Second Quarter Highlights

- Net sales $989 million, sequential and

year-on-year growth 8%

- Net income $116 million and earnings

per diluted share $0.48 (includes after-tax gain of $82 million, or

$0.34 per diluted share, from sale of K1 factory)

- EBITDA $316 million

- Completed Nanium acquisition

Amkor Technology, Inc. (NASDAQ: AMKR), a leading provider of

semiconductor packaging and test services, today announced

financial results for the second quarter ended June 30,

2017.

“Second quarter revenues were up 8% sequentially,” said Steve

Kelley, Amkor’s president and chief executive officer. “Our growth

in the quarter reflected solid demand across most end markets.”

“In late May, we completed our acquisition of Nanium. This

acquisition enhances Amkor’s leadership position in wafer-level

packaging, a critical technology for smartphones, tablets and other

small form-factor applications,” continued Kelley.

Results Q2 2017

Q1 2017 Q2 2016 ($ in millions, except per

share data) Net sales $ 989 $ 914 $ 917 Gross margin 17.4 % 15.6 %

14.3 % Net income (loss) $ 116 ($10 ) $ 5 Earnings per diluted

share $ 0.48 ($0.04 ) $ 0.02 EBITDA** $ 316 $ 154 $ 168 Net cash

provided by operating activities $ 97 $ 103 $ 135 Free cash flow**

$ 43 $ 17 ($22 )

**EBITDA and free cash flow are non-GAAP measures. The

reconciliations to the comparable GAAP measures are included below

under “Selected Operating Data.”

Cash and cash equivalents were $658 million and total debt was

$1.6 billion, at June 30, 2017.

“As expected, we completed the sale of our K1 factory in Korea

in Q2,” said Megan Faust, Amkor’s corporate vice president and

chief financial officer. “The sale price was $142 million, and we

recognized an after-tax gain of $82 million ($0.34 per diluted

share).”

“We also issued a redemption notice for $200 million of the

outstanding $400 million of our Senior Notes due 2021,” added

Faust. “The redemption was completed in July using cash on hand.

The redemption will result in annualized interest savings of

approximately $13 million.”

Business Outlook

“Looking ahead to Q3, we expect that revenues will increase

around 9% sequentially, driven by the launch of flagship mobile

devices,” said Kelley.

Third quarter 2017 outlook (unless otherwise noted):

- Net sales of $1.04 billion to $1.12

billion, up 5% to 13% from the prior quarter

- Gross margin of 17% to 20%

- Net income of $24 million to

$64 million, or $0.10 to $0.27 per share

- Full year capital expenditures of

around $525 million, up $25 million from our previous forecast

Conference Call Information

Amkor will conduct a conference call on Monday, July 31,

2017, at 5:00 p.m. Eastern Time. This call may include material

information not included in this press release. This call is being

webcast and can be accessed at Amkor’s website: www.amkor.com. You

may also access the call by dialing 1-877-645-6380 or

1-404-991-3911. A replay of the call will be made available at

Amkor’s website or by dialing 1-855-859-2056 or 1-404-537-3406

(conference ID 59359701). The webcast is also being distributed

over NASDAQ OMX’s investor distribution network to both

institutional and individual investors. Institutional investors can

access the call via NASDAQ OMX’s password-protected event

management site, Street Events (www.streetevents.com).

About Amkor Technology, Inc.

Amkor Technology, Inc. is one of the world’s largest providers

of outsourced semiconductor packaging and test services. Founded in

1968, Amkor pioneered the outsourcing of IC packaging and test, and

is now a strategic manufacturing partner for more than 250 of the

world’s leading semiconductor companies, foundries and electronics

OEMs. Amkor’s operating base includes 10 million square feet of

floor space, with production facilities, product development

centers, and sales and support offices located in key electronics

manufacturing regions in Asia, Europe and the U.S. For more

information, visit www.amkor.com.

AMKOR TECHNOLOGY, INC. Selected Operating Data

Q2 2017 Q1 2017 Q2

2016 Net Sales Data: Net sales (in millions): Advanced

products* $ 431 $ 383 $ 394 Mainstream products** 558

531 523 Total net sales $ 989 $

914 $ 917 Packaging services 81 % 81 % 83 %

Test services 19 % 19 % 17 % Net sales from top ten

customers 67 % 67 % 67 %

End Market Distribution Data

(an approximation including representative devices and applications

based on a sampling of our largest customers)

:

Communications (smart phones, tablets, handheld devices, wireless

LAN) 42 % 41 % 44 % Automotive and industrial (infotainment,

safety, performance, comfort) 26 % 26 % 25 % Consumer (televisions,

set top boxes, gaming, portable media, digital cameras) 14 % 14 %

14 % Networking (servers, routers, switches) 10 % 11 % 11 %

Computing (PCs, hard disk drives, printers, peripherals, servers)

8 % 8 % 6 % Total 100 % 100 %

100 %

Gross Margin Data: Net sales 100.0 %

100.0 % 100.0 % Cost of sales: Materials 35.3 % 35.4 % 37.7 % Labor

16.4 % 16.5 % 16.0 % Other manufacturing 30.9 % 32.5

% 32.0 % Gross margin 17.4 % 15.6 %

14.3 % * Advanced products include flip chip and

wafer-level processing and related test services ** Mainstream

products include wirebond packaging and related test services

AMKOR TECHNOLOGY, INC.Selected

Operating Data

In the press release above we provide EBITDA, which is not

defined by U.S. GAAP. We define EBITDA as net income before

interest expense, income tax expense and depreciation and

amortization. We believe EBITDA to be relevant and useful

information to our investors because it provides additional

information in assessing our financial operating results. Our

management uses EBITDA in evaluating our operating performance, our

ability to service debt and our ability to fund capital

expenditures. However, EBITDA has certain limitations in that it

does not reflect the impact of certain expenses on our consolidated

statements of income, including interest expense, which is a

necessary element of our costs because we have borrowed money in

order to finance our operations, income tax expense, which is a

necessary element of our costs because taxes are imposed by law,

and depreciation and amortization, which is a necessary element of

our costs because we use capital assets to generate income. EBITDA

should be considered in addition to, and not as a substitute for,

or superior to, operating income, net income or other measures of

financial performance prepared in accordance with U.S. GAAP.

Furthermore our definition of EBITDA may not be comparable to

similarly titled measures reported by other companies. Below is our

reconciliation of EBITDA to U.S. GAAP net income.

Non-GAAP Financial Measure

Reconciliation: Q2 2017 Q1 2017 Q2 2016

(in millions) EBITDA Data: Net income attributable to

Amkor $ 116 $ (10 ) $ 5 Plus: Interest expense 22 22 22 Plus:

Income tax expense 33 — 3 Plus: Depreciation & amortization 145

142 138 EBITDA $ 316 $ 154 $ 168

In the press release above we refer to free cash flow, which is

not defined by U.S. GAAP. We define free cash flow as net cash

provided by operating activities less payments for property, plant

and equipment, plus proceeds from the sale of and insurance

recovery for property, plant and equipment, if applicable. We

believe free cash flow to be relevant and useful information to our

investors because it provides them with additional information in

assessing our liquidity, capital resources and financial operating

results. Our management uses free cash flow in evaluating our

liquidity, our ability to service debt and our ability to fund

capital expenditures. However, free cash flow has certain

limitations, including that it does not represent the residual cash

flow available for discretionary expenditures since other,

non-discretionary expenditures, such as mandatory debt service, are

not deducted from the measure. The amount of mandatory versus

discretionary expenditures can vary significantly between periods.

This measure should be considered in addition to, and not as a

substitute for, or superior to, other measures of liquidity or

financial performance prepared in accordance with U.S. GAAP, such

as net cash provided by operating activities. Furthermore, our

definition of free cash flow may not be comparable to similarly

titled measures reported by other companies. Below is our

reconciliation of free cash flow to U.S. GAAP net cash provided by

operating activities.

Non-GAAP Financial Measures

Reconciliation: Q2 2017 Q1 2017 Q2 2016

(in millions) Free Cash Flow Data: Net cash provided

by operating activities $ 97 $ 103 $ 135 Less: Purchases of

property, plant and equipment (183 ) (88 ) (157 ) Plus: Proceeds

from sale of property, plant and equipment 129 2 —

Free cash flow $ 43 $ 17 $ (22 )

AMKOR TECHNOLOGY, INC. CONSOLIDATED STATEMENTS OF

INCOME (Unaudited) For the Three Months

Ended For the Six Months Ended June 30,

June 30, 2017 2016 2017

2016 (In thousands, except per share data) Net sales

$ 989,447 $ 917,326 $ 1,903,047 $ 1,786,008 Cost of sales

817,212 785,720 1,587,906

1,531,518 Gross profit 172,235 131,606

315,141 254,490 Selling, general

and administrative 67,783 70,896 144,478 144,531 Research and

development 44,268 30,168 85,824 57,323 Gain on sale of real estate

(108,109 ) — (108,109 ) —

Total operating expenses 3,942 101,064

122,193 201,854 Operating income

168,293 30,542 192,948 52,636 Interest expense 22,158 20,816 43,412

37,008 Interest expense, related party 293 1,242 1,535 2,484 Other

(income) expense, net (3,190 ) (242 ) 7,674

2,950 Total other expense, net 19,261

21,816 52,621 42,442

Income before taxes 149,032 8,726 140,327 10,194 Income tax

expense 32,573 3,360 33,012

5,233 Net income 116,459 5,366 107,315 4,961

Net income attributable to non-controlling interests (952 )

(653 ) (1,814 ) (1,123 ) Net income

attributable to Amkor $ 115,507 $ 4,713 $ 105,501

$ 3,838 Net income attributable to Amkor per

common share: Basic $ 0.48 $ 0.02 $ 0.44 $

0.02 Diluted $ 0.48 $ 0.02 $ 0.44 $

0.02 Shares used in computing per common share

amounts: Basic 238,863 237,090 238,774 237,058 Diluted 239,679

237,434 239,601 237,297

AMKOR TECHNOLOGY, INC.

CONSOLIDATED BALANCE SHEETS (Unaudited)

June 30, December 31, 2017 2016

(In thousands) ASSETS Current assets: Cash and cash

equivalents $ 657,627 $ 549,518 Restricted cash 2,000 2,000

Accounts receivable, net of allowances 604,366 563,107 Inventories

295,750 267,990 Other current assets 36,889

27,081 Total current assets 1,596,632 1,409,696 Property,

plant and equipment, net 2,645,810 2,564,648 Goodwill 25,161 24,122

Restricted cash 4,225 3,977 Other assets 112,303

89,643 Total assets $ 4,384,131 $ 4,092,086

LIABILITIES AND EQUITY Current liabilities:

Short-term borrowings and current portion of long-term debt $

313,004 $ 35,192 Current portion of long-term debt, related party

17,546 — Trade accounts payable 477,191 487,430 Capital

expenditures payable 231,481 144,370 Accrued expenses

348,869 338,669 Total current liabilities

1,388,091 1,005,661 Long-term debt 1,220,236 1,364,638 Long-term

debt, related party 17,454 75,000 Pension and severance obligations

170,554 166,701 Other non-current liabilities 60,842

76,682 Total liabilities 2,857,177

2,688,682 Stockholders’ equity: Preferred

stock — — Common stock 285 284 Additional paid-in capital 1,899,970

1,895,089 Accumulated deficit (198,056 ) (303,557 ) Accumulated

other comprehensive income (loss) 19,263 6,262 Treasury stock

(215,868 ) (214,490 ) Total Amkor stockholders’

equity 1,505,594 1,383,588 Non-controlling interests in

subsidiaries 21,360 19,816 Total equity

1,526,954 1,403,404 Total liabilities

and equity $ 4,384,131 $ 4,092,086

AMKOR

TECHNOLOGY, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS (Unaudited) For the Six Months

Ended June 30, 2017 2016 (In

thousands) Cash flows from operating activities: Net income $

107,315 $ 4,961 Depreciation and amortization 287,068 275,241 Gain

on sale of real estate (108,109 ) — Other operating activities and

non-cash items (3,787 ) (6,177 ) Changes in assets and liabilities

(82,528 ) (826 ) Net cash provided by operating

activities 199,959 273,199 Cash flows

from investing activities: Payments for property, plant and

equipment (271,651 ) (355,974 ) Proceeds from sale of property,

plant and equipment 130,962 593 Acquisition of business, net of

cash acquired (43,771 ) — Other investing activities (2,117

) (830 ) Net cash used in investing activities

(186,577 ) (356,211 ) Cash flows from financing activities:

Proceeds from revolving credit

facilities

75,000 115,000

Payments of revolving credit

facilities

— (100,000 ) Proceeds from short-term debt 41,228 24,630 Payments

of short-term debt (32,110 ) (23,035 ) Proceeds from issuance of

long-term debt 215,086 34,000 Payments of long-term debt (207,653 )

(8,582 ) Payment of deferred consideration for purchase of facility

(3,890 ) — Payments of capital lease obligations (2,665 ) (887 )

Other financing activities 561 (604 ) Net cash

provided by financing activities 85,557 40,522

Effect of exchange rate fluctuations on cash, cash

equivalents and restricted cash 9,418 18,782

Net increase (decrease) in cash, cash equivalents and

restricted cash 108,357 (23,708 ) Cash, cash equivalents and

restricted cash, beginning of period 555,495

527,348 Cash, cash equivalents and restricted cash, end of

period $ 663,852 $ 503,640

Forward-Looking Statement Disclaimer

This press release contains forward-looking statements within

the meaning of federal securities laws. All statements other than

statements of historical fact are considered forward-looking

statements including, without limitation, statements regarding our

position in wafer-level packaging as a result of the Nanium

acquisition, the amount of interest savings generated by the

redemption of $200 million of our 2021 Senior Notes, and all of the

statements made under “Business Outlook” above. These

forward-looking statements involve a number of risks,

uncertainties, assumptions and other factors that could affect

future results and cause actual results and events to differ

materially from historical and expected results and those expressed

or implied in the forward-looking statements, including, but not

limited to, the following:

- there can be no assurance regarding

when our new K5 factory and research and development center in

Korea will be fully utilized, or that the actual scope, costs,

timeline or benefits of the project will be consistent with our

current expectations;

- the highly unpredictable nature,

cyclicality, and rate of growth of the semiconductor industry;

- timing and volume of orders relative to

production capacity and the inability to achieve high capacity

utilization rates, control costs and improve profitability;

- volatility of consumer demand, double

booking by customers and deterioration in forecasts from our

customers for products incorporating our semiconductor packages,

including any slowdown in demand or changes in customer forecasts

for smartphones or other mobile devices and generally soft end

market demand for electronic devices;

- delays, lower manufacturing yields and

supply constraints relating to wafers, particularly for advanced

nodes and related technologies;

- dependence on key customers, the impact

of changes in our market share and prices for our services with

those customers and the business and financial condition of those

customers;

- the performance of our business,

economic and market conditions, the cash needs and investment

opportunities for the business, the need for additional capacity

and facilities to service customer demand and the availability of

cash flow from operations or financing;

- the effect of the global economy on

credit markets, financial institutions, customers, suppliers and

consumers, including the uncertain macroeconomic environment;

- the highly unpredictable nature and

costs of litigation and other legal activities and the risk of

adverse results of such matters and the impact of other legal

proceedings;

- changes in tax rates and taxes as a

result of changes in U.S. or foreign tax law or the interpretations

thereof (including possible tax reforms proposed by new

administrations), changes in our organizational structure, changes

in the jurisdictions in which our income is determined to be earned

and taxed, the outcome of tax reviews, audits and ruling requests,

our ability to realize deferred tax assets and the expiration of

tax holidays;

- curtailment of outsourcing by our

customers;

- our substantial indebtedness and

restrictive covenants;

- failure to realize sufficient cash flow

or access to other sources of liquidity to fund capital

expenditures;

- the effects of an economic slowdown in

major economies worldwide, particularly the recent slowdown in

China;

- disruptions in our business or

deficiencies in our controls resulting from the integration of

newly acquired operations, particularly J-Devices, or the

implementation and security of, and changes to, our enterprise

resource planning, factory shop floor systems and other management

information systems;

- economic effects of terrorist attacks,

political instability, natural disasters and military

conflict;

- competition, competitive pricing and

declines in average selling prices;

- fluctuations in manufacturing

yields;

- dependence on international operations

and sales and fluctuations in foreign currency exchange rates,

particularly in Japan;

- dependence on raw material and

equipment suppliers and changes in raw material and precious metal

costs;

- dependence on key personnel;

- enforcement of and compliance with

intellectual property rights;

- environmental and other governmental

regulations, including regulatory efforts by foreign governments to

support local competitors; and

- technological challenges.

Other important risk factors that could affect the outcome of

the events set forth in these statements and that could affect our

operating results and financial condition are discussed in the

company’s Annual Report on Form 10-K for the year ended

December 31, 2016 and in the company’s subsequent filings with

the Securities and Exchange Commission made prior to or after the

date hereof. Amkor undertakes no obligation to review or update any

forward-looking statements to reflect events or circumstances

occurring after the date of this press release.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170731006153/en/

Amkor Technology, Inc.Megan FaustCorporate Vice President &

Chief Financial Officer480-786-7707megan.faust@amkor.comorGreg

JohnsonVice President, Finance and Investor

Relations480-786-7594greg.johnson@amkor.com

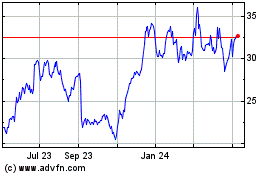

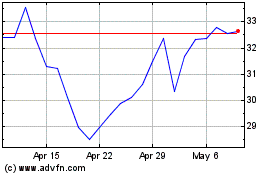

Amkor Technology (NASDAQ:AMKR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amkor Technology (NASDAQ:AMKR)

Historical Stock Chart

From Apr 2023 to Apr 2024