Report of Foreign Issuer (6-k)

July 31 2017 - 4:49PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of: July 2017

Commission

File Number: 001-36563

Orion Engineered Carbons S.A.

(Translation of registrant’s name into English)

6, Route de

Trèves

L-2633 Senningerberg (Municipality of Niederanven)

Grand Duchy of Luxembourg

(Address of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

☒ Form 40-F ☐

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is

submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

On July 31, 2017, Orion Engineered Carbons S.A. issued a press release announcing the

closing of the secondary offering of an aggregate 10,000,000 of its common shares by Kinove Luxembourg Holdings 1 S.à r.l. (“Kinove Holdings”) and certain other sellers, including current and former members of Orion’s

management team (together with Kinove Holdings, the “Selling Shareholders”). A copy of the press release is attached as Exhibit 99.1 hereto.

In connection with the offering, on July 25, 2017, the Company and the Selling Shareholders entered into an Underwriting Agreement (the

“Underwriting Agreement”), with Barclays Capital Inc. and Morgan Stanley & Co. LLC (the “Underwriters”), for the sale of 10,000,000 common shares, at a price to the public of $21.85 per share, resulting in gross proceeds

to the selling shareholders of $218.5 million, before deducting underwriting discounts and commissions (which will be paid by the Selling Shareholders). The Selling Shareholders received all of the net proceeds from the sale of these shares. The

Selling Shareholders have granted the Underwriters a 30-day option to purchase an additional 1,500,000 common shares at the public offering price, less the underwriting discount. The Underwriting Agreement contains representations, warranties and

covenants customary in agreements of this type, including an agreement by the Company to indemnify the Underwriters against certain liabilities arising out of or in connection with the offering.

The foregoing description of the Underwriting Agreement is not complete and is qualified in its entirety by reference to the complete text of

the Underwriting Agreement. A copy of the Underwriting Agreement is attached as Exhibit 99.2 to this Form 6-K and is incorporated herein by reference and into the Company’s Registration Statement on Form F-3 (File No. 333-209963).

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

Orion Engineered Carbons S.A.

|

|

|

|

|

By:

|

|

/s/ Charles Herlinger

|

|

|

|

Name:

|

|

Charles Herlinger

|

|

|

|

Title:

|

|

Chief Financial Officer

|

Date: July 31, 2017

EXHIBIT INDEX

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

99.1

|

|

Press release of Orion Engineered Carbons S.A., dated July 31, 2017.

|

|

|

|

|

99.2

|

|

Underwriting Agreement, dated as of July 25, 2017, among Orion Engineered Carbons S.A., the sellers named on Schedule I thereto and Barclays Capital Inc. and Morgan Stanley & Co. LLC.

|

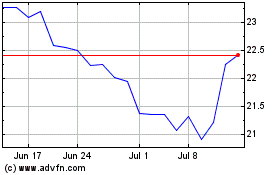

Orion (NYSE:OEC)

Historical Stock Chart

From Mar 2024 to Apr 2024

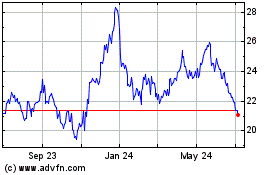

Orion (NYSE:OEC)

Historical Stock Chart

From Apr 2023 to Apr 2024