Avista Corp. (NYSE:AVA) today reported net income attributable to

Avista Corp. shareholders of $21.8 million, or $0.34 per diluted

share for the second quarter of 2017, compared to $27.3 million, or

$0.43 per diluted share for the second quarter of 2016. For the six

months ended June 30, 2017, net income attributable to Avista Corp.

shareholders was $83.9 million, or $1.30 per diluted share,

compared to $84.9 million, or $1.34 per diluted share for the six

months ended June 30, 2016.

"As previously announced, we recently took an important step to

position our company for the future by partnering with Hydro One,

Ontario’s largest electricity transmission and distribution

provider. We're excited that we were able to come to an agreement

in a manner that preserves our identity and legacy and allows us to

continue charting our own course in a rapidly changing industry,

while at the same time enjoying the benefits of a larger

organization. The transaction is expected to close in the second

half of 2018, subject to shareholder and regulatory approvals,"

said Scott Morris, chairman, president and chief executive officer

of Avista Corp.

"Focusing on 2017 earnings, we continued to have consolidated

earnings above our expectations. Our higher earnings in the second

quarter were mainly from lower than expected operating expenses and

lower resource costs. The lower resource costs were partially due

to increased hydroelectric generation that increased our benefit

position in the Energy Recovery Mechanism (ERM) in Washington.

While our 2017 earnings are better than our expectations, our

earnings are down compared to 2016 due to no revenue increases

being granted in our December 2016 Washington rate order.

"Alaska Electric Light and Power Company (AEL&P) had another

solid quarter with earnings above our expectations primarily due to

increased electric loads from colder weather.

"For 2017, we continue to focus on regulatory matters. During

the second quarter, we filed two separate rate requests with the

Washington Utilities and Transportation Commission. A $15 million

power cost rate adjustment was filed to update Washington power

supply costs, with a requested effective date of Sept. 1, 2017. We

expect a response from the Commission in August. We also filed

three-year electric and natural gas general rate cases, with

requested increases in May of 2018 through 2020.

"In Idaho, we filed two-year electric and natural gas general

rate cases during the second quarter. In Oregon, we reached a

settlement agreement to our 2016 general rate case that was filed

with the Oregon Commission.

"Based on our earnings for the first half of 2017 and our

expectations for the remainder of the year, we are confirming our

consolidated earnings guidance range of $1.80 to $2.00 per diluted

share and we expect to be in the upper half of this range,

excluding merger transaction costs," Morris said.

Summary Results: Avista Corp.’s results for the

second quarter of 2017 and the six months ended June 30, 2017

(year-to-date) as compared to the respective periods in 2016 are

presented in the table below (dollars in thousands, except

per-share data):

| |

|

Second Quarter |

|

Year-to-Date |

| |

|

2017 |

|

2016 |

|

2017 |

|

2016 |

| Net Income

(Loss) by Business Segment: |

|

|

|

|

|

|

|

|

| Avista Utilities |

|

$ |

21,765 |

|

|

$ |

26,771 |

|

|

$ |

80,204 |

|

|

$ |

81,758 |

|

| Alaska Electric Light

and Power Company (AEL&P) |

|

1,681 |

|

|

1,058 |

|

|

5,534 |

|

|

4,019 |

|

| Other |

|

(1,675 |

) |

|

(575 |

) |

|

(1,851 |

) |

|

(874 |

) |

|

Total net income attributable to Avista Corp.

shareholders |

|

$ |

21,771 |

|

|

$ |

27,254 |

|

|

$ |

83,887 |

|

|

$ |

84,903 |

|

|

|

| Earnings (Loss)

per Diluted Share by Business Segment: |

|

|

|

|

|

|

|

|

| Avista Utilities |

|

$ |

0.34 |

|

|

$ |

0.42 |

|

|

$ |

1.24 |

|

|

$ |

1.29 |

|

| AEL&P |

|

0.03 |

|

|

0.02 |

|

|

0.09 |

|

|

0.06 |

|

| Other |

|

(0.03 |

) |

|

(0.01 |

) |

|

(0.03 |

) |

|

(0.01 |

) |

|

Total earnings per diluted share attributable to Avista

Corp. shareholders |

|

$ |

0.34 |

|

|

$ |

0.43 |

|

|

$ |

1.30 |

|

|

$ |

1.34 |

|

The table below presents the change in net income attributable

to Avista Corp. shareholders and diluted earnings per share for the

second quarter of 2017 and the six months ended June 30, 2017 as

compared to the respective periods in 2016, as well as the various

factors that caused such change (dollars in thousands, except

per-share data):

| |

|

Second Quarter |

|

Year-to-Date |

| |

|

Net Income (a) |

|

Earnings per Share |

|

Net Income (a) |

|

Earnings per Share |

| 2016 consolidated

earnings |

|

$ |

27,254 |

|

|

$ |

0.43 |

|

|

$ |

84,903 |

|

|

$ |

1.34 |

|

| |

|

|

|

|

|

|

|

|

| Changes in net income

and diluted earnings per share: |

|

|

|

|

|

|

|

|

|

Avista Utilities |

|

|

|

|

|

|

|

|

| Electric

gross margin (including intracompany) (b) |

|

(196 |

) |

|

— |

|

|

2,585 |

|

|

0.04 |

|

| Natural

gas gross margin (including intracompany) (c) |

|

989 |

|

|

0.01 |

|

|

5,614 |

|

|

0.09 |

|

| Other

operating expenses (d) |

|

(2,014 |

) |

|

(0.04 |

) |

|

(1,036 |

) |

|

(0.02 |

) |

|

Depreciation and amortization (e) |

|

(1,801 |

) |

|

(0.03 |

) |

|

(3,492 |

) |

|

(0.05 |

) |

| Interest

expense (f) |

|

(1,479 |

) |

|

(0.02 |

) |

|

(2,913 |

) |

|

(0.05 |

) |

| Other

(g) |

|

(855 |

) |

|

(0.01 |

) |

|

(2,445 |

) |

|

(0.04 |

) |

| Effective

income tax rate |

|

350 |

|

|

0.01 |

|

|

133 |

|

|

— |

|

| Dilution

on earnings |

|

n/a |

|

— |

|

|

n/a |

|

(0.02 |

) |

|

Total Avista Utilities |

|

(5,006 |

) |

|

(0.08 |

) |

|

(1,554 |

) |

|

(0.05 |

) |

|

|

|

|

|

|

|

|

|

|

| AEL&P

earnings (h) |

|

623 |

|

|

0.01 |

|

|

1,515 |

|

|

0.03 |

|

| Other

businesses earnings (i) |

|

(1,100 |

) |

|

(0.02 |

) |

|

(977 |

) |

|

(0.02 |

) |

|

|

|

|

|

|

|

|

|

|

| 2017

consolidated earnings |

|

$ |

21,771 |

|

|

$ |

0.34 |

|

|

$ |

83,887 |

|

|

$ |

1.30 |

|

Analysis of 2017 Consolidated Earnings

(a) The tax impact of each line item was calculated using Avista

Corp.'s statutory tax rate (federal and state combined) of 36.69

percent.

(b) Electric gross margin (operating revenues less resource

costs) decreased for the second quarter, but increased for the

year-to-date. The fluctuations were primarily due to the

following:

- A change in the provision for earnings sharing, which reduced

electric gross margin for the second quarter and year-to-date when

compared to the respective periods in 2016. The fluctuation was

large enough in the second quarter that it offset any increases to

gross margin during the second quarter;

- An increase in retail electric rates due to a general rate

increase in Idaho;

- An increase in retail electric revenues compared to the prior

year resulting from customer growth and an increase in

non-decoupled electric revenues (industrial);

- Recognition of decoupling revenue from prior years that had not

met revenue recognition criteria until the current year; and

- A decrease in electric resource costs primarily due to a

decrease in purchased power and fuel for generation, which resulted

from a decrease in thermal generation and an increase in

hydroelectric generation. For the second quarter of 2017, we had a

$0.6 million pre-tax benefit under the ERM in Washington, compared

to a $0.2 million pre-tax expense for the second quarter of

2016. For the six months ended June 30, 2017, we

recognized a pre-tax benefit of $4.6 million under the ERM compared

to a benefit of $4.2 million for the six months ended June 30,

2016.

(c) Natural gas gross margin (operating revenues less resource

costs) increased for the second quarter and year-to-date primarily

due to the following:

- General rate increase in Oregon;

- An increase in retail natural gas revenues compared to the

prior year resulting from customer growth; and

- Recognition of decoupling revenue from prior years that had not

met revenue recognition criteria until the current year.

(d) Other operating expenses for the second quarter and

year-to-date 2017 increased as a result of an increase in

generation, transmission and distribution maintenance costs, as

well as a write-off in Oregon of utility plant associated with a

general rate case settlement. There were also merger transaction

costs incurred during the second quarter of 2017, which are not

being passed through to customers. These increases were partially

offset by decreases in pension, other postretirement benefit and

medical expenses.

(e) Depreciation and amortization increased for the second

quarter and year-to-date 2017 due to additions to utility

plant.

(f) Interest expense increased for the second quarter and

year-to-date 2017 due to additional outstanding debt during 2017 as

compared to 2016 and partially due to an increase in the overall

interest rate.

(g) Other for the second quarter and year-to-date 2017 increased

primarily due to an increase in utility taxes other than income

taxes. The increase in utility taxes other than income taxes was

primarily due to revenue related taxes and property taxes.

(h) AEL&P earnings increased for the second quarter and

year-to-date 2017 primarily as a result of an increase in electric

gross margin (due to an interim general rate increase, higher

electric loads due to colder weather and a slight increase in

residential and commercial customers), partially offset by an

increase in operating expenses.

(i) Losses at other businesses increased due to renovation

expenses and increased compliance costs at one of our subsidiaries

and higher losses on our investments as compared to 2016.

Non-Generally Accepted Accounting Principles (Non-GAAP)

Financial Measures

The tables above and below include electric gross margin and

natural gas gross margin, two financial measures that are

considered “non-GAAP financial measures.” Generally, a non-GAAP

financial measure is a numerical measure of a company's financial

performance, financial position or cash flows that excludes (or

includes) amounts that are included (or excluded) in the most

directly comparable measure calculated and presented in accordance

with generally accepted accounting principles (GAAP). The

presentation of electric gross margin and natural gas gross margin

for Avista Utilities is intended to supplement an understanding of

Avista Utilities' operating performance. We use these measures to

determine whether the appropriate amount of revenue is being

collected from customers to allow for the recovery of energy

resource costs and operating costs, as well as to analyze how

changes in loads (due to weather, economic or other conditions),

rates, supply costs and other factors impact our results of

operations. We present electric and natural gas gross margin

separately since each business has different cost sources, cost

recovery mechanisms and jurisdictions. These measures are not

intended to replace income from operations as determined in

accordance with GAAP as an indicator of operating performance. The

calculations of electric and natural gas gross margins are

presented below.

The following table presents Avista Utilities' operating

revenues, resource costs and resulting gross margin (pre-tax and

after-tax) for the three and six months ended June 30 (dollars in

thousands):

| |

Operating Revenues |

|

Resource Costs |

|

Gross Margin (Pre-Tax) |

|

Income Taxes (a) |

|

Gross Margin (Net of Tax) |

| For the three

months ended June 30, 2017: |

|

|

|

|

|

|

|

|

|

| Electric |

$ |

230,558 |

|

|

$ |

69,427 |

|

|

$ |

161,131 |

|

|

$ |

59,119 |

|

|

$ |

102,012 |

|

| Natural Gas |

80,430 |

|

|

44,275 |

|

|

36,155 |

|

|

13,265 |

|

|

22,890 |

|

| Less: Intracompany |

(14,241 |

) |

|

(14,241 |

) |

|

— |

|

|

— |

|

|

— |

|

| Total |

$ |

296,747 |

|

|

$ |

99,461 |

|

|

$ |

197,286 |

|

|

$ |

72,384 |

|

|

$ |

124,902 |

|

| For the three

months ended June 30, 2016: |

|

|

|

|

|

|

|

|

|

| Electric |

$ |

234,791 |

|

|

$ |

73,350 |

|

|

$ |

161,441 |

|

|

$ |

59,233 |

|

|

$ |

102,208 |

|

| Natural Gas |

80,955 |

|

|

46,362 |

|

|

34,593 |

|

|

12,692 |

|

|

21,901 |

|

| Less: Intracompany |

(13,105 |

) |

|

(13,105 |

) |

|

— |

|

|

— |

|

|

— |

|

| Total |

$ |

302,641 |

|

|

$ |

106,607 |

|

|

$ |

196,034 |

|

|

$ |

71,925 |

|

|

$ |

124,109 |

|

| For the six

months ended June 30, 2017: |

|

|

|

|

|

|

|

|

|

| Electric |

$ |

494,276 |

|

|

$ |

160,302 |

|

|

$ |

333,974 |

|

|

$ |

122,535 |

|

|

$ |

211,439 |

|

| Natural Gas |

250,642 |

|

|

134,562 |

|

|

116,080 |

|

|

42,590 |

|

|

73,490 |

|

| Less: Intracompany |

(32,790 |

) |

|

(32,790 |

) |

|

— |

|

|

— |

|

|

— |

|

| Total |

$ |

712,128 |

|

|

$ |

262,074 |

|

|

$ |

450,054 |

|

|

$ |

165,125 |

|

|

$ |

284,929 |

|

| For the six

months ended June 30, 2016: |

|

|

|

|

|

|

|

|

|

| Electric |

$ |

497,593 |

|

|

$ |

167,702 |

|

|

$ |

329,891 |

|

|

$ |

121,037 |

|

|

$ |

208,854 |

|

| Natural Gas |

236,365 |

|

|

129,153 |

|

|

107,212 |

|

|

39,336 |

|

|

67,876 |

|

| Less: Intracompany |

(31,170 |

) |

|

(31,170 |

) |

|

— |

|

|

— |

|

|

— |

|

| Total |

$ |

702,788 |

|

|

$ |

265,685 |

|

|

$ |

437,103 |

|

|

$ |

160,373 |

|

|

$ |

276,730 |

|

(a) Income taxes were calculated using Avista Corp.'s statutory

tax rate (federal and state combined) of 36.69 percent.

Liquidity and Capital Resources

We have a $400.0 million committed line of credit that expires

in April 2021. As of June 30, 2017, we had $207.3 million of

available liquidity under this line of credit. We also had $25.0

million of available liquidity under AEL&P's committed line of

credit that expires in November 2019.

In the second half of 2017, we expect to issue up to $90.0

million of long-term debt and up to $70.0 million of common stock

in order to fund planned capital expenditures and maintain an

appropriate capital structure. We have 2.2 million shares remaining

to be issued under our sales agency agreements, which were entered

into during March 2016.

Avista Utilities' capital expenditures were $174.0 million for

the six months ended June 30, 2017, and we expect Avista

Utilities' capital expenditures to total about $405.0 million in

2017. AEL&P's capital expenditures were $3.7 million for the

six months ended June 30, 2017, and we expect AEL&P's capital

expenditures to total about $7.0 million in 2017.

2017 Earnings Guidance and Outlook

Avista Corp. is confirming its 2017 guidance for consolidated

earnings to be in the range of $1.80 to $2.00 per diluted share and

we expect to be in the upper half of this range, excluding merger

transaction costs.

We expect Avista Utilities to contribute in the range of $1.71

to $1.85 per diluted share for 2017. The midpoint of Avista

Utilities' guidance range included $0.07 of expense under the ERM,

which is within the 90 percent customers/10 percent shareholders

sharing band. Our current expectation for the ERM is an expense

position within the $4 million deadband, which is an improvement of

$0.04 to $0.05 per diluted share from our original guidance. Our

outlook for Avista Utilities assumes, among other variables, normal

precipitation and temperatures and slightly lower than normal

hydroelectric generation for the remainder of the year.

Our 2017 Avista Utilities earnings guidance range continues to

encompass unrecovered structural costs estimated to reduce the

return on equity by 70 to 90 basis points. In addition, our 2017

guidance range includes regulatory timing lag directly associated

with the Washington jurisdiction and resulting from the denial of

our 2016 rate increase requests, which is estimated to reduce the

return on equity by 100 to 120 basis points. This results in an

expected return on equity range for Avista Utilities of 7.4 percent

to 7.8 percent in 2017. We will continue to strive to reduce this

timing lag and more closely align our earned returns with those

authorized by the 2019-2020 time period.

For 2017, we expect AEL&P to contribute in the range of

$0.10 to $0.14 per diluted share. Our outlook for AEL&P

assumes, among other variables, normal precipitation and

hydroelectric generation for the remainder of the year.

We expect the other businesses to be between a loss of $0.01 and

a gain of $0.01 per diluted share, which includes costs associated

with exploring strategic opportunities.

Our guidance generally includes only normal operating conditions

and does not include unusual items such as settlement transactions

or acquisitions/dispositions until the effects are known and

certain. Our guidance also does not include any amounts related to

our power cost rate adjustment request for 2017.

NOTE: We will host a conference call with

financial analysts and investors on Aug. 2, 2017, at 10:30 a.m. EDT

to discuss this news release. The call will be available

at (888) 771-4371, Confirmation number: 45222476. A

simultaneous webcast of the call will be available on our website,

www.avistacorp.com. A replay of the conference call will be

available through Aug. 9, 2017. Call (888) 843-7419, confirmation

number 45222476#, to listen to the replay.

Avista Corp. is an energy company involved in the production,

transmission and distribution of energy as well as other

energy-related businesses. Avista Utilities is our operating

division that provides electric service to 379,000 customers and

natural gas to 342,000 customers. Our service territory covers

30,000 square miles in eastern Washington, northern Idaho and parts

of southern and eastern Oregon, with a population of 1.6 million.

AERC is an Avista subsidiary that, through its subsidiary

AEL&P, provides retail electric service to 16,000 customers in

the city and borough of Juneau, Alaska. Our stock is traded under

the ticker symbol “AVA”. For more information about Avista, please

visit www.avistacorp.com.

Avista Corp. and the Avista Corp. logo are trademarks of Avista

Corporation.

This news release contains forward-looking statements, including

statements regarding our current expectations for future financial

performance and cash flows, capital expenditures, financing plans,

our current plans or objectives for future operations and other

factors, which may affect the company in the future. Such

statements are subject to a variety of risks, uncertainties and

other factors, most of which are beyond our control and many of

which could have significant impact on our operations, results of

operations, financial condition or cash flows and could cause

actual results to differ materially from those anticipated in such

statements.

The following are among the important factors that could cause

actual results to differ materially from the forward-looking

statements: weather conditions (temperatures, precipitation levels

and wind patterns), which affect both energy demand and electric

generating capability, including the effect of precipitation and

temperature on hydroelectric resources, the effect of wind patterns

on wind-generated power, weather-sensitive customer demand, and

similar effects on supply and demand in the wholesale energy

markets; our ability to obtain financing through the issuance of

debt and/or equity securities, which can be affected by various

factors including our credit ratings, interest rates and other

capital market conditions and the global economy; changes in

interest rates that affect borrowing costs, our ability to

effectively hedge interest rates for anticipated debt issuances,

variable interest rate borrowing and the extent to which we recover

interest costs through retail rates collected from customers;

changes in actuarial assumptions, interest rates and the actual

return on plan assets for our pension and other postretirement

benefit plans, which can affect future funding obligations, pension

and other postretirement benefit expense and the related

liabilities; deterioration in the creditworthiness of our

customers; the outcome of legal proceedings and other

contingencies; economic conditions in our service areas, including

the economy's effects on customer demand for utility services;

declining energy demand related to customer energy efficiency

and/or conservation measures; changes in the long-term global and

our utilities' service area climates, which can affect, among other

things, customer demand patterns and the volume and timing of

streamflows to our hydroelectric resources; state and federal

regulatory decisions or related judicial decisions that affect our

ability to recover costs and earn a reasonable return including,

but not limited to, disallowance or delay in the recovery of

capital investments, operating costs and commodity costs and

discretion over allowed return on investment; possibility that our

integrated resource plans for electric and natural gas will not be

acknowledged by the state commissions; volatility and illiquidity

in wholesale energy markets, including the availability of willing

buyers and sellers, changes in wholesale energy prices that can

affect operating income, cash requirements to purchase electricity

and natural gas, value received for wholesale sales, collateral

required of us by counterparties in wholesale energy transactions

and credit risk to us from such transactions, and the market value

of derivative assets and liabilities; default or nonperformance on

the part of any parties from whom we purchase and/or sell capacity

or energy; potential environmental regulations affecting our

ability to utilize or resulting in the obsolescence of our power

supply resources; severe weather or natural disasters, including,

but not limited to, avalanches, wind storms, wildfires,

earthquakes, snow and ice storms, that can disrupt energy

generation, transmission and distribution, as well as the

availability and costs of materials, equipment, supplies and

support services; explosions, fires, accidents, mechanical

breakdowns or other incidents that may impair assets and may

disrupt operations of any of our generation facilities,

transmission, and electric and natural gas distribution systems or

other operations and may require us to purchase replacement power;

wildfires caused by our electric transmission or distribution

systems that may result in public injuries or property damage;

public injuries or damage arising from or allegedly arising from

our operations; blackouts or disruptions of interconnected

transmission systems (the regional power grid); terrorist attacks,

cyber attacks or other malicious acts that may disrupt or cause

damage to our utility assets or to the national or regional economy

in general, including any effects of terrorism, cyber attacks or

vandalism that damage or disrupt information technology systems;

work force issues, including changes in collective bargaining unit

agreements, strikes, work stoppages, the loss of key executives,

availability of workers in a variety of skill areas, and our

ability to recruit and retain employees; increasing costs of

insurance, more restrictive coverage terms and our ability to

obtain insurance; delays or changes in construction costs, and/or

our ability to obtain required permits and materials for present or

prospective facilities; increasing health care costs and cost of

health insurance provided to our employees and retirees; third

party construction of buildings, billboard signs, towers or other

structures within our rights of way, or placement of fuel

receptacles within close proximity to our transformers or other

equipment, including overbuild atop natural gas distribution lines;

the loss of key suppliers for materials or services or disruptions

to the supply chain; adverse impacts to our Alaska operations that

could result from an extended outage of its hydroelectric

generating resources or their inability to deliver energy, due to

their lack of interconnectivity to any other electrical grids and

the extensive cost of replacement power (diesel); changing river

regulation at hydroelectric facilities not owned by us, which could

impact our hydroelectric facilities downstream; compliance with

extensive federal, state and local legislation and regulation,

including numerous environmental, health, safety, infrastructure

protection, reliability and other laws and regulations that affect

our operations and costs; the ability to comply with the terms of

the licenses and permits for our hydroelectric or thermal

generating facilities at cost-effective levels; cyber attacks on us

or our vendors or other potential lapses that result in

unauthorized disclosure of private information, which could result

in liabilities against us, costs to investigate, remediate and

defend, and damage to our reputation; disruption to or breakdowns

of information systems, automated controls and other technologies

that we rely on for our operations, communications and customer

service; changes in costs that impede our ability to effectively

implement new information technology systems or to operate and

maintain current production technology; changes in technologies,

possibly making some of the current technology we utilize obsolete

or the introduction of new technology that may create new cyber

security risk; insufficient technology skills, which could lead to

the inability to develop, modify or maintain our information

systems; growth or decline of our customer base and the extent to

which new uses for our services may materialize or existing uses

may decline, including, but not limited to, the effect of the trend

toward distributed generation at customer sites; the potential

effects of negative publicity regarding business practices, whether

true or not, which could result in litigation or a decline in our

common stock price; changes in our strategic business plans, which

may be affected by any or all of the foregoing, including the entry

into new businesses and/or the exit from existing businesses and

the extent of our business development efforts where potential

future business is uncertain; non-regulated activities may increase

earnings volatility; failure to complete the proposed merger

transaction could negatively impact the market price of Avista

Corp.'s common stock or result in termination fees that could have

a material adverse effect on our results of operations, financial

condition, and cash flows; the announced merger transaction could

result in shareholder class action lawsuits against the Company,

its management team and board of directors; changes in

environmental laws, regulations, decisions and policies, including

present and potential environmental remediation costs and our

compliance with these matters; the potential effects of legislation

or administrative rulemaking at the federal, state or local levels,

including possible effects on our generating resources of

restrictions on greenhouse gas emissions to mitigate concerns over

global climate changes; political pressures or regulatory practices

that could constrain or place additional cost burdens on our

distribution systems through accelerated adoption of distributed

generation or electric-powered transportation or on our energy

supply sources, such as campaigns to halt coal-fired power

generation and opposition to other thermal generation, wind

turbines or hydroelectric facilities; wholesale and retail

competition including alternative energy sources, growth in

customer-owned power resource technologies that displace

utility-supplied energy or that may be sold back to the utility,

and alternative energy suppliers and delivery arrangements; failure

to identify changes in legislation, taxation and regulatory issues

which are detrimental or beneficial to our overall business; policy

and/or legislative changes resulting from the new presidential

administration in various regulated areas, including, but not

limited to, potential tax reform, environmental regulation and

healthcare regulations; and the risk of municipalization in any of

our service territories.

For a further discussion of these factors and other important

factors, please refer to our Quarterly Report on Form 10-Q for the

quarter ended June 30, 2017. The forward-looking statements

contained in this news release speak only as of the date hereof. We

undertake no obligation to update any forward-looking statement or

statements to reflect events or circumstances that occur after the

date on which such statement is made or to reflect the occurrence

of unanticipated events. New risks, uncertainties and other factors

emerge from time to time, and it is not possible for management to

predict all of such factors, nor can it assess the impact of each

such factor on our business or the extent to which any such factor,

or combination of factors, may cause actual results to differ

materially from those contained in any forward-looking

statement.

To unsubscribe from Avista’s news release distribution, send

reply message to lena.funston@avistacorp.com.

| AVISTA CORPORATION |

|

|

|

|

| CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(UNAUDITED) |

|

|

|

|

| (Dollars in Thousands except Per Share

Amounts) |

|

|

|

|

| |

|

|

|

|

|

|

|

| |

Second Quarter |

|

Year-to-Date |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

| Operating revenues |

$ |

314,501 |

|

|

$ |

318,838 |

|

|

$ |

750,971 |

|

|

$ |

737,011 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

| Utility

resource costs |

102,751 |

|

|

109,815 |

|

|

268,337 |

|

|

271,534 |

|

| Other

operating expenses |

89,051 |

|

|

84,947 |

|

|

169,714 |

|

|

166,551 |

|

|

Depreciation and amortization |

42,800 |

|

|

39,870 |

|

|

84,973 |

|

|

79,250 |

|

| Utility

taxes other than income taxes |

23,802 |

|

|

22,615 |

|

|

56,464 |

|

|

52,000 |

|

| Total

operating expenses |

258,404 |

|

|

257,247 |

|

|

579,488 |

|

|

569,335 |

|

| Income from

operations |

56,097 |

|

|

61,591 |

|

|

171,483 |

|

|

167,676 |

|

| Interest

expense, net of capitalized interest |

22,980 |

|

|

20,635 |

|

|

45,986 |

|

|

41,132 |

|

| Other

income - net |

(1,656 |

) |

|

(3,041 |

) |

|

(4,757 |

) |

|

(5,463 |

) |

| Income before income

taxes |

34,773 |

|

|

43,997 |

|

|

130,254 |

|

|

132,007 |

|

| Income tax expense |

13,051 |

|

|

16,710 |

|

|

46,395 |

|

|

47,055 |

|

| Net income |

21,722 |

|

|

27,287 |

|

|

83,859 |

|

|

84,952 |

|

| Net loss

(income) attributable to noncontrolling interests |

49 |

|

|

(33 |

) |

|

28 |

|

|

(49 |

) |

| Net income attributable

to Avista Corp. shareholders |

$ |

21,771 |

|

|

$ |

27,254 |

|

|

$ |

83,887 |

|

|

$ |

84,903 |

|

| Weighted-average common

shares outstanding (thousands), basic |

64,401 |

|

|

63,386 |

|

|

64,382 |

|

|

62,995 |

|

| Weighted-average common

shares outstanding (thousands), diluted |

64,553 |

|

|

63,783 |

|

|

64,511 |

|

|

63,368 |

|

| |

|

|

|

|

|

|

|

| Earnings per common

share attributable to Avista Corp. shareholders: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.34 |

|

|

$ |

0.43 |

|

|

$ |

1.30 |

|

|

$ |

1.35 |

|

|

Diluted |

$ |

0.34 |

|

|

$ |

0.43 |

|

|

$ |

1.30 |

|

|

$ |

1.34 |

|

| Dividends declared per

common share |

$ |

0.3575 |

|

|

$ |

0.3425 |

|

|

$ |

0.7150 |

|

|

$ |

0.6850 |

|

| Issued Aug. 2,

2017 |

|

|

|

|

|

|

|

| AVISTA CORPORATION |

| CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED) |

| (Dollars in Thousands) |

| |

June 30, |

|

December 31, |

| |

2017 |

|

2016 |

|

Assets |

|

|

|

| Cash and

cash equivalents |

$ |

13,410 |

|

|

$ |

8,507 |

|

| Accounts

and notes receivable |

133,946 |

|

|

180,265 |

|

| Other

current assets |

173,380 |

|

|

162,569 |

|

| Total net

utility property |

4,227,460 |

|

|

4,147,500 |

|

| Other

non-current assets |

148,706 |

|

|

141,443 |

|

|

Regulatory assets for deferred income taxes |

118,984 |

|

|

109,853 |

|

|

Regulatory assets for pensions and other postretirement

benefits |

234,046 |

|

|

240,114 |

|

|

Regulatory asset for interest rate swaps |

168,084 |

|

|

161,508 |

|

| Other

regulatory assets |

149,556 |

|

|

152,670 |

|

| Other

deferred charges |

5,432 |

|

|

5,326 |

|

|

Total Assets |

$ |

5,373,004 |

|

|

$ |

5,309,755 |

|

| Liabilities and

Equity |

|

|

|

| Accounts

payable |

$ |

69,165 |

|

|

$ |

115,545 |

|

| Current

portion of long-term debt and capital leases |

277,814 |

|

|

3,287 |

|

|

Short-term borrowings |

136,398 |

|

|

120,000 |

|

| Other

current liabilities |

198,737 |

|

|

168,696 |

|

| Long-term

debt and capital leases |

1,403,064 |

|

|

1,678,717 |

|

| Long-term

debt to affiliated trusts |

51,547 |

|

|

51,547 |

|

|

Regulatory liability for utility plant retirement costs |

280,580 |

|

|

273,983 |

|

| Pensions

and other postretirement benefits |

219,584 |

|

|

226,552 |

|

| Deferred

income taxes |

886,727 |

|

|

840,928 |

|

|

Non-current unsettled interest rate swap derivative

liabilities |

336 |

|

|

28,705 |

|

| Other

non-current liabilities, regulatory liabilities and deferred

credits |

162,158 |

|

|

153,319 |

|

|

Total Liabilities |

3,686,110 |

|

|

3,661,279 |

|

| Equity |

|

|

|

| Avista

Corporation Shareholders' Equity: |

|

|

|

| Common

stock (64,408,983 and 64,187,934 outstanding shares) |

1,075,667 |

|

|

1,075,281 |

|

| Retained

earnings and accumulated other comprehensive loss |

611,506 |

|

|

573,446 |

|

|

Total Avista Corporation Shareholders' Equity |

1,687,173 |

|

|

1,648,727 |

|

|

Noncontrolling interests |

(279 |

) |

|

(251 |

) |

|

Total Equity |

1,686,894 |

|

|

1,648,476 |

|

| Total

Liabilities and Equity |

$ |

5,373,004 |

|

|

$ |

5,309,755 |

|

| Issued Aug. 2,

2017 |

|

|

|

Contact:

Media: Casey Fielder (509) 495-4916 casey.fielder@avistacorp.com

Investors: Jason Lang (509) 495-2930 jason.lang@avistacorp.com

Avista 24/7 Media Access (509) 495-4174

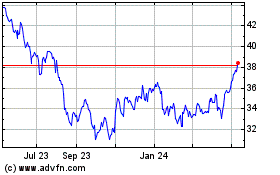

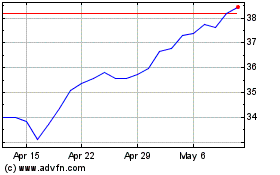

Avista (NYSE:AVA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Avista (NYSE:AVA)

Historical Stock Chart

From Apr 2023 to Apr 2024