PennyMac Mortgage Investment Trust (NYSE: PMT) today reported

net income attributable to common shareholders of $26.4 million, or

$0.38 per common share on a diluted basis, for the second quarter

of 2017, on net investment income of $84.0 million. PMT

previously announced a cash dividend for the second quarter of 2017

of $0.47 per common share of beneficial interest, which was

declared on June 27, 2017 and paid on July 27, 2017.

Second Quarter 2017 Highlights

Financial results:

- Diluted earnings per common share of

$0.38, down 5 percent from the prior quarter

- Net income attributable to common

shareholders of $26.4 million, down 6 percent from the prior

quarter

- Net investment income of

$84.0 million, up 30 percent from the prior quarter

- Book value per common share of $20.04,

down from $20.14 at March 31, 2017

- Return on average common equity of

8 percent, essentially unchanged from the prior quarter1

Investment activities and correspondent production results:

- Continued investment in GSE credit risk

transfer (CRT) and mortgage servicing rights (MSRs) resulting from

PMT’s correspondent production business

- Correspondent production related to

conventional conforming loans totaled $5.9 billion in UPB, up

28 percent from the prior quarter

- CRT deliveries totaled

$3.8 billion in unpaid principal balance (UPB), which will

result in approximately $132 million of new CRT investments

once the aggregation period is complete

- Added $66 million in new MSR

investments

- Focus on liquidation and sales of the

remaining distressed mortgage loan portfolio; successfully reduced

PMT's equity allocation for distressed mortgage loans to 31% of

total equity, down from 50 percent a year ago2

- Cash proceeds from the liquidation and

pay down of distressed mortgage loans and real estate acquired upon

settlement of loans (REO) were $71 million

- Entered into an agreement to sell $149

million in UPB of performing loans from the distressed

portfolio3

- Assessing opportunities to access the

market for bulk sales of performing and nonperforming loans from

the distressed loan portfolio

Notable activity after quarter end

- Issued 7.8 million preferred shares for

gross proceeds of $195 million4

1 Return on average common equity is calculated based on

annualized quarterly net income attributable to common shareholders

as a percentage of monthly average common equity during the

period.2 Management’s internal allocation of equity. Amounts as of

quarter end.3 This transaction is subject to continuing due

diligence and customary closing conditions. There can be no

assurance regarding the size of the transaction or that the

transaction will be completed at all.4 8.00% Series B

Fixed-to-Floating Rate Cumulative Redeemable preferred shares.

Includes 800,000 shares from the exercise of the underwriters’

over-allotment option.

“PMT continues to make solid progress in growing its credit risk

transfer and mortgage servicing rights investments and in

liquidating its distressed loan investments,” said President and

CEO David Spector. “Our second quarter results were driven by

strong contributions from our credit risk transfer investments and

from correspondent production, where we experienced significant

growth in volumes. The market volatility in interest rates, which

declined overall during the quarter, contributed to challenges in

managing our interest rate sensitive investments which include MSRs

and ESS. Our strategy is to continue transitioning PMT’s assets to

correspondent-related investments such as CRT and MSRs and to

assess opportunities to sell performing and non-performing loans

from our distressed portfolio.”

The following table presents the contributions of PMT’s

segments, consisting of Credit Sensitive Strategies, Interest Rate

Sensitive Strategies, Correspondent Production and Corporate.

Quarter ended June 30, 2017

Credit

sensitive strategies

Interest rate

sensitive strategies

Correspondent

production

Corporate

Consolidated (in thousands) Net gain on

mortgage loans acquired for sale $ 149 $ - $ 17,143 $ - $ 17,292

Net gain (loss) on investments Distressed mortgage loans at fair

value 1,030 - - - 1,030 Mortgage loans held by variable interest

entity net of

asset-backed secured financing

- 456 - - 456 Mortgage-backed securities 257 3,770 - - 4,027 CRT

Agreements 32,853 - - - 32,853 Hedging derivatives - (4,889 ) - -

(4,889 ) Excess servicing spread investments

-

(5,885 )

- -

(5,885 ) 34,140 (6,548 ) - - 27,592 Net

mortgage loan servicing fees 29 15,668 - - 15,697 Net interest

income Interest income 20,739 18,672 12,820 155 52,386 Interest

expense

(13,809 )

(15,655 ) (8,962

) -

(38,426 ) 6,930 3,017 3,858 155 13,960

Other (loss) income

(1,079 )

- 10,497

- 9,418

40,169 12,137

31,498 155

83,959 Expenses: Mortgage loan

fulfillment and servicing fees

payable to PennyMac Financial Services,

Inc.

3,522 6,576 21,108 - 31,206 Management fees payable to PennyMac

Financial Services, Inc. - - - 5,638 5,638 Other

6,197 145

2,302 6,645

15,289 9,719

6,721 23,410

12,283 52,133 Pretax

income (loss)

30,450

5,416 8,088

(12,128 ) 31,826

Credit Sensitive Strategies Segment

The Credit Sensitive Strategies segment includes results from

distressed mortgage loans, CRT, non-Agency subordinated bonds and

commercial real estate investments. Pretax income for the segment

was $30.4 million on revenues of $40.2 million, compared

with pretax income of $19.4 million on revenues of

$25.8 million in the prior quarter.

Net gain on investments was $34.1 million, an increase of

55 percent from $22.0 million in the prior quarter.

PMT’s distressed mortgage loan portfolio generated realized and

unrealized gains totaling $1.0 million, compared with realized

and unrealized gains of $3.2 million in the prior quarter.

Fair value gains on the performing loans in the distressed

portfolio were $15.5 million while fair value losses on

nonperforming loans were $15.8 million.

The schedule below details the realized and unrealized gains

(losses) on distressed mortgage loans:

Quarter ended June 30, 2017

March 31, 2017 June 30,

2016 (in thousands) Valuation changes: Performing

loans $ 15,466 $ 5,970 $ (8,356 ) Nonperforming loans

(15,750 ) (3,169 ) (5,919 ) (284 ) 2,801 (14,275 )

Gain on payoffs 1,348 415 1,208 Gain (loss) on sale (34 )

- (396 ) $ 1,030 $ 3,216 $

(13,463 )

The performing loan portfolio benefitted from a strong market

for portfolios with similar attributes. The nonperforming loan

portfolio was adversely impacted by home price indications that

were below prior forecasts and increased uncertainty regarding the

realization of cash flows on the remaining population of loans.

Net gain on CRT investments was $32.9 million compared with

a gain of $18.6 million in the prior quarter. These gains

resulted from higher income on a larger investment position and

market-driven value changes related to tight credit spreads. At

quarter end, PMT’s deposits in CRT totaled $503 million,

compared with $464 million at March 31, 2017.

Net interest income for the segment totaled $6.9 million,

up 15 percent from the prior quarter. Interest income totaled

$20.7 million, a 2 percent increase from the prior quarter,

which included $10.8 million of capitalized interest from loan

modifications, up from $9.9 million in the prior quarter.

Capitalized interest increases interest income and reduces loan

valuation gains. Interest expense totaled $13.8 million, down

3 percent from the prior quarter driven by a smaller

distressed mortgage loan portfolio.

Other investment losses were $1.1 million, compared with a

$2.3 million loss in the prior quarter. At quarter end, PMT’s

inventory of REO properties totaled $207.0 million, down from

$224.8 million at March 31, 2017.

Segment expenses were $9.7 million, a 52 percent increase

from $6.4 million in the prior quarter. Other expenses in the

first quarter included gains realized on previously sold REO.

Interest Rate Sensitive Strategies Segment

The Interest Rate Sensitive Strategies segment includes results

from investments in MSRs, excess servicing spread (ESS), Agency

mortgage-backed securities (MBS), non-Agency senior MBS and

interest rate hedges. The segment includes investments that have

offsetting exposures to changes in interest rates. Interest Rate

Sensitive Strategies generated pretax income of $5.4 million

on revenues of $12.1 million, compared with pretax income of

$0.7 million on revenues of $7.6 million in the prior

quarter.

The results in the Interest Rate Sensitive Strategies segment

consist of net gain/loss on investments, net interest income and

net loan servicing fees, as well as the associated expenses.

The net loss on investments was $6.5 million, consisting of

$3.8 million of gains on MBS and $0.5 million of gains on

mortgage loans held by a variable interest entity, net of the

related asset-backed secured funding; $4.9 million of losses

on hedging derivatives; and $5.9 million of net losses on

ESS.

Net interest income for the segment was $3.0 million,

compared to $1.1 million in the prior quarter. Interest income

totaled $18.7 million, a 16 percent increase from the

prior quarter, driven by higher placement fees on MSR-related

escrow deposits. Interest expense totaled $15.7 million, a

4 percent increase from the prior quarter due to higher

short-term borrowing costs.

Net mortgage loan servicing fees were $15.7 million, up

from $11.7 million in the prior quarter. Net loan servicing

fees included $41.1 million in servicing fees, reduced by

$19.5 million of amortization and realization of MSR cash

flows. Net loan servicing fees also included a $4.1 million

impairment provision for MSRs carried at the lower of amortized

cost or fair value, a $4.4 million valuation loss on MSRs

carried at fair value and $2.4 million of related hedging

gains, and $0.2 million of MSR recapture income. PMT’s hedging

activities are intended to manage its net exposure across all

interest rate-sensitive strategies, which include MSRs, ESS and

MBS.

The following schedule details net loan servicing fees:

Quarter ended June 30, 2017

March 30, 2017 June 30,

2016 (in thousands) From nonaffiliates Servicing fees

(1) $ 41,084 $ 38,505 $ 31,578 Effect of MSRs: Carried at lower of

amortized cost or fair value Amortization and realization of

cashflows (19,523 ) (17,858 ) (15,531 ) Reversal of (provision for)

impairment (4,089 ) 1,504 (23,170 ) Carried at fair value - change

in fair value (4,400 ) (1,993 ) (4,941 ) Gains (Losses) on hedging

derivatives 2,391 (8,698 ) 27,433

(25,621 ) (27,045 ) (16,198 ) From PennyMac Financial

Services, Inc. MSR recapture fee receivable from PFSI 234

292 311 Net mortgage loan

servicing fees $ 15,697 $ 11,752 $ 15,691

PMT’s MSR portfolio, which is subserviced by a subsidiary of

PennyMac Financial Services, Inc. (NYSE: PFSI), grew to

$63.3 billion in UPB compared with $59.6 billion at

March 31, 2017.

MSR and ESS valuation losses primarily resulted from higher

projected prepayment activity due to a decline in mortgage rates

during the quarter. ESS valuation losses are net of recapture

income totaling $1.4 million from PFSI for prepayment activity

during the quarter. When prepayment of a loan underlying PMT’s ESS

results from a refinancing by PFSI, PMT generally benefits from

recapture income.

Segment expenses were $6.7 million, a 1 percent

decrease from $6.8 million in the prior quarter.

Correspondent Production Segment

PMT acquires newly originated mortgage loans from third-party

correspondent sellers and typically sells or securitizes the loans,

resulting in current-period income and ongoing investments in MSRs

and GSE CRT related to a portion of its production. PMT’s

Correspondent Production segment generated pretax income of

$8.1 million versus $12.5 million in the prior

quarter.

Through its correspondent production activities, PMT acquired

$16.3 billion in UPB of loans and issued IRLCs totaling

$18.2 billion in the second quarter, compared with

$13.9 billion and $14.5 billion, respectively, in the

prior quarter. Of the correspondent acquisitions, conventional

conforming acquisitions totaled $5.9 billion, and

government-insured or guaranteed acquisitions totaled

$10.4 billion, compared with $4.6 billion and

$9.3 billion, respectively, in the prior quarter.

Segment revenues were $31.5 million, a 2 percent

increase from the prior quarter. Net gain on mortgage loans

acquired for sale in the quarter declined 10 percent from the

prior quarter, driven by a 35 percent quarter-over-quarter increase

in conventional lock volumes, partially offset by tighter margins

reflecting highly competitive market conditions. Additionally, net

gain on mortgage loans acquired for sale in the prior quarter

included a $4.6 million benefit from a reduction in the estimate of

the liability for representations and warranties as compared to a

reduction of $1.3 million in the second quarter.

The following schedule details the net gain on mortgage loans

acquired for sale:

Quarter ended June 30, 2017

March 31, 2017 June 30,

2016 (in thousands) Net gain on mortgage loans acquired

for sale: Receipt of MSRs in loan sale transactions $ 65,834

$ 58,688 $ 60,109 Provision for losses relating to representations

and warranties

provided in mortgage loan sales:

Pursuant to mortgage loans sales (607 ) (673 ) (650 ) Reduction in

liability due to change in estimate 1,305 4,576 — Cash investment

(1) (43,204 ) (37,248 ) (47,579 ) Fair value changes of pipeline,

inventory and hedges (6,036 ) (6,318 )

12,346 $ 17,292 $ 19,025 $ 24,226

(1) Includes cash hedge expense

Segment expenses were $23.4 million, up 28 percent

from $18.3 million in the prior quarter, driven by an increase

in volume-based fulfillment fee expense. The weighted average

fulfillment fee rate in the second quarter was 36 basis

points, unchanged from the prior quarter.

Corporate Segment

The Corporate segment includes interest income from cash and

short-term investments, management fees and corporate expenses.

Segment revenues were $155,000, a decrease from $326,000 in the

prior quarter.

Management fees, which include incentive fees, were

$5.6 million, up 13 percent compared with

$5.0 million in the prior quarter. Incentive fees were

$304,000 in the second quarter, compared to none in the prior

quarter.

Other segment expenses were $6.6 million compared with

$5.4 million in the prior quarter, driven by a 19 percent

increase in professional services expense, primarily related to

financing and distressed asset transaction activities.

Taxes

PMT recorded an income tax expense of $3.0 million compared

with a $6.1 million benefit in the prior quarter.

“PMT continues to focus on CRT and MSR investments that result

from our correspondent production business,” concluded Executive

Chairman Stanford L. Kurland. “Fannie Mae and Freddie Mac recently

announced structural improvements to their credit risk transfer

programs which we expect will benefit PMT’s future CRT investments.

We are pleased with our capital progress, highlighted by our

successful raise of new preferred equity after quarter-end. The

ability to finance mortgage servicing rights has also improved

markedly with attractive transactions recently in the market. These

are exciting developments that we believe will enhance the

attractiveness of PMT’s core strategies and earnings potential

going forward."

Management’s slide presentation will be available in the

Investor Relations section of the Company’s website at

www.pennymac-REIT.com beginning at 1:30 p.m. (Pacific Daylight

Time) on Thursday, August 3, 2017.

About PennyMac Mortgage Investment Trust

PennyMac Mortgage Investment Trust is a mortgage real estate

investment trust (REIT) that invests primarily in residential

mortgage loans and mortgage-related assets. PennyMac Mortgage

Investment Trust trades on the New York Stock Exchange under the

symbol “PMT” and is externally managed by PNMAC Capital Management,

LLC, an indirect subsidiary of PennyMac Financial Services, Inc.

Additional information about PennyMac Mortgage Investment Trust is

available at www.PennyMac-REIT.com.

This press release contains forward-looking statements within

the meaning of Section 21E of the Securities Exchange Act of

1934, as amended, regarding management’s beliefs, estimates,

projections and assumptions with respect to, among other things,

the Company’s financial results, future operations, business plans

and investment strategies, as well as industry and market

conditions, all of which are subject to change. Words like

“believe,” “expect,” “anticipate,” “promise,” “plan,” and other

expressions or words of similar meanings, as well as future or

conditional verbs such as “will,” “would,” “should,” “could,” or

“may” are generally intended to identify forward-looking

statements. Actual results and operations for any future period may

vary materially from those projected herein and from past results

discussed herein. Factors which could cause actual results to

differ materially from historical results or those anticipated

include, but are not limited to: changes in our investment

objectives or investment or operational strategies, including any

new lines of business or new products and services that may subject

us to additional risks; volatility in our industry, the debt or

equity markets, the general economy or the real estate finance and

real estate markets specifically; events or circumstances which

undermine confidence in the financial markets or otherwise have a

broad impact on financial markets; changes in general business,

economic, market, employment and political conditions, or in

consumer confidence and spending habits from those expected;

declines in real estate or significant changes in U.S. housing

prices or activity in the U.S. housing market; the availability of,

and level of competition for, attractive risk-adjusted investment

opportunities in mortgage loans and mortgage-related assets that

satisfy our investment objectives; the inherent difficulty in

winning bids to acquire distressed loans or correspondent loans,

and our success in doing so; the concentration of credit risks to

which we are exposed; the degree and nature of our competition; the

availability, terms and deployment of short-term and long-term

capital; the adequacy of our cash reserves and working capital; our

ability to maintain the desired relationship between our financing

and the interest rates and maturities of our assets; the timing and

amount of cash flows, if any, from our investments; unanticipated

increases or volatility in financing and other costs, including a

rise in interest rates; the performance, financial condition and

liquidity of borrowers; incomplete or inaccurate information or

documentation provided by customers or counterparties, or adverse

changes in the financial condition of our customers and

counterparties; changes in the number of investor repurchases or

indemnifications and our ability to obtain indemnification or

demand repurchase from our correspondent sellers; increased rates

of delinquency, default and/or decreased recovery rates on our

investments; increased prepayments of the mortgages and other loans

underlying our mortgage-backed securities or relating to our

mortgage servicing rights, excess servicing spread and other

investments; the degree to which our hedging strategies may or may

not protect us from interest rate volatility; the effect of the

accuracy of or changes in the estimates we make about

uncertainties, contingencies and asset and liability valuations

when measuring and reporting upon our financial condition and

results of operations; changes in regulations or the occurrence of

other events that impact the business, operation or prospects of

government sponsored enterprises; changes in government support of

homeownership; changes in governmental regulations, accounting

treatment, tax rates and similar matters; our ability to satisfy

complex rules in order to qualify as a REIT for U.S. federal income

tax purposes; and our ability to make distributions to our

shareholders in the future. You should not place undue reliance on

any forward-looking statement and should consider all of the

uncertainties and risks described above, as well as those more

fully discussed in reports and other documents filed by the Company

with the Securities and Exchange Commission from time to time. The

Company undertakes no obligation to publicly update or revise any

forward-looking statements or any other information contained

herein, and the statements made in this press release are current

as of the date of this release only.

PENNYMAC MORTGAGE INVESTMENT TRUST AND

SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

June 30, 2017 March 31,

2017 June 30, 2016 (in thousands

except share information)

ASSETS Cash $ 69,893 $ 120,049 $

95,705 Short-term investments 77,366 19,883 16,877 Mortgage-backed

securities at fair value 1,065,540 1,089,610 531,612 Mortgage loans

acquired for sale at fair value 1,318,603 1,278,441 1,461,029

Mortgage loans at fair value 1,527,812 1,583,356 2,035,997 Excess

servicing spread purchased from PennyMac Financial Services, Inc.

261,796 277,484 294,551 Derivative assets 73,875 41,213 35,007 Real

estate acquired in settlement of loans 207,034 224,831 299,458 Real

estate held for investment 40,316 35,537 20,662 Mortgage servicing

rights 734,800 696,970 471,458 Servicing advances 67,172 70,332

74,090 Deposits securing credit risk transfer agreements 503,108

463,836 338,812 Due from PennyMac Financial Services, Inc. 5,013

10,916 12,375 Other assets 57,916 90,488

79,929 Total assets $ 6,010,244 $

6,002,946 $ 5,767,562

LIABILITIES Assets sold

under agreements to repurchase $ 3,497,999 $ 3,500,190 $ 3,275,691

Mortgage loan participation and sale agreements 38,345 72,975

96,335 Notes payable 159,980 100,088 163,976 Asset-backed financing

of a variable interest entity at fair value 329,459 340,365 325,939

Exchangeable senior notes 246,629 246,357 245,564 Assets sold to

PennyMac Financial Services, Inc. under agreement to repurchase

150,000 150,000 150,000 Interest-only security payable at fair

value 6,577 4,601 1,663 Derivative liabilities 8,856 5,352 3,894

Accounts payable and accrued liabilities 74,253 80,219 75,587 Due

to PennyMac Financial Services, Inc. 17,725 20,756 22,054 Income

taxes payable 14,892 12,006 26,774 Liability for losses under

representations and warranties 10,697 11,447

19,258 Total liabilities 4,555,412

4,544,356 4,406,735

SHAREHOLDERS' EQUITY 8.125% Series A fixed-to floating rate

redeemable cumulative preferred shares of

beneficial interest, $0.01 par value per

share, 4,600,000 shares issued and outstanding,

$115,000,000 aggregate liquidation

preference

46 46 - Common shares of beneficial interest—authorized,

500,000,000 common shares of $0.01 par

value; issued and outstanding 66,842,495,

66,711,052, and 67,723,293 common shares, respectively

668 667 677 Additional paid-in capital 1,489,116 1,487,517

1,389,962 Accumulated deficit (34,998 ) (29,640 )

(29,812 ) Total shareholders' equity 1,454,832

1,458,590 1,360,827 Total liabilities

and shareholders' equity $ 6,010,244 $ 6,002,946 $

5,767,562

PENNYMAC MORTGAGE INVESTMENT TRUST AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

(UNAUDITED)

Quarter ended June 30,

2017 March 31, 2017

June 30, 2016 (in thousands, except per share

amounts)

Net investment income Net gain on mortgage loans

acquired for sale From nonaffiliates 14,088 16,624 22,095 From

PennyMac Financial Services, Inc. 3,204 2,401

2,131 17,292 19,025 24,226 Mortgage loan

origination fees 10,467 8,290 8,519 Net gain (loss) on investments:

From nonaffiliates 33,477 18,091 337 From PennyMac Financial

Services, Inc. (5,885 ) (1,370 ) (15,824 )

27,592 16,721 (15,487 ) Net mortgage loan servicing fees From

nonaffiliates 15,463 11,460 15,380 From PennyMac Financial

Services, Inc. 234 292 311

15,697 11,752 15,691 Interest income: From nonaffiliates

48,020 43,453 46,053 From PennyMac Financial Services, Inc.

4,366 4,647 5,713 52,386 48,100

51,766 Interest expense: To nonaffiliates 36,401 35,374 34,371 To

PennyMac Financial Services, Inc. 2,025 1,805

2,222 38,426 37,179 36,593 Net interest income

13,960 10,921 15,173 Results of real estate acquired in settlement

of loans (3,465 ) (4,246 ) (2,565 ) Other 2,416

2,011 2,061 Net investment income

83,959 64,474 47,618

Expenses Earned by PennyMac Financial Services, Inc.:

Mortgage loan fulfillment fees 21,107 16,570 19,111 Mortgage loan

servicing fees(1) 10,099 10,486 16,427 Management fees 5,638 5,008

5,199 Professional services 2,747 1,453 2,011 Compensation 1,959

1,892 2,224 Mortgage loan origination 1,993 1,512 1,557 Mortgage

loan collection and liquidation 3,338 354 4,290 Other 5,252

4,591 4,958 Total expenses

52,133 41,866 55,777 Income before benefit from income taxes 31,826

22,608 (8,159 ) Provision for (benefit) from income taxes

3,046 (6,129 ) (2,892 ) Net income 28,780

28,737 (5,267 ) Dividends on preferred shares 2,336

571 — Net income attributable to common

shareholders $ 26,444 $ 28,166 $ (5,267 )

Earnings

per common share Basic $ 0.39 $ 0.42 $ (0.08 ) Diluted $ 0.38 $

0.40 $ (0.08 )

Weighted-average common shares outstanding

Basic 66,761 66,719 68,446 Diluted 75,228 75,186 68,446

Dividends declared per common share $ 0.47 $ 0.47 $ 0.47

(1) Mortgage loan servicing fees expense includes both special

servicing for PMT’s distressed portfolio and subservicing for its

mortgage servicing rights

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170803006479/en/

PennyMac Mortgage Investment TrustMediaStephen Hagey,

(805) 530-5817orInvestorsChristopher Oltmann, (818)

224-7028

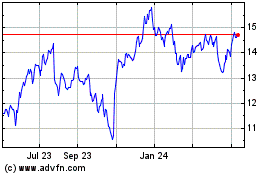

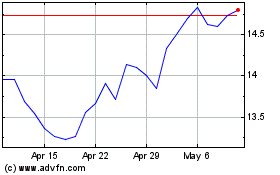

PennyMac Mortgage Invest... (NYSE:PMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

PennyMac Mortgage Invest... (NYSE:PMT)

Historical Stock Chart

From Apr 2023 to Apr 2024