Mueller Water Products, Inc. (NYSE:MWA) announced today that for

its fiscal third quarter ended June 30, 2017, net sales were

$232.2 million and net income was $24.0 million, or $0.15 per

diluted share compared with $0.09 in the prior year quarter.

Operating income from continuing operations was $42.6 million.

In the 2017 third quarter, we:

- Increased net sales 3.3% to $232.2 million as compared with

$224.7 million in the 2016 third quarter;

- Increased adjusted operating income from continuing operations

to $44.6 million as compared with $43.8 million in the 2016 third

quarter; and

- Improved adjusted income from continuing operations to $0.16

per diluted share as compared with $0.15 per diluted share in the

2016 third quarter. Adjusted income from continuing

operations was $25.4 million in the 2017 third quarter and $25.0

million in the 2016 third quarter.

“Overall we are pleased with third quarter net sales growth of

3.3 percent, which was about as we expected, highlighted by 4.5

percent growth at Mueller Co. Additionally, although overall

net sales declined slightly at Mueller Technologies, we experienced

net sales growth with both our AMI products and at Echologics,”

said Scott Hall, president and chief executive officer of Mueller

Water Products. “For our fourth quarter, we expect consolidated net

sales percentage growth to improve year-over-year to mid-single

digits.

“Operationally, in the third quarter we continued to execute on

our productivity plans and realize the resulting targeted cost

savings. However, higher material costs represented

stronger-than-expected headwinds in the quarter, offsetting all of

our productivity gains.

“During the quarter, we also completed our $50 million

accelerated share repurchase program and repurchased an

additional $5 million under our existing share repurchase

authorization.

“All in all, we were pleased with the quarter. Progress in

the market, progress in integrating Singer Valve, and progress in

operational improvements all met our expectations.

“Going forward, we will continue to execute on our initiatives

to drive productivity improvements, accelerate product

development and deliver exceptional value for our customers.”

Consolidated Results

Net sales increased 3.3 percent in the 2017 third quarter to

$232.2 million as compared with $224.7 million for the 2016 third

quarter. Net sales increased due to volume growth at Mueller

Co. and the February acquisition of Singer Valve.

Adjusted operating income from continuing operations increased

1.8 percent to $44.6 million as compared with $43.8 million for the

2016 third quarter. Volume growth, productivity improvements

and lower SG&A expenses were partially offset by higher

material costs.

Segment Results

Mueller Co.

Mueller Co. net sales for the 2017 third quarter increased 4.5

percent to $207.6 million as compared with $198.7 million for the

2016 third quarter. The increase was largely due to volume

growth in both the U.S. and Canada as well as the addition of

Singer Valve.

Mueller Co. operating income increased to $52.9 million in the

2017 third quarter compared with $51.7 million in the 2016 third

quarter. Adjusted operating income was $54.1 million in both

the 2017 third quarter and 2016 third quarter. Adjusted

operating income benefited from volume growth and productivity

improvements, offset by higher material costs. Adjusted

operating margin decreased 110 basis points to 26.1 percent for the

2017 third quarter compared with 27.2 percent for the 2016 third

quarter.

Mueller Technologies

Mueller Technologies net sales decreased $1.4 million to $24.6

million in the 2017 third quarter as compared with $26.0 million

for the 2016 third quarter due to lower shipment volumes.

Higher net sales of AMI and leak detection/condition assessment

products were more than offset by lower net sales of AMR and visual

read meters.

Operating loss was $1.6 million in the 2017 third quarter and

$1.5 million in the 2016 third quarter.

Interest Expense, Net

Net interest expense decreased $0.9 million to $5.1 million in

the 2017 third quarter as compared with $6.0 million in the 2016

third quarter.

Discontinued Operations

Discontinued operations pertain to our former Anvil business,

which we sold in January 2017.

Use of Non-GAAP Measures

In an effort to provide investors with additional information

regarding our results as determined by GAAP, we also provide

non-GAAP information that management believes is useful to

investors. These non-GAAP measures have limitations as

analytical tools, and securities analysts, investors and other

interested parties should not consider any of these non-GAAP

measures in isolation or as a substitute for analysis of our

results as reported under GAAP. These non-GAAP measures may

not be comparable to similarly titled measures used by other

companies.

We present adjusted income from continuing operations, adjusted

income from continuing operations per share, adjusted

operating income from continuing operations, adjusted operating

margin, adjusted EBITDA and adjusted EBITDA margin as performance

measures because management uses these measures in evaluating our

underlying performance on a consistent basis across periods and in

making decisions about operational strategies. Management

also believes these measures are frequently used by securities

analysts, investors and other interested parties in the evaluation

of our recurring performance.

We present net debt and net debt leverage as performance

measures because management uses them in evaluating its capital

management, and the investment community commonly uses them as

measures of indebtedness. We present free cash flow because

management believes it is commonly used by the investment community

to measure our ability to create liquidity.

The calculations of these non-GAAP measures and reconciliations

to GAAP results are included as an attachment to this press release

and have been posted online at www.muellerwaterproducts.com.

Conference Call Webcast

Mueller Water Products will conduct its quarterly earnings

conference call on Friday, August 4, 2017 at 9:00 a.m. ET.

Members of Mueller Water Products’ leadership team will

discuss the Company's recent financial performance and respond to

questions from financial analysts. A live webcast of the call

will be available on the Investor Relations section of our

website. Please go to our website

(www.muellerwaterproducts.com) at least 15 minutes prior to the

start of the call to register, download and install any necessary

software. A replay of the call will be available for 30 days

and can be accessed by dialing 1-866-446-5476. An archive of

the webcast will also be available on the Investor Relations

section of our website.

Forward-Looking Statements

This press release contains certain statements that may be

deemed “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. All

statements that address activities, events or developments that we

intend, expect, plan, project, believe or anticipate will or may

occur in the future are forward-looking statements.

Forward-looking statements are based on certain assumptions and

assessments made by us in light of our experience and perception of

historical trends, current conditions and expected future

developments. Examples of forward-looking statements include,

but are not limited to, statements we make regarding our

expectations for growth in our key end markets and financial

results. Actual results and the timing of events may differ

materially from those contemplated by the forward-looking

statements due to a number of factors, including regional, national

or global political, economic, business, competitive, market and

regulatory conditions and the other factors that are described in

the section entitled “RISK FACTORS” in Item 1A of our most recently

filed Annual Report on Form 10-K. Undue reliance should not

be placed on any forward-looking statements. We do not have

any intention or obligation to update forward-looking statements,

except as required by law.

About Mueller Water Products, Inc.

Mueller Water Products, Inc. (NYSE: MWA) is a leading

manufacturer and marketer of products and services used in the

transmission, distribution and measurement of water in North

America. Our broad product and service portfolio includes

engineered valves, fire hydrants, metering products and systems,

leak detection and pipe condition assessment. We help

municipalities increase operational efficiencies, improve customer

service and prioritize capital spending, demonstrating why Mueller

Water Products is Where Intelligence Meets Infrastructure®.

For more information about Mueller Water Products, visit

www.muellerwaterproducts.com.

| MUELLER WATER PRODUCTS, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE

SHEETS(UNAUDITED) |

| |

| |

June 30, |

|

September 30, |

| |

2017 |

|

2016 |

| |

(in millions, except share

amounts) |

| Assets: |

|

|

|

| Cash and

cash equivalents |

$ |

353.2 |

|

|

$ |

195.0 |

|

|

Receivables, net |

140.7 |

|

|

131.8 |

|

|

Inventories |

141.1 |

|

|

130.7 |

|

| Other

current assets |

20.0 |

|

|

12.7 |

|

| Current

assets held for sale |

— |

|

|

142.1 |

|

| Total

current assets |

655.0 |

|

|

612.3 |

|

| Property,

plant and equipment, net |

110.1 |

|

|

108.4 |

|

|

Intangible assets |

442.0 |

|

|

434.6 |

|

| Other

noncurrent assets |

27.1 |

|

|

25.4 |

|

|

Noncurrent assets held for sale |

— |

|

|

99.9 |

|

| Total

assets |

$ |

1,234.2 |

|

|

$ |

1,280.6 |

|

| |

|

|

|

| Liabilities and

equity: |

|

|

|

| Current

portion of long-term debt |

$ |

5.5 |

|

|

$ |

5.6 |

|

| Accounts

payable |

58.7 |

|

|

73.7 |

|

| Other

current liabilities |

46.9 |

|

|

61.7 |

|

| Current

liabilities held for sale |

— |

|

|

44.8 |

|

| Total

current liabilities |

111.1 |

|

|

185.8 |

|

| Long-term

debt |

475.7 |

|

|

478.8 |

|

| Deferred

income taxes |

99.0 |

|

|

109.9 |

|

| Other

noncurrent liabilities |

86.1 |

|

|

85.8 |

|

|

Noncurrent liabilities held for sale |

— |

|

|

0.8 |

|

| Total

liabilities |

771.9 |

|

|

861.1 |

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

| |

|

|

|

| Common

stock: 600,000,000 shares authorized; 158,514,187 and 161,693,051

shares outstanding at June 30,

2017 and September 30, 2016, respectively |

1.6 |

|

|

1.6 |

|

|

Additional paid-in capital |

1,497.5 |

|

|

1,563.9 |

|

|

Accumulated deficit |

(974.9 |

) |

|

(1,078.9 |

) |

|

Accumulated other comprehensive loss |

(63.0 |

) |

|

(68.3 |

) |

| Total

Company stockholders’ equity |

461.2 |

|

|

418.3 |

|

|

Noncontrolling interest |

1.1 |

|

|

1.2 |

|

| Total

equity |

462.3 |

|

|

419.5 |

|

| Total

liabilities and equity |

$ |

1,234.2 |

|

|

$ |

1,280.6 |

|

| MUELLER WATER PRODUCTS, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(UNAUDITED) |

|

|

| |

Three months ended |

|

Nine months ended |

| |

June 30, |

|

June 30, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

| |

(in millions, except per share

amounts) |

| Net sales |

$ |

232.2 |

|

|

$ |

224.7 |

|

|

$ |

599.1 |

|

|

$ |

585.0 |

|

| Cost of sales |

149.7 |

|

|

141.5 |

|

|

412.5 |

|

|

394.9 |

|

| Gross

profit |

82.5 |

|

|

83.2 |

|

|

186.6 |

|

|

190.1 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

| Selling,

general and administrative |

38.7 |

|

|

39.4 |

|

|

114.2 |

|

|

112.2 |

|

| Pension

settlement |

— |

|

|

16.6 |

|

|

— |

|

|

16.6 |

|

| Other

charges |

1.2 |

|

|

4.6 |

|

|

5.0 |

|

|

6.2 |

|

| Total

operating expenses |

39.9 |

|

|

60.6 |

|

|

119.2 |

|

|

135.0 |

|

| Operating

income |

42.6 |

|

|

22.6 |

|

|

67.4 |

|

|

55.1 |

|

| Interest expense,

net |

5.1 |

|

|

6.0 |

|

|

17.0 |

|

|

18.0 |

|

| Income

before income taxes |

37.5 |

|

|

16.6 |

|

|

50.4 |

|

|

37.1 |

|

| Income tax expense |

13.4 |

|

|

5.6 |

|

|

16.2 |

|

|

11.8 |

|

| Income

from continuing operations |

24.1 |

|

|

11.0 |

|

|

34.2 |

|

|

25.3 |

|

| Income (loss) from

discontinued operations |

(0.1 |

) |

|

4.5 |

|

|

69.8 |

|

|

12.1 |

|

| Net

income |

$ |

24.0 |

|

|

$ |

15.5 |

|

|

$ |

104.0 |

|

|

$ |

37.4 |

|

| |

|

|

|

|

|

|

|

| Income per basic

share: |

|

|

|

|

|

|

|

|

Continuing operations |

$ |

0.15 |

|

|

$ |

0.07 |

|

|

$ |

0.21 |

|

|

$ |

0.15 |

|

|

Discontinued operations |

— |

|

|

0.03 |

|

|

0.44 |

|

|

0.08 |

|

| Net

income |

$ |

0.15 |

|

|

$ |

0.10 |

|

|

$ |

0.65 |

|

|

$ |

0.23 |

|

| |

|

|

|

|

|

|

|

| Income per diluted

share: |

|

|

|

|

|

|

|

|

Continuing operations |

$ |

0.15 |

|

|

$ |

0.07 |

|

|

$ |

0.21 |

|

|

$ |

0.15 |

|

|

Discontinued operations |

— |

|

|

0.02 |

|

|

0.43 |

|

|

0.08 |

|

| Net

income |

$ |

0.15 |

|

|

$ |

0.09 |

|

|

$ |

0.64 |

|

|

$ |

0.23 |

|

| |

|

|

|

|

|

|

|

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

|

Basic |

159.1 |

|

|

161.6 |

|

|

160.6 |

|

|

161.2 |

|

|

Diluted |

160.6 |

|

|

163.6 |

|

|

162.4 |

|

|

163.3 |

|

|

|

|

|

|

|

|

|

|

| Dividends declared per

share |

$ |

0.04 |

|

|

$ |

— |

|

|

$ |

0.11 |

|

|

$ |

0.07 |

|

| MUELLER WATER PRODUCTS, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS(UNAUDITED) |

| |

|

|

Nine months ended |

| |

June 30, |

| |

2017 |

|

2016 |

| |

(in millions) |

| Operating

activities: |

|

|

|

| Net

income |

$ |

104.0 |

|

|

$ |

37.4 |

|

| Less

income from discontinued operations |

69.8 |

|

|

12.1 |

|

| Income

from continuing operations |

34.2 |

|

|

25.3 |

|

|

Adjustments to reconcile income from continuing operations to net

cash provided by operating activities of

continuing operations: |

|

|

|

|

Depreciation |

14.9 |

|

|

13.4 |

|

|

Amortization |

16.2 |

|

|

15.9 |

|

|

Stock-based compensation |

3.5 |

|

|

3.5 |

|

|

Retirement plans |

2.6 |

|

|

20.2 |

|

| Deferred

income taxes |

(14.4 |

) |

|

(8.5 |

) |

| Other,

net |

1.4 |

|

|

3.0 |

|

| Changes

in assets and liabilities, net of acquisitions: |

|

|

|

|

Receivables |

(5.8 |

) |

|

(13.0 |

) |

|

Inventories |

(4.6 |

) |

|

4.8 |

|

| Other

assets |

(4.0 |

) |

|

(5.7 |

) |

|

Liabilities |

(18.6 |

) |

|

(4.5 |

) |

| Net cash

provided by operating activities of continuing operations |

25.4 |

|

|

54.4 |

|

| Investing

activities: |

|

|

|

| Business

acquisitions, net of cash acquired |

(26.0 |

) |

|

— |

|

| Capital

expenditures |

(21.6 |

) |

|

(17.0 |

) |

| Proceeds

from sales of assets |

0.2 |

|

|

0.2 |

|

| Net cash

used in investing activities of continuing operations |

(47.4 |

) |

|

(16.8 |

) |

| Financing

activities: |

|

|

|

| Stock

repurchased under buyback program |

(55.0 |

) |

|

— |

|

|

Dividends |

(17.6 |

) |

|

(11.3 |

) |

| Employee

taxes related to stock-based compensation |

(2.7 |

) |

|

(3.2 |

) |

|

Repayments of debt |

(3.7 |

) |

|

(3.8 |

) |

| Issuance

of common stock |

5.2 |

|

|

2.9 |

|

| Deferred

financing costs |

(1.0 |

) |

|

(0.1 |

) |

|

Other |

0.2 |

|

|

(0.3 |

) |

| Net cash

used in financing activities of continuing operations |

(74.6 |

) |

|

(15.8 |

) |

| Net cash flows from

discontinued operations: |

|

|

|

| Operating

activities |

(42.5 |

) |

|

19.2 |

|

| Investing

activities |

297.2 |

|

|

(5.6 |

) |

| Financing

activities |

(0.1 |

) |

|

— |

|

| Net cash

provided by discontinued operations |

254.6 |

|

|

13.6 |

|

| Effect of currency

exchange rate changes on cash |

0.2 |

|

|

(0.2 |

) |

| Net

change in cash and cash equivalents |

158.2 |

|

|

35.2 |

|

| Cash and cash

equivalents at beginning of period |

195.0 |

|

|

113.1 |

|

| Cash and

cash equivalents at end of period |

$ |

353.2 |

|

|

$ |

148.3 |

|

| MUELLER WATER PRODUCTS, INC. AND

SUBSIDIARIESSEGMENT RESULTS AND RECONCILIATION OF

GAAP TO NON-GAAP PERFORMANCE

MEASURES(UNAUDITED) |

| |

Quarter ended June 30, 2017 |

| |

Mueller Co. |

|

MuellerTechnologies |

|

Corporate |

|

Consolidated |

| |

(dollars in millions, except per share

amounts) |

| Net sales |

$ |

207.6 |

|

|

$ |

24.6 |

|

|

$ |

— |

|

|

$ |

232.2 |

|

| |

|

|

|

|

|

|

|

| Gross profit |

$ |

76.9 |

|

|

$ |

5.6 |

|

|

$ |

— |

|

|

$ |

82.5 |

|

| Selling, general and

administrative expenses |

23.6 |

|

|

7.2 |

|

|

7.9 |

|

|

38.7 |

|

| Other charges |

0.4 |

|

|

— |

|

|

0.8 |

|

|

1.2 |

|

| Operating

income (loss) from continuing operations |

$ |

52.9 |

|

|

$ |

(1.6 |

) |

|

$ |

(8.7 |

) |

|

42.6 |

|

| Interest

expense, net |

|

|

|

|

|

|

5.1 |

|

| Income

tax expense |

|

|

|

|

|

|

13.4 |

|

| Income

from continuing operations |

|

|

|

|

|

|

$ |

24.1 |

|

| |

|

|

|

|

|

|

|

| Income from continuing

operations per diluted share |

|

|

|

|

|

|

$ |

0.15 |

|

| |

|

|

|

|

|

|

|

| Capital

expenditures |

$ |

6.1 |

|

|

$ |

1.3 |

|

|

$ |

0.1 |

|

|

$ |

7.5 |

|

| |

|

|

|

|

|

|

|

| Operating margin |

25.5 |

% |

|

(6.5 |

)% |

|

|

|

18.3 |

% |

|

|

|

|

|

|

|

|

|

| Reconciliation of

Non-GAAP performance measures to GAAP performance measures: |

|

|

|

|

|

|

|

| Income

from continuing operations |

|

|

|

|

|

|

$ |

24.1 |

|

| Inventory

purchase accounting adjustment |

|

|

|

|

|

|

0.8 |

|

| Other

charges |

|

|

|

|

|

|

1.2 |

|

| Income

tax benefit of adjusting items |

|

|

|

|

|

|

(0.7 |

) |

| Adjusted

income from continuing operations |

|

|

|

|

|

|

$ |

25.4 |

|

|

|

|

|

|

|

|

|

|

| Weighted

average diluted shares outstanding |

|

|

|

|

|

|

160.6 |

|

|

|

|

|

|

|

|

|

|

| Adjusted

income from continuing operations per share |

|

|

|

|

|

|

$ |

0.16 |

|

| |

|

|

|

|

|

|

|

| Net

income |

|

|

|

|

|

|

$ |

24.0 |

|

| Plus loss

from discontinued operations |

|

|

|

|

|

|

0.1 |

|

| Interest

expense, net (1) |

|

|

|

|

|

|

5.1 |

|

| Income

tax expense (1) |

|

|

|

|

|

|

13.4 |

|

| Operating

income (loss) from continuing operations |

$ |

52.9 |

|

|

$ |

(1.6 |

) |

|

$ |

(8.7 |

) |

|

42.6 |

|

| Inventory

purchase accounting adjustment |

0.8 |

|

|

— |

|

|

— |

|

|

0.8 |

|

| Other

charges |

0.4 |

|

|

— |

|

|

0.8 |

|

|

1.2 |

|

| Adjusted

operating income (loss) from continuing operations |

54.1 |

|

|

(1.6 |

) |

|

(7.9 |

) |

|

44.6 |

|

|

Depreciation and amortization |

8.9 |

|

|

1.2 |

|

|

0.1 |

|

|

10.2 |

|

| Adjusted

EBITDA |

$ |

63.0 |

|

|

$ |

(0.4 |

) |

|

$ |

(7.8 |

) |

|

$ |

54.8 |

|

|

|

|

|

|

|

|

|

|

| Adjusted

operating margin |

26.1 |

% |

|

(6.5 |

)% |

|

|

|

19.2 |

% |

|

|

|

|

|

|

|

|

|

| Adjusted

EBITDA margin |

30.3 |

% |

|

(1.6 |

)% |

|

|

|

23.6 |

% |

| |

|

|

|

|

|

|

|

| (1) We do not

allocate interest or income taxes to our segments. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted

EBITDA |

$ |

63.0 |

|

|

$ |

(0.4 |

) |

|

$ |

(7.8 |

) |

|

$ |

54.8 |

|

| Three

prior quarters' adjusted EBITDA |

137.8 |

|

|

(2.6 |

) |

|

(26.9 |

) |

|

108.3 |

|

| Trailing

twelve months' adjusted EBITDA |

$ |

200.8 |

|

|

$ |

(3.0 |

) |

|

$ |

(34.7 |

) |

|

$ |

163.1 |

|

| |

|

|

|

|

|

|

|

| Reconciliation of net

debt to total debt (end of period): |

|

|

|

|

|

|

|

| Current

portion of long-term debt |

|

|

|

|

|

|

$ |

5.5 |

|

| Long-term

debt |

|

|

|

|

|

|

475.7 |

|

| Total

debt |

|

|

|

|

|

|

481.2 |

|

| Less cash

and cash equivalents |

|

|

|

|

|

|

353.2 |

|

| Net

debt |

|

|

|

|

|

|

$ |

128.0 |

|

|

|

|

|

|

|

|

|

|

| Net debt leverage (net

debt divided by trailing twelve months' adjusted EBITDA) |

|

|

|

|

|

|

|

0.8x |

|

|

|

|

|

|

|

|

|

|

| Reconciliation of free

cash flow to net cash provided by operating activities of

continuing operations: |

|

|

|

|

|

|

|

| Net cash

provided by operating activities of continuing operations |

|

|

|

|

|

|

$ |

41.7 |

|

| Less

capital expenditures |

|

|

|

|

|

|

(7.5 |

) |

| Free cash

flow |

|

|

|

|

|

|

$ |

34.2 |

|

| MUELLER WATER PRODUCTS, INC. AND

SUBSIDIARIESSEGMENT RESULTS AND RECONCILIATION OF

GAAP TO NON-GAAP PERFORMANCE

MEASURES(UNAUDITED)

|

| |

Quarter ended June 30, 2016 |

| |

Mueller Co. |

|

MuellerTechnologies |

|

Corporate |

|

Consolidated |

| |

(dollars in millions, except per share

amounts) |

| Net sales |

$ |

198.7 |

|

|

$ |

26.0 |

|

|

$ |

— |

|

|

$ |

224.7 |

|

| |

|

|

|

|

|

|

|

| Gross profit |

$ |

77.5 |

|

|

$ |

5.7 |

|

|

$ |

— |

|

|

$ |

83.2 |

|

| Selling, general and

administrative expenses |

23.4 |

|

|

7.2 |

|

|

8.8 |

|

|

39.4 |

|

| Pension settlement |

2.2 |

|

|

— |

|

|

14.4 |

|

|

16.6 |

|

| Other charges |

0.2 |

|

|

— |

|

|

4.4 |

|

|

4.6 |

|

| Operating

income (loss) |

$ |

51.7 |

|

|

$ |

(1.5 |

) |

|

$ |

(27.6 |

) |

|

22.6 |

|

| Interest

expense, net |

|

|

|

|

|

|

6.0 |

|

| Income

tax expense |

|

|

|

|

|

|

5.6 |

|

| Income

from continuing operations |

|

|

|

|

|

|

$ |

11.0 |

|

|

|

|

|

|

|

|

|

|

| Income from continuing

operations per diluted share |

|

|

|

|

|

|

$ |

0.07 |

|

| |

|

|

|

|

|

|

|

| Capital

expenditures |

$ |

3.6 |

|

|

$ |

1.5 |

|

|

$ |

— |

|

|

$ |

5.1 |

|

|

|

|

|

|

|

|

|

|

| Operating margin |

26.0 |

% |

|

(5.8 |

)% |

|

|

|

10.1 |

% |

|

|

|

|

|

|

|

|

|

| Reconciliation of

Non-GAAP performance measures to GAAP performance measures: |

|

|

|

|

|

|

|

| Income

from continuing operations |

|

|

|

|

|

|

$ |

11.0 |

|

| Pension

settlement |

|

|

|

|

|

|

16.6 |

|

| Other

charges |

|

|

|

|

|

|

4.6 |

|

| Income

tax benefit of adjusting items |

|

|

|

|

|

|

(7.2 |

) |

| Adjusted

income from continuing operations |

|

|

|

|

|

|

$ |

25.0 |

|

|

|

|

|

|

|

|

|

|

| Weighted

average diluted shares outstanding |

|

|

|

|

|

|

163.6 |

|

|

|

|

|

|

|

|

|

|

| Adjusted

income from continuing operations per share |

|

|

|

|

|

|

$ |

0.15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

income |

|

|

|

|

|

|

$ |

15.5 |

|

| Less

income from discontinued operations |

|

|

|

|

|

|

(4.5 |

) |

| Interest

expense, net (1) |

|

|

|

|

|

|

6.0 |

|

| Income

tax expense (1) |

|

|

|

|

|

|

5.6 |

|

| Operating

income (loss) from continuing operations |

$ |

51.7 |

|

|

$ |

(1.5 |

) |

|

$ |

(27.6 |

) |

|

22.6 |

|

| Pension

settlement |

2.2 |

|

|

— |

|

|

14.4 |

|

|

16.6 |

|

| Other

charges |

0.2 |

|

|

— |

|

|

4.4 |

|

|

4.6 |

|

| Adjusted

operating income (loss) from continuing operations |

54.1 |

|

|

(1.5 |

) |

|

(8.8 |

) |

|

43.8 |

|

|

Depreciation and amortization |

8.5 |

|

|

1.2 |

|

|

0.1 |

|

|

9.8 |

|

| Adjusted

EBITDA |

$ |

62.6 |

|

|

$ |

(0.3 |

) |

|

$ |

(8.7 |

) |

|

$ |

53.6 |

|

|

|

|

|

|

|

|

|

|

| Adjusted

operating margin |

27.2 |

% |

|

(5.8 |

)% |

|

|

|

19.5 |

% |

|

|

|

|

|

|

|

|

|

| Adjusted

EBITDA margin |

31.5 |

% |

|

(1.2 |

)% |

|

|

|

23.9 |

% |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| (1) We do not

allocate interest or income taxes to our segments. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted

EBITDA |

$ |

62.6 |

|

|

$ |

(0.3 |

) |

|

$ |

(8.7 |

) |

|

$ |

53.6 |

|

| Three

prior quarters' adjusted EBITDA |

131.6 |

|

|

(6.5 |

) |

|

(23.8 |

) |

|

101.3 |

|

| Trailing

twelve months' adjusted EBITDA |

$ |

194.2 |

|

|

$ |

(6.8 |

) |

|

$ |

(32.5 |

) |

|

$ |

154.9 |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Reconciliation of net

debt to total debt (end of period): |

|

|

|

|

|

|

|

| Current

portion of long-term debt |

|

|

|

|

|

|

$ |

5.6 |

|

| Long-term

debt |

|

|

|

|

|

|

479.7 |

|

| Total

debt |

|

|

|

|

|

|

485.3 |

|

| Less cash

and cash equivalents |

|

|

|

|

|

|

148.3 |

|

| Net

debt |

|

|

|

|

|

|

$ |

337.0 |

|

|

|

|

|

|

|

|

|

|

| Net debt

leverage (net debt divided by trailing twelve months' adjusted

EBITDA) |

|

|

|

|

|

|

|

2.2x |

|

| |

|

|

|

|

|

|

|

| Reconciliation of free

cash flow to net cash provided by operating activities of

continuing operations: |

|

|

|

|

|

|

|

| Net cash

provided by operating activities of continuing operations |

|

|

|

|

|

|

59.5 |

|

| Less

capital expenditures |

|

|

|

|

|

|

(5.1 |

) |

| Free cash

flow |

|

|

|

|

|

|

$ |

54.4 |

|

| MUELLER WATER PRODUCTS, INC. AND

SUBSIDIARIESSEGMENT RESULTS AND RECONCILIATION OF

GAAP TO NON-GAAP PERFORMANCE

MEASURES(UNAUDITED) |

| |

Nine months ended June 30, 2017 |

| |

Mueller Co. |

|

MuellerTechnologies |

|

Corporate |

|

Consolidated |

| |

(dollars in millions, except per share

amounts) |

| Net sales |

$ |

535.5 |

|

|

$ |

63.6 |

|

|

$ |

— |

|

|

$ |

599.1 |

|

|

|

|

|

|

|

|

|

|

| Gross profit |

$ |

183.3 |

|

|

$ |

3.3 |

|

|

$ |

— |

|

|

$ |

186.6 |

|

| Selling, general and

administrative expenses |

67.9 |

|

|

20.7 |

|

|

25.6 |

|

|

114.2 |

|

| Other charges |

2.1 |

|

|

0.1 |

|

|

2.8 |

|

|

5.0 |

|

| Operating

income (loss) from continuing operations |

$ |

113.3 |

|

|

$ |

(17.5 |

) |

|

$ |

(28.4 |

) |

|

67.4 |

|

| Interest

expense, net |

|

|

|

|

|

|

17.0 |

|

| Income

tax expense |

|

|

|

|

|

|

16.2 |

|

| Income

from continuing operations |

|

|

|

|

|

|

$ |

34.2 |

|

| |

|

|

|

|

|

|

|

| Income from continuing

operations per diluted share |

|

|

|

|

|

|

$ |

0.21 |

|

| |

|

|

|

|

|

|

|

| Capital

expenditures |

$ |

13.8 |

|

|

$ |

7.6 |

|

|

$ |

0.2 |

|

|

$ |

21.6 |

|

| |

|

|

|

|

|

|

|

| Operating margin |

21.2 |

% |

|

(27.5 |

)% |

|

|

|

11.3 |

% |

|

|

|

|

|

|

|

|

|

| Reconciliation of

Non-GAAP performance measures to GAAP performance measures: |

|

|

|

|

|

|

|

| Income

from continuing operations |

|

|

|

|

|

|

$ |

34.2 |

|

| Discrete

warranty charge |

|

|

|

|

|

|

9.8 |

|

| Inventory

purchase accounting adjustment |

|

|

|

|

|

|

0.8 |

|

| Other

charges |

|

|

|

|

|

|

5.0 |

|

| Income

tax benefit of adjusting items |

|

|

|

|

|

|

(2.7 |

) |

| Adjusted

income from continuing operations |

|

|

|

|

|

|

$ |

47.1 |

|

|

|

|

|

|

|

|

|

|

| Weighted

average diluted shares outstanding |

|

|

|

|

|

|

162.4 |

|

|

|

|

|

|

|

|

|

|

| Adjusted

income from continuing operations per share |

|

|

|

|

|

|

$ |

0.29 |

|

| |

|

|

|

|

|

|

|

| Net

income |

|

|

|

|

|

|

$ |

104.0 |

|

| Less

income from discontinued operations |

|

|

|

|

|

|

(69.8 |

) |

| Interest

expense, net (1) |

|

|

|

|

|

|

17.0 |

|

| Income

tax expense (1) |

|

|

|

|

|

|

16.2 |

|

| Operating

income (loss) from continuing operations |

$ |

113.3 |

|

|

$ |

(17.5 |

) |

|

$ |

(28.4 |

) |

|

67.4 |

|

| Discrete

warranty charge |

— |

|

|

9.8 |

|

|

— |

|

|

9.8 |

|

| Inventory

purchase accounting adjustment |

0.8 |

|

|

— |

|

|

— |

|

|

0.8 |

|

| Other

charges |

2.1 |

|

|

0.1 |

|

|

2.8 |

|

|

5.0 |

|

| Adjusted

operating income (loss) from continuing operations |

116.2 |

|

|

(7.6 |

) |

|

(25.6 |

) |

|

83.0 |

|

|

Depreciation and amortization |

27.0 |

|

|

3.8 |

|

|

0.3 |

|

|

31.1 |

|

| Adjusted

EBITDA |

$ |

143.2 |

|

|

$ |

(3.8 |

) |

|

$ |

(25.3 |

) |

|

$ |

114.1 |

|

|

|

|

|

|

|

|

|

|

| Adjusted

operating margin |

21.7 |

% |

|

(11.9 |

)% |

|

|

|

13.9 |

% |

|

|

|

|

|

|

|

|

|

| Adjusted

EBITDA margin |

26.7 |

% |

|

(6.0 |

)% |

|

|

|

19.0 |

% |

| |

|

|

|

|

|

|

|

| Free cash flow: |

|

|

|

|

|

|

|

| Net cash

provided by operating activities of continuing operations |

|

|

|

|

|

|

$ |

25.4 |

|

| Less

capital expenditures |

|

|

|

|

|

|

(21.6 |

) |

| Free cash

flow |

|

|

|

|

|

|

$ |

3.8 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| (1) We do not

allocate interest or income taxes to our segments. |

|

|

|

|

|

|

|

| MUELLER WATER PRODUCTS, INC. AND

SUBSIDIARIESSEGMENT RESULTS AND RECONCILIATION OF

GAAP TO NON-GAAP PERFORMANCE

MEASURES(UNAUDITED)

|

| |

Nine months ended June 30, 2016 |

| |

Mueller Co. |

|

MuellerTechnologies |

|

Corporate |

|

Consolidated |

| |

(dollars in millions, except per share

amounts) |

| Net sales |

$ |

525.6 |

|

|

$ |

59.4 |

|

|

$ |

— |

|

|

$ |

585.0 |

|

|

|

|

|

|

|

|

|

|

| Gross profit |

$ |

179.2 |

|

|

$ |

10.9 |

|

|

$ |

— |

|

|

$ |

190.1 |

|

| Selling, general and

administrative expenses |

65.8 |

|

|

20.6 |

|

|

25.8 |

|

|

112.2 |

|

| Pension settlement |

2.2 |

|

|

— |

|

|

14.4 |

|

|

16.6 |

|

| Other charges |

0.8 |

|

|

0.5 |

|

|

4.9 |

|

|

6.2 |

|

| Operating

income (loss) |

$ |

110.4 |

|

|

$ |

(10.2 |

) |

|

$ |

(45.1 |

) |

|

55.1 |

|

| Interest

expense, net |

|

|

|

|

|

|

18.0 |

|

| Income

tax expense |

|

|

|

|

|

|

11.8 |

|

| Income

from continuing operations |

|

|

|

|

|

|

$ |

25.3 |

|

|

|

|

|

|

|

|

|

|

| Income from continuing

operations per diluted share |

|

|

|

|

|

|

$ |

0.15 |

|

| |

|

|

|

|

|

|

|

| Capital

expenditures |

$ |

12.4 |

|

|

$ |

4.5 |

|

|

$ |

0.1 |

|

|

$ |

17.0 |

|

|

|

|

|

|

|

|

|

|

| Operating margin |

21.0 |

% |

|

(17.2 |

)% |

|

|

|

9.4 |

% |

|

|

|

|

|

|

|

|

|

| Reconciliation of

Non-GAAP performance measures to GAAP performance measures: |

|

|

|

|

|

|

|

| Income

from continuing operations |

|

|

|

|

|

|

$ |

25.3 |

|

| Pension

settlement |

|

|

|

|

|

|

16.6 |

|

| Other

charges |

|

|

|

|

|

|

6.2 |

|

| Income

tax benefit of adjusting items |

|

|

|

|

|

|

(7.7 |

) |

| Adjusted

income from continuing operations |

|

|

|

|

|

|

$ |

40.4 |

|

|

|

|

|

|

|

|

|

|

| Weighted

average diluted shares outstanding |

|

|

|

|

|

|

163.3 |

|

|

|

|

|

|

|

|

|

|

| Adjusted

income from continuing operations per share |

|

|

|

|

|

|

$ |

0.25 |

|

|

|

|

|

|

|

|

|

|

| Net

income |

|

|

|

|

|

|

$ |

37.4 |

|

| Less

income from discontinued operations |

|

|

|

|

|

|

(12.1 |

) |

| Interest

expense, net (1) |

|

|

|

|

|

|

18.0 |

|

| Income

tax expense (1) |

|

|

|

|

|

|

11.8 |

|

| Operating

income (loss) from continuing operations |

$ |

110.4 |

|

|

$ |

(10.2 |

) |

|

$ |

(45.1 |

) |

|

55.1 |

|

| Pension

settlement |

2.2 |

|

|

— |

|

|

14.4 |

|

|

16.6 |

|

| Other

charges |

0.8 |

|

|

0.5 |

|

|

4.9 |

|

|

6.2 |

|

| Adjusted

operating income (loss) from continuing operations |

113.4 |

|

|

(9.7 |

) |

|

(25.8 |

) |

|

77.9 |

|

|

Depreciation and amortization |

25.5 |

|

|

3.5 |

|

|

0.3 |

|

|

29.3 |

|

| Adjusted

EBITDA |

$ |

138.9 |

|

|

$ |

(6.2 |

) |

|

$ |

(25.5 |

) |

|

$ |

107.2 |

|

|

|

|

|

|

|

|

|

|

| Adjusted

operating margin |

21.6 |

% |

|

(16.3 |

)% |

|

|

|

13.3 |

% |

|

|

|

|

|

|

|

|

|

| Adjusted

EBITDA margin |

26.4 |

% |

|

(10.4 |

)% |

|

|

|

18.3 |

% |

| |

|

|

|

|

|

|

|

| Free cash flow: |

|

|

|

|

|

|

|

| Net cash

provided by operating activities of continuing operations |

|

|

|

|

|

|

$ |

54.4 |

|

| Less

capital expenditures |

|

|

|

|

|

|

(17.0 |

) |

| Free cash

flow |

|

|

|

|

|

|

$ |

37.4 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| (1) We do not

allocate interest or income taxes to our segments. |

|

|

|

|

|

|

|

Investor Contacts: Martie Edmunds Zakas

Sr. Vice President - Strategy, Corporate Development

& Communications

770-206-4237

mzakas@muellerwp.com

John DeYarman

Director - Strategy, Corporate Development & Investor Relations

770-206-4228

jdeyarman@muellerwp.com

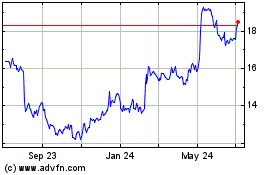

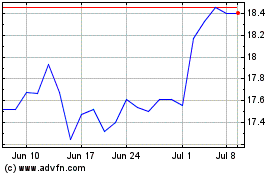

Mueller Water Products (NYSE:MWA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mueller Water Products (NYSE:MWA)

Historical Stock Chart

From Apr 2023 to Apr 2024