Catalyst Biosciences Reports Second Quarter 2017 Financial Results and Provides Subcutaneous (SQ) Hemophilia Program Update

August 03 2017 - 8:00AM

-- Enrollment into Phase 1/2 trial of Factor IX

SQ candidate CB 2679d is ongoing; trial is on track to announce

interim results by year-end --

Catalyst Biosciences, Inc. (NASDAQ:CBIO), today announced financial

results for the second quarter ended June 30, 2017 and provided a

corporate update.

Recent Milestones: Factor IX SQ CB 2679d (also known as

ISU304)

- Initiated and completed dosing of first patient cohort in Phase

1/2 clinical trial of subcutaneous (SQ) CB 2679d in individuals

with hemophilia B;

- Received a $0.7M milestone payment from Catalyst’s

collaborator, ISU Abxis, for initiation of the Phase 1/2 clinical

trial;

- Presented positive preclinical results at an international

hemophilia meeting (ISTH) that demonstrate the ability to normalize

Factor IX levels in a model of hemophilia B with daily SQ dosing;

and

- Received Orphan Medicine Designation from the European

Commission for the treatment of individuals with hemophilia B with

SQ CB 2679d.

Recent Milestones: Factor VIIa/marzeptacog alfa

(activated)

- Presented positive preclinical results at ISTH of Catalyst’s

subcutaneously administered Factor VIIa, marzeptacog alfa

(activated), that support the initiation of a Phase 2/3 clinical

trial to evaluate subcutaneous dosing as prophylaxis for

individuals with hemophilia and an inhibitor.

“We made significant progress in both our clinical programs and

strengthened our balance sheet in the second quarter” said Nassim

Usman, Ph.D., Catalyst’s President and Chief Executive Officer.

“The Factor IX program was initiated on schedule and we expect to

report interim results from the Phase 1/2 subcutaneous dosing study

in individuals with hemophilia B by year-end. We also intend to

initiate a Phase 2 clinical trial for our Factor VIIa product

candidate Marzeptacog alfa by the end of the year. With the

additional capital we raised in April, we are well positioned to

report clinical data from both programs over the next 12

months.”

2017 Anticipated Milestones

- Factor IX/CB 2679d: Announce interim results

from the SQ Phase 1/2 proof-of-concept clinical trial in

individuals with severe hemophilia B by the end of 2017; and

- Factor VIIa/marzeptacog alfa (activated):

Initiate the Phase 2 part of a Phase 2/3 SQ efficacy clinical trial

in individuals with hemophilia A or B with an inhibitor by the end

of 2017.

2017 Financial Highlights

- Raised $26 million through the six months ended June 30, 2017

consisting of $20.7 million raised through the underwritten public

equity offering and $5.3 million raised through our Capital on

DemandTM program. Cash, cash equivalents and short-term investments

as of June 30, 2017 were $32.4 million (excluding restricted cash).

The Company believes that its existing capital resources will be

sufficient to meet its projected operating requirements for at

least the next 12 months.

- Redeemable Convertible Notes balance was reduced to $5.8

million from $19.4 million at December 2016; all redemptions were

funded from the restricted cash, of which an additional $5.8

million is available to fund the remaining notes.

- Research and development expense for the three months ended

June 30, 2017 was $3.4 million, compared with $2.8 million for the

prior year period. The increase was due primarily to manufacturing

expenses for marzeptacog alfa (activated), partially offset by a

decrease in personnel-related costs and a decrease in lab supply

costs and costs related to preclinical third-party research and

development service contracts.

- General and administrative expense for the three months ended

June 30, 2017 was $2.7 million, compared with $2.3 million for the

prior year period. The increase was due primarily to an increase in

personnel-related costs and an increase in professional service

costs indirectly related to the underwritten public offering.

- Net loss attributable to common stockholders for the three

months ended June 30, 2017 was $9.8 million, or ($2.53) per basic

and diluted share, compared with $4.8 million, or ($6.33) per basic

and diluted share, for the prior year period. Convertible

preferred stock’s $4.0 million deemed dividend is a non-cash,

non-recurring charge.

About Catalyst Biosciences Catalyst is a

clinical-stage biopharmaceutical company focused on developing

novel medicines to address hematology indications. Catalyst is

focused on the field of hemostasis, including the subcutaneous

prophylaxis of hemophilia and facilitating surgery in individuals

with hemophilia.For more information, please visit

www.catbio.com.

Forward-Looking StatementsThis press release

contains forward-looking statements that involve substantial risks

and uncertainties. All statements, other than statements of

historical facts, included in this press release regarding our

strategy, the potential uses and benefits of CB 2679d and

marzeptacog alpha (activated) and development plans for these

product candidates are forward-looking statements. Examples of such

statements include, but are not limited to, statements relating to

Catalyst’s clinical trial timelines, including the initiation of a

Phase 2/3 efficacy study for marzeptacog alfa (activated) in 2017,

the anticipated completion of a Phase 1/2 proof-of-concept study

for CB 2679d or the plans to have results from this study by the

end of 2017, the potential uses and benefits of subcutaneously

dosed marzeptacog alfa (activated) or CB 2679d, and the Company’s

belief regarding sufficiency of its existing capital resources to

meet its projected operating requirements for at least the next 12

months. Actual results or events could differ materially from the

plans, intentions, expectations and projections disclosed in the

forward-looking statements. Various important factors could cause

actual results or events to differ materially from the

forward-looking statements that Catalyst makes, including, but not

limited to, the risk that clinical trials and studies may be

delayed and may not have satisfactory outcomes, that potential

adverse effects may arise from the testing or use of Catalyst’s

products, the risk that costs required to develop or manufacture

Catalyst’s products will be higher than anticipated, competition

and other factors that affect our ability to successfully develop

and commercialize our product candidates, and other risks described

in the “Risk Factors” section of the Company’s Annual Report on

Form 10-K and Quarterly Reports on Form 10-Q filed with the SEC.

Catalyst does not assume any obligation to update any

forward-looking statements, except as required by law.

| Catalyst Biosciences, Inc. |

| Condensed Consolidated Balance

Sheets |

| (In thousands, except share and per share amounts) |

| |

|

June 30, 2017 |

|

|

December 31, 2016 |

|

| |

|

(Unaudited) |

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and

cash equivalents |

|

$ |

32,388 |

|

|

$ |

10,264 |

|

|

Short-term investments |

|

|

— |

|

|

|

6,800 |

|

|

Restricted cash |

|

|

5,997 |

|

|

|

19,468 |

|

| Accounts

receivable |

|

|

135 |

|

|

|

31 |

|

| Prepaid

and other current assets |

|

|

752 |

|

|

|

958 |

|

| Total

current assets |

|

|

39,272 |

|

|

|

37,521 |

|

| Restricted cash,

noncurrent |

|

|

— |

|

|

|

125 |

|

| Property and equipment,

net |

|

|

358 |

|

|

|

444 |

|

| Total

assets |

|

$ |

39,630 |

|

|

$ |

38,090 |

|

| Liabilities and

stockholders’ equity |

|

|

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

|

| Accounts

payable |

|

$ |

501 |

|

|

$ |

837 |

|

| Accrued

compensation |

|

|

676 |

|

|

|

596 |

|

| Other

accrued liabilities |

|

|

1,460 |

|

|

|

805 |

|

| Deferred

revenue, current portion |

|

|

848 |

|

|

|

283 |

|

| Deferred

rent, current portion |

|

|

29 |

|

|

|

41 |

|

|

Redeemable convertible notes |

|

|

5,770 |

|

|

|

19,403 |

|

| Total

current liabilities |

|

|

9,284 |

|

|

|

21,965 |

|

| Deferred revenue,

noncurrent portion |

|

|

— |

|

|

|

47 |

|

| Deferred rent,

noncurrent portion |

|

— |

|

|

|

7 |

|

| Total liabilities |

|

|

9,284 |

|

|

|

22,019 |

|

| Stockholders’

equity: |

|

|

|

|

|

|

|

|

| Preferred

stock, $0.001 par value, 5,000,000 shares authorized; 5,500 and 0

shares issued and outstanding at June 30, 2017 and December

31, 2016, respectively |

|

|

— |

|

|

— |

|

| Common

stock, $0.001 par value, 100,000,000 shares authorized; 4,310,561

and 801,756 shares issued and outstanding at June 30, 2017

and December 31, 2016, respectively |

|

|

4 |

|

|

|

1 |

|

|

Additional paid-in capital |

|

|

192,290 |

|

|

|

164,053 |

|

|

Accumulated other comprehensive (loss) |

|

|

— |

|

|

|

(1 |

) |

|

Accumulated deficit |

|

|

(161,948 |

) |

|

|

(147,982 |

) |

| Total

stockholders’ equity |

|

|

30,346 |

|

|

|

16,071 |

|

| Total

liabilities and stockholders’ equity |

|

$ |

39,630 |

|

|

$ |

38,090 |

|

| Catalyst Biosciences, Inc. |

| Condensed Consolidated Statements of

Operations |

| (In thousands, except share and per share

amounts) |

| (Unaudited) |

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

|

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

| Contract revenue |

|

$ |

111 |

|

|

$ |

109 |

|

|

$ |

382 |

|

|

$ |

219 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research

and development |

|

|

3,401 |

|

|

|

2,752 |

|

|

|

5,481 |

|

|

|

5,046 |

|

| General

and administrative |

|

|

2,654 |

|

|

|

2,272 |

|

|

|

5,017 |

|

|

|

4,658 |

|

| Total

operating expenses |

|

|

6,055 |

|

|

|

5,024 |

|

|

|

10,498 |

|

|

|

9,704 |

|

| Loss from

operations |

|

|

(5,944 |

) |

|

|

(4,915 |

) |

|

|

(10,116 |

) |

|

|

(9,485 |

) |

| Interest and other

income, net |

|

|

67 |

|

|

|

82 |

|

|

|

101 |

|

|

|

1,061 |

|

| Net loss |

|

|

(5,877 |

) |

|

|

(4,833 |

) |

|

|

(10,015 |

) |

|

|

(8,424 |

) |

| Deemed dividend for

convertible preferred stock beneficial conversion feature |

|

|

(3,951 |

) |

|

|

— |

|

|

|

(3,951 |

) |

|

|

— |

|

| Net loss attributable

to common stockholders |

|

$ |

(9,828 |

) |

|

$ |

(4,833 |

) |

|

$ |

(13,966 |

) |

|

$ |

(8,424 |

) |

| Net loss per share

attributable to common stockholders, basic and diluted |

|

$ |

(2.53 |

) |

|

$ |

(6.33 |

) |

|

$ |

(5.82 |

) |

|

$ |

(11.05 |

) |

| Shares used to compute

net loss per share attributable to common stockholders, basic and

diluted |

|

|

3,877,736 |

|

|

|

763,138 |

|

|

|

2,400,101 |

|

|

|

762,573 |

|

Contacts:

Investors:

Fletcher Payne, CFO

Catalyst Biosciences, Inc.

+1.650.871.0761

investors@catbio.com

Media:

Denise Powell

Red House Consulting, LLC

+1.510.703.9491

denise@redhousecomms.com

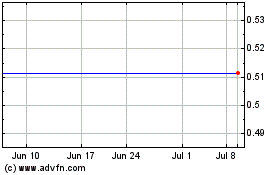

Catalyst Biosciences (NASDAQ:CBIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

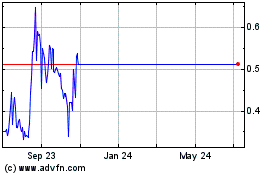

Catalyst Biosciences (NASDAQ:CBIO)

Historical Stock Chart

From Apr 2023 to Apr 2024