Report of Foreign Issuer (6-k)

August 03 2017 - 4:21PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a - 16 or 15d - 16 of

the Securities Exchange Act of 1934

As of August 2, 2017

TENARIS, S.A.

(Translation of Registrant's name into English)

TENARIS, S.A.

29, Avenue de la Porte-Neuve 3rd floor

L-2227 Luxembourg

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or 40-F.

Form 20-F

Ö

Form 40-F

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12G3-2(b) under the Securities Exchange Act of 1934.

Yes

No

Ö

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

.

The attached material is being furnished to the Securities and Exchange Commission pursuant to Rule 13a-16 and Form 6-K under the Securities Exchange Act of 1934, as amended. This report contains Tenaris’s Press Release announcing 2017 Second Quarter Results.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: August 2, 2017.

Tenaris, S.A.

By: /s/ Cecilia Bilesio

Cecilia Bilesio

Corporate Secretary

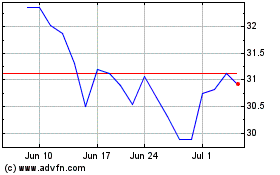

Tenaris (NYSE:TS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tenaris (NYSE:TS)

Historical Stock Chart

From Apr 2023 to Apr 2024