- Net earnings of $276 million

- Adjusted EPS up 39 percent over

prior-year quarter

Archer Daniels Midland Company (NYSE: ADM) today reported

financial results for the quarter ended June 30, 2017.

“We continued to deliver on our strategic plan and capitalize on

improving conditions in some markets to achieve strong 39 percent

year-over-year earnings growth,” said ADM Chairman and CEO Juan

Luciano.

“Our actions in the first half of the year reflect ADM’s

continuous efforts to create shareholder value. We are diversifying

our capabilities and geographic reach through acquisitions and

organic expansions. We are aggressively managing costs and capital,

and taking additional portfolio actions; and we are ahead of pace

to meet our 2017 target of $225 million in run-rate savings.

“With these collective actions, we expect to deliver solid

year-over-year earnings growth and returns in 2017, and we are

poised to be an even stronger company in 2018.”

Second Quarter 2017 Highlights

2017 2016 (Amounts in

millions except per share data)

Earnings per share (as

reported) $ 0.48 $ 0.48 Adjusted

earnings per share1 $ 0.57 $

0.41 Segment operating profit $

642 $ 680 Adjusted segment operating

profit1 $ 658 $ 573

Agricultural Services 109 57 Corn Processing 224 163 Oilseeds

Processing 206 235 WFSI 92 94 Other 27 24

- EPS as reported of $0.48 includes a

$0.04 per share charge related to asset impairments, restructuring

and settlement activities; a $0.04 per share net loss on the sale

of assets and businesses; and a $0.01 per share LIFO charge.

Adjusted EPS, which excludes these items, was $0.571.

- Trailing four-quarter-average adjusted

ROIC was 6.8 percent1, 80 basis points above annual WACC of 6.0

percent.

- During the first half of 2017, the

company returned $875 million to shareholders through dividends and

share repurchases.

1 Non-GAAP financial measures; see pages 4, 9 and 10 for

explanations and reconciliations, including after-tax amounts.

Results of Operations

Ag Services delivered its fourth consecutive quarter of

year-over-year increases in operating profits.

In Merchandising and Handling, North America Grain results

increased significantly over the prior year with strong carries in

wheat, corn and soybeans. Global Trade generated solid results and

was up over the year-ago quarter, benefiting from improved margins,

favorable timing effects and actions to improve performance.

Transportation decreased from the prior-year period, primarily

due to river conditions and lower freight rates.

Milling and Other delivered solid results on steady margins and

favorable merchandising.

Corn Processing results were up from the year-ago quarter.

Higher volumes and improved margins in North America Sweeteners and

Starches contributed to another strong performance. Bioproducts

results increased over a weak prior year, with an improvement in

ethanol margins.

Oilseeds Processing benefited from the diversity of its

feedstocks, products and geographies; however, overall results were

down compared to the second quarter of 2016. Weak margins in both

global soybean crush and South American origination impacted

Crushing and Origination results. Softseeds earnings were higher as

a result of leveraging the business’s global flex capacity to

capitalize on margin opportunities.

Refining, Packaging, Biodiesel and Other had solid results in

all regions, with South America refined and packaged oils and the

global peanut business contributing to strong performance in the

quarter. North America Biodiesel results also improved over the

prior-year quarter, which was impacted by unfavorable timing

effects.

Asia experienced another good quarter, growing significantly

over the prior-year period due both to ADM’s increased ownership

stake in, and strong results from, Wilmar.

WFSI was in line with the prior-year quarter. WILD Flavors

delivered double-digit operating profit growth with strong sales

globally. Specialty Ingredients was down for the quarter.

Other Items of Note

As additional information to help clarify underlying business

performance, the tables on page 9 include both reported EPS as well

as adjusted EPS excluding significant timing effects.

Segment operating profit of $642 million for the quarter

includes charges of $26 million related to asset impairment,

restructuring and settlement activities, and a net pretax gain on

the sale of assets and businesses of $8 million. Prior-year segment

operating profit included asset impairment and restructuring

charges of $10 million and a net pretax gain on the sale of assets

and businesses of $118 million.

In Corporate results, Minority Interest and Other charges

increased from the prior year primarily due to updated portfolio

investment valuations in CIP, and Unallocated Costs were up due to

continued investments in ADM’s business transformation program and

related IT costs, and in research and development.

The 28 percent effective tax rate reflects an approximately 1

percent decrease due primarily to changes in the forecast

geographic mix of earnings and the effect of changes in discrete

items year over year, partially offset by the expiration of U.S.

tax credits including the biodiesel tax credit.

Conference Call Information

ADM will host a webcast on August 1, 2017, at 8 a.m.

Central Time to discuss financial results and provide a company

update. A financial summary slide presentation will be available to

download approximately 60 minutes prior to the call. To listen to

the webcast or to download the slide presentation, go to

www.adm.com/webcast. A replay of the

webcast will also be available for an extended period of time at

www.adm.com/webcast.

Forward-Looking Statements

Some of the above statements constitute forward-looking

statements. These statements are based on many assumptions and

factors that are subject to risk and uncertainties. ADM has

provided additional information in its reports on file with the SEC

concerning assumptions and factors that could cause actual results

to differ materially from those in this presentation, and you

should carefully review the assumptions and factors in our SEC

reports. To the extent permitted under applicable law, ADM assumes

no obligation to update any forward-looking statements.

About ADM

For more than a century, the people of Archer Daniels Midland

Company (NYSE: ADM) have transformed crops into products that serve

the vital needs of a growing world. Today, we’re one of the world’s

largest agricultural processors and food ingredient providers, with

approximately 32,000 employees serving customers in more than 160

countries. With a global value chain that includes approximately

500 crop procurement locations, 250 ingredient manufacturing

facilities, 38 innovation centers and the world’s premier crop

transportation network, we connect the harvest to the home, making

products for food, animal feed, industrial and energy uses. Learn

more at www.adm.com.

Financial Tables Follow

Segment Operating Profit, Adjusted

Segment Operating Profit (a non-GAAP measure) and Corporate

Results

(unaudited)

Quarter endedJune 30 Six months endedJune 30

(In millions) 2017 2016 Change 2017 2016 Change

Segment Operating

Profit $ 642 $ 680 $

(38 ) $ 1,318 $ 1,253

$ 65 Less specified items: (Gains) losses on sales of

assets and businesses (8 ) (118 ) 110 (8 ) (118 ) 110 Impairment,

restructuring, and settlement charges 26 10 16 35 12 23 Hedge

timing effects (2 ) 1 (3 ) (9 ) (1 ) (8 )

Adjusted

Segment Operating Profit $ 658 $

573 $ 85 $ 1,336 $

1,146 $ 190 Agricultural

Services $ 109 $ 57

$ 52 $ 197 $

133 $ 64 Merchandising and

handling 40 (14 ) 54 59 10 49 Milling and other 58 56 2 103 104 (1

) Transportation 11 15 (4 ) 35 19 16

Corn Processing

$ 224 $ 163 $

61 $ 395 $ 292

$ 103 Sweeteners and starches 198 182

16 359 323 36 Bioproducts 26 (19 ) 45 36 (31 ) 67

Oilseeds Processing $ 206 $

235 $ (29 ) $ 520

$ 496 $ 24

Crushing and origination 38 135 (97 ) 158 255 (97 ) Refining,

packaging, biodiesel, and other 83 53 30 142 132 10 Asia 85 47 38

220 109 111

Wild Flavors & Specialty Ingredients

(WFSI) $ 92 $ 94

$ (2 ) $ 167 $

164 $ 3 WFSI 92 94 (2 ) 167 164

3

Other $ 27 $ 24

$ 3 $ 57 $ 61 $ (4 )

Financial 27 24 3 57 61

(4 )

Segment Operating Profit $ 642 $

680 $ (38 ) $ 1,318

$ 1,253 $ 65 Corporate

Results $ (259 ) $ (273

) $ 14 $ (477 )

$ (540 ) $ 63 LIFO credit

(charge) (9 ) (88 ) 79 4 (102 ) 106 Interest expense - net (81 )

(63 ) (18 ) (160 ) (131 ) (29 ) Unallocated corporate costs (134 )

(116 ) (18 ) (267 ) (232 ) (35 ) Minority interest and other

charges (35 ) (6 ) (29 ) (54 ) (75 ) 21

Earnings Before

Income Taxes $ 383 $ 407

$ (24 ) $ 841

$ 713 $ 128

Segment operating profit is ADM’s consolidated income from

operations before income tax excluding corporate items. Adjusted

segment operating profit, a non-GAAP measure, is segment operating

profit excluding specified items and timing effects. Timing effects

relate to hedge ineffectiveness and significant mark-to-market

hedge timing effects. Management believes that segment operating

profit and adjusted segment operating profit are useful measures of

ADM’s performance because they provide investors information about

ADM’s business unit performance excluding corporate overhead costs

as well as specified items and significant timing effects. Segment

operating profit and adjusted segment operating profit are not

measures of consolidated operating results under U.S. GAAP and

should not be considered alternatives to income before income

taxes, the most directly comparable GAAP financial measure, or any

other measure of consolidated operating results under U.S. GAAP.

Consolidated Statements of

Earnings

(unaudited)

Quarter endedJune 30 Six months endedJune 30

2017 2016 2017 2016 (in millions, except per

share amounts) Revenues $ 14,943 $ 15,629 $ 29,931 $

30,013 Cost of products sold 14,056 14,892 28,176

28,495 Gross profit 887 737 1,755 1,518 Selling,

general, and administrative expenses 531 500 1,052 979 Asset

impairment, exit, and restructuring costs 23 12 33 25 Equity in

earnings of unconsolidated affiliates (109 ) (90 ) (281 ) (155 )

Interest income (25 ) (23 ) (48 ) (45 ) Interest expense 86 65 167

135 Other (income) expense - net (2 ) (134 ) (9 ) (134 ) Earnings

before income taxes 383 407 841 713 Income taxes (108 ) (119 ) (226

) (195 ) Net earnings including noncontrolling interests 275 288

615 518 Less: Net earnings (losses) attributable to noncontrolling

interests (1 ) 4 — 4

Net earnings

attributable to ADM $ 276 $

284 $ 615 $ 514

Diluted earnings per common share $

0.48 $ 0.48 $ 1.07 $

0.87 Average number of shares outstanding

574

594

576 595

Other (income)

expense - net consists of:

Gains on sales of assets (a) $ (35 ) $ (121 ) $ (51 ) $ (124 )

Other - net (b) 33 (13 ) 42 (10 ) $ (2 ) $ (134 ) $

(9 ) $ (134 ) (a) Current period gain includes gains related to the

sale of the crop risk services business in Other and individually

insignificant disposals in Ag Services and Corporate partially

offset by an adjustment of the proceeds of the 2015 sale of the

cocoa business in Oilseeds. Prior period gain related to realized

contingent consideration from the sale of the Company’s equity

investment in Gruma S.A.B de C.V. in December 2012 partially offset

by loss on sale of assets in Ag Services, recovery of loss

provisions and gain on the sale of the Company’s Brazilian sugar

ethanol facilities in Corn, revaluation of the remaining interest

to settlement value in conjunction with the acquisition of the

remaining interest in Amazon Flavors in WFSI, and individually

insignificant disposals in Oilseeds. (b) Other - net in the

current period includes provisions for contingent losses related to

certain settlement items in Oilseeds and WFSI and foreign exchange

losses. Other - net in the prior period includes foreign exchange

gains and other income.

Summary of Financial Condition

(Unaudited)

June 30,2017 June 30,2016 (in

millions)

Net Investment In Cash and cash equivalents (b) $

433 $ 334 Short-term marketable securities (b) 237 396 Operating

working capital (a) 7,034 8,184 Property, plant, and equipment

9,945 9,802 Investments in and advances to affiliates 4,856 4,429

Long-term marketable securities 199 487 Goodwill and other

intangibles 3,866 3,865 Other non-current assets 750 648

$ 27,320 $ 28,145 Financed

By Short-term debt (b) $ 353 $ 1,554 Long-term debt, including

current maturities (b) 6,627 5,832 Deferred liabilities 2,895 3,049

Temporary equity 27 41 Shareholders’ equity 17,418 17,669

$ 27,320 $ 28,145 (a)

Current assets (excluding cash and cash equivalents and short-term

marketable securities) less current liabilities (excluding

short-term debt and current maturities of long-term debt).

(b) Net debt is calculated as short-term debt plus long-term debt,

including current maturities less cash and cash equivalents and

short-term marketable securities.

Summary of Cash Flows

(unaudited)

Six months endedJune 30 2017 2016 (in

millions)

Operating Activities Net earnings $ 615 $

518 Depreciation and amortization 452 452 Asset impairment charges

19 20 Gains on sales of assets (51 ) (121 ) Other - net (35 ) 169

Changes in operating assets and liabilities 314 (1,407 )

Total Operating Activities

1,314 (369 )

Investing Activities Purchases of property, plant and

equipment (452 ) (396 ) Net assets of businesses acquired (180 )

(120 ) Proceeds from sale of business/assets 149 96 Marketable

securities - net 106 63 Other investing activities (189 ) (456 )

Total Investing Activities

(566 ) (813

) Financing Activities Long-term debt

borrowings 17 — Long-term debt payments (269 ) (8 ) Net borrowings

(payments) under lines of credit 195 1,454 Share repurchases (511 )

(487 ) Cash dividends (364 ) (353 ) Other (7 ) (3 ) Total Financing

Activities

(939 ) 603 Increase

(decrease) in cash, cash equivalents, restricted cash, and

restricted cash equivalents (191 ) (579

) Cash, cash equivalents, restricted cash, and restricted

cash equivalents - beginning of period 688

1,003 Cash, cash equivalents, restricted cash, and

restricted cash equivalents - end of period $ 497

$ 424

Segment Operating Analysis

(unaudited)

Quarter endedJune 30 Six months

endedJune 30 2017 2016 2017 2016 (in ‘000s

metric tons)

Processed volumes Oilseeds

Processing 8,518 8,468 17,337 16,749 Corn Processing 5,840

5,087 11,384 10,829 Total processed volumes

14,358 13,555 28,721

27,578 Quarter endedJune 30 Six months

endedJune 30 2017 2016 2017 2016 (in millions)

Revenues Agricultural Services $ 5,848 $ 6,387 $ 12,654 $

12,867 Corn Processing 2,274 2,352 4,518 4,559 Oilseeds Processing

6,072 6,099 11,354 11,096 Wild Flavors and Specialty Ingredients

648 680 1,210 1,272 Other 101 111 195 219

Total revenues

$ 14,943 $ 15,629

$ 29,931 $ 30,013

Adjusted Earnings Per Share

A non-GAAP financial measure

(unaudited)

Quarter endedJune 30 Six months endedJune 30

2017 2016 2017 2016

EPS (fully diluted) as

reported $ 0.48 $ 0.48 $

1.07 $ 0.87 Adjustments: LIFO charge (credit)

(a) 0.01 0.09 — 0.11 (Gains) losses on sales of assets and

businesses (b) 0.04 (0.17 ) 0.04 (0.17 ) Asset impairment,

restructuring, and settlement charges (c) 0.04 0.01 0.05 0.02

Certain discrete tax adjustments (d) — — 0.01

— Sub-total adjustments 0.09 (0.07 ) 0.10

(0.04 )

Adjusted earnings per share $ 0.57

$ 0.41 $ 1.17

$ 0.83 Memo: Hedge timing effects

(gain) loss (e) — — (0.01 ) — Adjusted EPS

excluding timing effects $ 0.57 $ 0.41 $ 1.16

$ 0.83 (a) Current quarter and YTD changes in the

Company’s LIFO reserves of $9 million pretax ($6 million after tax)

and $4 million pretax ($2 million after tax), respectively, tax

effected using the Company’s U.S. effective income tax rate. Prior

quarter and YTD changes in the Company’s LIFO reserves of $88

million pretax ($55 million after tax), and $102 million pretax,

($63 million after tax), respectively, tax effected using the

Company’s U.S. effective income tax rate. (b)

Current period gain of $8 million pretax

($22 million loss after tax) related to the sale of the crop risk

services business partially offset by an adjustment of the proceeds

of the 2015 sale of the cocoa business, tax effected using the

applicable tax rates. Prior period gain of $118 million pretax

($101 million after tax), primarily related to recovery of loss

provisions and gain related to the sale of the Company’s Brazilian

sugar ethanol facilities, realized contingent consideration on the

sale of the Company’s equity investment in Gruma S.A.B de C.V. in

December 2012, and revaluation of the remaining interest to

settlement value in conjunction with the acquisition of the

remaining interest in Amazon Flavors, tax effected using the

applicable tax rates.

(c) Current quarter and YTD charges of $28 million pretax ($21

million after tax) and $38 million pretax ($29 million after tax),

respectively, related to impairment of certain long-lived assets,

restructuring charges, and a settlement charge, tax effected using

the applicable tax rates. Prior quarter and YTD charges of $12

million pretax ($8 million after tax) and $25 million pretax ($16

million after tax), respectively, primarily related to impairment

of certain long-lived assets and restructuring charges, tax

effected using the applicable tax rates. (d) Certain discrete tax

adjustments unrelated to current period earnings related to

valuation allowances totaling $4 million. (e) Current quarter and

YTD timing effect gains of $2 million pretax ($1 million after tax)

and $9 million pretax ($5 million after tax), respectively, tax

effected using the Company's U.S. effective income tax rate.

Adjusted EPS and adjusted EPS excluding timing effects reflect

ADM’s fully diluted EPS after removal of the effect on EPS as

reported of certain specified items and timing effects as more

fully described above. Management believes that these are useful

measures of ADM’s performance because they provide investors

additional information about ADM’s operations allowing better

evaluation of underlying business performance and better

period-to-period comparability. These non-GAAP financial measures

are not intended to replace or be an alternative to EPS as

reported, the most directly comparable GAAP financial measure, or

any other measures of operating results under GAAP. Earnings

amounts described above have been divided by the company’s diluted

shares outstanding for each respective period in order to arrive at

an adjusted EPS amount for each specified item and timing effect.

Adjusted Return on Invested

Capital

A non-GAAP financial measure

(unaudited)

Adjusted ROIC Earnings (in

millions) Four Quarters Quarter

Ended Ended Sep. 30, 2016 Dec. 31, 2016

Mar. 31, 2017 June 30, 2017 June 30, 2017

Net earnings attributable to ADM $ 341 $ 424 $ 339 $ 276

$ 1,380 Adjustments: Interest expense 78 80 81 86

325 LIFO (85 ) 2 (13 ) 9

(87 ) Other

adjustments 82 (19 ) 10 20

93

Total adjustments 75 63 78 115

331 Tax on adjustments (22 )

(2 ) (24 ) (13 )

(61 ) Net adjustments 53 61

54 102

270 Total Adjusted ROIC

Earnings $ 394 $ 485 $ 393 $ 378

$ 1,650 Adjusted

Invested Capital (in millions)

Quarter Ended Trailing Four Sep. 30, 2016

Dec. 31, 2016 Mar. 31, 2017 June 30, 2017

Quarter Average Equity (1) $ 17,538 $ 17,173 $ 17,121

$ 17,411

$ 17,311 + Interest-bearing liabilities (2)

7,073 6,931 7,207 6,980

7,048 + LIFO adjustment (net of tax)

45 47 39 44

44 Other adjustments 57 10 12

43

31 Total Adjusted Invested Capital $

24,713 $ 24,161 $ 24,379 $ 24,478

$ 24,434 Adjusted Return on

Invested Capital 6.8 % (1)

Excludes noncontrolling interests

(2)

Includes short-term debt, current

maturities of long-term debt, capital lease obligations, and

long-term debt

Adjusted ROIC is Adjusted ROIC earnings

divided by adjusted invested capital. Adjusted ROIC earnings is

ADM’s net earnings adjusted for the after tax effects of interest

expense, changes in the LIFO reserve and other specified items.

Adjusted invested capital is the sum of ADM’s equity (excluding

noncontrolling interests) and interest-bearing liabilities adjusted

for the after tax effect of the LIFO reserve, and other specified

items. Management believes Adjusted ROIC is a useful financial

measure because it provides investors information about ADM’s

returns excluding the impacts of LIFO inventory reserves and other

specified items and increases period-to-period comparability of

underlying business performance. Management uses Adjusted ROIC to

measure ADM’s performance by comparing Adjusted ROIC to its

weighted average cost of capital (WACC). Adjusted ROIC, Adjusted

ROIC earnings and Adjusted invested capital are non-GAAP financial

measures and are not intended to replace or be alternatives to GAAP

financial measures.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170801005384/en/

Archer Daniels Midland CompanyMedia RelationsColin

McBean, 312-634-8484orInvestor RelationsMark Schweitzer,

217-451-8286

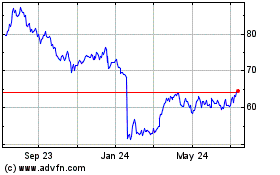

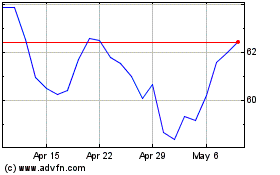

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

From Apr 2023 to Apr 2024