Current Report Filing (8-k)

July 28 2017 - 1:24PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

July 24, 2017

Date of Report (Date of earliest event reported)

|

SolarWindow Technologies, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

Nevada

(State or other jurisdiction of incorporation)

333-127953

(Commission File Number)

59-3509694

(I.R.S. Employer Identification No.)

10632 Little Patuxent Parkway

Suite 406

Columbia, Maryland 21044

(Address of principal executive offices)

(800) 213-0689

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01. Entry Into a Material Definitive Agreement.

On July 24, 2017, SolarWindow Technologies, Inc. (the “

Company

”) entered into a Subscription Agreement with Kalen Capital Corporation, a private corporation owning in excess of 10% of the Company’s issued and outstanding common stock, for the purchase and sale of 300,000 units of the Company’s equity securities (the “

Units

”) at a price of $2.30 per Unit, pursuant to a private placement offering conducted by the Company (the “

Offering

”) for aggregate proceeds of $690,000. The Unit price represents an approximately 15% discount to the prior days’ closing price of the Company’s common stock as quoted on the OTC Markets QB tier. Each Unit consists of: (i) one (1) share of common stock; and (ii) one (1) Series S Stock Purchase Warrant to purchase one (1) share of common stock at a price of $2.53 per share for a period of 5 years from the issue date (the “

Series S Warrants

”); the Series S Warrants may be exercised on a cashless basis using the formula contained therein. The consummation of the transactions contemplated by the Subscription Agreement occurred on July 28, 2017.

As part of the Offering, the Company and the Investors entered into a Registration Rights Agreement (the “

Registration Rights Agreement

”) requiring the Company to register for resale all of the shares of common stock sold as part of the Offering, including those issuable upon exercise of the Series S Warrants within 45 days from the closing.

The Company intends to use the proceeds from the Offering to continue the development and commercialization efforts of its novel SolarWindow

TM

technology and for general corporate purposes.

The summary of the terms of the Offering included in this Current Report on Form 8-K (this “

Report

”) does not purport to be complete and is qualified in its entirety by reference to the Form of Series S Warrant, the Form of Registration Rights Agreement and the Form of Subscription Agreement attached as

Exhibits 4.1, 4.2, 4.3 and 10.1

, respectively (collectively, the “

Transaction Documents

”) and are incorporated by reference herein; capitalized but undefined terms used in this Report have the meaning ascribed to such term as set forth in the Transaction Documents. The forms of the Transaction Documents have been included to provide investors and security holders with information regarding their terms. They are not intended to provide any other factual information about the Company. The Transaction Documents contain certain representations, warranties and indemnifications resulting from any breach of such representations or warranties. Investors and security holders should not rely on the representations and warranties as characterizations of the actual state of facts because they were made only as of the respective dates of the Transaction Documents. In addition, information concerning the subject matter of the representations and warranties may change after the respective dates of the Transaction Documents, and such subsequent information may not be fully reflected in the Company’s public disclosures.

The securities were issued to the Investors pursuant to exemptions from the registration requirements afforded by, among others, Regulation S as the Investors were not U.S. Persons, as such term is defined in Rule 902 of Regulation S.

Item 3.02. Unregistered Sales of Equity Securities.

The information provided in response to

Item 1.01

of this Report is incorporated by reference into this

Item 3.02

.

Section 9 – Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized on July 28, 2017.

|

|

SOLARWINDOW TECHNOLOGIES, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ John Conklin

|

|

|

|

Name:

|

John Conklin

|

|

|

|

Title:

|

President and Chief Executive Officer

|

|

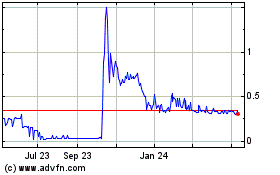

Solarwindow Technologies (PK) (USOTC:WNDW)

Historical Stock Chart

From Mar 2024 to Apr 2024

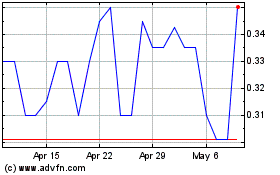

Solarwindow Technologies (PK) (USOTC:WNDW)

Historical Stock Chart

From Apr 2023 to Apr 2024