|

PROSPECTUS

SUPPLEMENT

|

Filed

pursuant to Rule 424(b)(5)

|

|

(To Prospectus

dated October 30, 2015)

|

Registration No. 333-205444

|

CEL-SCI

CORPORATION

100,000

Shares of Common Stock

We are

offering up to 100,000 shares of common stock, directly to the

investors in this offering at a price of $2.29 per share. In a

concurrent private placement, we are also selling to investors

warrants (Series OO) to purchase 60,000 shares of common stock. The

warrants will be exercisable beginning on the six-month anniversary

of the date of issuance, at an exercise price of $2.52 per share

and will expire five years after the initial issuance date. The

warrants and the common stock issuable upon the exercise of the

warrants are not being registered under the Securities Act of 1933,

as amended, pursuant to the registration statement, of which this

prospectus supplement and the accompanying base prospectus form a

part, and are not being offered pursuant to this prospectus

supplement and the accompanying base prospectus. The warrants and

the common stock issuable upon the exercise of the warrants are

being offered pursuant to an exemption from the registration

requirement of the Securities Act provided in Section 4(a)(2) of

the Securities Act and/or Rule 506(c) of Regulation D.

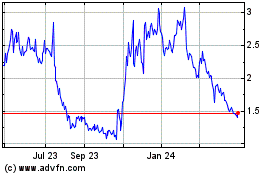

Our

common stock is currently traded on the NYSE America under the

symbol “CVM.” On July 26, 2017, the closing price of

our common stock on the NYSE American was $2.25 per share.

The aggregate market value of our outstanding voting common stock

held by non-affiliates, based upon a closing sale price of our

common stock on July 26, 2017 was approximately $18,871,000. During

the 12 calendar month period that ends on, and includes, the date

of this prospectus supplement, we have offered $4,246,885 of

securities pursuant to General Instruction I.B.6. of Form S-3.

Pursuant to General Instruction I.B.6 of Form S-3, in no event will

we sell securities registered by means of the registration

statement, of which this prospectus is a part, in a public primary

offering with a value exceeding more than one-third of the

aggregate market value of our voting and non-voting common equity

in any 12 month period so long as our public float remains below

$75 million.

An

investment in our common stock involves a high degree of risk. See

“Risk Factors” beginning on page S-16 of this

Prospectus Supplement, the Risk Factors in the accompanying

Prospectus and the risks set forth under the caption “Item

1A. Risk Factors” included in our most recent Annual Report

on Form 10-K and 10 K/A, as updated by our most recent Quarterly

Report on Form 10-Q which is incorporated by reference herein, for

a discussion of information that should be considered in connection

with an investment in our securities.

Neither

the SEC nor any state securities commission has approved or

disapproved of these securities, or passed upon the adequacy or

accuracy of this prospectus supplement. Any representation to

the contrary is a criminal offense.

We will

not pay any commissions to any person in connection with this

offering.

|

|

Offering Price

|

Proceeds, Before Expenses, To Us

|

|

Per

Share

|

$

2.29

|

$

2.29

|

|

Total

(1)

|

$

229,000

|

$

229,000

|

(1)

The amount of the

offering proceeds to us presented in this table does not give

effect to any exercise of the warrants (Series OO) being issued in

the concurrent private placement.

We

anticipate delivery of the shares will be made on or about July 31,

2017, subject to customary closing conditions.

__________________________

Prospectus

Supplement dated July 26, 2017

TABLE OF CONTENTS

Prospectus

Supplement

|

About

this Prospectus Supplement

|

S-iii

|

|

Prospectus

Supplement Summary

|

S-1

|

|

Risk

Factors

|

S-17

|

|

Forward-Looking

Statements

|

S-45

|

|

Use

of Proceeds

|

S-46

|

|

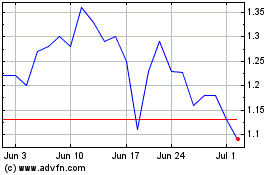

Price

Range of Common Stock

|

S-47

|

|

Dilution

|

S-47

|

|

Government

Regulation

|

S-48

|

|

Description

of Securities

|

S-56

|

|

Private

Placement Transaction and Warrants

|

S-59

|

|

Plan

of Distribution

|

S-60

|

|

Legal

Matters

|

S-60

|

|

Experts.

|

S-61

|

|

Where

You Can Find More Information.

|

S-61

|

|

Incorporation

by Reference

|

S-61

|

PROSPECTUS

|

Prospectus

Summary

|

1

|

|

Forward-Looking

Statements

|

10

|

|

Risk

Factors

|

11

|

|

Comparative

Share Data

|

33

|

|

Market

for CEL-SCI’s Common Stock.

|

36

|

|

Plan

of Distribution

|

37

|

|

Description

of Securities

|

38

|

|

Experts

|

42

|

|

Indemnification

|

42

|

|

Additional

Information

|

42

|

You

should rely only on the information contained in this prospectus

supplement and the accompanying prospectus, any document

incorporated or deemed to be incorporated by reference in this

prospectus supplement and the accompanying prospectus and any free

writing prospectus that we may prepare in connection with this

offering. Neither we nor the placement agent has authorized anyone

to provide you with any additional or different information. If

anyone provides you with any additional or different information,

you should not rely on it. Neither this prospectus supplement nor

the accompanying prospectus, nor any such free writing prospectus,

is an offer to sell or a solicitation of an offer to buy any

securities other than the securities to which it relates, or an

offer to sell or the solicitation of an offer to buy securities in

any jurisdiction where, or to any person to whom, it is unlawful to

make an offer or solicitation. You should not assume that the

information contained in this prospectus supplement,the

accompanying prospectus, any document incorporated or deemed to be

incorporated by reference in this prospectus supplement and the

accompanying prospectus, or any free writing prospectus that we may

prepare in connection with this offering is correct on any date

after their respective dates. Our business, financial condition,

liquidity, results of operations and prospects may have changed

since those respective dates.

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

document forms part of a registration statement that we filed with

the Securities and Exchange Commission, or the SEC, using a

“shelf” registration process. This document is in two

parts. The first part consists of this prospectus supplement,

including the documents incorporated by reference herein, which

describes the specific terms of this offering. The second part, the

accompanying prospectus, including the documents incorporated by

reference therein, provides more general information. We urge you

to carefully read this prospectus supplement and the accompanying

prospectus, and the documents incorporated herein and therein,

before buying any of the securities being offered by this

prospectus supplement and the accompanying prospectus. This

prospectus supplement may add, update or change information

contained in the accompanying prospectus. To the extent that any

statement that we make in this prospectus supplement is

inconsistent with statements made in the accompanying prospectus or

any documents incorporated by reference therein, the statements

made in this prospectus supplement will be deemed to modify or

supersede those made in the accompanying prospectus and such

documents incorporated by reference therein. In addition, any

statement in a filing we make with the SEC that adds to, updates or

changes information contained in an earlier filing we made with the

SEC shall be deemed to modify and supersede such information in the

earlier filing.

This

prospectus supplement, the accompanying prospectus, and the

information incorporated by reference herein and therein, may

include trademarks, service marks and trade names owned by us or

other companies. All trademarks, service marks and trade names

included or incorporated by reference into this prospectus

supplement or the accompanying prospectus are the property of their

respective owners.

In this

prospectus supplement, unless otherwise specified or the context

requires otherwise, we use the terms “CEL-SCI,” the

“Company,”“we,” “us” and

“our” to refer to CEL-SCI Corporation. Our fiscal year

ends on September 30.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights certain information about us, this offering

and information appearing elsewhere in this prospectus supplement,

in the accompanying prospectus and in the documents we incorporate

by reference. This summary is not complete and does not contain all

of the information that you should consider before investing in our

securities. To fully understand this offering and its consequences

to you, you should read this entire prospectus supplement and the

accompanying prospectus carefully, including the information

referred to under the heading “Risk Factors” in this

prospectus supplement and the accompanying prospectus, the

financial statements and other information incorporated by

reference in this prospectus supplement and the accompanying

prospectus when making an investment decision.

Our Company

We are

dedicated to research and development directed at improving the

treatment of cancer and other diseases by using the immune system,

the body’s natural defense system. We are currently focused

on the development of the following product candidates and

technologies:

1)

Multikine®

(Leukocyte Interleukin, Injection), or Multikine, an

investigational

immunotherapy under development for

the potential treatment of certain head and neck cancers, and anal

warts or cervical dysplasia in human immunodeficiency virus, or

HIV, and human papillomavirus, or HPV

co-infected patients;

2)

L.E.A.P.S. (Ligand

Epitope Antigen Presentation System) technology, or LEAPS, with two

investigational therapies, LEAPS-H1N1-DC, a product candidate under

development for the potential treatment of pandemic influenza in

hospitalized patients, and CEL-2000 and CEL-4000, vaccine product

candidates under development for the potential treatment of

rheumatoid arthritis.

The

following chart depicts our product candidates, their indications

and their current stage of development:

MULTIKINE

Our

lead investigational therapy, Multikine, is currently being

developed as a potential therapeutic agent directed at using the

immune system to produce an anti-tumor immune response. Data from

Phase 1

and Phase 2

clinical trials suggest that Multikine simulates the activities of

a healthy person’s immune system, enabling it to use the

body’s own anti-tumor immune response. Multikine is the

trademark we have registered for this investigational therapy, and

this proprietary name is subject to review by the U.S. Food and

Drug Administration, or FDA, in connection with our future

anticipated regulatory submission for approval.

Multikine has not been licensed

or approved for sale, barter or exchange by the FDA or any other

regulatory agency, such as the European Medicine Agency, or EMA.

Neither has its safety or efficacy been established for any

use.

Multikine is an

immunotherapy product candidate comprised of a patented defined

mixture of 14 human natural cytokines and is manufactured in a

proprietary manner in our manufacturing facility. We spent over 10

years and more than $80 million developing and validating the

manufacturing process for Multikine. The pro-inflammatory cytokine

mixture includes interleukins, interferons, chemokines and

colony-stimulating factors, which contain elements of the

body’s natural mix of defenses against cancer.

Multikine is

designed to be used in a different way than immune therapy is

normally used. It is designed to be administered locally to treat

local tumors before any other therapy has been administered.

For example, i

n the Phase 3

clinical trial, Multikine is injected locally at the site of the

tumor and near the adjacent draining lymph nodes as a first line of

treatment before surgery, radiation and/or chemotherapy because

that is when the immune system is thought to be strongest. The goal

is to help the intact immune system recognize and kill the micro

metastases that usually cause recurrence of the cancer. In short,

we believe that local administration and administration before

weakening of the immune system by chemotherapy and radiation will

result in better anti-tumor response than if Multikine were

administered as a second- or later-line therapy. In clinical

studies of Multikine, administration of the investigational therapy

to head and neck cancer patients has demonstrated the potential for

less or no appreciable toxicity.

Source: Adapted from Timar et al., Journal of Clinical Oncology

23(15) May 20, 2005

The

first indication CEL-SCI is pursuing for its investigational drug

product candidate Multikine is an indication for the neoadjuvant

therapy in patients with squamous cell carcinoma of the head and

neck, or SCCHN (hereafter also referred to as advanced primary head

and neck cancer). As detailed below, the Phase 3 Clinical trial of

the Multikine investigational drug as neoadjuvant therapy in SCCHN

is currently on clinical hold by the U.S. FDA. Per this hold we may

not enroll new patients and we may not resume investigational

product (Multikine) dosing in any previously enrolled patient.

CEL-SCI has no current needs or plans to do either of

these.

SCCHN

is a type of head and neck cancer, and CEL-SCI believes that, in

the aggregate, there is a large, unmet medical need among head and

neck cancer patients. CEL-SCI believes the last FDA approval of a

therapy indicated for the treatment of advanced primary head and

neck cancer was over 50 years ago. In the aggregate, head and neck

cancer represents about 6% of the world’s cancer cases, with

approximately over 650,000 patients diagnosed worldwide each year,

and nearly 60,000 patients diagnosed annually in the United States.

Multikine investigational immunotherapy was granted Orphan Drug

designation for neoadjuvant therapy in patients with SCCHN by the

FDA in the United States.

Status of Phase 3 Clinical Trial

Following

submissions to regulatory authorities in 24 countries around the

world, including the FDA in the United States, a global Phase 3

clinical trial of the investigational Multikine therapy as a

potential neoadjuvant therapy in patients with SCCHN was commenced

in late 2010. This clinical trial was placed on partial clinical

hold on September 26, 2016. In accordance with the clinical hold,

we are continuing to follow the 928 patients enrolled in the study,

and this includes following patients until the targeted 298 deaths

between the 2 comparison groups is observed. This number of deaths

is required to evaluate if the study’s primary endpoint is

achieved.

This

trial is currently primarily under the management of two clinical

research organizations, or CROs: ICON Inc. (who acquired Aptiv

Solutions, Inc., one of the two CROs), or ICON, and Ergomed

Clinical Research Limited, or Ergomed. Ergomed is responsible for

new patient enrollment and the clinical study management of the

various study sites, although enrollment of new patients has been

on hold since we received verbal notice of FDA’s partial

clinical hold on September 26, 2016.

The

Phase 3 study was designed with the objective that, if the study

endpoint, which is an improvement in overall survival of the

subjects treated with the Multikine treatment regimen plus the

current standard of care (SOC) as compared to subjects treated with

the current SOC only, is satisfied, the study results are expected

to be used to support applications that we plan to submit to

regulatory agencies in order to seek commercial marketing approvals

for Multikine in major markets around the world. This assessment

can only be made when a certain number of deaths have occurred in

these two main comparator groups of the study.

The

primary endpoint for the protocol for this Phase 3 head and neck

cancer study required that a 10% increase in overall survival be

obtained in the Multikine group which also is administered CIZ (CIZ

= low dose (non-chemotherapeutic) of cyclophosphamide, indomethacin

and Zinc-multivitamins) all of which are thought to enhance

Multikine activity), plus Standard of Care (Surgery + Radiotherapy

or Chemoradiotherapy) arm of the study over the Control comparator

(Standard of Care alone) arm. As the study was designed, the final

determination of whether this endpoint had been successfully

reached could only be determined when 298 events (deaths) had

occurred in the combined comparator arms of the study. Under the

study design, the plan was to enroll 880 patients in order to be

able to have 784 evaluable patients for the per-protocol

analysis.

In

August 2016, we announced that the data available at that time from

the Phase 3 clinical study reflected that the accumulation of

deaths in the study was lower than that which was anticipated based

on reported literature at the Phase 3 study’s inception. If

the number of deaths continued to be accumulated at the rate at

that time, it had been determined that it would take longer than

originally planned to complete the study. To minimize this

eventuality, we decided it would be necessary to enroll additional

patients. As required by law and in order to be able to implement

the plan, we submitted an amendment to the existing Phase 3

protocol for our head and neck cancer study to the FDA and multiple

regulatory agencies in the countries abroad where the Phase 3 study

is being conducted to allow for this expansion in patient

enrollment.

In

April 2017, we announced that in light of new information we have

decided to withdraw the study protocol amendment for additional

patients that was submitted to the FDA and other regulatory

agencies in the summer of 2016. It is now possible that we may not

need to add more patients to the study or that only a smaller

number of patients need to be added to the study to complete it in

a reasonable period of time. Should additional patients be needed,

we will submit a future study amendment to the FDA and other

regulatory agencies to seek their clearance to

proceed.

On

September 26, 2016, we received verbal notice from FDA that the

Phase 3 clinical trial in advanced primary head and neck cancer has

been placed on partial clinical hold. At such time, enrollment in

the Phase 3 study was 926 patients. Pursuant to this communication

from FDA, patients currently receiving study treatments can

continue to receive treatment, and patients already enrolled in the

study will continue to be followed.

On

October 21, 2016, we received a partial clinical hold letter from

FDA and, on November 18, 2016, we submitted a response to

FDA’s partial clinical hold letter.

In its

partial clinical hold letter, FDA identified the following

deficiencies: a) FDA stated that there is an unreasonable and

significant risk of illness or injury to human subjects and cited

among other things the absence of prompt reports by us to the FDA

of Independent Data Monitoring Committee (IDMC)

recommendations

to close the study entirely (made in spring of 2014) or at least to

close it to accrual of new patients (made in spring of 2016); b)

FDA stated that the investigator brochure is misleading, erroneous,

and materially incomplete; and c) FDA stated that the plan or

protocol is deficient in design to meet its stated objectives. In

its partial clinical hold letter, FDA also identified the

information needed to resolve these deficiencies. In addition,

FDA’s partial clinical hold letter included two requests

relating to quality information regarding our investigational final

drug product, which were noted by FDA as non-hold issues. We

believe that our response submitted to FDA on November 18, 2016,

addressed each of the deficiencies identified by FDA including

detailing our belief that, under the applicable FDA guidance, there

was no obligation to report the cited IDMC recommendations to the

FDA at the time they were issued, and it also requested a

face-to-face meeting with FDA, and outlined our commitment to

diligently work with FDA in an effort to have the partial clinical

hold for the study lifted.

On

December 8, 2016, FDA advised us that the Agency was denying our

request for a meeting at that time because FDA's review of our

November 18, 2016 response was ongoing. We also were advised that

we would be receiving a letter addressing its November 18, 2016

response by December 18, 2016.

On

December 16, 2016, FDA issued an Incomplete Response To Hold letter

to us indicating that based on the Agency’s preliminary

review of our November 18, 2016 submission, FDA has determined that

it is not a complete response to all of the issues listed in

FDA’s clinical hold letter. In its letter, FDA identified the

following deficiencies: a) FDA stated that we did not provide the

information identified as necessary to address FDA’s

statement that patients enrolled in the study are exposed to

unreasonable and significant risk of illness or injury to human

subjects; b) FDA stated that we did not provide the information

identified as necessary to address FDA’s statement that

continued enrollment of patients in the study exposes the patients

to unreasonable risks and the FDA furthermore stated that the study

is unlikely to demonstrate that the addition of our investigational

drug Multikine to the standard of care is superior to standard of

care and thus should be terminated for futility; (c) FDA stated

that we did not provide the information identified as necessary to

address FDA’s statement that the investigator brochure is

misleading, erroneous, and materially incomplete; (d) FDA stated

that we did not provide the information identified as necessary to

address FDA’s statement that the proposed revised clinical

protocol is inadequate in design to meet its stated objectives and

FDA furthermore stated that this deficiency cannot be addressed by

further revisions to the protocol. In its incomplete response to

hold letter, FDA also identified the steps we must take to address

these deficiencies. In addition, FDA’s Incomplete Response to

Hold letter noted with respect to FDA’s two requests relating

to quality information regarding our investigational final drug

product, which we had been instructed by FDA to submit separately

from the response to the partial clinical hold, which again were

noted by FDA as non-hold issues, that our November 18, 2016,

submission had not included the information addressing these two

requests.

In early

January 2017, in preparation for the request for a Type A meeting

with FDA and resolution of the partial clinical hold issues, we

prepared a comprehensive submission to FDA detailing our belief,

accompanied by what we believe to be appropriate supporting data,

records, and information reflecting that we have taken the steps

necessary to address the specific deficiencies identified by FDA,

including: a) demonstrating that patients enrolled in the study are

not exposed to unreasonable and significant risk of illness or

injury; b) demonstrating that continued enrollment of patients in

the study does not expose the patients to unreasonable risks and

that the study should not be terminated for futility; (c)

demonstrating that a supplemented investigator brochure is not

misleading, erroneous, or materially incomplete; (d) demonstrating

that the proposed revised clinical protocol is adequate in design

to meet its stated objectives and that this deficiency can be

addressed by the proposed revisions to the protocol.

On

February 8, 2017, we met with the FDA to allow an open and frank

discussion of the clinical hold issues raised by the FDA and to

secure the FDA’s input and clarification on how to address

the partial hold issues. On March 1, 2017 CEL-SCI received the

written minutes of this meeting from FDA. The Action Items for

CEL-SCI to pursue per the minutes from the FDA were the following:

1) provide an updated Investigator’s Brochure and current

procedures for compliance with requirements under 21 CFR 312

Subpart D to address the partial clinical hold, and 2) provide a

list of major protocol deviations, which CEL-SCI believes will

affect study results, and provide a plan to identify major protocol

deviations across all patients enrolled in the Phase 3

protocol.

We are

diligently continuing to work with the FDA to have the clinical

hold lifted. We have been in a continuing dialogue with them to try

to resolve their questions and to supply them with supplemental

information. We supplied our response to the Action Items to the

FDA in April 2017. We heard back from FDA in May 2017. The

continued hold issues addressed in the FDA communication were that

the study’s Investigator Brochure (IB) and the “Dear

Investigator” letter needed to be revised. Specific

deficiencies and their locations in each of the documents were

identified, and directions were given as to the specific

information that should be included in the revisions of the

documents. In its communication FDA also switched the terminology

for the hold from partial hold to full clinical hold. This was done

because CEL-SCI had completed all planned treatment of the patients

in the Phase 3 study. FDA said that the only action we need to be

aware of is that we may not enroll new patients and we may not

resume investigational product (Multikine) dosing in any previously

enrolled patient. CEL-SCI has no current needs or plans to do

either of these.

CEL-SCI

revised these documents as directed by the FDA and filed the

responses with FDA soon after FDA’s letter.

In June

2017, the FDA requested that three additional changes be made to

the IB that CEL-SCI submitted to the FDA on June 2, 2017. The FDA

provided instructions directing CEL-SCI on what the specific

changes should be. The FDA did not raise any other hold issues in

this letter.

As of

September 2016 nine hundred twenty-eight (928) head and neck cancer

patients have been enrolled in the Phase 3 study. In accordance

with the study protocol and FDA’s instructions, CEL-SCI

continues to follow these patients. The study endpoint is a 10%

increase in overall survival of patients between the two main

comparator groups. The determination if the study end point is met

when there are a total of 298 deaths in those two

groups.

Subject

to the clinical hold, we estimate that the total remaining cash

cost of the Phase 3 clinical trial, excluding any costs that will

be paid by our partners, would be approximately $21.2 million. This

is in addition to the approximately $37.4 million that we already

had spent on the trial as of June 30, 2017. This number may be

affected by the rate of any future patient enrollment, if needed,

rate of death accumulation in the study, foreign currency exchange

rates, and many other factors, some of which cannot be foreseen

today. It is therefore possible that the cost of the Phase 3

clinical trial will be higher than currently estimated. If FDA will

only lift the clinical hold with termination of the current study

and initiation of a new clinical trial, any such new trial can only

be initiated if permitted by FDA and, as appropriate, other

regulatory authorities around the world after the requisite

submissions are made to them, and the additional duration and costs

of the Phase 3 clinical program would likely exceed those already

incurred in connection with the Phase 3 clinical trial. If there is

a need to conduct an additional Phase 3 clinical trial, any such

requirement would have significant and severe material consequences

for us and could impact our ability to continue as a going

concern.

Currently we are

not looking to enroll any more patients. We will not be able to

enroll any additional patients in the Phase 3 study unless FDA

lifts the clinical hold. In addition, in the spring of 2016, the

IDMC recommended to us that new patient enrollment should stop in

the Phase 3 study, but patients already on study should continue to

be treated and followed. Although we had expected to work through

the concerns raised by the IDMC while we worked through the

clinical hold with FDA, the IDMC informed us on December 13, 2016,

that because the study is on clinical hold imposed by FDA, the IDMC

has no formal recommendation regarding continuation of the trial at

that time. Another IDMC meeting was held on February 6, 2017. Due

to the fact that the study is still on clinical hold imposed by the

FDA, the IDMC had no formal recommendation regarding continuation

of the trial at that time. If the clinical hold is not lifted by

FDA or if it is determined by FDA that the study has been

compromised, the study may be terminated, or if the clinical hold

is lifted by FDA but the IDMC continues to recommend that

enrollment not be allowed to continue, the study may be terminated

by us.

If the

clinical hold is not lifted, the Phase 3 study may not be able to

be completed to its prespecified endpoints in a timely manner, if

at all, and, if the Phase 3 study cannot be completed to its

prespecified endpoints, the study would not be able to be used as

the pivotal study supporting a marketing application in the United

States, and at least one entirely new Phase 3 clinical trial would

need to be conducted to support a marketing application in the

United States. Even if the clinical hold is lifted, if it is not

lifted in a timely fashion, the nature and duration of the clinical

hold could irreparably harm the data from the Phase 3 study such

that it may no longer be able to be used to support a marketing

application in the United States. Even if the clinical hold is

lifted in a timely fashion, it remains possible that the regulatory

authorities could determine that the Phase 3 study is not

sufficient to be used as a single pivotal study supporting a

marketing application in the United States.

Throughout the

course of the Phase 3 study, an Independent Data Monitoring

Committee, or IDMC, has met periodically to review safety data from

the Phase 3 study, and the IDMC is expected to continue doing so

throughout the remainder of the Phase 3 study. At various points in

the study at which the IDMC has completed review of thesafety data

and has issued recommendations, it has recommended that the Phase 3

study may continue, although on two occasions the IDMC has issued

recommendations that would have closed the study entirely (spring

of 2014) or at least closed it to accrual of new patients (spring

of 2016). On one occasion, in the spring of 2014, the IDMC made a

recommendation that the study be closed for safety and efficacy

reasons. However, following review of additional information

submitted by us, the IDMC recommended that the study may continue.

In the spring of 2016, with close to 800 patients enrolled, the

IDMC made a recommendation that enrollment in the Phase 3 study

should stop, but that patients already enrolled in the study should

continue treatment and follow-up. We responded to this letter and

indicated it would address the remaining three requests (generally

relating to study design considerations) that were not part of the

IDMC recommendation in a follow-up correspondence.

However, before

CEL-SCI could provide our follow-up response to the remaining three

requests, the IDMC sent another letter (a) indicating that our

initial letter responding to the IDMC recommendation was

unresponsive and (b) also indicating that the IDMC was deeply

concerned about patient safety in the trial based on its review of

cumulative data. The IDMC's initial letter in the spring of 2016

did not mention that the IDMC was concerned about safety. Instead,

the initial letter in the spring of 2016 noted that the study

should be closed to further accrual, and that patients who had been

randomized may continue treatment and should be followed. The

statement that patients who had been randomized may continue

treatment suggested to us that safety was not an issue. Because no

safety concern had been raised by the IDMC since the spring of

2014, when, after further communications with CEL-SCI, the IDMC

issued its recommendation that the study should proceed, CEL-SCI

believed based on the entirety of the course of correspondence with

the IDMC that acute safety was not an issue underlying the IDMC's

recommendation to halt accrual in the spring of 2016. As noted

above, all other correspondence to CEL-SCI from the IDMC from study

initiation through September 2015, with the exception of the

recommendation in spring 2014, stated that the IDMC recommends

“the study may continue". CEL-SCI responded to the

IDMC’s recommendation in spring of 2016 with a statistical

analysis showing that more patients were needed in order to

complete the study in a reasonable amount of follow-up time, since

the observed death rate in the study was lower than that which was

predicted from the literature at the onset of the study.

Subsequently a protocol amendment was prepared based on the

analysis provided to the IDMC and submitted to FDA in July 2016,

and a copy was then sent to the IDMC in response to its request for

a copy of the submission. To date, CEL-SCI has not received a

response from the IDMC regarding this protocol amendment. However,

two months after the amendment was submitted to FDA, FDA placed the

protocol on partial clinical hold. CEL-SCI expects to work through

the concerns raised by the IDMC while CEL-SCI works through the

hold with FDA. Ultimately, the decision as to whether

CEL-SCI’s drug product candidate is safe and effective can

only be made by FDA and/or by other regulatory authorities based

upon an assessment of all of the data from an entire drug

development program submitted as part of an application for

marketing approval. As detailed elsewhere in this prospectus

supplement, whether the clinical hold is lifted or not, the current

Phase 3 clinical study for CEL-SCI’s investigational drug may

or may not be able to be used as the pivotal study supporting a

marketing application in the United States, and, if not, at least

one entirely new Phase 3 pivotal study would need to be conducted

to support a marketing application in the United

States.

Follow-Up Analysis of Overall Survival in Phase 2

Patients

Prior

to starting the Phase 3 study, we had tested Multikine in over 200

patients. The following is a summary of results from our last Phase

2 study conducted with Multikine. This study employed the same

treatment protocol as is being followed in our Phase 3

study:

●

Reported potential for improved

survival:

In a follow-up analysis of the Phase 2 clinical

study population, which used the same dosage and treatment regimen

as is being used in the Phase 3 study, head and neck cancer

patients with locally advanced primary disease who received

CEL-SCI’s investigational therapy Multikine as first-line

investigational therapy, followed by surgery and radiotherapy, were

reported by the clinical investigators to have had a 63.2% overall

survival, or OS, rate at a median of 3.33 years from surgery. This

percentage of OS was arrived at as follows: of the 21 subjects

enrolled in the Phase 2 study, the consent for the survival

follow-up portion of the study was received from 19 subjects. OS

was calculated using the entire treatment population that consented

to the follow-up portion of the study (19 subjects), including two

subjects who, as later determined by three pathologists blinded to

the study, did not have oral squamous cell carcinoma, or OSCC.

These two subjects were thus not evaluable per the protocol and

were not included in the pathology portion of the study for

purposes of calculating complete response rate, as described below,

but were included in the OS calculation. The overall survival rate

of subjects receiving the investigational therapy in this study was

compared to the overall survival rate that was calculated based

upon a review of 55 clinical trials conducted in the same cancer

population (with a total of 7,294 patients studied), and reported

in the peer reviewed scientific literature between 1987 and 2007.

Review of this literature showed an approximate survival rate of

47.5% at 3.5 years from treatment. Therefore, the results of

CEL-SCI’s final Phase 2 study were considered to be

potentially favorable in terms of overall survival, recognizing the

limitations of this early-phase study. It should be noted that an

earlier investigational therapy Multikine study appears to lend

support to the overall survival findings described above -

Feinmesser et al Arch Otolaryngol. Surg. 2003. However, no

definitive conclusions can be drawn from these data about the

potential efficacy or safety profile of this investigational

therapy. Moreover, further research is required, and these results

must be confirmed in the Phase 3 clinical trial of this

investigational therapy that is currently in progress. Subject to

completion of that Phase 3 clinical trial and the FDA’s

review and acceptance of our entire data set on this

investigational therapy, we believe that these early-stage clinical

trial results indicate the potential for our Multikine product

candidate to become a treatment for advanced primary head and neck

cancer, if approved.

●

Reported average of 50% reduction in tumor

cells in Phase 2 trials (based on 19 patients evaluable by

pathology, having OSCC):

The clinical investigators who

administered the three-week Multikine treatment regimen used in the

Phase 2 study reported that, as was determined in a controlled

pathology study, Multikine administration appeared to have caused,

on average, the disappearance of about half of the cancer cells

present at surgery (as determined by histopathology assessing the

area of Stroma/Tumor (Mean+/- Standard Error of the Mean of the

number of cells counted per filed)) even before the start of

standard therapy, which normally includes surgery, radiation and

chemotherapy (Timar et al JCO 2005).

●

Reported 10.5% complete response in the final

Phase 2 trial (based on 19 patients evaluable by pathology, having

OSCC):

The

clinical investigators who administered the three-week Multikine

investigational treatment regimen used in the Phase 2 study

reported that, as was determined in a controlled pathology study,

the tumor apparently was no longer present (as determined by

histopathology) in approximately 10.5% of evaluable patients with

OSCC (Timar et al JCO 2005). In the original study, 21 subjects

received Multikine, two of which were later excluded, as subsequent

analysis by three pathologists blinded to the study revealed that

these two patients did not have OSCC. Two subjects in this study

had a complete response, leaving a reported complete response rate

of two out of 19 assessable subjects with OSCC (or 10.5%) (Timar et

al, JCO 2005).

●

Adverse events reported in clinical

trials:

In clinical trials conducted to date with the

Multikine investigational therapy, adverse events which have been

reported by the clinical investigators as possibly or probably

related to Multikine administration included pain at the injection

site, local minor bleeding and edema at the injection site,

diarrhea, headache, nausea, and constipation.

Subsequently, an

analysis on the 21 subjects originally treated with Multikine in

the study to evaluate overall survival was conducted, as described

above. In connection with the follow-up portion of the study for

overall survival, we also conducted an unreported post-hoc analysis

of complete response rate in the study population, which included

subjects who provided consent for the follow-up and who also had

OSCC. Two of the 21 subjects did not re-consent for follow-up, and

two of the remaining 19 subjects were excluded from the post-hoc

complete response rate analysis as they had previously been

determined by pathology analysis to not have OSCC. The two complete

responders with OSCC both consented to the follow-up study.

Therefore, the post-hoc analysis of complete response was based on

a calculation of the two complete responders out of 17 evaluable

subjects who consented to the follow-up analysis and who also had

OSCC (or 11.8%).

Furthermore, we

reported an overall response rate of 42.1% based on the number of

evaluable patients who experienced a favorable response to the

treatment, including those who experienced minor, major and

complete responses. Out of the 19 evaluable patients, two

experienced a complete response, two experienced a major response,

and four experienced a minor response to treatment. Thus, we

calculated the number of patients experiencing a favorable response

as eight patients out of 19 (or 42.1%) (Timar et al, JCO

2005).

The

clinical significance of these and other data, to date, from the

multiple Multikine clinical trials, is not yet known. These

preliminary clinical data do suggest the potential to demonstrate a

possible improvement in the clinical outcome for patients treated

with Multikine.

Peri-Anal Warts and Cervical Dysplasia in HIV/HPV Co-Infected

Patients

HPV is

a very common sexually transmitted disease in the United States and

other parts of the world. It can lead to cancer of the cervix,

penis, anus, esophagus and head and neck. Our focus in HPV,

however, is not on developing an antiviral for the potential

treatment or prevention of HPV in the general population. Instead,

our focus is on developing an immunotherapy product candidate

designed to be administered to patients who are immune-suppressed

by other diseases, such as HIV, and who are therefore less able or

unable to control HPV and its resultant or co-morbid diseases. Such

patients have limited treatment options available to

them.

One

condition that is commonly associated with both HIV and HPV is the

occurrence of anal intraepithelial dysplasia, or AIN, and anal and

genital warts. The incidence of AIN in HIV-infected people is

estimated to be about 25%. The incidence of anal HPV infection in

HIV-infected men who have sex with men, or MSM, is estimated to be

as high as 95%. In the aggregate, the United States and Europe have

about 875,000 HIV-infected patients with AIN (assuming AIN

prevalence of approximately 25% of the aggregate HIV-infected

population). Persistent HPV infection in the anal region is thought

to be responsible for up to 80% of anal cancers, and men and women

who are HIV positive have a 30-fold increase in their risk of anal

cancer.

Persistent HPV infection can

also be a precursor to cervical cancer, as well as certain head and

neck cancers.

In

October 2013, CEL-SCI signed a cooperative research and development

agreement, or CRADA, with the U.S. Naval Medical Center, San Diego,

or the USNMC. Pursuant to this agreement, the USNMC was to conduct

a Phase 1 study, approved by the Human Subjects Institutional

Review Board, of our investigational immunotherapy, Multikine, in

HIV/HPV co-infected men and women with peri-anal warts. The purpose

of this study was to evaluate the safety and clinical impact of

Multikine as a potential treatment of peri-anal warts and assess

its effect on AIN in HIV/HPV co-infected men and

women.

In July

2015, CEL-SCI added a clinical site at the University of

California, San Francisco, or UCSF, and Key Opinion Leader, or KOL,

to the ongoing Phase 1 study. In August 2016, the U.S. Navy

discontinued this Phase 1 study because of difficulties in

enrolling patients. UCSF is continuing with the study.

In

October 2013, we entered into a co-development and profit sharing

agreement with Ergomed for development of Multikine as a potential

treatment of HIV/HPV co-infected men and women with peri-anal

warts. This agreement is supporting the development of Multikine

with UCSF.

The

treatment regimen for this Phase 1 study of up to 15 HIV/HPV

co-infected patient volunteers with peri-anal warts, being

conducted by doctors at UCSF, is identical to the regimen that was

used in an earlier Institutional Review Board-approved Multikine

Phase 1 study in HIV/HPV co-infected patients, which was conducted

at the University of Maryland

.

In that study, the Multikine

investigational therapy was administered to HIV/HPV co-infected

women with cervical dysplasia, resulting in visual and histological

evidence of clearance of lesions in three out of the eight

subjects.

Furthermore, in

this earlier Phase 1 study, the number of HPV viral sub-types in

three volunteer subjects tested were reduced post-treatment with

Multikine, as opposed to pre-treatment, as determined by in situ

polymerase chain reaction performed on tissue biopsy collected

before and after Multikine treatment. As reported by the

investigators in the earlier study, the study volunteers, except

one subject volunteer, all appeared to tolerate the treatment with

no reported serious adverse events.

MANUFACTURING

FACILITY

Before

starting the Phase 3 clinical trial, CEL-SCI needed to build a

dedicated manufacturing facility to produce Multikine. This

facility has been completed and validated, and has produced

multiple clinical lots for the Phase 3 clinical trial. The facility

has also passed review by a European Union Qualified Person on

several occasions.

CEL-SCI’s

lease on the manufacturing facility expires on October 31, 2028.

CEL-SCI completed validation of its new manufacturing facility in

January 2010. The state-of-the-art facility is being used to

manufacture Multikine for CEL-SCI’s Phase 3 clinical trial.

In addition to using this facility to manufacture Multikine,

CEL-SCI, only if the facility is not being used for Multikine, may

offer the use of the facility as a service to pharmaceutical

companies and others, particularly those that need to “fill

and finish” their drugs in a cold environment (4 degrees

Celsius, or approximately 39 degrees Fahrenheit). Fill and finish

is the process of filling injectable drugs in a sterile manner and

is a key part of the manufacturing process for many medicines.

However, priority will always be given to Multikine as management

considers the Multikine supply to the clinical studies and

preparation for a final marketing approval to be more important

than offering fill and finish services.

LEAPS

Our

patented T-cell Modulation Process, referred to as LEAPS (Ligand

Epitope Antigen Presentation System), uses

“heteroconjugates” to direct the body to choose a

specific immune response. LEAPS is designed to stimulate the human

immune system to more effectively fight bacterial, viral and

parasitic infections as well as autoimmune, allergies,

transplantation rejection and cancer, when it cannot do so on its

own. Administered like a vaccine, LEAPS combines T-cell binding

ligands with small, disease-associated peptide antigens, and may

provide a new method to treat and prevent certain

diseases.

The

ability to generate a specific immune response is important because

many diseases are often not combated effectively due to the

body’s selection of the “inappropriate” immune

response. The capability to specifically reprogram an immune

response may offer a more effective approach than existing vaccines

and drugs in attacking an underlying disease.

On July

15, 2014 CEL-SCI announced that it has been awarded a Phase 1 Small

Business Innovation Research (SBIR) grant in the amount of $225,000

from the National Institute of Arthritis Muscoskeletal and Skin

Diseases, which is part of the National Institutes of Health. The

grant is funding the further development of CEL-SCI’s LEAPS

technology as a potential treatment for rheumatoid arthritis, an

autoimmune disease of the joints. The work is being conducted at

Rush University Medical Center in Chicago, Illinois in the

laboratories of Tibor Glant, MD, Ph.D., The Jorge O. Galante

Professor of Orthopedic Surgery; Katalin Mikecz, MD, Ph.D.

Professor of Orthopedic Surgery & Biochemistry; and Allison

Finnegan, Ph.D. Professor of Medicine.

With

the support of the SBIR grant, CEL-SCI is developing two new drug

candidates, CEL-2000 and CEL-4000, as potential rheumatoid

arthritis therapeutic vaccines. The data from animal studies using

the CEL-2000 treatment vaccine demonstrated that it could be used

as an effective treatment against rheumatoid arthritis with fewer

administrations than those required by other anti-rheumatoid

arthritis treatments currently on the market for arthritic

conditions associated with the Th17 signature cytokine

TNF-

. The data for CEL-4000 indicates it

could be effective against rheumatoid arthritis cases where a Th1

signature cytokine (IFN-c) is dominant. CEL-

2000 and

CEL-4000 have the potential to be a more disease-specific therapy,

significantly less expensive, act at an earlier step in the disease

process than current therapies and may be useful in patients not

responding to existing rheumatoid arthritis therapies. CEL-SCI

believes this represents a large unmet medical need in the

rheumatoid arthritis market.

In

February 2017 and November 2016, CEL-SCI announced new preclinical

data that demonstrate its investigational new drug candidate

CEL-4000 has the potential for use as a therapeutic vaccine to

treat rheumatoid arthritis. This efficacy study was supported in

part by the SBIR Phase I Grant and was conducted in collaboration

with Drs. Katalin Mikecz and Tibor Glant, and their research team

at Rush University Medical Center in Chicago, IL.

In

March 2015, CEL-SCI and its collaborators published a review

article on vaccine therapies for rheumatoid arthritis based in part

on work supported by the SBIR grant. The article is entitled

“Rheumatoid arthritis vaccine therapies: perspectives and

lessons from therapeutic Ligand Epitope Antigen Presentation System

vaccines for models of rheumatoid arthritis” and was

published in Expert Rev. Vaccines 1 - 18 and can be found at

http://www.ncbi.nlm.nih.gov/ pubmed/25787143.

In

August 2012, Dr. Zimmerman, CEL-SCI’s Senior Vice President

of Research, Cellular Immunology, gave a Keynote presentation at

the OMICS 2nd International Conference on Vaccines and Vaccinations

in Chicago. This presentation showed how the LEAPS peptides

administered altered only select cytokines specific for each

disease model, thereby improving the s

tatus of the test animals and even

preventing death and morbidity. These results support the growing

body of evidence that provides for its mode of action by a common

format in these unrelated conditions by regulation of Th1 (e.g.,

IL12 and IFN-c) and the

ir action on reducing

TNF-

and other

inflammatory cytokines as well regulation of antibodies to these

disease associated antigens. This was also illustrated by a

schematic model showing how these pathways interact and result in

the overall effect of protection and regulation of cytokines in a

beneficial manner.

In

February 2010, CEL-SCI announced that its CEL-2000 vaccine

demonstrated that it was able to block the progression of

rheumatoid arthritis in a mouse model, where a Th17 signature

cytokine (TNF-

) is

dominant. The results were published in the scientific

peer-reviewed Journal of International Immunopharmacology (online

edition) in an article titled “CEL-2000: A Therapeutic

Vaccine for Rheumatoid Arthritis Arrests Disease Development and

Alters Serum Cytokine / Chemokine Patterns in the Bovine Collagen

Type II Induced Arthritis in the DBA Mouse Model” Int

Immunopharmacol. 2010 Apr; 10(4):412-21 http://www.

ncbi.nlm.nih.gov/pubmed/20074669.

Using

the LEAPS technology, CEL-SCI has created a potential peptide

treatment for H1N1 (swine flu) hospitalized patients. This LEAPS

flu treatment is designed to focus on the conserved, non-changing

epitopes of the different strains of Type A Influenza viruses

(H1N1, H5N1, H3N1, etc.), including “swine”,

“avian or bird”, and “Spanish Influenza”,

in order to minimize the chance of viral “escape by

mutations” from immune recognition. Therefore one should

think of this treatment not really as an H1N1 treatment, but as a

potential pandemic flu treatment. CEL-SCI’s LEAPS flu

treatment contains epitopes known to be associated with immune

protection against influenza in animal models.

In

September 2009, the U.S. FDA advised CEL-SCI that it could proceed

with its first clinical trial to evaluate the effect of LEAPS-H1N1

treatment on the white blood cells of hospitalized H1N1 patients.

This followed an expedited initial review of CEL-SCI's regulatory

submission for this study proposal.

In

November 2009, CEL-SCI announced that The Johns Hopkins University

School of Medicine had given clearance for CEL-SCI’s first

clinical study to proceed using LEAPS-H1N1. Soon after the start of

the study, the number of hospitalized H1N1 patients dramatically

declined and the study was unable to complete the enrollment of

patients.

Additional work on

this treatment for the pandemic flu is being pursued in

collaboration with the National Institute of Allergy and Infectious

Diseases (NIAID), part of the National Institutes of Health, USA.

In May 2011 NIAID scientists presented data at the Keystone

Conference on “Pathogenesis of Influenza: Virus-Host

Interactions” in Hong Kong, China, showing the positive

results of efficacy studies in mice of LEAPS H1N1 activated

dendritic cells (DCs) to treat the H1N1 virus. Scientists at the

NIAID found that H1N1-infected mice treated with LEAPS-H1N1 DCs

showed a survival advantage over mice treated with control DCs. The

work was performed in collaboration with scientists led by Kanta

Subbarao, M.D., Chief of the Emerging Respiratory Diseases Section

in NIAID’s Division of Intramural Research, part of the

National Institutes of Health, USA.

In July

2013, CEL-SCI announced the publication of the results of influenza

studies by researchers from the NIAID in the Journal of Clinical

Investigation (www.jci.org/articles/view/67550). The studies

described in the publication show that when CEL-SCI’s

investigational J-LEAPS Influenza Virus treatments were used

“in vitro” to activate DCs, these activated DCs, when

injected into influenza infected mice, arrested the progression of

lethal influenza virus infection in these mice. The work was

performed in the laboratory of Dr. Subbarao.

Even

though the various LEAPS drug candidates have not yet been given to

humans, they have been tested in vitro with human cells. They have

induced similar cytokine responses that were seen in these animal

models, which may indicate that the LEAPS technology might

translate to humans. The LEAPS candidates have demonstrated

protection against lethal herpes simplex virus (HSV1) and H1N1

influenza infection, as a prophylactic or therapeutic agent in

animals. They have also shown some level of efficacy in animals in

two autoimmune conditions, curtailing and sometimes preventing

disease progression in arthritis and myocarditis animal models.

CEL-SCI’s belief is that the LEAPS technology may be a

significant alternative to the vaccines currently available on the

market for these diseases.

None of

the LEAPS investigational products have been approved for sale,

barter or exchange by the FDA or any other regulatory agency for

any use to treat disease in animals or humans. The safety or

efficacy of these products has not been established for any use.

Lastly, no definitive conclusions can be drawn from the

early-phase, preclinical-trials data involving these

investigational products. Before obtaining marketing approval from

the FDA in the United States, and by comparable agencies in most

foreign countries, these product candidates must undergo rigorous

preclinical and clinical testing which is costly and time consuming

and subject to unanticipated delays. There can be no assurance that

these approvals will be granted.

Corporate

Information

We were

formed as a Colorado corporation in 1983. Our principal office is

located at 8229 Boone Boulevard, Suite 802, Vienna, Virginia 22182.

Our telephone number is 703-506-9460 and our web site is

www.cel-sci.com

.

The

information contained in, and that which can be accessed through,

our website is not incorporated into and does not form a part of

this prospectus supplement.

The Offering

|

Issuer

|

CEL-SCI

Corporation

|

|

Securities

offered by us

|

100,000

shares of common stock.

|

|

Purchase

price

|

$2.29

per share

|

|

Common

stock outstanding immediately

prior to this

offering.

(1)

|

9,218,711

shares.

|

|

Common

stock to be outstanding

immediately after

this offering.

(1)

|

9,318,711

shares.

|

|

Concurrent

Private Placement

|

In a

concurrent private placement, we are selling to the purchasers of

shares of our common stock in this offering warrants to purchase

60,000 shares of our common stock. We will receive gross proceeds

from the concurrent private placement transaction solely to the

extent such warrants are exercised for cash. The warrants will be

exercisable six months after the issuance date at a price of $2.52

per share and will expire five years after the date of issuance.

If, after the warrants are first exercisable, there is no effective

registration statement registering, or no current prospectus

available for, the resale of the shares issuable upon the exercise

of the warrants, the warrants may also be exercised, in whole or in

part, by means of a “cashless” exercise. The warrants

and the shares of our common stock issuable upon the exercise of

the warrants are not being offered pursuant to this prospectus

supplement and the accompanying prospectus and are being offered

pursuant to the exemption provided in Section 4(a)(2) under

the Securities Act and Rule 506(b) promulgated

thereunder. See the “Private Placement Transaction and

Warrants” section of this prospectus supplement.

|

|

|

|

|

|

Use of

proceeds

|

We

estimate that the net proceeds from this offering will be

approximately $207,000 after deducting estimated offering expenses

payable by us.

|

|

|

|

We

intend to use the net proceeds from this offering primarily for the

Phase 3 clinical study and general corporate purposes.

See

“Use of Proceeds.”

|

|

|

Dividend

policy

|

We have

not declared or paid any cash or other dividends on our common

stock and do not expect to declare or pay any cash or other

dividends in the foreseeable future.

|

|

Risk

factors

|

Investing

in our securities involves a high degree of risk, and the

purchasers of our securities may lose all or part of their

investment. Before deciding to invest in our securities, please

carefully read “Risk Factors” beginning on page S-16 of

this Prospectus Supplement, the Risk Factors in the accompanying

Prospectus and the risks set forth under the caption “Item

1A. Risk Factors” included in our most recent Annual Report

on Form 10-K and 10 K/A, which is incorporated by reference

herein.

|

|

NYSE

America trading symbol

|

CVM

|

(1)

This number is

based on 9,218,711 shares outstanding as of the date of this

prospectus supplement, which excludes, as of such date (i)

9,660,944 shares that may be issued upon the exercise of

outstanding warrants, with a weighted average exercise price of

$9.68 per share and (ii) 364,741 shares that may be issued upon the

exercise of outstanding options, with a weighted average exercise

price of $52.91 per share; and (iii) 60,000 shares of common

underlying the warrants (Series OO) to be issued in the concurrent

private placement, at an exercise price of $2.52 per

share.

RISK

FACTORS

Investing in our

securities involves a high degree of risk. You should carefully

consider the following risks, the risks described in our Annual

Report on Form 10-K and 10 K/A for the year ended September 30,

2016, as well as the other information and data set forth in this

prospectus supplement, the accompanying prospectus and the

documents incorporated by reference herein and therein before

making an investment decision with respect to our common stock and

warrants. The risks and uncertainties we described are not the only

ones facing us. Additional risks not presently known to us, or that

we currently deem immaterial, may also impair our business

operations. If any of these risks were to occur, our business,

financial condition, result of operations and liquidity would

likely suffer. In that event, the trading price of our common stock

would decline, and you could lose all or part of your investment.

Some statements in this prospectus supplement, including statements

in the following risk factors, constitute forward-looking

statements. See “Forward-Looking

Statements.”

Risks Related to CEL-SCI

Our Phase 3 Study has been placed on clinical hold by the

FDA

We

received a partial clinical hold letter from FDA stating that our

Phase 3 study had been placed on clinical hold, precluding us from

continuing the study except that patients enrolled prior to

September 26, 2016 may continue to receive protocol-specified

treatment at the discretion of the treating physician with written

confirmation of their consent to remain on study after receiving an

updated informed consent document. The FDA’s partial clinical

hold letter identified the following specific deficiencies: there

is an unreasonable and significant risk of illness or injury to

human subjects; the investigator brochure is misleading, erroneous,

and materially incomplete; and that the plan or protocol is

deficient in design to meet its stated objectives. In its partial

clinical hold letter, the FDA also identified the information

needed to resolve these deficiencies. Although we believe we

addressed each of the deficiencies identified by the FDA in our

response to FDA, we also requested a face-to-face meeting with FDA.

We met with FDA on February 8, 2017. At this meeting, there was a

discussion of steps that would be required to lift the partial

clinical hold. We received a formal letter from the FDA following

our meeting and filed a response in April 2017.

We

heard back from FDA in May 2017. The continued hold issues

addressed in the FDA communication were that the study’s

Investigator Brochure (IB) and the “Dear Investigator”

letter needed to be revised. Specific deficiencies and their

locations in each of the documents were identified, and directions

were given as to the specific information that should be included

in the revisions of the documents. In its communication FDA also

switched the terminology for the hold from partial hold to full

clinical hold. This was done because CEL-SCI had completed all

planned treatment of the patients in the Phase 3 study. FDA said

that the only action we need to be aware of is that we may not

enroll new patients and we may not resume investigational product

(Multikine) dosing in any previously enrolled patient. CEL-SCI has

no current needs or plans to do either of these. CEL-SCI has

revised these documents exactly as directed by the FDA and filed

the responses with FDA soon after FDA’s letter. In June 2017,

the FDA requested that three additional changes be made to the IB

that CEL-SCI submitted to the FDA on June 2, 2017. The FDA provided

instructions directing CEL-SCI on what the specific changes should

be. The FDA did not raise any other hold issues in this letter. As

of September 2016 nine hundred twenty-eight (928) head and neck

cancer patients have been enrolled in the Phase 3 study. In

accordance with the study protocol and FDA’s instructions,

CEL-SCI continues to follow these patients. The study endpoint is a

10% increase in overall survival of patients between the two main

comparator groups. The determination if the study end point is met

when there are a total of 298 deaths in those two groups. We will

not be able to enroll any additional patients in the Phase 3 study

unless FDA lifts the clinical hold. In addition, in the spring of

2016, the IDMC recommended to us that new patient enrollment should

stop in the Phase 3 study, but patients already on study should

continue to be treated and followed. We expect to work through the

concerns raised by the IDMC while we work through the hold with

FDA. However, if the clinical hold is not removed or if it is

determined that the study has been compromised or if the IDMC does

not allow enrollment to continue, the study may be

terminated.

We have incurred significant losses since inception, and we

anticipate that we will continue to incur significant losses for

the foreseeable future and may never achieve or maintain

profitability.

We have

a history of net losses, expect to incur substantial losses and

have negative operating cash flow for the foreseeable future, and

may never achieve or maintain profitability. Since the date of our

formation and through March 31, 2017, we incurred net losses of

approximately $291 million. We have relied principally upon the

proceeds from the public and private sales of our securities to

finance our activities to date. To date, we have not commercialized

any products or generated any revenue from the sale of products,

and we do not expect to generate any product revenue for the

foreseeable future. We do not know whether or when we will generate

product revenue or become profitable.

We are

heavily dependent on the success of Multikine which is under

clinical development. We cannot be certain that Multikine will

receive regulatory approval or be successfully commercialized even

if we receive regulatory approval. On September 26, 2016, FDA

placed our Phase 3 clinical trial for Multikine on partial clinical

hold. We will not be able to enroll any additional patients in the

Phase 3 clinical trial unless FDA removes the clinical hold. In

addition, prior to FDA’s issuance of the partial clinical

hold, we were discussing with our Independent Data Monitoring

Committee issues related to enrollment of additional patients in

trial. Multikine is our only product candidate in late-stage

clinical development, and our business currently depends heavily on

its successful development, regulatory approval and

commercialization. We have no drug products for sale currently and

may never be able to develop approved and marketable drug

products.

Even if

we succeed in developing and commercializing one or more of our

product candidates, we expect to incur significant operating and

capital expenditures as we:

●

continue to

undertake preclinical development and clinical trials for product

candidates;

●

seek regulatory

approvals for product candidates; and

●

implement

additional internal systems and infrastructure.

To

become and remain profitable, we must succeed in developing and

commercializing our product candidates, which must generate

significant revenue. This will require us to be successful in a

range of challenging activities, including completing preclinical

testing and clinical trials of our product candidates, discovering

or acquiring additional product candidates, obtaining regulatory

approval for these product candidates and manufacturing, marketing

and selling any products for which we may obtain regulatory

approval. We are only in the preliminary stages of most of these

activities. We may never succeed in these activities and, even if

we do, may never generate revenue that is significant enough to

achieve profitability.

Even if

we do achieve profitability, we may not be able to sustain or

increase profitability on a quarterly or annual basis. Our failure

to become and remain profitable could depress the value of our

company and could impair our ability to raise capital, expand our

business, maintain our research and development efforts, diversify

our product offerings or even continue our operations. A decline in

the value of our company could cause our stockholders to lose all

or part of their investment.

We will require substantial additional capital to remain in

operation. A failure to obtain this necessary capital when needed

could force us to delay, limit, reduce or terminate our product

candidates’ development or commercialization

efforts.

As of

March 31, 2017, we had cash and cash equivalents of $1.5 million.

We believe that we will continue to expend substantial resources

for the foreseeable future developing Multikine, LEAPS and any

other product candidates or technologies that we may develop or

acquire. These expenditures will include costs associated with

research and development, potentially obtaining regulatory

approvals and having our products manufactured, as well as

marketing and selling products approved for sale, if any. In

addition, other unanticipated costs may arise. Because the outcome

of our current and anticipated clinical trials is highly uncertain,

we cannot reasonably estimate the actual amounts necessary to

successfully complete the development and commercialization of our

product candidates.

Our

future capital requirements depend on many factors,

including:

●

the rate of

progress of, results of and cost of completing Phase 3 clinical

development of Multikine for the treatment of certain head and neck

cancers;

●

the results of our

applications to and meetings with the FDA, the EMA and other

regulatory authorities and the consequential effect on our

operating costs;

●

assuming favorable

Phase 3 clinical results, the cost, timing and outcome of our

efforts to obtain marketing approval for Multikine in the United

States, Europe and in other jurisdictions, including the

preparation and filing of regulatory submissions for Multikine with

the FDA, the EMA and other regulatory authorities;

●

the scope,

progress, results and costs of additional preclinical, clinical, or

other studies for additional indications for Multikine, LEAPS and

other product candidates and technologies that we may develop or

acquire;

●

the timing of, and

the costs involved in, obtaining regulatory approvals for LEAPS if

clinical studies are successful;

●

the cost and timing

of future commercialization activities for our products, if any of

our product candidates are approved for marketing, including

product manufacturing, marketing, sales and distribution

costs;

●

the revenue, if

any, received from commercial sales of our product candidates for

which we receive marketing approval;

●

the cost of having

our product candidates manufactured for clinical trials and in

preparation for commercialization;

●

our ability to

establish and maintain strategic collaborations, licensing or other

arrangements and the financial terms of such

agreements;

●

the costs involved

in preparing, filing and prosecuting patent applications and

maintaining, defending and enforcing our intellectual property

rights, including litigation costs, and the outcome of such

litigation; and

●

the extent to which

we acquire or in-license other products or

technologies.

Based