Ramco-Gershenson Properties Trust (NYSE:RPT) today

announced its financial and operating results for the three and six

months ended June 30, 2017.

SECOND QUARTER FINANCIAL AND OPERATING

RESULTS:

- Net income attributable to common shareholders of $0.05 per

diluted share, compared to $0.32 per diluted share, for the same

period in 2016, reflecting lower gains on land sales during the

second quarter of 2017.

- Operating Funds from Operations (“Operating FFO”) of $0.35 per

diluted share, compared to $0.35 per diluted share for the same

period in 2016.

- Generated same property NOI growth with redevelopment of 1.1%

for the three months ended June 30, 2017, positively impacted by

strong minimum rent growth of 2.9% offset by lower comparable

recovery income and credit adjustments recognized in the same

period in 2016.

- Signed 38 comparable leases encompassing 234,503 square feet at

a positive leasing spread of 7.1% with an average base rent of

$16.53 per square feet.

- Posted portfolio leased occupancy of 93.7%, compared to 95.0%

for the same period in 2016.

“Our second quarter results reflect anticipated

short-term moderation in our operating performance. We are

maintaining same-property NOI and operating FFO guidance for the

year,” said Dennis Gershenson, President and Chief Executive

Officer. “Subsequent to quarter-end we closed, or expect to close

within the next 30 days, an additional $75 million in planned

shopping center dispositions, bringing our year-to-date sales to

$104 million and reducing our rental exposure to the state of

Michigan to less than 22%, in line with our stated goal.”

FINANCIAL RESULTS:

For the three months ended June 30,

2017:

- Net income available to common shareholders of $4.4 million, or

$0.05 per diluted share, compared to $25.7 million, which included

a $19.8 million gain on land sales, or $0.32 per diluted share for

the same period in 2016.

- Funds from Operations (“FFO”) of $30.4 million, or $0.35 per

diluted share, compared to $32.1 million, or $0.36 per diluted

share for the same period in 2016.

- Operating FFO of $31.0 million, or $0.35 per diluted share,

compared to $30.8 million or $0.35 per diluted share for the same

period in 2016.

For the six months ended June 30,

2017:

- Net income available to common shareholders of $15.9 million,

or $0.20 per diluted share, compared to $35.9 million, or $0.45 per

diluted share for the same period in 2016.

- Funds from Operations (“FFO”) of $61.2 million, or $0.69 per

diluted share, compared to $61.8 million, or $0.70 per diluted

share for the same period in 2016.

- Operating FFO of $61.6 million, or $0.70 per diluted share,

compared to $60.4 million or $0.69 per diluted share for the same

period in 2016.

BALANCE SHEET METRICS:

- Net debt to EBITDA of 7.0X, interest coverage of 3.7X, and

fixed charge coverage of 3.0X. Including funds held in escrow of

$26.1 million for two asset sales, net debt to EBITDA would have

been 6.9X.

- Weighted average cost and term of debt of 3.84% and 5.6 years,

respectively.

INVESTMENT ACTIVITY:

Dispositions

Subsequent to quarter-end, the Company sold or placed under

contract four Michigan shopping centers for $69.3 million. The

Company also sold a Walgreen’s Data Center in Mount Prospect,

Illinois for $6.2 million.

The Michigan Properties sold, or placed under contract, are:

Clinton Valley, Sterling Heights, 205,000 square feet anchored

by Hobby Lobby and Office DepotGaines Marketplace, Gaines Township,

60,000 square feet anchored by StaplesNew Towne Plaza, Canton,

193,000 square feet anchored by Kohl’s and JoAnnRoseville Plaza,

Roseville, 77,000 square feet anchored by Marshalls and Dollar

Tree

Year-to-date the Company has sold or placed

under contract to sell, seven non-core properties for a total of

$104.0 million, including six Michigan shopping centers for a total

of $97.8 million.

Redevelopment

At June 30, 2017, the Company's active

redevelopment pipeline consisted of 9 projects with an estimated

total cost of $86.5 million, which are expected to stabilize over

the next two years at a weighted average return on cost of

between 9% - 10%.

The Company’s redevelopment pipeline includes

the following strategic new projects:

- Woodbury Lakes - Woodbury, Minnesota - The

Company finalized plans for the expansion and relocation of H&M

to a strategic 20,000 square foot store and the addition of 44,000

square foot Alamo Drafthouse Cinema. Construction on the

initial phase of this multi-year redevelopment will begin in August

of 2017. The project will also feature a newly designed and

remerchandised Main Street. Woodbury Lakes is the

premier regional retail destination in the eastern Minneapolis/St.

Paul area. The cost of the initial phase of the redevelopment

is estimated at $22.8 million.

- Front Range Village - Fort Collins (Denver MSA),

Colorado - The Company initiated its Phase I site

densification project, which will include 15,000 square feet of

premium service and restaurant space, numerous placemaking

improvements, and a new TruFit fitness center in 28,000 square

feet. Phase I is expected to cost $11.4 million with a projected

stabilization in the second quarter of 2018.

DIVIDEND:

In the second quarter, the Company declared a

regular cash dividend of $0.22 per common share for the period

April 1, 2017 through June 30, 2017 and a Series D convertible

perpetual preferred share dividend of $0.90625 per share for the

same period. The dividends were paid on July 3, 2017 to

shareholders of record as of June 20, 2017.

GUIDANCE:The Company has

affirmed its 2017 Operating FFO guidance of $1.34 to $1.38 per

diluted share and its same-property with redevelopment NOI growth

guidance of 2.5% to 3.5%.

CONFERENCE CALL/WEBCAST:

Ramco-Gershenson Properties Trust will host a

live broadcast of its second quarter conference call on Wednesday,

August 2, 2017 at 1:00 p.m. eastern time, to discuss its

financial and operating results as well as its 2017 guidance.

The live broadcast will be available on-line at www.rgpt.com and

www.investorcalendar.com and also by telephone at (877) 407-9205,

no pass code needed. A replay will be available shortly after

the call on the aforementioned websites (for ninety days) or by

telephone at (877) 481-4010, (Conference ID: 15997) through August

9, 2017.

SUPPLEMENTAL MATERIALS:

The Company’s quarterly financial and operating

supplement is available on its corporate web site at

www.rgpt.com. If you wish to receive a copy via email, please

send requests to dhendershot@rgpt.com.

ABOUT RAMCO-GERSHENSON PROPERTIES

TRUST:

Ramco-Gershenson Properties Trust (NYSE:RPT) is

a premier, national publicly-traded shopping center real estate

investment trust (REIT) based in Farmington Hills, Michigan.

The Company's primary business is the ownership and

management of regional dominant and urban-oriented, infill shopping

centers in key growth markets in the 40 largest metropolitan

markets in the United States. At June 30, 2017, the

Company owned interests in and managed a portfolio of 64 shopping

centers, one property held for sale and two joint venture

properties. At June 30, 2017, the Company's consolidated

portfolio was 93.7% leased. Ramco-Gershenson is a

fully-integrated qualified REIT that is self-administered and

self-managed. For additional information about the Company please

visit www.rgpt.com or follow Ramco-Gershenson on Twitter

@RamcoGershenson and facebook.com/ramcogershenson/.

This press release may contain forward-looking statements that

represent the Company’s expectations and projections for the

future. Management of Ramco-Gershenson believes the expectations

reflected in any forward-looking statements made in this press

release are based on reasonable assumptions. Certain factors could

occur that might cause actual results to vary, including

deterioration in national economic conditions, weakening of real

estate markets, decreases in the availability of credit, increases

in interest rates, adverse changes in the retail industry, our

continuing ability to qualify as a REIT and other factors discussed

in the Company’s reports filed with the Securities and Exchange

Commission.

| |

| |

| RAMCO-GERSHENSON PROPERTIES TRUST |

| CONSOLIDATED BALANCE SHEETS |

| (In thousands, except per share

amounts) |

|

|

|

|

|

|

|

|

|

June 30, 2017 |

|

December 31, 2016 |

| |

|

|

|

ASSETS |

|

|

|

|

| Income producing

properties, at cost: |

|

|

|

|

| Land |

|

$ |

415,694 |

|

|

$ |

374,889 |

|

| Buildings

and improvements |

|

1,853,221 |

|

|

1,757,781 |

|

| Less

accumulated depreciation and amortization |

|

(368,292 |

) |

|

(345,204 |

) |

| Income producing

properties, net |

|

1,900,623 |

|

|

1,787,466 |

|

|

Construction in progress and land available for development or

sale |

|

68,853 |

|

|

61,224 |

|

| Real

estate held for sale |

|

13,837 |

|

|

8,776 |

|

| Net real estate |

|

1,983,313 |

|

|

1,857,466 |

|

| Equity investments in

unconsolidated joint ventures |

|

2,798 |

|

|

3,150 |

|

| Cash and cash

equivalents |

|

4,798 |

|

|

3,582 |

|

| Restricted cash and

escrows |

|

31,819 |

|

|

11,144 |

|

| Accounts receivable,

net |

|

25,842 |

|

|

24,016 |

|

| Acquired lease

intangibles, net |

|

76,328 |

|

|

72,424 |

|

| Other assets, net |

|

93,645 |

|

|

89,716 |

|

| TOTAL

ASSETS |

|

$ |

2,218,543 |

|

|

$ |

2,061,498 |

|

| |

|

|

|

|

| LIABILITIES AND

SHAREHOLDERS' EQUITY |

|

|

|

|

| Notes payable, net |

|

1,197,414 |

|

|

1,021,223 |

|

| Capital lease

obligation |

|

1,066 |

|

|

1,066 |

|

| Accounts payable and

accrued expenses |

|

53,982 |

|

|

57,357 |

|

| Acquired lease

intangibles, net |

|

67,237 |

|

|

63,734 |

|

| Other liabilities |

|

6,294 |

|

|

6,800 |

|

| Distributions

payable |

|

19,654 |

|

|

19,627 |

|

| TOTAL

LIABILITIES |

|

1,345,647 |

|

|

1,169,807 |

|

| |

|

|

|

|

| Commitments and

Contingencies |

|

|

|

|

| |

|

|

|

|

|

Ramco-Gershenson Properties Trust ("RPT") Shareholders'

Equity: |

|

|

|

|

| Preferred shares, $0.01

par, 2,000 shares authorized: 7.25% Series D Cumulative Convertible

Perpetual Preferred Shares, (stated at liquidation preference $50

per share), 1,849 shares issued and outstanding as of June 30, 2017

and December 31, 2016 |

|

$ |

92,427 |

|

|

$ |

92,427 |

|

| Common shares of

beneficial interest, $0.01 par, 120,000 shares authorized, 79,345

and 79,272 shares issued and outstanding as of June 30, 2017

and December 31, 2016, respectively |

|

793 |

|

|

793 |

|

| Additional paid-in

capital |

|

1,159,197 |

|

|

1,158,430 |

|

| Accumulated

distributions in excess of net income |

|

(401,179 |

) |

|

(381,912 |

) |

| Accumulated other

comprehensive income |

|

1,074 |

|

|

985 |

|

| TOTAL

SHAREHOLDERS' EQUITY ATTRIBUTABLE TO RPT |

|

852,312 |

|

|

870,723 |

|

| Noncontrolling

interest |

|

20,584 |

|

|

20,968 |

|

| TOTAL

SHAREHOLDERS' EQUITY |

|

872,896 |

|

|

891,691 |

|

| TOTAL

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

$ |

2,218,543 |

|

|

$ |

2,061,498 |

|

| |

|

| |

|

| RAMCO-GERSHENSON PROPERTIES

TRUST |

|

| CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

| (In thousands, except per share

amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months |

|

Six Months |

|

|

|

|

Ended June 30, |

|

Ended June 30, |

|

|

|

|

2017 |

|

2016 |

|

2017 |

|

2016 |

|

|

REVENUE |

|

|

|

|

|

|

|

|

|

| Minimum

rent |

|

$ |

50,797 |

|

|

$ |

48,554 |

|

|

$ |

100,234 |

|

|

$ |

96,950 |

|

|

|

Percentage rent |

|

225 |

|

|

138 |

|

|

463 |

|

|

440 |

|

|

| Recovery

income from tenants |

|

14,841 |

|

|

16,032 |

|

|

31,732 |

|

|

32,778 |

|

|

| Other

property income |

|

1,126 |

|

|

914 |

|

|

2,232 |

|

|

1,872 |

|

|

|

Management and other fee income |

|

73 |

|

|

245 |

|

|

226 |

|

|

355 |

|

|

| TOTAL

REVENUE |

|

67,062 |

|

|

65,883 |

|

|

134,887 |

|

|

132,395 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

EXPENSES |

|

|

|

|

|

|

|

|

|

| Real

estate tax expense |

|

10,730 |

|

|

11,132 |

|

|

21,723 |

|

|

21,441 |

|

|

|

Recoverable operating expense |

|

6,431 |

|

|

6,672 |

|

|

14,039 |

|

|

14,751 |

|

|

|

Non-recoverable operating expense |

|

1,242 |

|

|

564 |

|

|

2,390 |

|

|

1,957 |

|

|

|

Depreciation and amortization |

|

23,335 |

|

|

22,714 |

|

|

46,152 |

|

|

46,561 |

|

|

|

Acquisition costs |

|

— |

|

|

4 |

|

|

— |

|

|

63 |

|

|

| General

and administrative expense |

|

6,372 |

|

|

5,683 |

|

|

12,823 |

|

|

11,288 |

|

|

| Provision

for impairment |

|

820 |

|

|

— |

|

|

6,537 |

|

|

— |

|

|

| TOTAL

EXPENSES |

|

48,930 |

|

|

46,769 |

|

|

103,664 |

|

|

96,061 |

|

|

| |

|

|

|

|

|

|

|

|

|

| OPERATING

INCOME |

|

18,132 |

|

|

19,114 |

|

|

31,223 |

|

|

36,334 |

|

|

| |

|

|

|

|

|

|

|

|

|

| OTHER INCOME

AND EXPENSES |

|

|

|

|

|

|

|

|

|

| Other

expense, net |

|

(424 |

) |

|

198 |

|

|

(735 |

) |

|

(150 |

) |

|

| Gain on

sale of real estate |

|

— |

|

|

19,799 |

|

|

11,375 |

|

|

26,324 |

|

|

| Earnings

from unconsolidated joint ventures |

|

55 |

|

|

109 |

|

|

141 |

|

|

218 |

|

|

| Interest

expense |

|

(11,486 |

) |

|

(11,376 |

) |

|

(22,285 |

) |

|

(22,678 |

) |

|

| Other

gain on unconsolidated joint ventures |

|

— |

|

|

215 |

|

|

— |

|

|

215 |

|

|

| INCOME BEFORE

TAX |

|

6,277 |

|

|

28,059 |

|

|

19,719 |

|

|

40,263 |

|

|

| Income

tax provision |

|

(25 |

) |

|

(39 |

) |

|

(53 |

) |

|

(101 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| NET

INCOME |

|

6,252 |

|

|

28,020 |

|

|

19,666 |

|

|

40,162 |

|

|

| Net

income attributable to noncontrolling partner interest |

|

(147 |

) |

|

(659 |

) |

|

(462 |

) |

|

(956 |

) |

|

| NET INCOME

ATTRIBUTABLE TO RPT |

|

6,105 |

|

|

27,361 |

|

|

19,204 |

|

|

39,206 |

|

|

| Preferred

share dividends |

|

(1,675 |

) |

|

(1,675 |

) |

|

(3,350 |

) |

|

(3,350 |

) |

|

| NET INCOME

AVAILABLE TO COMMON SHAREHOLDERS |

|

$ |

4,430 |

|

|

$ |

25,686 |

|

|

$ |

15,854 |

|

|

$ |

35,856 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EARNINGS PER COMMON SHARE |

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.05 |

|

|

$ |

0.32 |

|

|

$ |

0.20 |

|

|

$ |

0.45 |

|

|

|

Diluted |

|

$ |

0.05 |

|

|

$ |

0.32 |

|

|

$ |

0.20 |

|

|

$ |

0.45 |

|

|

| |

|

|

|

|

|

|

|

|

|

| WEIGHTED

AVERAGE COMMON SHARES OUTSTANDING |

|

|

|

|

|

|

|

|

|

|

Basic |

|

79,344 |

|

|

79,233 |

|

|

79,322 |

|

|

79,214 |

|

|

|

Diluted |

|

79,529 |

|

|

86,027 |

|

|

79,525 |

|

|

79,413 |

|

|

| |

| |

| RAMCO-GERSHENSON PROPERTIES

TRUST |

| FUNDS FROM OPERATIONS |

| (In thousands, except per share

data) |

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

2017 |

|

2016 |

|

2017 |

|

2016 |

| |

|

|

|

|

|

|

|

| Net income |

$ |

6,252 |

|

|

$ |

28,020 |

|

|

$ |

19,666 |

|

|

$ |

40,162 |

|

| Net income attributable

to noncontrolling partner interest |

(147 |

) |

|

(659 |

) |

|

(462 |

) |

|

(956 |

) |

| Preferred share

dividends |

(1,675 |

) |

|

(1,675 |

) |

|

(3,350 |

) |

|

(3,350 |

) |

| Net income available to

common shareholders |

4,430 |

|

|

25,686 |

|

|

15,854 |

|

|

35,856 |

|

| Adjustments: |

|

|

|

|

|

|

|

| Rental

property depreciation and amortization expense |

23,275 |

|

|

22,671 |

|

|

46,033 |

|

|

46,478 |

|

| Pro-rata

share of real estate depreciation from unconsolidated joint

ventures |

79 |

|

|

81 |

|

|

152 |

|

|

163 |

|

| Gain on

sale of depreciable real estate |

— |

|

|

(18,473 |

) |

|

(11,190 |

) |

|

(24,747 |

) |

| Gain on

sale of joint venture depreciable real estate (1) |

— |

|

|

(26 |

) |

|

— |

|

|

(26 |

) |

| Provision

for impairment on income-producing properties |

820 |

|

|

— |

|

|

6,537 |

|

|

— |

|

| Other

gain on unconsolidated joint ventures (2) |

— |

|

|

(215 |

) |

|

— |

|

|

(215 |

) |

| FFO available

to common shareholders |

28,604 |

|

|

29,724 |

|

|

57,386 |

|

|

57,509 |

|

| |

|

|

|

|

|

|

|

|

Noncontrolling interest in Operating Partnership (1) |

147 |

|

|

659 |

|

|

462 |

|

|

956 |

|

| Preferred

share dividends (assuming conversion) (2) |

1,675 |

|

|

1,675 |

|

|

3,350 |

|

|

3,350 |

|

| FFO available

to common shareholders and dilutive securities |

$ |

30,426 |

|

|

$ |

32,058 |

|

|

$ |

61,198 |

|

|

$ |

61,815 |

|

| |

|

|

|

|

|

|

|

| Gain on

sale of land |

— |

|

|

(1,326 |

) |

|

(185 |

) |

|

(1,577 |

) |

| Severence

expense |

554 |

|

|

80 |

|

|

567 |

|

|

80 |

|

|

Acquisition costs |

— |

|

|

4 |

|

|

— |

|

|

63 |

|

| OPERATING FFO

available to common shareholders and dilutive

securities |

$ |

30,980 |

|

|

$ |

30,816 |

|

|

$ |

61,580 |

|

|

$ |

60,381 |

|

| |

|

|

|

|

|

|

|

| Weighted average common

shares |

79,344 |

|

|

79,233 |

|

|

79,322 |

|

|

79,214 |

|

| Shares issuable upon

conversion of Operating Partnership Units (1) |

1,917 |

|

|

1,936 |

|

|

1,917 |

|

|

1,969 |

|

| Dilutive effect of

restricted stock |

185 |

|

|

206 |

|

|

203 |

|

|

199 |

|

| Shares issuable upon

conversion of preferred shares (2) |

6,685 |

|

|

6,588 |

|

|

6,685 |

|

|

6,588 |

|

| Weighted

average equivalent shares outstanding, diluted |

88,131 |

|

|

87,963 |

|

|

88,127 |

|

|

87,970 |

|

| |

|

|

|

|

|

|

|

| FFO available

to common shareholders and dilutive securities per share,

diluted |

$ |

0.35 |

|

|

$ |

0.36 |

|

|

$ |

0.69 |

|

|

$ |

0.70 |

|

| |

|

|

|

|

|

|

|

| Operating FFO

available to common shareholders and dilutive securities per share,

diluted |

$ |

0.35 |

|

|

$ |

0.35 |

|

|

$ |

0.70 |

|

|

$ |

0.69 |

|

| |

|

|

|

|

|

|

|

| Dividend per common

share |

$ |

0.22 |

|

|

$ |

0.21 |

|

|

$ |

0.44 |

|

|

$ |

0.42 |

|

| Payout ratio -

Operating FFO |

62.9 |

% |

|

60.0 |

% |

|

62.9 |

% |

|

60.9 |

% |

|

|

|

|

|

|

|

|

|

(1) The total noncontrolling interest reflects OP units

convertible 1:1 into common shares.

(2) Series D convertible preferred shares

are paid annual dividends of $6.7 million and are currently

convertible into approximately 6.7 million shares of common stock.

They are dilutive only when earnings or FFO exceed approximately

$0.25 per diluted share per quarter and $1.00 per diluted share per

year. The conversion ratio is subject to adjustment based

upon a number of factors, and such adjustment could affect the

dilutive impact of the Series D convertible preferred shares on FFO

and earning per share in future periods.

Management considers funds from operations, also

known as “FFO”, to be an appropriate supplemental measure of the

financial performance of an equity REIT. Under the

NAREIT definition, FFO represents net income (computed in

accordance with generally accepted accounting principles),

excluding gains (or losses) from sales of depreciable property and

excluding impairment provisions on depreciable real estate or on

investments in non-consolidated investees that are driven by

measurable decreases in the fair value of depreciable real estate

held by the investee, plus depreciation and amortization,

(excluding amortization of financing costs). Adjustments for

unconsolidated partnerships and joint ventures are calculated to

reflect funds from operations on the same basis. In addition to FFO

available to common shareholders, we include Operating FFO

available to common shareholders as an additional measure of

financial and operating performance. Operating FFO excludes

acquisition costs and periodic items such as impairment provisions

on land available for development or sale, bargain purchase gains,

and gains or losses on extinguishment of debt that are not adjusted

under the current NAREIT definition of FFO. We provide a

reconciliation of FFO to Operating FFO. FFO and Operating FFO

should not be considered alternatives to GAAP net income available

to common shareholders or as alternatives to cash flow as measures

of liquidity. While we consider FFO available to common

shareholders and Operating FFO available to common shareholders

useful measures for reviewing our comparative operating and

financial performance between periods or to compare our performance

to different REITs, our computations of FFO and Operating FFO may

differ from the computations utilized by other real estate

companies, and therefore, may not be comparable.

|

|

|

|

| RAMCO-GERSHENSON PROPERTIES

TRUST |

| RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES |

| (amounts in thousands) |

|

|

|

Reconciliation of net income available to common

shareholders to Same Property NOI |

| |

|

|

|

|

|

|

|

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

| Net income available to

common shareholders |

$ |

4,430 |

|

|

$ |

25,686 |

|

|

$ |

15,854 |

|

|

$ |

35,856 |

|

| Preferred

share dividends |

1,675 |

|

|

1,675 |

|

|

3,350 |

|

|

3,350 |

|

| Net

income attributable to noncontrolling partner interest |

147 |

|

|

659 |

|

|

462 |

|

|

956 |

|

| Income

tax provision |

25 |

|

|

39 |

|

|

53 |

|

|

101 |

|

| Interest

expense |

11,486 |

|

|

11,376 |

|

|

22,285 |

|

|

22,678 |

|

| Earnings

from unconsolidated joint ventures |

(55 |

) |

|

(109 |

) |

|

(141 |

) |

|

(218 |

) |

| Gain on

sale of real estate |

— |

|

|

(19,799 |

) |

|

(11,375 |

) |

|

(26,324 |

) |

| Gain on

remeasurment of unconsolidated joint venture |

— |

|

|

(215 |

) |

|

— |

|

|

(215 |

) |

| Other

expense, net |

424 |

|

|

(198 |

) |

|

735 |

|

|

150 |

|

|

Management and other fee income |

(73 |

) |

|

(245 |

) |

|

(226 |

) |

|

(355 |

) |

|

Depreciation and amortization |

23,335 |

|

|

22,714 |

|

|

46,152 |

|

|

46,561 |

|

|

Acquisition costs |

— |

|

|

4 |

|

|

— |

|

|

63 |

|

| General

and administrative expenses |

6,372 |

|

|

5,683 |

|

|

12,823 |

|

|

11,288 |

|

| Provision

for impairment |

820 |

|

|

— |

|

|

6,537 |

|

|

— |

|

|

Amortization of lease inducements |

44 |

|

|

112 |

|

|

88 |

|

|

206 |

|

|

Amortization of acquired above and below market lease intangibles,

net |

(1,149 |

) |

|

(822 |

) |

|

(2,108 |

) |

|

(1,557 |

) |

| Lease

termination fees |

— |

|

|

— |

|

|

(33 |

) |

|

(68 |

) |

|

Straight-line ground rent expense |

70 |

|

|

— |

|

|

141 |

|

|

— |

|

|

Amortization of acquired ground lease intangibles |

6 |

|

|

— |

|

|

12 |

|

|

— |

|

|

Straight-line rental income |

(378 |

) |

|

(331 |

) |

|

(1,188 |

) |

|

(810 |

) |

| NOI |

47,179 |

|

|

46,229 |

|

|

93,421 |

|

|

91,662 |

|

| NOI from

Other Investments |

(3,769 |

) |

|

(3,310 |

) |

|

(6,301 |

) |

|

(6,745 |

) |

| Same Property NOI with

Redevelopment |

43,410 |

|

|

42,919 |

|

|

87,120 |

|

|

84,917 |

|

| NOI from

Redevelopment (1) |

(6,107 |

) |

|

(5,186 |

) |

|

(11,995 |

) |

|

(10,528 |

) |

| Same Property NOI

without Redevelopment |

$ |

37,303 |

|

|

$ |

37,733 |

|

|

$ |

75,125 |

|

|

$ |

74,389 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) The NOI from Redevelopment adjustments represent

100% of the NOI related to Deerfield Towne Center, Hunter’s Square,

Woodbury Lakes and West Oaks, and a portion of the NOI

related to specific GLA at Spring Meadows, The Shoppes at Fox River

II, The Shops on Lane Avenue, Mission Bay, River City Marketplace,

and Town & Country for the periods presented. Because of

the redevelopment activity, the center or specific space is not

considered comparable for the periods presented and adjusted out of

Same Property NOI with Redevelopment in arriving at Same Property

NOI without Redevelopment. |

| |

|

|

|

|

|

|

|

| |

| RAMCO-GERSHENSON PROPERTIES TRUST |

| RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES |

| (amounts in thousands) |

| |

| |

Three Months Ended June 30, |

| |

2017 |

|

2016 |

| Reconciliation

of net income to proforma adjusted EBITDA |

|

|

|

| Net income |

$ |

6,252 |

|

|

$ |

28,020 |

|

| Gain on sale of real

estate |

— |

|

|

(19,799 |

) |

| Depreciation and

amortization |

23,335 |

|

|

22,714 |

|

| Provision for

impairment |

820 |

|

|

— |

|

| Severance expense |

554 |

|

|

80 |

|

| (Gain) on sale of joint

venture real estate |

— |

|

|

(26 |

) |

| Gain on remeasurement

of unconsolidated joint ventures |

— |

|

|

(215 |

) |

| Interest expense |

11,486 |

|

|

11,376 |

|

| Income tax

provision |

25 |

|

|

39 |

|

| Acquisition costs |

— |

|

|

4 |

|

| Adjusted EBITDA |

42,472 |

|

|

42,193 |

|

| Proforma adjustments

(1) |

— |

|

|

(1,461 |

) |

| Proforma adjusted

EBITDA |

$ |

42,472 |

|

|

$ |

40,732 |

|

| Annualized proforma

adjusted EBITDA |

$ |

169,888 |

|

|

$ |

162,928 |

|

| |

|

|

|

| |

|

|

|

| Reconciliation

of Notes Payable, net to Net Debt |

|

|

|

| Notes payable, net |

$ |

1,197,414 |

|

|

$ |

1,026,418 |

|

| Unamortized

premium |

(4,537 |

) |

|

(6,025 |

) |

| Deferred financing

costs, net |

3,379 |

|

|

3,777 |

|

| Notional debt |

1,196,256 |

|

|

1,024,170 |

|

| Capital lease

obligation |

1,066 |

|

|

1,108 |

|

| Cash and cash

equivalents |

(4,798 |

) |

|

(4,369 |

) |

| Net debt |

$ |

1,192,524 |

|

|

$ |

1,020,909 |

|

| |

|

|

|

| |

|

|

|

| Reconciliation

of interest expense to total fixed charges |

|

|

|

| Interest expense |

$ |

11,486 |

|

|

$ |

11,376 |

|

| Preferred share

dividends |

1,675 |

|

|

1,675 |

|

| Scheduled mortgage

principal payments |

782 |

|

|

915 |

|

| Total fixed

charges |

$ |

13,943 |

|

|

$ |

13,966 |

|

| |

|

|

|

| |

|

|

|

| Net debt to annualized

proforma adjusted EBITDA(2) |

|

7.0X |

|

|

|

6.3X |

|

| Interest coverage ratio

(Adjusted EBITDA / interest expense) |

|

3.7X |

|

|

|

3.7X |

|

| Fixed

charge coverage ratio (Adjusted EBITDA / fixed charges) |

|

3.0X |

|

|

|

3.0X |

|

| |

|

|

|

| (1) 2Q16 excludes EBITDA of $1.0 million from

dispositions and approximately $0.5 million of insurance settlement

proceeds and miscellaneous income. The proforma adjustments treat

the activity as if they occurred at the start of each quarter. |

| (2) 2Q17 does not include $26.1 million of disposition

proceeds deposited in a 1031 escrow account at June 30, 2017.

The consolidated net debt to annualized proforma adjusted EBITDA

would have been 6.9X after adjusting for the $26.1 million. |

| |

| |

Ramco-Gershenson Properties

TrustNon-GAAP Financial DefinitionsJune

30, 2017

|

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- |

Certain of our key performance indicators are

considered non-GAAP financial measures. Management uses these

measures along with our GAAP financial statements in order to

evaluate our operations results. We believe these additional

measures provide users of our financial information additional

comparable indicators of our industry, as well as our

performance.

Funds From Operations (FFO) Available to

Common Shareholders

As defined by the National Association of Real

Estate Investment Trusts (NAREIT), Funds From Operations (FFO)

represents net income computed in accordance with generally

accepted accounting principles, excluding gains (or losses) from

sales of depreciable property and impairment provisions on

depreciable real estate or on investments in non-consolidated

investees that are driven by measurable decreases in the fair value

of depreciable real estate held by the investee, plus depreciation

and amortization, (excluding amortization of financing

costs). Adjustments for unconsolidated partnerships and joint

ventures are calculated to reflect funds from operations on the

same basis. We have adopted the NAREIT definition in our

computation of FFO available to common shareholders.

Operating FFO Available to Common

Shareholders

In addition to FFO available to common

shareholders, we include Operating FFO available to common

shareholders as an additional measure of our financial and

operating performance. Operating FFO excludes acquisition

costs and periodic items such as gains (or losses) from sales of

land and impairment provisions on land available for development or

sale, bargain purchase gains, severance expense, accelerated

amortization of debt premiums and gains or losses on extinguishment

of debt that are not adjusted under the current NAREIT definition

of FFO. We provide a reconciliation of FFO to Operating FFO.

FFO and Operating FFO should not be considered alternatives to GAAP

net income available to common shareholders or as alternatives to

cash flow as measures of liquidity.

While we consider FFO available to common

shareholders and Operating FFO available to common shareholders

useful measures for reviewing our comparative operating and

financial performance between periods or to compare our performance

to different REITs, our computations of FFO and Operating FFO may

differ from the computations utilized by other real estate

companies, and therefore, may not be comparable. We

recognize the limitations of FFO and

Operating FFO when compared to GAAP net

income available to common shareholders. FFO and Operating

FFO available to common shareholders do not represent amounts

available for needed capital replacement or expansion, debt service

obligations, or other commitments and uncertainties. In addition,

FFO and Operating FFO do not represent cash generated from

operating activities in accordance with GAAP and are not

necessarily indicative of cash available to fund cash needs,

including the payment of dividends. FFO and Operating FFO are

simply used as additional indicators of our operating

performance.

Adjusted EBITDA/Proforma Adjusted

EBITDA

Adjusted EBITDA is net income or loss plus

depreciation and amortization, net interest expense, severance

expense, income taxes, gain or loss on sale of real estate, and

impairments of real estate, if any. Adjusted EBITDA should

not be considered an alternative measure of operating results or

cash flow from operations as determined in accordance with

GAAP. Proforma Adjusted EBITDA further adjusts for the effect

of the acquisition or disposition of properties during the

period.

Same Property Operating

Income

Same Property Operating Income ("Same Property

NOI with Redevelopment") is a supplemental non-GAAP financial

measure of real estate companies' operating performance. Same

Property NOI with Redevelopment is considered by management to be a

relevant performance measure of our operations because it includes

only the NOI of comparable properties for the reporting

period. Same Property NOI with Redevelopment excludes

acquisitions and dispositions. Same Property NOI with

Redevelopment is calculated using consolidated operating income and

adjusted to exclude management and other fee income, depreciation

and amortization, general and administrative expense, provision for

impairment and non-comparable income/expense adjustments such as

straight-line rents, lease termination fees, above/below market

rents, and other non-comparable operating income and expense

adjustments.

In addition to Same Property NOI with

Redevelopment, the Company also believes Same Property NOI without

Redevelopment to be a relevant performance measure of our

operations. Same Property NOI without Redevelopment follows

the same methodology as Same Property NOI with Redevelopment,

however it excludes redevelopment activity that significantly

impacts the entire property, as well as lesser redevelopment

activity where we are adding GLA or retenanting a specific

space. A property is designated as redevelopment when

projected costs exceed $1.0 million, and the construction impacts

approximately 20% or more of the income producing property's gross

leasable area ("GLA") or the location and nature of the

construction significantly impacts or disrupts the daily operations

of the property. Redevelopment may also include a portion of

certain properties designated as same property for which we are

adding additional GLA or retenanting space.

Same Property NOI should not be considered an

alternative to net income in accordance with GAAP or as a measure

of liquidity. Our method of calculating Same Property NOI may

differ from methods used by other REITs and, accordingly, may not

be comparable to such other REITs.

Company Contact:

Dawn L. Hendershot, Senior Vice President Investor Relations and Public Affairs

31500 Northwestern Highway, Suite 300

Farmington Hills, MI 48334

dhendershot@rgpt.com

(248) 592-6202

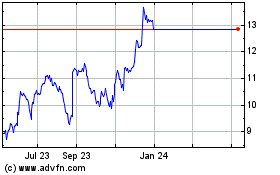

RPT Realty (NYSE:RPT)

Historical Stock Chart

From Mar 2024 to Apr 2024

RPT Realty (NYSE:RPT)

Historical Stock Chart

From Apr 2023 to Apr 2024