,326

|

)

|

|

(4,555

|

)

|

|

Total operating expenses

|

91,299

|

|

|

83,025

|

|

|

174,559

|

|

|

169,224

|

|

|

158,983

|

|

|

Loss from operations

|

(10,818

|

)

|

|

(23,665

|

)

|

|

(40,070

|

)

|

|

(57,700

|

)

|

|

(65,134

|

)

|

|

Interest expense and other (expense) income, net

|

(245

|

)

|

|

(119

|

)

|

|

(468

|

)

|

|

(31

|

)

|

|

562

|

|

|

Loss before provision for income taxes

|

(11,063

|

)

|

|

(23,784

|

)

|

|

(40,538

|

)

|

|

(57,731

|

)

|

|

(64,572

|

)

|

|

Provision for income taxes

|

1,363

|

|

|

909

|

|

|

1,707

|

|

|

1,479

|

|

|

186

|

|

|

Net loss

|

$

|

(12,426

|

)

|

|

$

|

(24,693

|

)

|

|

$

|

(42,245

|

)

|

|

$

|

(59,210

|

)

|

|

$

|

(64,758

|

)

|

|

Net loss per share, basic and diluted

|

$

|

(0.13

|

)

|

|

$

|

(0.28

|

)

|

|

$

|

(0.47

|

)

|

|

$

|

(0.68

|

)

|

|

$

|

(0.78

|

)

|

|

Weighted average shares used to compute net loss per share, basic and diluted

|

93,943

|

|

|

89,767

|

|

|

90,534

|

|

|

86,818

|

|

|

83,205

|

|

_____________

|

|

|

|

(1)

|

Includes stock-based compensation expense as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30,

|

|

Year Ended December 31,

|

|

|

2017

|

|

2016

|

|

2016

|

|

2015

|

|

2014

|

|

|

(unaudited)

|

|

|

|

|

|

|

|

|

(in thousands)

|

|

Cost of revenues

|

$

|

155

|

|

|

$

|

69

|

|

|

$

|

172

|

|

|

$

|

262

|

|

|

$

|

617

|

|

|

Technology and development

|

6,628

|

|

|

7,758

|

|

|

14,771

|

|

|

11,992

|

|

|

10,451

|

|

|

Sales and marketing

|

2,327

|

|

|

3,851

|

|

|

6,124

|

|

|

7,901

|

|

|

11,300

|

|

|

General and administrative

|

8,267

|

|

|

10,813

|

|

|

20,718

|

|

|

18,620

|

|

|

14,520

|

|

|

Total stock-based compensation expense

|

$

|

17,377

|

|

|

$

|

22,491

|

|

|

$

|

41,785

|

|

|

$

|

38,775

|

|

|

$

|

36,888

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of June 30, 2017

|

|

As of December 31,

|

|

|

Actual

|

|

As

Adjusted

(1)

|

|

2016

|

|

2015

|

|

|

(unaudited)

|

|

|

|

|

|

|

(in thousands)

|

|

Consolidated Balance Sheets Data:

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

$

|

66,086

|

|

|

$

|

194,433

|

|

|

$

|

77,329

|

|

|

$

|

67,029

|

|

|

Total assets

|

268,157

|

|

|

396,504

|

|

|

290,652

|

|

|

291,356

|

|

|

Total stockholders’ equity

|

222,056

|

|

|

350,403

|

|

|

221,939

|

|

|

231,075

|

|

_____________

|

|

|

|

(1)

|

The as adjusted consolidated balance sheet data above gives effect to our receipt of the net proceeds from the sale by us in this offering of 10,000,000 shares of common stock at the public offering price of $13.50 per share and after deducting underwriting discounts and commissions and estimated offering expenses payable by us.

|

.

RISK FACTORS

An investment in our securities involves a high degree of risk. Prior to making a decision about investing in our securities, you should carefully consider the risk factors described below together with all of the risks, uncertainties and assumptions discussed under Part II, Item 1A, “Risk Factors,” in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2017, which is incorporated herein by reference, and may be amended, supplemented or superseded from time to time by other reports we file with the Securities and Exchange Commission, or SEC, in the future. If any of the risks incorporated by reference or set forth below occurs, our business, results of operations and financial condition could suffer significantly. As a result, you could lose some or all of your investment in our common stock. The risks and uncertainties we have described are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business, results of operations and financial condition, or cause the value of our common stock to decline.

Our management will have broad discretion as to the use of the proceeds from this offering and we may not use the proceeds effectively.

Our management will have broad discretion in the application of the net proceeds from this offering and could spend the proceeds in ways that do not improve our results of operations or enhance the value of our common stock. You will be relying on the judgment of our management concerning these uses and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately. The failure of our management to apply these funds effectively could result in unfavorable returns and uncertainty about our prospects, each of which could cause the price of our common stock to decline.

If you purchase shares of common stock sold in this offering you will experience immediate and substantial dilution in your investment. You will experience further dilution if we issue additional equity securities in the future.

Since the price per share of our common stock being offered is substantially higher than the net tangible book value per share of our common stock, you will suffer substantial dilution with respect to the net tangible book value of the shares of common stock you purchase in this offering. Based on the

public offering price of $13.50 per share

and our net tangible book value as of June 30, 2017, if you purchase shares of common stock in this offering, you will suffer immediate and substantial dilution of

$11.02

per share with respect to the net tangible book value of the common stock. See “Dilution” for a more detailed discussion of the dilution you will incur if you purchase shares of common stock in this offering.

In addition, we have a significant number of stock options outstanding as well as shares subject to restricted stock units, or RSUs, and warrants outstanding and may also choose to issue additional common stock, or securities convertible into or exchangeable for common stock, in the future. In the event that the outstanding stock options or warrants are exercised and the RSUs are settled, or that we make additional issuances of common stock or other convertible or exchangeable securities, you will experience additional dilution.

Future sales of a substantial number of shares of our common stock by our existing stockholders could cause our stock price to decline.

The market price of our common stock could decline as a result of sales of substantial amounts of our common stock in the public market after the closing of this offering, or the perception that these sales could occur. For example, certain of our stockholders possess rights with respect to the registration of their shares under the Securities Act of 1933, as amended, or the Securities Act. Registration of these shares under the Securities Act would result in the shares becoming freely tradable without restriction under the Securities Act.

In addition, we have a significant number of stock options outstanding as well as RSUs outstanding. If a substantial number of shares of common stock underlying these stock options or RSUs are sold, or if it is perceived that they will be sold, in the public market, the trading price of our common stock could decline.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, including the documents incorporated into this prospectus by reference, contains forward-looking statements. All statements contained in or incorporated by reference in this prospectus other than statements of historical fact, including statements regarding our future results of operations and financial position, our business strategy and plans, and our objectives for future operations, are forward-looking statements. The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “seek” and similar expressions are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in the “Risk Factors” section. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. Also, forward-looking statements represent our management’s beliefs and assumptions only as of the date of this prospectus. In light of these risks, uncertainties and assumptions, the future events and trends discussed in this prospectus may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Although we undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise, you are advised to review any additional disclosures we make in the documents we subsequently file with the SEC that are incorporated by reference in this prospectus. See “Where You Can Find Additional Information.”

INDUSTRY AND MARKET DATA

This prospectus also contains statistical data, estimates and forecasts that are based on independent industry publications, including by comScore, and on assumptions we have made based on such data and other similar sources and our knowledge of the markets for our solutions. Although we believe that third-party sources referred to in this prospectus are reliable, neither we nor the underwriters have independently verified the information provided by these third parties. While we are not aware of any misstatements regarding any third-party information presented in this prospectus, their estimates, in particular, as they relate to projections, involve numerous assumptions, are subject to risks and uncertainties, and are subject to change based on various factors, including those described in the “Risk Factors” section and elsewhere in this prospectus.

Certain information in the test of this prospectus is contained in independent industry publications, The source of, and selected additional information contained in, these independent industry publications are provided below:

(1) comScore U.S. Annual Unique Visitors (Custom Analytics), Apr 2015 - Mar 2016

(2) comScore U.S. Annual Unique Visitors (Custom Analytics), Oct 2015 - Sept 2016

USE OF PROCEEDS

We estimate that our net proceeds from the common stock that we are selling in this offering will be approximately $

128.3

million, or approximately $

147.7

million if the underwriters exercise in full their option to purchase additional shares, based on the public offering price of $13.50 per share and after deducting underwriting discounts and commissions and estimated offering expenses payable by us.

The principal purpose of this offering is to obtain additional capital. We intend to use the net proceeds to us from this offering for working capital and other general corporate purposes, which may include acquisitions of businesses, technologies, or other assets.

Pending other uses, we intend to invest the proceeds to us in short- and intermediate-term, interest-bearing obligations, investment-grade instruments, certificates of deposit or direct or guaranteed obligations of the U.S. government. We cannot predict whether the proceeds invested will yield a favorable return. Our management will have broad discretion in the application of the net proceeds we receive from this offering, and investors will be relying on the judgment of our management regarding the application of the net proceeds.

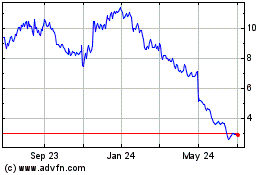

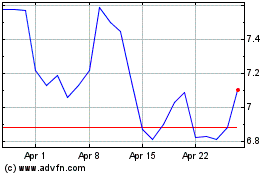

PRICE RANGE OF COMMON STOCK

Our common stock has been listed on the New York Stock Exchange under the symbol “CHGG” since November 13, 2013. Prior to that date there was no public trading market for our common stock. The following table presents, for the periods indicated, the high and low intraday sales prices per share of our common stock as reported on the New York Stock Exchange.

|

|

|

|

|

|

|

|

|

|

|

|

|

High

|

|

Low

|

|

Fiscal Year ended December 31, 2015

|

|

|

|

|

First Fiscal Quarter

|

$

|

8.85

|

|

|

$

|

6.35

|

|

|

Second Fiscal Quarter

|

$

|

8.77

|

|

|

$

|

7.20

|

|

|

Third Fiscal Quarter

|

$

|

8.84

|

|

|

$

|

6.90

|

|

|

Fourth Fiscal Quarter

|

$

|

8.03

|

|

|

$

|

6.55

|

|

|

Fiscal Year ended December 31, 2016

|

|

|

|

|

First Fiscal Quarter

|

$

|

6.67

|

|

|

$

|

3.15

|

|

|

Second Fiscal Quarter

|

$

|

5.13

|

|

|

$

|

4.26

|

|

|

Third Fiscal Quarter

|

$

|

7.29

|

|

|

$

|

4.82

|

|

|

Fourth Fiscal Quarter

|

$

|

8.57

|

|

|

$

|

6.51

|

|

|

Fiscal Year ending December 31, 2017

|

|

|

|

|

First Fiscal Quarter

|

$

|

8.47

|

|

|

$

|

6.84

|

|

|

Second Fiscal Quarter

|

$

|

13.10

|

|

|

$

|

8.04

|

|

|

Third Fiscal Quarter (through August 2, 2017)

|

$

|

15.37

|

|

|

$

|

11.93

|

|

On August 2, 2017, the reported closing sale price of our common stock on the New York Stock Exchange was $14.05 per share. As of August 2, 2017, there were approximately 59 holders of record of our common stock. The actual number of stockholders is greater than this number of record holders, and includes stockholders who are beneficial owners, but whose shares are held in street name by brokers and other nominees. This number of holders of record also does not include stockholders whose shares may be held in trust by other entities.

DIVIDEND POLICY

We have never declared or paid cash dividends on our common stock. We currently intend to retain any future earnings and do not expect to pay any dividends in the foreseeable future. Any determination to pay dividends in the future will be at the discretion of our board of directors, subject to applicable laws, and will be dependent on a number of factors, including our earnings, capital requirements, and overall financial conditions. In addition, our credit facility contains restrictions on our ability to pay dividends.

CAPITALIZATION

The following table sets forth our cash and capitalization as of June 30, 2017:

|

|

|

|

•

|

on an actual basis; and

|

|

|

|

|

•

|

on an as adjusted basis to give effect to the receipt of the net proceeds from the sale in this offering of 10,000,000 shares of common stock, based on the public offering price of $13.50 per share, after deducting underwriting discounts and commissions and estimated offering expenses payable by us.

|

You should read this table together with our consolidated financial statements and related notes, and the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2017 which is incorporated by reference in this prospectus.

|

|

|

|

|

|

|

|

|

|

|

|

|

As of June 30, 2017

|

|

|

Actual

|

|

As Adjusted

|

|

|

(in thousands, except share and per share amounts)

|

|

Cash

|

$

|

66,086

|

|

|

$

|

194,433

|

|

|

|

|

|

|

|

Stockholders’ equity:

|

|

|

|

|

Preferred stock, par value $0.001 per share, 10,000,000 shares authorized; no shares issued and outstanding, actual and as adjusted

|

—

|

|

|

—

|

|

|

Common stock, $0.001 par value per share, 400,000,000 shares authorized; 95,684,945 shares issued and outstanding, actual; 105,684,945 shares issued and outstanding, as adjusted

|

96

|

|

|

106

|

|

|

Additional paid-in capital

|

605,638

|

|

|

733,975

|

|

|

Accumulated other comprehensive income

|

76

|

|

|

76

|

|

|

Accumulated deficit

|

(383,754

|

)

|

|

(383,754

|

)

|

|

Total stockholders’ equity

|

222,056

|

|

|

350,403

|

|

|

Total capitalization

|

$

|

222,056

|

|

|

$

|

350,403

|

|

The number of shares of common stock issued and outstanding, actual and as adjusted, in the table above excludes:

• 9,819,342 shares of common stock issuable upon the exercise of outstanding stock options as of June 30, 2017, with a weighted-average exercise price of $8.65 per share;

• 15,059,800 shares subject to performance-based or other RSUs, outstanding as of June 30, 2017;

• 141,290 shares subject to RSUs granted after June 30, 2017;

• 200,000 shares of common stock issuable upon the exercise of warrants to purchase common stock outstanding as of June 30, 2017 with an exercise price of $12.00 per share;

• 11,017,995 shares of common stock reserved for future issuance under our 2013 Equity Incentive Plan as of June 30, 2017, plus annual increases thereunder; and

• 5,990,343 shares of common stock reserved for future issuance under our 2013 Employee Stock Purchase Plan as of June 30, 2017, plus annual increases thereunder.

DILUTION

If you invest in our common stock, your interest will be diluted to the extent of the difference between the amount per share paid by purchasers of shares of common stock in this public offering and the as adjusted net tangible book value per share of our common stock immediately after this offering.

As of June 30, 2017, our net tangible book value was approximately

$133.9 million

, or

$1.40

per share of common stock. Net tangible book value per share represents the amount of our total tangible assets less our total liabilities, divided by the shares of common stock outstanding at June 30, 2017. After giving effect to our sale of 10,000,000 shares of common stock in this offering at the public offering price of $13.50 per share, and after deducting underwriting discounts and commissions and estimated offering expenses payable by us, our as adjusted net tangible book value at June 30, 2017 would have been approximately

$262.3

million, or

$2.48

per share of common stock. This represents an immediate increase in as adjusted net tangible book value of

$1.08

per share to existing stockholders and an immediate dilution of

$11.02

per share to new investors.

The following table illustrates this dilution:

|

|

|

|

|

|

|

|

|

|

|

|

Public offering price per share

|

|

|

$

|

13.50

|

|

|

Net tangible book value per share as of June 30, 2017

|

$

|

1.40

|

|

|

|

|

Increase per share attributable to this offering

|

$

|

1.08

|

|

|

|

|

As adjusted net tangible book value per share after giving effect to this offering

|

|

|

$

|

2.48

|

|

|

Net tangible book value dilution per share to investors in this offering

|

|

|

$

|

11.02

|

|

If the underwriters exercise in full their option to purchase additional shares, the as adjusted net tangible book value per share after giving effect to this offering would be

$2.63

per share and the dilution in net tangible book value per share to investors in this offering would be

$10.87

per share.

The foregoing calculations are based on 95,684,945 shares of our common stock outstanding as of June 30, 2017, and exclude:

• 9,819,342 shares of common stock issuable upon the exercise of outstanding stock options as of June 30, 2017, with a weighted-average exercise price of $8.65 per share;

• 15,059,800 shares subject to performance-based or other RSUs, outstanding as of June 30, 2017;

• 141,290 shares subject to RSUs granted after June 30, 2017;

• 200,000 shares of common stock issuable upon the exercise of warrants to purchase common stock outstanding as of June 30, 2017 with an exercise price of $12.00 per share;

• 11,017,995 shares of common stock reserved for future issuance under our 2013 Equity Incentive Plan as of June 30, 2017, plus annual increases thereunder; and

• 5,990,343 shares of common stock reserved for future issuance under our 2013 Employee Stock Purchase Plan as of June 30, 2017, plus annual increases thereunder.

MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES

FOR NON-U.S. HOLDERS OF OUR COMMON STOCK

The following summary describes the material U.S. federal income tax consequences of the acquisition, ownership and disposition of our common stock acquired in this offering by Non-U.S. Holders (as defined below). This discussion does not address all aspects of U.S. federal income taxes, does not discuss the potential application of the alternative minimum tax or Medicare Contribution tax and does not deal with state or local taxes, U.S. federal gift and estate tax laws, except to the limited extent provided below, or any non-U.S. tax consequences that may be relevant to Non-U.S. Holders in light of their particular circumstances.

Special rules different from those described below may apply to certain Non-U.S. Holders that are subject to special treatment under the Internal Revenue Code of 1986, as amended, or Code, such as:

|

|

|

|

•

|

insurance companies, banks and other financial institutions;

|

|

|

|

|

•

|

tax-exempt organizations (including private foundations) and tax-qualified retirement plans;

|

|

|

|

|

•

|

foreign governments and international organizations;

|

|

|

|

|

•

|

broker-dealers and traders in securities;

|

|

|

|

|

•

|

U.S. expatriates and certain former citizens or long-term residents of the United States;

|

|

|

|

|

•

|

persons that own, or are deemed to own, more than 5% of our capital stock;

|

|

|

|

|

•

|

“controlled foreign corporations,” “passive foreign investment companies” and corporations that accumulate earnings to avoid U.S. federal income tax;

|

|

|

|

|

•

|

persons that hold our common stock as part of a “straddle,” “hedge,” “conversion transaction,” “synthetic security” or integrated investment or other risk reduction strategy;

|

|

|

|

|

•

|

persons who do not hold our common stock as a capital asset within the meaning of Section 1221 of the Code (generally, for investment purposes); and

|

|

|

|

|

•

|

partnerships and other pass-through entities, and investors in such pass-through entities (regardless of their places of organization or formation).

|

Such Non-U.S. Holders are urged to consult their own tax advisors to determine the U.S. federal, state, local and other tax consequences that may be relevant to them.

Furthermore, the discussion below is based upon the provisions of the Code, and Treasury regulations, rulings and judicial decisions thereunder as of the date hereof, and such authorities may be repealed, revoked or modified, possibly retroactively, and are subject to differing interpretations which could result in U.S. federal income tax consequences different from those discussed below. We have not requested a ruling from the Internal Revenue Service, or IRS, with respect to the statements made and the conclusions reached in the following summary, and there can be no assurance that the IRS will agree with such statements and conclusions or will not take a contrary position regarding the tax consequences described herein, or that any such contrary position would not be sustained by a court.

PERSONS CONSIDERING THE PURCHASE OF OUR COMMON STOCK PURSUANT TO THIS OFFERING SHOULD CONSULT THEIR OWN TAX ADVISORS CONCERNING THE U.S. FEDERAL INCOME TAX CONSEQUENCES OF ACQUIRING, OWNING AND DISPOSING OF OUR COMMON STOCK IN LIGHT OF THEIR PARTICULAR SITUATIONS AS WELL AS ANY CONSEQUENCES ARISING UNDER THE LAWS OF ANY OTHER TAXING JURISDICTION, INCLUDING ANY STATE, LOCAL OR NON-U.S. TAX CONSEQUENCES OR ANY U.S. FEDERAL NON-INCOME TAX CONSEQUENCES, AND THE POSSIBLE APPLICATION OF TAX TREATIES.

For the purposes of this discussion, a “Non-U.S. Holder” is, for U.S. federal income tax purposes, a beneficial owner of common stock that is not a U.S. Holder or a partnership for U.S. federal income tax purposes. A “U.S. Holder”

means a beneficial owner of our common stock that is for U.S. federal income tax purposes (a) an individual citizen or resident of the United States, (b) a corporation (or other entity taxable as a corporation for U.S. federal income tax purposes), created or organized in or under the laws of the United States, any state thereof or the District of Columbia, (c) an estate the income of which is subject to U.S. federal income taxation regardless of its source, or (d) a trust if it (1) is subject to the primary supervision of a court within the United States and one or more U.S. persons (within the meaning of Section 7701(a)(30) of the Code) have the authority to control all substantial decisions of the trust or (2) has a valid election in effect under applicable U.S. Treasury regulations to be treated as a U.S. person.

If you are an individual non-U.S. citizen, you may, in some cases, be deemed to be a resident alien (as opposed to a nonresident alien) by virtue of being present in the United States for at least 31 days in the calendar year and for an aggregate of at least 183 days during a three-year period ending in the current calendar year. Generally, for this purpose, all the days present in the current year, one-third of the days present in the immediately preceding year, and one-sixth of the days present in the second preceding year, are counted.

Resident aliens are generally subject to U.S. federal income tax as if they were U.S. citizens. Individuals who are uncertain of their status as resident or nonresident aliens for U.S. federal income tax purposes are urged to consult their own tax advisors regarding the U.S. federal income tax consequences of the ownership or disposition of our common stock.

Distributions

We do not expect to make any distributions on our common stock in the foreseeable future. If we do make distributions on our common stock, however, such distributions made to a Non-U.S. Holder of our common stock will constitute dividends for U.S. tax purposes to the extent paid out of our current or accumulated earnings and profits (as determined under U.S. federal income tax principles). Distributions in excess of our current and accumulated earnings and profits will constitute a return of capital that is applied against and reduces, but not below zero, a Non-U.S. Holder's adjusted tax basis in our common stock. Any remaining excess will be treated as gain realized on the sale or exchange of our common stock as described below under the section titled “—Gain on Disposition of Our Common Stock.”

Any distribution on our common stock that is treated as a dividend paid to a Non-U.S. Holder that is not effectively connected with the holder's conduct of a trade or business in the United States will generally be subject to withholding tax at a 30% rate or such lower rate as may be specified by an applicable income tax treaty between the United States and the Non-U.S. Holder's country of residence. To obtain a reduced rate of withholding under a treaty, a Non-U.S. Holder generally will be required to provide the applicable withholding agent with a properly executed IRS Form W-8BEN, IRS Form W-8BEN-E or other appropriate form, certifying the Non-U.S. Holder's entitlement to benefits under that treaty. Such form must be provided prior to the payment of dividends and must be updated periodically. If a Non-U.S. Holder holds stock through a financial institution or other agent acting on the holder's behalf, the holder will be required to provide appropriate documentation to such agent. The holder's agent may then be required to provide certification to the applicable withholding agent, either directly or through other intermediaries. If you are eligible for a reduced rate of U.S. withholding tax under an income tax treaty, you should consult with your own tax advisor to determine if you are able to obtain a refund or credit of any excess amounts withheld by timely filing an appropriate claim for a refund with the IRS.

We generally are not required to withhold tax on dividends paid to a Non-U.S. Holder that are effectively connected with the holder's conduct of a trade or business within the United States (and, if required by an applicable income tax treaty, are attributable to a permanent establishment that the holder maintains in the United States) if a properly executed IRS Form W-8ECI, stating that the dividends are so connected, is furnished to us (or, if stock is held through a financial institution or other agent, to the applicable withholding agent). In general, such effectively connected dividends will be subject to U.S. federal income tax on a net income basis at the regular graduated rates applicable to U.S. persons, unless a specific treaty exemption applies. A corporate Non-U.S. Holder receiving effectively connected dividends may also be subject to an additional “branch profits tax,” which is imposed, under certain circumstances, at a rate of 30% (or such lower rate as may be specified by an applicable treaty) on the corporate Non-U.S. Holder's effectively connected earnings and profits, subject to certain adjustments.

See also the section below titled “—Foreign Accounts” for additional withholding rules that may apply to dividends paid to certain foreign financial institutions or non-financial foreign entities.

Gain on Disposition of Our Common Stock

Subject to the discussions below under the sections titled “—Backup Withholding and Information Reporting” and “—Foreign Accounts,” a Non-U.S. Holder generally will not be subject to U.S. federal income or withholding tax with respect to gain realized on a sale or other disposition of our common stock unless (a) the gain is effectively connected with a trade or business of the holder in the United States (and, if required by an applicable income tax treaty, is attributable to a permanent establishment that the holder maintains in the United States), (b) the Non-U.S. Holder is a nonresident alien individual and is present in the United States for 183 or more days in the taxable year of the disposition and certain other conditions are met, or (c) we are or have been a “United States real property holding corporation” within the meaning of Code Section 897(c)(2) at any time within the shorter of the five-year period preceding such disposition or the holder's holding period in the common stock.

If you are a Non-U.S. Holder described in (a) above, you will be required to pay tax on the net gain derived from the sale at the regular graduated U.S. federal income tax rates applicable to U.S. persons, unless a specific treaty exemption applies. Corporate Non-U.S. Holders described in (a) above may also be subject to the additional branch profits tax at a 30% rate or such lower rate as may be specified by an applicable income tax treaty. If you are an individual Non-U.S. Holder described in (b) above, you will be required to pay a flat 30% tax on the gain derived from the sale, which gain may be offset by U.S. source capital losses (even though you are not considered a resident of the United States), provided you have timely filed U.S. federal income tax returns with respect to such losses. With respect to (c) above, in general, we would be a United States real property holding corporation if U.S. real property interests, as defined in the Code and applicable Treasury regulations, comprised (by fair market value) at least half of our assets. We believe that we are not, and do not anticipate becoming, a United States real property holding corporation. However, there can be no assurance that we will not become a United States real property holding corporation in the future. Even if we are treated as a United States real property holding corporation, gain realized by a Non-U.S. Holder on a disposition of our common stock will not be subject to U.S. federal income tax so long as (1) the Non-U.S. Holder owned, directly, indirectly or constructively, no more than five percent of our common stock at all times within the shorter of (i) the five-year period preceding the disposition or (ii) the holder's holding period and (2) our common stock is regularly traded on an established securities market. There can be no assurance that our common stock will continue to qualify as regularly traded on an established securities market.

See the section titled “—Foreign Accounts” for additional information regarding withholding rules that may apply to proceeds of a disposition of our common stock paid to foreign financial institutions or non-financial foreign entities.

U.S. Federal Estate Tax

The estates of nonresident alien individuals generally are subject to U.S. federal estate tax on property with a U.S. situs. Because we are a U.S. corporation, our common stock will be U.S. situs property and, therefore, will be included in the taxable estate of a nonresident alien decedent, unless an applicable estate tax treaty between the United States and the decedent's country of residence provides otherwise. The terms “resident” and “nonresident” are defined differently for U.S. federal estate tax purposes than for U.S. federal income tax purposes. Investors are urged to consult their own tax advisors regarding the U.S. federal estate tax consequences of the ownership or disposition of our common stock.

Backup Withholding and Information Reporting

Generally, we or certain financial middlemen must report information to the IRS with respect to any dividends we pay on our common stock including the amount of any such dividends, the name and address of the recipient, and the amount, if any, of tax withheld. A similar report is sent to the holder to whom any such dividends are paid. Pursuant to tax treaties or certain other agreements, the IRS may make its reports available to tax authorities in the recipient's country of residence.

Dividends paid by us (or our paying agents) to a Non-U.S. Holder may also be subject to U.S. backup withholding. U.S. backup withholding generally will not apply to a Non-U.S. Holder who provides a properly executed IRS Form W-8BEN or IRS Form W-8BEN-E, as applicable, or otherwise establishes an exemption, provided that the applicable withholding agent does not have actual knowledge or reason to know the holder is a U.S. person.

Under current U.S. federal income tax law, U.S. information reporting and backup withholding requirements generally will apply to the proceeds of a disposition of our common stock effected by or through a U.S. office of any broker, U.S. or non-U.S., unless the Non-U.S. Holder provides a properly executed IRS Form W-8BEN or IRS Form W-8BEN-E, as applicable, or otherwise meets documentary evidence requirements for establishing non-U.S. person status or otherwise establishes an exemption. Generally, U.S. information reporting and backup withholding requirements will not apply to a payment of disposition proceeds to a Non-U.S. Holder where the transaction is effected outside the United States through a non-U.S. office of a non-U.S. broker. Information reporting and backup withholding requirements may, however, apply to a payment of disposition proceeds if the broker has actual knowledge, or reason to know, that the holder is, in fact, a U.S. person. For information reporting purposes, certain brokers with substantial U.S. ownership or operations will generally be treated in a manner similar to U.S. brokers.

Backup withholding is not an additional tax. If backup withholding is applied to you, you should consult with your own tax advisor to determine whether you have overpaid your U.S. federal income tax, and whether you are able to obtain a tax refund or credit of the overpaid amount.

Foreign Accounts

In addition, U.S. federal withholding taxes may apply under the Foreign Account Tax Compliance Act, or FATCA, on certain types of payments, including dividends and, on or after January 1, 2019, the gross proceeds of a disposition of our common stock, made to non-U.S. financial institutions and certain other non-U.S. entities. Specifically, a 30% withholding tax may be imposed on dividends on, or, on or after January 1, 2019, gross proceeds from the sale or other disposition of, our common stock paid to a “foreign financial institution” or a “non-financial foreign entity” (each as defined in the Code), unless (1) the foreign financial institution agrees to undertake certain diligence and reporting obligations, (2) the non-financial foreign entity either certifies it does not have any “substantial United States owners” (as defined in the Code) or furnishes identifying information regarding each substantial United States owner, or (3) the foreign financial institution or non-financial foreign entity otherwise qualifies for an exemption from these rules. The 30% federal withholding tax described in this paragraph cannot be reduced under an income tax treaty with the United States. If the payee is a foreign financial institution and is subject to the diligence and reporting requirements in (1) above, it must enter into an agreement with the U.S. Department of the Treasury requiring, among other things, that it undertake to identify accounts held by certain “specified United States persons” or “United States-owned foreign entities” (each as defined in the Code), annually report certain information about such accounts, and withhold 30% on certain payments to non-compliant foreign financial institutions and certain other account holders. Foreign financial institutions located in jurisdictions that have an intergovernmental agreement with the United States governing FATCA may be subject to different rules.

Prospective investors should consult their tax advisors regarding the potential application of withholding under FATCA to their investment in our common stock.

EACH PROSPECTIVE INVESTOR SHOULD CONSULT ITS OWN TAX ADVISOR REGARDING THE TAX CONSEQUENCES OF PURCHASING, HOLDING AND DISPOSING OF OUR COMMON STOCK, INCLUDING THE CONSEQUENCES OF ANY PROPOSED CHANGE IN APPLICABLE LAW, AS WELL AS TAX CONSEQUENCES ARISING UNDER ANY STATE, LOCAL, NON-U.S. OR U.S. FEDERAL NON-INCOME TAX LAWS SUCH AS ESTATE AND GIFT TAX.

UNDERWRITERS

Under the terms and subject to the conditions in an underwriting agreement dated the date of this prospectus, the underwriters named below, for whom Morgan Stanley & Co. LLC and Merrill Lynch, Pierce, Fenner & Smith Incorporated are acting as representatives, have severally agreed to purchase, and we have agreed to sell to them, severally, the number of shares indicated below:

|

|

|

|

|

|

|

Name

|

Number of Shares

|

|

Morgan Stanley & Co. LLC

|

4,619,047

|

|

|

Merrill Lynch, Pierce, Fenner & Smith

Incorporated

|

2,771,429

|

|

|

Allen & Company LLC

|

1,847,619

|

|

|

Barrington Research Associates, Inc.

|

457,143

|

|

|

Northland Securities, Inc.

|

304,762

|

|

|

Total:

|

10,000,000

|

|

The underwriters and the representatives are collectively referred to as the “underwriters” and the “representatives,” respectively.

The underwriters are offering the shares of common stock subject to their acceptance of the shares from us and subject to prior sale. The underwriting agreement provides that the obligations of the several underwriters to pay for and accept delivery of the shares of common stock offered by this prospectus are subject to the approval of certain legal matters by their counsel and to certain other conditions. The underwriters are obligated to take and pay for all of the shares of common stock offered by this prospectus if any such shares are taken. However, the underwriters are not required to take or pay for the shares covered by the underwriters’ option to purchase additional shares described below.

The underwriters initially propose to offer part of the shares of common stock directly to the public at the offering price listed on the cover page of this prospectus and part to certain dealers. After the initial offering of the shares of common stock, the offering price and other selling terms may from time to time be varied by the representatives.

We have granted to the underwriters an option, exercisable for 30 days from the date of this prospectus, to purchase up to 1,500,000 additional shares of common stock at the public offering price listed on the cover page of this prospectus, less underwriting discounts and commissions. To the extent the option is exercised, each underwriter will become obligated, subject to certain conditions, to purchase about the same percentage of the additional shares of common stock as the number listed next to the underwriter’s name in the preceding table bears to the total number of shares of common stock listed next to the names of all underwriters in the preceding table.

The following table shows the per share and total public offering price, underwriting discounts and commissions, and proceeds before expenses to us. These amounts are shown assuming both no exercise and full exercise of the underwriters’ option to purchase up to an additional 1,500,000 shares of common stock.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

Per

Share

|

|

No

Exercise

|

|

Full

Exercise

|

|

Public offering price

|

$

|

13.50

|

|

|

$

|

135,000,000

|

|

|

$

|

155,250,000

|

|

|

Underwriting discounts and commissions to be paid by us

|

$

|

0.6075

|

|

|

$

|

6,075,000

|

|

|

$

|

6,986,250

|

|

|

Proceeds, before expenses, to us

|

$

|

12.8925

|

|

|

$

|

128,925,000

|

|

|

$

|

148,263,750

|

|

The estimated offering expenses payable by us, exclusive of the underwriting discounts and commissions, are approximately $578,500.

Our common stock is listed on the New York Stock Exchange under the trading symbol “CHGG.”

We have agreed that, without the prior written consent of Morgan Stanley & Co. LLC and Merrill Lynch, Pierce, Fenner & Smith Incorporated on behalf of the underwriters, we will not, during the period ending 90 days after the date of this prospectus (the “restricted period”): (1) offer, pledge, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase, lend or otherwise transfer or dispose of, directly or indirectly, any shares of common stock or any securities convertible into or exercisable or exchangeable for shares of common stock or (2) enter into any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership of the common stock, whether any such transaction described in (1) or (2) is to be settled by delivery of common stock or such other securities, in cash or otherwise or (3) file any registration statement with the SEC relating to the offering of any shares of common stock or any securities convertible into or exercisable or exchangeable for common stock. The restrictions described in the immediately preceding sentence a

re subject to certain exceptions, including, but not limited to, the sale or issuance of or entry into an agreement to sell or issue shares of common stock by us in connection with joint ventures, commercial relationships or other strategic transactions and our acquisition of one or more businesses, assets, products or technologies,

provided