Alimera Sciences, Inc. (NASDAQ:ALIM) (Alimera), a global

pharmaceutical company that specializes in the commercialization

and development of prescription ophthalmic pharmaceuticals, today

announced top-line financial results for the three months ended

June 30, 2017.

“We are very pleased that in the second quarter of 2017 we

achieved positive adjusted EBITDA for the first time in the history

of the Company”, said Dan Myers, Alimera's Chief Executive Officer.

“We accomplished this through revenue growth of 8% compared to the

same period in 2016 while establishing an appropriate level of

operating expenses following the U.S. launch. Additionally, we

amended our agreement with pSivida in July to allow for the

potential expansion of ILUVIEN’s indication to include posterior

uveitis in Europe, the Middle East and Africa. We continue to

present new real world data on ILUVIEN in Europe and the U.S. data

that we believe will resonate well with physicians. Importantly,

due to our anticipated growth and level of operating expenses, we

believe we will be able to achieve positive operating cash flow

late this year.”

Second Quarter Financial Results

Consolidated net revenue increased by approximately $800,000, or

8%, to approximately $10.4 million for the three months ended June

30, 2017, compared to net revenue of approximately $9.6 million for

the three months ended June 30, 2016. The increase was primarily

attributable to increased sales volume in the U.S.

U.S. net revenue increased by approximately $900,000, or 13%, to

approximately $8.1 million for the three months ended June 30,

2017, compared to U.S. net revenue of approximately $7.2 million

for the three months ended June 30, 2016. The increase was driven

by increased sales of ILUVIEN in the U.S., primarily attributable

to an increase in end user unit demand of 9%.

International net revenue was approximately $2.3 million for the

three months ended June 30, 2017 and 2016. International segment

demand, primarily in Germany, the UK and Portugal, was flat,

suppressed in the second quarter of 2017 due to an out of stock

situation in Germany as a result of increasing demand in the first

quarter of 2017.

Consolidated gross profit increased by $600,000, or 7%, to $9.6

million for three months ended June 30, 2017, compared to $9.0

million for the three months ended June 30, 2016. Gross margin was

93% and 94% for the three months ended June 30, 2017 and 2016,

respectively.

Consolidated operating expenses decreased by approximately $4.5

million, or 29%, to approximately $11.0 million for the three

months ended June 30, 2017, compared to $15.5 million for the three

months ended June 30, 2016.

Consolidated research, development and medical affairs expenses

for the three months ended June 30, 2017 decreased by approximately

$1.0 million, or 31%, to approximately $2.2 million, compared to

$3.2 million for the three months ended June 30, 2016. The

reduction was primarily attributable to a reduction in Alimera’s

international scientific study costs and decreases in personnel

costs.

Consolidated general and administrative expenses for the three

months ended June 30, 2017 decreased by approximately $1.0 million,

or 25%, to approximately $3.0 million, compared to approximately

$4.0 million for the three months ended June 30, 2016. The

reduction was primarily attributable to a reduction in personnel

costs and due to a payment we made to pSivida in 2016 as part of a

dispute that was later settled in 2017.

Consolidated sales and marketing expenses decreased by $2.4

million, or 32%, to $5.1 million for the three months ended June

30, 2017, compared to $7.5 million reported for the three months

ended June 30, 2016. The decrease was primarily attributable to

cost saving plans implemented by Alimera in late 2016 and early

2017.

Alimera's reported GAAP net loss was approximately $2.8 million

for the three months ended June 30, 2017, compared to approximately

$6.9 million loss reported for the three months ended June 30,

2016.

Non-GAAP Financial Results

Adjusted EBITDA, as defined below, was approximately positive

$0.5 million for the three months ended June 30, 2017, compared to

approximately negative $4.4 million for the three months ended June

30, 2016. This was due to the increase in revenue globally and the

decrease in operating expenses due to the cost savings plans

Alimera implemented in late 2016 and early 2017.

For purpose of this press release, “Adjusted EBITDA” is adjusted

earnings before interest, taxes, depreciation, amortization,

non-cash stock-based compensation expenses, and to the extent they

are included in the calculation of earnings, net unrealized gains

and losses from foreign currency exchange transactions and gains

and losses from the change in the fair value of derivative warrant

liability.

Alimera provides non-GAAP financial information, which it

believes can enhance an overall understanding of its financial

performance when considered together with GAAP figures. Refer to

the sections of this press release entitled “Non-GAAP Financial

Information” and “Reconciliation of GAAP Measures to Non-GAAP

Adjusted Measures,” which includes Adjusted EBITDA and Adjusted

Operating Expenses.

Conference Call

An accompanying conference call will be hosted by Dan Myers,

Chief Executive Officer and Rick Eiswirth, President and Chief

Financial Officer. The call will be held at 9:00 AM ET, on August

3, 2017. Please refer to the information below for conference call

dial-in information and webcast registration.

Conference date: August 3, 2017, 9:00 AM ET

Conference dial-in: 877-269-7756

International dial-in: 201-689-7817

Conference Call Name: Alimera Sciences Second

Quarter 2017 Results Call Webcast Registration:

Click Here

Following the live call, a replay will be available on the

Company's website, www.alimerasciences.com, under "Investor

Relations".

Non-GAAP Financial Information

This press release contains a discussion of a non-GAAP financial

measure, as defined in Regulation G of the Securities Exchange Act

of 1934, as amended. Alimera reports its financial results in

compliance with GAAP, but believes that the non-GAAP measure of

Adjusted EBITDA and Adjusted Operating Expenses will be a more

relevant measure of Alimera’s operating performance. Alimera uses

Adjusted EBITDA and Adjusted Operating Expenses in the management

of its business and Alimera’s lender uses Adjusted EBITDA as a

financial covenant measurement. Accordingly, Adjusted EBITDA and

Adjusted Operating Expenses for the second quarter of 2017 have

been presented in certain instances excluding items identified in

the reconciliations provided. For a reconciliation of these

non-GAAP financial measures to their most directly comparable GAAP

financial measure, see the table below.

This non-GAAP financial measure, as presented, may not be

comparable to similarly titled measures reported by other companies

since not all companies may calculate this measure in an identical

manner and, therefore, it is not necessarily an accurate measure of

comparison between companies.

The presentation of these non-GAAP financial measures is

not intended to be considered in isolation or as a substitute for

guidance prepared in accordance with GAAP. The principal limitation

of this non-GAAP financial measure is that it excludes significant

elements that are required by GAAP to be recorded in Alimera’s

financial statements. In addition, it is subject to inherent

limitations as they reflect the exercise of judgments by management

in determining this non-GAAP financial measure. In order to

compensate for these limitations, Alimera presents its non-GAAP

financial results in connection with its GAAP results. Investors

are encouraged to review the reconciliation of our non-GAAP

financial measures to their most directly comparable GAAP financial

measure.

About Alimera Sciences, Inc.

Alimera, founded in June 2003, is a pharmaceutical company that

specializes in the commercialization and development of

prescription ophthalmic pharmaceuticals. Alimera is presently

focused on diseases affecting the back of the eye, or retina,

because these diseases are not well treated with current therapies

and will affect millions of people in aging populations. Alimera's

commitment to retina specialists and their patients is manifest in

its product and in its development portfolio designed to treat

early- and late-stage diseases. For more information, please visit

www.alimerasciences.com.

Forward-Looking Statements

This press release contains "forward-looking statements," within

the meaning of the Private Securities Litigation Reform Act of

1995, regarding, among other things, the opportunity for further

growth in 2017 for ILUVIEN and the ability of Alimera to achieve

positive operating cash flow. Such forward-looking statements are

based on current expectations and involve inherent risks and

uncertainties, including factors that could delay, divert or change

any of them, and could cause actual results to differ materially

from those projected in its forward-looking statements. Meaningful

factors which could cause actual results to differ include, but are

not limited to, continued market acceptance of ILUVIEN in the U.S.

and Europe, including physicians' ability to obtain reimbursement,

as well as other factors discussed in the "Risk Factors" and

"Management's Discussion and Analysis of Financial Condition and

Results of Operations" sections of Alimera's Annual Report on Form

10-K for the year ended December 31, 2016 and Quarterly Report on

Form 10-Q for the quarter ended March 31, 2017, which are on file

with the Securities and Exchange Commission (the SEC) and available

on the SEC's website at http://www.sec.gov. Additional factors may

be set forth in those sections of Alimera's Quarterly Report on

Form 10-Q for the quarter ended June 30, 2017, to be filed with the

SEC in the third quarter of 2017. In addition to the risks

described above and in Alimera's Annual Report on Form 10-K,

Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and

other filings with the SEC, other unknown or unpredictable factors

also could affect Alimera's results. There can be no assurance that

the actual results or developments anticipated by Alimera will be

realized or, even if substantially realized, that they will have

the expected consequences to, or effects on, Alimera. Therefore, no

assurance can be given that the outcomes stated in such

forward-looking statements and estimates will be achieved. All

forward-looking statements contained in this press release are

expressly qualified by the cautionary statements contained or

referred to herein. Alimera cautions investors not to rely too

heavily on the forward-looking statements Alimera makes or that are

made on its behalf. These forward-looking statements speak only as

of the date of this press release (unless another date is

indicated). Alimera undertakes no obligation, and specifically

declines any obligation, to publicly update or revise any such

forward-looking statements, whether as a result of new information,

future events or otherwise.

| |

| |

| ALIMERA SCIENCES, INC. |

| CONSOLIDATED BALANCE SHEETS |

| |

| |

June 30,2017 |

|

December 31,2016 |

| |

(In thousands, except share and per

share data) |

| CURRENT ASSETS: |

|

|

|

| Cash and

cash equivalents |

$ |

26,882 |

|

|

$ |

30,979 |

|

|

Restricted cash |

33 |

|

|

31 |

|

| Accounts

receivable, net |

13,648 |

|

|

13,839 |

|

| Prepaid

expenses and other current assets |

2,574 |

|

|

2,107 |

|

|

Inventory, net |

1,143 |

|

|

446 |

|

|

Total current assets |

44,280 |

|

|

47,402 |

|

| NON-CURRENT

ASSETS: |

|

|

|

| Property

and equipment, net |

1,477 |

|

|

1,787 |

|

|

Intangible asset, net |

19,642 |

|

|

20,604 |

|

| Deferred

tax asset |

474 |

|

|

436 |

|

| TOTAL ASSETS |

$ |

65,873 |

|

|

$ |

70,229 |

|

| CURRENT

LIABILITIES: |

|

|

|

| Accounts

payable |

$ |

5,711 |

|

|

$ |

4,986 |

|

| Accrued

expenses |

3,729 |

|

|

3,758 |

|

|

Derivative warrant liability |

— |

|

|

188 |

|

| Capital

lease obligations |

137 |

|

|

191 |

|

|

Total current liabilities |

9,577 |

|

|

9,123 |

|

| NON-CURRENT

LIABILITIES: |

|

|

|

| Note

payable |

33,689 |

|

|

33,084 |

|

| Capital

lease obligations — less current portion |

132 |

|

|

274 |

|

| Other

non-current liabilities |

773 |

|

|

2,162 |

|

| COMMITMENTS AND

CONTINGENCIES |

|

|

|

| STOCKHOLDERS’

EQUITY: |

|

|

|

| Preferred

stock, |

|

|

|

|

Series A Convertible Preferred Stock |

19,227 |

|

|

19,227 |

|

|

Series B Convertible Preferred Stock |

49,568 |

|

|

49,568 |

|

| Common

stock |

670 |

|

|

649 |

|

|

Additional paid-in capital |

336,093 |

|

|

330,781 |

|

| Common

stock warrants |

3,707 |

|

|

3,707 |

|

|

Accumulated deficit |

(386,566 |

) |

|

(377,074 |

) |

|

Accumulated other comprehensive loss |

(997 |

) |

|

(1,272 |

) |

| TOTAL STOCKHOLDERS’

EQUITY |

21,702 |

|

|

25,586 |

|

| TOTAL LIABILITIES AND

STOCKHOLDERS’ EQUITY |

$ |

65,873 |

|

|

$ |

70,229 |

|

| |

| |

| ALIMERA SCIENCES, INC. |

| CONSOLIDATED STATEMENTS OF

OPERATIONS |

| FOR THE THREE AND SIX MONTHS ENDED

JUNE 30, 2017 AND 2016 |

| |

|

|

Three Months EndedJune

30, |

|

Six Months Ended June 30, |

|

|

2017 |

|

2016 |

|

2017 |

|

2016 |

|

|

(In thousands, except share and per share

data) |

| NET REVENUE |

$ |

10,368 |

|

|

$ |

9,557 |

|

|

$ |

16,986 |

|

|

$ |

15,358 |

|

| COST OF GOODS SOLD,

EXCLUDING DEPRECIATION AND AMORTIZATION |

(769 |

) |

|

(556 |

) |

|

(1,356 |

) |

|

(934 |

) |

| GROSS PROFIT |

9,599 |

|

|

9,001 |

|

|

15,630 |

|

|

14,424 |

|

| |

|

|

|

|

|

|

|

| RESEARCH, DEVELOPMENT

AND MEDICAL AFFAIRS EXPENSES |

2,238 |

|

|

3,205 |

|

|

4,348 |

|

|

6,225 |

|

| GENERAL AND

ADMINISTRATIVE EXPENSES |

3,012 |

|

|

4,039 |

|

|

6,276 |

|

|

7,434 |

|

| SALES AND MARKETING

EXPENSES |

5,060 |

|

|

7,510 |

|

|

10,562 |

|

|

14,619 |

|

| DEPRECIATION AND

AMORTIZATION |

667 |

|

|

696 |

|

|

1,333 |

|

|

1,385 |

|

| OPERATING EXPENSES |

10,977 |

|

|

15,450 |

|

|

22,519 |

|

|

29,663 |

|

| NET LOSS FROM

OPERATIONS |

(1,378 |

) |

|

(6,449 |

) |

|

(6,889 |

) |

|

(15,239 |

) |

| |

|

|

|

|

|

|

|

| INTEREST EXPENSE, NET

AND OTHER |

(1,384 |

) |

|

(1,177 |

) |

|

(2,721 |

) |

|

(2,512 |

) |

| UNREALIZED FOREIGN

CURRENCY GAIN (LOSS), NET |

28 |

|

|

(14 |

) |

|

— |

|

|

20 |

|

| CHANGE IN FAIR VALUE OF

DERIVATIVE WARRANT LIABILITY |

21 |

|

|

824 |

|

|

188 |

|

|

2,343 |

|

| LOSS ON EARLY

EXTINGUISHMENT OF DEBT |

— |

|

|

— |

|

|

— |

|

|

(2,564 |

) |

| NET LOSS BEFORE

TAXES |

(2,713 |

) |

|

(6,816 |

) |

|

(9,422 |

) |

|

(17,952 |

) |

| PROVISION FOR

TAXES |

(44 |

) |

|

(42 |

) |

|

(70 |

) |

|

(51 |

) |

| NET LOSS |

$ |

(2,757 |

) |

|

$ |

(6,858 |

) |

|

$ |

(9,492 |

) |

|

$ |

(18,003 |

) |

| NET LOSS PER SHARE —

Basic and diluted |

$ |

(0.04 |

) |

|

$ |

(0.15 |

) |

|

$ |

(0.15 |

) |

|

$ |

(0.40 |

) |

| WEIGHTED AVERAGE SHARES

OUTSTANDING — Basic and diluted |

65,485,106 |

|

|

45,088,072 |

|

|

65,175,724 |

|

|

45,046,952 |

|

|

|

|

|

| RECONCILIATION OF GAAP MEASURES TO NON-GAAP

ADJUSTED MEASURES |

| GAAP NET LOSS TO NON-GAAP ADJUSTED

EBITDA |

|

|

| |

Three Months EndedJune

30, |

|

Six Months Ended June 30, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

| |

(In thousands, unaudited) |

| GAAP Net Loss |

$ |

(2,757 |

) |

|

$ |

(6,858 |

) |

|

$ |

(9,492 |

) |

|

$ |

(18,003 |

) |

|

Adjustments to Net Loss: |

|

|

|

|

|

|

|

|

|

|

|

| Interest

Expense, Net and Other |

1,384 |

|

|

1,177 |

|

|

2,721 |

|

|

2,512 |

|

|

Depreciation and Amortization |

667 |

|

|

696 |

|

|

1,333 |

|

|

1,385 |

|

| Provision

for Taxes |

44 |

|

|

42 |

|

|

70 |

|

|

51 |

|

|

Stock-Based Compensation |

1,233 |

|

|

1,323 |

|

|

2,400 |

|

|

2,620 |

|

|

Unrealized Foreign Currency Exchange (Gains) Losses

|

(28 |

) |

|

14 |

|

|

— |

|

|

(20 |

) |

| Change in

the Fair Value of Derivative Warrant Liability |

(21 |

) |

|

(824 |

) |

|

(188 |

) |

|

(2,343 |

) |

| NON-GAAP Adjusted

EBITDA |

$ |

522 |

|

|

$ |

(4,430 |

) |

|

$ |

(3,156 |

) |

|

$ |

(13,798 |

) |

|

|

|

|

| GAAP OPERATING EXPENSES TO NON-GAAP ADJUSTED

OPERATING EXPENSES |

| |

| |

Three Months EndedJune

30, |

|

Six Months Ended June 30, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

| |

(In thousands, unaudited) |

| GAAP Operating

Expenses |

$ |

10,977 |

|

|

$ |

15,450 |

|

|

$ |

22,519 |

|

|

$ |

29,663 |

|

|

Adjustments to Operating Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and Amortization |

(667 |

) |

|

(696 |

) |

|

(1,333 |

) |

|

(1,385 |

) |

|

Stock-Based Compensation |

(1,233 |

) |

|

(1,323 |

) |

|

(2,400 |

) |

|

(2,620 |

) |

| NON-GAAP Adjusted

Operating Expenses |

$ |

9,077 |

|

|

$ |

13,431 |

|

|

$ |

18,786 |

|

|

$ |

25,658 |

|

|

|

For press inquiries:

Katie Brazel

for Alimera Sciences

404-317-8361

kbrazel@bellsouth.net

For investor inquiries:

CG Capital

for Alimera Sciences

877-889-1972

investorrelations@cg.capital

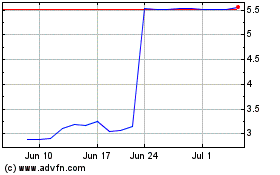

Alimera Sciences (NASDAQ:ALIM)

Historical Stock Chart

From Mar 2024 to Apr 2024

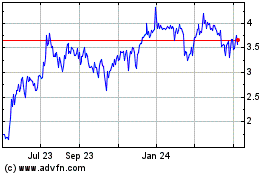

Alimera Sciences (NASDAQ:ALIM)

Historical Stock Chart

From Apr 2023 to Apr 2024