KKR Releases 2016 ESG and Citizenship Update

August 03 2017 - 7:00AM

Business Wire

Firm’s Seventh ESG Report Discusses Approach to

Responsible Investment

KKR, a leading global investment firm, today released its 2016

Environmental, Social, Governance (ESG) and Citizenship Update,

providing a snapshot of related activities throughout the year.

This is the Firm’s seventh report dedicated to discussing KKR’s

responsible investment approach and progress. Since KKR’s founding

41 years ago, the Firm’s approach to investing has evolved to

incorporate the thoughtful consideration of critical factors,

including ESG issues, in the decision-making process and management

of companies.

“In 2016 – a year of volatility and complexity – we remained

focused on our investment model, dedicated to our one-firm culture,

and committed to responsibly managing ESG issues in our investment

decisions,” said Henry Kravis and George Roberts, Co-Chairmen and

Co-CEOs of KKR. “Our understanding of today’s ever-changing world,

coupled with our commitment to be a responsible investor, provides

us with a differentiated view – one that we believe will help us

and our partners achieve continued success during the next 40 years

and beyond.”

Highlights of 2016 activities covered in the report include:

- Introducing an Eco-Innovation Award for

portfolio companies, in the spirit of innovation and value

creation.

- Launching KKR 40 for 40, an

employee-driven volunteer program, resulting in more than 6,600

hours of volunteer time by more than 550 employees. Video on the

program is available here.

- Publishing KKR responses to the

Principles for Responsible Investment (PRI) Limited Partners’

Responsible Investment Due Diligence Questionnaire.

- Continuing to collaborate with

portfolio companies to improve their business performance in

today’s dynamic world. A series of case studies can be explored

here.

- Advancing the Firm’s commitment to

wellness, diversity, and inclusion through a series of focused

initiatives at offices around the world.

To download the full 2016 ESG and Citizenship Update or obtain

more information about KKR's progress, visit www.kkresg.com.

For more on KKR’s Green Solutions Platform (GSP) and

participating portfolio companies, visit www.green.kkr.com.

About KKR

KKR is a leading global investment firm that manages multiple

alternative asset classes, including private equity, energy,

infrastructure, real estate, credit and, through its strategic

partners, hedge funds. KKR aims to generate attractive investment

returns by following a patient and disciplined investment approach,

employing world-class people, and driving growth and value creation

with KKR portfolio companies. KKR invests its own capital alongside

its partners' capital and provides financing solutions and

investment opportunities through its capital markets business.

References to KKR’s investments may include the activities of its

sponsored funds. For additional information about KKR & Co.

L.P. (NYSE: KKR), please visit KKR's website at www.kkr.com and on

Twitter @KKR_Co.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170803005237/en/

KKRKristi Huller / Cara Kleiman,

212-750-8300media@kkr.com

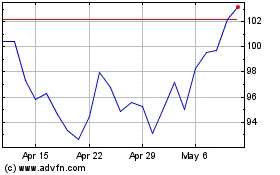

KKR (NYSE:KKR)

Historical Stock Chart

From Mar 2024 to Apr 2024

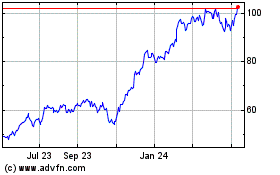

KKR (NYSE:KKR)

Historical Stock Chart

From Apr 2023 to Apr 2024