BEMAX INC.

Statement of Cash Flows

(Stated in U.S. Dollars)

For the Three Months Ended November

30, 2015 and November 30, 2014

(Unaudited)

|

|

|

Nine Months Ended

|

|

Nine Months Ended

|

|

|

|

February 29, 2016

|

|

February 28, 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

$

|

17,066

|

|

|

$

|

79,870

|

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Adjustments to reconcile net income (loss) to net cash

|

|

|

|

|

|

|

|

|

|

provided by (used in) operating activities:

|

|

|

|

|

|

|

|

|

|

Inventory

|

|

|

(41,576

|

)

|

|

|

—

|

|

|

Derivative liability

|

|

|

—

|

|

|

|

—

|

|

|

Debt discount

|

|

|

(3,858

|

)

|

|

|

—

|

|

|

Loan from shareholder and related party

|

|

|

16,400

|

|

|

|

10,334

|

|

|

Accounts payable

|

|

|

(972

|

)

|

|

|

3,272

|

|

|

Accrued interest on convertible loans

|

|

|

114

|

|

|

|

—

|

|

|

Convertible loan

|

|

|

40,000

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

Changes in operating assets

and liabilities

|

|

|

27,174

|

|

|

|

93,476

|

|

|

NET CASH PROVIDED BY OPERATING

ACTIVITIES

|

|

|

27,174

|

|

|

|

93,476

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Furniture and Equipment

|

|

|

|

|

|

|

(500

|

)

|

|

Net cash provided by investment activities

|

|

|

—

|

|

|

|

(550

|

)

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Common stock

|

|

|

25,361

|

|

|

|

118

|

|

|

Additional paid in capital

|

|

|

(25,357

|

)

|

|

|

58,632

|

|

|

NET CASH PROVIDED BY FINANCING

ACTIVITIES

|

|

|

4

|

|

|

|

58,750

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCREASE (DECREASE) IN CASH

|

|

|

27,179

|

|

|

|

151,726

|

|

|

CASH AT BEGINNING OF PERIOD

|

|

|

58,137

|

|

|

|

4,000

|

|

|

|

|

|

85,316

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH AT END OF PERIOD

|

|

$

|

85,316

|

|

|

$

|

155,726

|

|

|

|

|

|

85,316

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash paid during year for :

|

|

|

|

|

|

|

|

|

|

Interest

|

|

$

|

—

|

|

|

$

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

Income Taxes

|

|

$

|

—

|

|

|

$

|

—

|

|

See Notes to the Financials

|

BEMAX

INC.

Notes

to the Financial Statements

February

29, 2016

(Unaudited)

|

BEMAX

INC

. (“The Company”) was incorporated in the State of Nevada on November 28, 2012 to engage in the business of

exporting disposable baby diapers manufactured in the United States and then distributing them throughout Europe and South Africa.

The Company is in the development stage with no revenues and very limited operating history.

The

accompanying unaudited interim financial statements have been prepared in accordance with accounting principals generally accepted

in the United States of America and the rules of the Securities and Exchange commission (“SEC”) and should be read

in connection with the audited financial statements and notes thereto contained in the Company’s K-1 report filed with the

SEC. In the opinion of management, all adjustments consisting of normal recurring adjustments, necessary for a fair presentation

of financial position and the results of operations for the interim periods presented have been reflected herein. The results

of operations for our interim periods are not necessarily indicative of the results to be expected for the full year. Notes to

the financial statements that would substantially duplicate the disclosures in the audited financial statements, for the fiscal

2015, as reported, have been omitted.

The Company has elected to

adopt early application of Accounting Standards Update No. 2014-10,Development Stage Entities (Topic 915): Elimination of Certain

Financial Reporting Requirements; it no longer presents or discloses inception-to-date information and other disclosure requirements

of Topic 915.

NOTE 2 GOING CONCERN

These

financial statements have been prepared on a going concern basis which assumes the Company will be able to realize its assets

and discharge its liabilities in the normal course of business for the foreseeable future. The Company has incurred a loss since

inception resulting in an accumulated deficit of $(7,056) as of February 29, 2016 and further losses are anticipated in the development

of its business raising substantial doubt about the Company’s ability to continue as a going concern. The ability to continue

as a going concern is dependent upon the Company generating profitable operations in the future and/or obtaining the necessary

financing to meet its obligations and repay its liabilities arising from normal business operations when they come due. Management

intends to finance operating costs over the next twelve months with existing cash on hand, loans from directors and/or private

placement of common stock.

There is no guarantee

that the Company will be able to raise any capital through any type of offering.

NOTE 3 STOCKHOLDERS’

EQUITY

Between October 14 and

24, 2014, the Company authorized and issued 1,175,000 shares of common stock to various investors, for net proceeds to the Company

of $58,750.

On June

5, 2015, the Company decided to increase the authorized amount of common shares that can be issued from 70,000,000 to 500,000,000

with the same par value of $0.0001 per share. The Company also declared a Fifty (50) to One (1) forward stock split effective

immediately.

As of

February 29, 2016, there are 500,000,000 common shares at a par value of $0.0001 per share authorized and 258,750,000 issued and

outstanding.

BEMAX

INC.

Notes

to the Financial Statements

February

29, 2016

(Unaudited)

___________________________________________________________________________________

NOTE 4 RELATED PARTY TRANSACTIONS

The President of the Company

provides management fees and office premises to the Company for a fee of $1,500 per month, the right to which the President has

agreed to assign to the Company until such a time as the Company closes on an Equity or Debt financing of not less than $750,000.

The assigned rights are valued at $1,000 per month for rent and $500 for executive compensation. A total of $13,500 for donated

management fees were charged to “Loan from Shareholder” for the period June 1, 2015 through February 29, 2016

As of February 29, 2016,

there are loans from the majority shareholder and related party totalling $33,736. They were made in order to assist in meeting

general and administrative expenses. These advances are unsecured, due on demand and carry no interest or collateral.

NOTE 5 CONVERTIBLE LOANS

On

February 16, 2016, the Company issued a Convertible Promissory Note in favor of Crown Bridge Partners, LLC. The principal amount

of the loan is $40,000 (forty thousand dollars) and carries an interest rate of 8% per annum. It becomes due and payable with

accrued interest on February 22, 2017. Crown Bridge Partners LLC. has the option to convert the Note plus accrued interest into

common shares of the Company, after 180 days. The conversion rate will be at a discount of 48% of the lowest price for ten days

prior to the actual date of conversion. The Company has the right to prepay any part of the loan plus accrued interest up to 90

days from the issue date, subject to a cash payment of the principal plus 130% interest and 91 days through 180 for a cash payment

of the principal plus 150% interest. The Company cannot prepay any amount outstanding after 180 days. The company bifurcated the

conversion feature and accounted for it as a derivative liability. The Company recorded the derivative liability at its fair value

of $134,892 based on the Black Scholes Merton pricing model and a corresponding debt discount of $40,000 to be amortized utilizing

the interest method of accretion over the term of the note. As of February 29, 2016, the Company fair valued the derivative at

$101,839 resulting in a gain on the change in the fair value of $33,053. In addition, $1,424 of the debt discount has been amortized

to interest expense.

NOTE 6 SUBSEQUENT EVENTS

In Accordance with SFAS 165

(ASC 855-10) management has reviewed events through April 14, 2016, the date these financials were available to be issued and

it was determined that there are none to report

ITEM 2. MANAGEMENT'S DISCUSSION

AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Forward Looking Statements

This report on Form 10-Q contains

certain forward-looking statements. All statements other than statements of historical fact are "forward-looking statements"

for purposes of these provisions, including any projections of earnings, revenues, or other financial items; any statements of

the plans, strategies, and objectives of management for future operation; any statements concerning proposed new products, services,

or developments; any statements regarding future economic conditions or performance; statements of belief; and any statement of

assumptions underlying any of the foregoing. Such forward-looking statements are subject to inherent risks and uncertainties,

and actual results could differ materially from those anticipated by the forward-looking statements.

Business Overview

Bemax Inc. is new Nevada –based

company focusing on the distribution of disposable baby diapers made in North America and Asia by quality producers to wholesalers

and retailers in Europe and the emerging markets. We are a development stage corporation and have generated or realized minimal

revenues from our business operations.

Liquidity and Capital Resources

Cash Flows

|

|

|

|

Three Months

|

|

|

|

Three Months

|

|

|

|

|

|

Ended

|

|

|

|

Ended

|

|

|

|

|

|

February 29, 2016

|

|

|

|

February 28, 2015

|

|

|

|

|

|

$

|

|

|

|

$

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Cash Provided By (Used In) Operating Activities

|

|

|

27,174

|

|

|

|

93,476

|

|

|

Net Cash Used by Investing Activities

|

|

|

-

|

|

|

|

(500

|

)

|

|

Net Cash Provided By (Used In) Financing Activities

|

|

|

4

|

|

|

|

58,750

|

|

|

CASH AT BEGINNING OF PERIOD

|

|

|

58,137

|

|

|

|

4,000

|

|

|

CASH AT END OF PERIOD

|

|

|

85,316

|

|

|

|

155,726

|

|

Through

February 29, 2016, the Company’s revenue is 206,100 compared to $100,000 of same period ended February 28, 2015.

We

currently have minimal cash reserves. To date, the Company has covered operating deficits primarily through loans from the sole

director and third party convertible note of $40,000. Accordingly, our ability to pursue our plan of operations is contingent

on our being able to obtain funding for the development, marketing and commercialization of our products and services. However,

as a result of its lack of operating success, the Company may not be able to raise additional funding to cover operating deficits.

The accompanying financial statements

have been prepared assuming that the Company will continue as a going concern. The Company has accumulated deficit of $511,279

since inception (November 28, 2012) to the period ended February 29, 2016 and is dependent on its ability to raise capital from

shareholders or other sources to sustain operations. However, these conditions raise substantial doubt about the Company's ability

to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of

this uncertainty.

Management's Fiscal Quarter

Report on Internal Control over Financial Reporting.

Our management is responsible

for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Rules 13a-15(f)

and 15d-15(f) of the Exchange Act. Our internal control system was designed to provide reasonable assurance regarding the reliability

of financial reporting and the preparation of financial statements for external purposes, in accordance with generally accepted

accounting principles in the United States of America. Our internal control

over financial reporting includes those policies and

procedures that (i) pertain to the maintenance records that, in reasonable detail, accurately and fairly reflect the transactions

and dispositions of the assets of the Company; (ii) provide reasonable assurance that transactions are recorded as necessary to

permit preparation of financial statements in accordance with accounting principles generally accepted in the United States of

America, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management

of the Company; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use,

or disposition of the Company's assets that could have a material effect on the financial statements.

Because of inherent limitations,

a system of internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation

of effectiveness to future periods are subject to the risk that controls may become inadequate due to change in conditions, or

that the degree of compliance with the policies or procedures may deteriorate.

Results of Operations for

the Period Ended February 29, 2016

Revenue

Revenue for the period ended

February 29, 2016, and February 28, 2015 were $206,100 and $100,000 respectively.

Operating

Expense

The total operating expense

for the three months ended February 29, 2016 is $13,859 compared to $20,130 for the three months ended February 28, 2015. The

decrease is due to reduction in administrative expenses

Total Non-Operating Income (Loss)

For the period ended February

29, 2016, the Company generated net income loss of $1,856 and incurred net losses of $0 for same period ended February 28, 2015.

The increase is due interest expense and fees on loan.

Expenses

Our total expenses for the period

ended February 29, 2016 were $18,379 which consisted of general and administrative expenses

Inflation

The amounts presented in the

financial statements do not provide for the effect of inflation on our operations or financial position. The net operating losses

shown would be greater than reported if the effects of inflation were reflected either by charging operations with amounts that

represent replacement costs or by using other inflation adjustments.

Off-Balance Sheet Arrangements

As of February 29, 2016, we

had no off balance sheet transactions that have or are reasonably likely to have a current or future effect on our financial condition,

changes in our financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources.

ITEM 3. QUANTITATIVE AND QUALITATIVE

DISCLOSURE ABOUT MARKET RISK

Not applicable.

ITEM 4. CONTROLS AND PROCEDURES

We maintain disclosure controls

and procedures, as defined in Rule 13a-15(e) promulgated under the Securities Exchange Act of 1934 (the "Exchange Act"),

that are designed to ensure that information required to be disclosed by us in the reports that we file or submit under the Exchange

Act is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission's

rules and forms and that such information is accumulated and communicated to our sole officer, as appropriate to allow timely

decisions regarding required disclosure. We carried out an evaluation, under the supervision

and with the participation of

our sole officer, of the effectiveness of the design and operation of our disclosure controls and procedures as of February 29,

2016.

Based on the evaluation of these

disclosure controls and procedures, our Chief Executive and Chief Financial Officer concluded that as of the end of the periods

covered by this report, we have identified the following material weakness of our internal controls: Lack of sufficient accounting

staff which results in a lack of segregation of duties necessary for a good system of internal control.

There were no changes in our

internal control or in other factors during the last fiscal quarter covered by this report that have materially affected, or are

likely to materially affect the Company's internal control over financial reporting.

PART II – OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS

Management is not aware of any

legal proceedings contemplated by any governmental authority or any other party against us. None of our directors, officers or

affiliates are (i) a party adverse to us in any legal proceedings, or (ii) have an adverse interest to us in any legal proceedings.

Management is not aware of any other legal proceedings that have been threatened against us.

ITEM 2. UNREGISTERED SALES OF

EQUITY SECURITIES AND USE OF PROCEEDS

None.

ITEM 3. DEFAULTS UPON SENIOR

SECURITIES

None.

ITEM 4. MINE SAFETY DISCLOSURES

N/A.

ITEM 5. OTHER INFORMATION

None.

ITEM 6. EXHIBITS

Exhibits:

31.1 Certification of Chief

Executive Officer pursuant to Securities Exchange Act of 1934 Rule 13a-14(a)

or 15d-14(a).

31.2 Certification of Chief

Financial Officer pursuant to Securities Exchange Act of 1934 Rule 13a-14(a)

or 15d-14(a).

32.1 Certifications pursuant

to Securities Exchange Act of 1934 Rule 13a-14(b) or 15d- 14(b) and 18

U.S.C.

Section 1350, as adopted pursuant to Section 906 of the Sarbanes- Oxley Act of 2002.

SIGNATURES

Pursuant to the requirements

of Section 13 or 15(d) of the Exchange Act, the Registrant has duly caused this Quarterly Report to be signed on its behalf by

the undersigned thereunto duly authorized.

|

|

BEMAX INC.

|

|

|

|

|

Dated:

July 27, 2017

|

By: /s/ Taiwo Aimasiko

|

|

|

________________________________

|

|

|

Taiwo Aimasiko, President and

|

|

|

Chief Executive Officer

|

|

|

|

|

|

|

|

Dated: July 27, 2017

|

By: /s/ Taiwo Aimasiko

|

|

|

_________________________________

|

|

|

Taiwo Aimasiko, Chief Financial Office

|

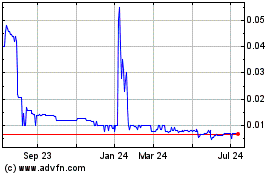

Bemax (PK) (USOTC:BMXC)

Historical Stock Chart

From Mar 2024 to Apr 2024

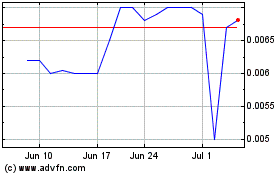

Bemax (PK) (USOTC:BMXC)

Historical Stock Chart

From Apr 2023 to Apr 2024