Total revenues of $50.2 million, up 30%

year-over-yearLicense revenues of $28.4 million, up 31%

year-over-year

Varonis Systems, Inc. (Nasdaq:VRNS), a leading provider of software

solutions that protect data from insider threats and cyberattacks,

today announced results for the second quarter ended June 30, 2017.

Yaki Faitelson, Varonis CEO, said, “This was another strong

quarter for Varonis with both license and total revenues increasing

30% or greater. We continue to experience strong demand

drivers for our business and are executing well on our key goals of

increasing awareness and adoption for our solutions, more

effectively targeting companies with 1,000 or more employees with

larger customer lifetime values, and innovating to expand the value

we deliver to our customers. With the Varonis Data Security

Platform, we are delivering a strategic approach to not only

protect enterprise data from cyberattacks, but also from insider

threats and data breaches.”

Financial Highlights for the Second Quarter Ended June

30, 2017

Revenues:

- Total revenues were $50.2 million, up 30% compared with the

second quarter of 2016.

- License revenues were $28.4 million, up 31% compared with the

second quarter of 2016.

- Maintenance and services revenues were $21.8 million, up 29%

compared with the year-ago period.

Operating Income (Loss):

- GAAP operating loss was ($5.3) million for the quarter,

compared to ($5.6) million in the second quarter of 2016.

- Non-GAAP operating income was $0.1 million for the quarter,

compared to a loss of ($2.1) million in the second quarter of

2016.

Net Income (Loss):

- GAAP net loss was ($5.0) million, compared to GAAP net loss of

($6.5) million in the second quarter of 2016.

- GAAP net loss per basic and diluted share was ($0.18) in the

second quarter of 2017 compared to ($0.25) in the second quarter of

2016, based on 27.3 million and 26.3 million basic and diluted

common shares outstanding, respectively.

- Non-GAAP net income was $0.4 million, compared to non-GAAP net

loss of ($3.0) million in the second quarter of 2016.

- Non-GAAP net income per diluted share was $0.01 in the second

quarter of 2017, compared to non-GAAP net loss per basic and

diluted share of ($0.12) in the second quarter of 2016, based on

30.5 million diluted common shares outstanding and 26.3 million

basic and diluted common shares outstanding, respectively.

The tables at the end of this press release include a

reconciliation of GAAP to non-GAAP net income (loss) from

operations and net income (loss) for the three and six months ended

June 30, 2017 and 2016. An explanation of these measures is also

included below under the heading "Non-GAAP Financial Measures."

Balance Sheet and Cash Flow:

- As of June 30, 2017, the Company had $121.6 million in cash and

cash equivalents and short-term investments compared with $113.8

million as of December 31, 2016.

- During the six months ended June 30, 2017, the Company

generated $7.4 million in cash from operations, compared with $2.3

million of cash provided by operations in the prior-year period.

Recent Business Highlights

- For the second quarter of 2017, total revenues in the United

States increased 36% over the prior-year period to $33.1 million,

total revenues from EMEA increased 17% over the prior-year period

to $13.9 million, and total revenues from Rest of World increased

29% over the prior-year period to $3.2 million.

- Generated 55% of license and first year maintenance revenues

from new customers and 45% from existing customers in the second

quarter of 2017, compared to 59% and 41%, respectively, in

prior-year period.

- Added 254 new customers during the second quarter of 2017

compared with 285 in the prior-year period.

- As of June 30, 2017, 50% of customers had purchased two or more

product families, up from 46% as of June 30, 2016.

- Recent findings from a customer survey with TechValidate show

that approximately 80% of respondents detected critical security

issues with DatAlert, including ransomware, hijacked accounts,

employees stealing data, and administrators violating policy.

Financial Outlook

For the third quarter of 2017, Varonis expects revenues in the

range of $50.0 million to $50.8 million, representing 22% to 24%

year-over-year growth. The Company anticipates third quarter 2017

non-GAAP operating income in the range of $100,000 to $500,000 and

non-GAAP net loss per basic and diluted share in the range of

($0.01) to $0.00, based on a tax provision of $450,000 to $650,000

and 27.5 million basic and diluted shares outstanding. Expectations

of non-GAAP operating income and non-GAAP net loss per basic and

diluted share exclude stock-based compensation expense and payroll

tax expense related to stock-based compensation.

For the full year 2017, Varonis now expects revenues in the

range of $205.0 million to $207.0 million, representing 25% to 26%

year-over-year growth. The Company now anticipates full year 2017

non-GAAP operating income of $2.7 million to $3.7 million and

non-GAAP net income per diluted share in the range of $0.07 to

$0.09, based on a tax provision of $1.9 million to $2.3 million and

30.5 million diluted shares outstanding. Expectations of non-GAAP

operating income and non-GAAP net income per diluted share exclude

stock-based compensation expense and payroll tax expense related to

stock-based compensation.

Conference Call and Webcast

Varonis will host a conference call today, August 3, 2017, at

5:00 p.m., Eastern Time, to discuss the Company’s second quarter

2017 financial results, current financial guidance and other

corporate developments. To access this call, dial

877-425-9470 (domestic) or 201-389-0878 (international). The

passcode is 13665665. A replay of this conference call will be

available through August 10, 2017 at 844-512-2921 (domestic) or

412-317-6671 (international). The replay passcode is

13665665. A live webcast of this conference call will be

available on the “Investors” page of the Company’s website

(www.varonis.com), and a replay will be archived on the website as

well.

Non-GAAP Financial Measures

Varonis believes that the use of non-GAAP operating income

(loss) and non-GAAP net income (loss) is helpful to our investors.

These measures, which the Company refers to as our non-GAAP

financial measures, are not prepared in accordance with GAAP.

For the three and six months ended June 30, 2017 and 2016,

non-GAAP operating income (loss) is calculated as operating loss

excluding (i) stock-based compensation expense and (ii) payroll tax

expense related to stock-based compensation.

For the three and six months ended June 30, 2017 and 2016,

non-GAAP net income (loss) is calculated as net loss excluding (i)

stock-based compensation expense and (ii) payroll tax expense

related to stock-based compensation.

Because of varying available valuation methodologies, subjective

assumptions and the variety of equity instruments that can impact a

company’s non-cash expense, the Company believes that providing

non-GAAP financial measures that exclude stock-based compensation

expense allow for more meaningful comparisons between our operating

results from period to period. In addition, the Company excludes

payroll tax expense related to stock-based compensation expense

because, without excluding these tax expenses, investors would not

see the full effect that excluding stock-based compensation expense

had on our operating results. These expenses are tied to the

exercise or vesting of underlying equity awards and the price of

our common stock at the time of vesting or exercise, which factors

may vary from period to period independent of the operating

performance of our business. Similar to stock-based compensation

expense, the Company believes that excluding this payroll tax

expense provides investors and management with greater visibility

to the underlying performance of our business operations and

facilitates comparison with other periods as well as the results of

other companies.

Each of our non-GAAP financial measures is an important tool for

financial and operational decision making and for evaluating our

own operating results over different periods of time. The non-GAAP

financial data are not measures of our financial performance under

U.S. GAAP and should not be considered as alternatives to operating

income (loss) or net income (loss) or any other performance

measures derived in accordance with GAAP. Non-GAAP financial

measures may not provide information that is directly comparable to

that provided by other companies in our industry, as other

companies in our industry may calculate non-GAAP financial results

differently, particularly related to non-recurring, unusual items.

In addition, there are limitations in using non-GAAP financial

measures because the non-GAAP financial measures are not prepared

in accordance with GAAP, may be different from non-GAAP financial

measures used by other companies and exclude expenses that may have

a material impact on our reported financial results. Further,

stock-based compensation expense and payroll tax expense related to

stock-based compensation have been, and will continue to be for the

foreseeable future, significant recurring expenses in our business

and an important part of the compensation provided to our

employees. The presentation of non-GAAP financial information is

not meant to be considered in isolation or as a substitute for the

directly comparable financial measures prepared in accordance with

GAAP. Varonis urges investors to review the reconciliation of our

non-GAAP financial measures to the comparable GAAP financial

measures included below, and not to rely on any single financial

measures to evaluate our business.

Forward-Looking Statements

This press release contains, and statements made during the

above referenced conference call will contain, “forward-looking”

statements, which are subject to the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995, including

regarding the Company’s growth rate and its expectations regarding

future revenues, operating income or loss or earnings or loss per

share. These statements are not guarantees of future performance,

but are based on management’s expectations as of the date of this

press release and assumptions that are inherently subject to

uncertainties, risks and changes in circumstances that are

difficult to predict. Forward-looking statements involve known and

unknown risks, uncertainties and other factors that may cause

actual results, performance or achievements to be materially

different from any future results, performance or achievements.

Important factors that could cause actual results to differ

materially from those expressed or implied by these forward-looking

statements include the following: risks associated with anticipated

growth in Varonis’ addressable market; competitive factors,

including increased sales cycle time, changes in the competitive

environment, pricing changes and increased competition; the risk

that Varonis may not be able to attract or retain employees,

including sales personnel and engineers; Varonis’ ability to build

and expand its direct sales efforts and reseller distribution

channels; general economic and industry conditions, including

expenditure trends for data security solutions; risks associated

with the closing of large transactions, including Varonis’ ability

to close large transactions consistently on a quarterly basis; new

product introductions and Varonis’ ability to develop and deliver

innovative products; risks associated with international

operations; and Varonis’ ability to provide high-quality service

and support offerings. These and other important risk factors are

described more fully in Varonis’ reports and other documents filed

with the Securities and Exchange Commission and could cause actual

results to vary from expectations. All information provided in this

press release and in the conference call is as of the date hereof,

and Varonis undertakes no duty to update or revise this

information, whether as a result of new information, new

developments or otherwise, except as required by law.

To find out more about Varonis, visit www.varonis.com

About Varonis

Varonis is a leading provider of software solutions that protect

data from insider threats and cyberattacks. Through its innovative

Data Security Platform, Varonis allows organizations to analyze,

secure, manage, and migrate their volumes of unstructured data.

Varonis specializes in file and email systems that store valuable

spreadsheets, word processing documents, presentations, audio and

video files, emails, and text. This rapidly growing data often

contains an enterprise's financial information, product plans,

strategic initiatives, intellectual property, and confidential

employee, customer or patient records. IT and business personnel

deploy Varonis software for a variety of use cases, including data

security, governance and compliance, user behavior analytics,

archiving, search, and file synchronization and sharing. With

offices and partners worldwide, Varonis had approximately 5,750

customers as of June 30, 2017, spanning leading firms in financial

services, healthcare, public, industrial, insurance, energy and

utilities, media and entertainment, consumer and retail, technology

and education sectors.

| |

|

| Varonis Systems, Inc. |

|

| Consolidated Statements of

Operations |

|

| (in thousands, except for share and per share

data) |

|

|

|

|

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

|

2017 |

|

|

|

|

2016 |

|

|

|

|

|

2017 |

|

|

|

|

2016 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Unaudited |

|

|

Unaudited |

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

Licenses |

|

$ |

28,420 |

|

|

|

$ |

21,742 |

|

|

|

|

$ |

47,575 |

|

|

|

$ |

35,586 |

|

|

|

|

Maintenance and services |

|

|

21,754 |

|

|

|

|

16,899 |

|

|

|

|

|

42,979 |

|

|

|

|

33,525 |

|

|

|

| Total

revenues |

|

|

50,174 |

|

|

|

|

38,641 |

|

|

|

|

|

90,554 |

|

|

|

|

69,111 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Cost of

revenues |

|

|

4,878 |

|

|

|

|

3,721 |

|

|

|

|

|

9,550 |

|

|

|

|

7,217 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Gross

profit |

|

|

45,296 |

|

|

|

|

34,920 |

|

|

|

|

|

81,004 |

|

|

|

|

61,894 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating costs and expenses: |

|

|

|

|

|

|

|

|

|

|

| Research

and development |

|

|

11,498 |

|

|

|

|

8,905 |

|

|

|

|

|

21,907 |

|

|

|

|

17,742 |

|

|

|

| Sales and

marketing |

|

|

32,560 |

|

|

|

|

26,840 |

|

|

|

|

|

63,371 |

|

|

|

|

51,204 |

|

|

|

| General

and administrative |

|

|

6,582 |

|

|

|

|

4,760 |

|

|

|

|

|

12,095 |

|

|

|

|

9,322 |

|

|

|

| Total

operating expenses |

|

|

50,640 |

|

|

|

|

40,505 |

|

|

|

|

|

97,373 |

|

|

|

|

78,268 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Operating loss |

|

|

(5,344 |

) |

|

|

|

(5,585 |

) |

|

|

|

|

(16,369 |

) |

|

|

|

(16,374 |

) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Financial income (expenses), net |

|

|

950 |

|

|

|

|

(605 |

) |

|

|

|

|

1,419 |

|

|

|

|

40 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Loss

before income taxes |

|

|

(4,394 |

) |

|

|

|

(6,190 |

) |

|

|

|

|

(14,950 |

) |

|

|

|

(16,334 |

) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Income

taxes |

|

|

(641 |

) |

|

|

|

(303 |

) |

|

|

|

|

(964 |

) |

|

|

|

(509 |

) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Net

loss |

|

$ |

(5,035 |

) |

|

|

$ |

(6,493 |

) |

|

|

|

$ |

(15,914 |

) |

|

|

$ |

(16,843 |

) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss

per share of common stock, basic and diluted |

|

$ |

(0.18 |

) |

|

|

$ |

(0.25 |

) |

|

|

|

$ |

(0.59 |

) |

|

|

$ |

(0.64 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted

average number of shares used in computing net loss per share

of common stock, basic and diluted |

|

|

27,321,837 |

|

|

|

|

26,273,380 |

|

|

|

|

|

27,137,930 |

|

|

|

|

26,195,269 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation expense for the three and six

months ended June 30, 2017 and 2016

is included in the Consolidated Statements of Operations

as follows (in thousands): |

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

|

2017 |

|

|

|

2016 |

|

|

|

|

2017 |

|

|

|

2016 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Unaudited |

|

|

Unaudited |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of

revenues |

|

$ |

273 |

|

|

$ |

172 |

|

|

|

$ |

500 |

|

|

$ |

318 |

|

|

| Research

and development |

|

|

1,301 |

|

|

|

793 |

|

|

|

|

2,431 |

|

|

|

1,458 |

|

|

| Sales

and marketing |

|

|

2,362 |

|

|

|

1,628 |

|

|

|

|

4,421 |

|

|

|

2,803 |

|

|

| General

and administrative |

|

|

1,323 |

|

|

|

780 |

|

|

|

|

2,311 |

|

|

|

1,418 |

|

|

| |

|

$ |

5,259 |

|

|

$ |

3,373 |

|

|

|

$ |

9,663 |

|

|

$ |

5,997 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Payroll tax expense related to stock-based

compensation for the three and six months ended June 30, 2017 and

2016 is included in the Consolidated Statements of

Operations as follows (in thousands): |

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

|

2017 |

|

|

|

2016 |

|

|

|

|

2017 |

|

|

|

2016 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Unaudited |

|

|

Unaudited |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of

revenues |

|

$ |

12 |

|

|

$ |

9 |

|

|

|

$ |

45 |

|

|

$ |

22 |

|

|

| Research

and development |

|

|

13 |

|

|

|

2 |

|

|

|

|

28 |

|

|

|

10 |

|

|

| Sales

and marketing |

|

|

166 |

|

|

|

60 |

|

|

|

|

485 |

|

|

|

123 |

|

|

| General

and administrative |

|

|

8 |

|

|

|

8 |

|

|

|

|

43 |

|

|

|

22 |

|

|

| |

|

$ |

199 |

|

|

$ |

79 |

|

|

|

$ |

601 |

|

|

$ |

177 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Varonis Systems, Inc. |

| Consolidated Balance Sheets |

| (in thousands) |

| |

|

|

|

|

|

| |

|

June 30, |

|

December 31, |

| |

|

|

2017 |

|

|

|

|

2016 |

|

|

| |

|

Unaudited |

|

|

|

Assets |

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

| Cash and

cash equivalents |

|

$ |

53,539 |

|

|

|

$ |

48,315 |

|

|

|

Short-term investments |

|

|

68,039 |

|

|

|

|

65,493 |

|

|

| Trade

receivables, net |

|

|

41,313 |

|

|

|

|

53,861 |

|

|

| Prepaid

expenses and other current assets |

|

|

7,571 |

|

|

|

|

3,650 |

|

|

| Total

current assets |

|

|

170,462 |

|

|

|

|

171,319 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Long-term assets: |

|

|

|

|

|

|

| Other

assets |

|

|

818 |

|

|

|

|

609 |

|

|

| Property

and equipment, net |

|

|

11,160 |

|

|

|

|

9,910 |

|

|

| Total

long-term assets |

|

|

11,978 |

|

|

|

|

10,519 |

|

|

|

|

|

|

|

|

|

|

|

|

| Total

assets |

|

$ |

182,440 |

|

|

|

$ |

181,838 |

|

|

| |

|

|

|

|

|

|

|

Liabilities and stockholders' equity |

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

| Trade

payables |

|

$ |

1,348 |

|

|

|

$ |

1,288 |

|

|

| Accrued

expenses and other short term liabilities |

|

|

30,769 |

|

|

|

|

28,479 |

|

|

| Deferred

revenues |

|

|

57,457 |

|

|

|

|

58,478 |

|

|

| Total

current liabilities |

|

|

89,574 |

|

|

|

|

88,245 |

|

|

| |

|

|

|

|

|

|

|

Long-term liabilities: |

|

|

|

|

|

|

| Deferred

revenues |

|

|

3,889 |

|

|

|

|

3,562 |

|

|

| Severance

pay |

|

|

1,472 |

|

|

|

|

1,664 |

|

|

| Other

liabilities |

|

|

5,273 |

|

|

|

|

5,628 |

|

|

| Total

long-term liabilities |

|

|

10,634 |

|

|

|

|

10,854 |

|

|

| |

|

|

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

|

|

| Common

stock |

|

|

27 |

|

|

|

|

27 |

|

|

|

Accumulated other comprehensive income (loss) |

|

|

2,128 |

|

|

|

|

(479 |

) |

|

|

Additional paid-in capital |

|

|

204,751 |

|

|

|

|

189,335 |

|

|

|

Accumulated deficit |

|

|

(124,674 |

) |

|

|

|

(106,144 |

) |

|

| Total

stockholders' equity |

|

|

82,232 |

|

|

|

|

82,739 |

|

|

| Total

liabilities and stockholders' equity |

|

$ |

182,440 |

|

|

|

$ |

181,838 |

|

|

| |

|

|

|

|

|

|

|

|

| Varonis Systems, Inc. |

|

| Consolidated Statements of Cash

Flows |

|

| (in thousands) |

|

| |

|

|

|

|

|

|

|

|

| |

|

Six Months Ended June 30, |

|

| |

|

|

2017 |

|

|

|

|

2016 |

|

|

|

| |

|

Unaudited |

|

Unaudited |

|

|

Cash flows from operating activities: |

|

|

|

|

|

| Net

loss |

|

$ |

(15,914 |

) |

|

|

$ |

(16,843 |

) |

|

|

|

Adjustments to reconcile net loss to net cash provided by operating

activities: |

|

|

|

|

|

|

Depreciation |

|

|

1,284 |

|

|

|

|

1,066 |

|

|

|

|

Stock-based compensation |

|

|

9,663 |

|

|

|

|

5,997 |

|

|

|

| Capital

gain from disposal of fixed assets |

|

|

(2 |

) |

|

|

|

- |

|

|

|

| Changes

in assets and liabilities: |

|

|

|

|

|

|

|

|

|

| Trade

receivables |

|

|

12,548 |

|

|

|

|

13,943 |

|

|

|

| Prepaid

expenses and other current assets |

|

|

(1,783 |

) |

|

|

|

47 |

|

|

|

| Trade

payables |

|

|

60 |

|

|

|

|

(538 |

) |

|

|

| Accrued

expenses and other short term liabilities |

|

|

2,769 |

|

|

|

|

16 |

|

|

|

| Severance

pay |

|

|

(192 |

) |

|

|

|

21 |

|

|

|

| Deferred

revenues |

|

|

(694 |

) |

|

|

|

(1,144 |

) |

|

|

| Other

long term liabilities |

|

|

(355 |

) |

|

|

|

(224 |

) |

|

|

| Net cash

provided by operating activities |

|

|

7,384 |

|

|

|

|

2,341 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

| Decrease

(increase) in short-term investments |

|

|

(2,556 |

) |

|

|

|

4,750 |

|

|

|

| Increase

in long-term deposits |

|

|

(160 |

) |

|

|

|

(27 |

) |

|

|

| Increase

in restricted cash |

|

|

(49 |

) |

|

|

|

(7 |

) |

|

|

| Proceeds

from sale of property and equipment |

|

|

2 |

|

|

|

|

- |

|

|

|

| Purchase

of property and equipment |

|

|

(2,534 |

) |

|

|

|

(1,447 |

) |

|

|

| Net cash

provided by (used in) investing activities |

|

|

(5,297 |

) |

|

|

|

3,269 |

|

|

|

| |

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

| Proceeds

from employee stock plans, net |

|

|

3,137 |

|

|

|

|

1,251 |

|

|

|

| Net cash

provided by financing activities |

|

|

3,137 |

|

|

|

|

1,251 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Increase

in cash and cash equivalents |

|

|

5,224 |

|

|

|

|

6,861 |

|

|

|

| Cash and

cash equivalents at beginning of period |

|

|

48,315 |

|

|

|

|

49,241 |

|

|

|

| Cash and

cash equivalents at end of period |

|

$ |

53,539 |

|

|

|

$ |

56,102 |

|

|

|

| |

|

|

|

|

|

| Varonis Systems, Inc. |

|

| Reconciliation of GAAP Measures to

non-GAAP |

|

| (in thousands, except share and per share

data) |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

|

2017 |

|

|

|

|

2016 |

|

|

|

|

|

2017 |

|

|

|

|

2016 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Unaudited |

|

|

Unaudited |

|

|

Reconciliation to non-GAAP income (loss) from

operations: |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| GAAP

operating loss |

|

$ |

(5,344 |

) |

|

|

$ |

(5,585 |

) |

|

|

|

$ |

(16,369 |

) |

|

|

$ |

(16,374 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Add

back: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation expense |

|

|

5,259 |

|

|

|

|

3,373 |

|

|

|

|

|

9,663 |

|

|

|

|

5,997 |

|

|

|

| Payroll

tax expenses related to stock-based compensation |

|

|

199 |

|

|

|

|

79 |

|

|

|

|

|

601 |

|

|

|

|

177 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP

operating income (loss) |

|

$ |

114 |

|

|

|

$ |

(2,133 |

) |

|

|

|

$ |

(6,105 |

) |

|

|

$ |

(10,200 |

) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Reconciliation to non-GAAP net income (loss): |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| GAAP net

loss |

|

$ |

(5,035 |

) |

|

|

$ |

(6,493 |

) |

|

|

|

$ |

(15,914 |

) |

|

|

$ |

(16,843 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Add

back: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation expense |

|

|

5,259 |

|

|

|

|

3,373 |

|

|

|

|

|

9,663 |

|

|

|

|

5,997 |

|

|

|

| Payroll

tax expenses related to stock-based compensation |

|

|

199 |

|

|

|

|

79 |

|

|

|

|

|

601 |

|

|

|

|

177 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP

net income (loss) |

|

$ |

423 |

|

|

|

$ |

(3,041 |

) |

|

|

|

$ |

(5,650 |

) |

|

|

$ |

(10,669 |

) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP

net income (loss) per common share - basic |

|

$ |

0.02 |

|

|

|

$ |

(0.12 |

) |

|

|

|

$ |

(0.21 |

) |

|

|

$ |

(0.41 |

) |

|

|

| Non-GAAP

net income (loss) per common share - diluted |

|

$ |

0.01 |

|

|

|

$ |

(0.12 |

) |

|

|

|

$ |

(0.21 |

) |

|

|

$ |

(0.41 |

) |

|

|

| GAAP net

loss per common share - basic and diluted |

|

$ |

(0.18 |

) |

|

|

$ |

(0.25 |

) |

|

|

|

$ |

(0.59 |

) |

|

|

$ |

(0.64 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP

weighted average number of common shares outstanding - basic |

|

|

27,321,837 |

|

|

|

|

26,273,380 |

|

|

|

|

|

27,137,930 |

|

|

|

|

26,195,269 |

|

|

|

| Non-GAAP

weighted average number of common shares outstanding - diluted |

|

|

30,545,216 |

|

|

|

|

26,273,380 |

|

|

|

|

|

27,137,930 |

|

|

|

|

26,195,269 |

|

|

|

| GAAP

weighted average number of common shares outstanding - basic and

diluted |

|

|

27,321,837 |

|

|

|

|

26,273,380 |

|

|

|

|

|

27,137,930 |

|

|

|

|

26,195,269 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investor Relations Contact:

Staci Mortenson

ICR

646-706-7516

Email: investors@varonis.com

News Media Contact:

Mia Damiano

Merritt Group

703-390-1502

Email: damiano@merrittgrp.com

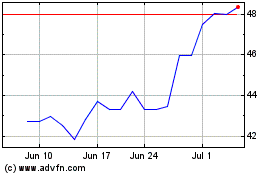

Varonis Systems (NASDAQ:VRNS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Varonis Systems (NASDAQ:VRNS)

Historical Stock Chart

From Apr 2023 to Apr 2024