Tab Swells to $25 Billion for Nuclear-Power Plant in Georgia

August 02 2017 - 12:56PM

Dow Jones News

By Russell Gold

It will cost more than $25 billion to complete a Georgia nuclear

power plant, according to a new estimate released Wednesday,

raising new questions about whether the sole remaining nuclear

facility under construction in the U.S. will get built.

The disclosure from utility Southern Co. comes two days after

Scana Corp. pulled the plug on a similar nuclear plant in South

Carolina following years of delays and rising costs that also put

final completion of that facility above $25 billion.

The escalating expenses, which have nearly doubled over the past

nine years, have heightened concern that what was supposed to be a

rebirth of the nuclear power industry in the U.S., driven by

Westinghouse Electric Co. reactors, is becoming a costly

failure.

On Wednesday morning, Southern released a preliminary estimate

that indicated overall costs for its Vogtle Electric Generating

Plant have risen to at least $25.2 billion. In 2008, when it first

proposed building the plant's two reactors, it said it expected to

spend $6.4 billion for its 45.7% stake, meaning the entire project

would cost roughly $14 billion.

The company also said the earliest the reactors could be

operational would be February 2021 and February 2022. Previously,

the company said it expected them to be in service by 2019 and

2020.

Southern said it would make a recommendation to Georgia

regulators later this month about whether it would proceed with the

project. Thomas A. Fanning, Southern's chairman and CEO, is

expected to talk to investors Wednesday afternoon on a conference

call to discuss quarterly earnings.

A company spokesman confirmed the latest figures on the Georgia

plant, but declined to comment on its future.

Earlier this week, Santee Cooper, a state-owned electric utility

that was a part owner of South Carolina's V.C. Summer Nuclear

Station along with Scana Corp., said total costs of that facility

had swelled to $25.7 billion, more than twice the original cost of

$11.5 billion proposed in 2008. The utilities decided to cancel the

project on Monday, citing the higher costs and anticipated

additional delays.

Both Southern and Scana tried to shield investors from the risk

of escalating costs by negotiating fixed-cost contracts with

Westinghouse, the plants' designer and contractor. But cost

overruns forced Westinghouse to seek bankruptcy protection earlier

this year, a situation that threatened the financial health of its

Japanese parent, Toshiba Corp.

Construction at the Georgia facility is 44% complete, compared

to 35% for the South Carolina plant. What's more, Southern

negotiated a $3.7 billion financial settlement with Toshiba Corp.,

which sought to cap its exposure to higher costs from the

Westinghouse projects by cutting deals with the utilities.

Vogtle is the only nuclear power plant under construction in the

U.S., and the first to be started since the 1980s.

The soaring costs of building new plants are reminiscent of the

1970s and early 1980s, when rising costs contributed to a total

halt in new nuclear construction. In 2008, Westinghouse proposed a

new design that was intended to be easier to build on time and on

budget. This has not turned out to be the case.

The troubles with building new plants come at a time when the

idea of generating electricity from nuclear power has received a

boost. Some environmentalists have supported nuclear plants as a

way of providing power that doesn't emit carbon dioxide. And

President Donald Trump said earlier this summer he wanted to

"revive and expand our nuclear-energy sector."

Southern said on Wednesday morning that it posted a $1.38

billion loss in the second quarter of the year, compared to a $623

million profit in the same period a year earlier.

The change was almost entirely due to a $2.8 billion pre-tax

charge the company took related to an expensive, and ultimately

unsuccessful, attempt to build a power plant In Mississippi that

could cleanly burn coal and capture much of its carbon-dioxide

output.

In June, Mississippi regulators said they were unwilling to pass

any additional costs onto to electricity customers. The plant cost

$7.5 billion and seven years to build, but Southern couldn't get

the carbon dioxide technology to operate properly for extended

periods.

Write to Russell Gold at russell.gold@wsj.com

(END) Dow Jones Newswires

August 02, 2017 12:41 ET (16:41 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

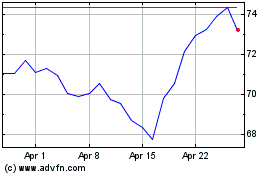

Southern (NYSE:SO)

Historical Stock Chart

From Mar 2024 to Apr 2024

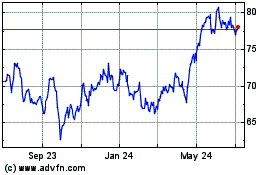

Southern (NYSE:SO)

Historical Stock Chart

From Apr 2023 to Apr 2024