Four Corners Property Trust, Inc. (“FCPT” or the “Company”,

NYSE: FCPT) today announced financial results for the second

quarter and six months ended June 30, 2017.

A supplemental financial and operating report that contains

non-GAAP measures and other defined terms, along with this press

release, has been posted to the investor relations section of the

Company’s website at http://investors.fcpt.com/.

Q2 and Year to Date 2017

Highlights:

- Second quarter net income attributable

to common shareholders of $18.3 million, or $0.30 per diluted

share, including a $3.3 million gain on the sale of an Olive Garden

property. These results compared to net income of $14.8 million, or

$0.25 per diluted share, for the same period in 2016.On a year to

date basis, the Company reported net income attributable to common

shareholders of $33.8 million. After excluding the $3.3 million

gain on sale in 2017 and the one-time, non-cash tax benefit of

$80.4 million included in the 2016 results, the Company’s net

income was $30.5 million, or $0.51 per diluted share for 2017,

which compared to net income of $28.7 million, or $0.48 per diluted

share, for the same period in 2016.

- Second quarter GAAP rental income of

$28.3 million, representing an increase of 8.2% when compared to

the same period in 2016 and consisting of $25.9 million in cash

rents and $2.4 million of straight-line rent adjustments.

- Second quarter NAREIT-defined Funds

from Operations (FFO) of $20.6 million, or $0.34 per diluted share,

representing an increase of 1.6% in per diluted share results

compared to the same period in 2016.Year to date FFO of $41.6

million, or $0.69 per diluted share, representing an increase of

4.4% in per diluted share results compared to the same period in

2016.

- Second quarter Adjusted Funds from

Operations (AFFO) of $19.3 million, or $0.32 per diluted share,

representing an increase of 4.2% in per diluted share results

compared to the same period in 2016.Year to date AFFO of $38.9

million, or $0.64 per diluted share, representing an increase of

6.3% in per diluted share results compared to the same period in

2016.

- Second quarter general and

administrative (G&A) expenses of $3.5 million including $0.7

million of non-cash, stock-based compensation.Year to date cash

G&A expenses (after excluding non-cash, stock-based

compensation) were 10.0% of cash rental income, compared to 10.8%

of cash rental income for the same period in 2016.

- Declared regular dividend of $0.2425

per common share for the second quarter of 2017.

- Acquired in the second quarter 23

restaurant properties in two transactions with a combined

investment value of $51.1 million, at an initial weighted average

cash yield of 7.0%, and a weighted average lease term of 20.0

years.

- Sold an Olive Garden property in the

second quarter for a gross sales price of $5.2 million,

representing a 5.1% cash capitalization rate.

- Issued 1,167,092 common shares in the

second quarter via the Company’s At-The-Market (ATM) stock offering

program. The shares were sold at a weighted average share price of

$24.29, generating $28.3 million in gross proceeds, excluding

brokerage and other issuance costs.

- At quarter-end, FCPT had $525 million

of outstanding debt, including $125 million of unsecured fixed rate

notes that closed on June 7, 2017. FCPT was undrawn on its $350

million revolving credit facility, and had $81.3 million of

available cash and cash equivalents.

Management Comments:

“June 30 marked the end of a full year with our acquisition team

and processes, and we are quite pleased with the results. Over that

period, we closed on over $160 million of acquisitions across 91

properties, with an average initial cash capitalization rate of

6.7% and 18 years of lease term,” said Bill Lenehan, Chief

Executive Officer. “In the second quarter, we also executed on an

inaugural investment grade note financing at an attractive

long-term rate, and raised $28.3 million of gross proceeds under

our ATM equity program. We ended the quarter well positioned to

fund our acquisition strategy while maintaining a net debt to

EBITDA level of 4.4x which is well below our targeted level of 5.5x

to 6.0x.”

Real Estate Portfolio:

As of June 30, 2017, the Company’s rental portfolio consisted of

506 restaurant properties located in 44 states. The properties are

100% occupied under long-term, triple-net leases with a weighted

average remaining lease term of approximately 13.4 years and an

estimated portfolio weighted average EBITDAR to Lease Rent coverage

of 4.7x.

Conference Call

Information:

Company management will host a conference call and audio webcast

on Thursday, August 3, 2017 at 11:00 am Eastern Time to discuss the

results.

Interested parties can listen to the call via the following:

Internet: Go to

http://dpregister.com/10110505 at

least 15 minutes prior to start time of the call in order to

register and to download any necessary audio software. Please note

for those that register, the dial-in number will be provided upon

registration.

Phone: 1-888-346-5243 (domestic) /

1-412-317-5120 (international). Participants not pre-registered

must ask to be joined into the Four Corners Property Trust

call.

Replay: Available through November 3, 2017 by

dialing 1-877-344-7529 (domestic) / 1-412-317-0088 (international),

Access Code 10110505.

About FCPT:

FCPT is a real estate investment trust primarily engaged in the

acquisition and leasing of restaurant properties. The Company seeks

to grow its portfolio by acquiring additional real estate to lease,

on a triple-net basis, for use in the restaurant and related food

services industry.

Cautionary Note Regarding

Forward-Looking Statements:

This press release contains forward-looking statements within

the meaning of the federal securities laws. Forward-looking

statements include all statements that are not historical

statements of fact and those regarding the Company’s intent, belief

or expectations, including, but not limited to, statements

regarding: operating and financial performance; and expectations

regarding the making of distributions and the payment of dividends.

Words such as “anticipate(s),” “expect(s),” “intend(s),” “plan(s),”

“believe(s),” “may,” “will,” “would,” “could,” “should,” “seek(s)”

and similar expressions, or the negative of these terms, are

intended to identify such forward-looking statements.

Forward-looking statements speak only as of the date on which such

statements are made and, except in the normal course of the

Company’s public disclosure obligations, the Company expressly

disclaims any obligation to publicly release any updates or

revisions to any forward-looking statements to reflect any change

in the Company’s expectations or any change in events, conditions

or circumstances on which any statement is based. Forward-looking

statements are based on management’s current expectations and

beliefs and the Company can give no assurance that its expectations

or the events described will occur as described. Forward-looking

statements are subject to a number of risks and uncertainties that

could cause actual results to differ materially from those set

forth in or implied by such forward-looking statements.

Factors that could have a material adverse effect on the

Company’s operations and future prospects or that could cause

actual results to differ materially from the Company’s expectations

are included in the sections entitled “Business,” “Risk Factors”

and “Management’s Discussion and Analysis of Financial Condition

and Results of Operations” of the Company’s Annual Report on Form

10-K filed with the Securities and Exchange Commission on February

27, 2017.

Notice Regarding Non-GAAP Financial

Measures:

In addition to U.S. GAAP financial measures, this press release

and the referenced supplemental financial and operating report

contain and may refer to certain non-GAAP financial measures. These

non-GAAP financial measures are in addition to, not a substitute

for or superior to, measures of financial performance prepared in

accordance with GAAP. These non-GAAP financial measures should not

be considered replacements for, and should be read together with,

the most comparable GAAP financial measures. Reconciliations to the

most directly comparable GAAP financial measures and statements of

why management believes these measures are useful to investors are

included in the supplemental financial and operating report, which

can be found in the investor relations section of our website.

Supplemental Materials and

Website:

Supplemental materials on the Second Quarter 2017 operating

results and other information on the Company are available on the

investors relations section of FCPT’s website at

www.investors.fcpt.com.

Four Corners Property Trust

Consolidated Statements of

Income

(Unaudited)

(In thousands, except share and per

share data)

Three Months Ended June 30, Six Months Ended June

30, 2017 2016

2017 2016 Revenues: Rental

income $ 28,327 $ 26,192 $ 56,091 $ 52,385 Restaurant revenues

4,826 4,701 9,766

9,560 Total revenues 33,153 30,893 65,857 61,945 Operating

expenses: General and administrative 3,459 2,508 6,316 5,826

Depreciation and amortization 5,426 5,101 10,829 10,288 Restaurant

expenses 4,583 4,593 9,251 9,291 Interest expense 4,508

3,858 8,604 8,039 Total

operating expenses 17,976 16,060 35,000 33,444 Other income

34 18 39 78 Realized gain on sale, net 3,291 -

3,291 - Income before income tax

18,502 14,851 34,187 28,579 Income tax (expense) benefit (1)

(61 ) (50 ) (106 ) 80,506 Net income

18,441 14,801 34,081 109,085 Net income attributable to

noncontrolling interest (128 ) - (245 )

-

Net Income Attributable to Common Shareholders $

18,313 $ 14,801 $ 33,836 $ 109,085

Basic net income per share $ 0.30 $ 0.25 $ 0.56 $ 2.02 Diluted net

income per share $ 0.30 $ 0.25 $ 0.56 $ 1.84 Regular dividends

declared per share $ 0.2425 $ 0.2425 $ 0.4850 $ 0.4850

Weighted-average shares outstanding: Basic 60,319,521 59,830,284

60,125,477 54,102,565 Diluted 60,430,606 59,844,059 60,215,050

59,271,807 (1) The 2016 results include a $80.4 million

income tax benefit which was principally the result of the reversal

of deferred tax liabilities recognized in connection with the

Company's election to be taxed as a REIT.

Four Corners

Property Trust Consolidated Balance Sheets (In

thousands, except share and per share data)

June 30, 2017 (Unaudited)

December 31, 2016 ASSETS Real estate investments:

Land $ 441,035 $ 421,941 Buildings, equipment and improvements

1,098,306 1,055,624 Total real estate

investments 1,539,341 1,477,565 Less: Accumulated depreciation

(589,913 ) (583,307 ) Total real estate investments,

net 949,428 894,258 Real estate held for sale 1,691 - Cash and cash

equivalents 81,328 26,643 Deferred rent 16,389 11,594 Derivative

assets 1,630 837 Other assets 3,827 3,819

Total Assets $ 1,054,293 $ 937,151

LIABILITIES AND EQUITY Liabilities: Revolving

facility ($350,000 available capacity) $ - $ 45,000 Term loan

($400,000, net of deferred financing costs) 394,691 393,895

Unsecured notes ($125,000, net of deferred financing costs) 123,327

- Dividends payable 14,820 14,519 Deferred rental revenue 8,228

7,974 Deferred tax liabilities 157 196 Other liabilities

4,932 5,450 Total liabilities 546,155

467,034 Equity: Preferred stock,

$0.0001 par value per share, 25,000,000 shares

authorized, zero shares issued and

outstanding

- - Common stock, $0.0001 par value per share, 500,000,000 shares

authorized, 61,193,753 and 59,923,557

shares issued and outstanding

at June 30, 2017 and December 31, 2016,

respectively

6 6 Additional paid-in capital 468,933 438,864 Accumulated other

comprehensive income 1,059 207 Noncontrolling interest 7,717 5,097

Retained earnings 30,423 25,943 Total

equity 508,138 470,117

Total

Liabilities and Equity $ 1,054,293 $ 937,151

Four Corners Property Trust FFO and AFFO

(Unaudited) (In thousands, except share and per share

data) Three Months Ended June

30, Six Months Ended June 30, 2017

2016 2017

2016 Funds from operations (FFO): Net income $

18,441 $ 14,801 $ 34,081 $ 109,085 Depreciation and amortization

5,426 5,101 10,829 10,288 Deferred tax benefit from REIT election -

- - (80,409 ) Realized gain on sales of real estate (3,291 )

- (3,291 ) -

FFO (as defined

by NAREIT) $ 20,576 $ 19,902

$ 41,619 $ 38,964

Non-cash stock-based compensation 704 429 1,198 742 Non-cash

amortization of deferred financing costs 415 398 813 796 Other

non-cash interest expense 11 55 63 435 Straight-line rent

(2,422 ) (2,595 ) (4,795 ) (5,191 )

Adjusted funds from operations (AFFO) $ 19,284

$ 18,189 $ 38,898

$ 35,746 Fully diluted shares

outstanding (1) 60,870,695 59,844,059 60,649,120 59,271,807

FFO per diluted share $ 0.34 $ 0.33 $ 0.69 $ 0.66

AFFO per diluted share $ 0.32 $ 0.30 $ 0.64 $ 0.60

(1) Assumes the issuance of common shares for OP units held by

non-controlling partners.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170802006410/en/

FCPTBill Lenehan,

415-965-8031CEOGerry Morgan, 415-965-8032CFO

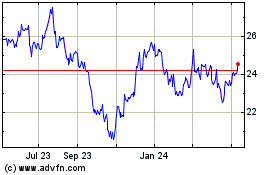

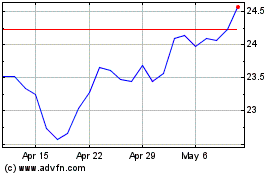

Four Corners Property (NYSE:FCPT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Four Corners Property (NYSE:FCPT)

Historical Stock Chart

From Apr 2023 to Apr 2024