Second Quarter Highlights

- Total Revenue Increased Slightly

Over Last Year, led by a 6.1 Percent Increase in Commercial

Revenue; Service Revenue1 Increased 1.2

Percent

- Diluted EPS was $0.63, up 14.5

Percent Over Last Year; Non-GAAP EPS1 was $0.73, up

5.8 Percent

- Contract Awards Were $340 Million;

TTM Contract Awards Were $1.47 Billion for a Book-to-Bill of

1.22x

- Operating Cash Flow for the First

Half Was $17.2 Million, up 9.6 Percent Over Last Year

ICF (NASDAQ:ICFI), a consulting and technology services provider

to government and commercial clients around the world, reported

results for the second quarter ended June 30, 2017.

Second Quarter and First Half 2017 Results

“ICF’s results continued to benefit from our diversified

business model, serving government and commercial clients both

domestically and internationally. In the second quarter, our work

for commercial clients increased 6 percent over prior-year levels,

representing our fourth consecutive quarter of strong year-on-year

growth. This momentum, along with positive state and local and

international government revenue comparisons, offset lower revenue

from federal government clients which was mainly due to reduced

materials and subcontracting activity,” said Sudhakar Kesavan,

ICF’s Chairman and Chief Executive Officer.

“Higher utilization and the increased contribution of higher

margin revenue drove significant EBITDA margin¹ expansion and led

to double-digit growth in diluted earnings for the quarter. The

EBITDA¹ results include the impact of $0.6 million in special

charges that were incurred in connection with ongoing efforts to

actively manage our cost structure.

“Positive trends in contract awards and a robust business

development pipeline have set the stage for ICF’s continued growth.

Contract wins for the first half of 2017 were $590 million, which

included a notable addition to ICF Olson’s loyalty program client

roster; and our business development pipeline continues to be

healthy at $4.6 billion as of the end of the quarter,” Mr. Kesavan

noted.

Second quarter 2017 total revenue was $306.4 million, a 0.3

percent increase from $305.4 million for the second quarter of

2016. Service revenue was up 1.2 percent at $224.9 million,

compared to $222.4 million reported last year. Net income was $11.9

million in the second quarter of 2017, up 12.8 percent from the

$10.6 million reported last year. Diluted earnings per share

increased 14.5 percent to $0.63 from $0.55 reported last year.

Non-GAAP EPS increased 5.8 percent to $0.73 per share compared to

$0.69 in the prior year. EBITDA for the second quarter of 2017 was

$29.3 million, up 10 percent from $26.6 million reported last year,

and the second quarter EBITDA margin expanded 80 basis points

year-on-year to 9.5 percent of total revenue. Adjusted EBITDA

margin¹ for the second quarter was 9.7 percent of total revenue and

13.3 percent of service revenue, which represents year-on-year

increases of 70 basis points and 80 basis points, respectively.

Operating cash flow for the first half of 2017 was up 9.6 percent

over last year.

Backlog and New Business Awards

Total backlog was $2.0 billion at the end of the second quarter

of 2017. Funded backlog was $927 million, or approximately 46

percent of the total backlog. The total value of contracts awarded

in the 2017 second quarter was $340 million, up 12 percent

year-on-year, bringing the trailing twelve month book-to-bill ratio

to 1.22.

Government Business Second Quarter 2017 Highlights

- U.S. federal government revenue was

$141.3 million, a 4.8 percent decline resulting primarily from

lower materials and subcontracting revenue. Federal government

revenue accounted for 46 percent of total revenue compared to 49

percent of total revenue in the second quarter of 2016.

- U.S. state and local government revenue

increased 4.7 percent year-on-year to $35.9 million and accounted

for 12 percent of total revenue, compared to 11 percent of total

revenue in the 2016 second quarter.

- International government revenue

increased 0.9 percent year-on-year, and accounted for 7 percent of

total revenue, compared to 6 percent of total revenue in the 2016

second quarter.

Key Government Contracts Awarded in the Second

Quarter

ICF was awarded more than 90 U.S. federal government contracts

and task orders and more than 200 additional contracts from state

and local and international governments. The largest awards

included:

- Cybersecurity: A recompete

contract with a value of up to $93 million with the U.S. Army

Research Laboratory to support research and develop solutions for

Defensive Cyber Operations.

- Program Support: A blanket

purchase agreement with a ceiling of $50 million with the U.S.

Agency for International Development (USAID) as one of four

awardees to support its Climate Integration Support Facility.

- Policy and Program Support: A

recompete contract with a value of up to $20.8 million with the

Federal Emergency Management Agency to provide policy support,

exercise planning, training development, program management and

administrative support.

- Program Support: A funding

increase of $5.7 million from the Pennsylvania Department of

Insurance to provide program support services for the Underground

Storage Tanks Indemnification Fund.

- Disaster Recovery: Two task

order extensions with a combined value of $4.3 million with the New

Jersey Department of Community Affairs to continue to implement

Hurricane Sandy housing recovery programs.

- Program Implementation: A

recompete contract with a value of up to $3.7 million with the

Administration for Children and Families of the Department of

Health and Human Services (HHS) for a regional customer services

improvement project.

Other government contract wins with a value of at least $2

million included: physical security system customization services

for the HHS Centers for Medicare and Medicaid Service; content

management and communications support for the Corporation for

National and Community Service; continued support for digital

strategy for the HHS Office of the Secretary; and extension of

services in support of enterprise strategy and management for the

Bureau of Consular Affairs of the U.S. Department of State.

Commercial Business Second Quarter 2017 Highlights

- Commercial revenue was $108.7 million,

6.1 percent above the $102.4 million in last year’s second quarter.

Commercial revenue accounted for 35 percent of total revenue

compared to 34 percent of total revenue in the 2016 second

quarter.

- Marketing services accounted for 40

percent of commercial revenue. Energy markets, which include energy

efficiency programs, represented 38 percent of commercial

revenue.

Key Commercial Contracts Awarded in the Second

Quarter

Commercial sales were $159.2 million in the second quarter of

2017, and ICF was awarded more than 650 commercial projects

globally during the period. The largest awards were:

Energy Markets:

- Two task orders with a combined value

of up to $29 million with two utilities in the eastern U.S. to

support commercial and industrial energy efficiency programs.

- Three contracts with a combined value

of $5.4 million with a renewable energy producer to provide

environmental compliance and cultural resources monitoring

services.

- A contract with a value of $5 million

with a western U.S. utility to provide permitting and construction

compliance services for a new substation.

Marketing Services:

- Two contracts with a combined value of

$36.4 million with a major hospitality company to implement a

Tally® loyalty program solution and provide ongoing loyalty

support.

- A contract with a value of $11.3

million with a U.S. health insurance provider to expand marketing

campaign support services.

- Two contracts with a combined value of

$7.3 million with a western U.S. utility to provide marketing

services support.

- A master services agreement with a

ceiling of $2.5 million with a publishing company to provide search

engine optimization and content production services.

Other commercial contract and task order wins which were at

least $1.5 million included: continued support for multiple energy

efficiency programs for an eastern U.S. utility; retainer and

additional resources for marketing services for a floor care

product manufacturer; digital services for a major U.S. health

insurer; consulting services for a provider of industrial aviation

services; marketing services for a global beverage company and a

global fast food chain; marketing automation services for a U.S.

software company; e-commerce design and implementation for a global

online employment solutions provider; additional resources to

support a digital transformation project for an international hotel

chain; and biological pre-construction surveys, construction

compliance monitoring and reporting for a western U.S. utility’s

substation construction project.

Summary and Outlook

“ICF’s second quarter results illustrate the advantages of

providing advisory work based on deep subject matter expertise and

offering implementation services to a diversified roster of

government and commercial clients. We have entered the second half

of 2017 with a substantial funded backlog, positive momentum in

year-to-date sales, the majority of which represented new

contracts, and a near-record business development pipeline.

“Our year-to-date performance has positioned us for continued

growth in 2017 and is consistent with our full-year revenue and

earnings expectations. Based on our current visibility, we

re-affirm our guidance for 2017 revenue ranging from $1.20 billion

to $1.24 billion. We maintain our guidance range for diluted

earnings per share at $2.50 to $2.75, and our Non-GAAP EPS guidance

range of $2.84 to $3.09 per diluted share. Additionally, we

continue to expect operating cash flow to be in the range of $90

million to $100 million,” Mr. Kesavan concluded.

About ICF

ICF (NASDAQ:ICFI) is a global consulting and technology services

provider with more than 5,000 professionals focused on making big

things possible for our clients. We are business analysts, public

policy experts, technologists, researchers, digital strategists,

social scientists and creatives. Since 1969, government and

commercial clients have worked with ICF to overcome their toughest

challenges on issues that matter profoundly to their success. Come

engage with us at www.icf.com.

Caution Concerning Forward-looking Statements

Statements that are not historical facts and involve known and

unknown risks and uncertainties are "forward-looking statements" as

defined in the Private Securities Litigation Reform Act of 1995.

Such statements may concern our current expectations about our

future results, plans, operations and prospects and involve certain

risks, including those related to the government contracting

industry generally; our particular business, including our

dependence on contracts with U.S. federal government agencies; and

our ability to acquire and successfully integrate businesses. These

and other factors that could cause our actual results to differ

from those indicated in forward-looking statements are included in

the "Risk Factors" section of our securities filings with the

Securities and Exchange Commission. The forward-looking statements

included herein are only made as of the date hereof, and we

specifically disclaim any obligation to update these statements in

the future.

1 Non-GAAP EPS, Service Revenue, EBITDA, and Adjusted EBITDA are

non-GAAP measurements. A reconciliation of all non-GAAP

measurements to the most applicable GAAP number is set forth below.

EBITDA margin and Adjusted EBITDA margin are calculated by dividing

these non-GAAP measures by the corresponding revenue.

ICF

International, Inc. and Subsidiaries Consolidated Statements

of Comprehensive Income (in thousands, except per share

amounts)

Three months ended

Six months ended

June 30,

June 30,

2017

2016

2017

2016

(Unaudited)

(Unaudited)

Revenue $ 306,392 $ 305,419 $ 602,687 $ 589,018 Direct Costs

190,896 194,188 374,503 371,387 Operating costs and expenses:

Indirect and selling expenses 86,240 84,641 175,042 166,200

Depreciation and amortization 4,299 4,084 8,818 8,103 Amortization

of intangible assets 2,749 3,148 5,483 6,276

Total operating costs and expenses 93,288 91,873

189,343 180,579 Operating Income 22,208

19,358 38,841 37,052 Interest expense (2,537 ) (2,460 ) (4,488 )

(4,905 ) Other income (expense) 226 (57 ) 335 218

Income before income taxes 19,897 16,841 34,688 32,365

Provision for income taxes 7,960 6,258 12,574

11,891 Net income $ 11,937 $ 10,583 $ 22,114

$ 20,474 Earnings per Share: Basic $ 0.64

$ 0.56 $ 1.17 $ 1.08 Diluted $ 0.63

$ 0.55 $ 1.15 $ 1.06

Weighted-average Shares: Basic 18,775 19,008 18,840

19,001 Diluted 19,086 19,293 19,252

19,320 Other comprehensive income (loss):

Foreign currency translation adjustments, net of tax 2,100

(2,026 ) 2,472 (2,943 ) Comprehensive income, net of tax $

14,037 $ 8,557 $ 24,586 $ 17,531

ICF

International, Inc. and Subsidiaries Reconciliation of

Non-GAAP Financial Measures (in thousands, except per share

amounts)

Three months ended

Six months ended

June 30,

June 30,

2017

2016

2017

2016

(Unaudited)

(Unaudited)

Reconciliation of

Service Revenue

Revenue $ 306,392 $ 305,419 $ 602,687 $ 589,018 Subcontractor and

Other Direct Costs (81,446 ) (83,052 ) (157,980 ) (154,221 )

Service Revenue $ 224,946 $ 222,367 $ 444,707

$ 434,797

Reconciliation of

EBITDA and Adjusted EBITDA

Net Income $ 11,937 $ 10,583 $ 22,114 $ 20,474 Other (income)

expense (226 ) 57 (335 ) (218 ) Interest expense 2,537 2,460 4,488

4,905 Provision for income taxes 7,960 6,258 12,574 11,891

Depreciation and amortization 7,048 7,232 14,301

14,379 EBITDA 29,256 26,590 53,142 51,431 Special

charges related to severance for staff realignment(2) 577 1,086 577

1,086 Special charges related to facility consolidations and office

closures 21 55 1,719 55 Adjusted EBITDA

$ 29,854 $ 27,731 $ 55,438 $ 52,572

Reconciliation of

Non-GAAP EPS

Diluted EPS $ 0.63 $ 0.55 $ 1.15 $ 1.06 Special charges related to

severance for staff realignment 0.03 0.06 0.03 0.06 Special charges

related to facility consolidations and office closures — — 0.10 —

Amortization of intangibles 0.14 0.16 0.28 0.32 Income tax

effects(3) (0.07 ) (0.08 ) (0.15 ) (0.14 ) Non-GAAP EPS $ 0.73

$ 0.69 $ 1.41 $ 1.30 (2)

Special charges related to severance were

for an unplanned reduction in workforce of senior management in the

second quarter of 2017, and international staff realignment in the

second quarter of 2016.

(3)

Income tax effects were calculated using

an effective U.S. GAAP tax rate of 40.0% and 37.2% for the second

quarter of fiscal year 2017 and 2016, respectively, and an

effective tax rate of 36.3% and 36.7% for the first six months of

fiscal year 2017 and 2016, respectively.

ICF International, Inc. and

Subsidiaries Consolidated Balance Sheets (in thousands,

except share and per share amounts)

June 30, 2017

December 31, 2016

(Unaudited)

Current Assets: Cash and cash equivalents $ 9,493 $ 6,042 Contract

receivables, net 288,178 281,365 Prepaid expenses and other 13,278

11,724 Income tax receivable 5,325 — Total current

assets 316,274 299,131 Total property and

equipment, net 37,881 40,484 Other assets: Goodwill 685,071

683,683 Other intangible assets, net 40,692 46,129 Restricted cash

1,254 1,843 Other assets 16,874 14,301 Total Assets $

1,098,046 $ 1,085,571 Current Liabilities:

Accounts payable $ 60,734 $ 70,586 Accrued salaries and benefits

40,793 44,003 Accrued expenses and other current liabilities 44,540

52,631 Deferred revenue 27,113 29,394 Income tax payable —

106 Total current liabilities 173,180 196,720

Long-term liabilities: Long-term debt 278,000 259,389 Deferred rent

14,983 15,600 Deferred income taxes 44,439 39,114 Other 14,314

8,744 Total Liabilities 524,916 519,567 Commitments

and Contingencies Stockholders’ Equity: Preferred stock, par value

$.001 per share; 5,000,000 shares authorized; none issued — —

Common stock, $.001 par value; 70,000,000 shares authorized;

21,920,299 and 21,663,432 shares issued; and 18,717,713 and

19,021,262 shares outstanding as of June 30, 2017, and December 31,

2016, respectively 22 22 Additional paid-in capital 300,394 292,427

Retained earnings 394,004 371,890 Treasury stock (114,122 ) (88,695

) Accumulated other comprehensive loss (7,168 ) (9,640 ) Total

Stockholders’ Equity 573,130 566,004 Total

Liabilities and Stockholders’ Equity $ 1,098,046 $ 1,085,571

ICF International, Inc. and

Subsidiaries

Consolidated Statements of Cash

Flows

(in thousands)

Six months ended

June 30,

2017

2016

(Unaudited)

Cash flows from operating activities Net income $ 22,114 $

20,474 Adjustments to reconcile net income to net cash provided by

operating activities: Non-cash equity compensation 5,361 5,042

Depreciation and amortization 14,301 14,379 Facilities

consolidation reserve 1,663 — Deferred taxes and other adjustments,

net 4,383 1,768 Changes in operating assets and liabilities:

Contract receivables, net (4,203 ) (27,158 ) Prepaid expenses and

other assets (2,978 ) (10,650 ) Accounts payable (9,953 ) (4,147 )

Accrued salaries and benefits (3,375 ) 18,336 Accrued expenses and

other current liabilities (8,876 ) (827 ) Deferred revenue (2,658 )

2,182 Income tax receivable and payable (5,441 ) (2,311 )

Restricted cash 597 (3 ) Other liabilities 6,307 (1,348 )

Net cash provided by operating activities 17,242

15,737

Cash flows from investing activities

Capital expenditures for property and equipment and capitalized

software (6,083 ) (7,856 ) Payments for business acquisitions, net

of cash received (91 ) —

Net cash used in investing

activities (6,174 ) (7,856 )

Cash flows from

financing activities Advances from working capital facilities

348,975 259,215 Payments on working capital facilities (330,364 )

(252,843 ) Payments on capital expenditure obligations (2,276 )

(2,020 ) Debt issue costs (1,489 ) — Proceeds from exercise of

options 2,431 1,158 Net payments for stockholder issuances and

buybacks (25,253 ) (10,695 )

Net cash used in financing

activities (7,976 ) (5,185 ) Effect of exchange rate changes on

cash 359 405

Increase in cash and cash

equivalents 3,451 3,101

Cash and cash equivalents, beginning

of period 6,042 7,747

Cash and cash

equivalents, end of period $ 9,493 $ 10,848

Supplemental disclosure of cash flow information Cash

paid during the period for: Interest $ 3,923 $ 3,804

Income taxes $ 12,982 $ 12,059

ICF International, Inc. and

Subsidiaries Supplemental Schedule

Revenue by market Three Months Ended Six Months Ended June

30, June 30, 2017 2016 2017 2016 Energy, environment, and

infrastructure 40 % 38 % 40 % 38 % Health, education, and social

programs 41 % 44 % 41 % 44 % Safety and security 9 % 8 % 9 % 8 %

Consumer and financial 10 % 10 % 10 % 10 % Total 100 % 100 %

100 % 100 %

Revenue by client Three

Months Ended Six Months Ended June 30, June 30, 2017 2016 2017 2016

U.S. federal government 46 % 49 % 46 % 49 % U.S. state and

local government 12 % 11 % 11 % 11 % International government 7 % 6

% 7 % 6 %

Government 65 % 66 % 64 % 66 %

Commercial 35 % 34 % 36 % 34 %

Total 100 % 100

% 100 % 100 %

Revenue by contract Three

Months Ended Six Months Ended June 30, June 30, 2017 2016 2017 2016

Time-and-materials 42 % 44 % 43 % 44 % Fixed-price 40 % 36 %

39 % 37 % Cost-based 18 % 20 % 18 % 19 % Total 100 % 100 %

100 % 100 %

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170802006134/en/

Investor Contacts:MBS Value PartnersLynn

Morgen,

+1.212.750.5800lynn.morgen@mbsvalue.comorMBS

Value PartnersDavid Gold,

+1.212.750.5800david.gold@mbsvalue.comorCompany

Information Contact:ICFErica Eriksdotter,

+1.703.934.3668erica.eriksdotter@icf.com

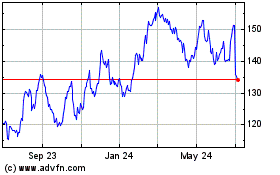

ICF (NASDAQ:ICFI)

Historical Stock Chart

From Mar 2024 to Apr 2024

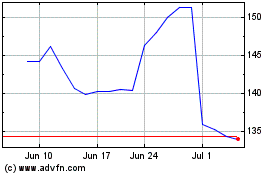

ICF (NASDAQ:ICFI)

Historical Stock Chart

From Apr 2023 to Apr 2024